Feed Plant-based Protein Market by Source (Soy, Wheat, Pea, Sunflower), Livestock (Pets, Swine, Ruminants, Poultry, and Aquatic Animals), Type (Concentrates & Isolates), and Region (North America, Europe, Asia Pacific, and RoW) - Global Forecast to 2025

Feed Plant-based Protein Market Growth Analysis, 2025

Feed plant-based protein market size was valued at USD 2.5 billion in 2020 and poised to grow at USD 3.4 billion by 2025, growing at a CAGR of 6.3% in the forecast period (2020-2025).

The market for feed plant-based protein in animal feed is growing as more farmers and feed producers look for sustainable and cost-effective alternatives to traditional animal protein sources. Plant-based protein sources such as soybeans, peas, and canola are commonly used in animal feed. These protein sources have been shown to have similar nutritional value to animal-based protein and can be produced at a lower cost. Additionally, the growing demand for plant-based protein in human food products has led to an increase in the availability and affordability of these protein sources for animal feed. However, the market for feed plant-based protein in animal feed is still relatively small compared to the market for traditional animal protein sources.

The growth of market can be attributed to the increase in demand for plant-based pet food due to rise in awareness among the pet owners. Pet owners’ inclination toward organic pet food ingredients, and innovative animal husbandry techniques to improve meat quality augments demand for nutritional plant-based protein. European region dominated the global market for feed plant-based protein, due to innovative product development in the region, backed with appropriate research and development facilities available in the region.

To know about the assumptions considered for the study, Request for Free Sample Report

Feed Plant-based Protein Market Growth Insights

Drivers: Increase in demand for plant-based pet food due to rise in awareness among the pet owners

The shift in human preferences to plant-based protein has affected a change in preferences for feed as well. Plant-based protein preferences in pets such as dog and cat food diets have been shown to closely mimic those of their vegan or vegetarian owners. According to the study published by the Pet Food Manufacturers Association in 2019, 34% of the British dog food buyers believe that a plant-based diet is better for their dog than a meat-based diet. The prime concern with meat-based pet food diets is farm animal welfare and rights. Moreover, most pet owners are animal-lovers and are more likely to place a high value on the humane and ethical treatment of animals raised for food production. An unhealthy perception of meat and environmental and sustainability concerns over animal protein production are also strong growth drivers promoting plant-based pet food in recent years.

Restraints: Stringent regulatory framework restrains international trade

According to the Federal Food, Drug, and Cosmetic Act of 1938 (FFDCA), animal food is required to be safe for consumption and manufactured in sanitary conditions. The animal feed must not contain harmful substances and should have approximate labeling. The Food Safety Modernization Act of 2010 (FSMA) introduced guidelines related to certification, sterilization, hygiene, and labeling ingredients for pet food manufacturers in the US. Government monitoring agencies in Europe and North America have strict regulations for the animal feed industry compared to those in the Asia Pacific and South American regions. The regulations related to pet food ingredients such as preservatives, ethoxyquin, and food dye are different in various countries. Due to the lack of a universal regulatory structure, global trading of feed ingredients has been restraint. Huge investments have been made in manufacturing feed ingredients; however, several regulations lead to severe losses for feed manufacturers. It becomes expensive to frequently update the technologies and facilities in accordance with the changing guidelines. Pet food manufacturers are required to submit patent and approval applications to launch new products in various countries.

Opportunities: Technological advancements to develop plant-based protein for feed

Key manufacturers such as DuPont (US), Roquette Frères (France), Kerry Group (Ireland), and Ingredion (US) have been emphasizing on development of feed plant-based protein. Extensive research & development has resulted in the advent of new technologies in the pet food industry. The study published by the Kerry Group (Ireland), Global Innovation Center in 2020, demonstrates that its pet food product, PurePal, has witnessed an increase of 24% in the uptake among pets (suggesting a preference) due to greater aroma from the plant-based protein pet food.

