Floating Production Storage and Offloading Market by Type (New-Build & Converted), Hull Type (Single & Double), Propulsion (Self-propelled & Towed), Usage (Shallow water, Deepwater & Ultra-Deepwater), and Region - Global Forecast to 2024

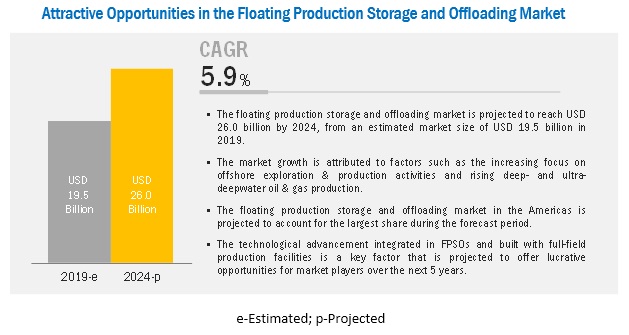

[122 Pages Report] The floating production storage and offloading market is projected to reach USD 26.0 billion by 2024 from an estimated USD 19.5 billion in 2019, recording a CAGR of 5.9% during the forecast period. The growth of the market is attributed to the high demand for FPSO in countries such as Brazil & Mexico. In addition, increased focus on offshore exploration and production activities, and rising exploration in deep- and ultra-deepwater are projected to drive the floating production storage and offloading market.

The converted segment is projected to be the largest segment in the floating production storage and offloading market, by type, during the forecast period

The floating production storage and offloading market is segmented, on the basis of type, as converted and new-build. The converted segment is projected to account for the largest market share by 2024. Converted FPSOs are floating production storage and offloading vessel developed by modifying an existing transportation vessel, usually a crude oil shuttle tanker. It takes a few months to convert a tanker into an FPSO. However, it takes a couple of years to construct a new-build FPSO. Therefore, the converted floating production storage and offloading segment is projected to witness significant growth in the market.

The self-propelled segment is projected to be the fastest-growing segment during the forecast period

On the basis of propulsion, the floating production storage and offloading market is segmented into self-propelled and towed. Self-propelled floating production storage and offloading segment witness high preference, as it can move without any external propulsion and the transportation cost is lower than the towed FPSOs. These factors are projected to contribute to the growth of the self-propelled floating production storage and offloading segment in the market during the forecast period.

The double hull segment is projected to be the fastest-growing segment in the floating production storage and offloading market, by hull type, during the forecast period

On the basis of hull type, the floating production storage and offloading market is segmented into double hull and single hull. Double hull FPSOs have two or double outer watertight layer, which covers the entire structure of the vessel, as they protect the vessel from marine pollution and water ingression. These factors are projected to contribute to the growth of the double hull segment in the market during the forecast period.

The shallow water segment is projected to be the fastest-growing segment in the floating production storage and offloading market, by usage, during the forecast period

On the basis of usage, the floating production storage and offloading market is segmented into shallow water, deepwater, and ultra-deepwater. FPSOs used in shallow water are for oil & gas exploration and production applications in less than 500 meters of water depth. The cost associated with exploration & production in shallow water is comparatively lower than both deep- and ultra-deepwater, which is projected to drive the demand for floating production storage and offloading.

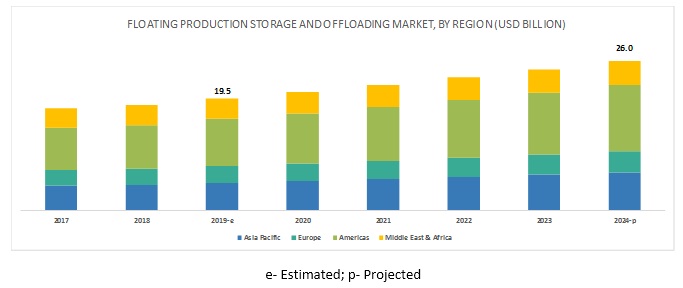

The Americas is projected to be the largest market during the forecast period

In this report, the floating production storage and offloading market is analyzed with respect to four regions, namely, the Americas, Europe, Asia Pacific, and the Middle East & Africa. The Americas is estimated to be the largest market from 2019 to 2024. Increasing investments to support energy infrastructure growth and the rising demand for offshore oil & gas production in countries such as Mexico and Brazil are factors that are projected to drive the growth of the floating production storage and offloading market.

