Automotive Green Tires Market by Vehicle Type (PC, LCV, Trucks and Buses), Rim Size (13-15”, 16-18”, 19-21” and >21”), Propulsion Type (ICE and EV), Application (On-road and off-road), Sales Channel & Region - Global Forecast to 2028

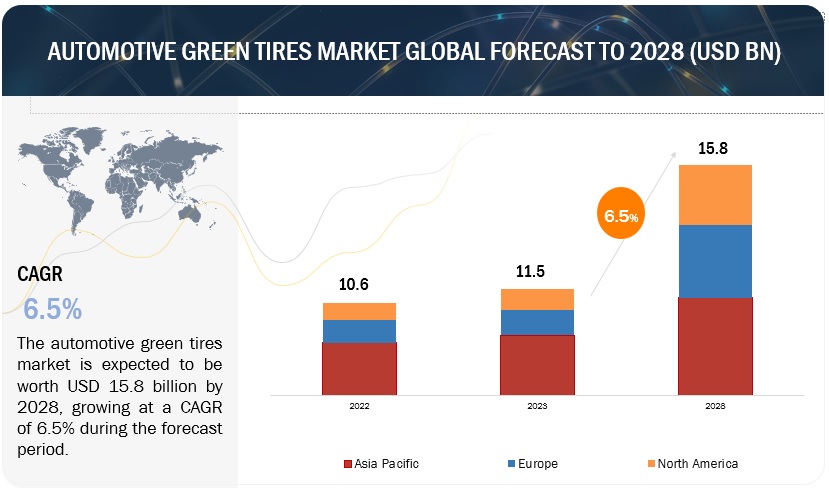

[218 Pages Report] The global automotive green tires market size is projected to grow from USD 11.5 billion in 2023 to USD 15.8 billion by 2028, at a CAGR of 6.5%. The major area of development in electric vehicles is their driving range on a single charge. Green tires can increase vehicle range. Green tires are designed to have lower rolling resistance than conventional tires. The lower the rolling resistance, the less energy is required to roll the tire, which can lead to increased vehicle range. The demand for electric vehicles with increased range will drive the green tires market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Automotive Green Tires Market Dynamics:

Driver: Government initiatives for clean and green environment

There is a rise in concern regarding the various factors affecting the fuel efficiency and emissions of CO2 into the atmosphere. Governments across the globe have started several initiatives to reduce the fuel consumption and release of greenhouse gases. Stringent CO2 emission norms have increased the demand for green tires. The European Union (EU) has set ambitious targets to reduce greenhouse gas emissions. The current target is to reduce emissions by at least 55% by 2030, compared to 1990 levels. This target is part of the EU's commitment to climate neutrality by 2050. The United States has set a target to reduce greenhouse gas emissions by 50-52% below 2005 levels by 2030. This target is part of the US administration's commitment to achieve net-zero emissions by 2050. China has pledged to achieve carbon neutrality by 2060. Tires contribute to around 17- 20% fuel usage and 20-24% of CO2 emission in a single vehicle. Green tires are low rolling resistance tires which reduce the fuel consumption by around 2-4%, thus, reducing the CO2 emission. Hence, with the reduced carbon emission targets, the green tires market will grow.

Restraint: Lack of awareness in emerging economies

The consumers are well-aware about the benefits of using CNG and hybrid vehicles; however, there is a lack of awareness regarding the benefits of green tires and the role it plays in reducing fuel consumption. In the emerging economies such as India and Indonesia, the general consumer is less focused on the benefits offered by green tires. There are a number of reasons why people are not aware of green tires. One reason is that they are not as widely available as traditional tires. Another reason is that they are often more expensive than traditional tires. Additionally, many people are not familiar with the benefits of green tires. There are a number of things that can be done to raise awareness about green tires. One thing is to make them more widely available. Another thing is to educate people about the benefits of green tires. This can be done through advertising, public relations, and educational materials.

Opportunity:Green replacement tires

Though the demand for green tires is increasing among various automotive manufacturers, i.e., at Original Equipment (OE) level, the replacement tires market is expected to provide a lot of opportunity for manufacturers in the future. The demand for replacement tires is expected to rise during the forecast period due to the higher vehicle utilization at the backdrop of an increase in cab sharing facility across the globe. As people's disposable incomes rise, they are more likely to replace their tires before they wear out. New tire technologies are being developed that offer improved fuel efficiency, performance, and safety. The logistics industry is a major consumer of fuel. As the industry grows, there is an increased demand for fuel-efficient vehicles. Green tires can help to improve the fuel efficiency of vehicles, which can reduce the environmental impact of the logistics industry. Governments are increasingly regulating the environmental impact of the logistics industry. This is leading to a demand for more fuel-efficient vehicles and green tires. This is also driving the demand for green replacement tires.

