Halogen-Free Flame Retardants Market by Type (Aluminum Hydroxide, Organophosphorus), Application (Polyolefins, UPE, ETP, Styrenics), End-Use Industry (Electrical & Electronics, Construction, Transportation), Region - Global Forecasts to 2025

Updated on : June 18, 2024

Halogen-Free Flame Retardant Market

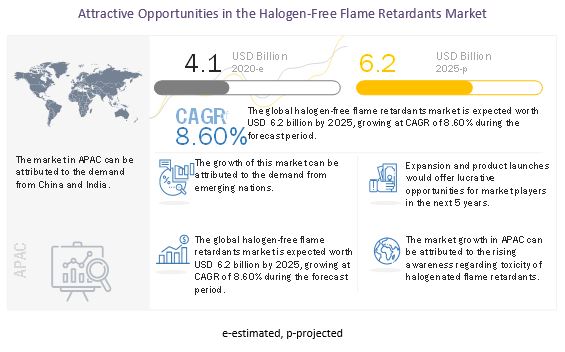

The halogen-free flame retardant market was valued at USD 4.1 billion in 2020 and is projected to reach USD 6.2 billion by 2025, growing at 8.60% cagr from 2020 to 2025. The major application of flame retardants is in electric wire insulation in building & construction, and transportation. Flame retardants are used in circuit boards, electronic casing, and cables & wire systems. Strict fire safety standards to reduce the spread of fires in residential and commercial buildings are driving the demand for halogen-free flame retardants.

This shift towards more environment-friendly alternatives will increase the demand for halogen-free flame retardants, which, in turn, will drive market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on halogen-free flame retardants market

The COVID-19 pandemic has impacted the growth of the APAC halogen-free flame retardants market, owing to which the market is expected to witness negative growth in 2020. According to the IMF, the GDP growth rate of the region will fall to 0% in 2020. China, India, and South Korea will also have slow economic growth. The GDP growth rate in China is expected to drop to 1.2% in 2020.

China was the epicenter of COVID-19 at first. The government quarantined millions of people, thus putting a pause on all supply chains dependent on China. The travel bans and lockdown imposed in most of the major cities in China have reduced the production of oil in the country. It has also affected the workforce community, without which many ports, such as Shenzhen and Shanghai, are closed for operations. However, the country is showing signs of recovery after a lockdown of three months. Most of the businesses have now reopened.

In Japan, major construction projects are on hold due to disturbances in the supply chain and the unavailability of labor. However, the Tokyo Olympics and Paralympic Games, which are postponed for 2021, are expected to boost the economy, thus driving the halogen-free flame retardants market.

In India, the government has allowed construction activities with all the required safety measures. This is expected to support the economy of India. The country has more than USD 70 billion worth of ongoing construction projects, which are expected to drive the adoption of halogen-free flame retardants.

Strick fire safety guidelines

The major application of flame retardants is in electric wire insulation in building & construction and transportation. Flame retardants are used in circuit boards, electronic casing, and cables & wire systems. Strict fire safety standards to reduce the spread of fires in residential and commercial buildings are driving the demand for halogen-free flame retardants.

The growing number of residential and commercial establishments has increased the chances of explosions and fire-related accidents. Due to this, several countries across North America and Europe have mandated strict fire safety regulations and protocols. This has led to the increased use of flame retardants across buildings to meet these government regulations.

Lower crude oil prices to benefit halogen-free flame retardants suppliers after COVID-19

The halogen-free flame retardants market is significantly influenced by the variation in the crude oil market. Between 2008 and 2014, the crude oil market enjoyed a profitable run as prices hit USD 100 barrier per barrel and beyond. The Brent crude was priced at USD 140 per barrel, and WTI was priced at USD 120 per barrel. In 2015, crude prices dropped to record lows. Such volatile prices affect the margins of manufacturing companies.

The majority of halogen-free flame retardants products are based on mineral oil, which is sourced from crude oil. Therefore, the prices of halogen-free flame retardants depend on crude oil prices. Price change has a huge impact on the halogen-free flame retardants market.

High loading levels of mineral-based flame retardants

One of the biggest drawbacks of halogen-free flame retardants is the high loading levels associated with mineral-based flame retardants. Retardants used as fillers are loaded in large quantities in the polymer matrix to ensure flame retardation. However, excessive loading increases the density and reduces the mechanical properties (thermal stability) of the final product. This process of adding fillers in high quantities to polymers affects their original chemical and rheological properties.

Introduction of more effective synergist compounds

To boost the performance of flame retardants, compounds like aluminum/magnesium hydroxides, phosphorus, and zinc are added to the polymer blends. With the combination of such blends in a polymer matrix, the combined effect is found to be more efficient than the compounds acting separately. Synergist blends reduce the amount of halogenated flame retardant by percent weight, reduce toxicity, and improve the retardant properties.

