Halal Ingredients Market by Type (Ingredients for Food & Beverage Industry, Ingredients for Pharmaceutical Industry, Ingredients for Cosmetics Industry), Application (Food & Beverage, Pharmaceuticals, and Cosmetics), and Region - Global Forecast to 2025

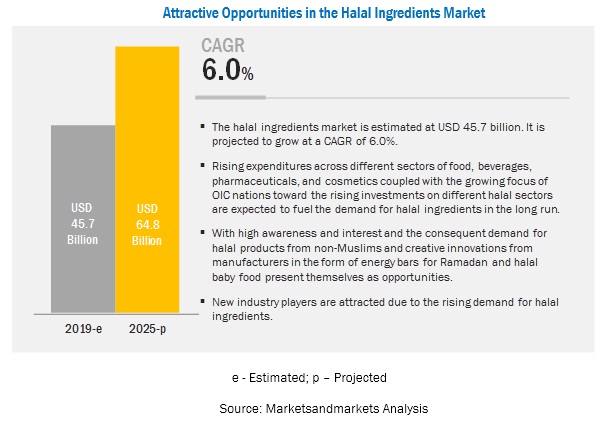

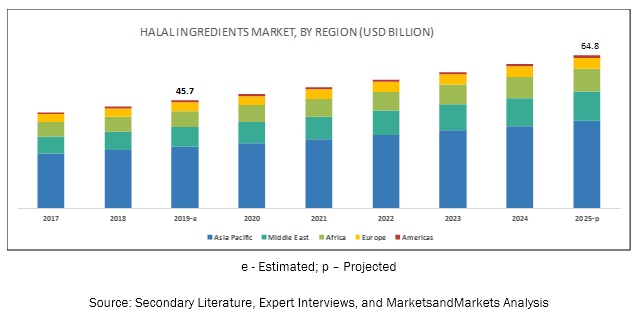

[188 Pages Report] The global halal ingredients market is estimated to be valued at USD 45.7 billion in 2019 and is projected to reach USD 64.8 billion by 2025, recording a CAGR of 6.0%. Consumption of food items is also increasing due to the surge in the Muslim population worldwide, which is projected to drive the growth of the market. Halal ingredients are also gaining traction in the healthcare and pharmaceutical industries due to the growing demand for dietary supplements and its health benefits. Consumers are witnessing an increasing demand for on-the-go, convenient, nutritionally enriched, and functional food & beverage products, due to their busy lifestyles. The growing trends of healthy snacking and increasing awareness about functional food & beverage products are also projected to drive the market for halal ingredients during the forecast period.

The food and beverages segment is estimated to dominate the global market in 2019.

By application, the halal ingredients market was dominated by the food & beverages segment in 2018, in terms of value. The food companies are focusing on product innovations and providing halal products to cater to the growing demand among consumers. In addition, companies are focusing on gaining consumer trust with several marketing campaigns and coming up with a wide variety of halal food products for consumers, which is positively stimulating the growth of the market. The health benefits and cleanliness associated with halal-certified foods is also driving the market in the food industry. The growing standardization in the halal certification sector is projected to offer growth opportunities to the halal ingredients manufacturers in the food and beverage industry.

The flavor segment is estimated to account for a larger share in the halal ingredients market in 2019.

By type, the flavors segment is estimated to account for a larger share in the halal ingredients market in 2019. Flavors are intense preparations added to food products to stimulate or impart a particular taste, maintain the flavor after processing, modify an already existing flavor, and masking an undesirable flavor. The demand for flavors is attributed to the changing consumer preferences toward convenience foods and rising demand for consumer products. The increasing popularity of new and innovative flavors in convenience and ready-to-eat food products among the young generation is also driving the demand for halal-based flavors in the markets. Majority of the flavor companies are inclined toward obtaining halal certification due to the growing demand, which is projected to create profitable opportunities for manufacturers in this market.

The Middle East market is projected to grow at the highest CAGR during the forecast period.

The Middle East is projected to be the fastest-growing regional market for halal ingredients in 2019. Favorable government regulations in GCC countries for halal food is driving the market. The growing population in the Middle Eastern countries is driving the overall halal food market. Global players are expanding their businesses in the Middle East to cater to the increasing demand for halal ingredients. In addition, rapid economic growth, as a result of the stable political environment in countries such as Saudi Arabia, Iran, and the UAE, is contributing to the growth in the food & beverage and consumer product industries. Similarly, the growing population and increase in the disposable income in the region are factors driving the demand for products manufactured using halal ingredients, which in turn, is projected to drive the market.

