Halogen-Free Flame Retardant Bopet Films Market by End-use Industry (Electrical Insulation, Transportation, Building & Construction), Region (APAC, North America, Europe, Rest Of World) - Global Forecast to 2026

Updated on : September 03, 2025

Halogen-Free Flame Retardant Bopet Films Market

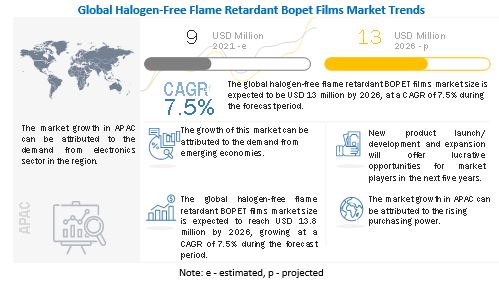

The halogen-free flame retardant BOPET films market was valued at USD 9 million in 2021 and is projected to reach USD 13 million by 2026, growing at 7.5% cagr from 2021 to 2026. The market is witnessing growing demand from end-use industries such as electrical insulation, transportation, and building & construction. Its growth is attributed to stringent government rules against the toxicity of halogenated flame retardants and strict fire-safety guidelines.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on the Global Halogen-Free Flame Retardant BOPET Films Market

The global pandemic has affected almost every sector in the world economy. The halogen-free flame retardant BOPET films market is expected to be negatively affected due to the disturbance in the global supply chain. The market is highly dependent on the growth in the electronics, building & construction, and transportation industries. China is the major market for electronics and building & construction in the world. Strict lockdown in the country’s major provinces has affected construction activities in China. The demand for construction equipment largely declined in the first quarter of this year, mainly due to the outbreak of COVID-19. Electrical insulation is the largest end-use industry in the halogen-free flame retardant BOPET films market. COVID-19 created severe disruption in electronics production and demand during the first half of 2020. The electronic supply chain is highly integrated across different economies globally, also has been adversely affected due to the pandemic. The electronics industry is an essential part of the export sector for many East Asian countries such as China, Vietnam, Taiwan, South Korea, Singapore, Malaysia, Thailand, and the Philippines. China is an important supplier of intermediate electronics parts to a number of Southeast Asian electronic sectors. Although production activities in China were severely affected during the first half of 2020, which further disrupted the supply chain of electronics items, the market has experienced a significant rebound since the fourth quarter of 2020.

Halogen-Free Flame Retardant Bopet Films Market Dynamics

Driver: Stringent government rules against toxicity of halogenated flame retardants

Halogenated flame retardants, along with their synergist (antimony trioxide, zinc-based substances), are highly toxic and also produce harmful gases/fumes on exposure to fire. These retardants act directly to the core of the fire. Also, these halogenated flame retardants and some of their derivatives pose a threat to the environment, as they get bio-accumulated in vegetation, water sources, and living beings. HFR chemicals pose a greater hazard to the environment. With the increasing environmental consciousness and growing popularity and demand for flame retardants in almost every end-use industry, there is a need to switch to better alternatives adhering to the environmental regulations.

Restraint: High loading levels

One of the major restraining factors for halogen-free flame retardant BOPET films is the high loading levels in its mineral-based flame retardants. Their initial loadings as fillers in the polymer matrix are kept high to attain flame retardant properties. Excessive loading increases the density and reduces the mechanical properties (thermal stability) of the final product. This process of adding fillers in high quantity to polymers affects their original chemical and rheological properties.

Opportunity: Developing more effective synergist compounds

To boost the performance of flame retardants, compounds such as aluminum/magnesium hydroxides, phosphorus, and zinc are added to polymer blends. With the combination of such blends in a polymer matrix, the combined effect is more efficient than the compounds acting separately. Synergist blends help in reducing the amount of halogenated flame retardants in BOPET films by percent weight, and thus, reduce the toxicity issues and improve retardant properties. Flame retardants are used as additives/reactive agents in submicron particles so that the original properties of polymeric material remain unaffected, leading the competitors in the manufacturing sector to gain an advantage over each other.