Flame retardants are also used as additives/reactive agents in submicron particles so that the original properties of the polymeric material remain unaffected

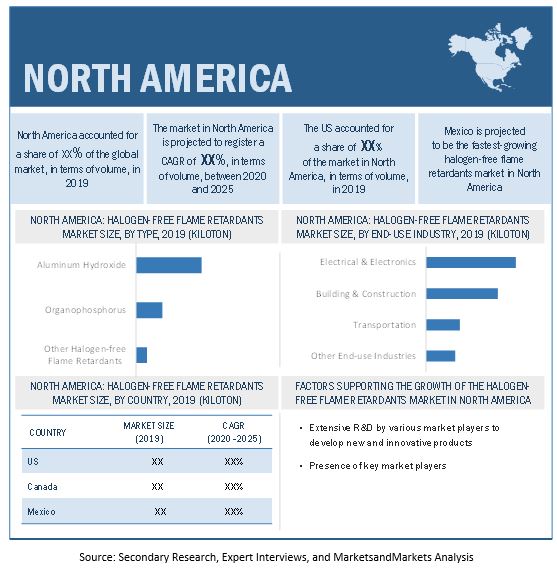

North America to account for the largest share of the global halogen-free flame retardants market during the forecast period

North America is expected to account for the largest market share in halogen-free flame retardants during the forecast period, in terms of value. The North American halogen-free flame retardants market is projected to register a low CAGR than the APAC during the forecast period. The market in this region is characterized by the increasing use of halogen-free flame retardants driven by stringent regulations and consumer awareness. Stringent and increasing environmental regulations and tough standards set by other regulatory authorities make North America a strong market for halogen-free flame retardant manufacturers.

Halogen-Free Flame Retardant Market Players

The key market players profiled in the report include as Clariant AG (Switzerland), Lanxess AG (Germany), Israel Chemicals Ltd. (Israel), Nabaltec AG (Germany), BASF SE (Germany), Italmatch Chemicals s.p.a.(Italy), Dupont De Nemours Inc. (US), RPT Company (US) and Huber Engineered Materials (US) among others.

Halogen-Free Flame Retardant Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments covered |

Type, Application, End-use Industry, and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Clariant AG (Switzerland), Lanxess AG (Germany), Israel Chemicals Ltd. (Israel), Nabaltec AG (Germany), BASF SE (Germany), Italmatch Chemicals s.p.a.(Italy), Dupont De Nemours Inc. (US), RPT Company (US) and Huber Engineered Materials (US) among others.Top 25 major players covered |

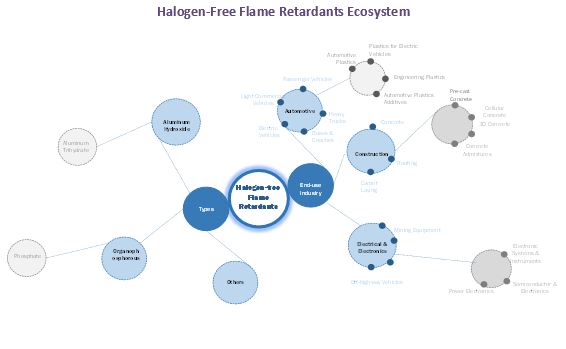

This report categorizes the global halogen-free flame retardants market based on type, application, end-use industry, and region.

On the basis of type, the halogen-free flame retardants market has been segmented as follows:

- Aluminum hydroxide

- Organophosphorous

-

Others

- Zinc Borate

- Magnesium Hydroxide

- Nitrogen-based flame retardants

- Boron-based flame retardants

On the basis of application, the halogen-free flame retardants market has been segmented as follows:

- Polyolefins

- Epoxy resin

- Unsaturated polyester

- Polyvinyl chloride

- Rubber

- Engineered thermoplastic

- Styrenics

- Others

On the basis of end-use industry, the halogen-free flame retardants market has been segmented as follows:

- Electrical & electronics

- Building & construction

- Transportation

- Others

On the basis of region, the halogen-free flame retardants market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Israel Chemicals Ltd. is the largest player in the halogen-free flame retardants market. Israel Chemicals Ltd. is a leading manufacturer of specialty fertilizers, phosphate products, and flame retardants. The company has four segments, namely, Industrial Products, Potash, Phosphate Solutions, and Innovative Agricultural Solutions. Its well-established distribution network and brand value serve as an important factor for its future growth prospects.

Clariant AG is also one of the largest companies in the halogen-free flame retardants market. It has a strong brand name in the industry. Clariant AG is a renowned leader in specialty chemicals. Its units are well managed in the following business areas-care chemicals, catalysis, and natural resources. The company has a vast product line, catering to a wide range of industries.

