Food Robotics Market by Type (Articulated, Cartesian, SCARA, Parallel, Collaborative, Cylindrical), Payload (Heavy, Medium, Low), Function (Palletizing, Packaging, Repackaging, Picking, Processing), Application and Region - Trends & Forecast to 2026

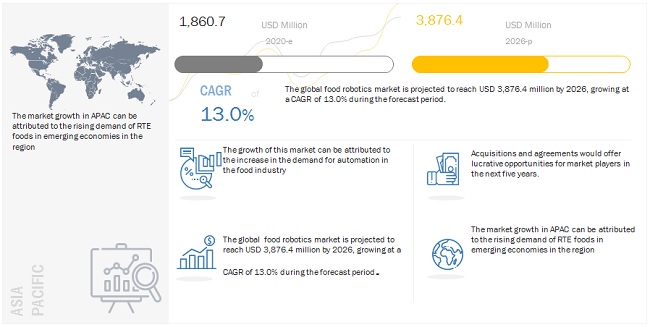

[256 Pages Report] According to MarketsandMarkets, The global food robotics market size is estimated to be valued at USD 1.9 billion in 2020 and projected to reach USD 4.0 billion by 2026, recording a CAGR of 13.1% during the forecast period. The demand for food robotics is increasing significantly owing to surging demand for food with increasing population and increasing demand for enhanced productivity in food processing. Additionally, increasing investments in automation in the food industry is projected to provide growth opportunities for the food robotics market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Growing demand for packaged food

In the last few years, there has been a growing need to package food products in order to increase their shelf life and cater to the demand for ready-to-cook and ready-to-eat products. Mass production of packaged food products especially in countries such as the U.S., Japan, France, and Italy has driven the market for food robotics. In most large-scale food manufacturing plants, processes are being automated in order to ensure quality and consistency in the Stock Keeping Units (SKUs). Food robotics is being increasingly implemented in the production of processed, frozen, dried, and chilled packaged food products. The growth in the packaged dairy products and baked goods industries is also driving the food robotics market as these products are manufactured on a large scale across regions.

Restraints: Scarcity of skilled workforce in emerging economies

The adoption and implementation of food robotics requires skilled workforce. There is a scarcity of people specializing in disciplines such as electrical, embedded, software, and mechanical, which are required for the installation and maintenance of robots. Also, there is a deficit of highly qualified employees with specific skills needed to develop high value-added robots integrated with advanced technologies.

In countries where the food & beverage industry has high potential for growth, such as China, India, and Brazil, there is a skill shortage in this domain. This is because knowledge of four to five engineering disciplines is required to become an expert in this field, and there is a scarcity of qualified faculty to teach the subjects. Moreover, there are limited branches of engineering that focus on robotics. This is a direct restraining factor for the food robotics market as the development of adequate skilled manpower is likely to be achieved only in the long run.

Opportunities: Increasing functionality of robots

Traditionally, the functionality and use of robots was limited to heavy payload in transportation equipment manufacturing. However, with the increasing functionality of robots more industries, such as the food processing industry are adopting automation with mainly low payload robots. Sections such as dairy and bakery in the food & beverage industry are minimizing human contact in the production process in order to comply with health authority standards. There is an opportunity for the food robotics market to grow with the increase in functionality of robots to include packaging, repackaging, and palletizing.

Challenges: High installation cost of robotic system

Most food manufacturers are reluctant to adopt automated processes due to the installation cost over and above the price of the robot. The added cost to turn the individual robots into a comprehensive robotic system, peripheral equipment such as safety barriers, sensors, programmable logic controllers (PLC), human machine interface (HMI), and safety systems is a challenge for market growth. Additionally there are engineering costs for programming, installation, and commissioning. These additional costs pose a challenge for the growth of the global market. Small- and medium-scale manufacturers are reluctant to incur high initial costs of installation as it could extend the period to achieve the break-even point.

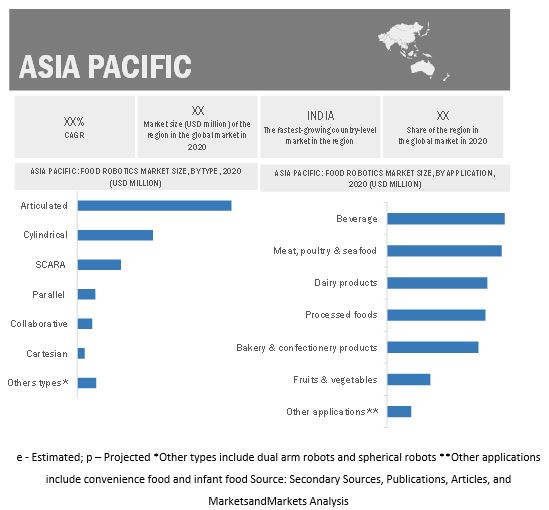

Asia Pacific is projected to account for the fastest-growing market during the forecast period

Due to the high population in the region and changing lifestyles, the demand for RTE foods is growing. The automation in production and processing of RTE foods in the Asia Pacific region is projected to provide growth opportunities for the food robotics market.

