Herbicides Market by Type (Glyphosate, 2, 4-D, Diquat), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Mode of Action (Non-selective, Selective), and Region - Global Forecast to 2022

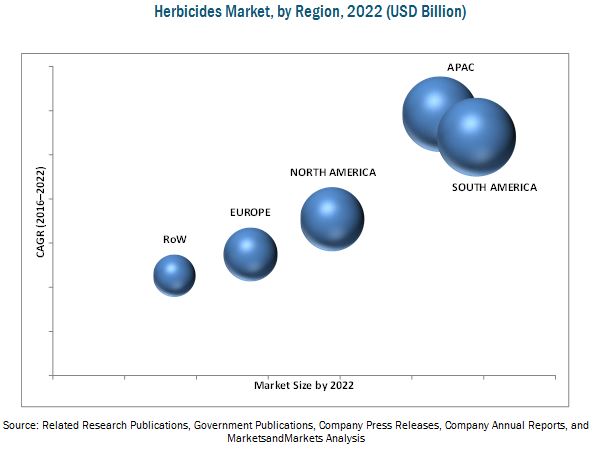

[141 Pages Report] The global herbicides market is estimated at USD 27.21 billion in 2016 and is projected to reach USD 39.15 billion by 2022, at a CAGR of 6.25% during the forecast period.

The years considered for the study are as follows:

- Base year: 2015

- Beginning of projection period: 2016

- End of projection period: 2022

Objectives of the report

- To define, segment, and measure the herbicides market in both quantitative and qualitative terms

- To provide an analysis of opportunities in the market for stakeholders through the identification of high-growth segments

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To understand the industry trends of the herbicides market along with a value chain and supply chain analysis

- To provide a strategic profiling of key players in the herbicides market and a comprehensive analysis of their core competencies

- To analyze the strategies of key players and developments, such as new product launches & product approvals, mergers & acquisitions and strategic alliances, agreements and collaborations, and investments & expansions

See how this study impacted revenues for other players in Herbicides Market

Clients Problem Statement

Our client wanted to identify the appropriate companion to implement their strategic distribution partnership into the herbicides market.

MnM Approach

The client observed that MnM was tracking the crop protection market for the past few years and also identified relevant opportunities in and around its eco-system. As per our preliminary assessment, the herbicides market is estimated to reach a potential of USD 39.1 billion by 2024. The client wanted information about the key trends that could disrupt the herbicides industry such as regulations, changing mix of herbicides, active ingredients (AIs) on key crops, effect of herbicide usage on Gm crops, and the replacement of older active ingredients, which could help the client identify the impact of these trends on their business.

During the clients global active ingredient (AI) meet, they investigated how innovations, including sustainable agricultural solutions, new active ingredients, and precision agriculture, could be harnessed for market growth. After their internal meeting, MnM offered advice on harnessing these to create opportunities. We delivered inputs on the dynamic pricing of herbicides, key formulations in the process of patent approval, upcoming launches, patent expiry of key AIs, and crop-wise assessment of each off-patent herbicide AI.

Revenue Impact (RI)

This helped the herbicide manufacturer to build revenue in the range of USD 110 120 million in the European and Asia Pacific regions.

Research Methodology:

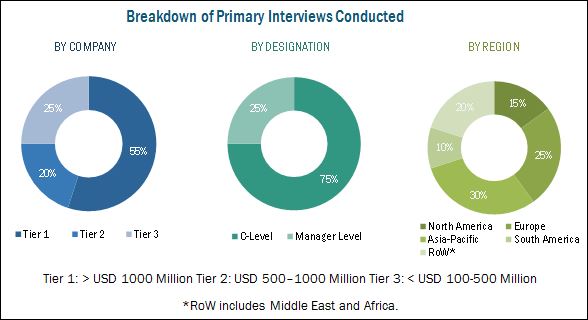

- Major regions were identified along with countries contributing the maximum share.

- Secondary research was conducted to obtain the value of herbicides market for regions such as North America, Europe, Asia Pacific, South America, and RoW.

- The key players have been identified through secondary sources such as the Bloomberg, Businessweek, Factiva, agricultural magazines and the annual reports of the companies, while their market share in the respective regions has been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the herbicides market.

To know about the assumptions considered for the study, download the pdf brochure

The contributors involved in the value chain of the herbicides market include raw material suppliers, R&D institutes, herbicides manufacturing companies, such as BASF (Germany), DowDuPont (US), Monsanto (US), and Syngenta (Switzerland) as well as government bodies & regulatory associations, such as USDA, FAO, PAN, and Eurostat.

Target Audience

The stakeholders for the report are as follows:

- Herbicides and other agrochemical importers/exporters

- Herbicides and other pesticides manufacturers/suppliers

- End consumers (farmers)

- Intermediary suppliers

- Wholesalers

- Traders

- Research institutes and organizations

- Regulatory bodies

Scope of the Report

This research report categorizes the herbicides market based on type, crop type, mode of action, and region.