Challenges: Challenges in the recycling of multilayer films

Multilayer films offer properties, such as improved strength and robustness, which cannot be obtained from single-layer films. Multilayer films are made by arranging two or more co-extruded films or laminated films to form one homogenous film with distinct individual layers. Multilayer films provide a range of properties that cannot be obtained from monolayer films. However, the recyclability of these multilayer films is a major challenge as these films are produced by using different materials. Thus, recycling of different materials needs different processing, thus, making it difficult to recycle.

Electrical Insulation is the largest end-use industry segment of the halogen-free flame retardant BOPET films market

The electrical insulation segment accounted for the largest share in the global halogen-free flame retardant BOPET films market during the forecast period. The increase in manufacturing of wires & cables and rising demand for high quality consumer electronics will drive the market. Halogen-free flame retardant BOPET films are used for insulation applications in motor winding, transformers, television screen films, battery labels, flexible printed circuits, wires & cables (secondary insulation), and semiconductors. Moreover, halogen-free flame retardant BOPET films are used to match the level of fire resistance that must be achieved based on the fire safety standards.

APAC is the largest and fastest-growing market for halogen-free flame retardant BOPET films market

APAC is projected to be the largest market for halogen-free flame retardant BOPET films during the forecast period and is projected to register the highest CAGR. The high economic growth in developing countries and increasing disposable incomes have made APAC an attractive market for halogen-free flame retardant BOPET films. The tremendous growth of industrial production increased trade, and the implementation of stringent regulations are primarily responsible for the high consumption of halogen-free flame retardant BOPET films in the region. China, Japan, South Korea, and India are the major markets for halogen-free flame retardant BOPET films in the region. Government regulations are being set up regarding the use of these films in APAC countries, which will boost the market during the forecast period. The market in this region is primarily driven by the demand from the electrical & electronics industry and the growing economy.

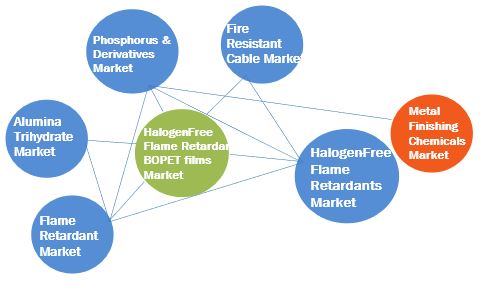

Halogen-Free Flame Retardant Bopet Films Market Interconnections

Halogen-Free Flame Retardant Bopet Films Market Players

Toray Industries, Inc. (Japan), Mitsubishi Chemical Holdings Corporation (Japan), DuPont Teijin Films (US), Shanghai Huzheng Industrial Co., Ltd. (China), Mainyang Prochema Commercial Co. Ltd. (China), and Teraoka Seisakusho Co. Ltd. (Japan)are the key players operating in the halogen-free flame retardant BOPET films market.

These companies have adopted several growth strategies to strengthen their position in the market. partnership/collaboration/alliance, joint ventures, new product launch/development, expansion/investment, mergers & acquisitions are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for halogen-free flame retardant BOPET films from emerging economies.

Halogen-Free Flame Retardant Bopet Films Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments |

End-Use Industry |

|

Regions |

APAC, Europe, North America, Rest of World |

|

Companies |

Toray Industries, Inc. (Japan), Mitsubishi Chemical Holdings Corporation (Japan), DuPont Teijin Films (US), Shanghai Huzheng Industrial Co., Ltd. (China), Mainyang Prochema Commercial Co. Ltd. (China), and Teraoka Seisakusho Co. Ltd. (Japan), and others. |

This research report categorizes the halogen-free flame retardant BOPET films market based on end-use industry and region.

The Halogen-Free Flame Retardant Bopet Films Market By End-Use Industry:

- Electrical Insulation

- Transportation

- Building & Construction

- Others (solar backup panels and lighting)

The Halogen-Free Flame Retardant Bopet Films Market, By Region:

- APAC

- Europe

- North America

- Rest of World

Recent Developments

- In December 2020, Toray Industries, Inc. launched Ecouse series of eco-friendly Polyethylene Terephthalate (PET) films. Ecouse PET films are made from used films from electronic components application. This new film will help to reduce carbon dioxide emission by 30-50% compared to conventional films. It is used in packaging, electronic components, and display items. This new product development is aimed to add sustainable products to its product portfolio.

