Data Recorder (Cockpit Voice & Flight Data Recorder) Market by Recorder Type (FDR, CVR, Combined CVFDR, QAR/WQAR), by Technology (Solid-State, Deployable/Crash-Protected), by Platform (Narrow-Body, Wide-Body, Regional, Business Jet, Rotorcraft, UAV), by Fit (Line-Fit, Retrofit), by End User (OEM, Airlines & Operators, MRO) and by Region — Global Forecast to 2035

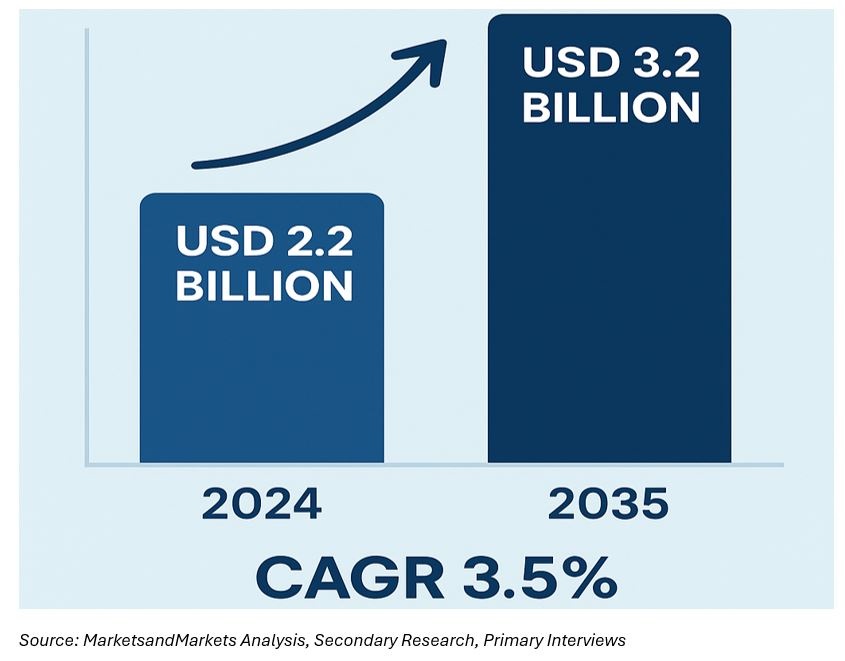

The data recorder market—covering cockpit voice recorders (CVR), flight data recorders (FDR), combined CVFDRs, and operational quick access recorders (QAR/WQAR)—is central to flight safety, compliance, and data-driven operations. Based on MarketsandMarkets' analysis (recorder hardware, crash-protected memory, beacons, integration, and lifecycle services), the market is estimated at USD 2.2 billion in 2024 and projected to reach USD 3.2 billion by 2035, reflecting a CAGR of 3.5%. Growth is sustained by long-term regulatory requirements, rising aircraft build rates, and the migration to higher-capacity, networked, and analytics-ready recording architectures that feed FDM/FOQA programs and inform maintenance decision-making.

Regulatory & Standards Context

Market demand remains anchored in ICAO Annex 6 carriage and performance provisions, which are harmonized through FAA and EASA rules, as well as the EUROCAE ED-112A crash-survivability standard for large aircraft. Lightweight categories increasingly fall under ED-155. Policy evolution since 2021 has required 25-hour CVR capability on newly certified/produced large transport aircraft in several jurisdictions, while underwater locator beacons (ULB) have shifted to extended transmission (typically 90 days). Parallel initiatives—GADSS for Autonomous Distress Tracking (ADT) and discussions around Timely Access to Recorder Data—shape upgrade paths for deployable and connected recorders. The net effect is a steady replacement cycle from legacy 2-hour CVR units to higher-endurance, higher-bit-rate, crash-protected memory solutions with secure download.