Challenge: Increasing number of mandatory tests to be performed before commercial use of Tires

Regulatory organizations such as the U.S. Department of Transportation (DOT), National Highway Traffic Safety Administration (NHTSA), European Tyre and Rim Technical Organization (ETRTO), Japanese Automobile Tire Manufacturers Association (JATMA), and others make it mandatory for tire manufacturers to conduct certain tests on tires before commercializing. These tests include durability, endurance, traction, rolling resistance, and load carrying. Tire manufacturers have to bear the cost of mandatory tests, which are expensive. In case a tire fails to fulfil the requirement of any of these mandatory tests, the manufacturer cannot sell that tire in the market and suffers complete loss on R&D for that tire. These tests help to ensure that tires are safe and meet certain performance standards, which can help to prevent accidents and improve air quality. In addition to mandatory tests, tire manufacturers also conduct voluntary tests to improve the performance and safety of their tires. Tests include braking test, handling test, wet traction, durability, fuel efficiency and others. These tests indirectly increase the total cost of tires, which negatively affects its demand in the OE as well as aftermarket.

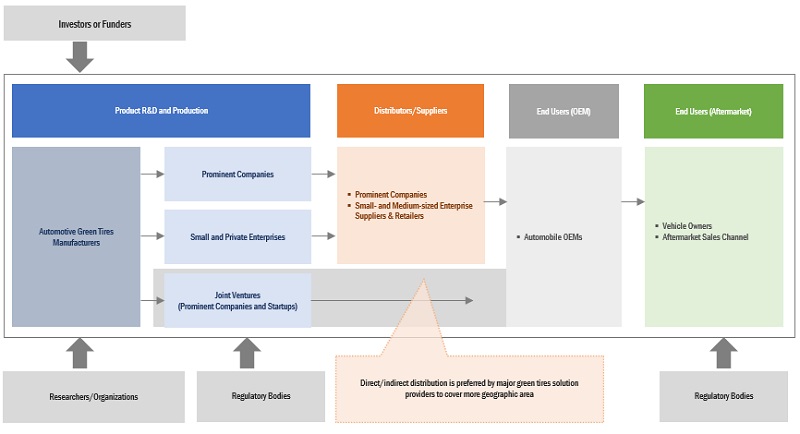

Automotive Green Tires Market Ecosystem

The ecosystem analysis highlights various players in the automotive green tires ecosystem, which is primarily represented by OEMs, Tire manufacturers, Suppliers. Prominent companies in this market as Michelin (France), Bridgestone Corporation (China), Goodyear (US), Continental (Germany) and Pirelli (Italy), etc.

19-21” segment is expected to witness significant growth rate in the global automotive green tires market during the forecast period

Tires with a rim size of 19–21” are estimated to have significant demand in premium cars and high performance sports cars. These vehicles are designed for performance and handling, and larger tires can provide better grip and performance. Michelin offers Pilot Sport Cup 2 tires for new Audi R8 with rim size of 21 inch. Drivers can choose tires with different widths, sidewall profiles, and tread patterns. The tires offered by OEM are also limited in terms of availability, especially for older vehicles, whereas the aftermarket tires, on the other hand, are often made for a variety of vehicle models and years. This makes it easier for drivers to find the tires they need for their older vehicles. Hence, tire size availability in the aftermarket and customization will drive the market for 19–21” rim-size tires during the forecast period.

On-Road segment is expected to be the largest in automotive green tires market during the forecast period

The on-road vehicles include passenger cars, LCVs, and trucks, which run on roads for the transportation of passengers and goods from one place to other. The demand for on-road vehicles such as passenger cars and LCVs is on the rise and expected to boost the automotive green tires market in the on-road application segment. In May 2023, Cheng Shin Rubber launched tire for two-wheel applications built using the company’s Eco-Re sustainable development technology. The tire’s rolling resistance has also been reduced by more than 10% and discarded rice husks were used as a renewable raw material in production. In September 2022, ZC Rubber announced to expand truck tire plant in Westlake, USA. The new plant will also recycle tires. The trucks generally run on highways as these are used for delivery of goods across different states and cities. The trucks can be long, medium, and short haul depending on the distance the trucks have to cover for delivery. In March 2023, Amazon announced that it would be using sustainable tires for its delivery fleet. The tires are made from recycled materials and are designed to reduce emissions. Amazon says that the new tires will help it to reduce its carbon footprint by 100,000 metric tons per year. The rise in frequency of deliveries will boost the demand for green tires, as it will have an economic benefit during the long run.

Light Commercial Vehicle segment is expected to have significant growth opportunities in automotive green tires market during the forecast period

Light commercial vehicles (LCVs) include automobiles having four wheels and a seating capacity of more than eight persons. LCVs include mini buses, and small trucks and are used for transportation of goods as well as passengers. LCVs can carry a weight of 3.5 to 7 tons, which depends on the regional transport regulations. Green tires can help to reduce the operating costs of commercial vehicles by improving fuel efficiency and reducing emissions. This can lead to significant savings for fleet owners. Green tires can also improve the safety of commercial vehicles by providing better traction and handling in wet and icy conditions. This can help to prevent accidents and reduce injuries. In 2020, Pirelli announced to supply sustainable tires to Rivian R1T and Ford F-150 Lightning. Sustainable tires can also have a longer lifespan than traditional tires. This can save money on replacement costs, especially for vehicles that are used for a lot of deliveries. In addition to these benefits, sustainable tires can also help to improve the environmental sustainability of delivery operations. By reducing fuel consumption and emissions, sustainable tires can help to reduce the environmental impact of delivery vehicles.