- In December 2020, Mitsubishi Chemical Holdings Corporation established a new subsidiary company Mitsubishi Chemical Holdings Asia Pacific Pte. Ltd. (Singapore). This new expansion is aimed at strengthening governance in the APAC region.

- In April 2020, DuPont Teijin Films launched Melinex FR32x PET films, which is a clear flame retardant halogen-free PET polyester film. These films comply with UL’s VTM-0 flame rating classification in accordance with ANSI / UL 94 and can be used in electronics, industrial, transportation, label, and construction industries. This new product launch will help the company to cater to the growing demand for high-performance environmentally friendly PET films.

- In December 2019, Toray Industries, Inc. established a new R&D Innovation Center in Otsu, Japan. This expansion is aimed at driving growth by developing technologies and using research through collaboration among its domestic and overseas production and sales offices.

- In October 2019, DuPont Teijin Films launched a wide range of super clear Ultra-Violet (UV) stable polyester films under the brand Melinex TCH. These new products block UV transmissions and retain optical and mechanical properties during the course of work. This new product is aimed at strengthening the company’s product portfolio and cater to the growing demand for UV stable polyester films in flexible electronics, lightening, photovoltaic, and label industries.

- In September 2018, Mitsubishi Polyester Film, Inc. (a subsidiary company of Mitsubishi Chemical Holdings Corporation) started a new production line for Biaxially Oriented Polyester (BOPET) film at its Greer, South Carolina (US) plant. It is a USD 100 million investment to increase the production capacity of BOPET film. This expansion is aimed to cater to the increasing demand for BOPET film in electronics and industrial packaging.

- In June 2018, Toray Industries, Inc. established a new representative office for its Thai Toray Synthetics Co., Ltd. (Thailand) in Hanoi, Vietnam. This organic growth strategy is aimed at catering to the growing engineering plastic demand in Vietnam.

- In September 2017, Toray Industries, Inc. signed an agreement with Idemitsu Kosan Co. Ltd. (Japan) for technical cooperation for OLED materials. This agreement is aimed at improving the durability and performance of OLED materials, which will drive growth for the company.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the halogen-free flame retardant BOPET films market?

To boost the performance of flame retardants, compounds such as aluminum/magnesium hydroxides, phosphorus, and zinc are added to polymer blends. With the combination of such blends in a polymer matrix, the combined effect is more efficient than the compounds acting separately. Synergist blends help in reducing the amount of halogenated flame retardants in BOPET films by percent weight, and thus, reduce the toxicity issues and improve retardant properties.

What are the market dynamics for the different materials of halogen-free flame retardant BOPET films?

The market players mainly concentrate on consolidation through product innovation and expansion to capture and maintain their market share. This has broadened product lines in major companies. The halogen-free flame retardant BOPET films market remains highly fragmented, with numerous small and medium players and few prominent players.

What are the market dynamics for the different end-use industries of halogen-free flame retardant BOPET films?

The halogen-free flame retardant BOPET films market is segmented on the basis of end-use industry into electrical insulation, transportation, and building & construction. The electrical insulation segment accounted for the largest share in the global halogen-free flame retardant BOPET films market during the forecast period.

Who are the major manufacturers of halogen-free flame retardant BOPET films market?

Toray Industries, Inc. (Japan), Mitsubishi Chemical Holdings Corporation (Japan), DuPont Teijin Films (US), Shanghai Huzheng Industrial Co., Ltd. (China), Mainyang Prochema Commercial Co. Ltd. (China), and Teraoka Seisakusho Co. Ltd. (Japan) are the key players operating in the halogen-free flame retardant BOPET films market

What are the major factors which will impact market growth during the forecast period?

The halogen-free flame retardant BOPET films market is witnessing growing demand from end-use industries such as electrical insulation, transportation, and building & construction. Its growth is attributed to stringent government rules against the toxicity of halogenated flame retardants and strict fire-safety guidelines.

What are the effects of COVID-19 on halogen-free flame retardant BOPET films market?

