Electric Powertrain Market by Component (Motor/Generator, Battery, BMS, Controller, PDM, Inverter/Converter, On Board Charger), Type (BEV, MHEV, Series, Parallel & Series-Parallel Hybrid), Vehicle (BEV, FCEV, PHEV, MHEV), & Region - Global Forecast to 2030

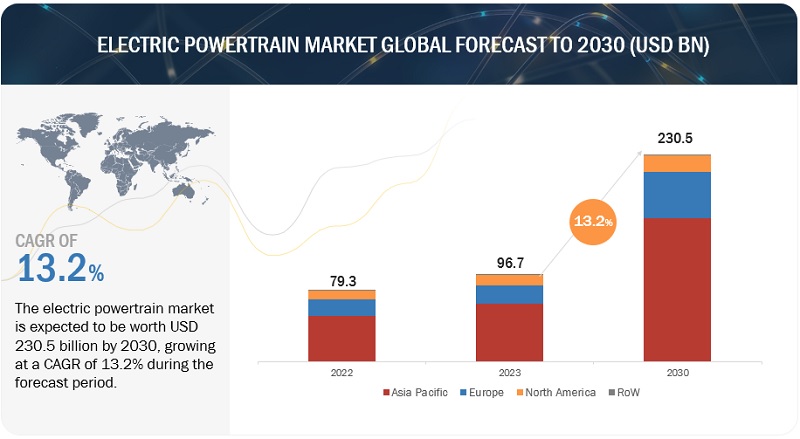

[480 Pages Report] The electric powertrain market is estimated at USD 96.7 billion in 2023 and is projected to reach USD 230.5 billion by 2030, at a CAGR of 13.2%. Attractive incentives by governments for mass adoption and domestic production of electric vehicles, increasing demand for electric cars, and the decreasing cost of electric powertrains will drive the market.

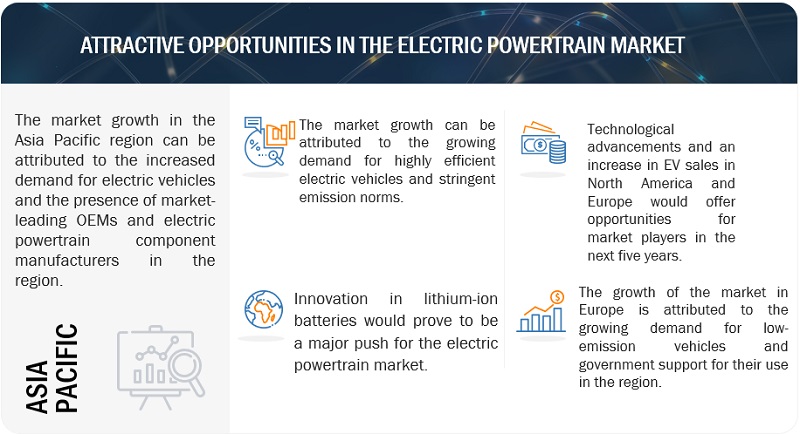

The increasing electric car fleet has pushed automakers to introduce innovative technologies in electrified powertrains. Key innovations in battery chemistry to increase energy density and the expansion of production plants, along with cost optimization, have also been major enablers for the electric powertrain market. The growth of the BEV electric powertrain market is a major trend in the automotive industry. As BEVs are becoming more affordable and practical, they are being supported by government regulations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Government support to increase EV sales to lower CO2 emissions

Governments worldwide are offering incentives to encourage people to buy electric vehicles. These incentives can include tax breaks, rebates, and free parking. These incentives make electric cars more affordable for consumers, which can help to boost demand. Stricter emission norms imposed by the government for lower CO2 emissions force automakers to make their vehicles more efficient and environmentally friendly. Companies across the globe, including governments, are investing in infrastructure to support electric vehicles. This includes building charging stations and improving the electrical grid. This will make it easier for people to own and operate electric vehicles, which will also help to boost demand. The government policies are helping to create a more favorable environment for electric powertrain manufacturers and electric vehicle consumers. As a result, the hybrid powertrain market is expected to grow rapidly in the coming years.

RESTRAINT: Lack of charging infrastructure for EVs

Electric vehicles (EVs) need to be charged regularly, and the lack of charging stations can make it difficult for people to own and operate EVs. This can be a significant barrier to adoption, as people may be hesitant to buy an EV if they are not confident they can find a place to charge it. Charging stations can be expensive, making it difficult for businesses and governments to justify the investment. The scarcity of charging infrastructure limits the market penetration of electric vehicles, particularly in regions with sparse charging options. Consumers may be hesitant to switch to electric vehicles if they cannot access convenient and readily available charging stations, leading to a slower adoption rate of EVs, impacting the electric powertrain market. This lack of a reliable and widespread charging network can deter potential electric vehicle (EV) buyers, who may be concerned about finding charging points during their daily commutes or longer trips. This, in turn, affects consumer confidence in the feasibility of owning an electric vehicle. Governments worldwide are investing in charging infrastructure, helping to increase the number of available charging stations. Businesses are also installing charging stations, as they see this to attract customers and employees who drive EVs.

OPPORTUNITY: Development of lithium-ion batteries

Lithium-ion batteries are the most common type of battery used in electric vehicles (EVs). They are lightweight, have a high energy density, and can be recharged quickly. As the demand for EVs grows, the need for lithium-ion batteries is also expected to grow. Developing new lithium-ion battery technologies is also an opportunity for the electric vehicle powertrain market. New technologies like solid-state batteries could offer higher energy densities and longer ranges than traditional lithium-ion batteries. This could make EVs even more attractive to consumers and could help to accelerate the growth of the market. The development of lithium-ion batteries is an integral part of the growth of the market. Lithium-ion batteries are also expected to grow as the demand for EVs grows. As the market grows, a higher need for cost-effective batteries exists. Developing more efficient and cost-competitive lithium-ion batteries can make electric vehicles more affordable and accessible to a broader range of consumers. Samsung SDI, CATL, LG Energy Solution, and Panasonic are some of the prominent players in the battery manufacturing market. These companies are investing heavily in research and development to improve the performance and cost of lithium-ion batteries. This is helping to drive the growth of the electric powertrain systems market.

CHALLENGE: High cost of electric components

Electric vehicles (EVs) rely on various electronic components, including power electronics, sensors, and actuators. These components are essential for the operation of EVs, but they can be expensive. The high cost of electronic components can make it difficult for automakers to produce affordable EVs for consumers. The battery pack is one of the most costly components of an electric vehicle. While advancements in battery technology have led to reductions in battery costs over the years, they remain a significant portion of the overall vehicle cost. Lithium-ion battery production involves expensive materials and complex manufacturing processes, impacting the final price of electric vehicles. High-performance electric motors and sophisticated power electronics are necessary for efficient energy conversion and vehicle performance, but they can add to the overall cost of the electric powertrain. Automakers are also exploring alternative materials like graphene that could replace rare earth metals in electronic components.

