Animal Growth Promoters and Performance Enhancers Market Size by Type (Antibiotic and Non-antibiotic (Hormones, Acidifiers, Feed Enzymes, Probiotics & Prebiotics, Phytogenic)), Animal Type (Poultry, Porcine, Livestock, Aquaculture) - Global Forecast to 2026

The size of animal growth promoters and performance enhancers market industry is projected to grow from $16.2 billion in 2021 and to reach $21.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Animal health products, including growth promoters and performance enhancers, are types of drugs and chemicals used for animal growth. These enhancers help to digest food more effectively and enable animals to grow faster, which, in turn, help to improve productivity. Growth in the animal growth promoters and performance enhancers market is majorly driven by the rising demand for animal consumption and consumption of livestock-based products, rising global demand for naturally produced growth promoters, and rising animal epidemics and climate change. However, a ban on antibiotics in different nations and stringent regulations restricting the use of antibiotics and hormones for growth promotion in animals are expected to restrain the growth of the animal growth promoters and performance enhancers market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Animal Growth Promoters and Performance Enhancers Market Global Dynamics

Driver: Rise in the global demand for naturally produced growth promoters

To curb the usage of antibiotics, various alternative positive measures are being taken to reduce the incidence of diseases in farm animals. Organic dairy farms are becoming increasingly popular in countries such as the UK, Norway, and Sweden. Good weaning practices are also being adopted to ensure that animals are independent of their mothers nutritionally, immunologically, and psychologically.

The growth in demand for organic products is one of the major factors driving the adoption of good husbandry practices in the animal farming industry. According to the Organic Trade Association, organic food is the fastest-growing sector in the US food industry, and organic food sales are witnessing double-digit annual growth in the country. Similarly, the demand for organic products is increasing in European countries. Factors such as numerous food scandals and increased interest in health, environmental issues, and animal welfare have led to an increase in the demand for organic food.

As a part of good husbandry practices, animal stock densities are kept low and excessive herd or flock sizes are also avoided. Moreover, the time of journey is reduced during the live transport of animals. Breeding animals for robustness and health is being recognized as an essential part of sustainable animal farming. This growing focus on high-welfare animal farming is, in turn, driving the natural growth promoters market.

Opportunity: Focus on increasing environmental sustainability

The development of highly intensive input systems has resulted in many environmental challenges. Grazing herds of cattle produce staggering amounts of greenhouse gases, contributing significantly to the greenhouse effect. It is reported that livestock animals produce more than 100 different types of gases, including ammonia and methane, a major contributor to global warming and more harmful than carbon dioxide. Currently, agriculture produces almost 14% of the world’s greenhouse gases. The USDA has predicted the agricultural methane output to increase by 60% by 2030.

The potential for explosive increases in pollution and resource loss levels has drawn attention from a number of bodies across the globe. For example, the International Feed Industry Federation (IFIF) represents a global feed industry body made up of national and regional feed associations from Africa, the Asia Pacific, Europe, North & South America, and the Middle East, as well as feed-related organizations and corporate members worldwide. Through collaborations with governmental, private-sector, and nongovernmental partners (such as the UN FAO, the World Organisation for Animal Health (OIE), alongside the Codex Alimentarius Commission, the IFIF ensures high standards for the health and welfare of animals and people. It promotes a regulatory framework that encourages the sustainable development of animal production. In view of this, corporate members of the IFIF, such as Bluestar Adisseo (China), Alltech (US), Elanco (US), MSD Animal Health (US), and Phibro Animal Health Corporation (US), are working towards achieving the dual aim of profitability and sustainability. Such initiatives for the development of environmentally friendly animal growth promoters are expected to provide huge growth opportunities in this market.

Challenge: Growing threat of disease transmission to and from agricultural animals

According to the International Livestock Research Institute (ILRI), 13 zoonoses cause 2.4 billion cases of human diseases and 2.2 million deaths per year. Infection caused due to consumption of undercooked meat is quite common in 10–20% of the UK population. According to the WHO, it is estimated that globally, about one billion cases of illnesses and millions of animal deaths occur every year from zoonoses. Approximately 60% of emerging infectious diseases that are reported globally are zoonotic diseases. Over 30 new human pathogens have been detected in the last three decades, 75% of which have originated in animals. In addition, according to the European Food Safety Authority, over 350,000 human cases of foodborne zoonotic diseases are reported each year in the European Union. Rising disease transmission is expected to pose a challenge to market growth.

