Bioherbicides Market by Source (Microbials, Biochemicals & Others), Application Mode (Seed, Soil, Foliar, Post-harvest), Formulation (Granular, Liquid & Others), Application, & by Region - Global Trends & Forecast to 2021

[162 Pages Report]The overall bioherbicides market is projected to grow from USD 801.0 million in 2016 to USD 1,573.7 million by 2021, at a CAGR of 14.5% from 2016 to 2021. Bioherbicides are organic or biological agents used to control weeds. There are various benefits of bioherbicides, the major one being, they can last across crop cycles until all unwanted crops are weeded out. The bioherbicides market has been growing consistently over the past few years. It is witnessing growth due to the strong initiatives with regard to developments in the organic food products industry. With advances in genetic studies and other technological advancements, new bioherbicide products are being developed, which are more effective against the weeds. Government initiatives to promote adoption of biologicals for integrated pest management further supported the bioherbicides market on exponential growth in the coming years. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Increasing demand for organic products

- Reduced chemical hazards and easier residue management

- Support from the government

Restraints

- Low consumer adoption & awareness

- Low availability & low shelf life of bioherbicides

Opportunities

- Advancements in R&D and integrated pest management (IPM)

- Rapid growth in biocontrol seed treatment solutions

- Progress in new & emerging markets-Latin America and Asia Pacific

Challenges

- Requirement of new skills & technology

- Product limitations of bioherbicides

The increasing demand for organic products drives the global bioherbicides market

The bioherbicides market for organic products is growing at a substantial rate due to increasing consumer interest. The main reasons for the increase in demand for the organic food market are growth in the number of health conscious individuals, increase in environmental concerns, and support provided by the respective governments through subsidies and premium market environments. This provides opportunities to farmers all over the world to produce crops using organic methods, which further drive the bioherbicides market. Also, there has been a significant change in the eating habits and preferences of people, globally. The organic food products market is also expected to benefit from subsidies, financial aids, and R&D programs conducted by different government and non-government organizations-FiBL (Switzerland), APEDA (Agricultural & Processed Food Products Export Development Authority) (India), and the United States Department of Agriculture (USDA) (US)-to help traditional farmers switch to organic farming. Growth in the organic food industry is triggering the demand for bioherbicides, along with organic manures, as these are the prerequisites of organic farming

The following are the major objectives of the study.

- To define, segment, and measure the bioherbicides market with respect to source, formulation, application, application mode, mode of action, and region

- To provide detailed information regarding the crucial factors influencing the growth of the bioherbicides market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To project the size of the bioherbicides market, in terms of value (USD million) in the five main regions, namely, North America, Europe, Asia Pacific, Latin America, and Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and collaborations in the agricultural inoculants market

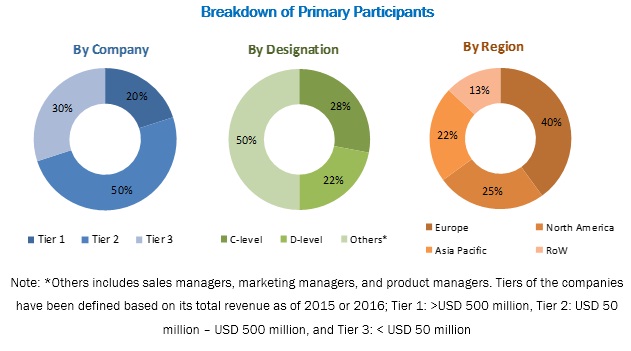

During this research study, major players operating in the bioherbicides market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for the key insights (both qualitative and quantitative) pertaining to the bioherbicides market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The bioherbicides market comprises a network of players involved in the research and product development; raw material supply; bioherbicide manufacturing; distribution and sale. Key players considered in the analysis of the bioherbicides market are Emery Oleochemicals (Malaysia), Deer Creek Holdings (US), Verdesian Life Sciences, LLC (US), Marrone Bio Innovations Inc. (US), Certified Organics Australia Pty Ltd (Australia), EcoPesticides International, Inc. (US), Bioherbicides Australia Pty Ltd. (Australia), Hindustan Bio-tech (India), and Special Biochem Pvt. Ltd. (India).

Major Market Developments

- In January 2016, MycoLogic Inc. Innovative Biologicals (Canada), entered into a license agreement with Lallemand Inc. (Canada). This helped the company to further develop its bioherbicide product in Canada and the US, and expand the market. It also facilitated the on-going development and registration of a similar Chondrostereum product for the European market.