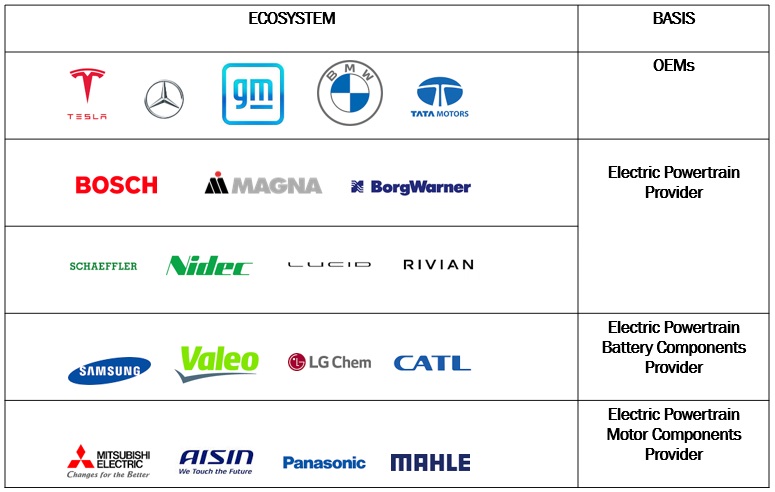

Electric Powertrain Market Ecosystem

The ecosystem analysis highlights various electric powertrain market players, primarily represented by raw material suppliers, component manufacturers, electric vehicle manufacturers, and end users. Three main components are used in electric powertrains: electric motor, power electronics, and battery. The market ecosystem is complex and continuously evolving as technological advancements, consumer preferences, and government policies shape the trajectory of the electric vehicle industry.

Air compressors will be the largest market in the FCEV powertrain market.

The growth of air compressors in FCEV powertrains is expected to be driven by the increasing demand for fuel-cell electric vehicles (FCEVs). Fuel-cell electric vehicles use air compressors to supply the required oxygen to the fuel cell stack for the electrochemical reaction that generates electricity to power the vehicle. The growth of FCEVs is estimated to grow across the globe, with the Asia-Pacific region leading the market as the demand for FCEVs also grew faster in this region. Several countries in the Asia Pacific region have implemented supportive policies and incentives to promote the adoption of fuel-cell vehicles. According to IEA, the number of FCEVs running on the road to grow by almost 40% in 2022. Governments across the globe have offered financial incentives, tax benefits, and subsidies to manufacturers and consumers to encourage the development, production, and purchase of FCEVs. As the hydrogen infrastructure expands, the demand for FCEVs and related components like air compressors also increases.

The motor/generator segment will be leading in the BEV powertrain market.

The motor/generator segment will lead the BEV powertrain market in the coming years. The electric motor converts electrical energy from the battery into mechanical energy to drive the vehicle's wheels. As the battery electric vehicle market expands, there has been ongoing research and development in motor/generator technology. This has resulted in more efficient, compact, and cost-effective motor/generator solutions for electric powertrains. For instance, Robert Bosch Gmbh developed a 230 E-Motor which provides long service life as a component. New technologies, such as silicon carbide (SiC) motors, are being developed that could improve the performance and efficiency of motors/generators. The market is estimated to be the fastest growing in RoW (Rest of World), including Brazil and South Africa. Other regions, such as Asia Pacific, Europe, and North America, have also been experiencing significant growth in electric vehicle adoption and the demand for electric powertrain components.

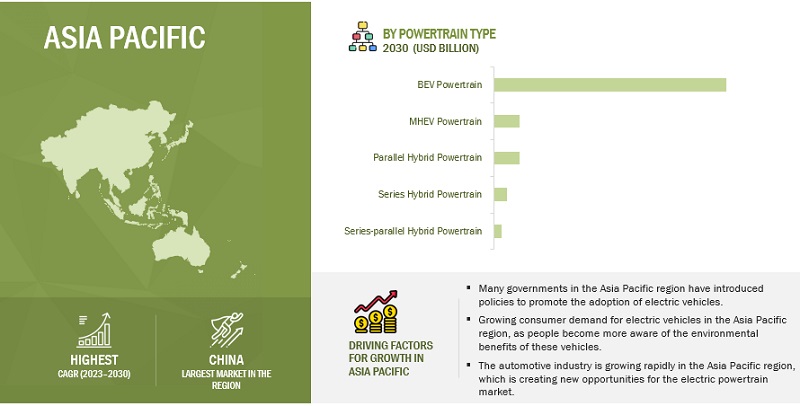

Asia Pacific is estimated to be the fastest-growing electric powertrain market.

Asia Pacific is home to some of the world's largest and most populous countries, such as China, India, and Japan. These countries are all seeing a rapid increase in demand for electric vehicles. The demand for electric vehicles in this region is increasing rapidly, and the government also offers subsidies to consumers who purchase electric vehicles and invest in charging infrastructure. In China, for instance, the government has set a target of 40% of all car sales to be electric vehicles by 2030. According to MnM analysis, China will be the largest market for electric powertrain market by 2030. Battery technology is also available in this country, another factor driving the growth of the market. China is also home to some of the world’s largest battery manufacturers, such as CATL and BYD. These companies are able to produce batteries at a lower cost than their counterparts in other countries, which will support the electrification trend in the region. According to MnM analysis, India is estimated to be the fastest-growing market. The Indian government has strongly endorsed electric vehicle development and aims to be a 100% electric-vehicle nation by 2030. The country has registered EV sales of more than 12,43,200 units making a 154% year-on-year growth compared to 2021 sales. Indian private companies like Tata Power and Mahindra Electric are putting up charging stations in shopping malls and other such places of public access, due to which consumers are more likely to buy EVs over other cars. This growing electric vehicle market drives the market. As a result of all of these factors, Asia Pacific is expected to continue to be a growing market for electric powertrains in the coming years.

Key Market Players

The key players in the electric powertrain manufacturers are Robert Bosch Gmbh (Germany), Mitsubishi Electric (Japan), Magna International Inc. (Canada), Continental AG (Germany), and Hitachi Astemo Ltd. (Japan). These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2022 |

|

Forecast period |

2023 - 2030 |

|

Market Growth forecast |

USD 230.5 billion by 2030 from USD 96.7 billion at 13.2% CAGR |

|

Companies |

Robert Bosch Gmbh (Germany), Mitsubishi Electric (Japan), Magna International Inc. (Canada), Continental AG (Germany), and Hitachi Astemo Ltd. (Japan) |

|

Segments Covered |

By Vehicle Type, By Powertrain Type, PHEV Powertrain, By Component, 48V MHEV Powertrain, By Component, BEV Powertrain, By Component, FCEV Powertrain, By |

|

Countries |

Asia Pacific, North America, Europe, Rest of the World |

Recent Developments

- In November 2021, Mitsubishi Electric Corporation (Mitsubishi Electric) entered the market of e-axles that integrate motors, inverters, and reduction gears for electric vehicles (EVs).

- In December 2021, Magna International Inc. (Magna) launched its all-electric connected powertrain, the EtelligentReach. The complete system comprises two electric motors, inverters, and transmissions and leverages advanced software to optimize vehicle range and driving dynamics.

- In February 2023, Continental AG launched a new electric motor rotor position sensor (eRPS) for electric vehicles. eRPS uses inductive technology to detect the precise position of the rotors of synchronous electric machines, resulting in increased efficiency and smoother operation.

- In April 2023, Denso Corporation (Denso) developed its first inverter with silicon carbide (SiC) power semiconductors. The inverter will be integrated into the BlueE Nexus Corporation's eAxle, installed in the Lexus RZ.

- In April 2021, Dana Inc. announced that their Spicer powertrain technologies, including the Dana 60 front-beam drive axle, the Dana 80 AdvanTEK dual rear-wheel drive, and the Spicer SPL drive shaft, are fitted to the Ford F-600 Super Duty.

Frequently Asked Questions (FAQ):

What is the current size of the global electric powertrain market?

The global electric powertrain market is projected to reach USD 230.5 billion by 2030 from USD 96.7 billion in 2023, with Asia Pacific dominating the market.

Which powertrain type is currently leading the electric powertrain market?

BEV powertrain type is the leading segment of the electric powertrain market.

Many companies are operating in the electric powertrain market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The global electric powertrain market is dominated by major players such as Robert Bosch Gmbh (Germany), Mitsubishi Electric (Japan), Magna International Inc. (Canada), Continental AG (Germany), and Hitachi Astemo Ltd. (Japan). These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

How is the demand for electric powertrain varies by region?