Key Market Players

Key players in the halal ingredients market include Koninklijke DSM N.V. (Netherlands), Cargill (US), Barentz B.V. (Netherlands), ADM (US), Kerry (Ireland), DowDupont (US), Solvay S.A. (Belgium), BASF (Germany), Symrise (Germany), Ashland (US), Purecircle Limited (Malaysia), and Halagel (Malaysia). Key market players, along with the other players, adopted various business strategies such as new product launches, expansions, and joint ventures & agreements in the last few years, to meet the growing demand for halal ingredients.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

20192025 |

|

Market size available for years |

20172025 |

|

Base year considered |

2018 |

|

Forecast period |

20192025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

Americas, Africa, the Middle East, Europe, and the Asia Pacific |

|

Companies covered |

Koninklijke DSM N.V. (Netherlands), ADM (US), DowDupont (US), Kerry (Ireland), Solvay S.A. (Belgium), Barentz B.V. (Netherlands), Cargill (US), BASF (Germany), Symrise (Germany), Ashland (US), Purecircle Limited (Malaysia), and Halagel (Malaysia). |

This research report categorizes the halal ingredients market based on type, application, and region.

On the basis of type, the market has been segmented as follows:

- Ingredients for the food & Beverages industry

- Ingredients for the pharmaceutical industry

- Ingredients for the cosmetic industry

On the basis of application, the market has been segmented as follows:<

- Pharmaceuticals

- Food & beverages

- Cosmetics

On the basis of region, the market has been segmented as follows:

- Americas

- Europe

- Middle East

- Africa

- Asia Pacific

Recent Developments:

- ADM (US) is focusing on expansions and new product developments to enhance its foothold in the market. For example, in March 2019, Archer Daniels Midland (ADM) launched high-quality organic flours. The new line of organic flour portfolio includes organic all-purpose flour and organic premium bread flour. The products will add to the complementary range of organic and grain-based products.

Key questions addressed by the report:

- What are the new trending products that halal ingredient companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What are the upcoming growth trends that halal ingredients manufacturers are focusing on in the future?

- What are the high-growth opportunities in the halal ingredients market for each segment?

- What are the key growth strategies adopted by major market players in the halal ingredients market?

Frequently Asked Questions (FAQ):

What is the leading type in the halal ingredients market?

The ingredients for the food & beverage industry segment was the highest revenue contributor to the market, with USD 25,261.8 million in 2018, and is estimated to reach USD 36,297.9 million by 2025, with a CAGR of 5.3%.

What is the estimated industry size of halal ingredients?

The global halal ingredients market was valued at USD 43,095.6 million in 2018, and is projected to reach USD 64,769.8 million by 2025, registering a CAGR of 6.0% from 2019 to 2025.

What is the leading application in the halal ingredients market?

The food & beverages segment was the highest revenue contributor to the market, with USD 25,261.8 million in 2018, and is estimated to reach USD 36,297.9 million by 2025, with a CAGR of 5.3%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Halal Ingredients Market: Market Segmentation

1.3.2 Halal Ingredients Market: Geographic Segmentation

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

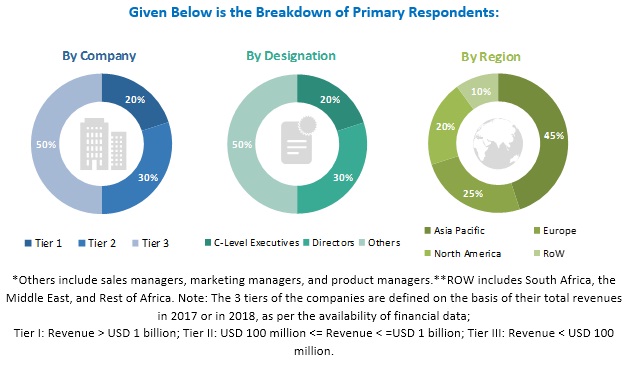

2.2 Breakdown of Primaries

2.3 Market Size Estimation

2.4 Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

2.6 Primary Insights

3 Executive Summary

4 Premium Insights

4.1 Attractive Growth Opportunities in Global Market

4.2 Halal Ingredients Market, By Application

4.3 Halal Ingredients: Key Countries

5 Market Overview

5.1 Introduction

5.2 Halal Ingredients: Supply Chain

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Non-Oic Countries are Increasingly Relying on the Halal Food Industry

