Graph Analytics Market by Component, Deployment Mode, Organization Size, Application (Route Optimization and Fraud Detection), Vertical (Healthcare and Life Sciences, Transportation and Logistics, and BFSI), and Region - Global Forecast to 2024

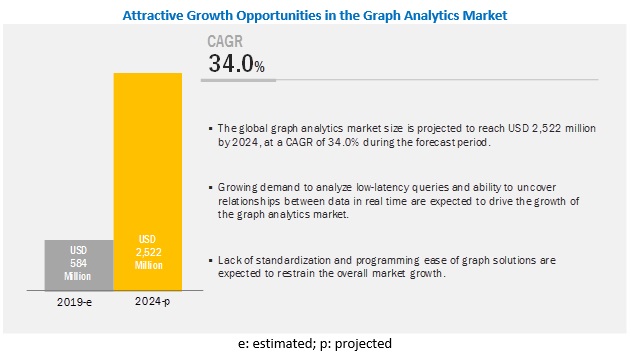

[181 Pages Report] The global graph analytics market size is expected to grow from USD 584 million in 2019 to USD 2,522 million by 2024, at a Compound Annual Growth Rate (CAGR) of 34.0% during the forecast period. Major growth drivers of the market are the growing demand to analyze low-latency queries and the ability to uncover relationships between data in real time.

Among applications, route optimization segment to grow at the highest CAGR during the forecast period

The graph analytics market is segmented by application, into customer analytics, risk and compliance management, recommendation engines, route optimization, fraud detection, and others (operations management and asset management). The route optimization segment is expected to be the fastest-growing segment in the market, owing to the growing need for identifying the fastest and safest route in verticals, such as supply chain and logistics, transportation, and retail and eCommerce.

Cloud deployment mode to grow at a rapid pace during the forecast period

Most vendors in the graph analytics market offer cloud-based maintenance solutions to gain maximum profits and automate the equipment maintenance process, effectively. The adoption of cloud-based graph analytics solutions is expected to grow, owing to benefits, such as easy maintenance of generated data, cost-effectiveness, scalability, and effective management of these solutions.

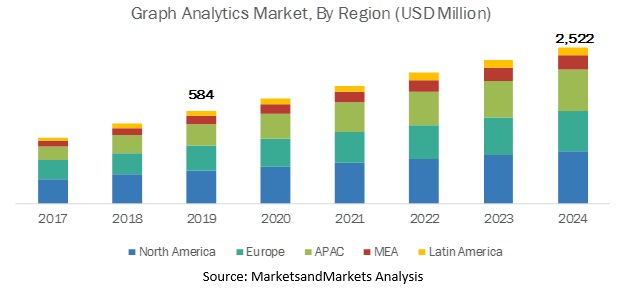

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global graph analytics market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The high growth rate in APAC can be attributed to organizations in the region seizing opportunities to go beyond ensuring their compliances and applying technologies to curtail criminal flows of capital that threaten customers and their communities. Graph analytics and Machine Learning (ML), when applied to a history of transactional data, can help organizations discover patterns of transaction.

North America is the most significant revenue contributor to the global graph analytics market. The region is witnessing significant developments in the market. In North America, the high growth rate can be attributed to the increasing use of the big data technology, growing amount of data across verticals, and rising investmentsby companies in real-time analytics.

Key Market Players

Major vendors in the global graph analytics market include Microsoft (US), IBM (US), AWS (US), Oracle (US), Neo4j (US), TigerGraph (US), Cray (US), DataStax (US), Teradata (US), TIBCO Software (US), Lynx Analytics (Singapore), Linkurious (France), Graphistry (US), Objectivity (US), Dataiku (US), Tom Sawyer Software (US), Kineviz (US), Franz (US), Expero (US), and Cambridge Intelligence (England). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global graph analytics market.