According to the American Veterinary Medical Association in 2019, pet diets tend to reflect the choices of their human counterparts due to the availability of plant-based diets for pets in the North American pet food market. Key pet food companies such as Purina, Pedigree, Natural Balance, and PetGuard have entered the vegetarian and vegan realm by offering plant-based options. They have been using protein from ingredients such as brown rice, barley, peas, spinach and potatoes. The strategic collaborations between pet food manufacturers and ingredient manufacturers have posed a huge opportunity for the feed plant-based protein market’s technological developments.

Challenges: High initial investment costs involved for small & medium enterprises

Small & medium-sized enterprises have efficient cost management due to limited capital and resources. Many quality and productivity improvement techniques are generally not used in SMEs (small- and medium-sized enterprises) due to the lack of knowledge and resources to implement the same. However, high costs involved in adapting to new technologies and production procedures have restricted SMEs from improving their operations.

Feed and pet food manufacturers require high capital investments to install different types of machinery and equipment. This equipment has high installation costs and requires timely maintenance, which is an additional cost. Feed and pet food manufacturers look for more economical options, such as equipment rentals, contract processing, and other related facilities. Renting equipment or contract manufacturing requires less capital investment and avoids annual maintenance costs, which are incurred by rental companies. However, capital investments are one-time investments that are usually offset in the long run.

Feed Plant-based Protein Market Scope

|

Report Metric |

Details |

|

Market valuation in 2020 |

USD 2.5 Billion |

|

Revenue prediction in 2025 |

USD 3.4 Billion |

|

Progress rate |

CAGR of 6.3% |

|

Forecast period |

2020–2025 |

|

Market Drivers |

|

| Market Opportunities |

|

|

Segments covered |

|

|

Regions covered |

|

|

Companies studied |

|

By source, pea is projected to be the fastest growing segment in the market during the forecast period

Based on source, pea is the fastest growing segment in the feed plant-based protein market. Pea proteins are used in alternatives to conventional feed protein ingredients. Due to its nutritional benefits and easy integration into final products, the demand for pea protein grows as a crucial ingredient in the feed industry.

By livestock, pet is projected to account for the largest share in the feed plant-based protein market during the forecast period

Based on livestock, pet dominated the feed plant-based protein market. Plant-based ingredients and plant-based protein are trending among pet food manufacturing professionals and becoming more mainstream in the pet food market. The plant-based pet food trend is growing because pet owners have been more inclined to consume a meatless diet. Moreover, protein preferences in dog and cat food diets have been shown to closely mimic those of their vegan or vegetarian owners, with more of these owners opting to feed their pets a diet consisting of plant-based protein. These factors are expected to drive growth in the pet segment.

By type, concentrates segment is projected to account for the largest share in the market during the forecast period

By type, concentrates segment dominated the market, and the same trend is projected to follow during the forecast period. Feed plant-based protein concentrates deliver balanced nutrition, offering fibers and micronutrients, along with protein. They are sustainably sourced from soy, peas, lentils, and fava beans, which can generally comprise up to 80% of protein content. The production of plant protein concentrates is of great interest in the feed industry due to greater protein requirements and an increase in awareness among pet owners, especially in developing countries.

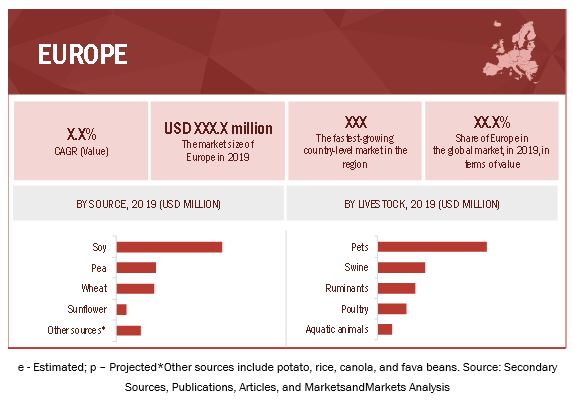

Europe is projected to account for the largest market share during the forecast period

The European market accounted for the largest share in 2019. In Europe, the demand for feed plant-based protein market is mainly concentrated from sources such as soy, pea, and wheat. Both North America and Europe are projected to contribute to the growth of the feed plant-based protein ingredients market due to the increasing preference for organic ingredients in the pet food and feed industry. However, the demand for feed plant-based protein in Asia Pacific is projected to remain high due to the rise in adoption of pets, rising urbanization, increase in animal husbandry, and growth in the meat consuming population. The demand for feed plant-based protein in China is projected to remain high, as the consumers in the country prefer opting for prepared pet food products.