Key Market Players:

Key players in this market include ABB Group(Switzerland),KUKA AG (Germany), Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Rockwell Automation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yasakawa Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), OMRON Corporation (Japan), Universal Robots A/S (Denmark), Staubli International AG (Switzerland), Bastian Solutions LLC (U.S.), Schunk GmbH (Germany), Asic Robotics AG (Switzerland), Mayekawa Mfg. Co. Ltd. (Japan), Apex Automation & Robotics (Australia), Aurotek Corporation (Taiwan), Ellison Technologies Inc. (U.S.), Fuji Robotics (Japan), and Moley Robotics (U.K.).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

20182026 |

|

Base year considered |

2019 |

|

Forecast period considered |

20202026 |

|

Units considered |

Value (USD) |

|

Segments Covered |

|

|

Regions covered |

|

|

Companies studied |

ABB Group (Switzerland), KUKA AG (Germany), Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Rockwell Automation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yasakawa Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), OMRON Corporation (Japan), Universal Robots A/S (Denmark), Staubli International AG (Switzerland), Bastian Solutions LLC (U.S.), Schunk GmbH (Germany), Asic Robotics AG (Switzerland), Mayekawa Mfg. Co. Ltd. (Japan), Apex Automation & Robotics (Australia), Aurotek Corporation (Taiwan), Ellison Technologies Inc. (U.S.), Fuji Robotics (Japan), and Moley Robotics (U.K.) |

This research report categorizes the food robotics market based on type, payload, function, application and region.

Based on type, the market has been segmented as follows:

- Articulated

- Cartesian

- Scara

- Parallel

- Cylindrical

- Collaborative

- Other types (Dual arm robots and spherical robots)

Based on payload, the market has been segmented as follows:

- High

- Medium

- Low

Based on function, the market has been segmented as follows:

- Palletizing

- Packaging

- Repackaging

- Picking

- Processing

- Other functions (Grading, sorting & defect removal)

Based on application, the market has been segmented as follows:

- Meat, poultry, and seafood

- Processed food

- Dairy products

- Fruits & vegetables

- Beverage

- Bakery & confectionery products

- Other applications (Convenience food & infant food)

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments

- November 2019, Mitsubishi (Japan) has extended its MELFA articulated arms and its SCARA robot products to a series of triangular robots, which will help the company to expand its line of robotic solutions.

- April 2018, 6d Bytes (US) launched a fully autonomous robotic station, Blended for preparing healthy and delicious blends. This helped the company expand its product portfolio for food robotic solutions.

- March 2017, Kawasaki Heavy Industries, Ltd. (Japan) and Softbank Group (Japan) collaborated to combine Kawasakis duAro and Softbanks humanoid robot called Pepper to perform a broader range of tasks.

Frequently Asked Questions (FAQ):

Does the report covers the market size and estimations for the country level markets for food robotics?

The report has overall number at regional and country level. The further country wise analysis can be further provided as a customization. Please let us know your geography/regional preferences.

Does the scope covers robotics for beverage and pharma based products?

The report covers robotics solutions for food and beverages. Pharma based products are not considered under the scope of the study.

Is it possible to provide the segmentation and analysis of food robots in food manufacturing and food service industry?

Yes, further segmentation is possible for food robotics market on the basis of end-users.

We are looking for quantification at each stage in the supply chain. Can this be provided?

The report covers value chain analysis and supply chain analysis at global levels. Further drill down at regional level can be provided for required products.

Can you provide estimation for countries of Middle Eastern region?

We can provide additional country wise estimation for different regions, such as: Egypt, Sudan, Turkey, Jordan, Oman, and Saudi Arabia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 20172019

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 FOOD ROBOTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 2 FOOD ROBOTICS MARKET SNAPSHOT, 2020 VS. 2026

FIGURE 9 MARKET SIZE, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 10 MARKET SIZE, BY APPLICATION, 2020 VS. 2026 (USD MILLION)

FIGURE 11 MARKET SIZE, BY PAYLOAD, 2020 VS. 2026 (USD MILLION)

FIGURE 12 MARKET SIZE, BY FUNCTION, 2020 VS. 2026 (USD MILLION)

FIGURE 13 MARKET SHARE AND GROWTH (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 BRIEF OVERVIEW OF THE GLOBAL MARKET

FIGURE 14 INCREASING DEMAND FOR AUTOMATION AND HYGIENE PRACTICE IN THE FOOD INDUSTRY TO DRIVE THE GROWTH OF THE GLOBAL MARKET