Technology Trends

Three converging vectors define the product roadmap. First, solid-state crash-protected memory continues to scale in capacity and survivability (including fire, impact, and deep-sea pressure), while packaging moves toward lighter housings and optimized thermal design. Second, combined CVFDR units reduce the number of line-replaceable units (LRUs) and wiring, simplifying certification and spares management. Third, connected QAR/WQAR and recorder gateways enable the secure offload of parameter sets for FOQA, predictive maintenance, and turnaround analytics—often via cellular or satellite communication (satcom) pipes. In parallel, deployable recorders with integrated beacons remain of interest for select wide-body and over-water operations. Cybersecurity hardening, authenticated data paths, and role-based access control are now embedded in upgrade specifications.

Market Dynamics

The primary demand driver is the sustained growth of the commercial fleet in narrow-body programs, which sets the cadence for line-fit volumes through 2030 and beyond. A second driver is retrofit and life-extension across mixed-age fleets, where operators align older platforms with 25-hour CVR mandates, ULB endurance, and ED-112A test envelopes. A third driver is the airline shift from pure compliance to data-value creation: FOQA/FDM, stabilized-approach monitoring, and reliability analytics increasingly justify QAR/WQAR investments. Constraints include certification lead times, retrofit downtime, and cost discipline in secondary markets; however, multi-airline framework agreements and base-visit phasing mitigate these pressures.

Segmentation Insights

By Recorder Type

Adoption favors CVFDR architectures that merge voice and parameter capture into a single crash-protected LRU, particularly on new-build narrow- and wide-bodies. Discrete FDR and CVR remain prevalent in legacy fleets and on certain rotorcraft where installation geometry or certification history favors separation. QAR/WQAR—not crash-protected but essential for operations—are gaining share as airlines routinize automated offload and event analytics, reducing manual data handling and enabling faster safety loops.

By Technology

Solid-state recorders dominate due to reliability and impact/fire survivability. Deployable options retain a focused niche tied to over-water routes and state operators seeking rapid recovery assurance. Across both, memory density, heat tolerance, and sealing techniques are improving, while encrypted file systems and signed logs strengthen evidentiary integrity.

By Platform

Narrow-body aircraft account for the most extensive installed base and the most consistent forward demand. Wide-bodies specify richer configurations (e.g., higher parameter counts, additional interfaces) and represent higher value per shipset. Regional aircraft and business jets undergo regular replacements, aligned with avionics refresh cycles, while rotorcraft increasingly standardize on ED-155-compliant light recorders. Select UAVs adopt lightweight voice/parameter capture to support beyond-visual-line-of-sight operations and accident investigation norms emerging in civil frameworks.

By Fit

Line-fit deliveries mirror OEM production schedules and drive stable annual volumes. Retrofit growth is supported by mandate cut-ins (25-hour CVR, extended ULB), operator standardization across fleets, and obsolescence management, where spares exposure is rising on older LRUs. STC-based retrofit packages that minimize rewiring and reuse mounting points are increasingly favored.

By End User

OEMs anchor baseline demand and certification momentum; airlines and operators create lifetime value through QAR/WQAR refresh, storage media rotation, shop visits, and software updates; MROs and avionics integrators capture recurring calibration and exchange programs, often bundled under long-term service agreements.

Regional Insights

North America leads in installed base and aftermarket throughput, supported by the largest operational fleets and mature adoption of FOQA/FDM. Europe complements with high compliance intensity, strong retrofit appetite, and active involvement in ED-112A/ED-155 standardization. The Asia Pacific region is delivering the fastest growth, pairing rapid fleet additions with a growing emphasis on data-driven reliability programs. Middle East carriers sustain premium wide-body demand and advanced connectivity options for data offload. Latin America shows steady modernization, typically adopting cost-optimized retrofit kits aligned to base-visit windows.

Sustainability & Lifecycle View

While indirectly related to propulsion, recorder modernization supports operational efficiency by enabling FOQA-led procedural improvements, adhering to stabilized approaches, and avoiding maintenance events—all of which can reduce fuel burn, diversions, and repeat defects. Solid-state designs with longer mean-time-between-failure curb waste from premature removals, and modular LRUs streamline shop-level repairs. Vendors are increasingly publishing RoHS/REACH compliance and offering responsible end-of-life processing for legacy memory modules and ULB batteries.