Asia Pacific is the largest electric powertrain market in terms of manufacturing and selling. In Asia Pacific, China and Japan have some dominant players focusing on developing electric vehicles and adopting this electrification trend. Europe and North America are also estimated to be growing in this market.

What are the drivers and opportunities for the electric powertrain manufacturer?

The growth in the electric powertrain industry is expected mainly due to driving factors for the market like government support to increase electric vehicle sales in support of lower emission transportation commute and growing adoption of electric vehicles due to the awareness of environmental benefits of using it. The growth of lithium-ion batteries is one of the opportunities that come with this growing market, as it is one of the most expensive and important components of EVs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Stringent emission norms- Growing vehicle electrification demand in automobile industryRESTRAINTS- Lack of infrastructure for electric vehicle charging- Emerging competing technologies in conventional enginesOPPORTUNITIES- Developments in lithium-ion batteries- Extended range offered by FCEVsCHALLENGES- High cost of electrical components- Technological challenges with electric powertrains

-

5.3 SUPPLY CHAIN ANALYSISELECTRIC POWERTRAIN MARKET: SUPPLY CHAIN ANALYSISELECTRIC POWERTRAIN RAW MATERIAL SUPPLIERSELECTRIC POWERTRAIN COMPONENT MANUFACTURERSELECTRIC POWERTRAIN MANUFACTURERSOEMS- Technologies used by OEMsELECTRIC POWERTRAIN MARKET: ROLE OF COMPANIES IN SUPPLY CHAIN

-

5.4 ECOSYSTEM

-

5.5 TRENDS/DISRUPTIONS IMPACTING ELECTRIC POWERTRAIN MARKET

- 5.6 AVERAGE SELLING PRICE ANALYSIS OF BATTERY ELECTRIC POWERTRAIN (BEV), BY REGION

- 5.7 AVERAGE SELLING PRICE ANALYSIS OF PLUG-IN HYBRID ELECTRIC POWERTRAIN (PHEV), BY REGION

-

5.8 TRADE ANALYSISIMPORT DATA- US- France- Germany- Mexico- BelgiumEXPORT DATA- US- France- Germany- Mexico- Belgium

-

5.9 PATENT ANALYSIS

-

5.10 CASE STUDY ANALYSISCASE STUDY 1CASE STUDY 2

- 5.11 REGULATORY LANDSCAPE

-

5.12 TECHNOLOGY OVERVIEWROBERT BOSCH GMBH: ELECTRIFIED POWERTRAIN SOLUTIONSMITSUBISHI ELECTRIC CORPORATION: NEW E-AXLEMAGNA INTERNATIONAL INC.: ALL-ELECTRIC CONNECTED POWERTRAIN – ETELLIGENTREACHMAGNA INTERNATIONAL INC.: E-BEAM TECHNOLOGYDENSO CORPORATION: INVERTER USING SIC POWER SEMICONDUCTORSDANA INCORPORATED: DRIVE TECHNOLOGIESVALEO: ELECTRIC MOTOR WITHOUT RARE EARTH MOTOR

- 5.13 KEY BUYING CRITERIA FOR ELECTRIC POWERTRAINS

- 5.14 KEY STAKEHOLDERS IN BUYING PROCESS

-

5.15 KEY CONFERENCES AND EVENTS 2023–2024ELECTRIC POWERTRAIN MARKET: KEY CONFERENCES AND EVENTS

- 5.16 WHO SUPPLIES TO WHOM (2021–2024)

-

5.17 BILL OF MATERIALS ANALYSISB- SEGMENTC- SEGMENTD-SUVF-SUV

- 5.18 IMPACT OF ELECTRIFICATION ON VEHICLE COST

-

6.1 INTRODUCTIONINDUSTRY INSIGHTS

-

6.2 OPERATIONAL DATALITHIUM-ION BATTERY REQUIREMENT FOR VARIOUS VEHICLE TYPES

-

6.3 PHEVSHIGHER FUEL EFFICIENCY AND INCREASING DEMAND FOR DOWNSIZED ENGINES TO DRIVE MARKET FOR PHEV POWERTRAINS

-

6.4 BEVSINNOVATIONS IN BATTERIES TO DRIVE DEMAND FOR BEV POWERTRAIN

-

6.5 48V MHEVSEASIER INTEGRATION OF MHEV ARCHITECTURE TO DRIVE 48V MHEV POWERTRAIN MARKET

-

6.6 FCEVSLONG DRIVING RANGE OFFERED BY FCEVS TO DRIVE MARKET

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 MOTORS/GENERATORSDEVELOPMENTS IN MOTORS/GENERATORS TO DRIVE MARKET

-

7.3 BATTERIESONGOING R&D IN BATTERIES TO DRIVE MARKET

-

7.4 BATTERY MANAGEMENT SYSTEMSSAFETY RISKS ASSOCIATED WITH BATTERIES TO DRIVE DEMAND FOR BATTERY MANAGEMENT SYSTEMSBATTERY CASINGSBUS BARSFUSESTHERMAL PROPAGATIONCONNECTORSBATTERY THERMAL MANAGEMENT SYSTEMS

-

7.5 CONTROL UNITSINNOVATIONS IN MOTOR ELECTRONICS TO DRIVE DEMAND FOR CONTROL UNITS

-

7.6 INVERTERSRAPID TECHNOLOGICAL DEVELOPMENTS IN INVERTER TECHNOLOGIES TO DRIVE MARKET

-

7.7 POWER DISTRIBUTION MODULESNEED FOR PROPER MAINTENANCE OF DIFFERENT CONTROL UNITS TO DRIVE DEMAND FOR POWER DISTRIBUTION MODULES

-

7.8 ON-BOARD CHARGERSDUAL ROLE OF ON-BOARD CHARGERS TO DRIVE MARKET

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 MOTORS/GENERATORSRISING DEMAND FOR MOTORS/GENERATORS IN BEVS TO DRIVE MARKET

-

8.3 BATTERY PACKSONGOING DEVELOPMENTS IN LITHIUM-ION BATTERIES TO DRIVE DEMAND FOR BATTERY PACKS

-

8.4 BATTERY MANAGEMENT SYSTEMSGROWING PREFERENCE FOR HIGH-PERFORMANCE EVS TO DRIVE DEMAND FOR BATTERY MANAGEMENT SYSTEMS

-

8.5 CONTROL UNITSINCREASING USE OF MOTORS TO IMPROVE BEV PERFORMANCE TO DRIVE DEMAND FOR CONTROL UNITS

-

8.6 INVERTERSINNOVATIONS IN INVERTERS TO DRIVE MARKET

-

8.7 POWER DISTRIBUTION MODULESNEED FOR SAFETY OF DRIVERS AND PROPER FUNCTIONING OF ELECTRONIC COMPONENTS TO DRIVE MARKET

-

8.8 ON-BOARD CHARGERSNEED FOR SAFE AND EFFECTIVE CHARGING OF BATTERIES TO DRIVE DEMAND FOR ON-BOARD CHARGERS

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 FUEL STACKSGROWING DEMAND FOR FUEL CONVERSION IN FCEVS TO DRIVE MARKET

-

9.3 FUEL PROCESSORSAVAILABILITY OF HYDROGEN FUEL AND REFUELING STRUCTURE TO DRIVE MARKET

-

9.4 POWER CONDITIONERSINCREASING NEED FOR EFFICIENT POWER MANAGEMENT IN FCEV TO DRIVE MARKET

-

9.5 AIR COMPRESSORSADVANCEMENTS IN FUEL CELL TECHNOLOGY TO DRIVE MARKET

-

9.6 HUMIDIFIERSNEED FOR HYDRATED PEM FUEL CELLS TO DRIVE MARKET FOR HUMIDIFIERS

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 BATTERIESDEVELOPMENTS IN LITHIUM-ION BATTERY TECHNOLOGY TO DRIVE DEMAND FOR 48V MHEV ARCHITECTURE