Key Market Players

The major players in the floating production storage and offloading market are Bumi Armada (Malaysia), Shell (Netherlands), BP (UK), ExxonMobil (US), Petrobras (Brazil), Chevron (US), MODEC (Japan), Teekay (Bermuda), SBM Offshore (Netherlands), and BW Offshore (Norway).

Bumi Armada (Malaysia) is one of the leading service providers of offshore energy and facilities. The company operates through two business segments, namely, floating production & operations and offshore marine services. It offers floating production storage and offloading (FPSO) services under its floating, production & operations (FPO) business segment. The company utilizes innovative technologies such as high-pressure swivels, topsides, turrets, and marine solutions for designing FPSO. This strategy increasingly contributed to the revenue generation of the company in its floating, production, storage, and offloading business.

Shell (Netherlands) is an oil and gas giant with expertise in exploration, production, development, refining, and marketing. The company operates through three business segments, namely, integrated gas, upstream, and downstream. The company offers FPSO under the upstream business segment. The companys future strategy is to focus on increasing the share of low carbon energy products and also reduce its carbon footprint. As the installation of energy-efficient equipment in FPSO vessels is expensive, it will ultimately impact the market for FPSO. The company focuses on widening the scope of its growth in the market by increasing the proportion of biofuels, natural gas, and hydrogen in its product mix.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Propulsion, Hull Type, Usage, and Region |

|

Geographies covered |

Americas, Europe, Asia Pacific, and Middle East & Africa |

|

Companies covered |

Bumi Armada (Malaysia), Shell (Netherlands), BP (UK), ExxonMobil (US), Petrobras (Brazil), Chevron (US), MODEC (Japan), Teekay (Bermuda), SBM Offshore (Netherlands), BW Offshore (Norway). |

This research report categorizes the floating production storage and offloading market by type, propulsion, hull type, usage, and region.

The floating production, storage and offloading market, by type, has been segmented as follows:

- Converted

- New-Build

The floating production, storage and offloading market, by propulsion, has been segmented as follows:

- Self-Propelled

- Towed

The floating production, storage and offloading market, by hull type, has been segmented as follows:

- Single Hull

- Double Hull

The floating production storage, and offloading market, by usage, has been segmented as follows:

- Shallow Water

- Deepwater

- Ultra-deepwater

The floating production storage and offloading market, by region, has been segmented as follows:

- Americas

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In May 2019, Bumi Armada, through its joint venture company Shapoorji Pallonji Bumi Armada Godavari, won a contract from the Oil and Natural Gas Corporation for the west coast of Kakinada. Under this contract, Bumi Armada would supply and operate FPSO vessels for 9 years.

- In March 2019, BP awarded a contract to TechnipFMC for Greater Tortue Ahmeyim FPSO, located in the offshore of Mauritania and Senegal. Under this contract, BP would operate with the FPSO, and TechnipFMC would provide engineering, construction, procurement, installation, and commissioning services of the FPSO.

- In February 2019, MODEC received a contract from Woodside Energy for the SNE field development. The SNE field development is a deepwater oilfield, which is located within the Sangomar Offshore, nearly 100 km south of Dakar, Senegal. Under this contract, MODEC would design and operate the FPSO vessel.

Key Questions Addressed by the Report

- What are the revolutionary technology trends that have been witnessed over the next five years?

- Which of the floating production storage and offloading market elements will dominate by 2024?

- Which of the type segments will have the maximum opportunity to grow during the forecast period?

- Which will be the leading regions with the largest market share by 2024?

- How are the companies implementing organic and strategies to gain increased market share?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What are the revolutionary technology trends that could be witnessed over the next five years?

Increased focus on offshore exploration and production activities, rising exploration in deep- and ultra-deepwater, and technological advancements integrated in FPSOs, built with full-field production facilities are the trends that could be witnessed in the next five years.

Which of the floating production storage and offloading market by type will dominate by 2024?

The converted segment, by type will dominate the floating production storage and offloading market by 2024, as it takes less time to convert a tanker into an FPSO rather building a new FPSO.

Which of the hull type segments will have the maximum opportunity to grow during the forecast period?

The double hull segment, by hull type will have the maximum opportunity to grow during the forecast period, as double hull FPSOs have two or double outer watertight layer, which covers the entire structure of the vessel, as they protect the vessel from marine pollution and water ingression.

Which will be the leading regions with the largest market share by 2024?

