Fire-Resistant Cable Market by Insulation Material (EPR, LSZH, PVC, XLPE), End-use Industry (Automotive & Transportation, Building & Construction, Energy, Manufacturing), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2026

Updated on : September 03, 2025

Fire Resistant Cable Market

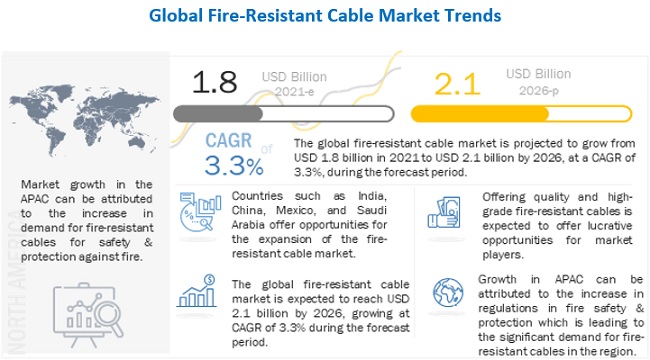

The global fire resistant cable market was valued at USD 1.8 billion in 2021 and is projected to reach USD 2.1 billion by 2026, growing at 3.3% cagr from 2021 to 2026. The market is expected to witness significant growth in the future due to the increasing consumption of fire-resistant cables across building & construction, manufacturing, energy, and automotive industries. Moreover, increasing awareness regarding fire safety, rapid pace of industrialization and urbanization, and the implementation of fire safety regulations by governments across the globe have propelled the consumption of fire-resistant cables.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global fire-resistant cable market

With the rise in cases of COVID-19, the market has faced negative impact on the demand for fire-resistant cables. The fire-resistant cable market has observed a significant decline in its demand in 2020 as well as in the first quarter of 2021, owing to the COVID-19 impact across various end-use industries (majorly the construction, manufacturing & energy industries). . Fire-resistant cable manufacturers were affected in 2020 due to business shutdown mandates, social distancing norms, and limited local and state government office activities. However, the demand for fire-resistant cables was hampered by the pandemic, majorly due to the decline in demand for these cables from the building & construction industry.

Fire Resistant Cable Market Dynamics

Driver: High demand for fire-resistant cables for fire safety & protection

Fire-resistant cables, known as fire-proof cables, fire performance cables, or fire survival cables, offer high resistance to combustion and high temperature, are flexible, and low smoke emitting and low toxicity along with the low generation of acid gases. Fire-resistant cables are designed to help maintain circuit integrity in case of fires. Properties of fire-resistant cables such as resistance to high temperature, low smoke emission, and reduction of corrosive gases help protect and safeguard human life in case of fires. The global market is experiencing an increase in the demand for fire-resistant cables across various end-use industries due to the need for public safety against fires. This indicates the need and growth opportunities for fire-resistant cables across various end-use industries for fire protection & safety during fire mishaps or incidents.

Restraint: Volatility in raw materials prices

Prices of raw materials and energy required to produce fire-resistant cables are volatile. The volatile prices of these materials directly affect the value chain, which includes procurement and operation costs. Sudden increase or decrease in prices affects the profit margin of manufacturers as well. The main raw materials used for the manufacture of fire-resistant cables are rubber, copper, plastic, and aluminum, among others. Volatility in the costs of energy and crude oil, which are required for the manufacture and the transportation of these materials, is the main factor in the fluctuations in the prices of these raw materials. The instability of energy and crude oil costs cause the prices of raw materials to rise, and, in turn, increase the cost of raw materials used in fire-resistant cables. Hence, the prices of these materials have a direct impact on the cost of fire-resistant cables.

Opportunity: Increase in demand for fire-resistant cables for power generation

According to the International Energy Agency, - The global electricity demand in 2021 has increased by 4.5% or over 1 000 TWh. Almost 80% of the projected increase in demand in 2021 is in emerging market and developing economies, with the People's Republic China (China) alone accounting for half of the global growth. According to the US Energy Information Administration, the global demand for energy is expected to increase to 736 quadrillions Btu by 2040. A major part of the rise in demand for energy is expected from the non-OECD countries, particularly India and China, and is expected to account for more than half of the global total energy consumption during this period. The demand is expected to be fulfilled by new generation capacity additions, which are expected to require new transmission and distribution infrastructure, thus creating opportunities for the fire-resistant cable market.

Challenge: Availability of cheap and inferior quality fire-resistant cables

The availability of cheap and duplicates of original branded products is a major challenge for the fire-resistant cable market. These products are generally available at competitive rates than the original products and are comparatively inferior in quality. Leading players are facing challenges from the unorganized sector which offers inexpensive products, particularly in the emerging economies of China and India. In such a competitive environment, it is challenging for the leading market players to enable profit margins and compete with the small unorganized players, which leads to a negative impact on the balance sheets of leading players.

XLPE widely preferred insulation material for fire-resistant cables

Based on insulation material, XLPE is projected to be the largest segment in the fire-resistant cable market. High thermal short circuit rating, excellent electrical property maintained under the complete temperature range, resistance to thermal deformation at high temperatures, excellent water resistance and low permeability to water, excellent chemical resistance, high durability, and long operational life are some of the properties fueling the growth of the XLPE insulation material segment.