Key Players in Feed Plant-based Protein Market

DuPont (US), Kerry Group (Ireland), Ingredion (US), Emsland Group (Germany), AGRANA (Austria), Avebe (Netherlands), Kroner (Germany), Batory Foods (US), Roquette Frères (France), AGT Foods (Canada), Aminola (Netherlands), BENEO (Germany), Scoular Company (US), Vestkorn (Norway), E T Chem (China), Bio Technologies (Russia), FoodChem International (China), Crown Soya Group (China), BioScience Food Solutions (Germany), and Sotexpro (France).

Target Audience

- Dairy, poultry farms, and livestock farms

- Feed manufacturers

- Pet food manufacturers

- Feed plant-based ingredient manufacturers

- Commercial research and development (R&D) institutions and financial institutions

- Government organizations, research organizations, and consulting firms

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the market

Report Segmentation

This research report categorizes the feed plant-based protein market based on source, livestock, type, and region.

Market By Source

- Soy

- Wheat

- Pea

- Sunflower

- Other sources (potato, rice, canola, and fava beans)

Market By Livestock

- Pets

- Swine

- Ruminants

- Poultry

- Aquatic animals

Market By Type

- Concentrates

- Isolates

- Other types (textured protein and hydrolyzed protein)

Market By Region:

- North America

- Europe

- Asia Pacific

-

Rest of the World (RoW)

- South America

- Africa

- Middle East

Recent Developments

- In May 2019, Roquette Frères expanded its presence in Lithuania by establishing a new R&D division. This strategy would bolster the regional experts and cater to the needs of regional customers as well as Northern Europe.

- In April 2019, Ingredion launched the VITESSENCE PULSE pea protein concentrate series to help pet food manufacturers create appealing, nutritionally balanced products with in-demand, grain-free claims and clean labels that are in demand among pet owners.

Frequently Asked Questions (FAQ):

What is feed plant-based protein?

Feed plant-based protein typically refers to providing protein derived from plants to animals as part of their diet. This practice is common in animal husbandry, particularly for animals like poultry, pigs, and cattle.

How big is the feed plant-based protein market?

The global feed plant-based protein market is predicted to develop at an 6.3% compound annual growth rate (CAGR) to $3.4 billion by 2025. In 2020, the global market size was valued $2.5 billion.

Which players are involved in the manufacturing of feed plant-based protein market?

Key players in this market include DuPont (US), Kerry Group (Ireland), Ingredion (US), Emsland Group (Germany), AGRANA (Austria), Avebe (Netherlands), Kroner (Germany), Batory Foods (US), Roquette Frères (France), AGT Foods (Canada), Aminola (Netherlands), BENEO (Germany), Scoular Company (US), Vestkorn (Norway), E T Chem (China), Bio Technologies (Russia), FoodChem International (China), Crown Soya Group (China), BioScience Food Solutions (Germany), and Sotexpro (France).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the feed plant-based protein market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

TABLE 1 INCLUSIONS & EXCLUSIONS

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 KEY DATA FROM PRIMARY SOURCES

FIGURE 4 KEY PRIMARY INSIGHT

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (BASED ON SOURCE, BY REGION)

2.2.2 APPROACH TWO (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 6 COVID-19: THE GLOBAL PROPAGATION

FIGURE 7 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 8 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 3 MARKET SHARE SNAPSHOT, 2020 VS. 2025 (USD BILLION)

FIGURE 11 IMPACT OF COVID-19 ON THE FEED PLANT-BASED PROTEIN MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 12 MARKET SIZE, BY SOURCE, 2020 VS. 2025 (USD MILLION)

FIGURE 13 MARKET SIZE, BY LIVESTOCK, 2020 VS. 2025 (USD MILLION)