-

10.3 BATTERY MANAGEMENT SYSTEMSNECESSITY TO MAINTAIN OPTIMUM TEMPERATURE AND PRESSURE IN BATTERIES TO DRIVE MARKET FOR BATTERY MANAGEMENT SYSTEMS

-

10.4 INVERTERSINNOVATIONS IN POWER ELECTRONICS TO DRIVE DEMAND FOR INVERTERS

-

10.5 DC-DC CONVERTERSELECTRIFICATION OF HYBRIDS TO DRIVE DEMAND FOR DC-DC CONVERTERS

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 BEV POWERTRAININCREASE IN BEV SALES TO DRIVE BEV POWERTRAIN MARKET

-

11.3 MHEV POWERTRAINEASE OF INTEGRATION OF 48V MHEV POWERTRAIN ARCHITECTURE IN EXISTING ICE ARCHITECTURE TO DRIVE SEGMENT

-

11.4 SERIES HYBRID POWERTRAINNEED FOR HIGHER POWER APPLICATIONS TO DRIVE SERIES HYBRID POWERTRAIN MARKET

-

11.5 PARALLEL HYBRID POWERTRAINBETTER PERFORMANCE DURING HIGHWAY DRIVING TO INCREASE DEMAND FOR PARALLEL HYBRID POWERTRAIN

-

11.6 SERIES-PARALLEL HYBRID POWERTRAINADVANTAGE OF DUAL OPERATION MODE TO DRIVE DEMAND FOR SERIES-PARALLEL POWERTRAIN

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 ASIA PACIFICCHINA- Stringent emission norms to drive marketINDIA- Introduction of BS VI norms to drive marketJAPAN- Electrification of automotive components by major players to drive marketSOUTH KOREA- Attractive government incentives to drive market

-

12.3 EUROPEFRANCE- Increasing investment in electrified powertrain components production to drive marketGERMANY- Government funding for charging infrastructure development to drive marketITALY- Government incentives and investments in charging infrastructure to drive marketNETHERLANDS- Increasing sales of electric vehicles to drive marketNORWAY- High demand for pure EVs to drive marketSPAIN- Incentives and policies to promote EV adoption to drive marketSWEDEN- Experimentation in innovative electric charging technology to drive marketUK- Government initiatives toward establishing charging infrastructure and encouraging start-ups to drive market

-

12.4 NORTH AMERICAUS- Government support and availability of EV models to drive marketCANADA- Government incentives and investments by automotive OEMs to promote EV adoption

-

12.5 REST OF THE WORLDBRAZIL- Stringent emission norms with increasing presence of EV manufacturers to drive marketSOUTH AFRICA- Adoption of stricter emission norms and local manufacturing to drive market

- 13.1 OVERVIEW

- 13.2 ELECTRIC POWERTRAIN MARKET SHARE ANALYSIS, 2022

-

13.3 COMPANY EVALUATION MATRIX: ELECTRIC POWERTRAIN MANUFACTURERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.4 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHER DEVELOPMENTS

- 13.5 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2023

- 13.6 COMPETITIVE BENCHMARKING

- 13.7 LIST OF KEY START-UPS/SMES

-

14.1 KEY PLAYERSROBERT BOSCH GMBH- Business overview- Products offered- Recent developments- MnM viewMITSUBISHI ELECTRIC CORPORATION- Business overview- Products offered- Recent developments- MnM viewMAGNA INTERNATIONAL INC.- Business overview- Products offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewHITACHI ASTEMO, LTD.- Business overview- Products offered- Recent developments- MnM viewBORGWARNER INC.- Business overview- Products offered- Recent developmentsZF FRIEDRICHSHAFEN AG- Business overview- Products offered- Recent developmentsDENSO CORPORATION- Business overview- Products offered- Recent developmentsDANA INCORPORATED- Business overview- Products offered- Recent developmentsVALEO S.A.- Business overview- Products offered- Recent developments

-

14.2 OTHER PLAYERSBRUSA ELEKTRONIK AGKELLY CONTROLSNIDEC CORPORATIONMAGNETI MARELLI CK HOLDINGSTOYOTA INDUSTRIES CORPORATIONPANASONICCURTIS INSTRUMENTSFILTRAN LLCMAGTECCASCADIA MOTION

-

15.1 KEY PLAYERSCATL- Business overview- Products offered- Recent developments- MnM viewSAMSUNG SDI- Business overview- Recent developments- MnM viewPANASONIC HOLDINGS CORPORATION- Business overview- Products offered- Recent developments- MnM viewLG CHEM- Business overview- Products offered- Recent developments- MnM viewBYD COMPANY LIMITED- Business overview- Products offered- Recent developments- MnM view

-

15.2 MID-TIER PLAYERSSK INNOVATION CO. LTD.- Business overview- Products offered- Recent developmentsVEHICLE ENERGY JAPAN INC.- Business overview- Products offered- Recent developmentsTOSHIBA CORPORATION- Business overview- Products offered- Recent developmentsMITSUBISHI CORPORATION- Business overview- Products offered- Recent developmentsENERSYS- Business overview- Products offered- Recent developments

-

15.3 START-UPSNORTHVOLT ABAUTOMOTIVE CELLS COMPANYBLUEOVAL SKCELLFORCE GROUP GMBHGOTION HI-TECH

-

16.1 KEY PLAYERSBORGWARNER INC.- Business overview- Products offered- Recent developments- MnM viewBYD CO., LTD.- Business overview- Products offered- Recent developments- MnM viewSCHAEFFLER GROUP- Business overview- Products offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products offered- Recent developments- MnM viewZF FRIEDRICHSHAFEN AG- Business overview- Products offered- Recent developments- MnM view

-

16.2 MID-TIER PLAYERSJOHNSON ELECTRIC HOLDINGS LTD.- Business overview- Products offered- Recent developmentsCONTINENTAL AG- Business overview- Products offered- Recent developmentsVALEO S.A.- Business overview- Products offered- Recent developmentsMAHLE GROUP- Business overview- Products offered- Recent developmentsNIDEC CORPORATION- Business overview- Products offered- Recent developments

-

16.3 OTHER PLAYERSJING-JIN ELECTRICSHANGHAI EDRIVE CO., LTD.XPT WEILAI DRIVE TECHNOLOGYZHUHAI ENPOWER ELECTRIC CO., LTD.ANAND MANDO EMOBILITY

- 17.1 ASIA PACIFIC TO BE MAJOR MARKET FOR ELECTRIC POWERTRAINS

- 17.2 BEV POWERTRAIN COMPONENTS CAN BE KEY FOCUS FOR MANUFACTURERS

- 17.3 CONCLUSION

- 18.1 KEY INDUSTRY INSIGHTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

18.4 CUSTOMIZATION OPTIONSELECTRIC POWERTRAIN MARKET, BY VEHICLE TYPE- BEV- HEV/PHEV- FCEVELECTRIC POWERTRAIN MARKET, BY TYPE- BEV powertrain- Series hybrid powertrain- Parallel hybrid powertrain- Series-parallel hybrid powertrain

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 SEGMENT-WISE INCLUSIONS & EXCLUSIONS

- TABLE 2 RESEARCH ASSUMPTIONS FOR PHEV AND BEV POWERTRAIN COMPONENTS

- TABLE 3 MODELS WITH ELECTRIC POWERTRAINS, 2023

- TABLE 4 MODELS WITH ELECTRIC POWERTRAINS, 2022

- TABLE 5 BATTERY TECHNOLOGIES USED IN ELECTRIC CAR MODELS

- TABLE 6 BEV POWERTRAIN: AVERAGE PRICE ANALYSIS, 2022 (USD)