5.3.1.2 The Increase in the Muslim Population is Contributing to Rise in Demand for Halal Food and Ingredients

5.3.2 Restraints

5.3.2.1 Lack of Uniformity for Halal Standards in Different Countries

5.3.3 Opportunities

5.3.3.1 Unaddressed High-Potential Product Segments for Halal Ingredients

5.3.4 Challenges

5.3.4.1 There are No Common Standards and Being Halal-Certified Does Not Guarantee Access to the Global Market

6 Regulations

6.1 Introduction

6.2 General Guidelines for the Use of the Term Halal, By Food and Agriculture Organization (FAO)

6.2.1 Definition

6.2.2 Criteria for the Use of the Term Halal

6.2.2.1 Food of Animal Origin

6.2.2.2 Food of Plant Origin

6.2.2.3 Beverages

6.3 Slaughtering

6.4 Halal Ingredients- Regulatory Landscape

6.5 List of Major Halal Certification Bodies, Globally

6.6 Major Accrediation Bodies for Halal Food

7 Halal Ingredients Market, By Application

7.1 Introduction

7.2 Food &Beverage

7.2.1 Convenience Food Products

7.2.2 Bakery Products

7.2.3 Beverage Products

7.2.4 Meat & Poultry Products

7.2.5 Confectionary Products

7.2.6 Others

7.3 Cosmetics

7.3.1 Skin Care

7.3.2 Hair Care

7.3.3 Make-Up

7.3.4 Fragrance

7.3.5 Others

7.4 Pharmaceuticals

8 Halal Ingredients Market, By Ingredient Type

8.1 Introduction

8.2 Ingredients for the Food & Beverage Industry

8.2.1 Flavors

8.2.2 Hydrocolloids (Thickeners, Binders, Stabilizers)

8.2.3 Starches

8.2.4 Sweeteners

8.2.5 Acidulants

8.2.6 Emulsifiers

8.2.7 Enzymes

8.2.8 Colors

8.2.9 Protein (Concentrates + Isolates)

8.2.10 Antioxidants

8.2.11 Preservatives

8.2.12 Others

8.3 Ingredients for the Pharmaceutical Industry

8.3.1 Active Pharma Ingredients

8.3.2 Excipients

8.4 Ingredients for the Cosmetic Industry

8.4.1 Specialty Additives

8.4.2 Active Ingredients

8.4.3 Others

9 Halal Ingredients Market, By Region

9.1 Introduction

9.2 Asia Pacific

9.2.1 Indonesia

9.2.1.1 Indonesia Accounted for the Largest Share in the Asia Pacific Halal Ingredient Market

9.2.2 India

9.2.2.1 Increasing Consumer Awareness Regarding Halal Products is Driving the Market

9.2.3 Malaysia

9.2.3.1 Malaysia is One of the Largest Exporters of Halal-Based Products, Globally

9.2.4 China

9.2.4.1 Increasing Consumer Spending is Fuelling the Market for Halal-Certified Products

9.2.5 Rest of Asia Pacific

9.2.5.1 Changing Consumer Preference has Boosted the Overall Food & Beverage Market in Asia Pacific

9.3 Middle East

9.3.1 GCC Countries

9.3.1.1 GCC Countries Accounted for the Largest Share in Middle East Halal Ingredients Market

9.3.2 Rest of Middle East

9.3.2.1 Increasing Consumer Spending on Food and Cosmetics in these Countries is Driving the Market

9.4 Africa

9.4.1 North Africa

9.4.1.1 North Africa Accounted for the Larger Share in the African Halal Ingredients Market

9.4.2 Rest of Africa

9.4.2.1 Increasing Consumer Awareness Regarding Halal Products is Driving the Market in Rest of Africa

9.5 Europe

9.5.1 Russia

9.5.1.1 Russia is the Largest Market in Europe for Halal Ingredients Followed By France and Germany. the Country Also has A Largest Population of Muslims in the European Region.

