Blood Meal Market by Source (Poultry, Porcine, and Ruminant), Application (Poultry Feed, Porcine Feed, Ruminant Feed, and Aquafeed), Process (Solar Drying, Drum Drying, Ring & Flash Drying, and Spray Drying), and Region - Global Forecast to 2025

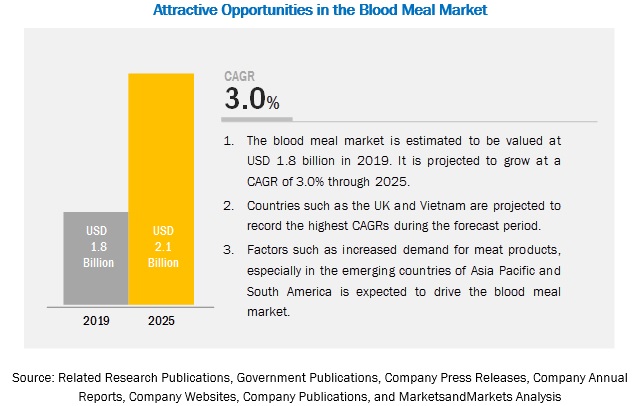

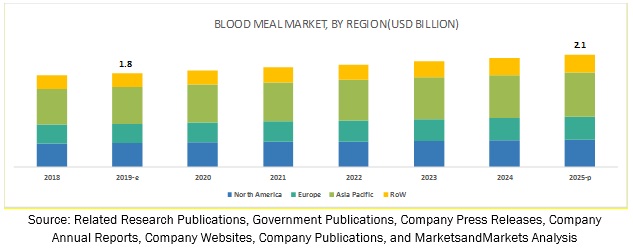

[110 Pages Report] The blood meal market is estimated to account for a value of USD 1.8 billion in 2019 and is projected to grow at a CAGR of 3.0% from 2019, to reach a value of USD 2.1 billion by 2025. The rise in disposable incomes, urbanization, and increased demand for animal proteins in the Asia Pacific countries is projected to drive the blood meal market in the coming years. In addition, increasing consumption of livestock products such as meat, eggs, and milk in the US, is projected to drive the blood meal market in North America.

By application, the poultry blood segment is projected to dominate the blood meal market during the forecast period.

The blood meal market, on the basis of application, is subsegmented into porcine feed, poultry feed, ruminant feed, and aqua feed. The demand for poultry products remains high in emerging countries of the Asia Pacific, resulting in the slaughter of animals. Thus, a large amount of blood is released from animals, creating opportunities for blood meal manufacturers. In addition, the rise in the consumption of poultry products in this region due to the increased demand for protein-rich foods is projected to drive the blood meal market in the coming years.

By source, the poultry blood segment is projected to dominate the blood meal market during the forecast period.

The poultry blood segment is estimated to account for the largest share in the blood meal market in 2019. Poultry blood is the most preferred raw material, which is used to produce blood meal due to its high amino acid content, particularly Lysine. Majority of the key players such as Boyer Valley (US), Valley Proteins Inc. (US), TerraMar Ingredients LLC (Chile), and FASA Group (Brazil) offer blood meal products that are made up of poultry blood meal.

The expansion of the feed industry due to the rise in population is projected to drive the blood meal market in Asia Pacific

The Asia Pacific blood meal market is driven by the increase in disposable incomes, rise in urbanization, and expansion of the feed industry. The Asia Pacific region witnesses the presence of major revenue generating countries such as China and Vietnam. These countries witness high consumption of meat products such as pork and are ranked among the largest producers of feed at a global level. These factors are projected to drive the blood mal market in the coming years in the region.

Key Market Players

Key players identified in this market include Darling Ingredients Inc (US), Terramar (Chile), Valley proteins Inc. (US), West Coast Reduction Ltd. (US), and Allana Group (India). These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Source, Application, and Region |

|

Geographies covered |

North America, Europe, the Asia Pacific, and Rest of World (RoW) |

|

Companies covered |

Darling Ingredients (US), Terramar (Chile), West Coast Reduction Ltd. (US), Valley Proteins, Inc. (US), Ridley Corporation Australia), Allana Group (India), Boyer Valley (US), FASA Group (Brazil), Sanimax (Canada), APC, Inc. (US), and Apelsa Guadalajara, S.A. de C.V (Mexico)

|

This research report categorizes the blood meal market based on source, application, and region.

On the basis of Source, the blood meal market has been segmented as follows:

- Porcine blood

- Poultry blood

- Ruminant blood

- On the basis of application, the blood meal market has been segmented as follows:

- Poultry feed

- Porcine feed

- Ruminant feed

- Aquafeed

On the basis of Region the blood meal market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)

Key questions addressed by the report

- What are the new application areas for blood meal that companies are exploring?

- Which are the key players in the blood meal market and how intense is the competition?