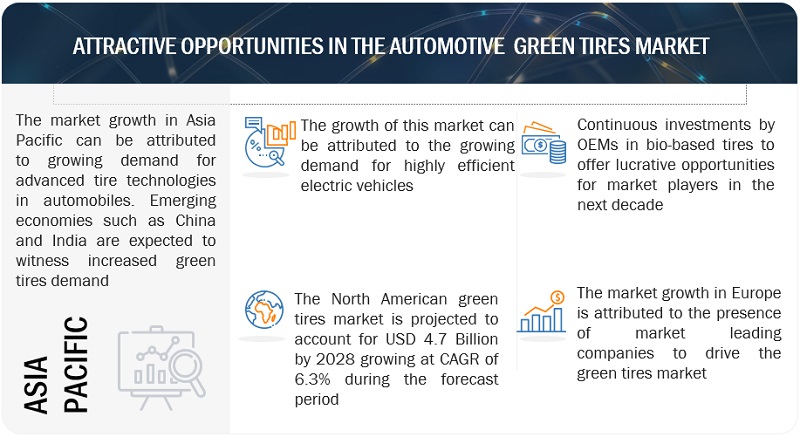

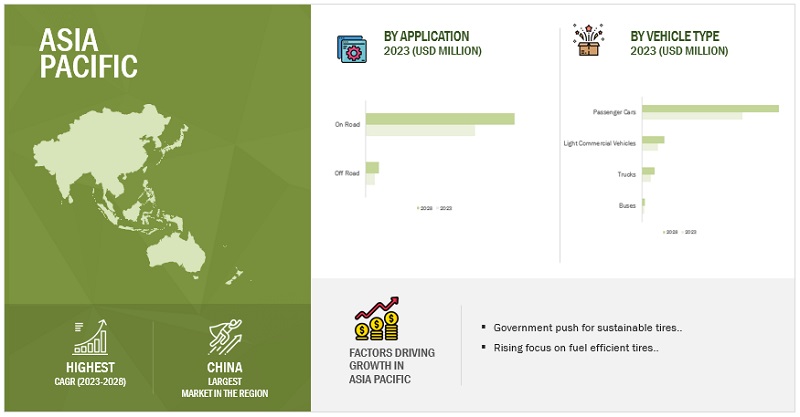

“The Asia pacific automotive green tires market is projected to hold the significant market share by 2028.”

China, Japan, South Korea, and India are the key green tires markets in this region. China is the largest market for green tires in the region. The growing population, government initiatives, and rapid industrialization in the developing countries have led to the increased demand for green tires in the APAC region. The increase in vehicle production and increased demand for low rolling resistance tires in vehicles are the key factors driving the growth of the green tire market in the Asia Pacific region.

China is considered as the manufacturing hub for the automotive industry. This, in turn, is estimated to drive the growth of the green tire market in the Asia Pacific region. In the past few years, the Asia Pacific region has experienced an increase in the demand for luxury or premium segment vehicles. Asia Pacific has emerged as a production hub for major tire manufacturing companies such as Continental (Germany), Goodyear (US), Cooper (US), Pirelli (Italy), Michelin (Singapore), Bridgestone Corporation, Yokohama, Hankook Technology Group Co. Ltd. (South Korea), Nokian (Finland), Apollo Tyres (India), and Sumitomo Rubber Industries (Japan) as of June 2023. In 2021, Asahi Kasei, a Japanese company announced to produce sustainable solution-polymerized styrene-butadiene rubber (S-SBR) for eco friendly tires.

Key Market Players

The Green Tires market is dominated by a few globally established players such as Michelin (France), Bridgestone Corporation (China), Goodyear (US), Continental (Germany) and Pirelli (Italy). The green tires market is highly competitive with growing capacity expansion by the regional players. These companies adopted strategies such as new product launches, deals and others to gain traction in the Green Tires market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Volume (Thousand Units) & Value (USD Million/Billion) |

|

Segments covered |

sales channel, application, rim size, vehicle type, propulsion type and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America and Middle East & Africa |

|

Companies Covered |

Michelin (France), Bridgestone Corporation (China), Goodyear (US), Continental (Germany) and Pirelli (Italy) |

This research report categorizes the automotive green tires market based on sales channel, application, rim size, vehicle type, propulsion type and Region.

Automotive Green Tires Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses

- Two-wheelers

Automotive Green Tires Market, By Rim Size

- 13-15”

- 16-18”

- 19-21”

- >21”

Automotive Green Tires Market, By Application Type

- On-Road

- Off-Road

Automotive Green Tires Market, By Propulsion Type

- ICE

- EV

Automotive Green Tires Market, By Sales Channel Type

- OEM

- Aftermarket

Automotive Green Tires Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In June 2023, Michelin announced to invest USD 27.8 million to expand car tire production capacity at its Shenyang, China factory by 1.3 million tires..

- In February 2023, Bridgestone announced to invest USD 72.4 million by 2025 expand production capacity and upgrade technology at its Pune-based plant. It will improve the plant capability in terms of technologies and capacities for the manufacture of tires for the passenger car segment.