The non-antibiotic growth promoters and performance enhancers holds the largest share in animal growth promoters and performance enhancers market by type, in the forecast period

The non-antibiotic growth promoters and performance enhancers segment accounted for the largest share of the animal growth promoters and performance enhancers market in 2020. The large share of this segment can be attributed to the economic benefits of these products, the wide range of substances with applications in different production animals, environmental sustainability, and the increased number of regulations on antibiotics and hormones.

Prebiotics & probiotics accounted for the largest share of the animal growth promoters and performance enhancers market in 2020. This is mainly due to their safety, natural performance-enhancing properties, and high nutritional value. The use of prebiotic, probiotic, and synbiotic growth promoters is safe and free of any accumulative future effects, which also boosts the adoption of these products.

The poultry segment accounted for the largest share of the global animal growth promoters and performance enhancers market.

The large market share of this segment can be attributed to the increasing demand for poultry meat and eggs, rising novel diet approaches, and increasing antibiotic phase-outs resulting in the development of alternatives.

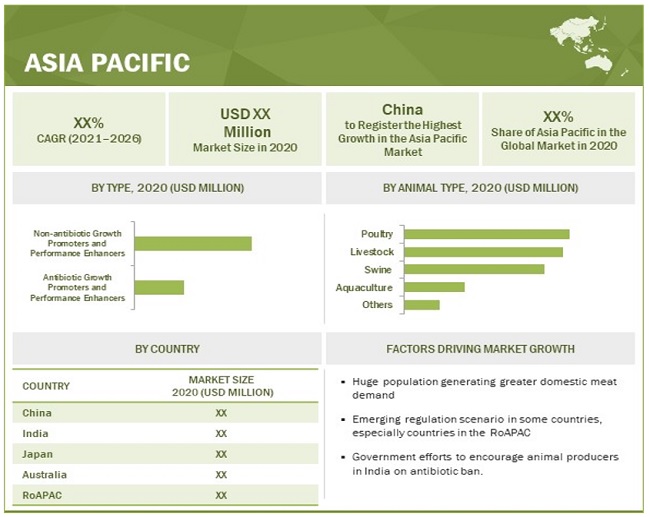

Asia Pacific accounted for the largest share of the global animal growth promoters and performance enhancers market, by region in the forecast period.

Asia Pacific region accounted for the largest market share, followed by North America with a share in 2020. The large share of the Asia Pacific region can be attributed to the strong animal products industry in this region, huge population generating greater domestic meat demand, comparatively relaxed regulatory scenario, and government efforts to encourage animal producers.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the animal growth promoters and performance enhancers market: Cargill, Incorporated (US), Royal DSM N.V. (Netherlands), Elanco Animal Health Incorporated (US), Boehringer Ingelheim Group (Germany), Merck & Co., Inc (US), Alltech Corporation (US), Archer-Daniels-Midland Company (ADM) (US), Vetoquinol S.A. (France), Bupo Animal Health Pty Ltd (South Africa), Novus International, Inc. (US), Associated British Foods plc (UK), Erber AG (Austria), Phibro Animal Health Corporation (US), Kemin Industries, Inc. (US), Zoetis Inc. (US), Nutreco N.V. (Netherlands), Novozymes A/S (Denmark), BASF SE (Germany), Evonik Industries AG (Germany), Bluestar Adisseo Company (China), Land O’Lakes, Inc. (US), Chr. Hansen (Denmark), Biomin Holding GmbH (Austria), Guangdong VTR Bio-Tech Co., Ltd. (China), and Lallemand Inc. (Canada).

Scope of the Animal Growth Promoters Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$16.2 billion |

|

Projected Revenue Size by 2026 |

$21.4 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 5.7% |

|

Market Driver |

Rise in the global demand for naturally produced growth promoters |

|

Market Opportunity |

Focus on increasing environmental sustainability |

The research report categorizes the animal growth promoters and performance enhancers market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Non-antibiotic growth promoters and performance enhancers

- Antibiotic growth promoters and performance enhancers

By Animal Type

- Poultry

- Swine

- Livestock

- Aquaculture

- Other Animals

By Region

-

North America North America

- US

- Canada

-

Europe

- Germany

- UK

- Switzerland

- Russia

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East

- Africa

Recent Developments:

PRODUCT LAUNCHES

|

Month & Year |

Approach |

Product Type |

Product Name |

dESCRIPTION |

Company NAme |

|

October 2021 |

Product Launch |

Poultry Nutrition |

Nutrena Naturewise |

Helps the birds thrive, keep eggs strong and keep coops fresh. |

Cargill, Incorporated (US) |

|

January 2021 |

Product Launch |

Pig e-commerce |

Digital platform |

Launched e-commerce business for millions of pig farmers in China |

Kemin Industries, Inc. (US) |

|

February 2021 |

Product Launch |

Cattle, swine, broiler, and horse diet |

KemTRACE Chromium-OR |

Launched KemTRACE Chromium-OR – an organic-compliant chromium propionate feed ingredient for use in swine, cattle, broiler, and horse diets |

Kemin Industries, Inc.(US) |

|

April 2021 |

Product Launch |

Livestock diet |

Paradigmox Green |

Launched Paradigmox Green, an antioxidant solution for the organic livestock production industry in the EMENA (Europe, Middle East, and North Africa) region. |

Kemin Industries, Inc. (US) |

|

June 2021 |

Product Launch |

Poultry |

ProAct 360 |

Launched ProAct 360, a protease technology for poultry on three key fronts: feed efficiency, affordability, and sustainability. |

Novozymes A/S (Denmark) |

DEALS

|

Month & Year |

APPROACH |

Company 1 |

Company 2 |

Description |

Deal Size |

|

October 2021 |

Partnership |

Cargill, Incorporated (US) |

BASF SE (Germany) |

The partnership will help the companies to produce enzyme products and solutions that reduce nutrient waste, improve feed efficiency, and promote animal growth and wellbeing |

NA |

|

July 2021 |

Acquisition |

Royal DSM N.V. (Netherlands) |

Midori USA, Inc. (US) |

Royal DSM acquired Midori USA. This acquisition helped DSM develop eubiotics to improve the health and environmental impact of animals. |

USD 63 Million |

|

August 2021 |

Acquisition |

Elanco Animal Health Incorporated (US) |

Kindred Biosciences Inc. (US) |

Elanco acquired the outstanding stock of Kindred Biosciences to expand its presence in the pet dermatology market |

USD 440 Million |

|

June 2021 |

Sales Agreement |

Elanco Animal Health |

TriRx Pharmaceuticals (US) |

Elanco entered into an agreement with TriRx Pharmaceuticals for the sale of three company sites located in the UK |

USD 440 Million |

|

February 2021 |

Joint Venture |

Alltech Corporation (US) |

DLG Group (UK) |

Alltech entered into a JV with DLG Group to provide advanced animal nutrition to the Scandinavian market. |

NA |

OTHER DEVELOPMENTS

|

MONTH & Year |

TYPE OF DEVELOPMENT |

COMPANY NAME |

DESCRIPTION |

|

January 2021 |

Expansion |

Kenya |

Cargill along with Heifer International, expand Hatching Hope into Kenya, improving nutrition and livelihoods through sustainable poultry production |

|

August 2020 |

Expansion |

Cargill Incorporated (US) |

Cargill invested USD 6.4 million to expand the food pilot capabilities at its North American Pilot Development Center. |

|

August 2020 |

Expansion |

Cargill, Incorporated (US) |

Cargill invested USD15 million in a new bio-industrial plant in India to enhance milk production to grow farm income and global competitiveness of the Indian dairy sector. |

|

January 2020 |

Expansion |

Cargill, Incorporated (US) |

Cargill expanded its manufacturing plant to complete all production and packaging of its natural immune support products in one facility. |

|

June 2019 |

Expansion |

Royal DSM N.V. (Netherlands) |

BIOMIN, in cooperation with the University of Veterinary Medicine Vienna and BOKU University (Austria), opened a new research laboratory to strengthen and improve the gut health of livestock. |

Frequently Asked Questions (FAQ):

Which are the top industry players in the global Animal Growth Promoters and Performance Enhancers Market?

The top market players in the global Animal Growth Promoters and Performance Enhancers Market include are Cargill, Incorporated (US), Royal DSM N.V. (Netherlands), Elanco Animal Health Incorporated (US), Boehringer Ingelheim Group (Germany), Merck & Co., Inc (US), Alltech Corporation (US), Archer-Daniels-Midland Company (ADM) (US), Vetoquinol S.A. (France), Bupo Animal Health Pty Ltd. (South Africa) and Novus International, Inc. (US).