The halogen-free flame retardant BOPET films market is expected to be negatively affected due to the disturbance in the global supply chain. The market is highly dependent on the growth in the electronics, building & construction, and transportation industries. Electrical insulation is the largest end-use industry in the halogen-free flame retardant BOPET films market. COVID-19 created severe disruption in electronics production and demand during the first half of 2020. The electronic supply chain is highly integrated across different economies globally, also has been adversely affected due to the pandemic. The electronics industry is an essential part of the export sector for many East Asian countries. China is an important supplier of intermediate electronics parts to a number of Southeast Asian electronic sectors. Although production activities in China were severely affected during the first half of 2020, which further disrupted the supply chain of electronics items, the market has experienced a significant rebound since the fourth quarter of 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH – 1

2.2.2 SUPPLY-SIDE APPROACH – 2

2.2.3 SUPPLY-SIDE APPROACH – 3

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE ANALYSIS

2.3.3 SUPPLY-SIDE ANALYSIS

2.4 MARKET SIZE ESTIMATION

2.5 DATA TRIANGULATION

2.6 MARKET SHARE ESTIMATION

2.7 RESEARCH ASSUMPTIONS & LIMITATIONS

2.7.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 SIGNIFICANT OPPORTUNITIES IN HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET

4.2 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY

4.3 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY REGION

4.4 APAC: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET, BY END-USE INDUSTRY AND COUNTRY, 2020

4.5 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent government rules against toxicity of halogenated flame retardants

5.2.1.2 Strict fire-safety guidelines

5.2.2 RESTRAINTS

5.2.2.1 High loading levels

5.2.2.2 Low performance against halogenated flame retardants

5.2.3 OPPORTUNITIES

5.2.3.1 Developing more effective synergist compounds

5.2.3.2 Emerging economies in APAC

5.2.3.3 Rising demand for consumer electronics worldwide

5.2.4 CHALLENGES

5.2.4.1 Challenges in recycling of multilayer films

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 REGULATORY LANDSCAPE

5.4.1 UNDERWRITERS LABORATORIES (UL) & VTM RATING

5.5 VALUE CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 IMPACT OF COVID-19

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 DOCUMENT TYPE

5.8.3 PATENT PUBLICATION TRENDS

5.8.4 INSIGHT

5.8.5 JURISDICTION ANALYSIS

5.8.6 TOP PATENT APPLICANTS

5.8.7 TOP PATENT OWNERS (US) IN LAST 10 YEARS

5.9 TRADE ANALYSIS

5.9.1 IMPORT-EXPORT SCENARIO OF HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET

5.10 MACRO-ECONOMIC FACTORS

5.10.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

6 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET, BY END-USE INDUSTRY (Page No. - 53)

6.1 INTRODUCTION

6.2 ELECTRICAL INSULATION

6.2.1 IMPACT OF COVID-19 ON ELECTRICAL INSULATION INDUSTRY

6.3 TRANSPORTATION

6.3.1 IMPACT OF COVID-19 ON TRANSPORTATION INDUSTRY

6.4 BUILDING & CONSTRUCTION

6.4.1 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY

6.5 OTHERS

7 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET, BY REGION (Page No. - 61)