- In June 2022, Michelin and Hyundai Motor Company announced collaborate on R&D for innovative tire technologies by 2025. The companies will develop eco-friendly tires with increased use of eco-friendly materials.

- In May 2022, Goodyear announced to invest USD 77 million for its new manufacturing facility in Dudelange, Luxembourg. It features a new process focused on small-batch production of large rim diameter ultra-high performance (UHP) and ultra-ultra-high performance (UUHP) tires, which enables the company to produce tires four times faster than a standard production cycle.

- In May 2022, Pirelli announced to invest USD 15 million to create an advanced technology and digitalization hub for tire production at its factory in Silao, Mexico.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive green tires market?

The global automotive green tires market is estimated to be USD 11.5 billion in 2023 and projected to reach USD 15.8 billion by 2028.

Who are the winners in the global automotive green tires market?

Michelin (France), Bridgestone Corporation (China), Goodyear (US), Continental (Germany) and Pirelli (Italy). These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the automotive green tires market.

What are the new market trends impacting the growth of the automotive green tires market?

Increasing demand for more efficient tires, and growing sales of electric vehicles equipped with automotive green tires are some of the major trends affecting this market.

Which region is expected to be the largest market during the forecast period?

Asia Pacific is expected to be largest market and is projected to grow at fastest CAGR during the forecast period.

What is the total CAGR expected to be recorded for the automotive green tires market during 2023-2028?

The CAGR is expected to record a CAGR of 6.5% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Government initiatives to reduce carbon emissions- Increasing preference for long-range electric vehicles- High demand for fuel-efficient vehicles- Rising adoption of low rolling resistance tiresRESTRAINTS- Lack of awareness in emerging economies- Longevity of tires to affect aftermarket salesOPPORTUNITIES- Growing replacement tires market- Rising focus on environmental sustainabilityCHALLENGES- Compliance with mandatory tests for commercialization of tires- Structural limitations to impede future adoption

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 CASE STUDIESMICHELIN, AXENS, AND IFP ENERGIES NOUVELLESBRIDGESTONE CORPORATION, ARLANXEO, AND SOLVAYMICHELIN AND ENVIRO

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE OF GREEN TIRES, BY KEY PLAYERVERAGE SELLING PRICE OF GREEN TIRES, BY REGION

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISSMART TIRES3D PRINTED TIRESRUN-FLAT TIRES

- 5.9 REGULATORY LANDSCAPE

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.13 MNM INSIGHTS ON MATERIALS USED IN GREEN TIRESSILICANATURAL RUBBERSTEEL BELTSILANEBIO-BASED RESIN

-

5.14 GREEN TIRES MARKET SCENARIOS, 2023–2028MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 6.1 INTRODUCTION

-

6.2 EVRISE IN ADOPTION OF ELECTRIC VEHICLES TO DRIVE GROWTH

-

6.3 ICERAPID DEVELOPMENT OF NEW TIRE TECHNOLOGIES TO DRIVE GROWTH

- 6.4 KEY INDUSTRY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 PASSENGER CARSRISE IN DEMAND FOR IMPROVED SAFETY TO DRIVE GROWTH

-

7.3 LIGHT COMMERCIAL VEHICLESREDUCTION IN OPERATING COSTS TO DRIVE GROWTH

-

7.4 TRUCKSSTRINGENT REGULATIONS FOR VEHICLE SAFETY TO DRIVE GROWTH

-

7.5 BUSESSURGE IN DEMAND FOR SUSTAINABLE TRANSPORTATION SOLUTIONS TO DRIVE GROWTH

-

7.6 TWO-WHEELERSINCREASE IN PRODUCTION OF LOW ROLLING RESISTANCE TIRES TO DRIVE GROWTH

- 7.7 KEY INDUSTRY INSIGHTS

- 8.1 INTRODUCTION

-

8.2 ON-ROADINCREASE IN DEMAND FOR ON-ROAD VEHICLES TO DRIVE GROWTH

-

8.3 OFF-ROADBOOST IN CONSTRUCTION AND MINING ACTIVITIES TO DRIVE GROWTH

- 8.4 KEY INDUSTRY INSIGHTS

- 9.1 INTRODUCTION

-

9.2 13–15”RISING PREFERENCE FOR COMPACT CARS TO DRIVE GROWTH

-

9.3 16–18”EXPANDING LOGISTICS INDUSTRY TO DRIVE GROWTH

-

9.4 19–21”SURGE IN SALES OF LUXURY CARS TO DRIVE GROWTH

-

9.5 >21”EXTENSIVE USE IN HEAVY COMMERCIAL VEHICLES TO DRIVE GROWTH

- 9.6 KEY INDUSTRY INSIGHTS

- 10.1 INTRODUCTION

- 10.2 OEM

- 10.3 AFTERMARKET

- 10.4 KEY INDUSTRY INSIGHTS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Government initiatives to promote adoption of electric vehicles to drive growthSOUTH KOREA- Rising partnerships for development of sustainable tires to drive growthJAPAN- Increase in R&D investments to drive growthINDIA- Boost in automobile sales to drive growthTHAILAND- Rise in production of pickup trucks to drive marketREST OF ASIA PACIFIC