4.2 MARKET FOR FOOD ROBOTICS: MAJOR REGIONAL SUBMARKETS

FIGURE 15 CHINA IS THE LARGEST MARKET GLOBALLY FOR FOOD ROBOTICS IN 2020

4.3 ASIA PACIFIC: MARKET FOR FOOD ROBOTICS, BY PAYLOAD AND COUNTRY

FIGURE 16 CHINA IS PROJECTED TO DOMINATE IN THE ASIA PACIFIC MARKET BY 2026

4.4 MARKET FOR FOOD ROBOTICS, BY TYPE AND REGION

FIGURE 17 ARTICULATED SEGMENT IS PROJECTED TO DOMINATE THE GLOBAL MARKET IN 2020

4.5 FOOD ROBOTICS MARKET, BY APPLICATION

FIGURE 18 BAKERY & CONFECTIONERY PRODUCTS TO DOMINATE THE GLOBAL MARKET, 2020 VS. 2026

4.6 MARKET FOR FOOD ROBOTICS, BY FUNCTION

FIGURE 19 PALLETIZING IS PROJECTED TO DOMINATE THE GLOBAL MARKET, 2020 VS. 2026

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

FIGURE 20 ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS, BY KEY COUNTRY, 2019 (THOUSAND UNITS)

5.2 MARKET DYNAMICS

FIGURE 21 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing integration of robotics in food manufacturing to optimize errors in production would save time and space

5.2.1.1.1 Increasing density of robots in the manufacturing sector

FIGURE 22 ESTIMATED ANNUAL SUPPLY OF INDUSTRIAL ROBOTS WORLDWIDE, BY INDUSTRY, 2016-2018, (THOUSAND UNITS)

FIGURE 23 ROBOT DENSITY IN THE MANUFACTURING INDUSTRY, 2018 (UNITS INSTALLED PER 10,000 EMPLOYEES)

5.2.1.2 Growing demand for robots to ensure safe and hygienic food manufacturing process

5.2.1.2.1 Increasing food safety regulations

5.2.1.3 Limited workforce to drive the use of robots

5.2.1.3.1 Anticipated shortage of workforce due to high labor cost in some countries

5.2.1.4 Increasing popularity and consumption of RTE & packaged foods

5.2.2 RESTRAINTS

5.2.2.1 High installation costs of robotic systems

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing investments in automation

FIGURE 24 AVERAGE ANNUAL SUPPLY OF ROBOTS IN UNITS

5.2.3.2 Increasing functionality of robots

5.2.3.2.1 Increasing need to improve productivity

5.2.3.3 Growing demand for collaborative robots owing to their simpler functional use

FIGURE 25 COLLABORATIVE VS. TRADITIONAL ROBOTS, 2017-2019 (THOUSAND UNITS)

5.2.4 CHALLENGES

5.2.4.1 Reduction of jobs due to automation

5.2.4.2 Interoperability issues related to robotic technologies

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 COVID-19 TO IMPACT MASS ADOPTION OF ROBOTICS BY SMALL AND MEDIUM-SIZED FOOD COMPANIES DUE TO HIGH INSTALLATION COST

5.3.2 FOOD ROBOTICS TO ENSURE CONTINUED MANUFACTURING AND SUPPLY OF FOOD PRODUCTS GIVEN THE RESTRICTION DUE TO COVID-19

5.3.3 GOVERNMENT AND PUBLIC-PRIVATE COMPANIES INITIATIVES TO MITIGATE THE COVID-19 IMPACT

5.3.4 COVID-19 TO DRIVE THE USE OF FOOD ROBOTICS AND ELIMINATE THE RISK OF FOREIGN CONTAMINATION

6 INDUSTRY TRENDS (Page No. - 65)

6.1 INDUSTRY OVERVIEW

6.2 VALUE CHAIN ANALYSIS

6.2.1 PLANNING AND REVISING FUND

6.2.2 RESEARCH & DEVELOPMENT (R&D)

6.2.3 MANUFACTURING

6.2.4 ASSEMBLY, DISTRIBUTION, AND AFTER-SALES SERVICES

FIGURE 26 VALUE CHAIN ANALYSIS OF THE FOOD ROBOTICS MARKET

6.3 YC-YCC SHIFT

FIGURE 27 FOOD ROBOTICS MARKET: YC-YCC SHIFT

6.4 TECHNOLOGY ANALYSIS

6.4.1 INTEGRATION OF VISION SYSTEMS WITH FOOD ROBOTS

TABLE 3 LIST OF TOP MANUFACTURERS OF 3D VISION SYSTEMS

6.4.2 PENETRATION OF IOT AND AI IN MANUFACTURING

6.4.3 PENETRATION OF 5G IN MANUFACTURING

6.5 TRADE ANALYSIS

FIGURE 28 GLOBAL SHIPMENTS OF INDUSTRIAL ROBOTS FROM VARIOUS REGIONS, 2010-2017 (THOUSAND UNITS)