7.1 INTRODUCTION

7.2 APAC

7.2.1 CHINA

7.2.1.1 Economic growth in the country supporting the adoption of halogen-free flame retardant BOPET films

7.2.2 JAPAN

7.2.2.1 Rising demand from electrical insulation sector propelling the market

7.2.3 SOUTH KOREA

7.2.3.1 Growth of electronics industry in the country spurring the demand

7.2.4 INDIA

7.2.4.1 Rising industrialization to propel the market growth rate during the forecast period

7.2.5 REST OF APAC

7.3 NORTH AMERICA

7.3.1 US

7.3.1.1 Dominates the halogen-free flame retardant BOPET films market in North America

7.3.2 CANADA

7.3.2.1 Construction industry to boost the demand for halogen-free flame retardant BOPET films

7.3.3 MEXICO

7.3.3.1 Increasing plastics production to boost the market

7.4 EUROPE

7.4.1 GERMANY

7.4.1.1 Germany to lead the halogen-free flame retardant BOPET films market in the region

7.4.2 UK

7.4.2.1 Increased investment by the government in construction and other industries to boost the market in the UK

7.4.3 FRANCE

7.4.3.1 Increase in new construction projects to propel the halogen-free flame retardant BOPET films market

7.4.4 ITALY

7.4.4.1 Growth of the Italian automotive industry to drive the demand for halogen-free flame retardant BOPET films

7.4.5 SPAIN

7.4.5.1 Rising demand from the construction industry to govern the market growth

7.4.6 REST OF EUROPE

7.5 REST OF THE WORLD (ROW)

7.5.1 BRAZIL

7.5.1.1 Growing automotive and power generation industries driving the market

7.5.2 SOUTH AFRICA

7.5.2.1 Second-largest market for halogen-free flame retardant BOPET films

7.5.3 SAUDI ARABIA

7.5.3.1 Third-largest market for halogen-free flame retardant BOPET films

7.5.4 ARGENTINA

7.5.4.1 Growth in industrialization to drive the halogen-free flame retardant BOPET films market

7.5.5 OTHERS

8 COMPETITIVE LANDSCAPE (Page No. - 83)

8.1 INTRODUCTION

8.2 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

8.3 MARKET EVALUATION FRAMEWORK

8.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

8.5 COMPANY EVALUATION QUADRANT

8.5.1 STAR

8.5.2 EMERGING LEADER

8.5.3 PERVASIVE

8.5.4 PARTICIPANT

8.6 COMPETITIVE SCENARIO

9 COMPANY PROFILES (Page No. - 96)

9.1 MAJOR PLAYERS

9.1.1 TORAY INDUSTRIES, INC.

9.1.1.1 Business and financial overview

9.1.1.2 Products/solutions/services offered

9.1.1.3 Recent developments

9.1.1.4 SWOT analysis

9.1.1.5 Winning imperatives

9.1.1.6 Current focus and strategies

9.1.1.7 Threat from competition

9.1.1.8 Right to win

9.1.2 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

9.1.2.1 Business and financial overview

9.1.2.2 Products/solutions/services offered

9.1.2.3 Recent developments

9.1.2.4 SWOT analysis

9.1.2.5 Winning imperatives

9.1.2.6 Current focus and strategies

9.1.2.7 Threat from competition

9.1.2.8 Right to win

9.1.3 DUPONT TEIJIN FILMS

9.1.3.1 Business and financial overview

9.1.3.2 Products/solutions/services offered

9.1.3.3 Recent developments

9.1.3.4 SWOT analysis

9.1.3.5 Winning imperatives

9.1.3.6 Current focus and strategies

9.1.3.7 Threat from competition

9.1.3.8 Right to win

9.1.4 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.

9.1.4.1 Business and financial overview

9.1.4.2 Products/solutions/services offered

9.1.4.3 Recent developments

9.1.4.4 SWOT analysis

9.1.4.5 Winning imperatives

9.1.4.6 Current focus and strategies

9.1.4.7 Threat from competition

9.1.4.8 Right to win

9.1.5 MAINYANG PROCHEMA COMMERCIAL CO. LTD.

9.1.5.1 Business and financial overview

9.1.5.2 Products/solutions/services offered

9.1.5.3 MnM view

9.1.6 TERAOKA SEISAKUSHO CO. LTD.

9.1.6.1 Business and financial overview

9.1.6.2 Products/solutions/services offered

9.1.6.3 MnM view

10 APPENDIX (Page No. - 118)

10.1 DISCUSSION GUIDE

10.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

10.3 AVAILABLE CUSTOMIZATIONS

10.4 RELATED REPORTS

10.5 AUTHOR DETAILS

LIST OF TABLES (74 Tables)

TABLE 1 COUNTRY-WISE REGULATION OR APPROVING AUTHORITIES FOR HALOGEN-FREE FLAME RETARDANT BOPET FILMS

TABLE 2 FLAMMABILITY RATING UL 94 VTM

TABLE 3 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: REGISTERED PATENTS

TABLE 4 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF PATENTS, BY NITTO DENKO CORPORATION

TABLE 5 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF PATENTS, BY MITSUBISHI PLASTICS INC.

TABLE 6 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF PATENTS, BY CLARIANT PLASTICS & COATINGS LTD

TABLE 7 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF PATENTS, BY DUPONT TEIJIN FILMS

TABLE 8 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF PATENTS, BY BASF SE

TABLE 9 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF PATENTS, BY MGC FILSHEET CO., LTD.