Competitive Landscape

The landscape features leading avionics groups and specialist recorder manufacturers supplying CVFDR, QAR/WQAR, ULBs, and integration toolchains. Competitive differentiation turns on certification pedigree, ED-112A/ED-155 compliance history, memory density and survivability, secure offload workflows, and lifecycle service programs (pooling, exchanges, media refresh, software currency). Multi-year service contracts that bundle spares, test equipment, and engineering support are increasingly central to the selection process—particularly for airlines standardizing mixed fleets.

Forecast Summary (2024–2035)

2024: USD 2.2 billion (base year) → 2035: USD 3.2 billion, at a 3.5% CAGR.

The trajectory reflects stable OEM line-fit demand, durable retrofit cycles driven by mandates and obsolescence triggers, and incremental QAR/WQAR penetration tied to FOQA/FDM value capture.

The data recorder market is transitioning from minimum-compliance hardware to a connected, analytics-ready backbone for enhanced safety and operational efficiency. Over the 2024–2035 period, procurement will prioritize 25-hour voice endurance, extended ULB signaling, ED-112A survivability, cyber-secure interfaces, and seamless data offload. Vendors combining robust crash-protected designs with proven certification support, secure connectivity, and long-horizon service agreements are positioned to outperform purely hardware-centric competitors.

Frequently Asked Questions (FAQs)

What is the current size and outlook?

The market is expected to reach USD 2.2 billion by 2024 and is projected to grow to USD 3.2 billion by 2035, at a 3.5% CAGR.

Which recorder types are most in demand?

Combined CVFDR units dominate new builds; QAR/WQAR gain share for FOQA/FDM analytics; ED-155 units scale in rotorcraft/light segments.

What mandates shape upgrades?

25-hour CVR endurance on new large transports, extended ULB signaling, and ED-112A/ED-155 performance envelopes drive replacement programs.

Where is growth fastest?

The Asia Pacific leads growth, North America leads aftermarket value, and Europe sustains a high retrofit intensity.

What matters most in selection?

Certification track record, crash survivability, secure and rapid data access, integration effort, and total lifecycle cost.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Stakeholders

1.4 Market Scope

1.5 Currency

1.5.1 Limitations

2 Research Methodology (Page No. - 17)

2.1 Secondary Data

2.1.1 Key Data Taken From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase In Aircraft Accidents

2.2.2.2 Increase in Passenger Traffic

2.2.2.3 Evolution of Naval Power

2.2.3 Supply-Side Indicators

2.2.3.1 Integration of CVR And FDR

2.2.3.2 Technological Advancement

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.4 Market Breakdown And Data Triangulation

2.5 Research Assumptions And Limitations

2.5.1 Assumptions

2.5.2 Key Industry Insights

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in Market

4.2 Market, By Product Type

4.3 Asia-Pacific Data Recorder Market, By Type

4.4 Market, By Region

4.5 Aviation And Marine Application, By Region

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Technology

5.2.2 Market, By Product Type

5.2.3 Market, By Application

5.2.4 Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Number of Aircraft Deliveries