FIGURE 29 GLOBAL ROBOT IMPORTS, 2010 VS. 2015 (THOUSAND UNITS)

FIGURE 30 TOP 15 EXPORTING COUNTRIES OF INDUSTRIAL ROBOTS, 2019 (USD MILLION)

FIGURE 31 TOP 15 POSITIVE NET EXPORTING COUNTRIES OF INDUSTRIAL ROBOTS, 2019 (USD MILLION)

FIGURE 32 TOP 15 NEGATIVE NET EXPORTING COUNTRIES OF INDUSTRIAL ROBOTS, 2019 (USD MILLION)

6.6 PRICING ANALYSIS

FIGURE 33 GLOBAL ASP OF FOOD ROBOTICS, BY TYPE, 2019 (USD PER UNIT)

FIGURE 34 PRICING TRENDS OF ROBOTIC SYSTEMS, 2017 2020 (USD)

FIGURE 35 CUMULATIVE CASHFLOW OF TYPICAL ROBOTIC SYSTEMS OVER 15 YEARS (USD)

6.7 PORTERS FIVE FORCES MODEL

TABLE 4 FOOD ROBOTICS MARKET: PORTERS FIVE FORCES ANALYSIS

6.8 PATENT ANALYSIS

FIGURE 36 PATENTS GRANTED IN THE FOOD ROBOTICS ECOSYSTEM, 2018-2019

TABLE 5 LIST OF KEY PATENTS GRANTED IN FOOD ROBOTICS, 2020

6.9 REGULATORY LANDSCAPE

6.9.1 NORTH AMERICA

6.9.2 EUROPE

6.9.3 ASIA PACIFIC

6.10 CASE STUDIES

6.10.1 RIEBER GMBH & CO. KG USED APAS ASSISTANT FROM ROBERT BOSCH FOR PROCESS AND LOGISTICS AUTOMATION IN INDUSTRIAL KITCHENS

TABLE 6 CASE STUDY ON PROCESS AND LOGISTICS AUTOMATION

6.10.2 ATRIA SCANDINAVIA OPTIMIZED LABELING, PACKAGING, AND PALLETIZING TASKS WITH COLLABORATIVE ROBOTS

TABLE 7 CASE STUDY ON LABELING, PACKAGING, AND PALLETIZING TASKS

6.10.3 CASCINA ITALIA IMPROVED FLEXIBILITY AND OPERATIONAL EFFICIENCY OF ITS BUSINESS WITH THE UR5 CO-BOT FROM UNIVERSAL ROBOTS

TABLE 8 CASE STUDY ON FLEXIBILITY AND OPERATIONAL EFFICIENCY OF BUSINESS

6.10.4 ROBOTIC LASER CUTTING AND HEAVY-PART MATERIAL HANDLING HELP UPF REDUCE OPERATING COSTS AND INCREASE PRODUCTION FLEXIBILITY

TABLE 9 CASE STUDY ON ROBOTIC LASER CUTTING AND HEAVY-PART MATERIAL HANDLING

6.10.5 BAUMRUK & BAUMRUK AUTOMATED ITS PROCESS OF LOADING SMALLER PARTS INTO MILLING CENTERS

TABLE 10 CASE STUDY ON PROCESS AUTOMATION FOR PARTS LOADING

6.11 ECOSYSTEM MAP

6.11.1 FOOD ROBOTICS: ECOSYSTEM VIEW

6.11.2 FOOD ROBOTICS: MARKET MAP

6.11.2.1 Supply side

6.11.2.1.1 Robot OEMs

TABLE 11 OEMS OF INDUSTRIAL ROBOTS

6.11.2.1.2 Suppliers

6.11.2.1.3 Regulatory bodies & certification providers

6.11.2.2 Demand side

6.11.2.2.1 Manufacturers of food & beverage and pharmaceuticals

TABLE 12 TOP 20 FOOD & BEVERAGE PROCESSING COMPANIES IN THE WORLD, 2018

6.11.2.2.2 Distributers of robots

7 FOOD ROBOTICS MARKET, BY TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 37 FOOD ROBOTICS MARKET SIZE, BY TYPE, 2020 VS. 2026 (USD MILLION)

TABLE 13 MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 14 MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

7.1.1 COVID-19 IMPACT ON THE GLOBAL MARKET, BY TYPE

7.1.1.1 Optimistic scenario

TABLE 15 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

7.1.1.2 Realistic scenario

TABLE 16 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

7.1.1.3 Pessimistic scenario

TABLE 17 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

7.2 ARTICULATED

FIGURE 38 ARTICULATED: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 2020 VS. 2026 (USD MILLION)

TABLE 18 ARTICULATED: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 19 ARTICULATED: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

7.3 CARTESIAN

TABLE 20 CARTESIAN: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 21 CARTESIAN: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