The Americas is expected to be the leading region by 2024, owing to increasing investments to support energy infrastructure growth and the rising demand for offshore oil & gas production in countries such as Mexico and Brazil.

How are the companies implementing organic and strategies to gain increased market share?

The companies are emphasizing on contracts & agreements and mergers & acquisitions to increase their share in the floating production storage and offloading market.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Scope

2.2 Market Size Estimation

2.2.1 Demand-Side Analysis

2.2.1.1 Assumptions

2.2.2 Supply-Side Analysis

2.2.2.1 Assumptions

2.2.2.2 Calculation

2.2.3 Forecast

2.3 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Floating Production Storage and Offloading Market

4.2 Market, By Type

4.3 Market, By Hull Type

4.4 Market, By Propulsion

4.5 Market, By Usage

4.6 Market, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Focus on Offshore Exploration & Production Activities

5.2.1.2 Increase in Deep- and Ultra-Deepwater Oil & Gas Production

5.2.2 Restraints

5.2.2.1 High Initial Cost of Building FPSOs

5.2.2.2 Volatile Oil & Gas Prices

5.2.3 Opportunities

5.2.3.1 Technological Advancement of FPSOs Over Other Production Systems

5.2.4 Challenges

5.2.4.1 Increasing Usage of Renewable Energy

5.2.4.2 Decommissioning of Existing Infrastructures

6 Floating Production Storage and Offloading Market, By Propulsion (Page No. - 34)

6.1 Introduction

6.2 Self-Propelled

6.2.1 Low Transportation Cost and Less Time to Transport Crude Oil and Natural Gas to End-Users are Likely to Boost the Demand for Self-Propelled FPSO

6.3 Towed

6.3.1 Growing Demand for New-Build FPSO Would Foster the Demand for Towed FPSO

7 Floating Production Storage & Offloading Market, By Hull Type (Page No. - 38)

7.1 Introduction

7.2 Single Hull

7.2.1 Low Maintenance and Greater Stability are Likely to Generate the Demand for Single Hull Type FPSO

7.3 Double Hull

7.3.1 Protection of Vessels From Marine Pollution and Water Ingression is Likely to Foster the Demand for the Double Hull Segment

8 Floating Production Storage & Offloading Market, By Usage (Page No. - 42)

8.1 Introduction

8.2 Shallow Water

8.2.1 Cost-Efficiency and Clear Compliance Requirements are Likely to Boost Demand for FPSO in Shallow Water

8.3 Deepwater

8.3.1 Easy Transportation of Crude Oil and Natural Gas Using FPSO in Deepwater is Likely to Foster the Demand for Deepwater FPSO

8.4 Ultra-Deepwater

8.4.1 Lack of Pipeline Infrastructure in Ultra-Deepwater is Likely to Foster the Demand for FPSO in Ultra-Deepwater

9 Floating Production Storage and Offloading Market, By Type (Page No. - 47)

9.1 Introduction

9.2 New-Build

9.2.1 New-Build FPSO is Designed With Advanced Features & Meet All the Regulatory Requirements Which is Likely to Generate Its Demand

9.3 Converted

9.3.1 Lower Modification Cost and Lesser Construction Time to Build Converted FPSO is Likely to Foster Its Demand in the Floating Production Storage and Offloading Market

10 Floating Production Storage and Offloading Market, By Region (Page No. - 51)

10.1 Introduction

10.2 Americas

10.2.1 By Propulsion

10.2.2 By Hull Type

10.2.3 By Usage

10.2.4 By Type

10.2.5 By Country

10.2.5.1 Brazil

10.2.5.1.1 Increasing Deep- and Ultra-Deepwater Discoveries to Drive the Floating Production Storage and Offloading Market in Brazil

10.2.5.2 Mexico

10.2.5.2.1 Increasing Number of Upcoming FPSOs Projects are Likely to Drive the Market

10.2.5.3 US

10.2.5.3.1 Additions in Liquefaction Capacities Ans Increasing Demand for Production of Oil & Gas is Likely to Drive the US Market

10.2.5.4 Canada

10.2.5.4.1 Exploration & Production Activities in Offshore Unconventional Reserves and Upcoming Lng Projects is Expected To Drive the Market in Canada

10.2.5.5 Rest of Americas

10.3 Asia Pacific

10.3.1 By Propulsion

10.3.2 By Hull Type

10.3.3 By Usage

10.3.4 By Type

10.3.5 By Country

10.3.5.1 China

10.3.5.1.1 Shift Toward Production From Unconventional Resources and New Offshore Oilfield Discoveries are Likely to Drive the Chinese Floating Production Storage and Offloading Market

