Feed Testing Market by Livestock (Swine, Poultry, Pets, Equine, Cattle, and Aquatic Animals), by Type (Mycotoxin, Pathogen, Nutritional Labeling, Crop Chemicals, Fats & Oils, and Others), & Geography - Global Trends & Forecasts to 2019

Feed testing includes testing for pesticides, mycotoxin, metals, minerals, drugs, antibiotics, and pathogens in feed and feed ingredients to ensure the absence of contaminants that are responsible for foodborne illnesses, toxicity, or poisoning. This report describes the feed testing market in terms of tests conducted such as pathogen testing, nutritional and labeling analysis, mycotoxin testing, fat and oil analysis, proximate analysis, and pesticide & fertilizer analysis; the type of livestock that consumes the feed, which includes swine, poultry, aquatic animals, pets, cattle, and equines; and various key geographical markets.

The consumption of contaminated feed has been responsible for the outbreak of several illnesses such as bovine spongiform encephalopathy (BSE). The contamination of feed can occur due to contaminated raw materials, exposure to contaminated water, improper handling, and inefficient treatment of the ingredients during production and packaging. Feed products have been contaminated by pathogens, toxins, genetically modified products, pesticides, and other contaminants such as allergens and chemical residues. Regulatory bodies have been implementing several feed testing regulations to manufacture safe feed of high quality using Good Manufacturing Practices (GMP), Good Agriculture Practices (GAP), and Hazard Analysis Critical Control Point signify (HACCP) systems. The regulations specify testing of feed ingredients and manufacturing processes at every stage so as to prevent contamination and outbreaks of diseases. The global implementation of these feed testing regulations has been driving the feed testing market.

The report provides a complete analysis of the key players in feed testing industry, the main technologies employed to detect contaminants, adulterants, and mycotoxins, along with analysis of feed ingredients and additives, with a clear insight and commentary on the developments and major trends observed in the market. With a huge opportunity existing in the market, the existing laboratories are experiencing a significant boom in the industry. The growth is also attributed to the increasing new product/service/technology launches in the feed testing market. The report provides a detailed analysis on the current phase of the industry and the competitive strategies adopted by the leading players in the feed testing industry.

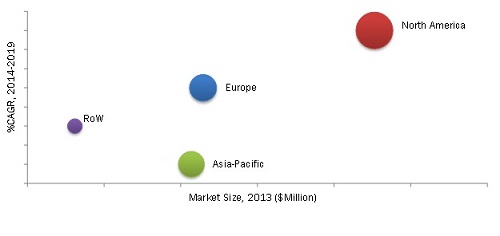

Feed Testing Market Size, By Geography, 2013 ($Million)

Source: MarketsandMarkets Analysis

In 2013, North America dominated the feed testing market, followed by Europe. The regulatory bodies in North America have been strictly supervising the implementation several regulations on the labeling of ingredients used on the final product. The food safety concern among consumers has also been increasing due to the media’s influence. The prevalence of the BSE disease in North America and some countries of Europe have led to the implementation of stringent regulations that bind the feed manufacturers to test their feed occasionally.

Scope of the Report

This report categorizes the market for feed testing market on the basis of types, feed as per livestock and region; forecasting revenues and analyzing trends in each of the following submarkets:

On the basis of types, the market was sub-segmented as follows:

- Pathogen testing

- Nutritional labeling analysis

- Mycotoxin testing

- Fats & oils analysis

- Crop chemicals analysis

- Others (feed ingredient analysis, proximate analysis, metal & mineral analysis, and drugs & antibiotics testing)

On the basis of livestock type that consumes the feed, the market was sub-segmented as follows:

- Poultry

- Swine

- Pets

- Equine

- Cattle

- Aquatic animals

On basis of geography, the market was sub-segmented as follows:

- North America

- Europe

- Asia-Pacific

- ROW

Feed Testing Market is estimated to reach $2.1 Billion by 2019, at a CAGR of 7%.