On the basis of Type, the herbicides market has been segmented into the following:

- Glyphosate

- Diquat

- 2,4-D

- Others (dicamba, acetochlor and glufosinate)

On the basis of Mode of Action, the herbicides market has been segmented into the following:

- Non-selective

- Selective

On the basis of crop Type, the herbicides market has been segmented into the following:

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Others (lawns, forests, and aquatic vegetation)

On the basis of Region, the herbicides market has been segmented into the following:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographical Analysis

- Further breakdown of the Rest of Europe region herbicides market into the Netherlands, Hungary, and Romania

- Further breakdown of the Rest of Asia Pacific region herbicides market into Australia and Malaysia

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global herbicides market is estimated at USD 27.21 billion in 2016 and is projected to reach USD 39.15 billion by 2022, at a CAGR of 6.25% during the forecast period. The primary factors that drive the herbicides market are the adoption of better farming practices and rise in production of cereals & grains particularly in the Asia Pacific region.

Herbicides are one of the major crop protection chemicals used for weed control. The herbicides market is segmented on the basis of herbicides type, mode of action, crop type, and region. On the basis of type, the herbicides market was dominated by the glyphosate segment and was followed by diquat and 2,4-D segments in 2015. With increasing use of glyphosate-based products in various forms, such as gel and powder across countries, glyphosate is projected to remain a leading segment. Diquat herbicide accounted for the second largest market share in 2015. Diquat is considered as a substitute for paraquat as both are non-selective contact herbicides and have almost similar chemical properties. Hence, the usage of diquat has increased, particularly in China and other developing economies, after declaring paraquat a restricted use pesticide (RUP) by environmental protection agencies in more than 30 countries.

The herbicides market, based on mode of action, is segmented into non-selective and selective. The non-selective herbicide segment has the largest market share in 2015. As non-selective herbicide is formulated for both, broadleaf and grass weeds, it finds application in most of the vegetation types and is a preferred alternative to selective herbicides. Additionally, with the introduction of GM crops that have herbicide tolerance, the demand for non-selective herbicides is projected to increase during the forecast period.

South America held the largest market share for herbicides market in 2015 and is projected to increase further in the next 5 years. Additionally, less stringent regulations in South America as compared to those imposed in other regions has led major players to expand in this region. Asia Pacific is projected to grow at the highest CAGR of 6.96% during the forecast period, due to advancements in crop protection techniques against weeds and increasing demand for low-priced generic herbicides formulations.

The herbicides market is highly concentrated at the global level with several multinational companies accounting for a significant share of the herbicides market. The herbicides market in developed countries has become saturated, and the demand is projected to increase in the developing countries. The key players identified have a strong presence in the global herbicides market. The major market players include BASF (Germany), DowDuPont (US), Monsanto (US), and Syngenta (Switzerland), FMC Corporation (US), Arysta (US), Nufarm Ltd. (Australia), Nissan Chemical Industries (Japan), and Drexel Chemical (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered in the Study

1.5 Currency

1.6 Units Considered

1.7 Stakeholders

1.8 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in this Market

4.2 Market, By Type

4.3 South America: Herbicides Market

4.4 Market: Major Countries

4.5 Market, By Application

4.6 Market: Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Mode of Action

5.2.3 By Crop Type

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Adoption of Better Farming Practices Globally