FIGURE 14 MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 15 MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 16 EXTENSIVE RESEARCH & DEVELOPMENT HAS RESULTED IN THE ADVENT OF NEW TECHNOLOGIES IN THE PET FOOD AND FEED INDUSTRY TO PROPEL THE MARKET

4.2 MAJOR REGIONAL SUBMARKETS

FIGURE 17 EUROPE WAS THE LARGEST MARKET GLOBALLY FOR FEED PLANT-BASED PROTEIN IN 2019

4.3 EUROPE: MARKET, BY KEY APPLICATION & COUNTRY

FIGURE 18 GERMANY ACCOUNTED FOR THE LARGEST SHARE IN THE EUROPEAN MARKET IN 2019

4.4 MARKET, BY LIVESTOCK

FIGURE 20 THE PETS SEGMENT PROJECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.5 MARKET, BY SOURCE & REGION

FIGURE 21 EUROPE IS ESTIMATED TO DOMINATE THE MARKET FOR FEED PLANT-BASED PROTEIN DURING THE FORECAST PERIOD

4.6 MARKET, BY TYPE

FIGURE 23 CONCENTRATES TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.7 COVID-19 IMPACT ON THE MARKET

FIGURE 24 COVID-19 IMPACT ON THE MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand for plant-based pet food due to rise in awareness among the pet owners

5.2.1.2 Pet owners’ inclination toward organic pet food ingredients

FIGURE 26 US: PET INDUSTRY EXPENDITURE, 2018–2020 (USD BILLION)

5.2.1.3 Innovative animal husbandry techniques to improve meat quality augments the demand for nutritional plant-based protein

FIGURE 27 US: MEAT PRODUCTION SHARE, BY MEAT TYPE, 2017 (BILLION KG)

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory framework restrains international trade

5.2.2.2 Possibilities of nutritional and vitamins deficiency among pets

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements to develop plant-based protein for feed

5.2.3.2 Focus on cannabis and aquatic plants as new and emerging plant-based protein sources

5.2.4 CHALLENGES

5.2.4.1 Concern over quality of feed due to GM adulteration

5.2.4.2 High initial investment costs involved for small & medium enterprises

5.3 COVID-19 DRIVERS

5.4 AVERAGE SELLING PRICES

TABLE 4 AVERAGE PRICE OF FEED PLANT-BASED PROTEIN, BY SOURCE, 2018 & 2019 (USD/TON)

5.5 PATENT ANALYSIS

TABLE 5 KEY PATENTS PERTAINING TO FEED PLANT-BASED PROTEIN, 2019–2020

5.6 TECHNOLOGY ANALYSIS

5.7 VALUE CHAIN

FIGURE 28 FEED PLANT-BASED PROTEIN MARKET: VALUE CHAIN

5.8 ECOSYSTEM & MARKET MAP

FIGURE 29 MARKET ECOSYSTEM

FIGURE 30 MARKET MAP

5.9 KEY MARKET FOR IMPORT/EXPORT

5.9.1 SOYBEAN

TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF SOYBEANS, 2019 (KT)

5.9.2 WHEAT

TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF WHEAT, 2019 (KT)

5.9.3 SUNFLOWER SEEDS

TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF SUNFLOWER SEEDS, 2019 (KT)

5.9.4 PEA

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF PEA, 2019 (KT)

5.9.5 RICE

TABLE 10 TOP 10 IMPORTERS AND EXPORTERS OF RICE, 2019 (KT)

5.9.6 POTATO

TABLE 11 TOP 10 IMPORTERS AND EXPORTERS OF POTATO, 2019 (KT)

5.1 PORTER’S FIVE FORCES

TABLE 12 MARKET: PORTER’S FIVE FORCES

5.11 YC-YCC SHIFT

FIGURE 31 YC & YCC SHIFT FOR THE MARKET

6 FEED PLANT-BASED PROTEIN, BY SOURCE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 32 MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2020 VS. 2025 (USD MILLION)

TABLE 13 MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 14 MARKET SIZE, BY SOURCE, 2018–2025 (KT)