Significant increase in the demand for fire-resistant cable from the building & construction industry

By End-use industry, the building & construction segment is projected to be the largest segment in the fire-resistant cable market. Fire-resistant cables can be used for wiring and interconnection purposes in residential and non-residential areas. The cables are easy-to-install, maintain the reliability of electrical circuits, and can withstand high temperatures during fires, thus, ensuring human safety. Increasing awareness about the safety of buildings among the masses has led to the increase in demand for fire-resistant cables. These cables find applications in the distribution of power in almost every commercial and residential building. Increasing construction activities are driving the fire-resistant cable market in the building & construction industry.

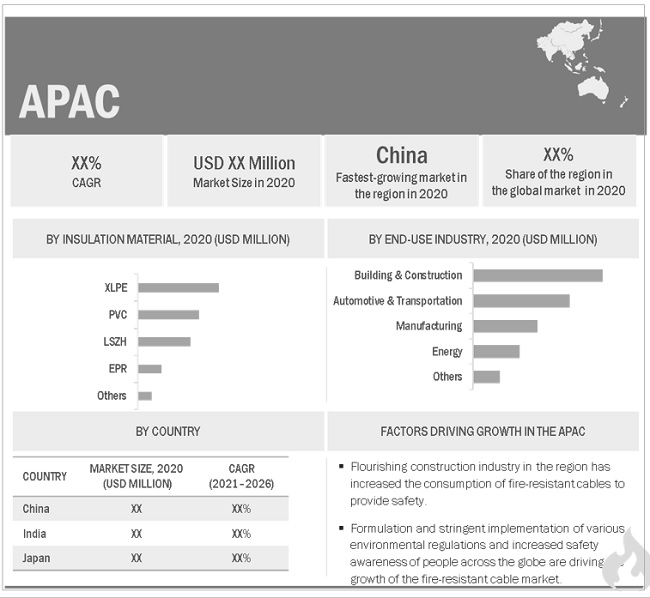

APAC region to lead the global fire-resistant cable market by 2026

The APAC region accounted for the largest market share in 2020. The demand for fire-resistant cables in APAC is mainly driven by China, India, and ASEAN countries, which are experiencing substantial growth in the end-use industries. Increasing population and rapid urbanization are among the key factors expected to propel industry expansion in the region during the forecast period. Growing manufacturing, building & construction, and automotive & transportation industries, among others in several APAC countries are fueling the demand for fire-resistant cables in the region.

To know about the assumptions considered for the study, download the pdf brochure

Fire Resistant Cable Market Players

The fire-resistant cable market is dominated by a few globally established players, such as Prysmian Group (Italy), Nexans S.A. (France), NKT Group (Denmark), LEONI AG (Germany), LS Cable & System Limited (South Korea), and Elsewedy Electric Company (Egypt), amongst others.

Fire Resistant Cable Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.8 billion |

|

Revenue Forecast in 2026 |

USD 2.1 billion |

|

CAGR |

3.3% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Kilometer) |

|

Segments covered |

Insulation Material, End-use Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

Prysmian Group (Italy), Nexans S.A. (France), NKT Group (Denmark), Leoni AG (Germany), LS Cable & System Limited (South Korea), Jiangnan Group Limited (China), Tratos Limited (United Kingdom), EL Sewedy Electric Company (Egypt), and Furukawa Electric Co., Ltd. (Japan) |

This research report categorizes the fire-resistant cable market based on insulation material, end-use industry, and region.

Fire Resistant Cable Market on the basis of insulation material:

- XLPE

- PVC

- EPR

- LSZH

- Others (includes silicone rubber (SiR), ethylene-vinyl acetate (EVA), and polyethylene (PE))

Fire Resistant Cable Market on the basis of end-use industry:

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others (includes data centers, electronics, and telecommunication)

Fire Resistant Cable Market on the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In April 2021, NKT Group entered into a frame agreement for high voltage cables with the French Transmission System Operator, Réseau de Transport d’Electricité (RTE) for the renewal and modernization of the power grid in France.

- In 2021, Jiangnan Group plans to install four imported cross-linked cable production lines, including two production lines for 35kV ultra-high-speed medium-voltage crosslinked cables, one production line for 110kV PP cables and one production line for 110kV cross-linked cables and import two German concentric stranding machines in 2021.

- In November 2020, NKT Group entered into service agreements with Elia, 50 Hertz, and Nemo Link with the purpose of ensuring the efficient integration of energy into the Belgian, UK, and German power grids.

- In October 2020, NKT Group entered into a frame agreement for low and medium voltage power cables with Ellevio to ensure the timely reinforcement and development of the power grid in central Sweden.

Upcoming Changes in Fire Resistant Cable Market

|

CHANGE |

DESCRIPTION |

|

Scope of the market |

|

|

COVID-19 impact |

|

|

Market Overview |

|

|

Competitive Landscape |

|

|

Company Profiles |

|

Frequently Asked Questions (FAQ):

How big is the Fire Resistant Cable Market?

Fire Resistant Cable Market worth $2.1 billion by 2026.

What is the growth rate of Fire Resistant Cable Market?

Fire Resistant Cable Market grows at a CAGR of 3.3% during the forecast period.

What is the current size of global fire-resistant cable market?