- In December 2014, Marrone Bio Innovations Inc. (US), launched Phoma, a fungal bioherbicide which controls Canada thistle, dandelion, and wild mustard. It was approved by Health Canada’s Pest Management Regulatory Agency (PMRA) for turfgrass in 2011.

- In May 2014, Canada’s Health Pest Management Regulatory Agency (PMRA) approved EMERION 7005, a bioherbicide used in weed and crop management, developed by Emery Oleochemicals (Malaysia).

Target Audience

- Bioherbicide manufacturers

- Bioherbicide importers and exporters

- Government regulatory authorities and research organizations

- Bioherbicide associations and industry bodies

- Organic certification agencies

- Crop producers and exporters

Report Scope

By Source

- Microbial

- Biochemical

- Others (plant phytotoxic residues and other botanical extracts)

By Formulation:

- Granular

- Liquid

- Others (pellets, dust, and powder form)

By Mode of Application

- Seed treatment

- Soil application

- Foliar

- Post-harvest

By Application:

- Agricultural crops

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Non-agricultural crops

- Turf & ornamentals

- Plantation crops

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World (RoW)

Critical questions which the report answers

- What are the major opportunities for growth of bioherbicides market?

- Which are the key players and how consolidated is the bioherbicides market?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

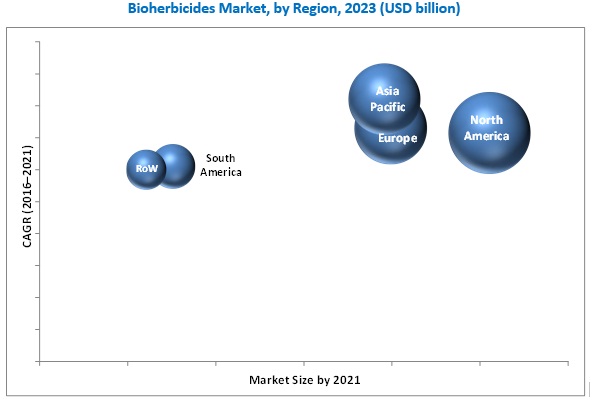

The overall bioherbicides market is projected to grow from USD 801.0 million in 2016 to reach USD 1,537.7 million in 2021, at a CAGR of 14.5%. The demand for bioherbicides has been witnessing significant demand in developing countries such as China, India, Thailand, and Vietnam because of the rising domestic demand. Factors such as rising adoption of integrated pest management along with sustainable farming practices are the major driving factor for this market. Moreover, bioherbicides help in decreasing the maximum residue levels (MRLs) laid for a pesticide by government authorities.

The increased food demand has led to extensive chemical use in agricultural practices, which ensures a qualitative yield. The agricultural export market, in particular, is more concerned about the quality standards of the produce. Due to chemical hazards, consumers, as well as governmental bodies, are largely emphasizing on chemical-free agricultural pesticides and fertilizers. Various programs designed by governments and different agencies are being conducted across the globe to promote the application of bioherbicides. Increasing need for sustainable agriculture has changed drastically with the passage of time and advancement in technology and research. For instance, the European market is responding to the demands of the consumer by supplying products with lower pesticide residue, according to the standard MRL limits.

The bioherbicides market has been segmented, on the basis of mode of application, into seed treatment, soil application, foliar, and post-harvest. The bioherbicides market for foliar application is projected to dominate the market between 2016 and 2021. The precise application of bioherbicides with lower application rates and ability to overcome the attacks during growth phase are the major reasons for increasing development of these products in the bioherbicides market.

The bioherbicides market in the Asia Pacific region is projected to grow at the highest CAGR during the forecast period. The increasing agricultural practices and requirement of high-quality agricultural produce are projected to drive the bioherbicides market in this region. The increasing interest of the population in developed countries for organically grown food products is also expected to strengthen the demand for bioherbicides in various crop applications such as pulses, cereals, grains, and oilseeds. The government organizations in many countries such as India, China, Japan, and Australia are promoting the use of bioherbicides to protect the environment. The Asia Pacific bioherbicides market is fragmented among multinational companies and numerous small-scale manufacturers who produce bioherbicides depending on the crops cultivated.