7.4 SCARA

TABLE 22 SCARA: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 23 SCARA: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

7.5 PARALLEL

TABLE 24 PARALLEL: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 25 PARALLEL: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

7.6 CYLINDRICAL

TABLE 26 CYLINDRICAL: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 27 CYLINDRICAL: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

7.7 COLLABORATIVE

TABLE 28 COLLABORATIVE: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 29 COLLABORATIVE: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

7.8 OTHER TYPES

TABLE 30 OTHER TYPES: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 31 OTHER TYPES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

8 FOOD ROBOTICS MARKET, BY PAYLOAD (Page No. - 106)

8.1 INTRODUCTION

FIGURE 39 FOOD ROBOTICS MARKET SIZE, BY PAYLOAD, 2020 VS. 2026 (USD MILLION)

TABLE 32 MARKET SIZE, BY PAYLOAD, 20162019 (USD MILLION)

TABLE 33 MARKET SIZE, BY PAYLOAD, 20202026 (USD MILLION)

8.2 LOW

8.2.1 SMALL INSTALLATION FOOTPRINT OF LOW PAYLOAD PRESENTS COST-EFFECTIVE AUTOMATION SOLUTIONS TO USERS

FIGURE 40 LOW: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 2020 VS. 2026 (USD MILLION)

TABLE 34 LOW: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 35 LOW: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

8.3 MEDIUM

8.3.1 MULTI-PURPOSE ABILITY OF MEDIUM PAYLOAD ROBOTS TO BE USED FOR PALLETIZING AND PROCESSING APPLICATIONS DRIVES THE MARKET

TABLE 36 MEDIUM: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 37 MEDIUM: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

8.4 HEAVY

8.4.1 HEAVY PAYLOAD ROBOTS ARE NOT PREFERRED IN THE FOOD INDUSTRY BECAUSE THESE ARE MORE SUITED FOR HEAVY GOODS AND COMMODITIES

TABLE 38 HEAVY: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 39 HEAVY: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

9 FOOD ROBOTICS MARKET, BY FUNCTION (Page No. - 112)

9.1 INTRODUCTION

FIGURE 41 FOOD ROBOTICS MARKET SIZE, BY FUNCTION, 2020 VS. 2026 (USD MILLION)

TABLE 40 MARKET SIZE, BY FUNCTION, 20162019 (USD MILLION)

TABLE 41 MARKET SIZE, BY FUNCTION, 20202026 (USD MILLION)

9.2 PALLETIZING

9.2.1 PALLETIZING ROBOTS ARE EFFICIENT AND CAN LOAD HEAVY CARTONS EASILY, HENCE MINIMIZING THE DEPENDENCE ON MANUAL LABOR

FIGURE 42 PALLETIZING: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 2020 VS. 2026 (USD MILLION)

TABLE 42 PALLETIZING: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 43 PALLETIZING: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

9.3 PACKAGING

9.3.1 ABILITY OF PACKAGING ROBOTS TO STREAMLINE THE ASSEMBLY LINE HAS INCREASED ITS DEMAND IN THE FOOD INDUSTRY

TABLE 44 PACKAGING: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 45 PACKAGING: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

9.4 REPACKAGING

9.4.1 COMPANIES ARE LARGELY INSTALLING REPACKAGING ROBOTS TO DECREASE HUMAN LABOR IN THE UNHEALTHY ENVIRONMENT OF WAREHOUSES

TABLE 46 REPACKAGING: MARKET SIZE FOR FOOD ROBOTICS, BY REGION,20162019 (USD MILLION)

TABLE 47 REPACKAGING: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

9.5 PICKING

9.5.1 TO ENSURE MINIMUM DAMAGE TO THE FINAL PRODUCT AND ACCURATE PLACING OF PRODUCTS, PICKING ROBOTS ARE LARGELY INSTALLED BY BEVERAGE COMPANIES

TABLE 48 PICKING: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 49 PICKING: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

9.6 PROCESSING

9.6.1 HYGIENIC ENVIRONMENT REQUIRED TO PROCESS FOOD PRODUCTS IS DRIVING THE MARKET FOR PROCESSING ROBOTS

TABLE 50 PROCESSING: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 51 PROCESSING: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

9.7 OTHER FUNCTIONS

9.7.1 DEFECT REMOVAL ROBOTS ARE FAVORED BY COMPANIES AS THEY HAVE A PRECISE DETECTION OF FAULT IN THE FINAL PRODUCTS, WHICH CAN BE MISSED BY THE HUMAN EYE

TABLE 52 OTHER FUNCTIONS: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 53 OTHER FUNCTIONS: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

10 FOOD ROBOTICS MARKET, BY APPLICATION (Page No. - 122)

10.1 INTRODUCTION

FIGURE 43 FOOD ROBOTICS MARKET SIZE, BY APPLICATION, 2020 VS. 2026 (USD MILLION)