The global fire-resistant cable market size is projected to grow from USD 1.8 billion in 2021 to USD 2.1 billion by 2026, at a CAGR of 3.32% from 2021 to 2026.

How is the fire-resistant cable market aligned?

The fire-resistant cable market is highly competitive and has a number of global players who have a very strong presence in the market, and cater a larger share of the market. Furthermore, the market consists of various regional and domestic players.

Who are the key players in the global fire-resistant cable market?

The key players operating in the fire-resistant cable market are Prysmian Group (Italy), Nexans S.A. (France), NKT Group (Denmark), LEONI AG (Germany), LS Cable & System Limited (South Korea), and Elsewedy Electric Company (Egypt), amongst others.

What are the ongoing trend in the fire-resistant cable market?

The fire-resistant cable is made of silicon-free and inorganic mineral is one of the manufacturing trends in the market. The insulated solid copper and magnesium oxide cable is highly efficient with melting points of 1,083° C and 2,800° C. Hence, it can survive and resist fires and survive in a high temperature of 1,000° C with ease. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.3.1 SECONDARY DA T A

2.3.2 PRIMARY DATA

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

3.1 INTRODUCTION

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 HIGHER DEMAND FOR FIRE-RESISTANT CABLES EXPECTED FROM EMERGING ECONOMIES

4.2 APAC: FIRE-RESISTANT CABLE MARKET, BY END-USE INDUSTRY AND COUNTRY

4.3 FIRE-RESISTANT CABLE MARKET, BY INSULATION MATERIAL

4.4 FIRE-RESISTANT CABLE MARKET, BY END-USE INDUSTRY

4.5 FIRE-RESISTANT CABLE MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand for fire-resistant cables for fire safety & protection

5.2.1.2 Increasing fire safety standards & regulations globally

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for fire-resistant cables for power generation

5.2.3.2 Population growth and rapid urbanization translating to large number of construction projects

5.2.3.3 Increasing developments in the automotive industry

5.2.4 CHALLENGES

5.2.4.1 Availability of cheap and inferior quality fire-resistant cables

5.3 RANGE SCENARIO ANALYSIS

5.3.1 OPTIMISTIC SCENARIO

5.3.2 PESSIMISTIC SCENARIO

5.3.3 REALISTIC SCENARIO

5.4 SUPPLY CHAIN ANALYSIS

5.4.1 PROMINENT COMPANIES

5.4.2 SMALL & MEDIUM ENTERPRISES

5.5 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 YC-YCC DRIVERS

5.7 MARKET MAPPING/ ECOSYSTEM MAP

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

5.8.4 INSIGHT

5.8.5 TOP COMPANIES/ APPLICANTS

5.8.6 DISCLAIMER

5.9 REGULATORY ANALYSIS

5.10 TECHNOLOGY ANALYSIS

5.11 TRADE ANALYSIS

5.12 AVERAGE SELLING PRICE ANALYSIS

5.13 CASE STUDY ANALYSIS

5.13.1 CAERPHILLY HOSPITAL

5.13.2 MILLENNIUM COPTHORNE HOTEL

5.13.3 MADRID UNDERGROUND

5.13.4 CENTRE COURT AT WIMBLEDON

6 IMPACT OF COVID-19 ON THE FIRE-RESISTANT CABLE MARKET (Page No. - 80)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON THE FIRE-RESISTANT CABLE MARKET

6.2.1 END-USE INDUSTRIES

6.2.1.1 Impact of COVID-19 on the building & construction industry

6.2.1.2 Impact of COVID-19 on the automotive industry

6.2.1.3 Impact of COVID-19 on the energy industry

7 FIRE-RESISTANT CABLE MARKET, BY INSULATION MATERIAL (Page No. - 83)

7.1 INTRODUCTION

7.2 CROSS-LINKED POLYETHYLENE (XLPE)

7.3 POLYVINYL CHLORIDE (PVC)

7.4 LOW SMOKE ZERO HALOGEN (LSZH)

7.5 ETHYLENE PROPYLENE RUBBER (EPR)

7.6 OTHERS

8 FIRE-RESISTANT CABLE MARKET, BY END-USE INDUSTRY (Page No. - 90)

8.1 INTRODUCTION

8.2 BUILDING & CONSTRUCTION

8.3 AUTOMOTIVE & TRANSPORTATION

8.4 MANUFACTURING

8.5 ENERGY

8.6 OTHERS

9 FIRE-RESISTANT CABLE MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.1.1 China to be the fastest-growing market for fire-resistant cables globally

9.2.2 JAPAN

9.2.2.1 Infrastructure and commercial building projects to offer growth opportunities for the market

9.2.3 INDIA

9.2.3.1 Increasing demand for fire-resistant cables from building & construction and manufacturing sectors

9.2.4 SOUTH KOREA

9.2.4.1 Rising construction activities to drive demand for fire-resistant cables

9.2.5 REST OF APAC

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Germany to lead the market for fire-resistant cables in Europe