Microsoft (US) develops and supports software, services, devices, and solutions. Its product offerings include Operating Systems (OS), cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools, and video games. The company also designs, manufactures, and sells devices, such as Personal Computers (PCs), tablets, gaming and entertainment consoles, other intelligent devices, and related accessories. It offers a range of services, which include solution support, consulting services, and cloud-based solutions that provide customers with software, services, platforms.In the graph analytics market, the company offers Microsoft Graph, which is a developers’ Application Program Interface (API) platform, to connect to data that drives productivity. It is built on top of Office 365 and enables developers to integrate their services with Azure AD, Excel, Intune, Outlook, One Drive, OneNote, SharePoint, Planner, and other Microsoft products. In the Microsoft 365 platform, there are 3 main components that facilitate the access and flow of data, namely, the Microsoft Graph API, Microsoft Graph data connect, and Microsoft Graph Security connectors. Microsoft Graph data connect enables users to analyze meeting requests to provide insights into conference room utilization.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Deployment Mode, Organization Size, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Microsoft (US), IBM (US), AWS (US), Oracle (US), Neo4j (US), TigerGraph (US), Cray (US), DataStax (US), Teradata (US), TIBCO Software (US), Lynx Analytics (Singapore), Linkurious (France),Graphistry (US), Objectivity (US), Dataiku (US), Tom Sawyer Software (US), Kineviz (US), Franz (US), Expero (US), and Cambridge Intelligence (England) |

This research report categorizes the graph analytics market based on component, deployment mode, organization size, application, verticals, and regions.

By Component, the graph analytics market is divided into the following segments:

-

Solutions

- Software Tools

- Platform

-

Services

- Consulting

- System Integration

- Support and Maintenance

By Deployment Mode, the graph analytics market is divided into the following segments:

- On-premises

- Cloud

By Organization Size, the market is divided into the following segments:

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Application, the graph analytics market is divided into the following segments:

- Customer Analytics

- Risk and Compliance Management

- Recommendation Engines

- Route Optimization

- Fraud Detection

- Others (Operations Management and Asset Management)

By Vertical, the market is divided into the following segments:

- Banking, Financial Services, and Insurance (BFSI)

- Retail and eCommerce

- Telecom

- Healthcare and Life Sciences

- Government and Public Sector

- Manufacturing

- Transportation and Logistics

- Others (Media And Entertainment, Education, and Real Estate)

By Region, the Graph Analytics market is divided into the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- Rest of APAC

-

Middle East and Africa (MEA)

- Israel

- United Arab Emirates (UAE)

- South Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2019, Microsoft announced enhancements in Microsoft Graph. It introduced the data connect functionality in the Microsoft Graph, which is a service that combines analytics data from the Microsoft Graph with customers’ business data.

- In August 2019, IBM officially announced the availability of the Watson API Kit on IBM Cloud Pak for Data, which allows clients to combine and utilize Watson APIs anywhere, enabling access to data stored on-premises or in any private, public, hybrid, or multi-cloud environment.

- In September 2019, AWS announced new features in its solution Amazon QuickSight. The new features improve organizing assets, send email alerts on anomalies, and include improvements with anomaly detection capabilities, as well as introduce Word Cloud chart types to represent categorical fields.

Critical Questions the Report Answers

- What are the current trends driving the graph analytics market?

- In which vertical are most industrial companies deploying graph analytics solutions?

- Where will recent developments of market vendors take the industry in the mid- to long-term?

- Who are the top vendors in the market, and what is their competitive analysis?

- What are the drivers and challenges faced by vendors in the market?

Frequently Asked Questions (FAQ):

What is graph analytics?

Graph analytics leverages graph structures to understand, codify, and visualize relationships that exist between people or devices in a network. Graph analytics, built on the mathematics of graph theory, is used to model pairwise relationships between people, objects, or nodes in a network. It can uncover insights about the strength and direction of the relationship.

What is the market size of graph analytics market?

The global graph analytics market size is expected to grow from USD 584 million in 2019 to USD 2,522 million by 2024, at a Compound Annual Growth Rate (CAGR) of 34.0% during the forecast period. The major factors driving the growth of the graph analytics market are the ability to uncover relationships between data in real time, growing demand to analyze low-latency queries, and advancements in graph analytics by integration of AI, IoT, and blockchain.

Who are the top vendors in the graph analytics market?

The major vendors operating in the graph analytics market include IBM, Oracle, Microsoft, AWS, Neo4j, TigerGraph, and Cray. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

What are the major applications of graph analytics?