Which are the segments that have been included in this report?

This report has the following main segments:

In the Animal Growth Promoters and Performance Enhancers Market:

- By Type

- By Animal Type

- By Region

Which geographical region is dominating in the Animal Growth Promoters and Performance Enhancers Market?

The animal growth promoters and performance enhancers market is segmented into six major regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. The Asia Pacific region accounted for the largest market share, followed by North America with a share in 2020. The large share of the Asia Pacific region can be attributed to the strong animal products industry in this region, huge population generating greater domestic meat demand, comparatively relaxed regulatory scenario, and government efforts to encourage animal producers.

Which is the leading segment in the Animal Growth Promoters and Performance Enhancers Market, by Type?

The non-antibiotic growth promoters and performance enhancers segment accounted for the largest share of the animal growth promoters and performance enhancers market in 2020. The large share of this segment can be attributed to the economic benefits of these products, the wide range of substances with applications in different production animals, environmental sustainability, and the increased number of regulations on antibiotics and hormones.

What is the current size of the global Animal Growth Promoters and Performance Enhancers Market?

The animal growth promoters and performance enhancers market was valued at an estimated USD 16.2 billion in 2021 and is projected to reach USD 21.4 billion by 2026, at a CAGR of 5.7% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET SEGMENTATION

FIGURE 2 ANIMAL GROWTH PROMOTERS MARKET, BY REGION

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: ROYAL DSM N.V.

FIGURE 9 SUPPLY SIDE MARKET SIZE ESTIMATION: ANIMAL GROWTH PROMOTERS MARKET (2020)

FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ANIMAL GROWTH PROMOTERS MARKET (2021–2026): IMPACT ON MARKET GROWTH & CAGR

FIGURE 11 CAGR PROJECTIONS

FIGURE 12 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 13 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 14 ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 GEOGRAPHICAL SNAPSHOT OF THE ANIMAL GROWTH PROMOTERS MARKET

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ANIMAL GROWTH PROMOTERS MARKET OVERVIEW

FIGURE 18 CONTINUOUS GROWTH IN THE GLOBAL MEAT DEMAND TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE (2020)

FIGURE 19 NON-ANTIBIOTIC GROWTH PROMOTERS ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 GEOGRAPHICAL SNAPSHOT OF THE ANIMAL GROWTH PROMOTERS MARKET

FIGURE 20 EUROPEAN COUNTRIES TO WITNESS HIGH CAGR DURING THE FORECAST PERIOD

4.4 ANIMAL GROWTH PROMOTERS MARKET: REGIONAL MIX

FIGURE 21 ASIA PACIFIC IS THE LARGEST MARKET FOR ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 ANIMAL GROWTH PROMOTERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in demand and consumption of livestock-based products

TABLE 2 PAST AND PROJECTED TRENDS IN THE CONSUMPTION OF MEAT AND MILK IN DEVELOPED AND DEVELOPING REGIONS

FIGURE 23 ASIA: COUNTRY-LEVEL CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

FIGURE 24 ASIA: COUNTRY-LEVEL PRODUCTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

5.2.1.2 Research for alternatives to antibiotics and hormones and increasing demand for non-antibiotic growth promoters

5.2.1.3 Rise in the global demand for naturally produced growth promoters

5.2.1.4 Rise in awareness about growth promoters

FIGURE 25 US: ANTIBIOTICS SALES (2018)

5.2.1.5 Rise in animal epidemics and climate change

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations restricting the use of antibiotics and hormones for growth promotion in animals

5.2.2.2 Ban on antibiotics in different nations

TABLE 3 BANS ON ANTIBIOTICS AND HORMONES, BY COUNTRY AND YEAR

5.2.3 OPPORTUNITIES

5.2.3.1 Focus on increasing environmental sustainability

5.2.4 CHALLENGES

5.2.4.1 Increasing global feed tonnage and high feed costs leading to the adoption of conventional feeding systems

5.2.4.2 Growing threat of disease transmission to and from agricultural animals

6 INDUSTRY INSIGHTS (Page No. - 64)

6.1 INDUSTRY TRENDS

6.1.1 INVESTMENT TOWARDS NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

TABLE 4 INVESTMENT TOWARDS ANIMAL GROWTH PROMOTERS

6.1.2 GROWING CONSOLIDATION IN THE ANIMAL HEALTH INDUSTRY

TABLE 5 MAJOR ACQUISITIONS IN THE ANIMAL HEALTH INDUSTRY (2017–2019)