5.3.1.2 Rise in Production of Cereals and Grains in Asian Countries

5.3.2 Restraints

5.3.2.1 Carcinogenic Nature of Certain Active Ingredients

5.3.2.2 Herbicide Residue Issues

5.3.3 Opportunities

5.3.3.1 Rise in Agricultural Industry in Developing Economies

5.3.3.2 Development of Novel Formulations

5.3.4 Challenges

5.3.4.1 Stringent Approval Procedures

5.4 Trade Data

5.4.1 Herbicide Imports

5.4.2 Herbicide Exports

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain

6.3 Supply Chain

6.4 Porters Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Intensity of Competitive Rivalry

6.5 List of Banned Herbicides

7 Herbicides Market, By Type (Page No. - 49)

7.1 Introduction 7.2 Glyphosate

7.3 Diquat

7.4 2,4-D

7.5 Others

8 Herbicides Market, By Mode of Action (Page No. - 57)

8.1 Introduction8.2 Non-Selective

8.3 Selective

9 Herbicides Market, By Crop Type (Page No. - 61)

9.1 Introduction9.2 Cereals & Grains

9.3 Oilseeds & Pulses

9.4 Fruits & Vegetables

9.5 Others

10 Herbicides Market, By Region (Page No. - 67)

10.1 Introduction10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 Spain

10.3.4 Italy

10.3.5 U.K.

10.3.6 Poland

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Thailand

10.4.3 Japan

10.4.4 India

10.4.5 Rest of Asia-Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 RoW

10.6.1 Africa

10.6.2 Middle East

11 Competitive Landscape (Page No. - 102)

11.1 Overview

11.2 Ranking Analysis

11.3 Competitive Situation & Trend

11.3.1 New Product Launches and Product Approvals

11.3.2 Mergers & Acquisitions and Strategic Alliances

11.3.3 Agreements and Collaborations

11.3.4 Investments and Expansions

12 Company Profiles (Page No. - 109)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 BASF SE

12.2 The DOW Chemical Company

12.3 E.I. Du Pont De Nemours and Company

12.4 Monsanto Company

12.5 Syngenta AG

12.6 FMC Corporation

12.7 Platform Specialty Products Corporation

12.8 Nufarm Limited

12.9 Nissan Chemical Industries Ltd.

12.10 Drexel Chemical Company

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (73 Tables)

Table 1 Commonly Used Herbicides

Table 2 List of Banned Herbicides

Table 3 Herbicides Market Size, By Type ,2014-2022 (USD Billion)

Table 4 Market Size For Herbicides, By Type,20142022 (KT)

Table 5 Glyphosate: Market Size, By Region, 2014-2022 (USD Billion)

Table 6 Glyphosate: Market Size For Herbicides, By Region, 20142022 (KT)

Table 7 Diquat: Market Size, By Region, 20142022 (USD Million)

Table 8 Diquat: Market Size For Herbicides, By Region, 20142022 (KT)

Table 9 2,4-D: Market Size, By Region, 20142022 (USD Million)

Table 10 2,4-D: Market Size For Herbicides, By Region, 20142022 (KT)

Table 11 Others: Herbicides Market Size, By Region, 20142022 (USD Billion)

Table 12 Others: Market Size For Herbicides, By Region, 20142022 (KT)

Table 13 Market Size, By Mode of Action, 2014-2022 (USD Billion)

Table 14 Non-Selective Herbicides Market Size, By Region, 2014-2022 (USD Billion)

Table 15 Selective Herbicides Market Size, By Region, 2014-2022 (USD Billion)

Table 16 Market Size, By Crop Type, 20142022 (USD Billion)

Table 17 Cereals & Grains: Market Size, By Region, 20142022 (USD Billion)

Table 18 Oilseeds & Pulses: Market Size, By Region, 20142022 (USD Million)

Table 19 Fruits & Vegetables: Market Size, By Region, 20142022 (USD Million)

Table 20 Others: Market Size, By Region, 20142022 (USD Million)

Table 21 Market Size, By Region, 20142022 (USD Billion)

Table 22 Market Size, By Region, 20142022 (KT)

Table 23 North America: Herbicides Market Size, By Country, 20142022 (USD Million)

Table 24 North America: Market Size For Herbicides, By Country, 20142022 (KT)

Table 25 North America: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 26 North America: Market Size For Herbicides, By Type, 20142022 (KT)

Table 27 North America: Market Size For Herbicides, By Crop Type, 20142022 (USD Million)

Table 28 North America: Market Size For Herbicides, By Mode of Action, 20142022 (USD Million)

Table 29 U.S.: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 30 Canada: Market Size, By Type, 20142022 (USD Million)

Table 31 Mexico: Market Size, By Type, 20142022 (USD Million)

Table 32 Europe: Market Size, By Country, 20142022 (USD Million)

Table 33 Europe: Market Size For Herbicides, By Country, 20142022 (KT)

Table 34 Europe: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 35 Europe: Market Size For Herbicides, By Type, 20142022 (KT)

Table 36 Europe: Market Size For Herbicides, By Crop Type, 20142022 (USD Million)

Table 37 Europe: Market Size For Herbicides, By Mode of Action, 20142022 (USD Million)

Table 38 France: Market Size, By Type, 20142022 (USD Million)

Table 39 Germany: Market Size, By Type, 20142022 (USD Million)

Table 40 Spain: Market Size, By Type, 20142022 (USD Million)

Table 41 Italy: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 42 UK:Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 43 Poland: Market Size, By Type, 20142022 (USD Million)

Table 44 Rest of Europe: Market Size, By Type, 20142022 (USD Million)

Table 45 Asia-Pacific: Market Size, By Country, 20142022 (USD Million)

Table 46 Asia-Pacific: Market Size For Herbicides, By Country, 20142022 (KT)

Table 47 Asia-Pacific: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 48 Asia-Pacific: Market Size For Herbicides, By Type, 20142022 (KT)

Table 49 Asia-Pacific: Market Size For Herbicides, By Crop Type, 20142022 (USD Million)