- TABLE 7 PHEV ELECTRIC POWERTRAIN, BY REGION: AVERAGE PRICE ANALYSIS, 2022 (USD)

- TABLE 8 US: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 9 FRANCE: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 10 GERMANY: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 11 MEXICO: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 12 BELGIUM: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 13 US: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 14 FRANCE: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 15 GERMANY: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 16 MEXICO: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 17 BELGIUM: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 18 INNOVATION & PATENT REGISTRATIONS, 2018–2022

- TABLE 19 SAFETY REGULATIONS, BY COUNTRY/REGION

- TABLE 20 KEY BUYING CRITERIA FOR DIFFERENT ELECTRIC POWERTRAINS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRIC POWERTRAINS

- TABLE 22 ELECTRIC POWERTRAIN MARKET: KEY CONFERENCES AND EVENTS

- TABLE 23 B-SEGMENT: BILL OF MATERIALS, 2023

- TABLE 24 C-SEGMENT: BILL OF MATERIALS, 2023

- TABLE 25 D-SUV: BILL OF MATERIALS, 2023

- TABLE 26 F-SUV: BILL OF MATERIALS, 2023

- TABLE 27 REQUIREMENT OF LITHIUM-ION BATTERY SIZES ACROSS DIFFERENT POWERTRAINS

- TABLE 28 ELECTRIC POWERTRAIN MARKET, BY VEHICLE TYPE, 2018–2022 (‘000 UNITS)

- TABLE 29 MARKET, BY VEHICLE TYPE, 2023–2030 (‘000 UNITS)

- TABLE 30 MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 31 MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 32 PHEVS: MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 33 PHEVS: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 34 PHEVS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 PHEVS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 36 BEVS: MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 37 BEVS: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 38 BEVS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 BEVS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 40 MHEVS: MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 41 MHEVS: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 42 MHEVS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 MHEVS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 44 FCEVS: MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 45 FCEVS: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 46 FCEVS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 FCEVS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 48 PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 49 PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 50 MOTORS/GENERATORS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 51 MOTORS/GENERATORS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 52 MOTORS/GENERATORS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 MOTORS/GENERATORS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 54 BATTERIES: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 55 BATTERIES: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 56 BATTERIES: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 BATTERIES: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 58 BATTERY MANAGEMENT SYSTEMS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 59 BATTERY MANAGEMENT SYSTEMS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 60 BATTERY MANAGEMENT SYSTEMS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 BATTERY MANAGEMENT SYSTEMS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 62 CONTROL UNITS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 63 CONTROL UNITS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 64 CONTROL UNITS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 CONTROL UNITS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 66 INVERTERS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 67 INVERTERS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 68 INVERTERS: PHEV POWERTRAIN MARKET, BY REGION, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 69 INVERTERS: PHEV POWERTRAIN MARKET, BY REGION, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 70 POWER DISTRIBUTION MODULES: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 71 POWER DISTRIBUTION MODULES: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 72 POWER DISTRIBUTION MODULES: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 POWER DISTRIBUTION MODULES: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 74 ON-BOARD CHARGERS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 75 ON-BOARD CHARGERS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 76 ON-BOARD CHARGERS: PHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 ON-BOARD CHARGERS: PHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 78 BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 79 BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 80 MOTORS/GENERATORS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 81 MOTORS/GENERATORS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 82 MOTORS/GENERATORS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 83 MOTORS/GENERATORS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 84 BATTERY PACKS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 85 BATTERY PACKS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 86 BATTERY PACKS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 87 BATTERY PACKS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 88 BATTERY MANAGEMENT SYSTEMS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 89 BATTERY MANAGEMENT SYSTEMS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 90 BATTERY MANAGEMENT SYSTEMS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 91 BATTERY MANAGEMENT SYSTEMS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 92 CONTROL UNITS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 93 CONTROL UNITS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 94 CONTROL UNITS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 95 CONTROL UNITS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 96 INVERTERS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 97 INVERTERS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 98 INVERTERS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 99 INVERTERS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 100 POWER DISTRIBUTION MODULES: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 101 POWER DISTRIBUTION MODULES: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 102 POWER DISTRIBUTION MODULES: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 103 POWER DISTRIBUTION MODULES: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 104 ON-BOARD CHARGERS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 105 ON-BOARD CHARGERS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 106 ON-BOARD CHARGERS: BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 107 ON-BOARD CHARGERS: BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 108 FCEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 109 FCEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 110 FUEL STACKS: FCEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 111 FUEL STACKS: FCEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 112 FUEL PROCESSORS: FCEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 113 FUEL PROCESSORS: FCEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 114 POWER CONDITIONERS: FCEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 115 POWER CONDITIONERS: FCEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 116 AIR COMPRESSORS: FCEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 117 AIR COMPRESSORS: FCEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 118 HUMIDIFIERS: FCEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 119 HUMIDIFIERS: FCEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 120 48V MHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 121 48V MHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 122 BATTERIES: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (’000 UNITS)

- TABLE 123 BATTERIES: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (’000 UNITS)

- TABLE 124 BATTERIES: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 125 BATTERIES: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 126 BATTERY MANAGEMENT SYSTEMS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (’000 UNITS)

- TABLE 127 BATTERY MANAGEMENT SYSTEMS: 48V MHEV POWERTRAIN MARKET, BY REGION, BY REGION, 2023–2030 (’000 UNITS)

- TABLE 128 BATTERY MANAGEMENT SYSTEM: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 129 BATTERY MANAGEMENT SYSTEMS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 130 INVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (’000 UNITS)

- TABLE 131 INVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (’000 UNITS)

- TABLE 132 INVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 133 INVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 134 DC-DC CONVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (’000 UNITS)

- TABLE 135 DC-DC CONVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (’000 UNITS)

- TABLE 136 DC-DC CONVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 137 DC-DC CONVERTERS: 48V MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 138 MARKET, BY TYPE, 2018–2022 (‘000 UNITS)

- TABLE 139 MARKET, BY TYPE, 2023–2030 (‘000 UNITS)

- TABLE 140 MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 141 MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 142 BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 143 BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 144 BEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 145 BEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 146 MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 147 MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 148 MHEV POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 149 MHEV POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 150 SERIES HYBRID POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 151 SERIES HYBRID POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 152 SERIES HYBRID POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 153 SERIES HYBRID POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 154 PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 155 PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 156 PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 157 PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 158 SERIES-PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 159 SERIES-PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 160 SERIES-PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 161 SERIES-PARALLEL HYBRID POWERTRAIN MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 162 MARKET, BY REGION, 2018–2022 (’000 UNITS)

- TABLE 163 MARKET, BY REGION, 2023–2030 (’000 UNITS)

- TABLE 164 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 165 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (’000 UNITS)

- TABLE 167 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 168 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 170 CHINA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 171 CHINA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 172 CHINA: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 173 CHINA: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 174 INDIA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 175 INDIA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 176 INDIA: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 177 INDIA: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 178 JAPAN: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 179 JAPAN: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 180 JAPAN: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 181 JAPAN: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 182 SOUTH KOREA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 183 SOUTH KOREA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 184 SOUTH KOREA: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 185 SOUTH KOREA: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 186 EUROPE: MARKET, BY COUNTRY, 2018–2022 (’000 UNITS)