6.2 PRICING ANALYSIS

TABLE 6 AVERAGE SELLING PRICE OF ANIMAL GROWTH PROMOTERS

TABLE 7 SIMULATION OF THE ECONOMIC IMPACT OF REMOVING ANTIBIOTIC GROWTH PROMOTERS (AGP)

6.3 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS: ANIMAL GROWTH PROMOTERS MARKET

6.4 ECOSYSTEM MAPPING

FIGURE 27 ECOSYSTEM ANALYSIS: ANIMAL GROWTH PROMOTERS MARKET

6.5 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS: ANIMAL GROWTH PROMOTERS MARKET

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTERS FIVE FORCES ANALYSIS: ANIMAL GROWTH PROMOTERS MARKET (2020)

6.6.1 INTENSITY OF COMPETITIVE RIVALRY

6.6.2 BARGAINING POWER OF SUPPLIERS

6.6.3 BARGAINING POWER OF BUYERS

6.6.4 THREAT OF NEW ENTRANTS

6.6.5 THREAT OF SUBSTITUTES

6.7 REGULATORY ANALYSIS

FIGURE 29 DEVELOPMENT AND APPROVAL PROCESS FOR ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

FIGURE 30 APPROVAL PROCESS FOR ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS IN EUROPE

6.8 PATENT ANALYSIS

6.8.1 PATENT PUBLICATION TRENDS FOR ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

FIGURE 31 GLOBAL PATENT PUBLICATION TRENDS IN THE ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, 2015–2020

6.9 TRADE ANALYSIS

TABLE 9 IMPORT SHIPMENT RELATED TO ANIMAL GROWTH PROMOTERS

6.10 IMPACT OF THE COVID-19 PANDEMIC ON THE ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET

7 ANIMAL GROWTH PROMOTERS MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

TABLE 10 ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2 NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

TABLE 11 NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 PREBIOTICS & PROBIOTICS

7.2.1.1 Prebiotics & probiotics hold the largest share of the market

TABLE 13 PREBIOTIC & PROBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 ACIDIFIERS

7.2.2.1 Regulations on antibiotics and wide applications in different production animals to drive the use of acidifiers

TABLE 14 ACIDIFIER GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3 PHYTOGENICS

7.2.3.1 Natural performance enhancement and antioxidative & disease defense properties to support the use of phytogenics

TABLE 15 PHYTOGENICS GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.4 FEED ENZYMES

7.2.4.1 Feed enzymes segment to benefit from the bans on antibiotics and hormones

TABLE 16 FEED ENZYME GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.5 HORMONES

7.2.5.1 Human health implications and restricted usage due to regulations to hamper the growth of the hormones segment

TABLE 17 HORMONAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.6 OTHER NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

TABLE 18 OTHER NON-ANTIBIOTIC ANIMAL GROWTH PROMOTERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 ANTIBIOTIC GROWTH PROMOTERS

7.3.1 ANTIBIOTIC GROWTH PROMOTERS TO FACE A GRADUAL DECLINE DUE TO UNFAVORABLE REGULATIONS AND BANS

TABLE 19 PERCENTAGE SALES OF ANTIMICROBIAL SUBSTANCES IN THE US (2019)

TABLE 20 ANTIBIOTICS BANS AND REGULATIONS, BY COUNTRY

TABLE 21 ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE (Page No. - 93)

8.1 INTRODUCTION

TABLE 22 ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

8.2 POULTRY

8.2.1 THE POULTRY SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

TABLE 23 IMPORTANT STATISTICS RELATED TO POULTRY MEAT (2020)

TABLE 24 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET FOR POULTRY, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 LIVESTOCK

8.3.1 THE LIVESTOCK SEGMENT TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 25 ANIMAL GROWTH PROMOTERS MARKET FOR LIVESTOCK, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 SWINE

8.4.1 RISING DEMAND FOR PORK MEAT AND THE INCREASING AWARENESS OF AFRICAN SWINE FEVER (ASF) OUTBREAK TO DRIVE THE ADOPTION OF GROWTH PROMOTERS AND PERFORMANCE ENHANCERS

TABLE 26 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET FOR SWINE, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 AQUATIC ANIMALS