-

11.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Presence of leading tire manufacturers to drive growthSPAIN- Increasing focus on environmental sustainability to drive growthUK- Government efforts to achieve net zero emissions to drive growthFRANCE- Stringent emission laws to drive growthITALY- Growing emphasis on reducing carbon emissions to drive growthRUSSIA- Rising adoption of eco-friendly technologies to drive growthTURKEY- Extensive use of trucks in mining industry to drive growthREST OF EUROPE

-

11.4 NORTH AMERICARECESSION IMPACT ANALYSISUS- Integration of new technologies in automobiles to drive growthCANADA- Development of innovative green tires to drive growthMEXICO- Rising consumer awareness regarding green tire technologies to drive growth

-

11.5 LATIN AMERICARECESSION IMPACT ANALYSISBRAZIL- Presence of leading automotive companies to drive growthARGENTINA- Government policies for use of fuel-efficient vehicles to drive growthREST OF LATIN AMERICA

-

11.6 MIDDLE EAST & AFRICARECESSION IMPACT ANALYSISIRAN- Booming automotive industry to drive growthSOUTH AFRICA- Sustainability initiatives by domestic associations to drive growthREST OF MIDDLE EAST & AFRICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2023

-

12.3 MARKET SHARE ANALYSIS, 2022MICHELINBRIDGESTONE CORPORATIONTHE GOODYEAR TIRE & RUBBER COMPANYCONTINENTAL AGPIRELLI & C. S.P.A.

- 12.4 REVENUE ANALYSIS, 2018–2022

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPANY FOOTPRINT

-

12.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.8 COMPETITIVE BENCHMARKING

-

12.9 COMPETITIVE SCENARIOPRODUCT DEVELOPMENTSDEALSEXPANSIONS

-

13.1 KEY PLAYERSMICHELIN- Business overview- Products offered- Recent developments- MnM viewBRIDGESTONE CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHE GOODYEAR TIRE & RUBBER COMPANY- Business overview- Products offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewPIRELLI & C. S.P.A.- Business overview- Products offered- Recent developments- MnM viewSUMITOMO RUBBER INDUSTRIES, LTD.- Business overview- Products offered- Recent developmentsHANKOOK TIRE & TECHNOLOGY CO., LTD.- Business overview- Products offered- Recent developmentsNOKIAN TYRES PLC- Business overview- Products offered- Recent developmentsCHENG SHIN RUBBER IND. CO., LTD.- Business overview- Products offered- Recent developmentsZHONGCE RUBBER GROUP CO., LTD.- Business overview- Products offered- Recent developmentsKUMHO TIRE CO., INC.- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSAPOLLO TYRES LTD.SHANDONG LINGLONG TIRE CO., LTD.KENDA TIRESGITI TIRECOOPER TIRE & RUBBER COMPANYTHE YOKOHAMA RUBBER CO., LTD.NEXEN TIREMRF LIMITEDPETLASBALKRISHNA INDUSTRIES LTD.TOYO TIRE CORPORATIONCEAT LIMITED

- 14.1 ASIA PACIFIC TO BE KEY MARKET FOR GREEN TIRE MANUFACTURERS

- 14.2 COMPANIES MUST EMPHASIZE HIGH-PERFORMANCE GREEN TIRES

- 14.3 CONCLUSION

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 GREEN TIRES MARKET, DEFINITION BY VEHICLE TYPE

- TABLE 2 GREEN TIRES MARKET, DEFINITION BY PROPULSION TYPE

- TABLE 3 GREEN TIRES MARKET, DEFINITION BY SALES CHANNEL

- TABLE 4 INCLUSIONS AND EXCLUSIONS

- TABLE 5 CURRENCY EXCHANGE RATES (PER USD)

- TABLE 6 CARBON EMISSION REDUCTION TARGETS

- TABLE 7 FACTORS IMPROVING FUEL EFFICIENCY

- TABLE 8 PRODUCTS OFFERED BY KEY PLAYERS

- TABLE 9 FACTORS LEADING TO LOW AWARENESS IN EMERGING ECONOMIES

- TABLE 10 FACTORS PROMOTING USE OF GREEN TIRES

- TABLE 11 IMPACT OF ECO-FRIENDLY MATERIALS ON TIRE PERFORMANCE

- TABLE 12 COMMERCIALIZATION OF GREEN TIRES BY TEST CATEGORY

- TABLE 13 IMPACT OF MARKET DYNAMICS

- TABLE 14 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 15 AVERAGE SELLING PRICE OF GREEN TIRES, BY KEY PLAYER (USD)

- TABLE 16 AVERAGE SELLING PRICE OF GREEN TIRES, BY REGION (USD)

- TABLE 17 KEY PATENT REGISTRATIONS

- TABLE 18 PATENTED DOCUMENTS ANALYSIS, BY PUBLISHED, FILED, AND GRANTED, 2018–2022

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF GREEN TIRES, BY VEHICLE TYPE (%)