- What kind of competitors and stakeholders such as blood meal companies, would be interested in this market? What will be their go-to-market strategy for this market, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the blood meal market projected to create a disrupting environment in the coming years?

- What will be the level of impact on the revenues of stakeholders due to the benefits of blood meal to different stakeholders??from rising revenue, environmental regulatory compliance, to sustainable profits for the suppliers?

Frequently Asked Questions (FAQ):

What is the leading application in the blood meal market?

The poultry feed segment was the highest revenue contributor to the market, with USD 782.5 million in 2018, and is estimated to reach USD 934.3 million by 2025, with a CAGR of 2.6%.

What is the estimated industry size of blood meal?

The global blood meal market was valued at USD 1,738.8 million in 2018, and is projected to reach USD 2,128.2 million by 2025, registering a CAGR of 3.0% from 2019 to 2025.

What is the leading source in the blood meal market?

The poultry blood segment was the highest revenue contributor to the market, with USD 717.8 million in 2018, and is estimated to reach USD 871.5 million by 2025, with a CAGR of 2.9%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Units Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Blood Meal Market

4.2 Blood Meal Market, By Region

4.3 Blood Meal Market, By Source

4.4 Asia Pacific: Blood Meal Market, By Source & Country

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Regulations

5.2.1 South Africa

5.2.2 Japan

5.2.3 Feed Regulation on Bse Prevention in Japan

5.3 Fao

5.3.1 “Animal Proteins Prohibited From Use in Ruminant Feed,” Title 21, Code of Federal Regulations, Part 589.2000, Effective Date: August 4, 1997

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Demand for Meat Products in Developing Countries

5.4.1.2 Growth in Feed Production

5.4.1.3 Increase in Demand for Aquaculture Products

5.4.2 Restraints

5.4.2.1 Rising Operational and Raw Material Costs

5.4.2.2 Stringent Regulatory Framework

5.4.3 Opportunities

5.4.3.1 Increase in Demand for Nutritional Supplements for Monogastric Animals

5.4.4 Challenges

5.4.4.1 Quality of Feed Additive Products Manufactured By Asian Companies

6 Blood Meal Market, By Source (Page No. - 40)

6.1 Introduction

6.2 Porcine Blood

6.2.1 Porcine Blood Meal is Expected to Experience Notable Demand in the Coming Years, Owing to Its Health Benefits

6.3 Poultry Blood

6.3.1 The Increasing Demand for Poultry Meat and Eggs is Expected to Drive the Market for Poultry Blood Meal

6.4 Ruminant Blood

6.4.1 Rising Trend of On-Farm Blood Mixing By Small Farmers, Millers, and Livestock Manufacturers for Providing Specific Nutrients to Animals Required Quantities is Driving the Demand of Ruminant Blood

7 Blood Meal Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Porcine Feed

7.2.1 Blood Meal is High in Crude Protein and is Commonly Used as A Protein Source in Diets for Porcine

7.3 Poultry Feed

7.3.1 Growing Concerns About Animal Health and Consumer Preferences for A Specific Color of Yolk and Meat Have Led to Increasing Demand for Blood Meal

7.4 Ruminant Feed

7.4.1 The Addition of Blood Meal Not Only Increases the Production of End-Products Obtained From Ruminants But Also Improves Their Health and Immune Systems

7.5 Aqua Feed

7.5.1 With the Increasing Consumption of Fish and Fish-Based Products Globally, the Demand for Blood Meal in the Aquatic Animals Segment Remains High

8 Blood Meal Market, By Process (Page No. - 55)

8.1 Introduction

8.1.1 Solar Drying

8.1.2 Drum Drying

8.1.3 Ring and Flash Drying

8.1.4 Spray Drying

9 Blood Meal Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Consumption of Livestock Products Such as Meat, Eggs, and Milk as A Source of Energy

9.2.2 Canada

9.2.2.1 Export of Pork and Other Meat Products to Drive Domestic Slaughter

9.2.3 Mexico

9.2.3.1 Increased Demand for Meat and Pork Products in the Country

9.3 Europe

9.3.1 Germany

9.3.1.1 The Country Houses 330 Feed Mills, With A Feed Production of Over 27 Million Tons Annually

9.3.2 UK

9.3.2.1 The Country is Expected to Maintain A Higher Growth Rate for Blood Meal Owing to Increased Demand for Nutritional Livestock Feed, Growth in Focus on Livestock Welfare, and Adoption of Advanced Feed Manufacturing Systems

9.3.3 France

9.3.3.1 France is One of the Major Contributors for Feed in the EU Region, With Over 300 Feed Mills in the Country Resulting in A Feed Production of Over 25 Million Tons

9.3.4 Spain

9.3.4.1 The Continual Increase in the Demand for Meat and Dairy Products has Encouraged Manufacturers to Produce Better Quality, and Nutritious Livestock Feed Products Incorporating Blood Meal