The feed testing market has been growing with increase in concern for animal safety among farmers, feed manufacturers, regulatory bodies, and respective governments. The concern for feed safety has been increasing due to the consumption of contaminated feed, and this has been responsible for the outbreak of several illnesses such as BSE and PED. The factors responsible for feed contamination include improper handling, contaminated feed ingredients, contaminated water, and inadequate treatment/processing of materials.

The driving force of the market includes stringent regulations and increasing feed supply trade. The global market involves tests for contaminants such as pathogens, toxins, genetically modified feed ingredients, and pesticides. Introduction of novel techniques to detect and identify contaminants present in the feed samples has also been driving the market. The key market players include Silliker Inc. (U.S.), Intertek Group Plc (U.K.), Eurofins Scientific (Luxembourg), Institut für Produktqualität (Germany), and Romer Labs Inc. (U.S.), which are using strategies such as expansions, investments, new technology/product/service launches, and mergers & acquisitions to strengthen their position in the market.

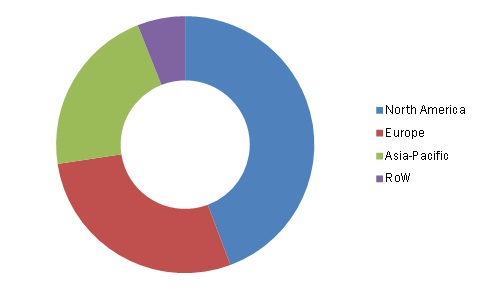

Feed Testing Market Share (Volume), By Region, 2013

Source: MarketsandMarkets Analysis

In 2013, North America dominated the feed testing market due to the outbreak of several diseases that affected the health of animals and humans. Stringent regulations regarding feed testing were implemented by several regulatory bodies such as FDA, FAO, USDA, EUROPA, and EFSA, which made it mandatory for the feed manufacturers to test the quality of their feed ingredients and accordingly label the products.

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

2 Research Methodology (Page No. - 21)

2.1 Description of the Feed Market

2.2 Market Size Estimation

2.3 Market Crackdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data Taken From Secondary Sources

2.4.2 Key Data from Primary Sources

2.4.3 Key Industry Insights

2.4.4 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Market Opportunities in Feed Testing Market