- TABLE 24 MOST LIKELY SCENARIO: GREEN TIRES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 OPTIMISTIC SCENARIO: GREEN TIRES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY PROPULSION TYPE, 2018–2022 (MILLION UNITS)

- TABLE 28 MARKET, BY PROPULSION TYPE, 2023–2028 (MILLION UNITS)

- TABLE 29 MARKET, BY PROPULSION TYPE, 2018–2022 (USD MILLION)

- TABLE 30 MARKET, BY PROPULSION TYPE, 2023–2028 (USD MILLION)

- TABLE 31 EV: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 32 EV: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 33 EV: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 34 EV: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 35 ICE: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 36 ICE: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 37 ICE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 ICE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY VEHICLE TYPE, 2018–2022 (MILLION UNITS)

- TABLE 40 MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 41 MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 42 MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 43 PASSENGER CARS: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 44 PASSENGER CARS: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 45 PASSENGER CARS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 PASSENGER CARS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 LIGHT COMMERCIAL VEHICLES: GREEN TIRES MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 48 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 49 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 TRUCKS: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 52 TRUCKS: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 53 TRUCKS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 TRUCKS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 BUSES: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 56 BUSES: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 57 BUSES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 BUSES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MARKET, BY APPLICATION, 2018–2022 (THOUSAND UNITS)

- TABLE 60 MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 61 MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 62 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 ON-ROAD: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 64 ON-ROAD: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 65 ON-ROAD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 ON-ROAD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OFF-ROAD: GREEN TIRES MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 68 OFF-ROAD: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 69 OFF-ROAD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 OFF-ROAD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 MARKET, BY RIM SIZE, 2018–2022 (MILLION UNITS)

- TABLE 72 MARKET, BY RIM SIZE, 2023–2028 (MILLION UNITS)

- TABLE 73 MARKET, BY RIM SIZE, 2018–2022 (USD MILLION)

- TABLE 74 MARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- TABLE 75 13–15”: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 76 13–15”: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 77 13–15”: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 13–15”: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 16–18”: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 80 16–18”: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 81 16–18”: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 16–18”: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 19–21”: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 84 19–21”: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 85 19–21”: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 19–21”: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 >21”: MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 88 >21”: MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 89 >21”: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 >21”: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 92 MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 93 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 CHINA: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 100 CHINA: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 101 CHINA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 103 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 104 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 105 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 106 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 107 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 108 JAPAN: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 109 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 110 JAPAN: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 111 INDIA: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 112 INDIA: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 113 INDIA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 114 INDIA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 115 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 116 THAILAND: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 117 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 118 THAILAND: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: GREEN TIRES MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 120 EUROPE: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 121 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 124 GERMANY: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 125 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 126 GERMANY: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 127 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 128 SPAIN: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 129 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 130 SPAIN: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 131 UK: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 132 UK: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 133 UK: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 134 UK: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 135 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 136 FRANCE: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 137 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 138 FRANCE: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 139 ITALY: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 140 ITALY: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 141 ITALY: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 142 ITALY: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 143 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 144 RUSSIA: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 145 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 146 RUSSIA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 147 TURKEY: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 148 TURKEY: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 149 TURKEY: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 150 TURKEY: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 152 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 153 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 US: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 156 US: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 157 US: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 158 US: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 159 CANADA: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 160 CANADA: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 161 CANADA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 162 CANADA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 163 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 164 MEXICO: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 165 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 166 MEXICO: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 168 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 169 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 170 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 172 BRAZIL: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 173 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 174 BRAZIL: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 175 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 176 ARGENTINA: MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 177 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 178 ARGENTINA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: GREEN TIRES MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 183 IRAN: MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

- TABLE 184 IRAN: MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

- TABLE 185 IRAN: MARKET, BY VEHICLE TYPE, 2018–2022 (USD THOUSAND)

- TABLE 186 IRAN: MARKET, BY VEHICLE TYPE, 2023–2028 (USD THOUSAND)

- TABLE 187 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

- TABLE 188 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

- TABLE 189 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2022 (USD THOUSAND)

- TABLE 190 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD THOUSAND)

- TABLE 191 STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2023

- TABLE 192 MARKET SHARE ANALYSIS, 2022

- TABLE 193 COMPANY FOOTPRINT, 2023

- TABLE 194 PRODUCT FOOTPRINT, 2023

- TABLE 195 REGION FOOTPRINT, 2023

- TABLE 196 KEY START-UPS/SMES

- TABLE 197 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 198 AUTOMOTIVE MARKET: PRODUCT DEVELOPMENTS, 2020–2023

- TABLE 199 AUTOMOTIVE MARKET: DEALS, 2020–2023

- TABLE 200 AUTOMOTIVE MARKET: EXPANSIONS, 2020–2023

- TABLE 201 MICHELIN: COMPANY OVERVIEW

- TABLE 202 MICHELIN: PRODUCTS OFFERED

- TABLE 203 MICHELIN: PRODUCT DEVELOPMENTS

- TABLE 204 MICHELIN: DEALS

- TABLE 205 MICHELIN: OTHERS

- TABLE 206 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- TABLE 207 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