9.3.5 Italy

9.3.5.1 According to Association of Poultry Processors and Poultry Trade in the EU (AVEC), Italy Stood Sixth in the Production of Poultry Meat in the Region

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Wide Consumption of Pork in the Chinese Market

9.4.2 Vietnam

9.4.2.1 Consumers in the Country are Shifting Toward Animal Protein Sources Owing to the Increase in Income Levels

9.4.3 Philippines

9.4.3.1 Increased Demand for Poultry Products

9.4.4 Australia & New Zealand

9.4.4.1 Increase in Pork Consumption

9.4.5 Rest of Asia Pacific

9.4.5.1 Presence of New Revenue Pocket Countries

9.5 Rest of the World (RoW)

9.5.1 South America

9.5.1.1 Brazil and Argentina are Among the Top Five Beef Producers and Exporters

9.5.2 Middle East & Africa

9.5.2.1 Increase in Demand for Meat Products

10 Competitive Landscape (Page No. - 87)

10.1 Overview

10.2 Competitive Landscape Mapping, 2017

10.2.1 Dynamic Differentiators

10.2.2 Innovators

10.2.3 Visionary Leaders

10.2.4 Emerging Companies

10.3 Ranking of Key Players in the Blood Meal Market

11 Company Profiles (Page No. - 90)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Darling Ingredients

11.2 Terramar

11.3 West Coast Reduction Ltd.

11.4 Valley Proteins Inc.

11.5 Ridley Corporation Limited

11.6 Allanasons Pvt Ltd

11.7 The Boyer Valley Company

11.8 FASA Group

11.9 Sanimax

11.10 APC, Inc.

11.11 Apelsa Guadalajara

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 102)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (59 Tables)

Table 1 Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 2 Blood Meal Market Size, By Source, 2017–2025 (KT)

Table 3 Porcine Blood Market Size, By Region, 2017–2025 (USD Million)

Table 4 Porcine Blood Market Size, By Region, 2017–2025 (KT)

Table 5 Poultry Blood Market Size, By Region, 2017–2025 (USD Million)

Table 6 Poultry Blood Market Size, By Region, 2017–2025 (KT)

Table 7 Ruminant Blood Market Size, By Region, 2017–2025 (USD Million)

Table 8 Ruminant Blood Market Size, By Region, 2017–2025 (KT)

Table 9 Global Blood Meal Market Size, By Application, 2017-2025 (USD Million)

Table 10 Global Blood Meal Market Size, By Application, 2017-2025 (KT)

Table 11 Porcine Feed: Blood Meal Market Size, By Region, 2017-2025 (USD Million)

Table 12 Porcine Feed: Blood Meal Market Size, By Region, 2017-2025 (KT)

Table 13 Poultry Feed: Blood Meal Market Size, By Region, 2017-2025 (USD Million)

Table 14 Poultry Feed: Blood Meal Market Size, By Region, 2017-2025 (KT)

Table 15 Ruminant Feed: Blood Meal Market Size, By Region, 2017-2025 (USD Million)

Table 16 Ruminant Feed: Blood Meal Market Size, By Region, 2017-2025 (KT)

Table 17 Aqua Feed: Blood Meal Market Size, By Region, 2017-2025 (USD Million)

Table 18 Aqua Feed: Blood Meal Market Size, By Region, 2017-2025 (KT)

Table 19 Blood Meal Market Size, By Region, 2017–2025 (USD Million)

Table 20 Blood Meal Market Size, By Region, 2017–2025 (KT)

Table 21 North America: Blood Meal Feed Market Size, By Country, 2017–2025 (USD Million)

Table 22 North America: Blood Meal Market Size, By Country, 2017–2025 (KT)

Table 23 North America: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 24 North America: Blood Meal Market Size, By Source, 2017–2025 (KT)

Table 25 North America: Blood Meal Market Size, By Application, 2017–2025 (USD Million)

Table 26 North America: Blood Meal Market Size, By Application, 2017–2025 (KT)

Table 27 US: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 28 Canada: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 29 Mexico: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 30 Europe: Blood Meal Market Size, By Country, 2017–2025 (USD Million)

Table 31 Europe: Blood Meal Market Size, By Country, 2017–2025 (KT)

Table 32 Europe: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 33 Europe: Blood Meal Market Size, By Application, 2017–2025 (USD Million)

Table 34 Europe: Market Size, By Application, 2017–2025 (KT)

Table 35 Germany: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 36 UK: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 37 France: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 38 Spain: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 39 Italy: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 40 Rest of Europe: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 41 Asia Pacific: Blood Meal Market Size, By Country/Region, 2017–2025 (USD Million)

Table 42 Asia Pacific: Blood Meal Market Size, By Country/Region, 2017–2025 (KT)