- TABLE 187 EUROPE: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 188 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 189 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 190 FRANCE: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 191 FRANCE: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 192 FRANCE: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 193 FRANCE: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 194 GERMANY: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 195 GERMANY: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 196 GERMANY: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 197 GERMANY: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 198 ITALY: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 199 ITALY: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 200 ITALY: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 201 ITALY: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 202 NETHERLANDS: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 203 NETHERLANDS: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 204 NETHERLANDS: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 205 NETHERLANDS: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 206 NORWAY: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 207 NORWAY: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 208 NORWAY: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 209 NORWAY: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 210 SPAIN: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 211 SPAIN: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 212 SPAIN: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 213 SPAIN: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 214 SWEDEN: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 215 SWEDEN: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 216 SWEDEN: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 217 SWEDEN: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 218 UK: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 219 UK: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 220 UK: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 221 UK: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 222 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 223 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 224 US: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 225 US: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 226 US: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 227 US: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 228 CANADA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 229 CANADA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 230 CANADA: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 231 CANADA: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 232 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 233 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 234 BRAZIL: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 235 BRAZIL: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 236 BRAZIL: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 237 BRAZIL: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 238 SOUTH AFRICA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 239 SOUTH AFRICA: PHEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 240 SOUTH AFRICA: BEV POWERTRAIN MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 241 SOUTH AFRICA: BEV POWERTRAIN MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 242 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2022–2023

- TABLE 243 ELECTRIC POWERTRAIN MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021–2023

- TABLE 244 ELECTRIC POWERTRAIN MARKET: DEALS, 2021–2023

- TABLE 245 MARKET: OTHER DEVELOPMENTS, 2022–2023

- TABLE 246 KEY GROWTH STRATEGIES, 2022–2023

- TABLE 247 MARKET: COMPETITIVE BENCHMARKING

- TABLE 248 ELECTRIC POWERTRAIN MANUFACTURERS: LIST OF KEY START-UPS/SMES

- TABLE 249 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 250 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 251 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

- TABLE 252 ROBERT BOSCH GMBH: DEALS

- TABLE 253 ROBERT BOSCH GMBH: OTHERS

- TABLE 254 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 255 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 256 MITSUBISHI ELECTRIC CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 257 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 258 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 259 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 260 MAGNA INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 261 MAGNA INTERNATIONAL INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 262 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 263 MAGNA INTERNATIONAL INC.: OTHERS

- TABLE 264 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 265 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 266 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

- TABLE 267 CONTINENTAL AG: DEALS

- TABLE 268 CONTINENTAL AG: OTHERS

- TABLE 269 HITACHI ASTEMO, LTD.: COMPANY OVERVIEW

- TABLE 270 HITACHI ASTEMO, LTD: PRODUCTS OFFERED

- TABLE 271 HITACHI ASTEMO, LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 272 HITACHI ASTEMO, LTD.: DEALS

- TABLE 273 HITACHI ASTEMO, LTD.: OTHERS

- TABLE 274 BORGWARNER INC.: COMPANY OVERVIEW

- TABLE 275 BORGWARNER INC.: PRODUCTS OFFERED

- TABLE 276 BORGWARNER INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 277 BORGWARNER INC.: DEALS

- TABLE 278 BORGWARNER INC.: OTHERS

- TABLE 279 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 280 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

- TABLE 281 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 282 ZF FRIEDRICHSHAFEN AG: OTHERS

- TABLE 283 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 284 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 285 DENSO CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 286 DENSO CORPORATION: DEALS

- TABLE 287 DENSO CORPORATION: OTHERS

- TABLE 288 DANA INCORPORATED: COMPANY OVERVIEW

- TABLE 289 DANA INCORPORATED: PRODUCTS OFFERED

- TABLE 290 DANA INCORPORATED: NEW PRODUCT DEVELOPMENTS

- TABLE 291 DANA INCORPORATED: DEALS

- TABLE 292 DANA INCORPORATED: OTHERS

- TABLE 293 VALEO S.A.: COMPANY OVERVIEW

- TABLE 294 VALEO S.A.: PRODUCTS OFFERED

- TABLE 295 VALEO S.A.: NEW PRODUCT DEVELOPMENTS

- TABLE 296 VALEO S.A.: DEALS

- TABLE 297 BRUSA ELEKTRONIK AG: COMPANY OVERVIEW

- TABLE 298 KELLY CONTROLS: COMPANY OVERVIEW

- TABLE 299 NIDEC CORPORATION: COMPANY OVERVIEW

- TABLE 300 MAGNETI MARELLI CK HOLDINGS: COMPANY OVERVIEW

- TABLE 301 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 302 PANASONIC: COMPANY OVERVIEW

- TABLE 303 CURTIS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 304 FILTRAN LLC: COMPANY OVERVIEW

- TABLE 305 MAGTEC: COMPANY OVERVIEW

- TABLE 306 CASCADIA MOTION: COMPANY OVERVIEW

- TABLE 307 CATL: BUSINESS OVERVIEW

- TABLE 308 CATL: SUPPLY AGREEMENTS

- TABLE 309 CATL: PRODUCTS OFFERED

- TABLE 310 CATL: NEW PRODUCT DEVELOPMENTS

- TABLE 311 CATL: DEALS

- TABLE 312 CATL: OTHERS

- TABLE 313 SAMSUNG SDI: BUSINESS OVERVIEW

- TABLE 314 SAMSUNG SDI: SUPPLY AGREEMENTS

- TABLE 315 SAMSUNG SDI: PRODUCTS OFFERED

- TABLE 316 SAMSUNG SDI: NEW PRODUCT DEVELOPMENTS

- TABLE 317 SAMSUNG SDI: DEALS

- TABLE 318 SAMSUNG SDI: OTHERS

- TABLE 319 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 320 PANASONIC HOLDINGS CORPORATION: SUPPLY AGREEMENTS

- TABLE 321 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 322 PANASONIC HOLDINGS CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 323 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 324 PANASONIC HOLDINGS CORPORATION: OTHERS

- TABLE 325 LG CHEM: BUSINESS OVERVIEW

- TABLE 326 LG CHEM: R&D OVERVIEW

- TABLE 327 LG CHEM.: SUPPLY AGREEMENTS

- TABLE 328 LG CHEM: PRODUCTS OFFERED

- TABLE 329 LG CHEM: NEW PRODUCT DEVELOPMENTS

- TABLE 330 LG CHEM: DEALS

- TABLE 331 LG CHEM: OTHERS

- TABLE 332 BYD COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 333 BYD COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 334 BYD: NEW PRODUCT DEVELOPMENTS