Rise in the number of launches of microbial herbicides from key players has been witnessed to meet the demand potential of this market

Microbials

Microbial bioherbicides contain microorganisms as the main active ingredient that controls the growth of weeds. Microbials can control many different kinds of weeds, where it can still be specific to a particular weed. The main microbial weed controlling fungi include coelomycetes, hyphomycetes, agaricomycetes, ascomycetes, and oomycetes.

Biochemicals

Biochemicals contain naturally occurring substances that control the growth of weeds by the non-toxic mechanism. These products, which include organic acids, fats, and oils, improve the management of weeds in organic agriculture and provide new modes of action. It is sometimes difficult to determine whether a substance meets the criteria for classification as a biochemical pesticide as in the case of US EPA regulations.

Critical questions the report answers:

- What are the strategies adopted by players in the crop protection industry to cope with the developments in bioherbicides market?

- What are the upcoming technological innovations in bioherbicides market?

Despite various advantages, several barriers restrict the adoption of bioherbicides by farmers. The presence of many large-scale market players of chemical pesticides, which have large economies of scale, is one of the major barriers restricting the entry of small-scale bioherbicide producers in the bioherbicides market. The fact that chemical pesticides are much cheaper than bioherbicides makes it difficult for small bioherbicide companies to develop marketing programs, educate the masses, and to conduct field trials. Moreover, the shelf life of bioherbicides is evaluated by the number of viable spores and formulation (solid or liquid formulations). Bioherbicides are easily affected by various biotic and abiotic stress factors in farm fields because they are naturally occurring organisms or substances. This can directly affect their efficacy in the field and can become low or inactive.

Key players in the bioherbicides market include Emery Oleochemicals (Malaysia), Deer Creek Holdings (US), Verdesian Life Sciences, LLC (US), Marrone Bio Innovations Inc. (US), Certified Organics Australia Pty Ltd. (Australia), EcoPesticides International, Inc. (US), Bioherbicides Australia Pty Ltd. (Australia), Hindustan Bio-tech (India), and Special Biochem Pvt. Ltd. (India). These players have been launching new bioherbicide products, specifically for developing regions, and have also been collaborating with small players to develop new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Source

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 33)

4.1 Opportunities in the Bioherbicides Market

4.2 Bioherbicides Market, Key Countries, 2016

4.3 Life Cycle Analysis: Bioherbicides Market, By Region

4.4 Bioherbicides Market, By Application, 2016 vs 2021

4.5 Bioherbicides Market, By Formulation, 2016 vs 2021

4.6 Asia-Pacific to Be the Fastest-Growing Market for Bioherbicides, 2016–2021

4.7 Developed vs Emerging Bioherbicides Markets, 2016 vs 2021

4.8 Bioherbicides Market, By Application Mode & Region, 2016

4.9 Bioherbicides Market, By Source & Region, 2015

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Macro Indicators

5.2.1 Increase in the Global Population

5.2.2 GDP: Agricultural Sector

5.2.3 Global Availability of Arable Land

5.3 Market Segmentation

5.3.1 By Source

5.3.2 By Formulation

5.3.3 By Mode of Application

5.3.4 By Application

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand for Organic Products

5.4.1.2 Reduced Chemical Hazards and Easier Residue Management

5.4.1.3 Support From the Government

5.4.2 Restraints

5.4.2.1 Low Consumer Adoption & Awareness

5.4.2.2 Low Availability & Low Shelf Life of Bioherbicides

5.4.3 Opportunities

5.4.3.1 Advances in Research & Development and Integrated Pest Management (IPM)

5.4.3.2 Rapid Growth in Biocontrol Seed Treatment Solutions

5.4.3.3 Progress in New & Emerging Markets: Latin America & Asia-Pacific

5.4.4 Challenges

5.4.4.1 Requirement of New Skills & Technology

5.4.4.2 Product Limitations of Bioherbicides

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users (Manufacturers/Consumers)