TABLE 10 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: LIST OF 20 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 11 IMPORT-EXPORT TRADE DATA FOR SELECTED COUNTRIES, 2019

TABLE 12 TRENDS AND FORECAST OF GDP, BY MAJOR ECONOMIES, 2017–2024 (USD BILLION)

TABLE 13 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 14 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE IN ELECTRICAL INSULATION INDUSTRY, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 15 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 16 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 17 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 18 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 19 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 20 APAC: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 21 APAC: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 22 CHINA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 23 JAPAN: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 24 SOUTH KOREA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 25 INDIA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 26 REST OF APAC: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 27 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 28 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 29 US: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 30 CANADA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 31 MEXICO: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 32 EUROPE: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 33 EUROPE: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 34 GERMANY: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 35 UK: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 36 FRANCE: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 37 ITALY: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 38 SPAIN: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 39 REST OF EUROPE: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 40 ROW: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 41 ROW: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 42 BRAZIL: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 43 SOUTH AFRICA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 44 SAUDI ARABIA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 45 ARGENTINA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 46 OTHERS: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD THOUSAND)

TABLE 47 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: DEGREE OF COMPETITION

TABLE 48 MARKET EVALUATION FRAMEWORK

TABLE 49 COMPANY PRODUCT FOOTPRINT

TABLE 50 COMPANY INDUSTRY FOOTPRINT

TABLE 51 COMPANY REGION FOOTPRINT

TABLE 52 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: PRODUCT LAUNCHES, JANUARY 2017–JANUARY 2021

TABLE 53 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: DEALS, JANUARY 2017- JANUARY 2021

TABLE 54 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: OTHERS, JANUARY 2017- JANUARY 2021

TABLE 55 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

TABLE 56 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

TABLE 57 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 58 TORAY INDUSTRIES, INC.: DEALS

TABLE 59 TORAY INDUSTRIES, INC.: OTHERS

TABLE 60 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY OVERVIEW

TABLE 61 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: PRODUCTS OFFERED

TABLE 62 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: DEALS

TABLE 63 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: OTHERS

TABLE 64 DUPONT TEIJIN FILMS: COMPANY OVERVIEW

TABLE 65 DUPONT TEIJIN FILMS: PRODUCTS OFFERED

TABLE 66 DUPONT TEIJIN FILMS: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 67 DUPONT TEIJIN FILMS: DEALS

TABLE 68 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

TABLE 69 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

TABLE 70 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 71 MAINYANG PROCHEMA COMMERCIAL CO. LTD.: COMPANY OVERVIEW

TABLE 72 MAINYANG PROCHEMA COMMERCIAL CO. LTD.: PRODUCTS OFFERED

TABLE 73 TERAOKA SEISAKUSHO CO. LTD.: COMPANY OVERVIEW

TABLE 74 TERAOKA SEISAKUSHO CO. LTD.: PRODUCTS OFFERED

LIST OF FIGURES (50 Figures)

FIGURE 1 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: MARKET DEFINITION

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET, BY REGION

FIGURE 4 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: RESEARCH DESIGN

FIGURE 5 BREAKDOWN OF PRIMARIES

FIGURE 6 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: SUPPLY-SIDE APPROACH - 1

FIGURE 7 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: SUPPLY-SIDE APPROACH - 2

FIGURE 8 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: SUPPLY-SIDE APPROACH – 3

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 11 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: DATA TRIANGULATION

FIGURE 12 ELECTRICAL INSULATION TO BE THE LARGEST END-USE INDUSTRY FOR HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET

FIGURE 13 APAC ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 14 GROWING ELECTRONICS INDUSTRY TO DRIVE HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET DURING FORECAST PERIOD

FIGURE 15 ELECTRICAL INSULATION TO BE THE LARGEST SEGMENT

FIGURE 16 APAC TO BE LARGEST HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET DURING FORECAST PERIOD

FIGURE 17 CHINA ACCOUNTED FOR THE LARGEST MARKET SHARE

FIGURE 18 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

FIGURE 19 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: MARKET DYNAMICS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 HALOGEN-FREE FLAME RETARDANT BOPET FILMS: VALUE CHAIN ANALYSIS