9.5.2 France

9.5.3 Germany

9.5.4 UK

9.5.5 Rest of Europe

9.6 Americas

9.6.1 US

9.6.2 Brazil

9.6.3 Canada

9.6.4 Rest of Americas

10 Competitive Landscape

10.1 Overview

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Dynamic Differentiators

10.2.3 Innovators

10.2.4 Emerging Companies

10.3 Ranking of Key Players, 2019

10.4 Competitive Scenario

11 Company Profiles

11.1 Koninklijke Dsm N.V

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Archer Daniels Midland

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 DowDupont

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Kerry

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Solvay S.A.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 Barentz International Bv

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 Cargill

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 SWOT Analysis

11.7.5 MnM View

11.8 BASF

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 SWOT Analysis

11.8.5 MnM View

11.9 Ashland

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 SWOT Analysis

11.9.5 MnM View

11.10 Symrise

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 SWOT Analysis

11.10.5 MnM View

11.11 Purecircle Limited

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.11.4 SWOT Analysis

11.11.5 MnM View

11.12 Halagel

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Recent Developments

11.12.4 SWOT Analysis

11.12.5 MnM View

12 Appendix

12.1 Discussion Guide

12.2 Available Customizations

12.3 Related Reports

List of Tables (97 Tables)

Table 1 US Dollar Exchange Rate Considered for Study, 2014-2016

Table 2 Halal Ingredients Market Size, By Application , 2019-2025 (USD Billion)

Table 3 Halal Ingredients Market, Food & Beverage , By Value (USD Billion)

Table 4 Halal Ingredients Market in Food & Beverage, By Region (USD Billion)

Table 5 Halal Ingredients Market, Convenience Food Products, By Value (USD Million)

Table 6 Halal Ingredients Market, Bakery Products, By Value (USD Million)

Table 7 Halal Ingredients Market, Beverage, By Value (USD Million)

Table 8 Halal Ingredients Market, Meat and Poultry, By Value (USD Million)

Table 9 Halal Ingredients Market, Confectionery Food Products, By Value (USD Million)

Table 10 Halal Ingredients Market, Others, By Value (USD Million)

Table 11 Halal Ingredients Market, Pharmaceuticals, By Value (USD Billion)

Table 12 Halal Ingredients Market, Cosmetics, By Value (USD Million)

Table 13 Halal Ingredients Market, Skin Care , By Value (USD Million)

Table 14 Halal Ingredients Market, Hair Care, By Value (USD Million)

Table 15 Halal Ingredients Market, Make Up, By Value (USD Million)

Table 16 Halal Ingredients Market, Fragrance, By Value (USD Billion)

Table 17 Halal Ingredients Market, Others in Cosmetics , By Value (USD Billion)

Table 18 Halal Ingredients Market Size, By Type, 20172025 (USD Million)

Table 19 Halal Ingredients Market Size for the Food & Beverage Industry, By Type, 20172025 (USD Million)

Table 20 Halal Ingredients Market Size for the the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 21 Halal-Certified Flavors Market Size for the Food & Beverages Industry, By Region, 20172025 (USD Million)

Table 22 Halal-Certified Hydrocolloids Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 23 Halal-Certified Starch Ingredients Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 24 Halal-Certified Sweeteners Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 25 Halal-Certified Acidulants Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 26 Halal-Certified Emulsifiers Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 27 Halal-Certified Enzymes Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 28 Halal-Certified Colors Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 29 Halal-Certified Protein Ingredients Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 30 Halal-Certified Antioxidant Ingredients Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 31 Halal-Certified Preservatives Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 32 Other Halal Ingredients Market Size for the Food & Beverage Industry, By Region, 20172025 (USD Million)

Table 33 Market Size for the Pharmaceutical Industry, By Type, 20172025 (USD Million)

Table 34 Halal-Certified Active Pharma Ingredients Market Size for the Pharmaceutical Industry, 20172025 (USD Million)

Table 35 Halal-Certified Excipients Market Size for the Pharmaceutical Industry, 20172025 (USD Million)

Table 36 Market Size for the Cosmetics Industry, By Type, 20172025 (USD Million)

Table 37 Halal Ingredients Market Size for the Cosmetics Industry, By Region, 20172025 (USD Million)

Table 38 Halal-Certified Speciality Additives Market Size for the Cosmetics Industry, By Region, 20172025 (USD Million)