TABLE 54 MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 55 MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE GLOBAL MARKET, BY APPLICATION

10.1.1.1 Optimistic scenario

TABLE 56 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

10.1.1.2 Realistic scenario

TABLE 57 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 58 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

10.2 BAKERY & CONFECTIONERY PRODUCTS

10.2.1 ROBOTS WITH IMPROVED GRIPPING PROCESS AND PICK & PLACE SYSTEMS HAVE DECREASED MANUAL WORK IN BAKERIES

FIGURE 44 BAKERY & CONFECTIONERY PRODUCTS: FOOD ROBOTICS MARKET SIZE, BY REGION, 2020 VS. 2026 (USD MILLION)

TABLE 59 BAKERY & CONFECTIONERY PRODUCTS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 60 BAKERY & CONFECTIONERY PRODUCTS: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

10.3 BEVERAGES

10.3.1 WITH THE INCREASING DEMAND FOR MANPOWER AND SHORTAGE OF LABOR, BEVERAGE IS A GROWING SECTOR IN THE FOOD ROBOTICS MARKET

TABLE 61 BEVERAGES: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 62 BEVERAGES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

10.4 MEAT, POULTRY, AND SEAFOOD

10.4.1 REPETITIVE WORK SUCH AS DEBONING AND SKINNING OF CHICKEN AND MEAT LEADS TO HIGH DEMAND FOR ROBOTS IN THE MEAT & POULTRY SECTOR

TABLE 63 MEAT, POULTRY, AND SEAFOOD: MARKET SIZE FOR FOOD ROBOTICS BY REGION, 20162019 (USD MILLION)

TABLE 64 MEAT, POULTRY, AND SEAFOOD: MARKET SIZE, BY, REGION, 20202026 (USD MILLION)

10.5 DAIRY PRODUCTS

10.5.1 AUTOMATED MILKING SYSTEMS ARE THE PIONEERS OF USING ROBOTS IN THE DAIRY SECTOR, WHICH HAS PAVED THE WAY FOR INNOVATIVE ROBOTIC TECHNOLOGIES IN THIS SECTOR

TABLE 65 DAIRY PRODUCTS: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 66 DAIRY PRODUCTS: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

10.6 PROCESSED FOOD

10.6.1 INCREASED DEMAND FOR PROCESSED FOOD ACROSS THE GLOBE IS DRIVING THE MARKET FOR FOOD ROBOTICS

TABLE 67 PROCESSED FOOD: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 68 PROCESSED FOOD: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

10.7 FRUITS & VEGETABLES

10.7.1 EFFICIENT AND ACCURATE SORTING & GRADING OF FRUITS FOR EXPORT TO DRIVE THE GLOBAL MARKET

TABLE 69 FRUITS AND VEGETABLES: FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 70 FRUITS AND VEGETABLES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

10.8 OTHER APPLICATIONS

10.8.1 HYGIENE AND SAFETY ARE IMPORTANT PARAMETERS THAT HAVE FUELED THE DEMAND FOR ROBOTS IN INFANT FOOD PROCESSING

TABLE 71 OTHER APPLICATIONS: MARKET SIZE FOR FOOD ROBOTICS, BY REGION, 20162019 (USD MILLION)

TABLE 72 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

11 FOOD ROBOTICS MARKET, BY REGION (Page No. - 135)

11.1 INTRODUCTION

FIGURE 45 CHINA TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 73 FOOD ROBOTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 74 MARKET SIZE, BY REGION, 20202026 (USD MILLION)

11.1.1 COVID-19 IMPACT ON THE GLOBAL MARKET, BY REGION

11.1.1.1 Realistic scenario

TABLE 75 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY REGION, 20182021 (USD MILLION)

11.1.1.2 Pessimistic scenario

TABLE 76 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY REGION, 20182021 (USD MILLION)

11.1.1.3 Optimistic scenario

TABLE 77 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY REGION, 20182021 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: FOOD ROBOTICS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY PAYLOAD, 20162019 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY PAYLOAD, 20202026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 20162019 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 20202026 (USD MILLION)

11.2.1 US

11.2.1.1 Legislative framework regarding food safety in the US to fuel the global market

TABLE 88 US: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 89 US: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 90 US: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 91 US: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Active involvement of regulatory bodies, such as CFIA, to drive the growth of the global market in Canada

TABLE 92 CANADA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 94 CANADA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Growth in food trade resulting in the demand for better food robotics systems to ensure food safety in the country

TABLE 96 MEXICO: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 97 MEXICO: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 98 MEXICO: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 99 MEXICO: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.3 EUROPE

FIGURE 47 EUROPE: FOOD ROBOTICS MARKET SNAPSHOT

TABLE 100 EUROPE: MARKET SIZE FOR FOOD ROBOTICS, BY COUNTRY, 20162019 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY PAYLOAD, 20162019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY PAYLOAD, 20202026 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY FUNCTION, 20162019 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY FUNCTION, 20202026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 High adaptability rate among consumers and manufacturers