- TABLE 208 BRIDGESTONE CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 209 BRIDGESTONE CORPORATION: OTHERS

- TABLE 210 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- TABLE 211 THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 212 THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCT DEVELOPMENTS

- TABLE 213 THE GOODYEAR TIRE & RUBBER COMPANY: OTHERS

- TABLE 214 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 215 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 216 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 217 PIRELLI & C. S.P.A.: COMPANY OVERVIEW

- TABLE 218 PIRELLI & C. S.P.A.: PRODUCTS OFFERED

- TABLE 219 PIRELLI & C. S.P.A.: PRODUCT DEVELOPMENTS

- TABLE 220 PIRELLI & C. S.P.A.: DEALS

- TABLE 221 PIRELLI & C. S.P.A.: OTHERS

- TABLE 222 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 223 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 224 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCT DEVELOPMENTS

- TABLE 225 SUMITOMO RUBBER INDUSTRIES, LTD.: OTHERS

- TABLE 226 HANKOOK TIRE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 227 HANKOOK TIRE & TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 228 HANKOOK TIRE & TECHNOLOGY CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 229 HANKOOK TIRE & TECHNOLOGY CO., LTD.: DEALS

- TABLE 230 HANKOOK TIRE & TECHNOLOGY CO., LTD.: OTHERS

- TABLE 231 NOKIAN TYRES PLC: COMPANY OVERVIEW

- TABLE 232 NOKIAN TYRES PLC: PRODUCTS OFFERED

- TABLE 233 NOKIAN TYRES PLC: PRODUCT DEVELOPMENTS

- TABLE 234 NOKIAN TYRES PLC: OTHERS

- TABLE 235 CHENG SHIN RUBBER IND. CO., LTD.: COMPANY OVERVIEW

- TABLE 236 CHENG SHIN RUBBER IND. CO., LTD.: PRODUCTS OFFERED

- TABLE 237 CHENG SHIN RUBBER IND. CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 238 CHENG SHIN RUBBER IND. CO., LTD.: OTHERS

- TABLE 239 ZHONGCE RUBBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 240 ZHONGCE RUBBER GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 241 ZHONGCE RUBBER GROUP CO., LTD.: OTHERS

- TABLE 242 KUMHO TIRE CO., INC.: COMPANY OVERVIEW

- TABLE 243 KUMHO TIRE CO., INC.: PRODUCTS OFFERED

- TABLE 244 KUMHO TIRE CO., INC.: PRODUCT DEVELOPMENTS

- TABLE 245 KUMHO TIRE CO., INC.: DEALS

- TABLE 246 KUMHO TIRE CO., INC.: OTHERS

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 FACTORS IMPACTING MARKET GROWTH

- FIGURE 7 REGIONAL FACTOR ANALYSIS

- FIGURE 8 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 9 REPORT SUMMARY

- FIGURE 10 ASIA PACIFIC TO BE LARGEST MARKET FOR GREEN TIRES DURING FORECAST PERIOD

- FIGURE 11 PASSENGER CARS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 INCREASED PREFERNCE FOR ADVANCED TIRE TECHNOLOGIES

- FIGURE 13 ON-ROAD SEGMENT TO ACQUIRE LARGEST MARKET SHARE BY VALUE IN 2028

- FIGURE 14 PASSENGER CARS TO SECURE LEADING MARKET POSITION BY VALUE DURING FORECAST PERIOD

- FIGURE 15 ICE TO BE LARGEST SEGMENT BY VALUE DURING FORECAST PERIOD

- FIGURE 16 19–21” TO BE FASTEST-GROWING SEGMENT BY VALUE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO SECURE MAXIMUM MARKET SHARE IN 2023

- FIGURE 18 MARKET DYNAMICS

- FIGURE 19 STRUCTURE OF GREEN TIRE

- FIGURE 20 SUPPLY CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM MAPPING

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF GREEN TIRES, BY VEHICLE TYPE

- FIGURE 23 KEY BUYING CRITERIA FOR GREEN TIRES

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 25 GREEN TIRES MARKET, BY PROPULSION TYPE, 2023–2028 (USD MILLION)

- FIGURE 26 MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- FIGURE 27 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- FIGURE 28 MARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- FIGURE 29 MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 EUROPE: MARKET SNAPSHOT

- FIGURE 32 MARKET SHARE ANALYSIS, 2022

- FIGURE 33 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 34 COMPANY EVALUATION MATRIX, 2023

- FIGURE 35 START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 36 MICHELIN: COMPANY SNAPSHOT

- FIGURE 37 MICHELIN’S PARTNERSHIPS WITH LEADING ELECTRIC VEHICLE OEMS

- FIGURE 38 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 GLOBAL PRESENCE OF BRIDGESTONE CORPORATION

- FIGURE 40 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- FIGURE 41 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 42 GLOBAL PRESENCE OF CONTINENTAL AG

- FIGURE 43 PIRELLI & C. S.P.A.: COMPANY SNAPSHOT

- FIGURE 44 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 45 HANKOOK TIRE & TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 NOKIAN TYRES PLC: COMPANY SNAPSHOT