4.2 Market By Type

4.3 Feed Testing Market in North America

4.4 U.S. Dominates the Overall Market

4.5 Different Type of Feed Tests

4.6 Developed Vs. Emerging Markets

4.7 Mycotoxin Testing Accounts for the Largest Market Share

4.8 Impact Analysis for Types of Testing

4.9 Feed Testing Market Life Cycle Analysis, By Geography

4.10 Market Chasm Analysis

5 Industry Trends (Page No. - 46)

5.1 Introduction

5.1.1 Feed Ingredients

5.2 Value Chain Analysis

5.2.1 Testing, Inspection & Certification Of Feed

5.2.1.1 Input Market

5.2.1.2 Feed Market

5.2.1.3 End Market

5.3 Supply Chain Analysis

5.3.1 Upstream Process

5.3.1.1 R&D

5.3.1.2 Production

5.3.2 Midstream Process

5.3.2.1 Processing & Transforming

5.3.2.2 Transportation

5.3.3 Downstream Process

5.3.3.1 Final Preparation

5.3.3.2 Distribution

5.4 Industry Insights

5.4.1 Mycotoxins: Aflatoxin & Ochratoxin Contaminate Major Feed Ingredients

5.4.2 Adulterants: Urea, Saw Dust & Sand Are Common Adulterants in Feed

5.4.3 Contaminants

5.5 Porter’s Five Forces Analysis

5.5.1 Intensity of Competitive Rivalry

5.5.2 Bargaining Power of Suppliers

5.5.3 Bargaining Power of Buyers

5.5.4 Threat of New Entrants

5.5.5 Threat of Substitutes

5.6 Pestle Analysis

5.6.1 Political Factors

5.6.1.1 Change in Government and Political Forces

5.6.1.2 Added Service Tariffs

5.6.2 Economic Factors

5.6.2.1 Economic Depression

5.6.2.2 Acquisitions

5.6.3 Social Factors

5.6.3.1 Consumer Concerns

5.6.3.2 Awareness among Farmers

5.6.4 Technological Factors

5.6.4.1 Advanced Testing Technology

5.6.4.2 Regulatory Approval for Application Of Testing Technologies

5.6.5 Legal Factors

5.6.5.1 Regulations in Various Countries

5.6.6 Environmental Factors

5.6.6.1 Animal Epidemic Due To Contaminated Feed Consumption

5.7 Strategic Benchmarking

5.7.1 Strategic Development & Product Enhancement

6 Market Overview (Page No. - 59)

6.1 Introduction

6.1.1 Qualitative & Quantitative Testing Of Feed & Feed Ingredients

6.2 Evolution of Feed Testing

6.3 Market Segmentation

6.3.1 Market By Type

6.3.2 Market By Livestock

6.4 Market Dynamics

6.4.1 Drivers

6.4.1.1 High Demand For Quality & Sustainable Animal Nutrition Products

6.4.1.2 Mandatory Analysis for Feed Quality & Safety

6.4.1.3 Customized Testing Services Have Emerged As Cost- & Time-Effective Solutions

6.4.1.4 Management of Operating Cost of Feed Production

6.4.1.5 Increase in Demand for Inclusion of Protein and Specific Feed Additives

6.4.2 Restraints

6.4.2.1 Lack of Awareness about Animal Feed Regulations

6.4.2.2 High Cost and Extensive Sample Preparation Require Expert Analysts To Use Advanced Testing Technologies

6.4.3 Opportunity

6.4.3.1 Emerging Markets and Untapped Regions Offer Potential Scope For Market Growth

6.4.4 Challenge

6.4.4.1 Lack of Basic Supporting Infrastructure

6.4.5 Burning Issue

6.4.5.1 Rapid Alert to Feed Contamination Threats

7 Feed Analysis & Testing Technology (Page No. - 70)

7.1 Introduction

7.1.1 Feed Contamination

7.2 Testing Technologies

7.2.1 Traditional Method

7.2.2 Rapid Method

7.2.2.1 Hybridization-Based Technology

7.2.2.2 Chromatography-Based Technology

7.2.2.3 Spectrometry-Based Technology

7.2.2.4 Immunoassay-Based Technology

7.2.2.5 Testing Kits

8 Feed Testing Market, By Livestock (Page No. - 76)

8.1 Introduction

8.2 Swine Feed

8.3 Poultry Feed

8.4 Pets Feed

8.5 Cattle Feed

8.6 Equine Feed

8.7 Aquafeed

9 Market By Type (Page No. - 89)

9.1 Introduction

9.2 Mycotoxin Testing

9.3 Pathogen Testing

9.4 Nutritional Labeling Analysis

9.5 Crop Chemicals Testing

9.6 Fats & Oils Analysis

9.7 Other Feed Testing

10 Market By Geography (Page No. - 103)

10.1 Introduction

10.2 North America

10.2.1 North America Feed Testing Market, By Type

10.2.2 North America: Market By Livestock

10.2.3 Statistics of BSE Cases In North America

10.2.4 North America: Market By Country

10.2.4.1 U.S.

10.2.4.2 Canada

10.2.4.3 Mexico

10.3 Europe

10.3.1 Financial Costs of Some Major Feed Incidents In Europe

10.3.2 Europe Feed Testing Market, By Type

10.3.3 Europe: Market By Livestock

10.3.4 Europe: Market By Country

10.3.4.1 U.K.

10.3.4.2 France

10.3.4.3 Germany

10.3.4.4 Italy

10.3.4.5 Spain

10.3.4.6 Russia

10.3.4.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 Asia-Pacific Feed Testing Market By Type