Recent Developments:

- In October 2019, Clariant introduced 11 new bio-based additives under the Eolit OP Terra and Licocene Terra brands. These high-performance additives will reduce fossil consumption and create a sustainable value chain.

- Clariant AG collaborated with Floreon to expand its high-performance biopolymer applications to additional markets. The companies will work together on a broad range of additives such as stabilizers, flame retardants, and surface aids.

Frequently Asked Questions (FAQ):

What are the high growth applications of halogen-free flame retardants?

Epoxy resins are extensively used in the electronics and automotive industries. They are used in integrated circuits, transistors, and hybrid circuits. Electronic equipment needs protection against fires caused due to short circuits. t

What are the major factors impacting market growth during the forecast period?

The market growth is primarily due to the growing use of polymers in automotive industry coupled with the stringent regulations against use of toxic halogenated flame retardants. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 HALOGEN-FREE FLAME RETARDANTS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 HALOGEN-FREE FLAME RETARDANTS MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

1.2.3 HALOGEN-FREE FLAME RETARDANTS MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 HALOGEN-FREE FLAME RETARDANTS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS OF THE STUDY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 HALOGEN-FREE FLAME RETARDANTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.2 DATA TRIANGULATION

FIGURE 2 HALOGEN-FREE FLAME RETARDANTS MARKET: DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.3 HALOGEN-FREE FLAME RETARDANTS MARKET: STUDY APPROACH

2.3.4 MARKET SIZE CALCULATION USING PARENT MARKET

2.3.5 HALOGEN-FREE FLAME RETARDANTS MARKET, BY TYPE

2.3.6 HALOGEN-FREE FLAME RETARDANTS MARKET, BY END-USE INDUSTRY

2.4 ASSUMPTIONS

2.5 FACTORS ANALYSIS

2.5.1 HALOGEN-FREE FLAME RETARDANTS MARKET: FACTORS IMPACTING THE MARKET

2.5.2 KEY INDUSTRY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 HALOGEN-FREE FLAME RETARDANTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 3 MARKET SIZE IN TERMS OF REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

3.1.1 NON-COVID-19 SCENARIO

3.1.2 OPTIMISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

3.1.4 REALISTIC SCENARIO

FIGURE 4 POLYOLEFINS IS THE LARGEST APPLICATION SEGMENT OF THE HALOGEN-FREE FLAME RETARDANTS MARKET

FIGURE 5 ORGANOPHOSPHORUS IS THE FASTEST-GROWING HALOGEN-FREE FLAME RETARDANT

FIGURE 6 ELECTRICAL & ELECTRONICS IS THE LARGEST END-USE INDUSTRY FOR HALOGEN-FREE FLAME RETARDANTS

FIGURE 7 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 HALOGEN-FREE FLAME RETARDANTS MARKET OVERVIEW

FIGURE 8 STRINGENT GOVERNMENT RULES AGAINST TOXIC HALOGENATED FLAME RETARDANTS TO DRIVE MARKET GROWTH

4.2 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION

FIGURE 9 NORTH AMERICA WILL CONTINUE TO DOMINATE THE HALOGEN-FREE FLAME RETARDANTS MARKET DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SHARE, BY END-USE INDUSTRY & COUNTRY, 2019

FIGURE 10 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN HALOGEN-FREE FLAME RETARDANTS MARKET IN 2019

4.4 REGIONAL MIX: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION

FIGURE 11 POLYOLEFINS IS THE LARGEST APPLICATION SEGMENT OF THE MARKET

4.5 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020 VS. 2025

FIGURE 12 ALUMINUM HYDROXIDE SEGMENT DOMINATES THE HALOGEN-FREE FLAME RETARDANTS MARKET

4.6 HALOGEN-FREE FLAME RETARDANTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 13 INDIA WILL REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 51)