5.3.1.2 Aircraft Modernization Programs

5.3.1.3 Advancements in Voyage Data Recorder Technology Market

5.3.1.4 Boost in Maritime Commerce

5.3.2 Restraints

5.3.2.1 Unstable Macro-Economic Factors

5.3.2.2 International Regulatory Issues

5.3.3 Opportunities

5.3.3.1 Global Focus On the Development of Blue Economy

5.3.3.2 Real-Time Flight Data Transmission

5.3.4 Challenge

5.3.4.1 Technological Constraint in Data Recorders

5.3.5 Burning Issue

5.3.5.1 Estimation of Aircraft Taxi-Out Fuel Burn Using FDR

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Strategic Benchmarking

6.6.1 Technological Integration & Product Enhancement

7 Data Recorder Market, By Product Type (Page No. - 48)

7.1 Introduction

7.2 CVR

7.3 FDR

7.4 Quick Access Recorder

7.5 Voyage Data Recorder

7.6 Data Loggers

8 Data Recorder Market, By Technology (Page No. - 55)

8.1 Introduction

8.1.1 Solid State Cockpit Voice Recorder

8.1.2 Cloud Computing

8.1.3 Flash Cards

9 Market, By Application (Page No. - 60)

9.1 Introduction

9.2 Data Recorder - Aviation Application

9.3 Data Recorder – Marine Application

10 Geographic Analysis (Page No. - 64)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 U.K.

10.4 Asia-Pacific (APAC)

10.4.1 India

10.4.2 China

10.5 the Middle East

10.5.1 Saudi Arabia

10.5.2 UAE

10.6 Rest of the World

10.6.1 South Africa

10.6.2 Brazil

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Market Share Analysis: Data Recorders Market

11.3 Competitive Scenario

11.3.1 Contracts

11.3.2 New Product Launches

11.3.3 Agreements, Partnerships, And Acquisitions

11.3.4 Other Developments

11.3.5 Other Developments, 2011

12 Company Profiles (Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, Mnm View)* (Page No. - 106)

12.1 Introduction

12.2 L-3 Communications Holdings, Inc.

12.3 Hr Smith Group

12.4 Teledyne Technologies Inc.

12.5 Honeywell International Inc.

12.6 Universal Avionics Systems Corporation

12.7 Phoenix International Holdings, Inc.

12.8 DAC International, Inc.

12.9 Flyht Aerospace Solutions Ltd.

12.10 Acr Electronics, Inc.

12.11 Raytheon Company

12.12 Consilium Ab

12.13 Danelec Marine A/S

12.14 Captec Ltd.

12.15 Telemar Norge As

*Details On Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, Mnm View Might Not Be Captured In Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Discussion Guide

13.2 Related Report

List of Tables (74 Tables)

Table 1 Bifurcation of Years

Table 2 CVR Market Size, By Component, 2012–2020 ($Million)

Table 3 FDR Market Size, By Component, 2012–2020 ($Million)

Table 4 VDR Market Size, By Component, 2012–2020 ($Million)

Table 5 Market Size, By Application, 2012–2020 ($Million)

Table 6 Market Size, By Region, 2012-2020 ($Million)

Table 7 North America Data Recorder Market Size, By Country, 2012–2020 ($Million)

Table 8 North America Market Size, By Product Type, 2012–2020 ($Million)

Table 9 North America: Cockpit Voice Recorder Market Size, By Component, 2012-2020 ($Million)

Table 10 North America: Flight Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 11 North America: Voyage Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 12 North America: Market Size, By Technology, 2012-2020 ($Million)

Table 13 North America: Market Size, By Application, 2012-2020 ($Million)

Table 14 U.S. Market Size, By Product Type, 2012–2020 ($Million)

Table 15 U.S. Market Size, By Technology, 2012–2020 ($Million)

Table 16 U.S.: Market Size, By Application, 2012-2020 ($Million)

Table 17 Canada Data Recorder Market Size, By Product Type, 2012–2020 ($Million)

Table 18 Canada Market Size, By Technology, 2012–2020 ($Million)

Table 19 Canada Market Size, By Application, 2012-2020 ($Million)

Table 20 Europe: Market, By Country, 2012–2020 ($Million)

Table 21 Europe Data Recorder Market Size, By Product Type, 2012–2020 ($Million)

Table 22 Europe: Cockpit Voice Recorder Market Size, By Component, 2012-2020 ($Million)

Table 23 Europe: Flight Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 24 Europe: Voyage Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 25 Europe: Market Size, By Technology, 2012-2020 ($Million)

Table 26 Europe Market Size, By Application, 2012-2020 ($Million)

Table 27 U.K. Market Size, By Product Type, 2012–2020 ($Million)

Table 28 U.K.: Market Size, By Technology, 2012–2020 ($Million)

Table 29 U.K. Market Size, By Application, 2012-2020 ($Million)

Table 30 France Market Size, By Product Type, 2012–2020 ($Million)