9.3.2 UK

9.3.2.1 Stringent environmental and fire safety regulations to boost the market for fire-resistant cables

9.3.3 FRANCE

9.3.3.1 Rise in the construction of buildings to offer market growth opportunities for fire-resistant cables

9.3.4 RUSSIA

9.3.4.1 Increasing demand for safety products for fire incidents in buildings

9.3.5 ITALY

9.3.5.1 Building & construction sector to accelerate demand for fire-resistant cables

9.3.6 SPAIN

9.3.6.1 Energy sector to accelerate demand for fire-resistant cables

9.3.7 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 US

9.4.1.1 The US to dominate the market for fire-resistant cables in North America

9.4.2 CANADA

9.4.2.1 Growing construction sector to drive the market for fire-resistant cables

9.4.3 MEXICO

9.4.3.1 Fastest-growing country in fire-resistant cables in the North American region

9.5 MIDDLE EAST & AFRICA

9.5.1 UAE

9.5.1.1 UAE to be the fastest-growing market for fire-resistant cables

9.5.2 SAUDI ARABIA

9.5.2.1 Saudi Arabia leads the fire-resistant cable market in Middle East & Africa region

9.5.3 SOUTH AFRICA

9.5.3.1 Growth potential owing to the increasing number of construction projects

9.5.4 REST OF MIDDLE EAST & AFRICA

1.1.1.1 Brazil to dominate the market for fire-resistant cables in South America

1.1.2.1 Increasing demand for fire-resistant cables from the building & construction industry

10 COMPETITIVE LANDSCAPE (Page No. - 180)

10.1 OVERVIEW

10.2 MARKET RANKING

10.2.1 PRYSMIAN GROUP

10.2.2 NEXANS S.A.

10.2.3 NKT GROUP

10.2.4 LEONI AG

10.2.5 LS CABLE & SYSTEM LIMITED

10.3 MARKET SHARE ANALYSIS

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STAR

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 EMERGING COMPANIES

10.6 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 STARTING BLOCKS

10.6.4 DYNAMIC COMPANIES

SOURCE: COMPANY WEBSITES, PRESS RELEASES, COMPANY ANNUAL REPORTS, EXPERT INTERVIEWS, AND MARKETSANDMARKETS ANALYSIS

10.7 COMPETITIVE SCENARIO

11 COMPANY PROFILES (Page No. - 194)

11.1 PRYSMIAN GROUP

11.1.1 BUSINESS OVERVIEW

11.1.2 OPERATIONAL ASSESSMENT

11.1.3 PRODUCTS OFFERED

11.1.4 RECENT DEVELOPMENTS

11.1.5 MNM VIEW

11.1.5.1 Weaknesses and competitive threats

11.1.5.2 Strategic choices made

11.1.5.3 Right to win

11.2 NEXANS S.A.

11.2.1 BUSINESS OVERVIEW

11.2.2 OPERATIONAL ASSESSMENT

11.2.3 PRODUCTS OFFERED

11.2.4 RECENT DEVELOPMENTS

11.2.5 MNM VIEW

11.2.5.1 Weaknesses and competitive threats

11.2.5.2 Strategic choices made

11.2.5.3 Right to win

11.3 NKT GROUP

11.3.1 BUSINESS OVERVIEW

11.3.2 OPERATIONAL ASSESSMENT

11.3.3 PRODUCTS OFFERED

11.3.4 RECENT DEVELOPMENTS

11.3.5 MNM VIEW

11.3.5.1 Weaknesses and competitive threats

11.3.5.2 Strategic choices made

11.3.5.3 Right to win

11.4 LEONI AG

11.4.1 BUSINESS OVERVIEW

11.4.2 OPERATIONAL ASSESSMENT

11.4.3 PRODUCTS OFFERED

11.4.4 RECENT DEVELOPMENTS

11.4.5 MNM VIEW

11.4.5.1 Weaknesses and competitive threats

11.4.5.2 Strategic choices made

11.4.5.3 Right to win

11.5 LS CABLE & SYSTEM LIMITED

11.5.1 BUSINESS OVERVIEW

11.5.2 OPERATIONAL ASSESSMENT

11.5.3 PRODUCTS OFFERED

11.5.4 RECENT DEVELOPMENTS

11.5.5 MNM VIEW

THE COMPANY AIMS TO INCREASE ITS PRESENCE IN GLOBAL GROWTH MARKETS AND INNOVATE BUSINESS MODELS FOR HIGH VALUES BY DEDICATING ITSELF TO THE RESEARCH & DEVELOPMENT OF NEW TECHNOLOGY AND PRODUCTS. IN ADDITION TO THIS, IT IS ALSO ENGAGED IN ACTIVITIES FOR THE INNOVATION OF CABLE & WIRE PRODUCTS. THE COMPANY FURTHER AIMS TO ENHANCE CUSTOMER VALUE BY STRENGTHENING PRODUCT COMPETITIVENESS (DEVELOPING PRODUCTS FOR DISASTER PREVENTION: FIRE-RESISTANT AND LOW-TOXIC CABLES). IN ADDITION TO THIS, THE COMPANY FOCUSES ON PROVIDING DIFFERENTIATED SOLUTION SERVICES AND CREATE CUSTOMER VALUE FOR THE CABLE MARKET. 216

