Flight Data Monitoring Market by Solution Type (On Board, On Ground), Component (FDM Service, FDM System, FDM Software), End User (Fleet Operators, Drone Operators, FDM Service Providers, Investigation Agencies), Region - Global Forecast to 2022

[143 Pages Report] The flight data monitoring market is estimated to grow from USD 3.45 Billion in 2016 to USD 5.34 Billion by 2022, at a CAGR of 7.55% from 2017 to 2022.

Objectives of this study are to analyze the flight data monitoring market, along with its statistics from 2017 to 2022. It also aims to define, describe, and forecast the flight data monitoring market on the basis of end user, solution type, component, and region. The year 2016 has been considered as the base year for the study, whereas, the forecast period is from 2017 to 2022.

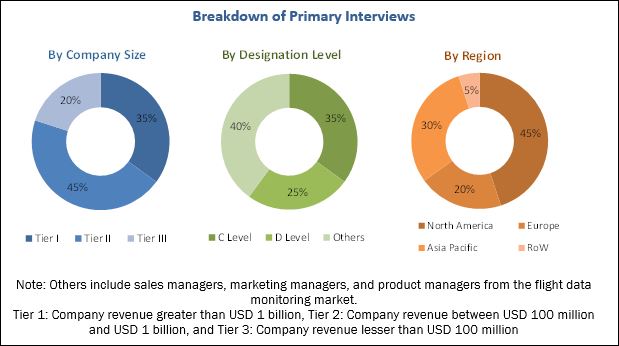

This research study involved extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect relevant information on the flight data monitoring market. Primary sources included industry experts from the concerned market as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. Both, top-down and bottom-up approaches were used to estimate and validate the size of the flight data monitoring market.

After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives of leading companies operating in the flight data monitoring market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The flight data monitoring market ecosystem comprises flight data software, system, and service providers, such as Curtiss Wright (US), Teledyne Controls LLC (US), Safran Electronics & Defense (US), Guardian Mobility (US), Flight Data Services Ltd. (US), and Scaled Analytics Inc. (US).

Target Audience for this Report:

- Private Aircraft Operators

- UAV Operators

- Aviation Industry

- Technology Support Providers

- Aircraft Data Analysis Service Providers

- Scientific Research Centers across Regions

“This study on the flight data monitoring market answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing their efforts and investments.”

Scope of the Report

This research report categorizes the flight data monitoring market into the following segments:

- Flight Data Monitoring Market, by End User

- Fleet Operators

- Drone operators

- FDM Service Providers

- Investigation Agencies

- Flight Data Monitoring Market, by Solution Type

- On Board

- On Ground

- Flight Data Monitoring Market, by Component

- FDM Service

- FDM Software

- FDM System

- Flight Data Monitoring Market, by Region

- North America

- Europe

- Asia Pacific

- Rest of the World (Latin America, Middle East, and Africa)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of the companies. The following customization options are available for the report on the flight data monitoring market:

- Regional Analysis

- Further breakdown of the Rest of the World flight data monitoring market

- Company Information

- Detailed analysis and profiling of the additional market players (up to five)

The flight data monitoring market is projected to grow from USD 3.71 Billion in 2017 to USD 5.34 Billion by 2022, at a CAGR of 7.55% from 2017 to 2022. The increasing demand for enhanced situational awareness for efficient airline operations, need to reduce the cost of unscheduled maintenance, increasing volume of data generated by the aviation industry, and rise in aircraft deliveries are factors that are expected to drive the flight data monitoring market.

Based on component, the FDM service segment is estimated to lead the flight data monitoring market in 2017. Factors such as increasing aircraft deliveries and the demand for the improved operational efficiency of airlines are fueling the growth of the FDM service segment.

Based on solution type, the on ground segment is expected to lead the flight data monitoring market during the forecast period. The increasing use of the ground-based flight data monitoring analysis software is driving the on ground segment.

Based on end user, the fleet operators segment is estimated to account for a major share of the flight data monitoring market in 2017. The increasing fleet size of major airlines in the APAC region is driving the flight data monitoring market.