Major applications of graph analytics include recommendation engines, fraud detection, customer analytics, risk and compliance management, and route optimization.

Which verticals are adopting graph analytics solutions and services?

The top verticals adopting graph analytics solutions and services include BFSI, retail and eCommerce, telecom, and healthcare and life sciences. The growing need to identify complex patterns from the data in motion and rapid use of virtualization for big data analytics are vreating opportunities for graph analytics solutions and services across verticals. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Attractive Market Opportunities in the Graph Analytics Market

4.2 Market: Top 3 Applications

4.3 Market: By Region

4.4 Market in North America, By Application and Vertical

5 Market Overview and Industry Trends (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ability to Uncover Relationships Between Data in Real Time to Drive the Market

5.2.1.2 Growing Demand to Analyze Low-Latency Queries

5.2.1.3 Advancements in Graph Analytics By Integration of Ai, Iot, and Blockchain to Drive the Market

5.2.2 Restraints

5.2.2.1 Lack of Standardization and Programming Ease

5.2.3 Opportunities

5.2.3.1 Growing Need to Identify Complex Patterns From the Data in Motion

5.2.3.2 Rapid use of Virtualization for Big Data Analytics

5.2.4 Challenges

5.2.4.1 Lack of Technical Skills

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.3.4 Use Case: Scenario 4

5.4 Regulatory Implications

5.4.1 General Data Protection Regulation

5.4.2 Payment Card Industry Data Security Standard

5.4.3 Health Insurance Portability and Accountability Act of 1996

5.4.4 Basel Committee on Banking Supervision 239 Compliance

5.4.5 Sarbanes–Oxley Act of 2002

6 Graph Analytics Market, By Component (Page No. - 48)

6.1 Introduction

6.2 Solutions

6.2.1 Software Tools

6.2.1.1 Software Tools Enable Easy Integration of Graph Analytics in the Existing Business Architecture Leading to the Growth of the Market

6.2.2 Platform

6.2.2.1 Platform to Provide a Complete Foundation for Designing Graph Analytics Solutions in Various Applications

6.3 Services

6.3.1 Consulting

6.3.1.1 Technicalities in Graph Analytics Solutions to Drive the Demand for Consulting Services

6.3.2 System Integration

6.3.2.1 Need for Seamless Deployment of Graph Analytics Solutions to Drive the Adoption of System Integration Services

6.3.3 Support and Maintenance

6.3.3.1 Growing Deployment of Graph Analytics Solutions to Drive the Demand for Support and Maintenance Services

7 Graph Analytics Market, By Deployment Mode (Page No. - 57)

7.1 Introduction

7.2 Cloud

7.2.1 Cost-Effectiveness and Scalability Offered By Cloud-Based Solutions to Drive Its Adoption in the Market

7.3 On-Premises

7.3.1 Data Integrity and Security Offered By On-Premises Solutions to Drive Its Adoption in theMarket

8 Market, By Organization Size (Page No. - 61)

8.1 Introduction

8.2 Large Enterprises

8.2.1 Need to Manage Large Volumes of Data Being Generated From Multiple Business Units and Transform It Into Actionable Insights to Drive the Adoption of the Market in Large Enterprises

8.3 Small and Medium-Sized Enterprises

8.3.1 Development of Feasible Cloud-Based Graph Analytics Solutions to Drive the Adoption of the Market in Small and Medium-Sized Enterprises

9 Market, By Application (Page No. - 65)

9.1 Introduction

9.2 Customer Analytics

9.2.1 Growing Need to Understand Customer Buying Behavior and Optimize Customer Engagement to Drive the Adoption of the Graph Analytics Market in the Customer Analytics Application

9.3 Risk and Compliance Management

9.3.1 Demand to Secure Customer Data and Ensure Stringent Regulatory Compliances to Drive the Adoption of Graph Analytics

9.4 Recommendation Engines

9.4.1 Increasing Need to Provide Efficient, Accurate, and Personalized Customer Services for Customer Retention and Enhanced Experiences to Drive the Adoption of Graph Analytics Solutions