10.4.2 Asia-Pacific: Market By Livestock

10.4.3 Asia-Pacific: Market By Country

10.4.3.1 China

10.4.3.2 India

10.4.3.3 Japan

10.4.3.4 Rest of Asia-Pacific

10.5 ROW

10.5.1 Row: Market By Type

10.5.2 Row: Market By Livestock

10.5.3 Row: Market By Geography

10.5.3.1 Latin America

10.5.3.2 Middle East

10.5.3.3 Africa

11 Regulations on Feed Testing (Page No. - 144)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.1.1 Food and Agriculture Organization (FAO)

11.2.1.2 Food and Drug Administration (FDA)

11.2.1.3 Association of American Feed Control Officials (AAFCO)

11.2.2 Canada

11.2.2.1 Canadian Food Inspection Agency (CFIA)

11.3 European Union

11.3.1 European Commission (Europe)

11.3.2 Code of Practice Of Labeling By FEFANA, FEFAC & EMFEMA

11.3.3 European Food Safety Authority (EFSA)

11.4 Asia-Pacific

11.4.1 Biosafety Regulations of Asia-Pacific Countries By APAARI, APCOAB & FAO

11.4.2 Bureau of Indian Standards (BIS)

12 Competitive Landscape (Page No. - 158)

12.1 Overview

12.2 Development Share Analysis of Feed Testing Service Market

12.3 Competitive Situation & Trends

13 Company Profiles (Company at a Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)* (Page No. - 163)

13.1 Introduction

13.2 Adpen Laboratories Inc.

13.3 Bureau Veritas SA

13.4 Eurofins Scientific

13.5 Genon Laboratories Ltd.

13.6 Institut Für Produktqualität Gmbh (IFP)

13.7 Intertek Group Plc

13.8 R J Hill Laboratories Ltd

13.9 Romer Labs Inc.

13.10 SGS SA

13.11 Silliker Inc.

*Details On Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured In Case Of Unlisted Companies.

14 Appendix (Page No. - 193)

14.1 Discussion Guide

14.2 Introducing RT: Real Time Market Intelligence

14.3 Related Reports

List of Tables (132 Tables)

Table 1 Origin & Type of Feed Ingredients

Table 2 Production Volume of Feed Raw Materials

Table 3 List of Animals Affected, By Mycotoxins Found In Feed Ingredients

Table 4 Adulterants In Feed Ingredients

Table 5 Potential Contaminants In Feed

Table 6 Testing of Feed & Feed Ingredients

Table 7 Feed Testing Parameters & Technology

Table 8 Evolution of NIR Spectroscopy Technology

Table 9 Laboratory Work Flow For PCR Method

Table 10 PCR Technology, By Suppliers For Various Pathogens

Table 11 Suppliers of Immunoassay-Based Technologies

Table 12 Feed Concentration With Enhanced Protein Content, By Ingredient

Table 13 Feed Testing Market Size, By Livestock, 2012–2019 ($Million)

Table 14 Market Size, By Livestock, 2012–2019 (Thousand Tests)

Table 15 Swine Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 16 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 17 Specification For Composition of Poultry Feed

Table 18 Poultry Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 19 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 20 Pet Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 21 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 22 Specification of Cattle Feed, By Regulatory Body

Table 23 Cattle Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 24 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 25 Equine Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 26 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 27 Aquafeed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 28 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 29 Number of Samples To Be Collected For Analysis of Feed As Per The Packages Produced

Table 30 Market Size, By Type, 2012–2019 ($Million)

Table 31 Market Size, By Type, 2012–2019 (Thousand Tests)

Table 32 Feed Mycotoxin Testing Market Size, By Geography, 2012–2019 ($Million)

Table 33 Feed Mycotoxin Testing Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 34 Feed Pathogen Testing Market Size, By Geography, 2012–2019 ($Million)

Table 35 Feed Pathogen Testing Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 36 Probability of Acceptability of A Batch With Respect To Number of Samples Tested And Contamination Ratio

Table 37 Feed Nutritional Labeling Analysis Market Size, By Geography, 2012–2019 ($Million)

Table 38 Feed Nutritional Labeling Analysis Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 39 Nutrient Verification Criteria

Table 40 Feed Crop Chemicals Testing Market Size, By Geography, 2012–2019 ($Million)