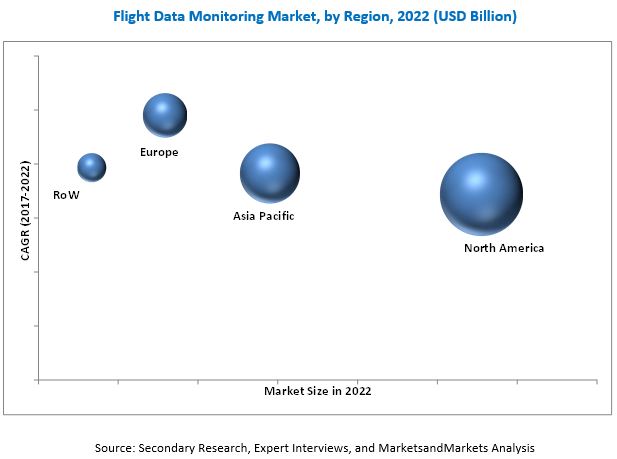

Major system manufacturers, software developers, and service providers in the flight data monitoring market are located in the US, the UK, and France. Europe and the Asia Pacific are the prime markets for service providers. This market study further analyses market drivers, restraints, opportunities, and challenges to access the impact of these factors on the market.

Key players operating in this market include Curtiss Wright Corporation (US), FLYHT Aerospace Solutions Ltd. (Canada), Safran Electronics & Defense (France), and Skytrac Systems Ltd. (Canada).

North America is estimated to account for the largest share of the flight data monitoring market in 2017. This share of North America can be attributed to the large aircraft fleet size as well as the presence of component manufacturers and service providers in the US. However, the market in the Asia Pacific is projected to grow at the highest CAGR of 9.80% during the forecast period due to the growing demand for aircraft and flight data monitoring services from Asia Pacific countries in recent years.

Significant investments are required at different stages of the value chain of the flight data monitoring market (especially in the R&D, manufacturing, system integration, and assembly stages). Products offered by various companies operating in the flight data monitoring market have been listed in the report. The recent developments section of the report provides information on the strategies adopted by various companies to strengthen their positions in the flight data monitoring market. Key players operating in this market include Curtiss Wright Corporation (US), FLYHT Aerospace Solutions Ltd. (Canada), Safran Electronics & Defense (France), and Skytrac Systems Ltd. (Canada).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Flight Data Monitoring Market

4.2 Flight Data Monitoring Market, By Component

4.3 FDM Market, By Service Type

4.4 FDM Market, By Solution Type

4.5 FDM Market, By End User

4.6 FDM Market Growth Analysis, By Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Flight Data Monitoring Market, By Component

5.2.2 Market, By Solution Type

5.2.3 Market, By End User

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need for Situational Awareness

5.3.1.2 Reducing Unscheduled Maintenance and Increasing Asset Utilization

5.3.1.3 Cost-Effective Maintenance

5.3.1.4 Increasing Volume of Data Generated for Analysis in the Aviation Industry

5.3.1.5 Increase in Aircraft Deliveries

5.3.2 Restraints

5.3.2.1 Certification Clearance

5.3.2.2 Environmental Parameters

5.3.2.3 Lack of Expertise

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Real-Time Analytics in the Aviation Industry

5.3.3.2 Usage of Wireless Sensors for Flight Data Monitoring

5.3.4 Challenges

5.3.4.1 Assurance of the Quality and Accuracy of Information Received By Flight Data Monitoring

5.3.4.2 Ageing Aircraft

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Decision Support Provided By Flight Data Monitoring