5.1 MARKET DYNAMICS

FIGURE 14 OVERVIEW OF THE MARKET DYNAMICS GOVERNING THE HALOGEN-FREE FLAME RETARDANTS MARKET

5.1.1 DRIVERS

5.1.1.1 Stringent government rules against toxic halogenated flame retardants

5.1.1.2 Growing use of polymers in the automobile industry

5.1.1.3 Strict fire safety guidelines

5.1.2 RESTRAINTS

5.1.2.1 High loading levels of mineral-based flame retardants

5.1.2.2 Lower performance than halogenated flame retardants

5.1.3 OPPORTUNITIES

5.1.3.1 Introduction of more effective synergist compounds

5.1.3.2 Emerging economies in the APAC region

5.1.3.3 Rising demand for consumer electronics worldwide

5.2 SUPPLY CHAIN ANALYSIS

FIGURE 15 SUPPLY CHAIN OF HALOGEN-FREE FLAME RETARDANTS

5.2.1 RAW MATERIAL

5.2.2 MANUFACTURING

5.2.3 APPLICATIONS

5.2.4 END-USE INDUSTRIES

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT FROM NEW ENTRANTS

5.3.2 THREAT FROM SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

FIGURE 17 HALOGEN-FREE FLAME RETARDANTS MARKET: CHANGING REVENUE MIX

5.5 CONNECTED MARKETS: ECOSYSTEM

FIGURE 18 HALOGEN-FREE FLAME RETARDANTS MARKET: ECOSYSTEM

5.6 CASE STUDIES

FIGURE 19 ASSESSMENT OF THE HALOGEN-FREE FLAME RETARDANTS INDUSTRY

5.7 AVERAGE SELLING PRICE

TABLE 1 HALOGEN-FREE FLAME RETARDANTS: GLOBAL AVERAGE PRICE, 2018–2025 (USD/KG)

5.8 INDUSTRY OUTLOOK

5.8.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

TABLE 2 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMY, 2017–2024 (USD BILLION)

5.8.2 AUTOMOTIVE INDUSTRY

TABLE 3 VEHICLE PRODUCTION, BY MAJOR ECONOMY, 2019 (UNITS)

5.9 IMPACT OF COVID-19: CUSTOMER ANALYSIS

5.9.1 DISRUPTIONS IN THE AUTOMOTIVE INDUSTRY

5.9.1.1 Impact on customers’ output & strategies to resume/improve production

TABLE 4 ANNOUNCEMENTS BY AUTOMOTIVE COMPANIES

5.9.1.2 Customers’ most-impacted regions

TABLE 5 OPPORTUNITY ASSESSMENT: SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURES AND SUPPLY CHAINS

5.9.1.3 MnM’s viewpoint on the growth outlook and new market opportunities

5.9.2 DISRUPTIONS IN THE CONSTRUCTION INDUSTRY

5.9.2.1 Impact on customers’ output and strategies to resume/improve production

TABLE 6 ANNOUNCEMENTS BY CONSTRUCTION COMPANIES

5.9.2.2 Customers’ most-affected regions

5.9.2.3 MnM’s viewpoint on the growth outlook and new market opportunities

5.1 RECOVERY ROAD FOR 2020 AND 2021

FIGURE 20 RECOVERY ROAD FOR 2020 AND 2021

6 HALOGEN-FREE FLAME RETARDANTS MARKET, BY TYPE (Page No. - 67)

6.1 INTRODUCTION

FIGURE 21 ALUMINUM HYDROXIDE TO DOMINATE THE HALOGEN-FREE FLAME RETARDANTS MARKET, BY TYPE, DURING THE FORECAST PERIOD

TABLE 7 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 8 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 9 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 10 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

6.2 ALUMINUM HYDROXIDE

6.2.1 LOW COST AND EASY AVAILABILITY OF ALUMINUM HYDROXIDE TO DRIVE MARKET GROWTH

FIGURE 22 NORTH AMERICA TO BE THE LARGEST MARKET FOR ALUMINUM HYDROXIDE HALOGEN-FREE FLAME RETARDANTS

TABLE 11 ALUMINUM HYDROXIDE HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 12 ALUMINUM HYDROXIDE HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 13 ALUMINUM HYDROXIDE HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 ALUMINUM HYDROXIDE HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 ORGANOPHOSPHORUS

6.3.1 DEMAND FOR ECO-FRIENDLY PRODUCTS TO DRIVE THE MARKET

FIGURE 23 EUROPE IS THE SECOND-LARGEST MARKET FOR ORGANOPHOSPHORUS HALOGEN-FREE FLAME RETARDANTS

TABLE 15 ORGANOPHOSPHORUS HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 16 ORGANOPHOSPHORUS HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 17 ORGANOPHOSPHORUS HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 ORGANOPHOSPHORUS HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 OTHER HALOGEN-FREE FLAME RETARDANTS

6.4.1 ZINC BORATE

6.4.2 MAGNESIUM HYDROXIDE

6.4.3 NITROGEN-BASED FLAME RETARDANTS

6.4.4 BORON-BASED FLAME RETARDANTS

FIGURE 24 APAC TO REGISTER THE HIGHEST CAGR IN THE OTHER HALOGEN-FREE FLAME RETARDANTS MARKET DURING THE FORECAST PERIOD

TABLE 19 OTHER HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 20 OTHER HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 21 OTHER HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 OTHER HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 HALOGEN-FREE FLAME RETARDANTS MARKET, BY APPLICATION (Page No. - 77)