10.3.5.2 Australia

10.3.5.2.1 Production Initiation From Shale Resources Along With Plans to Redevelop Mature Fields is Likely to Drive the Market

10.3.5.3 Indonesia

10.3.5.3.1 Deepwater Discoveries in Eastern Indonesian Region is Expected to Drive the Floating Production Storage & Offloading Market in Indonesia

10.3.5.4 Vietnam

10.3.5.4.1 Increase in Offshore Exploration & Production Activities are Expected to Drive the FPSO Market in the Country

10.3.5.5 Malaysia

10.3.5.5.1 Rising Focus on New Offshore Discovery Would Leverage Opportunities for the Malaysian Floating Production Storage & Offloading Market

10.3.5.6 India

10.3.5.6.1 Rising Investments for Offshore Field Development to Drive the Floating Production Storage & Offloading Market in India

10.3.5.7 Rest of Asia Pacific

10.4 Middle East & Africa

10.4.1 By Propulsion

10.4.2 By Hull Type

10.4.3 By Usage

10.4.4 By Type

10.4.5 By Country

10.4.5.1 Angola

10.4.5.1.1 Deepwater Developments are Expected to Drive the Market

10.4.5.2 Nigeria

10.4.5.2.1 Rising Exploration & Production Activities in Deepwater and Ultra-Deepwater Oil & Gas Fields are Expected to Support the Market During the Forecast Period

10.4.5.3 Ghana

10.4.5.3.1 Demand for Deepwater FPSOs to Provide Lucrative Opportunities to the FPSO Operators

10.4.5.4 Egypt

10.4.5.4.1 Rise in Demand for Converted FPSOs to Drive the Floating Production Storage & Offloading Market During the Forecast Period

10.4.5.5 Saudi Arabia

10.4.5.5.1 The Surge in Offshore Exploration is Expected to Drive Floating Production Storage & Offloading Market

10.4.5.6 Rest of Middle East & Africa

10.5 Europe

10.5.1 By Propulsion

10.5.2 By Hull Type

10.5.3 By Usage

10.5.4 By Type

10.5.5 By Country

10.5.5.1 UK

10.5.5.1.1 Redevelopments in Brownfields are Expected to Drive the Floating Production Storage & Offloading Market in the UK

10.5.5.2 Norway

10.5.5.2.1 Discoveries in Offshore Norwegian Continental Shelf are Likely to Boost the Market

10.5.6 Rest of Europe

11 Competitive Landscape (Page No. - 85)

11.1 Introduction

11.2 Market Share Analysis

11.3 Competitive Scenario

11.3.1 Contracts & Agreements

11.3.2 Mergers & Acquisitions

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic Differentiators

11.4.4 Emerging Companies

12 Company Profiles (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 Bumi Armada

12.2 SBM Offshore

12.3 Bluewater Energy Services

12.4 Teekay

12.5 Shell

12.6 BP

12.7 Exxonmobil

12.8 Petrobras

12.9 Total

12.10 Chevron

12.11 MODEC

12.12 BW Offshore

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 115)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (66 Tables)

Table 1 Annual Total Number of Operational FPSO, Day Rates of FPSO, and their Utilization Rates are the Determining Factors for the Global Floating Production Storage and Offloading Market

Table 2 Floating Production Storage and Offloading Market Snapshot

Table 3 Floating Production Storage and Offloading Market Size, By Propulsion, 20172024 (USD Million)

Table 4 Self-Propelled: Market Size, By Region, 20172024 (USD Million)

Table 5 Towed: Market Size, By Region, 20172024 (USD Million)

Table 6 Market Size, By Hull Type, 20172024 (USD Million)

Table 7 Single Hull: Market Size, By Region, 20172024 (USD Million)

Table 8 Double Hull: Market Size, By Region, 20172024 (USD Million)

Table 9 Floating Production Storage and Offloading Market Size, By Usage, 20172024 (USD Million)

Table 10 Shallow Water: Market Size, By Region, 20172024 (USD Million)

Table 11 Deepwater: Market Size, By Region, 20172024 (USD Million)

Table 12 Ultra-Deepwater: Market Size, By Region, 20172024 (USD Million)

Table 13 Floating Production Storage and Offloading Market Size, By Type, 20172024 (USD Million)