FIGURE 22 GDP GROWTH RATE, BY KEY COUNTRIES, 2020

FIGURE 23 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: REGISTERED PATENTS

FIGURE 24 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: PATENT PUBLICATION TRENDS, 2015-2020

FIGURE 25 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: JURISDICTION ANALYSIS

FIGURE 26 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET: TOP PATENT APPLICANTS

FIGURE 27 ELECTRICAL INSULATION TO BE THE LARGEST END-USE INDUSTRY DURING THE FORECAST PERIOD

FIGURE 28 APAC TO BE THE LARGEST HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET IN ELECTRICAL INSULATION INDUSTRY

FIGURE 29 EUROPE TO BE THE SECOND-LARGEST HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET IN TRANSPORTATION INDUSTRY

FIGURE 30 APAC TO BE THE LARGEST MARKET IN BUILDING & CONSTRUCTION INDUSTRY

FIGURE 31 NORTH AMERICA TO BE THE SECOND-LARGEST MARKET IN OTHER END-USE INDUSTRIES

FIGURE 32 REGIONAL SNAPSHOT: CHINA TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

FIGURE 33 APAC: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SNAPSHOT

FIGURE 34 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SNAPSHOT

FIGURE 35 EUROPE: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SNAPSHOT

FIGURE 36 COMPANIES ADOPTED NEW PRODUCT LAUNCH/DEVELOPMENT AND EXPANSION AS THE KEY GROWTH STRATEGY, 2017–2021

FIGURE 37 HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET SHARE ANALYSIS, 2020

FIGURE 38 TOP 5 PLAYERS HAVE DOMINATED THE MARKET IN THE LAST 5 YEARS

FIGURE 39 COMPETITIVE LEADERSHIP MAPPING: HALOGEN-FREE FLAME RETARDANT BOPET FILMS MARKET, 2020

FIGURE 40 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 41 TORAY INDUSTRIES, INC.: SWOT ANALYSIS

FIGURE 42 TORAY INDUSTRIES, INC.: WINNING IMPERATIVES

FIGURE 43 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 44 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: SWOT ANALYSIS

FIGURE 45 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: WINNING IMPERATIVES

FIGURE 46 DUPONT TEIJIN FILMS: SWOT ANALYSIS

FIGURE 47 DUPONT TEIJIN FILMS: WINNING IMPERATIVES

FIGURE 48 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.: SWOT ANALYSIS

FIGURE 49 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.: WINNING IMPERATIVES

FIGURE 50 TERAOKA SEISAKUSHO CO. LTD.: COMPANY SNAPSHOT

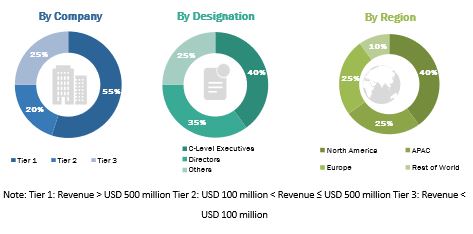

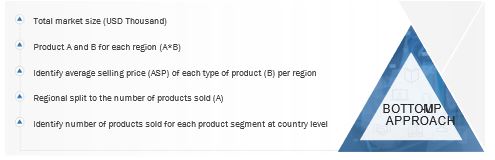

The study involved four major activities in estimating the current market size for the halogen-free flame retardant BOPET films market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The halogen-free flame retardant BOPET films comprise several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The halogen-free flame retardant BOPET films market is witnessing growing demand from end-use industries such as electrical insulation, transportation, and building & construction. Its growth is attributed to stringent government rules against the toxicity of halogenated flame retardants and strict fire-safety guidelines. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of halogen-free flame retardant BOPET films market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Halogen-Free Flame Retardant Bopet Films Market Size: Bottom-UP Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Data Triangulation

- To define, describe, and forecast the global halogen-free flame retardant BOPET films market size, in terms of value

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the halogen-free flame retardant BOPET films market based on end-use industry and region

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, Rest of World along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as partnership/collaboration/alliance, joint ventures, new product launch/development, expansion/investment, mergers & acquisitions in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Halogen-Free Flame Retardant Bopet Films Market