7.1 INTRODUCTION

FIGURE 25 POLYOLEFINS ACCOUNTED FOR THE LARGEST SHARE OF THE HALOGEN-FREE FLAME RETARDANTS MARKET, BY APPLICATION

TABLE 23 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 24 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 25 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 26 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

7.2 POLYOLEFINS

7.2.1 HIGH DEMAND FROM CONSUMER-CENTRIC INDUSTRIES TO DRIVE THE MARKET FOR POLYOLEFINS

FIGURE 26 NORTH AMERICA TO DOMINATE THE HALOGEN-FREE FLAME RETARDANTS MARKET FOR POLYOLEFINS

TABLE 27 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR POLYOLEFIN APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 28 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR POLYOLEFIN APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 29 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR POLYOLEFIN APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR POLYOLEFIN APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.3 EPOXY RESINS

7.3.1 HIGH DEMAND FROM THE ELECTRONICS AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET GROWTH

FIGURE 27 NORTH AMERICA TO BE THE LARGEST MARKET FOR HALOGEN-FREE FLAME RETARDANTS FOR EPOXY RESINS

TABLE 31 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR EPOXY RESIN APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 32 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR EPOXY RESIN APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 33 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR EPOXY RESIN APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR EPOXY RESIN APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.4 UNSATURATED POLYESTER

7.4.1 HIGH CONSUMPTION IN EVERY INDUSTRY IS DRIVING THE MARKET

FIGURE 28 APAC TO BE THE THIRD-LARGEST MARKET FOR UPE APPLICATIONS DURING THE FORECAST PERIOD

TABLE 35 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR UPE APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 36 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR UPE APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 37 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR UPE APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR UPE APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.5 POLYVINYL CHLORIDE

7.5.1 BROAD RANGE OF APPLICATIONS OF PVC IS DRIVING MARKET GROWTH

FIGURE 29 EUROPE TO BE THE SECOND-LARGEST MARKET FOR PVC APPLICATIONS DURING THE FORECAST PERIOD

TABLE 39 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR PVC APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 40 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR PVC APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 41 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR PVC APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR PVC APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.6 RUBBER

7.6.1 HIGH THERMO-MECHANICAL PROPERTIES MAKE RUBBER SUITABLE FOR USE IN VARIOUS INDUSTRIES

FIGURE 30 EUROPE TO BE THE SECOND-LARGEST MARKET FOR RUBBER APPLICATIONS DURING THE FORECAST PERIOD

TABLE 43 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR RUBBER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 44 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR RUBBER APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 45 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR RUBBER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR RUBBER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.7 ENGINEERED THERMOPLASTICS

7.7.1 HIGHER STRENGTH AND LOW WEIGHT TO DRIVE THE DEMAND FOR ETP IN VARIOUS PRODUCTS

FIGURE 31 APAC TO BE THE THIRD-LARGEST MARKET FOR ETP APPLICATIONS DURING THE FORECAST PERIOD

TABLE 47 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR ETP APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 48 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR ETP APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 49 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR ETP APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR ETP APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.8 STYRENICS

7.8.1 HEAT AND IMPACT RESISTANCE OF STYRENE MAKE IT A KEY INGREDIENT IN VARIOUS PRODUCTS

FIGURE 32 NORTH AMERICA TO DOMINATE THE MARKET FOR STYRENICS APPLICATIONS DURING THE FORECAST PERIOD

TABLE 51 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR STYRENICS APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 52 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR STYRENICS APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 53 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR STYRENICS APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR STYRENICS APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

7.9 OTHER APPLICATIONS

FIGURE 33 EUROPE WILL BE THE SECOND-LARGEST MARKET FOR OTHER APPLICATIONS DURING THE FORECAST PERIOD

TABLE 55 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 56 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

TABLE 57 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

8 HALOGEN-FREE FLAME RETARDANTS MARKET, BY END-USE INDUSTRY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 34 ELECTRICAL & ELECTRONICS TO BE THE LARGEST END-USE INDUSTRY DURING THE FORECAST PERIOD

TABLE 59 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 60 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 61 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 62 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

8.2 ELECTRICAL & ELECTRONICS

8.2.1 ELECTRICAL & ELECTRONICS HOLD THE LARGEST MARKET SHARE

8.2.2 WIRES & CABLES

8.2.3 IMPACT OF COVID-19 ON THE ELECTRICAL & ELECTRONICS INDUSTRY

FIGURE 35 NORTH AMERICA TO BE THE LARGEST HALOGEN-FREE FLAME RETARDANTS MARKET FOR THE ELECTRICAL & ELECTRONICS INDUSTRY

TABLE 63 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 64 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 65 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.3 BUILDING & CONSTRUCTION