Table 39 Halal-Certified Active Ingredients Market Size for the Cosmetics Industry, By Region, 20172025 (USD Million)

Table 40 Other Halal Ingredients Market Size for the Cosmetics Industry, By Region, 20172025 (USD Million)

Table 41 Asia Pacific Halal Ingredients for the Food & Beverage Industry, 2017-2025 (USD Million)

Table 42 Asia Pacific Halal Ingredients for the Pharmaceutical Industry, By Type, 2017-2025 (USD Million)

Table 43 Asia Pacific Halal Ingredients for the Cosmetic Industry, By Type, 2017-2025 (USD Million)

Table 44 Asia Pacific: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 45 Asia Pacific: Market, By Application in Food & Beverages, 2017-2025 (USD Million)

Table 46 Asia Pacific: Market, By Application in Cosmetics, 2017-2025 (USD Million)

Table 47 Asia Pacific: Market, By Country, 2017-2025 (USD Million

Table 48 Indonesia: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 49 India: Market, By Application, 2017-2025 (USD Million)

Table 50 Malaysia: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 51 China: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 52 Rest of Asia Pacific: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 53 Middle East: Halal Ingredients Market, By Type, 2017-2025 (USD Million)

Table 54 Middle East: Halal Ingredients for the Food & Beverage Industry, 2017-2025 (USD Million)

Table 55 Middle East: Halal Ingredients for the Pharmaceutical Industry, By Type, 2017-2025 (USD Million)

Table 56 Middle East: Halal Ingredients Market for the Cosmetic Industry, By Type, 2017-2025 (USD Million)

Table 57 Middle East: Market, By Application, 2017-2025 (USD Million)

Table 58 Middle East: Market, By Application in the Food & Beverage Industry 2017-2025 (USD Million)

Table 59 Middle East: Market, By Application in the Cosmetic Industry, 2017-2025 (USD Million)

Table 60 Middle East: Halal Ingredients Market, By Region, 2017-2025 (USD Million)

Table 61 GCC Countries: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 62 Rest of Middle East: Halal Ingredients Market, Application,2017-2025 (USD Million)

Table 63 Africa: Halal Ingredients Market, By Type, 20172025 (USD Million)

Table 64 Africa: Market Size for the Food & Beverage Industry, By Type, 20172025 (USD Million)

Table 65 Africa: Market Size for the Pharmaceutical Industry, By Type, 20172025 (USD Million)

Table 66 Africa: Market Size for the Cosmetics Industry, By Type, 20172025 (USD Million)

Table 67 Africa: Market Size, By Application, 20172025 (USD Million)

Table 68 Africa: Market Size for the Food & Beverage Industry, By Subapplication, 20172025 (USD Million)

Table 69 Africa: Market Size for the Cosmetic Industry, By Subapplication, 20172025 (USD Million)

Table 70 Africa: Market Size, By Country, 20172025 (USD Million)

Table 71 North Africa: Halal Ingredients Market Size, By Type, 20172025 (USD Million)

Table 72 Rest of Africa: Market Size, By Type, 20172025 (USD Million)

Table 73 Europe: Halal Ingredients Market, By Country, 20172025 (USD Million)

Table 74 Europe: Market,By Ingredient, 20172025 (USD Million)

Table 75 Europe: Market, By Application, 20172025 (USD Million)

Table 76 Europe: Ingredients for the Food & Beverage Industry, 20172025 (USD Million)

Table 77 Europe: Ingredients for the Pharmaceutical Industry, 20172025 (USD Million)

Table 78 Europe: Ingredients for the Cosmetics Industry, 20172025 (USD Million)

Table 79 Europe: Food & Beverage Industry, By Application, 20172025 (USD Million)

Table 80 Europe: Cosmetic Industry, By Application, 20172025 (USD Million)

Table 81 Russia: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 82 France: Market, By Application, 2017-2025 (USD Million)

Table 83 Germany: Market, By Application, 2017-2025 (USD Million)

Table 84 UK: Market, By Application, 2017-2025 (USD Million)

Table 85 Rest of Europe: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 86 Americas: Halal Ingredients Market, By Country, 20172025 (USD Million)

Table 87 Americas: Market,By Ingredient, 20172025 (USD Million)