Table 41 Feed Crop Chemicals Testing Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 42 Summary of Animal Feed Analyzed For Pesticides

Table 43 Feed Fats & Oils Analysis Market Size, By Geography, 2012–2019 ($Million)

Table 44 Feed Fats & Oils Analysis Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 45 Other Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 46 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 47 Feed Testing Market Size, By Geography, 2012–2019 ($Million)

Table 48 Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 49 North America Feed Testing Market Size, By Type, 2012–2019 ($Million)

Table 50 North America: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 51 North America: Market Size, By Livestock, 2012–2019 ($Million)

Table 52 North America: Market Size, By Livestock, 2012–2019 (Thousand Tests)

Table 53 North America: Market Size, By Country, 2012–2019 ($Million)

Table 54 North America: Market Size, By Country, 2012–2019 (Thousand Tests)

Table 55 U.S. Feed Testing Market Size, By Type, 2012–2019 ($Million)

Table 56 U.S.: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 57 Summary of BSE Prevention Efforts In U.S.

Table 58 Canada Feed Testing Market Size, By Type, 2012–2019 ($Million)

Table 59 Canada: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 60 Mexico: Market Size, By Type, 2012–2019 ($Million)

Table 61 Mexico Feed Testing Market Size, By Type, 2012–2019 (Thousand Tests)

Table 62 Europe Market Size, By Type, 2012–2019 ($Million)

Table 63 Europe: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 64 Europe: Market Size, By Livestock, 2012–2019 ($Million)

Table 65 Europe: Feed Safety Market Size, By Livestock, 2012–2019 (Thousand Tests)

Table 66 Europe: Market Size, By Country, 2012–2019 ($Million)

Table 67 Europe: Market Size, By Country, 2012–2019 (Thousand Tests)

Table 68 U.K. Feed Testing Market Size, By Type, 2012–2019 ($Million)

Table 69 U.K.: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 70 Incidence of Salmonella Contamination In Various Feed Ingredients In U.K. 120

Table 71 France Market Size, By Type, 2012–2019 ($Million)

Table 72 France: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 73 Germany Market Size, By Type, 2012–2019 ($Million)

Table 74 Germany: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 75 An Overview of The Available Analytical Results On Food of Animal Origin From Blocked Farms (Situation 23/02/2011)

Table 76 Italy Market Size, By Type, 2012–2019 ($Million)

Table 77 Italy: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 78 Spain: Market Size, By Type, 2012–2019 ($Million)

Table 79 Spain: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 80 Russia Market Size, By Type, 2012–2019 ($Million)

Table 81 Russia: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 82 Rest of Europe Market Size, By Type, 2012–2019 ($Million)

Table 83 Rest of Europe: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 84 Asia-Pacific: Market Size, By Type, 2012–2019 ($Million)

Table 85 Asia-Pacific: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 86 Asia-Pacific: Market Size, By Livestock, 2012–2019 ($Million)

Table 87 Asia-Pacific: Market Size, By Livestock, 2012–2019 (Thousand Tests)

Table 88 Asia-Pacific: Market Size, By Country, 2012–2019 ($Million)

Table 89 Asia-Pacific: Market Size, By Country, 2012–2019 (Thousand Tests)

Table 90 China: Market Size, By Type, 2012–2019 ($Million)

Table 91 China Feed Testing Market Size, By Type, 2012–2019 (Thousand Tests)

Table 92 India Feed Testing Market Size, By Type, 2012–2019 ($Million)

Table 93 India: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 94 Composition And Nutritive Value of The Commonly Used Indian Fodder

Table 95 Japan Feed Testing Market Size, By Type, 2012–2019 ($Million)

Table 96 Japan: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 97 Mandatory Regulatory Processes For Feed And Feed Ingredients In Japan

Table 98 Regulations, Methods, Types of Analysis, And Equipment Used In Malaysia

Table 99 Rest of Asia-Pacific: Market Size, By Type, 2012–2019 ($Million)

Table 100 Rest of Asia-Pacific: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 101 Row: Market Size, By Type, 2012–2019 ($Million)