8.3.1 DEMAND FOR HIGH-PERFORMANCE HALOGEN-FREE FLAME RETARDANTS TO BOOST THE MARKET

8.3.2 CARPET LAYING

8.3.3 CERAMIC TILES

8.3.4 CONCRETE

8.3.5 SLIDING

8.3.6 ROOFING

8.3.7 OTHERS

8.3.8 IMPACT OF COVID-19 ON THE BUILDING & CONSTRUCTION INDUSTRY

FIGURE 36 APAC TO BE THE THIRD-LARGEST MARKET IN THE CONSTRUCTION INDUSTRY

TABLE 67 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 68 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 69 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 70 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.4 TRANSPORTATION

8.4.1 DEMAND FROM APAC TO FUEL THE HALOGEN-FREE FLAME RETARDANTS MARKET IN THIS SEGMENT

8.4.2 AUTOMOTIVE

8.4.3 AEROSPACE

8.4.4 IMPACT OF COVID-19 ON THE TRANSPORTATION INDUSTRY

FIGURE 37 EUROPE TO BE THE LARGEST HALOGEN-FREE FLAME RETARDANTS MARKET FOR THE TRANSPORTATION INDUSTRY

TABLE 71 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE TRANSPORTATION END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 72 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE TRANSPORTATION END-USE INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 73 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE TRANSPORTATION END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR THE TRANSPORTATION END-USE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.5 OTHER END-USE INDUSTRIES

FIGURE 38 NORTH AMERICA TO BE THE LARGEST MARKET FOR HALOGEN-FREE FLAME RETARDANTS IN OTHER END-USE INDUSTRIES

TABLE 75 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (KILOTON)

TABLE 76 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2020–2025 (KILOTON)

TABLE 77 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 78 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2020–2025 (USD MILLION)

9 HALOGEN-FREE FLAME RETARDANTS MARKET, BY REGION (Page No. - 110)

9.1 INTRODUCTION

FIGURE 39 APAC IS THE FASTEST-GROWING MARKET FOR HALOGEN-FREE FLAME RETARDANTS

TABLE 79 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 80 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 81 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 82 HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 APAC

9.2.1 IMPACT OF COVID-19 ON THE APAC HALOGEN-FREE FLAME RETARDANTS MARKET

FIGURE 40 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SNAPSHOT

TABLE 83 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 84 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 85 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 87 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 88 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 89 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 90 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 91 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 92 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 93 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 94 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 95 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 96 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 97 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 98 APAC: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.2 CHINA

9.2.2.1 Economic growth in the country is supporting the adoption of halogen-free flame retardants

TABLE 99 CHINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 100 CHINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 101 CHINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 102 CHINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Rising demand from the automotive sector to support market growth

TABLE 103 JAPAN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 104 JAPAN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 105 JAPAN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 106 JAPAN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.2.4 INDIA

9.2.4.1 Rising industrialization to propel market growth

TABLE 107 INDIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 108 INDIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 109 INDIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 110 INDIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.2.5 SOUTH KOREA

9.2.5.1 Growth of the automotive industry to support market growth

TABLE 111 SOUTH KOREA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 112 SOUTH KOREA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 113 SOUTH KOREA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 SOUTH KOREA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.3 NORTH AMERICA

9.3.1 IMPACT OF COVID-19 ON THE NORTH AMERICAN HALOGEN-FREE FLAME RETARDANTS MARKET

FIGURE 41 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SNAPSHOT

TABLE 115 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 116 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 117 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 118 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 119 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 120 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 121 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 122 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 123 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 124 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 125 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 126 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 127 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 128 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 129 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 NORTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.2 US

9.3.2.1 Strong industrial infrastructure likely to fuel the halogen-free flame retardants market

TABLE 131 US: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 132 US: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 133 US: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 134 US: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.3.3 CANADA

9.3.3.1 Automotive industry to boost the demand for halogen-free flame retardants

TABLE 135 CANADA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 136 CANADA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 137 CANADA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 138 CANADA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.3.4 MEXICO

9.3.4.1 Rising industrialization to propel the halogen-free flame retardants market in Mexico

TABLE 139 MEXICO: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 140 MEXICO: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 141 MEXICO: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 142 MEXICO: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.4 EUROPE

9.4.1 IMPACT OF COVID-19 ON THE EUROPEAN HALOGEN-FREE FLAME RETARDANTS MARKET

FIGURE 42 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SNAPSHOT

TABLE 143 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 144 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 145 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 146 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 147 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 148 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 149 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 150 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 151 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 152 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 153 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 154 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 155 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 156 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 157 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 158 EUROPE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.2 GERMANY