TABLE 110 GERMANY: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 111 GERMANY: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 112 GERMANY: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 113 GERMANY: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.3.2 UK

11.3.2.1 Occurrence of several health hazards in recent times has increased the demand for safe food

TABLE 114 UK: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 115 UK: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 116 UK: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 117 UK: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 With an increase in the demand for services from hospitality and related industries, the need for robotics is increasing

TABLE 118 FRANCE: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 119 FRANCE: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 120 FRANCE: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 121 FRANCE: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Introduction of new technology is boosting confidence among manufacturers for food robotics services

TABLE 122 ITALY: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 123 ITALY: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 124 ITALY: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 125 ITALY: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Rising consumer awareness is the key to drive the market in the country

TABLE 126 SPAIN: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 127 SPAIN: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 128 SPAIN: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 129 SPAIN: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.3.6 REST OF EUROPE

11.3.6.1 Growing demand for robots in the dutch dairy industry to drive the market growth in the rest of Europe

TABLE 130 REST OF EUROPE: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 132 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 134 ASIA PACIFIC: FOOD ROBOTICS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY PAYLOAD, 20162019 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY PAYLOAD, 20202026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY FUNCTION, 20162019 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY FUNCTION, 20202026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Technological advancements in China to fuel the global market

TABLE 144 CHINA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 145 CHINA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 146 CHINA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 147 CHINA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Demand for effective food supply chain management in India to drive the growth of food robotics solutions

TABLE 148 INDIA: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 149 INDIA : MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 150 INDIA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 151 INDIA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Need for compliance with food safety standards to drive the demand for food robotics in the country

TABLE 152 JAPAN: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 153 JAPAN : MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 154 JAPAN: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 155 JAPAN: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Due to environmental concerns, there is an increase in the usage of technology and equipment

TABLE 156 SOUTH KOREA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 157 SOUTH KOREA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 158 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 159 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.4.5 AUSTRALIA & NEW ZEALAND

11.4.5.1 Increasing instances of foodborne illnesses to drive the growth of food robotics technologies

TABLE 160 AUSTRALIA & NEW ZEALAND: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 161 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 162 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 163 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

11.4.6.1 Stringent food safety standards to present various opportunities for the growth of food robotics in Southeast Asian countries

TABLE 164 REST OF ASIA PACIFIC: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 168 SOUTH AMERICA: FOOD ROBOTICS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 169 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 171 SOUTH AMERICA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 172 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 173 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

TABLE 174 SOUTH AMERICA: MARKET SIZE, BY PAYLOAD, 20162019 (USD MILLION)

TABLE 175 SOUTH AMERICA: MARKET SIZE, BY PAYLOAD, 20202026 (USD MILLION)

TABLE 176 SOUTH AMERICA: MARKET SIZE, BY FUNCTION, 20162019 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY FUNCTION, 20202026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 High adaptability rate among consumers and manufacturers to drive the market

TABLE 178 BRAZIL: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 179 BRAZIL: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 180 BRAZIL: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 181 BRAZIL: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Occurrence of several health hazards in recent times has increased the demand for safe food

TABLE 182 ARGENTINA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 183 ARGENTINA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 184 ARGENTINA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 185 ARGENTINA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 With an increase in the demand for services of hospitality and related industries, the need for robotics is increasing

TABLE 186 REST OF SOUTH AMERICA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 187 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 189 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 190 ROW: FOOD ROBOTICS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 191 ROW: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 192 ROW: MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 193 ROW: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 194 ROW: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 195 ROW: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

TABLE 196 ROW MARKET SIZE, BY PAYLOAD, 20162019 (USD MILLION)

TABLE 197 ROW: MARKET SIZE, BY PAYLOAD, 20202026 (USD MILLION)

TABLE 198 ROW: MARKET SIZE, BY FUNCTION, 20162019 (USD MILLION)

TABLE 199 ROW: MARKET SIZE, BY FUNCTION, 20202026 (USD MILLION)

11.6.1 SOUTH AFRICA

11.6.1.1 Adoption of new and advanced robotics technologies in the region to present growth opportunities

TABLE 200 SOUTH AFRICA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 201 SOUTH AFRICA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 202 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 203 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Introduction of strict guidelines to ensure food safety to drive the demand for food robotics technologies

TABLE 204 MIDDLE EAST: FOOD ROBOTICS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 205 MIDDLE EAST: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 206 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 207 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

11.6.3 REST OF AFRICA

11.6.3.1 Lack of supporting infrastructure restrains the growth of the African food robotics market

TABLE 208 REST OF AFRICA: MARKET SIZE FOR FOOD ROBOTICS, BY TYPE, 20162019 (USD MILLION)