6.1.1 COVID-19 IMPACT ON THE MARKET, BY SOURCE

6.1.1.1 Optimistic Scenario

TABLE 15 OPTIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

6.1.1.2 Realistic Scenario

TABLE 16 REALISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

6.1.1.3 Pessimistic Scenario

TABLE 17 PESSIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

6.2 SOY

6.2.1 SOY CONCENTRATES OFFER 70% PROTEIN CONTENT

TABLE 18 FEED SOY-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3 WHEAT

6.3.1 COST BENEFITS AND WIDESPREAD AVAILABILITY PROPEL THE DEMAND FOR WHEAT PROTEINS

TABLE 19 FEED WHEAT-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.4 PEA

6.4.1 ALLERGEN-FRIENDLY AND FUNCTIONAL CHARACTERISTICS DRIVE DEMAND FOR PEA PROTEIN

TABLE 20 FEED PEA-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.5 SUNFLOWER

6.5.1 HIGH RAW MATERIAL COSTS OFFER SLUGGISH GROWTH FOR SUNFLOWER PROTEINS

TABLE 21 FEED SUNFLOWER-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.6 OTHER SOURCES

6.6.1 OTHER PROTEIN SOURCES WITNESSED AN INCREASE IN DEMAND AMONG FEED MANUFACTURERS

TABLE 22 FEED OTHER SOURCE-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 FEED PLANT-BASED PROTEIN MARKET, BY LIVESTOCK (Page No. - 81)

7.1 INTRODUCTION

FIGURE 33 MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY LIVESTOCK, 2020 VS. 2025 (USD MILLION)

TABLE 23 MARKET SIZE, BY LIVESTOCK, 2018–2025 (USD MILLION)

TABLE 24 MARKET SIZE, BY LIVESTOCK, 2018–2025 (KT)

7.1.1 COVID-19 IMPACT ON THE MARKET, BY LIVESTOCK

7.1.1.1 Optimistic Scenario

TABLE 25 OPTIMISTIC SCENARIO: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY LIVESTOCK, 2018–2021 (USD MILLION)

7.1.1.2 Realistic Scenario

TABLE 26 REALISTIC SCENARIO: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY LIVESTOCK, 2018–2021 (USD MILLION)

7.1.1.3 Pessimistic Scenario

TABLE 27 PESSIMISTIC SCENARIO: MARKET SIZE, BY LIVESTOCK, 2018–2021 (USD MILLION)

7.2 PETS

7.2.1 PET OWNERS’ SWITCH TOWARD VEGANISM FUELS THE MARKET FOR PLANT-BASED PET FOOD

TABLE 28 PLANT-BASED PROTEIN MARKET SIZE IN PET FOOD, BY REGION, 2018–2025 (USD MILLION)

7.3 SWINE

7.3.1 RISE IN PORK TRADE FUELS THE DEMAND FOR PLANT-BASED FEED FOR SWINE

TABLE 29 PLANT-BASED PROTEIN MARKET SIZE IN SWINE FEED, BY REGION, 2018–2025 (USD MILLION)

7.4 RUMINANTS

7.4.1 NUTRITION OBTAINED FROM PLANT-BASED PROTEINS HELP RUMINANTS OFFER HIGH-QUALITY END-PRODUCTS

TABLE 30 PLANT-BASED PROTEIN MARKET SIZE IN RUMINANT FEED, BY REGION, 2018–2025 (USD MILLION)

7.5 POULTRY

7.5.1 PLANT-BASED PROTEIN COULD OFFER ENHANCED MUSCLE GROWTH IN POULTRY BIRDS

TABLE 31 PLANT-BASED PROTEIN MARKET SIZE IN POULTRY FEED, BY REGION, 2018–2025 (USD MILLION)

7.6 AQUATIC ANIMALS

7.6.1 AQUATIC ANIMALS NEED MORE PROTEINS THAN CARBOHYDRATES

TABLE 32 PLANT-BASED PROTEIN MARKET SIZE IN AQUAFEED, BY REGION, 2018–2025 (USD MILLION)