9.4.2.1 Rising government expenditure on the manufacturing sector to drive market growth

TABLE 159 GERMANY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 160 GERMANY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 161 GERMANY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 162 GERMANY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.4.3 UK

9.4.3.1 Growth in the automotive and construction industries is driving the demand for halogen-free flame retardants in the UK

TABLE 163 UK: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 164 UK: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 165 UK: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 166 UK: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.4.4 FRANCE

9.4.4.1 Economic growth in the country will support the growth of the halogen-free flame retardants market

TABLE 167 FRANCE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 168 FRANCE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 169 FRANCE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 170 FRANCE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.4.5 ITALY

9.4.5.1 Growth of the Italian automotive industry is propelling market growths

TABLE 171 ITALY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 172 ITALY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 173 ITALY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 174 ITALY: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

9.4.6 RUSSIA

9.4.6.1 Rising demand from the construction industry to drive market growth

TABLE 175 RUSSIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 176 RUSSIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 177 RUSSIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 RUSSIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.4.7 SPAIN

9.4.7.1 The demand for greener materials to augment the demand for halogen-free flame retardants

TABLE 179 SPAIN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 180 SPAIN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 181 SPAIN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 182 SPAIN: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 IMPACT OF COVID-19 ON THE MIDDLE EASTERN & AFRICAN HALOGEN-FREE FLAME RETARDANTS MARKET

TABLE 183 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 184 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 185 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 188 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 189 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 190 MIDDLE EAST: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 192 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 193 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 194 MIDDLE EAST: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 196 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 197 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.2 SAUDI ARABIA

9.5.2.1 Saudi Arabia is the largest market for halogen-free flame retardants in the region

TABLE 199 SAUDI ARABIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 200 SAUDI ARABIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 201 SAUDI ARABIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2025 (USD MILLION)

TABLE 202 SAUDI ARABIA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.5.3 UAE

9.5.3.1 Growth in real estate and infrastructure projects to drive market growth

TABLE 203 UAE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 204 UAE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 205 UAE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 206 UAE: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.5.4 EGYPT

9.5.4.1 Egypt is the third-largest halogen-free flame retardants market in the Middle East & Africa

TABLE 207 EGYPT: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 208 EGYPT: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 209 EGYPT: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 210 EGYPT: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 IMPACT OF COVID-19 ON THE SOUTH AMERICAN HALOGEN-FREE FLAME RETARDANTS MARKET

TABLE 211 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 212 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 213 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 214 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 215 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 216 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 217 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 218 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 219 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 220 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 221 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 222 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 223 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 224 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 225 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 226 SOUTH AMERICA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.6.2 BRAZIL

9.6.2.1 Brazil is the largest market for halogen-free flame retardants in South America

TABLE 227 BRAZIL: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 228 BRAZIL: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 229 BRAZIL: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 230 BRAZIL: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.6.3 ARGENTINA

9.6.3.1 Rising vehicle sales likely to drive market growth

TABLE 231 ARGENTINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 232 ARGENTINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 233 ARGENTINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 234 ARGENTINA: HALOGEN-FREE FLAME RETARDANTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 176)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 43 HALOGEN-FREE FLAME RETARDANTS: MARKET EVALUATION FRAMEWORK, 2016-2020

10.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 44 HALOGEN-FREE FLAME RETARDANTS MARKET: REVENUE OF KEY PLAYERS, 2015-2019

10.4 COMPETITIVE LEADERSHIP MAPPING FOR TIER 1 COMPANIES

10.4.1 STARS

10.4.2 EMERGING LEADERS

FIGURE 45 HALOGEN-FREE FLAME RETARDANTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.5 STRENGTH OF PRODUCT PORTFOLIO

10.6 BUSINESS STRATEGY EXCELLENCE

10.7 COMPETITIVE LEADERSHIP MAPPING FOR SMALL AND MEDIUM-SIZED ENTERPRISES

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

FIGURE 46 HALOGEN-FREE FLAME RETARDANTS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMALL AND MEDIUM-SIZED ENTERPRISES, 2019

10.8 STRENGTH OF PRODUCT PORTFOLIO

10.9 BUSINESS STRATEGY EXCELLENCE

10.1 MARKET SHARE ANALYSIS

FIGURE 47 HALOGEN-FREE FLAME RETARDANTS MARKET SHARE, BY COMPANY, 2019

10.11 COMPETITIVE SCENARIO

10.11.1 PRODUCT LAUNCHES

TABLE 235 PRODUCT LAUNCHES, 2016–2020

10.11.2 EXPANSIONS

TABLE 236 EXPANSIONS, 2016–2020

10.11.3 AGREEMENTS

TABLE 237 AGREEMENTS, 2016–2020

10.11.4 ACQUISITIONS

TABLE 238 ACQUISITIONS, 2016–2020

11 COMPANY PROFILES (Page No. - 187)

(Business overview, Products offered, Recent developments, Winning imperatives, Short-term strategies: COVID-19 impact, Current focus and strategies, Threat from competitors & Right to win)*