Table 14 New-Build: Market Size, By Region, 20172024 (USD Million)

Table 15 Converted: Market Size, By Region, 20172024 (USD Million)

Table 16 Floating Production Storage and Offloading Market Size, By Region, 20172024 (USD Million)

Table 17 Americas: Market Size, By Propulsion, 20172024 (USD Million)

Table 18 Americas: Market Size, By Hull Type, 20172024 (USD Million)

Table 19 Americas: Market Size, By Usage, 20172024 (USD Million)

Table 20 Americas: Market Size, By Type, 20172024 (USD Million)

Table 21 New-Build: Market Size, By Country, 20172024 (USD Million)

Table 22 Converted: Market Size, By Country, 20172024 (USD Million)

Table 23 Americas: Market Size, By Country, 20172024 (USD Million)

Table 24 Brazil: Market Size, By Type, 20172024 (USD Million)

Table 25 Mexico: Market Size, By Type, 20172024 (USD Million)

Table 26 US: Market Size, By Type, 20172024 (USD Million)

Table 27 Canada: Market Size, By Type, 20172024 (USD Million)

Table 28 Rest of Americas: Market Size, By Type, 20172024 (USD Million)

Table 29 Asia Pacific: Market Size, By Propulsion, 20172024 (USD Million)

Table 30 Asia Pacific: Market Size, By Hull Type, 20172024 (USD Million)

Table 31 Asia Pacific: Market Size, By Usage, 20172024 (USD Million)

Table 32 Asia Pacific: Market Size, By Type, 20172024 (USD Million)

Table 33 New-Build: Market Size, By Country, 20172024 (USD Million)

Table 34 Converted: Market Size, By Country, 20172024 (USD Million)

Table 35 Asia Pacific: Market Size, By Country, 20172024 (USD Million)

Table 36 China: Market Size, By Type, 20172024 (USD Million)

Table 37 Australia: Market Size, By Type, 20172024 (USD Million)

Table 38 Indonesia: Market Size, By Type, 20172024 (USD Million)

Table 39 Vietnam: Market Size, By Type, 20172024 (USD Million)

Table 40 Malaysia: Market Size, By Type, 20172024 (USD Million)

Table 41 India: Market Size, By Type, 20172024 (USD Million)

Table 42 Rest of Asia Pacific: Market Size, By Type, 20172024 (USD Million)

Table 43 Middle East & Africa: Market Size, By Propulsion, 20172024 (USD Million)

Table 44 Middle East & Africa: Market Size, By Hull Type, 20172024 (USD Million)

Table 45 Middle East & Africa: Market Size, By Usage, 20172024 (USD Million)

Table 46 Middle East & Africa: Market Size, By Type, 20172024 (USD Million)

Table 47 New-Build: Market Size, By Country, 20172024 (USD Million)

Table 48 Converted: Market Size, By Country, 20172024 (USD Million)

Table 49 Middle East & Africa: Market Size, By Country, 20172024 (USD Million)

Table 50 Angola: Market Size, By Type, 20172024 (USD Million)

Table 51 Nigeria: Market Size, By Type, 20172024 (USD Million)

Table 52 Ghana: Market Size, By Type, 20172024 (USD Million)

Table 53 Egypt: Market Size, By Type, 20172024 (USD Million)

Table 54 Saudi Arabia: Market Size, By Type, 20172024 (USD Million)

Table 55 Rest of Middle East & Africa: Market Size, By Type, 20172024 (USD Million)

Table 56 Europe: Market Size, By Propulsion, 20172024 (USD Million)

Table 57 Europe: Market Size, By Hull Type, 20172024 (USD Million)

Table 58 Europe: Market Size, By Usage, 20172024 (USD Million)

Table 59 Europe: Market Size, By Type, 20172024 (USD Million)

Table 60 New-Build: Market Size, By Country, 20172024 (USD Million)

Table 61 Converted: Market Size, By Country, 20172024 (USD Million)

Table 62 Europe: Market Size, By Country, 20172024 (USD Million)

Table 63 UK: Market Size, By Type, 20172024 (USD Million)

Table 64 Norway: Market Size, By Type, 20172024 (USD Million)

Table 65 Rest of Europe: Market Size, By Type, 20172024 (USD Million)

Table 66 Developments of Key Players in the Market, January 2016August 2019

List of Figures (37 Figures)

Figure 1 Market Share Analysis, 2018

Figure 2 Converted Segment is Expected to Lead the Floating Production Storage and Offloading Market, By Type, During the Forecast Period