6.3.4 Key Influencers

6.4 Porter’s Five Forces Analysis

6.4.1 Intensity of Competitive Rivalry

6.4.2 Bargaining Power of Suppliers

6.4.3 Bargaining Power of Buyers

6.4.4 Threat of New Entrants

6.4.5 Threat of Substitutes

6.5 Regulatory Environment

6.5.1 Registered Microbial Bioherbicides, 1980-2015

6.5.2 Registered Als

6.5.3 Commercially Registered Bioherbicides

6.5.4 Patents for Bioherbicides

6.5.4.1 Natural Bioherbicides and Related Materials & Methods

6.5.4.2 Bioherbicide From Festuca SPP

6.5.4.3 Chickweed Bioherbicides

7 Bioherbicides Market, By Source (Page No. - 63)

7.1 Introduction

7.2 Microbials

7.3 Biochemicals

7.4 Others

8 Bioherbicides Market, By Application (Page No. - 69)

8.1 Introduction

8.2 Agricultural Crop Type

8.2.1 Cereals & Grains

8.2.2 Oilseeds & Pulses

8.2.3 Fruits & Vegetables

8.3 Non-Agricultural Crop Type

8.3.1 Turf & Ornamentals

8.3.2 Plantation Crops

9 Bioherbicides Market, By Formulation (Page No. - 78)

9.1 Introduction

9.2 Granular

9.3 Liquid

9.4 Others

10 Bioherbicides Market, By Mode of Application (Page No. - 84)

10.1 Introduction

10.2 Seed Treatment

10.3 Soil Application

10.4 Foliar

10.5 Post-Harvest

11 Bioherbicides Market, By Mode of Action (Page No. - 92)

11.1 Introduction

11.2 MOA Involving Photosynthesis

11.3 MOA Targeting Enzymes

11.4 Others

12 Bioherbicides Market, By Region (Page No. - 94)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 France

12.3.2 Spain

12.3.3 Italy

12.3.4 Germany

12.3.5 U.K.

12.3.6 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 India

12.4.3 Japan

12.4.4 Australia

12.4.5 Rest of Asia-Pacific

12.5 Latin America

12.5.1 Brazil

12.5.2 Argentina

12.5.3 Rest of Latin America

12.6 Rest of the World (RoW)

12.6.1 South Africa

12.6.2 Middle East

12.6.3 Others in RoW

13 Competitive Landscape (Page No. - 128)

13.1 Overview

13.2 Competitive Situation & Trends

13.2.1 New Product Launches & Product Registrations

13.2.2 Expansions

13.2.3 Agreements

13.2.4 Acquisitions & Investments

13.2.5 Partnerships

13.2.6 Research & Development

14 Company Profiles (Page No. - 135)

14.1 Introduction

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

14.2 Marrone Bio Innovations Inc.

14.3 Emery Oleochemicals

14.4 Deer Creek Holdings

14.5 Verdesian Life Sciences

14.6 Certified Organics Australia PTY Ltd

14.7 Ecopesticides International, Inc.

14.8 Special Biochem Pvt. Ltd

14.9 Mycologic Inc. Innovative Biologicals

14.10 Hindustan Bio-Tech

14.11 Bioherbicides Australia PTY Ltd.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15 Appendix (Page No. - 154)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Other Developments

15.4.1 New Product Launches & Product Registrations, 2011–2016

15.4.2 Acquisitions & Investments, 2011–2016

15.4.3 Partnerships, 2011–2016

15.5 Introducing RT: Real-Time Market Intelligence

15.6 Available Customizations

15.7 Related Reports

List of Tables (75 Tables)

Table 1 Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 2 Bioherbicides Market Size, By Source, 2014–2021 (KT)

Table 3 Microbials Market Size, By Region, 2014–2021 (USD Million)

Table 4 Biochemicals Market Size, By Region, 2014–2021 (USD Million)

Table 5 Others Market Size, By Region, 2014–2021 (USD Million)

Table 6 Bioherbicides Market Size, By Application, 2014-2021 (USD Million)

Table 7 Bioherbicides Market Size, By Application, 2014-2021 (KT)

Table 8 Bioherbicides Market Size, By Crop Type, 2014-2021 (USD Million)

Table 9 Bioherbicides Market Size for Agricultural Crop Type, By Region, 2014-2021 (USD Million)

Table 10 Bioherbicides Market Size for Non-Agricultural Crop Type, By Non-Crop Type, 2014-2021 (USD Million)

Table 11 Bioherbicides Market Size for Non-Agricultural Crop Type, By Region, 2014-2021 (USD Million)

Table 12 Bioherbicides Market Size, By Formulation, 2014–2021 (USD Million)

Table 13 Bioherbicides Market Size, By Formulation, 2014–2021 (KT)