6.3 Flight Data Monitoring Over Non-Destructive Testing

6.4 Big Data: Crucial Role to Play in Flight Data Monitoring Market

6.5 Advancements in Technology Contributing to Cheaper Prices

6.6 Technology Trends

6.6.1 Cloud/Satellite Based Architecture Solution for Flight Data Recorder

6.6.2 Wireless Sensor for Measuring In-Flight Torque Data

6.6.3 In-Flight Voice Recognition to Make Cockpit Voice Recorder More Efficient

6.6.3.1 Flight Safety Mandates Concerning Cockpit Voice Recorder (CVR) Preferred By the European Aviation Safety Agency

6.6.4 Advanced All-In-One Flight Data Recorder

6.6.5 Crash-Protected Flight Recorder

6.6.6 Flight Messenger to Monitor Maintenance Needs

6.7 Patent Analysis

6.8 Key Trend Analysis

7 Flight Data Monitoring Market, By Solution Type (Page No. - 57)

7.1 Introduction

7.2 on Board Solution

7.3 on Ground Solution

8 Flight Data Monitoring Market, By Component (Page No. - 60)

8.1 Introduction

8.2 FDM Service

8.2.1 Flight Data Analysis Service

8.2.2 Flight Operations Quality Assurance (Foqa)

8.2.3 Helicopter FDM (Hfdm)

8.2.4 Training & Simulation

8.2.5 FDR Readouts

8.2.6 Condition Monitoring

8.2.7 Maintenance Monitoring

8.2.8 Inspection

8.2.9 FDM Consulting

8.3 FDM System

8.3.1 FD Recorder & Storage Unit

8.3.1.1 Rugged Mission Recorder

8.3.1.2 Crash Protected Data Recorder (CPDR)

8.3.1.2.1 Tape-Based Flight Data Recorder (TBFDR)

8.3.1.2.2 Solid State Flight Data Recorder (SSFDR)

8.3.1.2.3 Combined Voice & Data Recorder

8.3.1.3 Cockpit Video Recorder

8.3.1.4 Engine Monitoring Recorder

8.3.1.5 Cockpit Voice Recorder (CVR)

8.3.1.6 Usage Monitoring Recorder

8.3.1.7 Quick Access Data Recorder

8.3.1.7.1 Tape

8.3.1.7.2 Optical

8.3.1.7.3 Pcmcia

8.3.1.7.4 Mini AQR

8.3.1.7.5 Wireless AQR

8.3.2 Flight Data Acquisition Unit

8.3.3 Flight Data Concentrator Unit

8.4 FDM Software

8.4.1 Flight Data Visualization Software

8.4.2 Flight Data Analysis Software

8.4.3 Flight Data Information Reporting Software

8.4.4 Flight Data Cloud Software

9 Flight Data Monitoring Market, By End User (Page No. - 70)

9.1 Introduction

9.2 Fleet Operators

9.2.1 Commercial Aviation

9.2.2 Military Aviation

9.3 Drone Operators

9.4 Investigation Agencies

9.5 FDM Service Providers

10 Flight Data Monitoring Market, By Geography (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 France

10.3.2 UK

10.3.3 Germany

10.3.4 Russia

10.3.5 Ireland

10.3.6 Spain

10.3.7 Netherlands

10.3.8 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Middle East

10.5.2 Latin America

10.5.3 Africa

11 Competitive Landscape (Page No. - 110)

11.1 Introduction

11.2 Market Ranking

11.3 Competitive Situation and Trends

12 Company Profiles (Page No. - 114)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Curtiss-Wright

12.2 Flyht

12.3 Safran Electronics & Defense

12.4 Skytrac

12.5 Teledyne Controls

12.6 Flight Data Services

12.7 Flight Data Systems

12.8 Flightdatapeople

12.9 Guardian Mobility

12.10 Scaled Analytics

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 135)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (83 Tables)

Table 1 Need for Network, Threat, and Mission Awareness (2017-2022)

Table 2 US: Boeing 737 Sensor Data From Cross-Country Flight

Table 3 Flight Data Monitoring Market Size, By Solution Type, 2015-2022 (USD Million)

Table 4 Market Size, By Component, 2015−2022 (USD Million)

Table 5 FDM Service Market Size, By Type, 2015−2022 (USD Million)

Table 6 FDM System Market Size, By Subcomponent, 2015−2022 (USD Million)

Table 7 Flight Data Recorder & Storage Unit Market Size, By Recorder Type, 2015−2022 (USD Million)

Table 8 FDM Software Market Size, By Type, 2015−2022 (USD Million)

Table 9 Flight Data Monitoring Market Size, By End User, 2015-2022 (USD Million)

Table 10 Market Size, By Fleet Operators, 2015-2022 (USD Million)

Table 11 Market Size, By Commercial Aviation, 2015-2022 (USD Million)

Table 12 FDM Market Size, By Military Aviation, 2015-2022 (USD Million)

Table 13 Market Size, By Region, 2015-2022 (USD Million)

Table 14 North America: Market Size, By Component, 2015-2022 (USD Million)