8 FEED PLANT-BASED PROTEIN MARKET, BY TYPE (Page No. - 89)

8.1 INTRODUCTION

FIGURE 34 MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 33 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE MARKET, BY TYPE

8.1.1.1 Optimistic Scenario

TABLE 34 OPTIMISTIC SCENARIO: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.2 Realistic Scenario

TABLE 35 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE 36 PESSIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.2 CONCENTRATES

8.2.1 INCLUSION OF PLANT PROTEIN CONCENTRATES IN RUMINANT FEED TO DRIVE MARKET GROWTH

TABLE 37 FEED PLANT-BASED PROTEIN CONCENTRATES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 ISOLATES

8.3.1 FUNCTIONAL BENEFITS FROM AMINO ACIDS PROPEL FEED PLANT PROTEIN ISOLATES

TABLE 38 FEED PLANT-BASED PROTEIN ISOLATES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.4 OTHER TYPES

8.4.1 HYDROLYZED PROTEIN BUILDS IMMUNITY IN PET DIGESTIVE SYSTEMS

TABLE 39 OTHER FEED PLANT-BASED PROTEIN TYPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 FEED PLANT-BASED PROTEIN, BY REGION (Page No. - 95)

9.1 INTRODUCTION

TABLE 40 AVERAGE PRICE OF FEED PLANT-BASED PROTEIN, BY REGION, 2018 & 2019 (USD/TON)

FIGURE 35 REGIONAL SNAPSHOT: ASIA PACIFIC HAS SIGNIFICANT GROWTH RATES FOR FEED PLANT-BASED PROTEIN

TABLE 41 MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 MARKET SIZE, BY REGION, 2018–2025 (KT)

9.1.1 COVID-19 IMPACT ON THE FEED PLANT-BASED PROTEIN MARKET, BY REGION

9.1.1.1 Optimistic Scenario

TABLE 43 OPTIMISTIC SCENARIO: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY REGION, 2018–2021 (USD MILLION)

9.1.1.2 Realistic Scenario

TABLE 44 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic Scenario

TABLE 45 PESSIMISTIC SCENARIO: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY REGION, 2018–2021 (USD MILLION)

9.2 REGULATORY FRAMEWORK

9.2.1 US FOOD AND DRUG ADMINISTRATION (FDA)

9.3 REGULATIONS FOR FOOD FROM NEW PLANT VARIETIES

9.4 NORTH AMERICA

TABLE 46 NORTH AMERICA: FEED PRODUCTION, BY LIVESTOCK, 2017–2019 (MILLION TONNE)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: FEED SOY-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: FEED WHEAT-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: FEED PEA-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: FEED SUNFLOWER-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: FEED OTHER SOURCE-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: FEED PLANT-BASED PROTEIN MARKET SIZE, BY LIVESTOCK, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.1 US

9.4.1.1 Huge production capacity of the feed and pet food can boost the market in the US

TABLE 57 US: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.4.2 CANADA

9.4.2.1 High production of pulse crops augments the demand for plant-based protein in feed

TABLE 58 CANADA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Rise in pet food manufacturers in Mexico drives the demand for nutritional feed plant-based protein

TABLE 59 MEXICO: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.5 EUROPE

FIGURE 36 EUROPE: MARKET SNAPSHOT

TABLE 60 EUROPE: FEED PRODUCTION, BY LIVESTOCK, 2017–2019 (MILLION TONNE)

TABLE 61 EUROPE: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 63 EUROPE: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: FEED SOY-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: FEED WHEAT-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: FEED PEA-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: FEED SUNFLOWER-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: FEED OTHER SOURCES-BASED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY LIVESTOCK, 2018–2025 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.1 GERMANY