11.6 ELSEWEDY ELECTRIC COMPANY

11.6.1 BUSINESS OVERVIEW

11.6.2 OPERATIONAL ASSESSMENT

11.6.3 PRODUCTS OFFERED

11.6.4 RECENT DEVELOPMENTS

11.6.5 MNM VIEW

11.7 JIANGNAN GROUP LIMITED

11.7.1 BUSINESS OVERVIEW

11.7.2 OPERATIONAL ASSESSMENT

11.7.3 PRODUCTS OFFERED

11.7.4 RECENT DEVELOPMENTS

11.7.5 MNM VIEW

11.8 HITACHI METALS LTD.

11.8.1 BUSINESS OVERVIEW

11.8.2 OPERATIONAL ASSESSMENT

11.8.3 PRODUCTS OFFERED

11.8.4 MNM VIEW

11.9 FURUKAWA ELECTRIC CO., LTD.

11.9.1 BUSINESS OVERVIEW

11.9.2 OPERATIONAL ASSESSMENT

11.9.3 PRODUCTS OFFERED

11.9.4 MNM VIEW

11.10 SUMITOMO ELECTRIC INDUSTRIES, LTD.

11.10.1 BUSINESS OVERVIEW

11.10.2 OPERATIONAL ASSESSMENT

11.10.3 PRODUCTS OFFERED

11.10.4 MNM VIEW

11.11 YAZAKI CORPORATION

11.11.1 BUSINESS OVERVIEW

11.11.2 OPERATIONAL ASSESSMENT

11.11.3 PRODUCTS OFFERED

11.11.4 MNM VIEW

11.12 SWCC SHOWA CABLE SYSTEMS CO LTD.

11.12.1 BUSINESS OVERVIEW

11.12.2 OPERATIONAL ASSESSMENT

11.12.3 PRODUCTS OFFERED

11.12.4 MNM VIEW

11.13 ADDITIONAL PLAYERS

11.13.1 UNIVERSAL CABLE (M) BERHAD

11.13.2 TRATOS LIMITED

11.13.3 KEYSTONE CABLE

11.13.4 DUBAI CABLE COMPANY (PRIVATE) LTD.

11.13.5 TIANJIN SULI CABLE GROUP

11.13.6 TELE-FONIKA KABLE SA

11.13.7 TOP CABLE

11.13.8 SHANGHAI JIUKAI WIRE & CABLE CO., LTD.

11.13.9 SICCET SRL

11.13.10 RSCC WIRE & CABLE LLC

11.13.11 RR KABEL LIMITED

11.13.12 BAHRA ADVANCED CABLE MANUFACTURE CO. LTD.

11.13.13 MIDDLE EAST SPECIALIZED CABLES COMPANY (MESC)

11.13.14 WALSIN LIHWA CORPORATION

11.13.15 CAVICEL S.P.A

11.13.16 ST CABLE CORPORATION

12 ADJACENT MARKETS (Page No. - 242)

12.1 FLAME RETARDANT MARKET

12.2 CABLES AND ACCESSORIES MARKET

SOURCE: COMPANY PRESS RELEASES, INVESTOR PRESENTATIONS, JOURNALS, EXPERT INTERVIEWS, AND MARKETSANDMARKETS ANALYSIS

12.3 HALOGEN-FREE FLAME RETARDANTS MARKET

13 APPENDIX (Page No. - 250)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (276 TABLES)

TABLE 1 INCLUSIONS AND EXCLUSIONS

TABLE 2 APAC URBANIZATION TRENDS, 1990–2050

TABLE 3 MOTOR VEHICLE PRODUCTION, 2016-2020

TABLE 4 FIRE-RESISTANT CABLE MARKET: ECOSYSTEM

TABLE 5 FIRE-RESISTANT CABLES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 6 TOTAL NUMBER OF PATENTS FOR FIRE-RESISTANT CABLES

TABLE 7 LIST OF PATENTS BY NEXANS S.A.

TABLE 8 LIST OF PATENTS BY STATE GRID CORPORATION OF CHINA (SGCC)

TABLE 9 LIST OF PATENTS BY THE PRYSMIAN GROUP

TABLE 10 LIST OF PATENTS BY LS CABLE & SYSTEM LIMITED

TABLE 11 STANDARDS FOR FIRE RESISTANCE

TABLE 12 STANDARDS FOR HALOGEN & SMOKE EMISSION, CORROSIVITY & TOXICITY

TABLE 13 STANDARDS FOR FIRE-RESISTANT CABLES

TABLE 14 HS CODE FOR FIRE-RESISTANT CABLE

TABLE 15 COPPER ORE EXPORTS, BY COUNTRY (2019)

TABLE 16 TOP COPPER IMPORTERS, BY COUNTRY (2017)

TABLE 17 TOP ALUMINUM EXPORTERS, BY COUNTRY (2019)

TABLE 18 TOP ALUMINUM IMPORTERS, BY COUNTRY (2017)

TABLE 19 AVERAGE PRICES OF FIRE-RESISTANT CABLE INSULATION MATERIALS (USD/ METER), 2020

TABLE 20 FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 21 FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 22 FIRE-RESISTANT CABLE MARKET SIZE FOR XLPE: BY REGION, 2019–2026 (USD MILLION)

TABLE 23 FIRE-RESISTANT CABLE MARKET SIZE FOR XLPE: BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 24 FIRE-RESISTANT CABLE MARKET SIZE FOR PVC: BY REGION, 2019–2026 (USD MILLION)