9.5 Route Optimization

9.5.1 Ability of Graph Analytics to Identify Shortest and Safest Routes to Drive Its Adoption in Route Optimization Application

9.6 Fraud Detection

9.6.1 Ability to Detect Real-Time Fraud Patterns to Drive the Adoption of Graph Analytics in Fraud Detection

9.7 Others

10 Graph Analytics Market, By Vertical (Page No. - 73)

10.1 Introduction

10.2 Banking, Financial Services and Insurance

10.2.1 Growing Focus to Control Frauds, Abide By Compliances, and Enable Data-Based Actionable Insights to Drive the Adoption of the Market in the Banking, Financial Services and Insurance Vertical

10.3 Retail and Ecommerce

10.3.1 Growing Demand to Enable Real-Time Customer Behavior-Based Experience to Drive the Adoption of Graph Analytics in the Retail and Ecommerce Vertical

10.4 Telecom

10.4.1 Ability of Graph Analytics to Visualize Complex Networks to Drive Its Adoption in the Telecom Vertical

10.5 Healthcare and Life Sciences

10.5.1 Growing Demand to Control Fraud, Achieve Better Patient Experience, and Offer Personalized Treatment in Real Time to Fuel the Growth of Graph Analytics in the Healthcare and Life Sciences Vertical

10.6 Government and Public Sector

10.6.1 Growing Demand for Greater Flexibility, Enhanced Data Security, and Advanced Intelligence to Drive the Market

10.7 Manufacturing

10.7.1 Growing Need to Extend the Lifespan of Factory Equipment, Enhance Product Quality, and Reduce the Risk of Production Delays to Fuel the Growth of the Graph Analytics Application in the Manufacturing Vertical

10.8 Transportation and Logistics

10.8.1 Growing Need to Get Complete and Real-Time Visibility Into Operations for Minimizing the Risks to Drive the Adoption of Graph Analytics in the Transportation and Logistics Vertical

10.9 Others

11 Graph Analytics Market, By Region (Page No. - 83)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Government’s Focus on Innovation and Research to Fuel the Adoption of Graph Analytics Solutions in the United States

11.2.2 Canada

11.2.2.1 Increase in Investments and Research Activities to Drive Graph Analytics Solutions and Services Adoption in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Increasing Government Initiatives to Fuel the Adoption of Graph Analytics Solutions in the United Kingdom

11.3.2 Germany

11.3.2.1 Growing Investments By Tech Companies to Provide Opportunities for Development of Graph Analytics Solutions

11.3.3 France

11.3.3.1 Focus on R&D and Heavy Inflow of Capital From Global Players and Investors to Drive the Market Growth in France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Increasing Focus on Integrating Artificial Intelligence and Big Data Technologies to Drive the Adoption of Graph Analytics in China

11.4.2 Japan

11.4.2.1 Existing Market and Already Adopted Graph Technology to Boost the Graph Analytics Market Growth in Japan

11.4.3 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Israel

11.5.1.1 Regulatory Compliance Backed By Presence of Graph Analytics Vendors to Lead the Adoption of Graph Analytics Solutions

11.5.2 United Arab Emirates

11.5.2.1 Advanced Analytics Coupled With Ai Adoption to Drive the Market Growth in the United Arab Emirates

11.5.3 South Africa

11.5.3.1 Increasing Adoption of Graph Analytics Among Enterprises to Boost the Market Growth in South Africa

11.5.4 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Need to Offer Enhanced Customer Experience and Improved Business Processes to Drive the Market Growth in Brazil

11.6.2 Mexico

11.6.2.1 Investments By Multinational Companies to Drive the Market Growth in Brazil

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 128)

12.1 Overview

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

13 Company Profiles (Page No. - 130)

13.1 Introduction

(Business Overview, Platform, Solutions. Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Microsoft