- TABLE 335 BYD: DEALS

- TABLE 336 BYD: OTHERS

- TABLE 337 SK INNOVATION CO. LTD.: BUSINESS OVERVIEW

- TABLE 338 SK INNOVATION CO. LTD.: SUPPLY AGREEMENTS

- TABLE 339 SK INNOVATION CO. LTD.: PRODUCTS OFFERED

- TABLE 340 SK INNOVATION CO. LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 341 SK INNOVATION CO. LTD.: DEALS

- TABLE 342 SK INNOVATION CO. LTD.: OTHERS

- TABLE 343 VEHICLE ENERGY JAPAN INC.: BUSINESS OVERVIEW

- TABLE 344 VEHICLE ENERGY JAPAN INC.: SUPPLY AGREEMENTS

- TABLE 345 VEHICLE ENERGY JAPAN INC.: PRODUCTS OFFERED

- TABLE 346 VEHICLE ENERGY JAPAN INC.: DEALS

- TABLE 347 VEHICLE ENERGY JAPAN INC.: OTHERS

- TABLE 348 TOSHIBA CORPORATION: BUSINESS OVERVIEW

- TABLE 349 TOSHIBA CORPORATION: SUPPLY AGREEMENTS

- TABLE 350 TOSHIBA CORPORATION: PRODUCTS OFFERED

- TABLE 351 TOSHIBA CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 352 TOSHIBA CORPORATION: DEALS

- TABLE 353 TOSHIBA CORPORATION: OTHERS

- TABLE 354 MITSUBISHI CORPORATION: BUSINESS OVERVIEW

- TABLE 355 MITSUBISHI CORPORATION: PRODUCTS OFFERED

- TABLE 356 MITSUBISHI CORPORATION: NEW PRODUCT DEVELOPMENT

- TABLE 357 MITSUBISHI CORPORATION: DEALS

- TABLE 358 MITSUBISHI CORPORATION: OTHERS

- TABLE 359 ENERSYS: BUSINESS OVERVIEW

- TABLE 360 ENERSYS: PRODUCTS OFFERED

- TABLE 361 ENERSYS: NEW PRODUCT DEVELOPMENTS

- TABLE 362 ENERSYS: DEALS

- TABLE 363 NORTHVOLT AB: BUSINESS OVERVIEW

- TABLE 364 AUTOMOTIVE CELL COMPANY: BUSINESS OVERVIEW

- TABLE 365 BLUEOVAL SK: BUSINESS OVERVIEW

- TABLE 366 CELLFORCE GROUP GMBH: BUSINESS OVERVIEW

- TABLE 367 GOTION HI-TECH: BUSINESS OVERVIEW

- TABLE 368 BORGWARNER INC.: BUSINESS OVERVIEW

- TABLE 369 BORGWARNER INC.: SUPPLY AGREEMENTS

- TABLE 370 BORGWARNER INC.: PRODUCTS OFFERED

- TABLE 371 BORGWARNER INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 372 BORGWARNER INC.: DEALS

- TABLE 373 BORGWARNER INC.: OTHERS

- TABLE 374 BYD CO., LTD.: BUSINESS OVERVIEW

- TABLE 375 BYD CO., LTD.: SUPPLY AGREEMENTS

- TABLE 376 BYD CO., LTD.: PRODUCTS OFFERED

- TABLE 377 BYD CO., LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 378 BYD CO., LTD.: DEALS

- TABLE 379 BYD CO., LTD.: OTHERS

- TABLE 380 SCHAEFFLER GROUP: BUSINESS OVERVIEW

- TABLE 381 SCHAEFFLER GROUP: SUPPLY AGREEMENTS

- TABLE 382 SCHAEFFLER GROUP: PRODUCTS OFFERED

- TABLE 383 SCHAEFFLER GROUP: NEW PRODUCT DEVELOPMENTS

- TABLE 384 SCHAEFFLER GROUP: DEALS

- TABLE 385 SCHAEFFLER GROUP: OTHERS

- TABLE 386 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 387 ROBERT BOSCH GMBH: SUPPLY AGREEMENTS

- TABLE 388 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 389 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

- TABLE 390 ROBERT BOSCH GMBH: DEALS

- TABLE 391 ROBERT BOSCH GMBH: OTHERS

- TABLE 392 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

- TABLE 393 ZF FRIEDRICHSHAFEN AG: SUPPLY AGREEMENTS

- TABLE 394 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 395 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

- TABLE 396 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 397 ZF FRIEDRICHSHAFEN AG: OTHERS

- TABLE 398 JOHNSON ELECTRIC HOLDINGS LTD.: BUSINESS OVERVIEW

- TABLE 399 JOHNSON ELECTRIC HOLDINGS LTD.: PRODUCTS OFFERED

- TABLE 400 JOHNSON ELECTRIC: OTHER DEVELOPMENTS

- TABLE 401 CONTINENTAL AG: BUSINESS OVERVIEW

- TABLE 402 CONTINENTAL AG: SUPPLY AGREEMENTS

- TABLE 403 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 404 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

- TABLE 405 CONTINENTAL AG: OTHERS

- TABLE 406 VALEO S.A.: BUSINESS OVERVIEW

- TABLE 407 VALEO S.A.: SUPPLY AGREEMENTS

- TABLE 408 VALEO S.A.: PRODUCTS OFFERED

- TABLE 409 VALEO S.A.: NEW PRODUCT DEVELOPMENT

- TABLE 410 VALEO S.A.: DEALS

- TABLE 411 MAHLE GROUP: BUSINESS OVERVIEW

- TABLE 412 MAHLE GROUP: PRODUCTS OFFERED

- TABLE 413 MAHLE GROUP: NEW PRODUCT DEVELOPMENT

- TABLE 414 MAHLE GROUP: DEALS

- TABLE 415 MAHLE GROUP: OTHERS

- TABLE 416 NIDEC CORPORATION: BUSINESS OVERVIEW

- TABLE 417 NIDEC CORPORATION: SUPPLY AGREEMENTS

- TABLE 418 NIDEC CORPORATION: PRODUCTS OFFERED

- TABLE 419 NIDEC CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 420 NIDEC CORPORATION: DEALS

- TABLE 421 NIDEC CORPORATION: OTHERS

- TABLE 422 JING-JIN ELECTRIC: BUSINESS OVERVIEW

- TABLE 423 SHANGHAI EDRIVE CO., LTD.: BUSINESS OVERVIEW

- TABLE 424 XPT WEILAI DRIVE TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 425 ZHUHAI ENPOWER ELECTRIC CO., LTD.: BUSINESS OVERVIEW

- TABLE 426 ANAND MANDO EMOBILITY: BUSINESS OVERVIEW

- FIGURE 1 MARKET SEGMENTATION: MARKET

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 MARKET: DATA TRIANGULATION

- FIGURE 6 MARKET OUTLOOK

- FIGURE 7 MARKET, BY REGION, 2023–2030

- FIGURE 8 STRINGENT EMISSION NORMS AND GROWING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- FIGURE 9 BATTERIES SEGMENT TO LEAD MARKET FROM 2023 TO 2030

- FIGURE 10 BATTERY PACKS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 DC-DC CONVERTERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 FUEL STACKS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 BEV POWERTRAIN SEGMENT TO DOMINATE MARKET FROM 2023 TO 2030

- FIGURE 14 FCEVS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 16 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 EURO EMISSION NORMS LIMIT OF NOX: EURO V VS. EURO VII

- FIGURE 18 CHINA EMISSION NORMS LIMIT OF NOX: CHINA V VS. CHINA VI

- FIGURE 19 GLOBAL BEV SALES, 2019-2023 (THOUSAND UNITS)

- FIGURE 20 WIRELESS CHARGING FOR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 21 MARKET ECOSYSTEM

- FIGURE 22 ELECTRIFICATION TREND PRESENTS NEW REVENUE SHIFT FOR ELECTRIC POWERTRAIN MANUFACTURERS

- FIGURE 23 KEY BUYING CRITERIA FOR ELECTRIC POWERTRAINS

- FIGURE 24 COMPARISON OF BILL OF MATERIALS OF ICE AND EVS: 2023 VS 2030

- FIGURE 25 MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 26 PHEV POWERTRAIN MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- FIGURE 27 BEV POWERTRAIN MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- FIGURE 28 FCEV POWERTRAIN MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- FIGURE 29 48V MHEV POWERTRAIN MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- FIGURE 30 MARKET, BY TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 31 MARKET, BY REGION, 2023 VS 2030 (USD MILLION)

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 EUROPE: ELECTRIC POWERTRAIN MARKET, 2023 VS. 2030 (USD MILLION)

- FIGURE 34 NORTH AMERICA: ELECTRIC POWERTRAIN MARKET, 2023 VS. 2030 (USD MILLION)

- FIGURE 35 REST OF THE WORLD: ELECTRIC POWERTRAIN MARKET, 2023 VS. 2030 (USD MILLION)

- FIGURE 36 ELECTRIC POWERTRAIN MARKET SHARE ANALYSIS, 2022

- FIGURE 37 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS: 2020–2022

- FIGURE 38 COMPETITIVE EVALUATION MATRIX (ELECTRIC POWERTRAIN MANUFACTURERS), 2022

- FIGURE 39 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 40 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 42 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 43 HITACHI ASTEMO, LTD.: COMPANY SNAPSHOT