8.5.1 GROWING PRODUCTION AND CONSUMPTION OF SEAFOOD TO DRIVE THE DEMAND FOR GROWTH PROMOTERS

TABLE 27 ANIMAL GROWTH PROMOTERS MARKET FOR AQUATIC ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 OTHER ANIMALS

TABLE 28 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET FOR OTHER ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

9 ANIMAL GROWTH PROMOTERS MARKET, BY REGION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC WILL DOMINATE THE ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET DURING THE FORECAST PERIOD

TABLE 29 ANIMAL GROWTH PROMOTERS MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET SNAPSHOT

TABLE 30 ASIA PACIFIC: ANIMAL GROWTH PROMOTERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 31 ASIA PACIFIC: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 32 ASIA PACIFIC: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 33 ASIA PACIFIC: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 China to dominate the APAC ANIMAL GROWTH PROMOTERS MARKET

TABLE 34 CHINA: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 CHINA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 CHINA: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.2.2 INDIA

9.2.2.1 Large livestock population and increased production and export capacities to drive market growth

TABLE 37 INDIA: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 INDIA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 INDIA: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Rising domestic meat demand and government efforts to encourage animal producers to drive the demand for growth promoters in Japan

TABLE 40 JAPAN: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 JAPAN: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 42 JAPAN: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.2.4 AUSTRALIA

9.2.4.1 Large cattle population and heavy meat exports to support the market in Australia

TABLE 43 AUSTRALIA: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 AUSTRALIA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 AUSTRALIA: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.2.5 REST OF ASIA PACIFIC

9.2.5.1 Lack of a defined regulatory scenario to result in the wide use of antibiotic growth promoters in the RoAPAC

TABLE 46 REGULATORY SCENARIO FOR ANTIBIOTICS IN THE ROAPAC, BY COUNTRY

TABLE 47 ROAPAC: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 ROAPAC: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 ROAPAC: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

TABLE 50 NORTH AMERICA: ANIMAL GROWTH PROMOTERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 Increasing meat consumption to drive the market in the US

FIGURE 34 US: GROWTH IN BEEF CONSUMPTION, 2014–2019 (BILLION POUNDS)

TABLE 54 US: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 US: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 US: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Production and export of meat and aquaculture in Canada to drive the market growth

TABLE 57 BEEF AND VEAL EXPORTS BY CANADA BETWEEN OCTOBER 2018 AND OCTOBER 2019

TABLE 58 CANADA: ANIMAL GROWTH PROMOTERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 CANADA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 CANADA: ANIMAL GROWTH PROMOTERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 35 EUROPE: ANIMAL GROWTH PROMOTERS MARKET SNAPSHOT

TABLE 61 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.4.1 UK

9.4.1.1 Preventive measures to avoid the risk of zoonotic diseases to drive the market in the UK

TABLE 65 UK: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 UK: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 UK: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.4.2 GERMANY

9.4.2.1 Increasing veterinary visits and growing healthcare expenditure to boost the growth of the market in Germany

FIGURE 36 SALES SURVEILLANCE OF ANTIMICROBIALS FOR VETERINARY USE IN GERMANY (2011 TO 2018)

TABLE 68 GERMANY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 GERMANY: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.4.3 SWITZERLAND

9.4.3.1 Increasing milk demand to drive the market in Switzerland

TABLE 71 SWITZERLAND: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 SWITZERLAND: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 SWITZERLAND: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.4.4 RUSSIA

9.4.4.1 Russia to hold the largest share of the European market due to its large poultry production

TABLE 74 RUSSIA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 RUSSIA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 RUSSIA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.4.5 REST OF EUROPE

9.4.5.1 Technological advancements and the strong trade industry to support the RoE market

TABLE 77 ROE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 ROE: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 ROE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

TABLE 80 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 81 LATIN AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 LATIN AMERICA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 LATIN AMERICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Brazil to dominate the Latin American market for animal growth promoters and performance enhancers

TABLE 84 BRAZIL: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 BRAZIL: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 BRAZIL: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.5.2 REST OF LATIN AMERICA

9.5.2.1 Strong demand for animal products and support initiatives to help the market in the RoLA

TABLE 87 ROLA: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 ROLA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 ROLA: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST

9.6.1 INCREASING DEMAND FOR CHICKEN AND SEAFOOD TO CONTRIBUTE TO MARKET GROWTH IN THE MIDDLE EAST

TABLE 90 MIDDLE EAST: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 MIDDLE EAST: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 MIDDLE EAST: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

9.7 AFRICA

9.7.1 RELIANCE ON CONVENTIONAL LIVESTOCK PRODUCTION PRACTICES TO HAMPER THE MARKET GROWTH IN AFRICA

TABLE 93 AFRICA: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 AFRICA: NON-ANTIBIOTIC GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 AFRICA: ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 144)

10.1 INTRODUCTION

FIGURE 37 KEY MARKET DEVELOPMENTS (JANUARY 2018 TO AUGUST 2021)

10.2 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS OPERATING IN THE ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET

10.3 MARKET SHARE ANALYSIS

FIGURE 39 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET SHARE, BY KEY PLAYER, 2020

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES

TABLE 96 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET: PRODUCT LAUNCHES (JANUARY 2018 TO AUGUST 2021)

10.4.2 DEALS

TABLE 97 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET: DEALS (JANUARY 2018 TO AUGUST 2021)

10.4.3 OTHER DEVELOPMENTS

TABLE 98 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET: OTHER DEVELOPMENTS (JANUARY 2018 TO AUGUST 2021)

10.5 COMPETITIVE BENCHMARKING

10.5.1 COMPANY FOOTPRINT FOR KEY PLAYERS

10.5.2 PRODUCT TYPE FOOTPRINT OF COMPANIES

10.5.3 ANIMAL TYPE FOOTPRINT OF COMPANIES

10.5.4 REGIONAL FOOTPRINT OF COMPANIES

10.6 GEOGRAPHIC FOOTPRINT OF COMPANIES

10.6.1 GEOGRAPHIC REVENUE MIX: KEY PLAYERS

10.7 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET: R&D EXPENDITURE

10.7.1 R&D EXPENDITURE OF KEY PLAYERS IN THE ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET (2019 VS. 2020)

10.8 COMPANY EVALUATION MATRIX

10.8.1 STARS

10.8.2 EMERGING LEADERS

10.8.3 PERVASIVE PLAYERS

10.8.4 EMERGING COMPANIES

FIGURE 40 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET: GLOBAL COMPANY EVALUATION MATRIX

10.9 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

10.9.1 PROGRESSIVE COMPANIES

10.9.2 STARTING BLOCKS

10.9.3 RESPONSIVE COMPANIES

10.9.4 DYNAMIC COMPANIES

FIGURE 41 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET: COMPANY EVALUATION MATRIX FOR SMES/START-UPS

11 COMPANY PROFILES (Page No. - 160)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 CARGILL, INCORPORATED

TABLE 99 CARGILL, INCORPORATED: BUSINESS OVERVIEW

11.1.2 ROYAL DSM N.V.

TABLE 100 ROYAL DSM N.V.: BUSINESS OVERVIEW

FIGURE 42 COMPANY SNAPSHOT: ROYAL DSM N.V. (2020)

11.1.3 ELANCO ANIMAL HEALTH INCORPORATED

TABLE 101 ELANCO ANIMAL HEALTH INCORPORATED: BUSINESS OVERVIEW

FIGURE 43 COMPANY SNAPSHOT: ELANCO ANIMAL HEALTH INCORPORATED (2020)

11.1.4 BOEHRINGER INGELHEIM GROUP

TABLE 102 BOEHRINGER INGELHEIM GROUP: BUSINESS OVERVIEW

FIGURE 44 COMPANY SNAPSHOT: BOEHRINGER INGELHEIM GROUP (2020)

11.1.5 MERCK & CO., INC.

TABLE 103 MERCK & CO., INC.: BUSINESS OVERVIEW

FIGURE 45 COMPANY SNAPSHOT: MERCK & CO., INC. (2020)

11.1.6 ARCHER-DANIELS-MIDLAND COMPANY (ADM)

TABLE 104 ARCHER-DANIELS-MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 46 COMPANY SNAPSHOT: ARCHER-DANIELS-MIDLAND COMPANY (2020)

11.1.7 BLUESTAR ADISSEO COMPANY

TABLE 105 BLUESTAR ADISSEO COMPANY: BUSINESS OVERVIEW

FIGURE 47 COMPANY SNAPSHOT: BLUESTAR ADISSEO COMPANY (2020)

11.1.8 ALLTECH CORPORATION

TABLE 106 ALLTECH CORPORATION: BUSINESS OVERVIEW

11.1.9 EVONIK INDUSTRIES AG

TABLE 107 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

FIGURE 48 COMPANY SNAPSHOT: EVONIK INDUSTRIES AG (2020)

11.1.10 VETOQUINOL S.A.

TABLE 108 VETOQUINOL S.A.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 BUPO ANIMAL HEALTH PTY LTD.