13.3 IBM

13.4 AWS

13.5 Oracle

13.6 Neo4j

13.7 TigerGraph

13.8 Cray

13.9 DataStax

13.10 Teradata

13.11 TIBCO Software

13.12 Lynx Analytics

13.13 Linkurious

13.14 Graphistry

13.15 Objectivity

13.16 Dataiku

13.17 Tom Sawyer Software

13.18 Kineviz

13.19 Franz

13.20 Expero

13.21 Cambridge Intelligence

13.22 Right-To-Win

*Details on Business Overview, Platform, Solutions. Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 170)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (128 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Global Graph Analytics Market Size and Growth Rate, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Market Size, By Component, 2017–2024 (USD Million)

Table 5 Solutions: Market Size, By Type, 2017–2024 (USD Million)

Table 6 Solutions: Market Size, By Region, 2017–2024 (USD Million)

Table 7 Software Tools: Market Size, By Region, 2017–2024 (USD Million)

Table 8 Platform: Market Size, By Region, 2017–2024 (USD Million)

Table 9 Services: Market Size, By Type, 2017–2024 (USD Million)

Table 10 Services: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Consulting: Market Size, By Region, 2017–2024 (USD Million)

Table 12 System Integration: Graph Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 13 Support and Maintenance: Market Size, By Region, 2017–2024 (USD Million)

Table 14 Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 15 Cloud: Market Size, By Region, 2017–2024 (USD Million)

Table 16 On-Premises: Market Size, By Region, 2017–2024 (USD Million)

Table 17 Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 18 Large Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 19 Small and Medium-Sized Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 20 Market Size, By Application, 2017–2024 (USD Million)

Table 21 Customer Analytics: Graph Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 22 Risk and Compliance Management: Market Size, By Region, 2017–2024 (USD Million)

Table 23 Recommendation Engines: Market Size, By Region, 2017–2024 (USD Million)

Table 24 Route Optimization: Market Size, By Region, 2017–2024 (USD Million)

Table 25 Fraud Detection: Market Size, By Region, 2017–2024 (USD Million)

Table 26 Others Applications: Market Size, By Region, 2017–2024 (USD Million)

Table 27 Market Size, By Vertical, 2017–2024 (USD Million)

Table 28 Banking, Financial Services and Insurance: Graph Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 29 Retail and Ecommerce: Market Size, By Region, 2017–2024 (USD Million)

Table 30 Telecom: Market Size, By Region, 2017–2024 (USD Million)

Table 31 Healthcare and Life Sciences: Market Size, By Region, 2017–2024 (USD Million)

Table 32 Government and Public Sector: Market Size, By Region, 2017–2024 (USD Million)

Table 33 Manufacturing: Market Size, By Region, 2017–2024 (USD Million)

Table 34 Transportation and Logistics: Market Size, By Region, 2017–2024 (USD Million)

Table 35 Other Verticals: Market Size, By Region, 2017–2024 (USD Million)

Table 36 Market Size, By Region, 2017–2024 (USD Million)

Table 37 Market Size, By Country, 2017–2024 (USD Million)

Table 38 North America: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 39 North America: Market Size, By Solution, 2017–2024 (USD Million)

Table 40 North America: Market Size, By Service, 2017–2024 (USD Million)

Table 41 North America: Market Size, By Application, 2017–2024 (USD Million)

Table 42 North America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 43 North America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 44 North America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 45 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 46 United States: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 47 United States: Market Size, By Solution, 2017–2024 (USD Million)

Table 48 United States: Market Size, By Service, 2017–2024 (USD Million)

Table 49 United States: Market Size, By Application, 2017–2024 (USD Million)

Table 50 United States: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 51 United States: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 52 United States: Market Size, By Vertical, 2017–2024 (USD Million)

Table 53 Europe: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 54 Europe: Market Size, By Solution, 2017–2024 (USD Million)

Table 55 Europe: Market Size, By Service, 2017–2024 (USD Million)

Table 56 Europe: Market Size, By Application, 2017–2024 (USD Million)

Table 57 Europe: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 58 Europe: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 59 Europe: Market Size, By Vertical, 2017–2024 (USD Million)

Table 60 Europe: Market Size, By Country, 2017–2024 (USD Million)

Table 61 United Kingdom: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 62 United Kingdom: Market Size, By Solution, 2017–2024 (USD Million)

Table 63 United Kingdom: Market Size, By Service, 2017–2024 (USD Million)