TABLE 25 FIRE-RESISTANT CABLE MARKET SIZE FOR PVC: BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 26 FIRE-RESISTANT CABLE MARKET SIZE FOR LSZH: BY REGION, 2019–2026 (USD MILLION)

TABLE 27 FIRE-RESISTANT CABLE MARKET SIZE FOR LSZH: BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 28 FIRE-RESISTANT CABLE MARKET SIZE FOR EPR: BY REGION, 2019–2026 (USD MILLION)

TABLE 29 FIRE-RESISTANT CABLE MARKET SIZE FOR EPR: BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 30 FIRE-RESISTANT CABLE MARKET SIZE FOR OTHERS: BY REGION, 2019–2026 (USD MILLION)

TABLE 31 FIRE-RESISTANT CABLE MARKET SIZE FOR OTHERS: BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 32 FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 33 FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 34 FIRE-RESISTANT CABLE MARKET SIZE FOR BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 FIRE-RESISTANT CABLE MARKET SIZE FOR BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 36 FIRE-RESISTANT CABLE MARKET SIZE FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 FIRE-RESISTANT CABLE MARKET SIZE FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 38 FIRE-RESISTANT CABLE MARKET SIZE FOR MANUFACTURING, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 FIRE-RESISTANT CABLE MARKET SIZE FOR MANUFACTURING, BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 40 FIRE-RESISTANT CABLE MARKET SIZE FOR ENERGY, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 FIRE-RESISTANT CABLE MARKET SIZE FOR ENERGY, BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 42 FIRE-RESISTANT CABLE MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 FIRE-RESISTANT CABLE MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 44 FIRE-RESISTANT CABLE MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 45 FIRE-RESISTANT CABLE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 FIRE-RESISTANT CABLE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND KILOMETER)

TABLE 47 FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 48 FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 49 FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 50 FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 51 FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 52 FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 53 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 54 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 55 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 56 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 57 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 58 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 59 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 60 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 61 APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 62 CHINA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 63 CHINA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 64 CHINA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 65 CHINA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 66 CHINA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 67 CHINA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 68 JAPAN: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 69 JAPAN: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 70 JAPAN: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 71 JAPAN: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 72 JAPAN: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 73 JAPAN: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 74 INDIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 75 INDIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 76 INDIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 77 INDIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 78 INDIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 79 INDIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 80 SOUTH KOREA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 81 SOUTH KOREA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 82 SOUTH KOREA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 83 SOUTH KOREA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 84 SOUTH KOREA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 85 SOUTH KOREA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 86 REST OF APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 87 REST OF APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 88 REST OF APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 89 REST OF APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 90 REST OF APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 91 REST OF APAC: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 92 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 93 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 94 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 95 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 96 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 97 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 98 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 99 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 101 GERMANY: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 102 GERMANY: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 103 GERMANY: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 104 GERMANY: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 105 GERMANY: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 106 GERMANY: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 107 UK: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 108 UK: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 109 UK: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 110 UK: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 111 UK: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 112 UK: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 113 FRANCE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 114 FRANCE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 115 FRANCE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 116 FRANCE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 117 FRANCE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 118 FRANCE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 119 RUSSIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 120 RUSSIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 121 RUSSIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 122 RUSSIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 123 RUSSIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 124 RUSSIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 125 ITALY: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 126 ITALY: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 127 ITALY: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 128 ITALY: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 129 ITALY: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 130 ITALY: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KT)

TABLE 131 SPAIN: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 132 SPAIN: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 133 SPAIN: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 134 SPAIN: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 135 SPAIN: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 136 SPAIN: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 137 REST OF EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 138 REST OF EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 139 REST OF EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 140 REST OF EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 141 REST OF EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 142 REST OF EUROPE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 143 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 144 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 145 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 146 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 147 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 148 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 149 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 150 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 151 NORTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 152 US: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 153 US: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 154 US: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 155 US: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 156 US: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 157 US: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 158 CANADA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 159 CANADA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 160 CANADA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 161 CANADA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 162 CANADA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 163 CANADA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 164 MEXICO: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 165 MEXICO: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 166 MEXICO: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 167 MEXICO: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 168 MEXICO: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 169 MEXICO: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 170 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 173 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 176 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 179 UAE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 180 UAE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 181 UAE: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 182 UAE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 183 UAE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 184 UAE: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 185 SAUDI ARABIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 186 SAUDI ARABIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 187 SAUDI ARABIA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 188 SAUDI ARABIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 189 SAUDI ARABIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 190 SAUDI ARABIA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 191 SOUTH AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 192 SOUTH AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 193 SOUTH AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 194 SOUTH AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 195 SOUTH AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 196 SOUTH AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 197 REST OF MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 200 REST OF MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 202 REST OF MIDDLE EAST & AFRICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 203 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 204 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 205 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 206 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 207 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 208 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 209 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 210 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 211 SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 212 BRAZIL: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 213 BRAZIL: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 214 BRAZIL: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 215 BRAZIL: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 216 BRAZIL: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 217 BRAZIL: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 218 ARGENTINA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 219 ARGENTINA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 220 ARGENTINA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 221 ARGENTINA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 222 ARGENTINA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 223 ARGENTINA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 224 REST OF SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2015–2018 (USD MILLION)