TABLE 209 REST OF AFRICA: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 210 REST OF AFRICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 211 REST OF AFRICA: MARKET SIZE, BY APPLICATION, 20202026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 207)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 49 MARKET EVALUATION FRAMEWORK, 20172020

12.3 MARKET SHARE ANALYSIS, 2019

TABLE 212 FOOD ROBOTICS: DEGREE OF COMPETITION

12.4 REVENUE ANALYSIS (SEGMENTAL REVENUE) OF KEY PLAYERS, 2019

FIGURE 50 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 20172019 (USD MILLION)

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.6 COMPANY EVALUATION QUADRANT: DEFINITIONS & METHODOLOGY

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

12.7 COMPANY EVALUATION QUADRANT, 2019 (OVERALL MARKET)

FIGURE 51 FOOD ROBOTICS MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.8 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

12.8.1 PROGRESSIVE COMPANIES

12.8.2 STARTING BLOCKS

12.8.3 RESPONSIVE COMPANIES

12.8.4 DYNAMIC COMPANIES

FIGURE 52 FOOD ROBOTICS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS, 2020

12.8.5 PRODUCT FOOTPRINT

TABLE 213 FOOD ROBOTICS MARKET: COMPANY APPLICATION FOOTPRINT

12.9 COMPETITIVE SCENARIO

TABLE 214 FOOD ROBOTICS MARKET DEALS, 20182020

13 COMPANY PROFILES (Page No. - 217)

(Business overview, Products offered, Recent Developments, SWOT analysis, Right to win)*

13.1 KEY COMPANIES

13.1.1 MITSUBISHI ELECTRIC CORPORATION

FIGURE 53 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 54 MITSUBISHI ELECTRIC CORPORATION: SWOT ANALYSIS

13.1.2 ABB GROUP

FIGURE 55 ABB GROUP: COMPANY SNAPSHOT

FIGURE 56 ABB GROUP: SWOT ANALYSIS

13.1.3 KAWASAKI HEAVY INDUSTRIES LTD.

FIGURE 57 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 58 KAWASAKI HEAVY INDUSTRIES LTD.: SWOT ANALYSIS

13.1.4 ROCKWELL AUTOMATION, INC.

FIGURE 59 ROCKWELL AUTOMATION INCORPORATED: COMPANY SNAPSHOT

FIGURE 60 ROCKWELL AUTOMATION INCORPORATED: SWOT ANALYSIS

13.1.5 FANUC CORPORATION

FIGURE 61 FANUC CORPORATION: COMPANY SNAPSHOT

FIGURE 62 FANUC CORPORATION: SWOT ANALYSIS

13.1.6 KUKA AG

FIGURE 63 KUKA AG: COMPANY SNAPSHOT

13.1.7 SEIKO EPSON CORPORATION

FIGURE 64 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

13.1.8 YASKAWA ELECTRIC CORPORATION

FIGURE 65 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

13.1.9 STAUBLI INTERNATIONAL CORPORATION

13.1.10 MAYEKAWA MFG CO. LTD

13.2 START-UPS/SMES

13.2.1 BASTIAN SOLUTIONS, INC.

13.2.2 PEARSON PACKAGING SYSTEM

13.2.3 STARSHIP INDUSTRIES

13.2.4 CHOWBOTICS

13.2.5 UNIVERSAL ROBOTS A/S

13.2.6 KARAKURI LTD.

13.2.7 CANTRELL

13.2.8 RETAIL ROBOTICS

13.2.9 JUNGLE ROBOTICS GMBH

13.2.10 TM ROBOTICS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, Right to win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 246)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

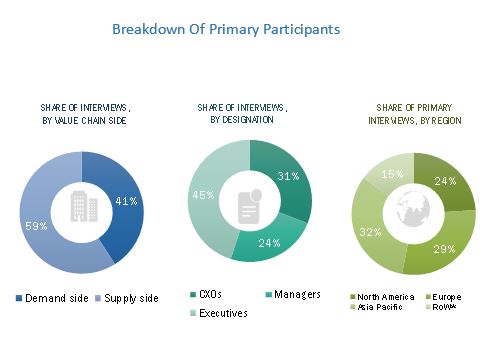

The study involved four major activities in estimating the food robotics market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food robotics market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of food robotics was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adoptedtop-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the food robotics market, with respect to type, payload, function, application and regional markets, over a period, ranging from 2020 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Providing detailed information about the impact of COVID-19 on food robotics supply chain and its impact on various stakeholders such as suppliers, manufacturers, R&D laboratories and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the food robotics market and impact of COVID-19 on the key vendors.

- Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the food robotics market.

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe food robotics market, by key country

- Further breakdown of the Rest of Asia Pacific food robotics market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of robots

- Market segmentation by end-users as food manufacturing industry and food service industry

Company Information

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Food Robotics Market