Table 64 United Kingdom: Market Size, By Application, 2017–2024 (USD Million)

Table 65 United Kingdom: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 66 United Kingdom: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 67 United Kingdom: Market Size, By Vertical, 2017–2024 (USD Million)

Table 68 Asia Pacific: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 69 Asia Pacific: Market Size, By Solution, 2017–2024 (USD Million)

Table 70 Asia Pacific: Market Size, By Service, 2017–2024 (USD Million)

Table 71 Asia Pacific: Market Size, By Application, 2017–2024 (USD Million)

Table 72 Asia Pacific: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 73 Asia Pacific: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 74 Asia Pacific: Market Size, By Vertical, 2017–2024 (USD Million)

Table 75 Asia Pacific: Market Size, By Country, 2017–2024 (USD Million)

Table 76 China: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 77 China: Market Size, By Solution, 2017–2024 (USD Million)

Table 78 China: Market Size, By Service, 2017–2024 (USD Million)

Table 79 China: Market Size, By Application, 2017–2024 (USD Million)

Table 80 China: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 81 China: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 82 China: Market Size, By Vertical, 2017–2024 (USD Million)

Table 83 Middle East and Africa: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 84 Middle East and Africa: Market Size, By Solution, 2017–2024 (USD Million)

Table 85 Middle East and Africa: Market Size, By Service, 2017–2024 (USD Million)

Table 86 Middle East and Africa: Market Size, By Application, 2017–2024 (USD Million)

Table 87 Middle East and Africa: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 88 Middle East and Africa: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 89 Middle East and Africa: Market Size, By Vertical, 2017–2024 (USD Million)

Table 90 Middle East and Africa: Market Size, By Country, 2017–2024 (USD Million)

Table 91 South Africa: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 92 South Africa: Market Size, By Solution, 2017–2024 (USD Million)

Table 93 South Africa: Market Size, By Service, 2017–2024 (USD Million)

Table 94 South Africa: Market Size, By Application, 2017–2024 (USD Million)

Table 95 South Africa: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 96 South Africa: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 97 South Africa: Market Size, By Vertical, 2017–2024 (USD Million)

Table 98 Latin America: Market Size, By Component, 2017–2024 (USD Million)

Table 99 Latin America: Graph Analytics Market Size, By Solution, 2017–2024 (USD Million)

Table 100 Latin America: Market Size, By Service, 2017–2024 (USD Million)

Table 101 Latin America: Market Size, By Application, 2017–2024 (USD Million)

Table 102 Latin America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 103 Latin America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 104 Latin America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 105 Latin America: Market Size, By Country, 2017–2024 (USD Million)

Table 106 Brazil: Graph Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 107 Brazil: Market Size, By Solution, 2017–2024 (USD Million)

Table 108 Brazil: Market Size, By Service, 2017–2024 (USD Million)

Table 109 Brazil: Market Size, By Application, 2017–2024 (USD Million)

Table 110 Brazil: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 111 Brazil: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 112 Brazil: Market Size, By Vertical, 2017–2024 (USD Million)

Table 113 Evaluation Criteria

Table 114 Microsoft: Organic Growth Strategies

Table 115 IBM: Organic Growth Strategies

Table 116 AWS: Organic Growth Strategies

Table 117 AWS: Inorganic Growth Strategies

Table 118 Oracle: Organic Growth Strategies

Table 119 Oracle: Inorganic Growth Strategies

Table 120 Neo4j: Organic Growth Strategies

Table 121 Neo4j: Inorganic Growth Strategies

Table 122 TigerGraph: Organic Growth Strategies

Table 123 TigerGraph: Inorganic Growth Strategies

Table 124 Datatsax: Organic Growth Strategies

Table 125 DataStax: Inorganic Growth Strategies

Table 126 Teradata: Organic Growth Strategies

Table 127 TIBCO Software: Organic Growth Strategies

Table 128 TIBCO Software: Inorganic Growth Strategies

List of Figures (43 Figures)

Figure 1 Graph Analytics Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Market Snapshot, By Component