Figure 3 Self-Propelled Segment is Expected to Dominate the Market, By Propulsion, During the ForecastPeriod

Figure 4 Double Hull Segment is Expected to Lead the Market, By Hull Type, During the Forecast Period

Figure 5 Shallow Water Segment is Expected to Lead the Market, By Usage, During the Forecast Period

Figure 6 Americas is Expected to Dominate the Market, By Region, in Terms of CAGR (20192024)

Figure 7 Increasing Focus on Offshore Exploration & Production Activities and Rising Deep- and Ultra-Deepwater Oil & Gas Production are Driving theFloating

Production Storage and Offloading Market, 20192024

Figure 8 Converted Segment Dominated the Market in 2018

Figure 9 Double Hull Segment Dominated the Market in 2018

Figure 10 Self-Propelled Segment Dominated the Market in 2018

Figure 11 Shallow Water Segment is Expected to Dominate the Market During the Forecast Period

Figure 12 Americas Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Floating Production Storage and Offloading Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Average Annual Opec Crude Oil Price, 20132019 (USD/Barrel,)

Figure 15 Electricity Mix (Twh), Oecd 2018

Figure 16 Self-Propelled Segment Accounted for the Largest Market Share in 2018

Figure 17 Double Hull Segment Accounted for the Largest Market Share in 2018

Figure 18 Shallow Water Segment Accounted for the Largest Market Share in 2018

Figure 19 Converted Segment Accounted for the Largest Market Share in 2018

Figure 20 Americas Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Floating Production Storage and Offloading Market Share, By Region, 2018

Figure 22 Americas: Regional Snapshot

Figure 23 Asia Pacific: Regional Snapshot

Figure 24 Key Developments in the Market During January 2016August 2019

Figure 25 Market Share Analysis, 2018

Figure 26 Floating Production Storage and Offloading Market (Global) Competitive Leadership Mapping, 2018

Figure 27 Bumi Armada: Company Snapshot

Figure 28 SBM Offshore: Company Snapshot

Figure 29 Teekay: Company Snapshot

Figure 30 Shell: Company Snapshot

Figure 31 BP: Company Snapshot

Figure 32 Exxonmobil: Company Snapshot

Figure 33 Petrobras: Company Snapshot

Figure 34 Total: Company Snapshot

Figure 35 Chevron: Company Snapshot

Figure 36 MODEC: Company Snapshot

Figure 37 BW Offshore: Company Snapshot

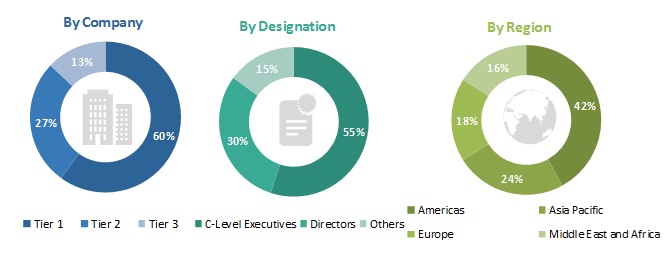

This study involved four major activities in estimating the current size of the floating production storage and offloading market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as UNCTAD data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and floating production storage and offloading journal, to identify and collect information useful for a technical, market-oriented, and commercial study of the floating production storage and offloading market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The floating production storage and offloading market comprise several stakeholders such as associations and industry bodies, consulting companies dealing with the floating production, storage and offloading industry, offshore logistics and ship authorities, offshore platform operators, floating production, storage and offloading manufacturers and suppliers, floating production, storage, and offloading operators and oil & gas companies. The demand-side of the market is characterized by the operational FPSOs and day rates of FPSOs and their utilization rates across countries and region. The supply side is characterized by the increasing adoption of contracts & agreements and mergers & acquisitions among leading players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global floating production, storage and offloading market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market were identified through extensive secondary research, and their market shares in the respective regions were determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the floating production, storage and offloading market.

Report Objectives

- To define, describe, segment, and forecast the floating production storage and offloading market by type, propulsion, hull type, usage, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the regions, namely, the Americas, Asia Pacific, Europe, and the Middle East & Africa

- To profile and rank key players and comprehensively analyze their respective market share

- To analyze competitive developments such as contracts & agreements, investments & expansions, new product launches, and mergers & acquisitions in the floating production storage and offloading market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Floating Production Storage and Offloading Market