Table 14 Granular Market Size, By Region, 2014–2021 (USD Million)

Table 15 Liquid Market Size, By Region, 2014–2021 (USD Million)

Table 16 Others Market Size, By Region, 2014–2021 (USD Million)

Table 17 Bioherbicides Market Size, By Mode of Application, 2014-2021 (USD Million)

Table 18 Bioherbicides Market Size, By Mode of Application, 2014-2021 (KT)

Table 19 Seed Treatment Market Size, By Region, 2014-2021 (USD Million)

Table 20 Soil Application Market Size, By Region, 2014-2021 (USD Million)

Table 21 Foliar Market Size, By Region, 2014-2021 (USD Million)

Table 22 Post-Harvest Market Size, By Region, 2016-2021 (USD Million)

Table 23 Bioherbicides Market Size, By Region, 2014-2021 (USD Million)

Table 24 Bioherbicides Market Size, By Region, 2014-2021 (KT)

Table 25 North America: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 26 North America: Bioherbicides Market Size, By Application, 2014-2021 (USD Million)

Table 27 North America: Bioherbicides Market Size, By Mode of Application, 2014-2021 (USD Million)

Table 28 North America: Bioherbicides Market Size, By Formulation, 2014-2021 (USD Million)

Table 29 North America: Bioherbicides Market Size, By Country, 2014-2021 (USD Million)

Table 30 U.S.: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 31 Canada: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 32 Mexico: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 33 Europe: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 34 Europe: Bioherbicides Market Size, By Application, 2014–2021 (USD Million)

Table 35 Europe: Bioherbicides Market Size, By Mode of Application, 2014–2021(USD Million)

Table 36 Europe: Bioherbicides Market Size, By Formulation, 2014–2021 (USD Million)

Table 37 Europe: Bioherbicides Market Size, By Country, 2014–2021 (USD Million)

Table 38 France: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 39 Spain: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 40 Italy: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 41 Germany: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 42 U.K.: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 43 Rest of Europe: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 44 Asia-Pacific: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 45 Asia-Pacific: Bioherbicides Market Size, By Application, 2014–2021 (USD Million)

Table 46 Asia-Pacific: Bioherbicides Market Size, By Mode of Application, 2014–2021 (USD Million)

Table 47 Asia-Pacific: Bioherbicides Market Size, By Formulation, 2014–2021 (USD Million)

Table 48 Asia-Pacific: Bioherbicides Market Size, By Country, 2014–2021 (USD Million)

Table 49 China: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 50 India: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 51 Japan: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 52 Australia: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 53 Rest of Asia-Pacific: Bioherbicides Market Size, By Source, 2014–2021 (USD Million)

Table 54 Latin America: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 55 Latin America: Bioherbicides Market Size, By Application, 2014-2021 (USD Million)

Table 56 Latin America: Bioherbicides Market Size, By Mode of Application, 2014-2021 (USD Million)

Table 57 Latin America: Bioherbicides Market Size, By Formulation, 2014-2021 (USD Million)

Table 58 Latin America: Bioherbicides Market Size, By Country, 2014-2021 (USD Million)

Table 59 Brazil: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 60 Argentina: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 61 Rest of Latin America: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 62 RoW: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 63 RoW: Bioherbicides Market Size, By Application, 2014-2021 (USD Million)

Table 64 RoW: Bioherbicides Market Size, By Mode of Application, 2014-2021 (USD Million)

Table 65 RoW: Bioherbicides Market Size, By Formulation, 2014-2021 (USD Million)

Table 66 RoW: Bioherbicides Market Size, By Country, 2014-2021 (USD Million)

Table 67 South Africa: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 68 Middle East: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 69 Others in RoW: Bioherbicides Market Size, By Source, 2014-2021 (USD Million)

Table 70 New Product Launches & Product Regictrations, 2011–2016

Table 71 Expansions, 2011–2016

Table 72 Agreements, 2011–2016

Table 73 Acquisitions & Investments, 2011–2016

Table 74 Partnerships, 2011–2016

Table 75 Research & Development, 2011–2016

List of Figures (64 Figures)

Figure 1 Bioherbicides Market Segmentation

Figure 2 Bioherbicides Market: Research Design

Figure 3 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Bioherbicides Market Size, By Source, 2016 vs 2021 (USD Million)