- FIGURE 44 BORGWARNER INC.: COMPANY SNAPSHOT

- FIGURE 45 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 46 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 DANA INCORPORATED: COMPANY SNAPSHOT

- FIGURE 48 VALEO S.A.: COMPANY SNAPSHOT

- FIGURE 49 CATL: COMPANY SNAPSHOT

- FIGURE 50 SAMSUNG SDI: COMPANY SNAPSHOT

- FIGURE 51 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 LG CHEM: COMPANY SNAPSHOT

- FIGURE 53 BYD COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 54 SK INNOVATION CO. LTD.: COMPANY SNAPSHOT

- FIGURE 55 BORGWARNER INC.: COMPANY SNAPSHOT

- FIGURE 56 BYD CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 SCHAEFFLER GROUP: COMPANY SNAPSHOT

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 59 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 60 JOHNSON ELECTRIC HOLDINGS LTD.: COMPANY SNAPSHOT

- FIGURE 61 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 62 VALEO S.A.: COMPANY SNAPSHOT

- FIGURE 63 MAHLE GROUP: COMPANY SNAPSHOT

- FIGURE 64 NIDEC CORPORATION: COMPANY SNAPSHOT

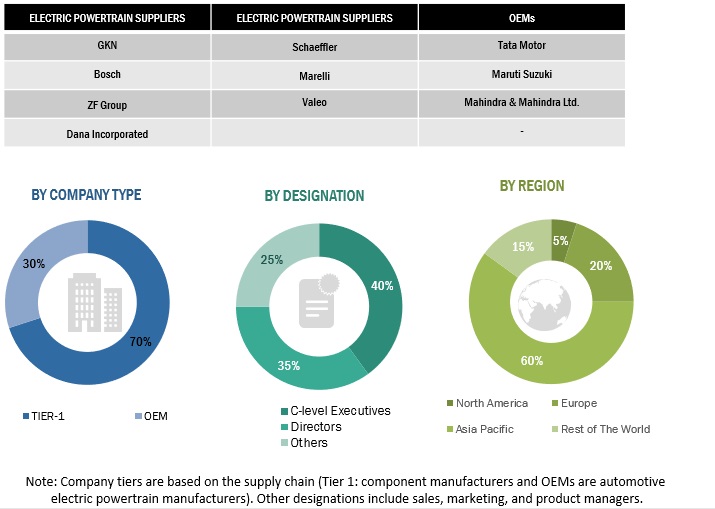

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, electric powertrain magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the electric powertrain market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of electric vehicle sales’ OEMs, EEA (European Energy Agency), IEA (International Energy Agency), ACEA (European Automobile Manufacturers Association), T&E (Transport and Environment), country-level automotive associations, trade organizations, and the US Department of Transportation (DOT)], articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles are used to identify and collect information useful for an extensive commercial study of the global electric powertrain market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from the primaries. This and the in-house subject matter experts’ opinions have led to the findings described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

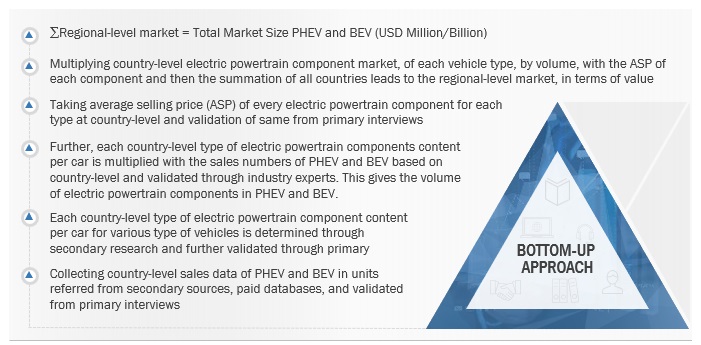

Market Size Estimation

A bottom-up approach has been followed to derive the market size by vehicle type and component in terms of volume and value. The country-level penetration of electric powertrains in BEV, PHEV, MHEV, and FCEVs is derived through country-wise model mapping of electric vehicle types, validated through primary respondents. This gives the country-level electric powertrain market by vehicle and powertrain types. The summation of the country-level market gives the regional market, and further summation of the regional markets provides the global BEV market. A similar methodology was followed to estimate the market for FCEV, PHEV, and MHEV.

Electric Powertrain Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

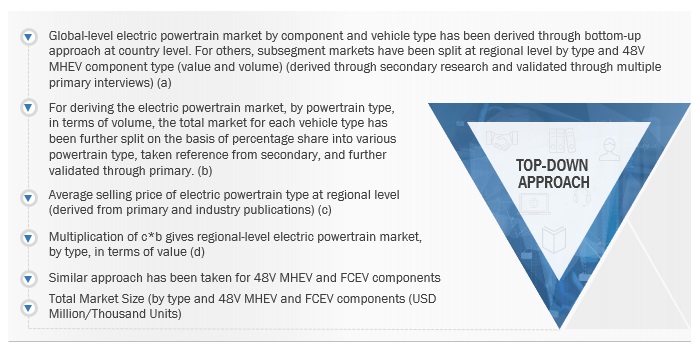

Electric Powertrain Market: Top-Down Approach

The top-down methodology has been followed for the electric powertrain market by type (BEV powertrain, mild hybrid powertrain, series powertrain, parallel powertrain, and series-parallel powertrain). For deriving the market by type, the total volume of the market is divided into various powertrain types based on its usage in passenger cars and validated through secondary and primary sources. This gives the market, by type, in terms of volume. The market size volume, by type, is multiplied by the average selling price of each powertrain type to get the regional-level market by value.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by the primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

An electric powertrain is a system that converts electrical energy into mechanical energy to propel a vehicle. It consists of three main components, motor, battery, and power electronics. The electric motor is the heart of the powertrain. It converts electrical energy into mechanical energy, which is then used to propel the vehicle. The battery stores the electrical energy that is used to power the electric motor. The size and type of battery will determine the range of the electric vehicle. The power electronics system controls the flow of electricity in the powertrain. It ensures that the electric motor always receives the correct amount of power.

Key Stakeholders

- Electric vehicle manufacturers

- Electric vehicle powertrain components manufacturers

- Electric vehicle powertrain manufacturers

- Automotive distributors and retailers

- Raw Material Suppliers of EV components

- Traders, Distributers and Suppliers of Electric Powertrain components

- Government agencies and policymakers

- Associations, forums, and alliances related to electric powertrain and their components

Report Objectives

-

To define, describe, and forecast the electric powertrain market in terms of value (USD million) and volume (thousand units), which includes the following segments:

- By PHEV component [motor/generator, battery pack {battery casing, bus bar, fusing, thermal propagation, connectors, BTMS}, battery management system, control unit, inverter, power distribution module, and on-board charger.]

- By BEV component [motor/generator, battery, battery management system, control unit, inverter/converter, power distribution module, and on-board charger]

- By 48V MHEV component [battery, battery management system, inverter, DC-DC Converter]

- By FCEV component [Fuel Stack, Fuel processor, Power conditioner, Air compressor, Humidifier]

- By powertrain type (series hybrid powertrain, parallel hybrid powertrain, series-parallel hybrid powertrain, BEV powertrain, and MHEV powertrain)

- By vehicle type (PHEV, BEV, 48V MHEV, and FCEV)

- By region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the electric powertrain market

- To analyze the market ranking of key players operating in the market

- To understand the dynamics of the market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in the electric powertrain market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Electric Powertrain Market, By Vehicle Type (Country Level)

- BEV

- HEV/PHEV

- 48V MHEV

- FCEV

Electric Powertrain Market, By Type (Country Level)

- BEV powertrain

- Series hybrid powertrain

- Parallel hybrid powertrain

- Series-Parallel powertrain

Growth opportunities and latent adjacency in Electric Powertrain Market