Table 102 Row: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 103 Row: Market Size, By Livestock, 2012–2019 ($Million)

Table 104 Row: Market Size, By Livestock, 2012–2019 (Thousand Tests)

Table 105 Row: Market Size, By Geography, 2012–2019 ($Million)

Table 106 Row: Market Size, By Geography, 2012–2019 (Thousand Tests)

Table 107 Latin America: Market Size, By Type, 2012–2019 ($Million)

Table 108 Latin America: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 109 Middle East: Market Size, By Type, 2012–2019 ($Million)

Table 110 Middle East: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 111 Africa: Market Size, By Type, 2012–2019 ($Million)

Table 112 Africa: Market Size, By Type, 2012–2019 (Thousand Tests)

Table 113 Regulatory Bodies Active In Various Countries & Their Regulations On Testing of Animal Feed

Table 114 Compulsory Declaration For Feed Materials As Referred To In Article 16 (1) (B)

Table 115 Aflatoxin B1 Is Strictly Regulated By EFSA

Table 116 EFSA Provides Guidance Values For Other Mycotoxins

Table 117 Crop Genetic Modification Events Approved For Various Uses In Some Asia-Pacific Countries

Table 118 BIS Standards For Dairy Feed Requirements

Table 119 BIS Standards, Poultry Feed Requirements

Table 120 BIS Standards, Poultry Feed Declaration Requirements

Table 121 BIS Standards, Poultry Feed Requirements For Minerals, Fatty Acids, Amino Acids, And Vitamins

Table 122 Eurofins Scientific Grew At The Fastest Rate Between 2009–2013

Table 123 Adpen Laboratories: Services & Their Description

Table 124 Bureau VERITAS Sa: Services & Their Description

Table 125 Eurofins: Services & Their Description

Table 126 Genon: Services & Their Description

Table 127 IFP: Services & Their Description

Table 128 Intertek: Services & Their Description

Table 129 Hill Laboratories: Services & Their Description

Table 130 Romer: Services & Their Description

Table 131 Sgs: Services & Their Description

Table 132 Silliker: Services & Their Description

List of Figures (72 Figures)

Figure 1 Feed Testing Market, By Type

Figure 2 Market: Research Methodology

Figure 3 Feed Production Share, By The Top 10 Countries, 2013

Figure 4 Feed Production Share, By Livestock & Geography, 2013

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Breakdown of Primary Interviews: By Company Type, Designation & Geography

Figure 8 Feed Testing Market Snapshot (2013 Vs. 2019): Market For Mycotoxin Testing Is Projected To Grow At The Highest Cagr

Figure 9 Market By Livestock, 2013-2019

Figure 10 Feed Testing Market Share, 2013

Figure 11 Attractive Market Opportunities In Feed Testing

Figure 12 Pet Feed To Grow At Highest Growth Rate Due To Growing Awareness of Feed Additives In Pet Feed

Figure 13 Poultry Feed Occupies Largest Market Share

Figure 14 U.S. Dominates The Overall Market

Figure 15 Nutritional Labeling Analyses Dominates The North American Market

Figure 16 Emerging Markets To Grow Faster Than The Developed Markets

Figure 17 Mycotoxin Testing Accounts For The Largest Market Share

Figure 18 Mycotoxin Testing Imposes Long-Term Impact On Market Growth

Figure 19 Feed Testing Market Is In Its Growth Phase

Figure 20 Imposition of Stringent Regulations On Testing of Animal Feed Drives The Market

Figure 21 Value Chain Analysis: Feed Testing Add To About 5%-6% of The Overall Feed Price

Figure 22 Supply Chain Analysis

Figure 23 Porter’S Five Forces Analysis: Consumer Awareness & Government Regulations On Animal Feed Is Increasing The Competition In The Industry

Figure 24 Strategic Benchmarking: Silliker & Eurofins Prefer Organic Growth Strategies

Figure 25 Market Segmentation

Figure 26 Demand For Standard Quality of Feed & Testing Regulations Drive The Market