Table 43 Asia Pacific: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 44 Asia Pacific: Blood Meal Market Size, By Source, 2017–2025 (KT)

Table 45 Asia Pacific: Blood Meal Market Size, By Application, 2017–2025 (USD Million)

Table 46 Asia Pacific: Blood Meal Market Size, By Application, 2017–2025 (KT)

Table 47 China: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 48 Vietnam: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 49 Philippines: Blood Market Size, By Source, 2017–2025 (USD Million)

Table 50 Australia & New Zealand: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 51 Rest of Asia Pacific: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 52 RoW: Blood Meal Market Size, By Region, 2017–2025 (USD Million)

Table 53 RoW: Blood Meal Market Size, By Region, 2017–2025 (KT)

Table 54 RoW: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 55 RoW: Blood Meal Market Size, By Source, 2017–2025 (KT)

Table 56 RoW: Blood Meal Market Size, By Application, 2017–2025 (USD Million)

Table 57 RoW: Blood Meal Market Size, By Application, 2017–2025 (KT)

Table 58 South America: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

Table 59 Middle East & Africa: Blood Meal Market Size, By Source, 2017–2025 (USD Million)

List of Figures (31 Figures)

Figure 1 Blood Meal Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Blood Meal Market: Research Design

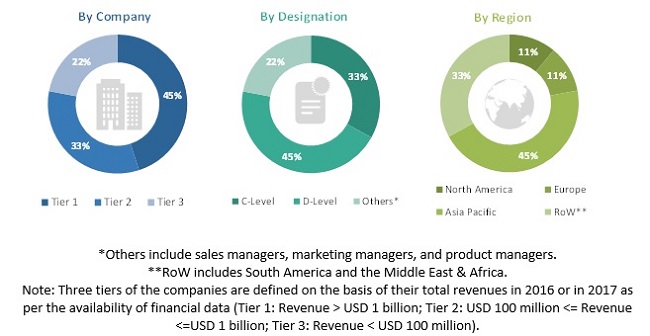

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Research Methodology Flow

Figure 8 Data Triangulation Methodology

Figure 9 Blood Meal Market Snapshot, 2017–2025 (USD Million)

Figure 10 Poultry Blood Segment, By Source, to Dominate the Blood Meal Market Throughout 2025, in Terms of Value

Figure 11 Poultry Feed Segment, By Application, to Dominate the Blood Meal Market Through 2025, in Terms of Value

Figure 12 Blood Meal Market Share and Growth (By Value), By Region, 2018

Figure 13 Growth in Demand for Meat and Meat Products to Drive the Blood Meal Market

Figure 14 Asia Pacific to Dominate the Blood Meal Market From 2019 to 2025

Figure 15 The Poultry Blood Segment is Estimated to Be the Largest Segment of the Blood Meal Market From 2019 to 2025

Figure 16 The Porcine Blood Segment Accounted for the Largest Share of the Asia Pacific Blood Meal Market in 2018

Figure 17 China, Canada, and India are Projected to Grow at the Highest Rates During the Forecast Period

Figure 18 Blood Meal Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Global Feed Production, 2012–2016, By Volume

Figure 20 Poultry Blood Segment, By Source, 2019 vs 2025 (USD Million)

Figure 21 Poultry Feed Segment to Dominate the Blood Meal Market in 2025

Figure 22 China Held the Largest Market Share in the Blood Meal Market During the Forecast Period

Figure 23 North America: Blood Meal Snapshot

Figure 24 Europe: Blood Meal Market Snapshot

Figure 25 Asia Pacific: Blood Meal Market Snapshot

Figure 26 Domestic Consumption of Pork in China, 2014–2018 (1000 Metric Tons)

Figure 27 Animal Feed Industry, Vietnam, 2012–2020, (Tons)

Figure 28 South America: Feed Production, By Species, 2016 (KT)

Figure 29 Blood Meal Market, Competitive Leadership Mapping, 2018

Figure 30 Blood Meal Market Ranking, By Key Player 2018

Figure 31 Darling INGR

The study involves four major activities to estimate the current market size for blood meal. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The blood meal market comprises several stakeholders such as blood meal manufacturers, feed manufacturers, and end-use industries such as feed processors, fish culture industries, livestock producers, the agriculture sector, government & research organizations, associations, and industry bodies. The demand-side of this market is characterized by the rising demand for animal protein sources. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the blood meal market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology was used to estimate the market size, which includes the following:

Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through the primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the feed industry.

Report Objectives

- To define, segment, and project the global market size for blood meal

- To understand the structure of the blood meal market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to, individual growth trends, future prospects, and their contribution to the total blood meal market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Further segmentation of applications of blood meal

Regional Analysis

- Further breakdown of the Rest of Asia Pacific blood meal market, by country

- Further breakdown of other Rest of Europe blood meals market, by key country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Blood Meal Market