9.5.1.1 German laws on pet food imports drive the market for feed plant-based protein

TABLE 71 GERMANY: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.5.2 SPAIN

9.5.2.1 High demand for nutritional feed as Spain is among the top feed producing countries

TABLE 72 SPAIN: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.5.3 UK

9.5.3.1 The demand for nutritional pet food poses a growth opportunity for the plant-based protein market in the UK

TABLE 73 UK: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.5.4 FRANCE

9.5.4.1 Demand for premium products in France to drive the market

TABLE 74 FRANCE: FEED PLANT-BASED PROTEIN MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.5.5 ITALY

9.5.5.1 Increase in meat consumption in Italy augments the demand for nutritional feed

TABLE 75 ITALY: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.5.6 REST OF EUROPE

9.5.6.1 Increase in awareness about the plant-based protein feed among the manufacturers to drive the market

TABLE 76 REST OF EUROPE: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.6 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 77 ASIA PACIFIC: FEED PRODUCTION, BY LIVESTOCK, 2017-2019 (MILLION TONNE)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (KT)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: FEED SOY-BASED PROTEIN MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 82 ASIA PACIFIC: FEED WHEAT-BASED PROTEIN MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: FEED PEA-BASED PROTEIN MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 84 ASIA PACIFIC: FEED SUNFLOWER-BASED PROTEIN MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: FEED OTHER SOURCE-BASED PROTEIN MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY LIVESTOCK, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.6.1 CHINA

9.6.1.1 Increase in demand for superior-quality feed in China to augment the market

TABLE 88 CHINA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.6.2 JAPAN

9.6.2.1 Increase in focus on protein-rich pet food to drive the market in Japan

TABLE 89 JAPAN: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.6.3 AUSTRALIA & NEW ZEALAND

9.6.3.1 Rise in popularity of nutrition-based diet in Australia & New Zealand

TABLE 90 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.6.4 INDIA

9.6.4.1 Increase in focus of livestock growers on livestock health and productivity to augment the demand for plant-based feed

TABLE 91 INDIA: FEED PLANT-BASED PROTEIN MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.6.5 REST OF ASIA PACIFIC

9.6.5.1 Rise in awareness regarding the importance of livestock nutrition for good-quality meat to propel the market

TABLE 92 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.7 REST OF THE WORLD (ROW)

TABLE 93 ROW: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 94 ROW: MARKET SIZE, BY REGION, 2018–2025 (KT)

TABLE 95 ROW: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 96 ROW: FEED SOY-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 97 ROW: FEED WHEAT-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 98 ROW: FEED PEA-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 99 ROW: FEED SUNFLOWER-BASED PROTEIN MARKET SIZE, BY REGION,2018–2025 (USD MILLION)

TABLE 100 ROW: FEED OTHER SOURCE-BASED PROTEIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 101 ROW: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY LIVESTOCK, 2018–2025 (USD MILLION)

TABLE 102 ROW: MARKET SIZE, BY TYPE,2018–2025 (USD MILLION)

9.7.1 SOUTH AMERICA

9.7.1.1 Trend of pet humanization contributes to the growth of the market for the pet food segment

TABLE 103 LATIN AMERICA: FEED PRODUCTION, BY LIVESTOCK, 2017–2019 (MILLION TONNE)

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.7.2 AFRICA

9.7.2.1 Presence of a substantial livestock population to encourage plant-based protein use in the region

TABLE 105 AFRICA: FEED PRODUCTION, BY LIVESTOCK, 2017–2019 (MILLION TONNE)

TABLE 106 AFRICA: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

9.7.3 MIDDLE EAST

9.7.3.1 An increase in livestock disease outbreaks is expected to drive the growth

TABLE 107 MIDDLE EAST: FEED PRODUCTION, BY LIVESTOCK, 2017–2019 (MILLION TONNE)

TABLE 108 MIDDLE EAST: MARKET SIZE FOR FEED PLANT-BASED PROTEIN, BY SOURCE, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 134)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS, 2019

FIGURE 38 MARKET SHARE ANALYSIS OF MAJOR PLAYERS IN THE GLOBAL MARKET, 2019

10.3 REVENUE ANALYSIS OF THE KEY MARKET PLAYERS

FIGURE 39 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2017–2019 (USD BILLION)

10.4 COMPANY EVALUATION QUADRANT: (KEY PLAYERS)

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 40 MARKET: COMPANY EVALUATION QUADRANT, 2019 (OVERALL MARKET)