Table 50 Asia-Pacific: Market Size For Herbicides, By Mode of Action, 20142022 (USD Billion)

Table 51 China: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 52 Thailand: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 53 Japan: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 54 India : Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 55 Rest of Asia-Pacific: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 56 South America: Market Size For Herbicides, By Country, 20142022 (USD Million)

Table 57 South America: Market Size For Herbicides, By Country, 20142022 (KT)

Table 58 South America: Market Size, By Type, 20142022 (USD Million)

Table 59 South America: Market Size For Herbicides, By Type, 20142022 (KT)

Table 60 South America: Market Size For Herbicides, By Crop Type, 20142022 (USD Million)

Table 61 South America: Market Size For Herbicides, By Mode of Action, 20142022 (USD Million)

Table 62 Brazil: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 63 Argentina: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 64 Rest of South America: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 65 RoW: Market Size For Herbicides, By Region, 20142022 (USD Million)

Table 66 RoW: Market Size For Herbicides, By Region, 20142022 (KT)

Table 67 RoW: Market Size Herbicides, By Type, 20142022 (USD Million)

Table 68 RoW: Market Size For Herbicides, By Type, 20142022 (KT)

Table 69 RoW: Market Size For Herbicides, By Crop Type, 20142022 (USD Million)

Table 70 RoW: Market Size For Herbicides, By Mode of Action, 20142022 (USD Million)

Table 71 Africa: Market Size For Herbicides, By Type, 20142022 (USD Million)

Table 72 Middle East: Market Size, By Type, 20142022 (USD Million)

Table 73 Ranking Based on Herbicides Sales, 2015

List of Figures (43 Figures)

Figure 1 Herbicides Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Herbicides Market: Data Triangulation

Figure 5 Market Size For Herbicides, By Type, 2016 vs 2022

Figure 6 Cereals & Grains Segment is Projected to Hold the Largest Market Share By 2022

Figure 7 Non-Selective Segment is Projected to Hold the Largest Market Share By 2022

Figure 8 South America is Expected to Dominate the Herbicides Market From 2016 to 2022

Figure 9 Increasing Applicability of Herbicides Provides Opportunities for This Market

Figure 10 Glyphosate Segment to Grow at the Highest Rate

Figure 11 South American Region Was the Largest Market for Herbicides in 2015

Figure 12 India is Projected to Be the Fastest-Growing Country-Level Market for Herbicides From 2016 to 2022

Figure 13 South America Dominated the Herbicides Market for Oilseeds & Pulses in 2015

Figure 14 Herbicides Market in Asia-Pacific is Experiencing Rapid Growth

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Rice Production in Asian Countries (20142015)

Figure 17 Gross Agriculture Production Index: Asia

Figure 18 Value Chain Analysis for Herbicides Market: Major Value is Added During Registration and Formulation

Figure 19 Supply Chain for Herbicides Market

Figure 20 Glyphosate Projected to Grow at the Highest Rate From 2016 to 2022

Figure 21 Non-Selective Segment is Expected to Dominate the Herbicides Market, 2016-2022 (USD Billion)

Figure 22 South America is Expected to Dominate the Non-Selective Herbicides Market, 2016-2022 (USD Billion)

Figure 23 Cereals & Grains is Expected to Have has the Largest Market Share During 20162022

Figure 24 South America Accounted for the Largest Market Share in the Global Market for Herbicides

Figure 25 Regional Snapshot: Asia-Pacific Herbicide Market is Projected to Grow at the Highest CAGR During 2016 to 2022

Figure 26 Asia-Pacific: Market Snapshot

Figure 27 South America: Market Snapshot

Figure 28 Companies Adopted New Product Launches and Product Approvals as the Key Growth Strategy

Figure 29 New Product Launches and Product Approvals Was the Key Strategy 20122016

Figure 30 BASF SE: Company Snapshot

Figure 31 BASF SE: SWOT Analysis

Figure 32 The DOW Chemical Company: Company Snapshot

Figure 33 The DOW Chemical Company: SWOT Analysis

Figure 34 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 35 E.I. Du Pont De Nemours and Company: SWOT Analysis

Figure 36 Monsanto Company: Company Snapshot

Figure 37 Monsanto Company : SWOT Analysis

Figure 38 Syngenta AG: Company Snapshot

Figure 39 Syngenta AG: SWOT Analysis

Figure 40 FMC Corporation: Company Snapshot

Figure 41 Platform Specialty Products Corporation.: Company Snapshot

Figure 42 Nufarm Limited: Company Snapshot

Figure 43 Nissan Chemical Industries Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Herbicides Market

Need information on the Canadian and US Selective herbicide market in terms of players and brands and the channels where these are sold. Also need market size data and market share information along with information on European herbicide market for all the segments in the region not limited to Golf & Sports, and Agriculture.

Interested in global herbicide consumption by crops and countries