Figure 8 Bioherbicides Market Size, By Application Mode, 2016 vs 2021 (USD Million)

Figure 9 Bioherbicides Market Size, By Application, 2016 vs 2021 (USD Million)

Figure 10 Bioherbicides Market Size, By Formulation, 2016 vs 2021 (USD Million)

Figure 11 Bioherbicides Market Trend, By Region, 2014-2021

Figure 12 Asia-Pacific is Projected to Be the Fastest-Growing Region for the Bioherbicides Market From 2016 to 2021

Figure 13 Easier Residue Management and Increasing Demand for Organic Products Drive the Growth of the Bioherbicides Market, 2016 -2021

Figure 14 Emerging Economies to Drive the Growth of the Global Bioherbicides Market From 2016 to 2021

Figure 15 Latin America Poised for Robust Growth From 2016 to 2021

Figure 16 Fruits & Vegetables Projected to Record Highest Growth Between 2016 & 2021

Figure 17 Liquid Formulation Segment Projected to Record High Growth Between 2016 & 2021

Figure 18 Soil Treatment and Foliar Application Mode Expected to Dominate the Bioherbicides Market in the Asia-Pacific, 2016

Figure 19 China & India are Expected to Be the Most Attractive Markets for Bioherbicides From 2016 to 2021

Figure 20 Foliar Segment Estimated to Be the Largest for Bioherbicides, 2016

Figure 21 Bioherbicides Market Was the Largest, in Terms of Type, 2015

Figure 22 Global Population Projected to Reach ~9.5 Billion By 2050

Figure 23 GDP: Contribution From Agricultural Sectors of Key Countries in 2014

Figure 24 Global Arable Land (000’ Hectares), 2009-2013

Figure 25 Bioherbicides Market, By Source

Figure 26 Bioherbicides Market, By Formulation

Figure 27 Bioherbicides Market, By Mode of Application

Figure 28 Bioherbicides Market, By Application

Figure 29 Bioherbicides Market Dynamics

Figure 30 U.S. Organic Food Sales, By Category, 2005-2014

Figure 31 Value Chain Analysis: Major Value is Added During the Product Development Phase

Figure 32 Bioherbicides: Supply Chain Analysis

Figure 33 Porter’s Five Forces Analysis

Figure 34 Microbials to Form the Fastest-Growing Segment of Bioherbicides Market Between 2016 & 2021 (USD Million)

Figure 35 Microbials Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 36 Biochemicals Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 37 Others Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 38 Bioherbicides Market Size, By Application, 2016 vs 2021 (USD Million)

Figure 39 Bioherbicides Market Size, By Crop Type, 2016 vs 2021 (USD Million)

Figure 40 Bioherbicides Market Size, By Crop Type, 2016 vs 2021 (USD Million)

Figure 41 Bioherbicides Market Size, By Formulation, 2016 vs 2021 (USD Million)

Figure 42 Granular Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 43 Liquid Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 44 Others Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 45 Bioherbicides Market Size, By Mode of Application, 2016 vs 2021 (USD Million)

Figure 46 Seed Treatment Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 47 Soil Application Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 48 Foliar Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 49 Post-Harvest Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 50 Geographic Snapshot (2014-2021): Rapidly Growing Markets are Emerging as New Hot Spots

Figure 51 North America: Bioherbicides Market Snapshot

Figure 52 European Bioherbicides Market: Snapshot

Figure 53 Asia-Pacific: Bioherbicides Market: Snapshot

Figure 54 Latin America: Bioherbicides Market: Snapshot

Figure 55 Expansions and New Product Launches Were Preferred By Key Bioherbicides Companies From 2011 to 2016

Figure 56 New Product Launches Fueled Growth & Innovation of Bioherbicides Between 2011 and 2015

Figure 57 New Product Launches, Expansions & Agreements: the Key Strategies, 2011–2016

Figure 58 Top Five Companies: Product Mapping

Figure 59 Marrone Bio Innovations Inc.: Company Snapshot

Figure 60 Marrone Bio Innovations Inc.: SWOT Analysis

Figure 61 Emery Oleochemicals: SWOT Analysis

Figure 62 Deer Creek Holdings: SWOT Analysis

Figure 63 Verdesian Life Sciences: SWOT Analysis

Figure 64 Certified Organics Australia PTY Ltd: SWOT Analysis

Growth opportunities and latent adjacency in Bioherbicides Market