Figure 27 Increased Demand For Quality & Sustainable Animal Nutrition Products Are Key Drivers of The Market

Figure 28 Animal Feed Recalls In 2013–2014: Dominated By Dog Feed Products

Figure 29 Lack of Awareness About Feed Safety Regulations Among Feed Manufacturers Is A Key Restraint In The Market

Figure 30 Emerging & Untapped Markets offer Potential Opportunity For Growth of The Market

Figure 31 Contamination Notifications of Livestock Feed (2004-2009)

Figure 32 Contaminants In Livestock Feed

Figure 33 Pcr & Kits Are Extensively Used For Feed Testing

Figure 34 Malpractice Poses The Biggest Risk In The Feed Industry

Figure 35 Increasing Feed Production Volume & Its Importance In Animal Husbandry Drives The Market

Figure 36 Pets Feed Is A Significant Segment of The Feed Testing Market

Figure 37 Horse Racing Industry Plays A Significant Role In Driving The Forage Testing Market

Figure 38 More Than Half of The Market Is Dominated By Mycotoxin Testing & Nutritional Labeling Analysis

Figure 39 Survey Results For Maximum Mycotoxin Incidences

Figure 40 North America Dominates The Animal Feed Pathogen Testing Market

Figure 41 North America Dominates The Animal Feed Testing Market

Figure 42 Economic Development & Implementation of Regulations Drive The Asia-Pacific Market

Figure 43 19 Cases of Bse Detected In Canada Since 2003

Figure 44 Bse Epidemic Incurred Heavy Losses In U.K.

Figure 45 U.K. Is Estimated To Show Highest Growth In The European Market

Figure 46 Pets Feed Testing Is The Fastest-Growing Segment In The Asia-Pacific Market

Figure 47 Presence of Aflatoxin Is Regulated In Eight Latin American Countries

Figure 48 Aflatoxin B1 Is Highly Regulated In Africa

Figure 49 Presence of Aflatoxin & Deoxynivalenol In Feed Is Regulated In The U.S. & Canada

Figure 50 Dacs Created The Inspection Process For Feed & Feed Additives In The U.S. 148

Figure 51 Presence of Aflatoxin B1 In Feed Is Regulated In 33 Eu Countries

Figure 52 Presence of Aflatoxin B1 In Feed Is Regulated In 10 Asia-Pacific Countries

Figure 53 Key Companies Preferred Expansion & Investment Strategy Over The Last Four Years

Figure 54 Feed Testing Market Development Strategy Share, By Key Player, 2009–2014

Figure 55 Expansions & Investments Have Fuelled Growth & Innovation Between 2011 To 2014

Figure 56 Expansions & Investments: The Key Strategy

Figure 57 Geographic Revenue Mix of Top 4 Market Players

Figure 58 Adpen Laboratories Inc.: Business Overview

Figure 59 Bureau Veritas Sa: Business Overview

Figure 60 Bureau Veritas: Swot Analysis

Figure 61 Eurofins Scientific: Business Overview

Figure 62 Eurofins: Swot Analysis

Figure 63 Genon Laboratories Ltd.: Business Overview

Figure 64 Institut Für Produktqualität Gmbh: Business Overview

Figure 65 Intertek Group Plc: Business Overview

Figure 66 Intertek Plc: Swot Analysis

Figure 67 Rj Hill Laboratories Ltd: Business Overview

Figure 68 Hill Laboratories: Swot Analysis

Figure 69 Romer Labs Inc.: Business Overview

Figure 70 Sgs Sa: Business Overview

Figure 71 Sgs Sa: Swot Analysis

Figure 72 Silliker Inc.: Business Overview

Growth opportunities and latent adjacency in Feed Testing Market

Thank you for your valuable feedback.Related interesting reports -https://www.marketsandmarkets.com/Market-Reports/feed-acidifiers-market-163262152.htmlhttps://www.marketsandmarkets.com/Market-Reports/feed-phytogenic-market-162036047.htmlPlease feel free to drop an email to sales@marketsandmarkets.com and we would be happy to connect

Thanks for the wonderful report