TABLE 109 BUPO ANIMAL HEALTH PTY LTD: BUSINESS OVERVIEW

11.2.2 NOVUS INTERNATIONAL, INC.

TABLE 110 NOVUS INTERNATIONAL, INC.: BUSINESS OVERVIEW

11.2.3 ASSOCIATED BRITISH FOODS PLC

TABLE 111 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 49 COMPANY SNAPSHOT: ASSOCIATED BRITISH FOODS PLC (2020)

11.2.4 ERBER AG

TABLE 112 ERBER AG: BUSINESS OVERVIEW

11.2.5 PHIBRO ANIMAL HEALTH CORPORATION

TABLE 113 PHIBRO ANIMAL HEALTH CORPORATION: BUSINESS OVERVIEW

FIGURE 50 COMPANY SNAPSHOT: PHIBRO ANIMAL HEALTH CORPORATION (2020)

11.2.6 KEMIN INDUSTRIES, INC.

TABLE 114 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

11.2.7 ZOETIS INC.

TABLE 115 ZOETIS INC.: BUSINESS OVERVIEW

FIGURE 51 COMPANY SNAPSHOT: ZOETIS INC. (2020)

11.2.8 NUTRECO N.V. (A WHOLLY-OWNED SUBSIDIARY OF SHV GROUP)

TABLE 116 NUTRECO N.V.: BUSINESS OVERVIEW

FIGURE 52 COMPANY SNAPSHOT: SHV GROUP (2020)

11.2.9 NOVOZYMES A/S

TABLE 117 NOVOZYMES A/S.: BUSINESS OVERVIEW

FIGURE 53 COMPANY SNAPSHOT: NOVOZYMES A/S (2020)

11.2.10 BASF SE

TABLE 118 BASF SE: BUSINESS OVERVIEW

FIGURE 54 COMPANY SNAPSHOT: BASF SE (2020)

11.2.11 LAND O’LAKES, INC.

11.2.12 CHR. HANSEN A/S

11.2.13 BIOMIN HOLDING GMBH

11.2.14 GUANGDONG VTR BIO-TECH CO., LTD.

11.2.15 LALLEMAND INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 237)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

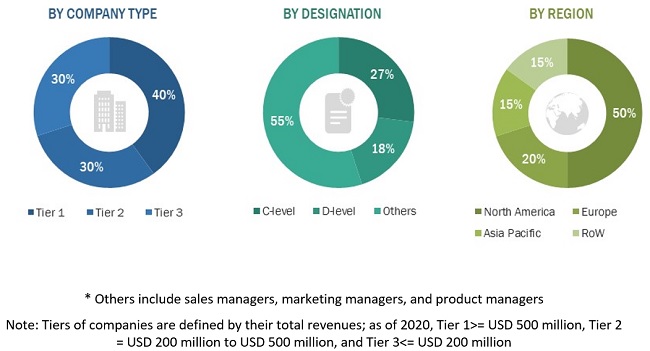

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the animal growth promoters and performance enhancers market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The animal growth promoters and performance enhancers market comprises several stakeholders such as animal growth promoters and performance enhancers manufacturers and distributors and regulatory organizations. The demand side of this market is characterized by Veterinary hospitals & clinics and animal farms.

Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents for animal growth promoters and performance enhancers market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Animal Growth Promoters Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, by animal type, and by region).

Data Triangulation

After arriving at the market size, the total animal growth promoters and performance enhancers market was divided into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the animal growth promoters and performance enhancers market on the basis of product, application, end user and region.

- To provide detailed information on the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market segments with respect to North America, Europe, Asia Pacific, Latin America and Middle East and Africa.

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, partnerships, acquisitions and other developments in the market.

- To benchmark players within the animal growth promoters and performance enhancers market using the Competitive Leadership Mapping framework which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Antibiotic Growth Promoters And Performance Enhancers market into South Korea, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Growth Promoters and Performance Enhancers Market