11.1 CLARIANT AG

FIGURE 48 CLARIANT AG: COMPANY SNAPSHOT

FIGURE 49 CLARIANT AG: WINNING IMPERATIVES

11.2 LANXESS AG

FIGURE 50 LANXESS AG: COMPANY SNAPSHOT

FIGURE 51 LANXESS AG: WINNING IMPERATIVES

11.3 ISRAEL CHEMICALS LTD. (ICL)

FIGURE 52 ISRAEL CHEMICALS LTD.: COMPANY SNAPSHOT

FIGURE 53 ISRAEL CHEMICALS LTD.: WINNING IMPERATIVES

11.4 NABALTEC AG

FIGURE 54 NABALTEC AG: COMPANY SNAPSHOT

FIGURE 55 NABALTEC AG: WINNING IMPERATIVES

11.5 BASF SE

FIGURE 56 BASF SE: COMPANY SNAPSHOT

FIGURE 57 BASF SE: WINNING IMPERATIVES

11.6 HUBER ENGINEERED MATERIALS

11.7 ITALMATCH CHEMICALS S.P.A.

FIGURE 58 ITALMATCH CHEMICALS S.P.A.: COMPANY SNAPSHOT

11.8 DUPONT DE NEMOURS INC.

FIGURE 59 DUPONT DE NEMOURS INC.: COMPANY SNAPSHOT

11.9 RTP COMPANY

11.10 KISUMA CHEMICALS BV

*Details on Business overview, Products offered, Recent developments, Winning imperatives, Short-term strategies: COVID-19 impact, Current focus and strategies, Threat from competitors & Right to win might not be captured in case of unlisted companies.

11.11 OTHER MARKET PLAYERS

11.11.1 BUDENHEIM CHEMICALS KG

11.11.2 GREENCHEMICALS SPA

11.11.3 STAHL HOLDINGS B.V.

11.11.4 GULEC CHEMICALS GMBH

11.11.5 AKZONOBEL N.V.

11.11.6 CELANESE CORPORATION

11.11.7 AMFINE CHEMICAL CORPORATION

11.11.8 THOR COMPANY

11.11.9 ARKEMA SA

11.11.10 AXIPOLYMER INC.

11.11.11 DONGYING JINGDONG CHEMICAL CO., LTD.

11.11.12 QINGDAO FUNDCHEM CO., LTD.

11.11.13 POLYPLASTICS CO., LTD.

11.11.14 CENTURY MULTECH, INC.

11.11.15 PRESAFER (QINGYUAN) PHOSPHOR CHEMICAL CO. LTD

12 ADJACENT & RELATED MARKETS (Page No. - 212)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 NON-PHTHALATE PLASTICIZERS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE

TABLE 239 NON-PHTHALATE PLASTICIZERS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 240 NON-PHTHALATE PLASTICIZERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.5 NON-PHTHALATE PLASTICIZERS MARKET, BY APPLICATION

TABLE 241 NON-PHTHALATE PLASTICIZERS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 242 NON-PHTHALATE PLASTICIZERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.6 NON-PHTHALATE PLASTICIZERS MARKET, BY REGION

TABLE 243 NON-PHTHALATE PLASTICIZERS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 244 NON-PHTHALATE PLASTICIZERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13 APPENDIX (Page No. - 216)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

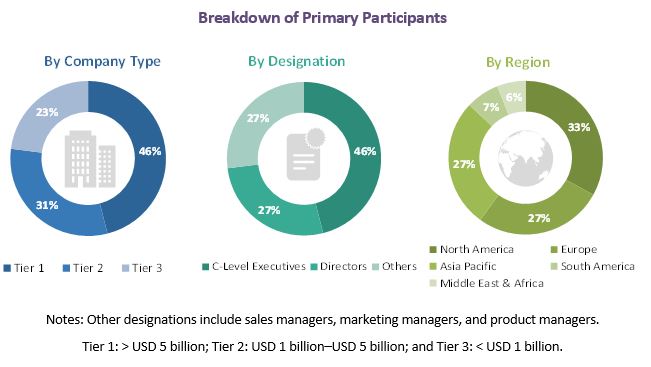

The study involved four major activities in estimating the market size for the halogen-free flame retardants market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The halogen-free flame retardants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the electronics, construction and transportation industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the halogen-free flame retardants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the electronics, construction and transportation industry.

Report Objectives

- To analyze and forecast the size of the halogen-free flame retardants market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the halogen-free flame retardants market based on type, application and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Halogen-Free Flame Retardants Market