Table 15 North America: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 16 North America: Market Size, By End User, 2015-2022 (USD Million)

Table 17 North America: Flight Data Monitoring Market Size, By Country, 2015-2022 (USD Million)

Table 18 US: Market Size, By Component, 2015-2022 (USD Million)

Table 19 US: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 20 US: Market Size, By End User, 2015-2022 (USD Million)

Table 21 Canada: Flight Data Monitoring Market Size, By Component, 2015-2022 (USD Million)

Table 22 Canada: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 23 Canada: Market Size, By End User, 2015-2022 (USD Million)

Table 24 Europe: Market Size, By Component, 2015-2022 (USD Million)

Table 25 Europe: Flight Data Monitoring Market Size, By Solution Type, 2015-2022 (USD Million)

Table 26 Europe: Market Size, By End User, 2015-2022 (USD Million)

Table 27 Europe: Market Size, By Country, 2015-2022 (USD Million)

Table 28 France: Market Size, By Component, 2015-2022 (USD Million)

Table 29 France: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 30 France: Market Size, By End User, 2015-2022 (USD Million)

Table 31 UK: Market Size, By Component, 2015-2022 (USD Million)

Table 32 UK: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 33 UK: Flight Data Monitoring Market Size, By End User, 2015-2022 (USD Million)

Table 34 Germany: Market Size, By Component, 2015-2022 (USD Million)

Table 35 Germany: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 36 Germany: Market Size, By End User, 2015-2022 (USD Million)

Table 37 Russia: Market Size, By Component, 2015-2022 (USD Million)

Table 38 Russia: FDM Market Size, By Solution Type, 2015-2022 (USD Million)

Table 39 Russia: Market Size, By End User, 2015-2022 (USD Million)

Table 40 Ireland: Market Size, By Component, 2015-2022 (USD Million)

Table 41 Ireland: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 42 Ireland: Market Size, By End User, 2015-2022 (USD Million)

Table 43 Spain: Market Size, By Component, 2015-2022 (USD Million)

Table 44 Spain: Flight Data Monitoring Market Size, By Solution Type, 2015-2022 (USD Million)

Table 45 Spain: Market Size, By End User, 2015-2022 (USD Million)

Table 46 Netherlands: Market Size, By Component, 2015-2022 (USD Million)

Table 47 Netherlands: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 48 Netherlands: Market Size, By End User, 2015-2022 (USD Million)

Table 49 Rest of Europe: Market Size, By Component, 2015-2022 (USD Million)

Table 50 Rest of Europe: FDM Market Size, By Solution Type, 2015-2022 (USD Million)

Table 51 Rest of Europe: Market Size, By End User, 2015-2022 (USD Million)

Table 52 Asia Pacific: Market Size, By Component, 2015-2022 (USD Million)

Table 53 Asia Pacific: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 54 Asia Pacific: Market Size, By End User, 2015-2022 (USD Million)

Table 55 Asia Pacific: FDM Market Size, By Country, 2015-2022 (USD Million)

Table 56 China: Market Size, By Component, 2015-2022 (USD Million)

Table 57 China: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 58 China: Market Size, By End User, 2015-2022 (USD Million)

Table 59 Japan: Flight Data Monitoring Market Size, By Component, 2015-2022 (USD Million)

Table 60 Japan: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 61 Japan: Market Size, By End User, 2015-2022 (USD Million)

Table 62 India: Market Size, By Component, 2015-2022 (USD Million)

Table 63 India: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 64 India: Market Size, By End User, 2015-2022 (USD Million)

Table 65 Australia: Flight Data Monitoring Market Size, By Component, 2015-2022 (USD Million)

Table 66 Australia: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 67 Australia: Market Size, By End User, 2015-2022 (USD Million)

Table 68 Rest of Asia Pacific: Market Size, By Component, 2015-2022 (USD Million)

Table 69 Rest of Asia Pacific: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 70 Rest of Asia Pacific: Market Size, By End User, 2015-2022 (USD Million)

Table 71 Rest of the World: FDM Market Size, By Component, 2015-2022 (USD Million)

Table 72 Rest of the World: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 73 Rest of the World: Market Size, By End User, 2015-2022 (USD Million)

Table 74 Rest of the World: Market Size, By Region, 2015-2022 (USD Million)