Table 31 France: Market Size, By Technology, 2012–2020 ($Million)

Table 32 France Market Size, By Application, 2012-2020 ($Million)

Table 33 APAC: Market, By Country, 2012–2020 ($Million)

Table 34 APAC: Market Size, By Product Type, 2012–2020 ($Million)

Table 35 APAC: Cockpit Voice Recorder Market Size, By Component, 2012-2020 ($Million)

Table 36 APAC Flight Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 37 APAC: Voyage Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 38 APAC: Market Size, By Technology, 2012-2020 ($Million)

Table 39 APAC: Market Size, By Application, 2012-2020 ($Million)

Table 40 India : Market Size, By Product Type, 2012–2020 ($Million)

Table 41 India: Market Size, By Technology, 2012–2020 ($Million)

Table 42 India: Market Size, By Application, 2012-2020 ($Million)

Table 43 China: Market Size, By Product Type, 2012–2020 ($Million)

Table 44 China: Market Size, By Technology, 2012–2020 ($Million)

Table 45 China Market Size, By Application, 2012-2020 ($Million)

Table 46 The Middle East: Market Size, By Country, 2012–2020 ($Million)

Table 47 The Middle East: Market Size, By Product Type, 2012–2020 ($Million) Table 48 The Middle East: Cockpit Voice Recorder Market Size, By Component, 2012-2020 ($Million)

Table 49 The Middle East: Flight Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 50 The Middle East: Voyage Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 51 The Middle East: Market Size, By Technology, 2012-2020 ($Million)

Table 52 The Middle East Market Size, By Application, 2012-2020 ($Million)

Table 53 Saudi Arabia Data Recorder Market Size, By Product Type, 2012–2020 ($Million)

Table 54 Saudi Arabia: Market Size, By Technology, 2012–2020 ($Million)

Table 55 Saudi Arabia: Market Size, By Application, 2012-2020 ($Million)

Table 56 UAE Data Recorder Market Size, By Product Type, 2012–2020 ($Million)

Table 57 UAE: Market Size, By Technology, 2012–2020 ($Million)

Table 58 UAE: Market Size, By Application, 2012-2020 ($Million)

Table 59 ROW Market Size, By Country, 2012–2020 ($Million)

Table 60 ROW: Market Size, By Product Type, 2012–2020 ($Million)

Table 61 ROW: Cockpit Voice Recorder Market Size, By Component, 2012-2020 ($Million)

Table 62 ROW: Flight Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 63 ROW: Voyage Data Recorder Market Size, By Component, 2012-2020 ($Million)

Table 64 ROW: Market Size, By Technology, 2012-2020 ($Million)

Table 65 ROW: Market Size, By Application, 2012-2020 ($Million)

Table 66 South Africa Data Recorder Market Size, By Product Type, 2012–2020 ($Million)

Table 67 South Africa: Market Size, By Technology, 2012–2020 ($Million)

Table 68 South Africa: Market Size, By Application, 2012-2020 ($Million)

Table 69 Brazil: Data Recorder Market Size, By Product Type, 2012–2020 ($Million)

Table 70 Brazil: Market Size, By Technology, 2012–2020 ($Million)

Table 71 Brazil: Market Size, By Application, 2012-2020 ($Million)

Table 72 Contract, 2011–2014

Table 73 New Product Launches, 2011–2014

Table 74 Agreements, Partnerships & Acquisitions, 2011–2014

List of Figures (64 Figures)

Figure 1 Market Classification

Figure 2 Limitations of The Research Study

Figure 3 Market Research Design

Figure 4 Breakdown of Primaries

Figure 5 Number of Aircraft Accidents Per Year, 1960-2013

Figure 6 Global Air Traffic Passenger Flow, 2005-2013

Figure 7 Lightweight Compact Recorder

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation Methodology

Figure 11 Assumptions For the Research Study

Figure 12 Market Size, By Technology, 2014 Vs. 2020 ($Million)