10.4.5 PRODUCT FOOTPRINT

TABLE 109 MARKET: COMPANY SOURCE FOOTPRINT

TABLE 110 MARKET: COMPANY LIVESTOCK FOOTPRINT

TABLE 111 COMPANY REGIONAL FOOTPRINT

10.5 COMPANY EVALUATION QUADRANT (OTHER PLAYERS)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 41 FEED PLANT-BASED PROTEIN MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS, 2019

10.6 COMPETITIVE SCENARIO

10.6.1 EXPANSIONS

TABLE 112 KEY EXPANSIONS, 2019

10.6.2 NEW PRODUCT LAUNCHES

TABLE 113 KEY NEW PRODUCT LAUNCHES, 2019

11 COMPANY PROFILES (Page No. - 142)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 KEY PLAYERS

11.1.1 DUPONT

FIGURE 42 DUPONT: COMPANY SNAPSHOT

FIGURE 43 DUPONT: SWOT ANALYSIS

11.1.2 ROQUETTE FRÈRES

FIGURE 44 ROQUETTE FRÈRES: COMPANY SNAPSHOT

FIGURE 45 ROQUETTE: SWOT ANALYSIS

11.1.3 KERRY GROUP

FIGURE 46 KERRY GROUP: COMPANY SNAPSHOT

FIGURE 47 KERRY GROUP: SWOT ANALYSIS

11.1.4 INGREDION

FIGURE 48 INGREDION: COMPANY SNAPSHOT

FIGURE 49 INGREDION: SWOT ANALYSIS

11.1.5 AGRANA

FIGURE 50 AGRANA: COMPANY SNAPSHOT

FIGURE 51 AGRANA: SWOT ANALYSIS

11.1.6 AVEBE

FIGURE 52 AVEBE: COMPANY SNAPSHOT

11.1.7 KRONER STARKE

11.1.8 EMSLAND GROUP

11.1.9 BATORY FOODS

11.1.10 AGT FOOD & INGREDIENTS

FIGURE 53 AGT FOODS & INGREDIENTS: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 AMINOLA

11.2.2 BENEO

11.2.3 THE SCOULAR COMPANY

11.2.4 VESTKORN

11.2.5 ET CHEM

11.2.6 BIO TECHNOLOGIES

11.2.7 FOODCHEM INTERNATIONAL

11.2.8 CROWN SOYA PROTEIN GROUP

11.2.9 BIOSCIENCE FOOD SOLUTIONS

11.2.10 SOTEXPRO

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 168)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

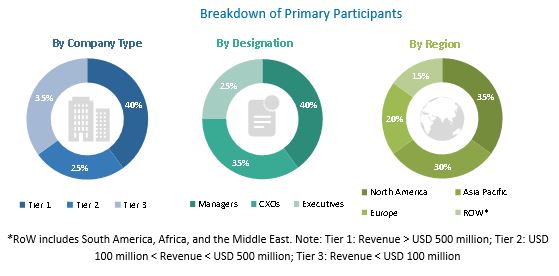

The study involved four major activities in estimating the feed plant-based protein market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The feed plant-based protein market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of global and regional feed and pet food manufacturers; dairy, poultry farms, and livestock farms; commercial research and development (R&D) institutions and financial institutions. The supply side is characterized by the presence of key feed plant-based ingredient manufacturers, plant-based protein manufacturers for feed and pet food, marketing directors, and key executives from various key companies and organizations in the market.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Feed Plant-based Protein Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the feed plant-based protein market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the feed plant-based protein market, with respect to its source, type, livestock, and regional markets, over a five-year period, ranging from 2020 to 2025

- Analyzing and projecting the impact of the optimistic, pessimistic, and realistic scenarios pertaining to COVID-19 in the market, with respect to source, type, livestock, and regional markets between 2020 and 2021

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the feed plant-based protein markets

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market into Russia, Netherlands and Denmark

- Further breakdown of the Rest of Asia Pacific market into Southeast Asian countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Feed Plant-based Protein Market