Table 75 Middle East: Market Size, By Component, 2015-2022 (USD Million)

Table 76 Middle East: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 77 Middle East: Flight Data Monitoring Market Size, By End User, 2015-2022 (USD Million)

Table 78 Latin America: Market Size, By Component, 2015-2022 (USD Million)

Table 79 Latin America: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 80 Latin America: Market Size, By End User, 2015-2022 (USD Million)

Table 81 Africa: Market Size, By Component, 2015-2022 (USD Million)

Table 82 Africa: Market Size, By Solution Type, 2015-2022 (USD Million)

Table 83 Africa: Flight Data Monitoring Market Size, By End User, 2015-2022 (USD Million)

List of Figures (45 Figures)

Figure 1 Flight Data Monitoring Information Flow

Figure 2 Flight Data Monitoring Market Segmentation

Figure 3 Study Years

Figure 4 Research Process Flow

Figure 5 Research Design

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 7 Bottom-Up Approach

Figure 8 Top-Down Approach

Figure 9 Data Triangulation

Figure 10 FDM Service Component Segment Projected to Lead FDM Market During Forecast Period

Figure 11 On Ground Solution Segment Estimated to Account for Larger Share of FDM Market in 2017

Figure 12 Fleet Operators Segment Estimated to Account for Largest Share of FDM Market in 2017

Figure 13 FDM Market in Asia Pacific Projected to Grow at Highest CAGR During Forecast Period

Figure 14 Increased Focus on Cost-Effective Aircraft Maintenance, Increasing Aircraft Deliveries, and Growing Situational Awareness to Drive Operations are Expected to Fuel Growth of Flight Data Monitoring Market During Forecast Period

Figure 15 Flight Data Monitoring Service Segment Projected to Be Largest Component Segment During Forecast Period

Figure 16 FD Analysis Service Segment Projected to Be Largest FDM Service Segment Till 2022

Figure 17 On Ground Solution Segment Projected to Be Largest Solution Type Segment Till 2022

Figure 18 Fleet Operators Segment Projected to Be Largest End User Segment of Flight Data Monitoring Market Till 2022

Figure 19 India Projected to Be Fastest-Growing Market for Flight Data Monitoring During Forecast Period

Figure 20 FDM Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Airbus and Boeing Aircraft Fleet Size Comparison By 2035

Figure 22 Efficiency of Flight Data Monitoring

Figure 23 FDM Market: Importance of Aviation Analytics

Figure 24 Consumer Price Indexes for Televisions, Computers, Software, and Related Items in the US (1997-2015)

Figure 25 On Ground Solution Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 26 Flight Data Monitoring Market, By Component, 2017 & 2022 (USD Million)

Figure 27 Drone Operators Segment Expected to Grow at Highest CAGR During Forecast Period

Figure 28 Commercial Aviation Under Fleet Operators Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 29 Fixed Wing Aircraft Under Commercial Aviation Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 30 Fixed Wing Aircraft Under Military Aviation Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 31 North America Estimated to Account for Largest Share of Flight Data Monitoring Market in 2017

Figure 32 North America: FDM Market Snapshot

Figure 33 Europe: FDM Market Snapshot

Figure 34 Asia Pacific: FDM Market Snapshot

Figure 35 Growth Strategies Adopted By Key Players

Figure 36 Market Ranking

Figure 37 Contracts & Agreements Was the Most Commonly Adopted Growth Strategy

Figure 38 Contracts & Agreements Accounted for Major Share of Overall Developments By Key Players in Flight Data Monitoring Market

Figure 39 Curtiss-Wright : Company Snapshot

Figure 40 Curtiss-Wright : SWOT Analysis

Figure 41 Flyht: Company Snapshot

Figure 42 Flyht: SWOT Analysis

Figure 43 Safran Electronics & Defense: SWOT Analysis

Figure 44 Skytrac: SWOT Analysis

Figure 45 Teledyne Controls: SWOT Analysis

Growth opportunities and latent adjacency in Flight Data Monitoring Market

Hello, Our company is looking for a market study related to the Flight Data Monitoring market. A sample could help us take our decision. Regards

I want to understand the size of FDM in the commercial general aviation market split by rotary, fixed wing, and vertical. Also, market share by vendor.