Figure 4 Market Snapshot, By Solution

Figure 5 Market Snapshot, By Service

Figure 6 Market Snapshot, By Deployment Mode

Figure 7 Graph Analytics Market Snapshot, By Organization Size

Figure 8 Market Snapshot, By Application

Figure 9 Market Snapshot, By Vertical

Figure 10 Market Snapshot, By Region

Figure 11 Growing Demand for Enhanced Visualization of the Data, Identification of Patterns, and Strengthening the System Capability to Process Low-Latency Queries are the Key Factors Driving the Overall Growth of the Market

Figure 12 Route Optimization Segment to Grow at the Highest CAGR During the Forecast Period

Figure 13 North America to Hold the Highest Market Share in 2019

Figure 14 Recommendation Engines Segment and Banking, Financial Services and Insurance Vertical in North America Accounted for the Highest Shares in the Graph Analytics Market in 2019

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 16 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 17 Software Tools Segment to Grow at a Higher CAGR During the Forecast Period

Figure 18 Support and Maintenance Segment to Grow at the Highest CAGR During the Forecast Period

Figure 19 Cloud Segment to Register a Higher CAGR as Compared to the On-Premises Segment During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment to Register a Higher CAGR During the Forecast Period

Figure 21 Route Optimization Segment to Witness the Highest Growth Rate During the Forecast Period

Figure 22 Healthcare and Life Sciences Vertical to Witness the Highest Growth Rate During the Forecast Period

Figure 23 North America to Account for the Largest Market Size During the Forecast Period

Figure 24 Asia Pacific to Account for the Highest CAGR During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Route Optimization Segment to Register the Highest CAGR During the Forecast Period

Figure 27 Route Optimization Segment to Grow at the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Route Optimization Segment to Grow at the Highest CAGR During the Forecast Period

Figure 30 Route Optimization Segment to Grow at the Highest CAGR During the Forecast Period

Figure 31 Route Optimization Segment to Grow at the Highest CAGR During the Forecast Period

Figure 32 Graph Analytics Market (Global) Competitive Leadership Mapping, 2019

Figure 33 Microsoft: Company Snapshot

Figure 34 Microsoft: SWOT Analysis

Figure 35 IBM: Company Snapshot

Figure 36 IBM: SWOT Analysis

Figure 37 AWS: Company Snapshot

Figure 38 AWS: SWOT Analysis

Figure 39 Oracle: Company Snapshot

Figure 40 Oracle: SWOT Analysis

Figure 41 Neo4j: SWOT Analysis

Figure 42 Cray: Company Snapshot

Figure 43 Teradata: Company Snapshot

The study involved 4 major activities in estimating the current market size of the graph analytics market. An extensive secondary research was done to collect information on the market, peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg, BusinessWeek, Dun Bradstreet, and Factiva have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases. Journals, repositories, and resources from the Journal of Graph Algorithms and Applications, Institute of Electrical and Electronics Engineers (IEEE), Elsevier B.V., and Electronic Journal of Graph Theory and Applications (EJGTA) were referred to understand the integration of graph analytics.

Primary Research

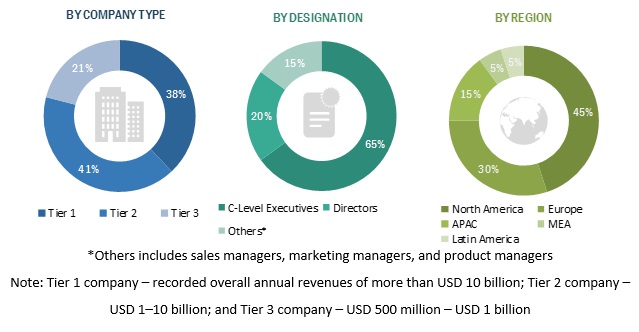

Various primary sources from both the supply and demand sides of the graph analytics market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), technology and innovation directors, and related key executives from various vendors offering graph analytics solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the graph analytics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage, shares split, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global market size for graph analytics

- To understand the structure of the graph analytics market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To project the size of the market and its submarkets, in terms of value, for the 5 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze competitive developments, such as expansions and fundings, new product launches, mergers and acquisitions, strategic partnerships and agreements in the graph analytics market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American graph analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Graph Analytics Market