Figure 13 Market Share (%), By Region, 2014

Figure 14 Market Size, By Product Ranking, 2014

Figure 15 Emerging Economies offer Attractive Market Opportunities in Market, 2014-2020

Figure 16 Data Logger Holds the Largest Market Share in the Market, 2012-2020

Figure 17 China Dominates the APAC Data Recorder Market, 2014

Figure 18 North America To Hold the Largest Market Share in the Market By 2020 Figure 19 Aviation And Marine Projected To Have A Positive Outlook in APAC And Middle East By 2020

Figure 20 Latin American Market Is Expected To Meet the Pace of Middle East And APAC Market During the Forecast Period

Figure 21 Market Segmentation, By Technology

Figure 22 Market Segmentation, By Product Type

Figure 23 Market Segmentation, By Application

Figure 24 Market Segmentation, By Region

Figure 25 Technological Advancements Are Driving the Market By Increasing the Scope of Data Recorder Applications

Figure 26 Aircraft Modernization Will Propel the Growth of the Data Recorders Market

Figure 27 Macro-Economic Shocks & Regulatory Issues Restraining the Market Growth

Figure 28 Global Focus On Development of Blue Economy Will Be An Opportunity in This Market

Figure 29 Technological Constraints in Data Recorders Is A Challenge Faced By the Aviation Industry

Figure 30 Value Chain Analysis of the Market

Figure 31 Market: Supply Chain

Figure 32 Technological Advancements Will Drive the Demand For Data Recorders

Figure 33 Porter’s Five Forces Analysis, 2013

Figure 34 Strategic Benchmarking: L-3 Aviation Recorder Has Adopted Growth Strategies For Integration & Product Enhancement

Figure 35 Wireless Transmission Is Driving the Market For Qar

Figure 36 Annual Data Loggers Market Size Analysis, 2012–2020 ($Million)

Figure 37 Market Size, By Region, 2012-2020 ($Million)

Figure 38 Solid State Technology Market, 2012-2020 ($Million)

Figure 39 Cloud Computing Technology Market, 2012-2020 ($Million)

Figure 40 Flash Card Technology Market, 2012-2020 ($Million)

Figure 41 Market Size, By Application, 2014-2020 ($Million)

Figure 42 Aviation Application Data Recorder Market Size, 2012-2020 ($Million)

Figure 43 Marine Application Data Recorder Market Size, 2012-2020 ($Million)

Figure 44 Geographic Snapshot (2014) - Rapid Growth Markets Are Emerging As New Hotspots

Figure 45 India: An Attractive Destination For All Technology Types

Figure 46 North America: Data Recorder Market Snapshot (2014)

Figure 47 APAC Data Recorder Market Snapshot (2014)

Figure 48 New Product Launches & Agreements Continue To Be the Key Growth Strategy Over the Last Five Years

Figure 49 L-3 Aviation Recorders And Honeywell International, Inc. Grew At the Highest Rate Between 2011 And 2013

Figure 50 Data Recorders Market Share, By Key Player, 2013

Figure 51 Data Recorders Market Share: Contracts Were the Key Strategy, 2011-2013

Figure 52 Geographic Revenue Mix of Top 5 Player in the Market

Figure 53 L-3 Communications Holdings, Inc.: Company Snapshot

Figure 54 L-3 Communications Holdings, Inc.: Swot Analysis

Figure 55 Hr Smith Group of Companies: Swot Analysis

Figure 56 Teledyne Technologies Inc.: Company Snapshot

Figure 57 Teledyne Technologies, Inc.: Swot Analysis

Figure 58 Honeywell International, Inc.: Business Overview

Figure 59 Honeywell International, Inc.: Swot Analysis

Figure 60 Universal Avionics Systems Corporation: Swot Analysis

Figure 61 Flyht Aerospace Solutions Ltd.: Company Snapshot

Figure 62 Raytheon Company: Company Snapshot

Figure 63 Raytheon Company: Swot Analysis

Figure 64 Consilium Ab: Company Snapshot

Growth opportunities and latent adjacency in Data Recorder (Cockpit Voice & Flight Data Recorder) Market