TABLE 225 REST OF SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (USD MILLION)

TABLE 226 REST OF SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY INSULATION MATERIAL, 2019–2026 (THOUSAND KILOMETER)

TABLE 227 REST OF SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD MILLION)

TABLE 228 REST OF SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 229 REST OF SOUTH AMERICA: FIRE-RESISTANT CABLE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND KILOMETER)

TABLE 230 FIRE-RESISTANT CABLE MARKET: DEGREE OF COMPETITION

TABLE 231 COMPANY REGION FOOTPRINT

TABLE 232 FIRE-RESISTANT CABLE MARKET: NEW PRODUCT DEVELOPMENTS, 2016–2021

TABLE 233 FIRE-RESISTANT CABLE MARKET: DEALS, 2016- 2021

TABLE 234 FIRE-RESISTANT CABLE MARKET: OTHERS, 2016–2021

TABLE 235 PRYSMIAN GROUP: COMPANY OVERVIEW

TABLE 236 PRYSMIAN GROUP: DEALS

TABLE 237 PRYSMIAN GROUP: OTHERS

TABLE 238 NEXANS S.A.: COMPANY OVERVIEW

TABLE 239 NEXANS S.A.: NEW PRODUCT DEVELOPMENTS

TABLE 240 NEXANS S.A.: DEALS

TABLE 241 NEXANS S.A.: OTHERS

TABLE 242 NKT GROUP: COMPANY OVERVIEW

TABLE 243 NKT GROUP: DEALS

TABLE 244 NKT GROUP: OTHERS

TABLE 245 LEONI AG: COMPANY OVERVIEW

TABLE 246 LEONI AG: OTHERS

TABLE 247 LS CABLE & SYSTEM LIMITED: COMPANY OVERVIEW

TABLE 248 LS CABLE & SYSTEM LIMITED: DEALS

TABLE 249 LS CABLE & SYSTEM LIMITED: OTHERS

TABLE 250 ELSEWEDY ELECTRIC COMPANY: COMPANY OVERVIEW

TABLE 251 ELSEWEDY ELECTRIC COMPANY: DEALS

TABLE 252 JIANGNAN GROUP LIMITED: COMPANY OVERVIEW

TABLE 253 JIANGNAN GROUP LIMITED: OTHERS

TABLE 254 HITACHI METALS LTD.: COMPANY OVERVIEW

TABLE 255 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

TABLE 256 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

TABLE 257 YAZAKI CORPORATION: COMPANY OVERVIEW

TABLE 258 SWCC SHOWA CABLE SYSTEMS CO LTD.: COMPANY OVERVIEW

TABLE 259 FLAME RETARDANTS MARKET SIZE, BY REGION, 2014–2021 (KILOTON)

TABLE 260 FLAME RETARDANTS MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 261 FLAME RETARDANTS MARKET SIZE, BY TYPE, 2014–2021 (KILOTON)

TABLE 262 FLAME RETARDANTS MARKET SIZE, BY TYPE, 2014–2021 (USD MILLION)

TABLE 263 FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2014–2021 (KILOTON)

TABLE 264 FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2014–2021 (USD MILLION)

TABLE 265 CABLES & ACCESSORIES MARKET SIZE, BY VOLTAGE, 2015–2022 (USD BILLION)

TABLE 266 LOW VOLTAGE: CABLES & ACCESSORIES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 267 MEDIUM VOLTAGE: CABLES & ACCESSORIES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 268 HIGH VOLTAGE: CABLES & ACCESSORIES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 269 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 270 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 271 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 272 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 273 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 274 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 275 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 276 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

LIST OF FIGURES (56 FIGURES)

FIGURE 1 FIRE-RESISTANT CABLE MARKET SEGMENTATION

FIGURE 2 FIRE-RESISTANT CABLE MARKET, BY REGION

FIGURE 3 FIRE-RESISTANT CABLE MARKET: RESEARCH DESIGN

FIGURE 4 APPROACH 1: BASED ON PARENT MARKET

FIGURE 5 APPROACH 2: TOP-DOWN APPROACH

FIGURE 6 FIRE-RESISTANT CABLE MARKET: DATA TRIANGULATION

FIGURE 7 KEY MARKET INSIGHTS

FIGURE 8 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 9 ASSUMPTIONS

FIGURE 10 LIMITATIONS

FIGURE 11 LIMITATIONS & ASSOCIATED RISKS

FIGURE 12 RISKS

FIGURE 13 XLPE SEGMENT TO DOMINATE THE FIRE-RESISTANT CABLE MARKET BY 2026

FIGURE 14 BUILDING & CONSTRUCTION TO BE THE LARGEST SEGMENT IN THE FIRE-RESISTANT CABLE MARKET DURING THE FORECAST PERIOD

FIGURE 15 APAC ACCOUNTED FOR THE LARGEST SHARE OF THE FIRE-RESISTANT CABLE MARKET IN 2020

FIGURE 16 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES FOR THE FIRE-RESISTANT CABLE MARKET DURING THE FORECAST PERIOD