Table 88 Americas: Market, By Application, 20172025 (USD Million)

Table 89 Americas: Ingredients for the Food & Beverage Industry, 20172025 (USD Million)

Table 90 Americas: Ingredients for the Pharmaceutical Industry, 20172025(USD Million)

Table 91 Americas: Ingredients for the Cosmetic Industry, 20172025 (USD Million)

Table 92 Americas: Food & Beverage Industry, By Application, 20172025 (USD Million)

Table 93 Americas: Cosmetics, By Application, 20172025 (USD Million)

Table 94 US: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 95 Brazil: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 96 Canada: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

Table 97 Rest of the Americas: Halal Ingredients Market, By Application, 2017-2025 (USD Million)

List of Figures (41 Figures)

Figure 1 Market Segmentation

Figure 2 Geographic Segmentation

Figure 3 Research Design

Figure 4 Report Process Flow

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation,And Region

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Size Estimation: Bottom-Up Approach

Figure 8 Data Triangulation

Figure 9 Assumptions

Figure 10 Limitations

Figure 11 Key Primary Insights

Figure 12 Halal Ingredients Market, By Type (USD Billion)

Figure 13 Market, By Application (USD Billion)

Figure 14 Market Share for the Cosmetics Industry (2019)

Figure 15 Halal Ingredients Market, By Region

Figure 16 Growing Demand for Halal Ingredients in the Pharmaceutical and Cosmetic Industries Driving the Market Growth

Figure 17 Food and Beverages Segment to Dominate the Market Through 2019

Figure 18 Halal Ingredients: Key Countries

Figure 19 Market Dynamics

Figure 20 Top Exporters of Meat & Live Animals to Oic, 2014 (USD Billion)

Figure 21 Halal Ingredients Regulatory Landscape

Figure 22 Food & Beverages Dominated the Application Segment for Halal Ingredients Due to the Widespread Applications in Products Such as Convenience Foods, Bakery Products, Confectionery Products, and Meat and Poultry Products

Figure 23 Halal Ingredients Market Size, By Type, 2019 vs. 2025 (USD Million)

Figure 24 Indonesia Halal Ingredient Market is Estimated to Grow at the Highest CAGR During Forecast Period

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Malaysia Halal Exports, 2011-2016, USD Billion

Figure 27 Middle East: Market Snapshot

Figure 28 Key Developments of the Leading Players in the Halal Ingredient Market, 2014 2019

Figure 29 Competitive Benchmarking

Figure 30 Competitive Leadership Mapping

Figure 31 Koninklijke Dsm N.V. Led the Halal Ingredient Market in 2018

Figure 32 Koninklijke Dsm N.V: Company Snapshot

Figure 33 ADM: Company Snapshot

Figure 34 DowDupont: Company Snapshot

Figure 35 Kerry: Company Snapshot

Figure 36 Solvay S.A.: Company Snapshot

Figure 37 Cargill: Company Snapshot

Figure 38 BASF: Company Snapshot

Figure 39 Symrise: Company Snapshot

Figure 40 Ashland: : Company Snapshot

Figure 41 Purecircle Limited: Company Snapshot

The study involves four major activities to estimate the current market size of the halal ingredients market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. These findings, assumptions, and the market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The halal ingredients market comprises several stakeholders such as manufacturers, importers & exporters, traders, distributors, suppliers of halal ingredients, food safety authorities, food technologists, food product manufacturers, raw material suppliers, and regulatory bodies such as the Food and Agriculture Organization (FAO), Environmental Protection Agency (EPA), the Food Safety Council (FSC), government and research organizations, trade associations, and industry bodies. The demand-side of this market is characterized by the rising consumption of halal ingredients globally. The supply-side is characterized by the advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the halal ingredients market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary and primary research.

- The industrys value chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary research and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary sources, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches, which was then verified through primary interviews. Thus, there are three approaches; first is the top-down approach, second is the bottom-up approach, and the third approach includes learning and verification of collected information through expert interviews. Only when the values derived through these three approaches match is the data assumed to be correct.

Report Objectives

- To define, segment, and project the global market size for halal ingredients

- To understand the structure of the halal ingredients market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contributions to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Americas, European, Asia Pacific, African, the Middle Eastern, and South America halal ingredients market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Halal Ingredients Market