- FIGURE 47 CHENG SHIN RUBBER IND. CO., LTD.: COMPANY SNAPSHOT

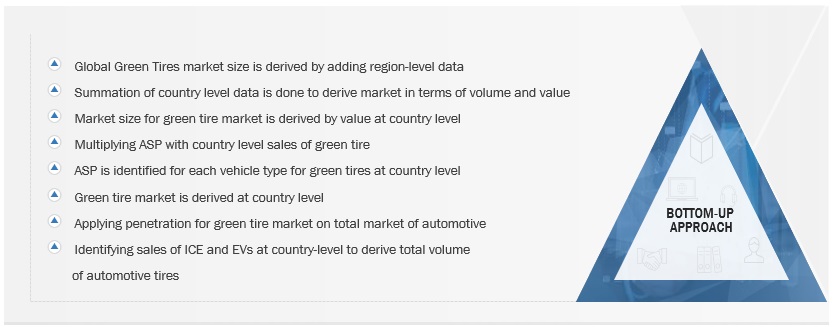

The study involved four major activities to estimate the current size of the automotive green tires market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used for determining the market size of segments and subsegments.

Secondary Research

The secondary sources referred for this research study include associations such as the Tire Industry Association, Tire and Rim Association, Inc., Rubber Manufacturers Association, Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated through primary research.

Primary Research

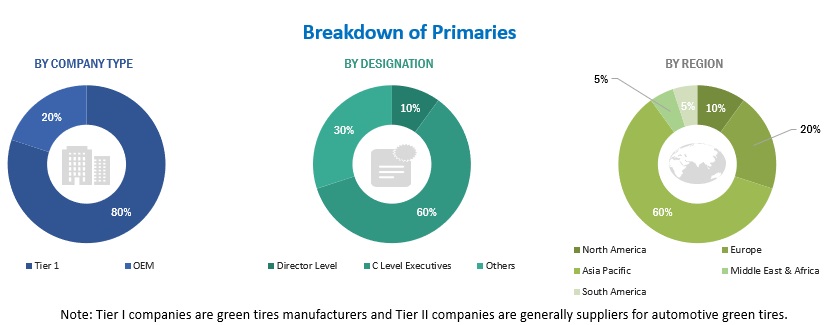

Extensive primary research has been conducted after acquiring an understanding of the automotive tire market through secondary research. Several primary interviews have been conducted with market experts from both the demand- (Automotive OEMs and Retreading Organizations) and supply-side (rubber suppliers, steel suppliers, oil companies, and others) players across four major regions—namely, North America, Europe, Asia-Pacific, South America & Middle East and Africa. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. The primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, MnM has strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in the report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the volume & value of the green tires market. Key players in the green tires market were identified through secondary research, and their global market shares were determined through primary and secondary research. The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights. All major penetration rates, percentage shares, splits, and breakdowns for the green tires market were determined using secondary sources, model mapping, and verified through primary sources. All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data. The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Automotive Green Tires Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Automotive Green Tires: Green tires are defined as tires honed for low rolling resistance, using materials such as silica. Rolling resistance is the energy dissipated from the friction of the tire rolling on a given surface as well as the energy wasted by the contracting of the tire sidewalls as the tire moves across the road. The addition of silica to the tire formulation results in the tires being more energy-efficient as well as increasing the overall safety of the green tires.

Key Stakeholders

- Associations, Forums, and Alliances related to Green Tires

- Automobile Manufacturers

- Automotive Component Manufacturers

- Automotive Investors

- Aftermarket & Tire Retreading Associations

- Companies Operating in Autonomous Vehicle Ecosystem

- Electric Pick-up Truck Manufacturers

- Electric Medium and Heavy-duty Truck Manufacturers

- Distributors and retailers

- EV Component Manufacturers

- EV Distributors and Retailers

- Government Agencies and Policy Makers

- Green tires manufacturers

- Green tires traders, distributors, and suppliers

- Government and research organizations

- Original Equipment Manufacturer (OEM)

- Organized and Unorganized Aftermarket Suppliers

- Raw Material Suppliers of Tires/Tire Components (suppliers for tier I)

- Transport Authorities

- Technology Providers

Report Objectives

- To segment and forecast the size of the green tires market in terms of volume and value.

- To segment and forecast the size of the global market, by volume & value, based on propulsion type [ICE and EV]

- To segment and forecast the size of the global market, by volume & value at based on vehicle type [ passenger cars, light commercial vehicles, heavy commercial vehicles, buses and two-wheelers]

- To segment and forecast the size of the global market, by volume & value, based on rim size (13-15”, 16-18”, 19-21” and >21”)

- To segment and forecast the size of the global market, by volume & value at global level, based on application (on-road and off-road)

- To segment and forecast the size of the global market, by volume & value at global level, based on sales channel (OEM and Aftermarket)

- To segment and forecast the market size, by volume & value, based on region [Asia Pacific, Europe, South America, North America and Middle East & Africa]

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive Green Tires market, by EV type, at regional level

- Automotive Green Tires market, by Sales Channel, at regional level

- Profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Automotive Green Tires Market