FIGURE 17 CHINA WAS THE LARGEST MARKET FOR FIRE-RESISTANT CABLES IN THE APAC IN 2020

FIGURE 18 XLPE SEGMENT TO LEAD THE FIRE-RESISTANT CABLE MARKET DURING THE FORECAST PERIOD

FIGURE 19 BUILDING & CONSTRUCTION PROJECTED TO BE THE LARGEST END-USE INDUSTRY IN THE GLOBAL FIRE-RESISTANT CABLE MARKET BY 2026

FIGURE 20 THE FIRE-RESISTANT CABLE MARKET IN CHINA IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

FIGURE 21 FIRE-RESISTANT CABLES MARKET DYNAMICS

FIGURE 22 CRUDE OIL PRICE TRENDS

FIGURE 23 OECD & NON-OECD NET ELECTRICITY GENERATION, 2012-2040 (TRILLION KILOWATT HOURS)

FIGURE 24 RANGE SCENARIO FOR THE FIRE-RESISTANT CABLE MARKET

FIGURE 25 FIRE-RESISTANT CABLE MARKET: SUPPLY CHAIN

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 YC-YCC DRIVERS

FIGURE 28 ECOSYSTEM MAP

FIGURE 29 FIRE-RESISTANT CABLE MARKET: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 30 PUBLICATION TRENDS - LAST TEN YEARS

FIGURE 31 JURISDICTION ANALYSIS

FIGURE 32 TOP APPLICANTS OF FIRE-RESISTANT CABLES

FIGURE 33 XLPE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 34 BUILDING & CONSTRUCTION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 35 REGIONAL SNAPSHOT: CHINA IS PROJECTED TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

FIGURE 36 APAC: FIRE-RESISTANT CABLE MARKET SNAPSHOT

FIGURE 37 COMPANIES ADOPTED ACQUISITIONS AS THE KEY GROWTH STRATEGY, 2016–2021

FIGURE 38 MARKET RANKING OF KEY PLAYERS, 2020

FIGURE 39 FIRE-RESISTANT CABLE MARKET: MARKET SHARE ANALYSIS, 2020

FIGURE 40 REVENUE ANALYSIS FOR KEY PLAYERS IN THE FIRE-RESISTANT CABLE MARKET

FIGURE 41 FIRE-RESISTANT CABLE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 42 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 43 BUSINESS STRATEGY EXCELLENCE

FIGURE 44 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

FIGURE 45 PRYSMIAN GROUP: COMPANY SNAPSHOT

FIGURE 46 NEXANS S.A.: COMPANY SNAPSHOT

FIGURE 47 NKT GROUP: COMPANY SNAPSHOT

FIGURE 48 LEONI AG: COMPANY SNAPSHOT

FIGURE 49 LS CABLE & SYSTEM LIMITED: COMPANY SNAPSHOT

FIGURE 50 ELSEWEDY ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 51 JIANGNAN GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 52 HITACHI METALS LTD.: COMPANY SNAPSHOT

FIGURE 53 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

FIGURE 54 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 55 YAZAKI CORPORATION: COMPANY SNAPSHOT

FIGURE 56 SWCC SHOWA CABLE SYSTEMS CO LTD.: COMPANY SNAPSHOT

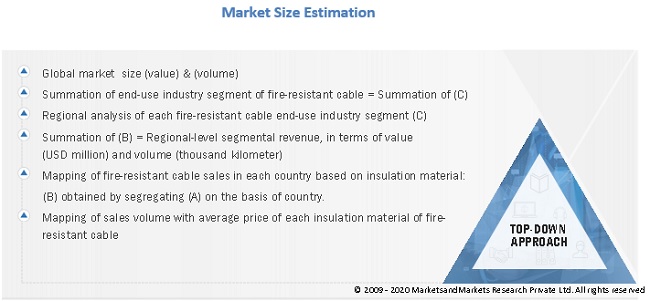

The study involved four major activities for estimating the current global size of the fire-resistant cable market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of fire-resistant cable through primary research. The supply-side approach was employed to estimate the overall size of the fire-resistant cable market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the fire-resistant cable market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

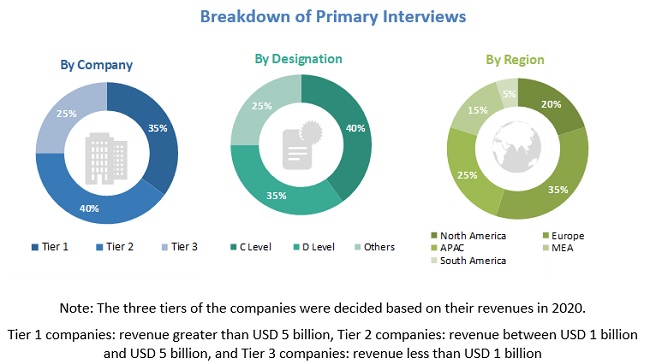

Primary Research

Various primary sources from both the supply and demand sides of the fire-resistant cable market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the fire-resistant cable industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach was used to estimate and validate the global size of the fire-resistant cable market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the fire-resistant cable market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the fire-resistant cable market in terms of value and volume based on insulation material, end-use industry, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments, expansions, collaborations, new product developments, and acquisitions, in the fire-resistant cable market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the fire-resistant cable report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the fire-resistant cable market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fire-Resistant Cable Market