Fatty Alcohols Market by Type (Short Chain, Pure and Mid Cut, Long Chain, Higher Chain), Application (Industrial & Domestic Cleaning, Personal Care, Plasticizers, Lubricants, Food & Nutrition), and by Region - Global Forecast to 2025

Updated on : June 18, 2024

Fatty Alcohols Market

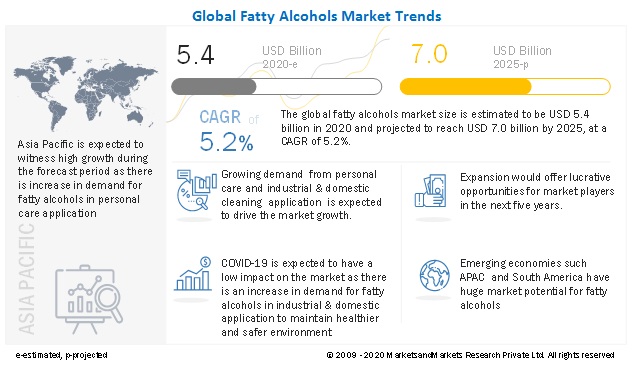

The global fatty alcohols market was valued at USD 5.4 billion in 2020 and is projected to reach USD 7.0 billion by 2025, growing at 5.2% cagr from 2020 to 2025. The driving factors for the market is its growing demand from personal care and industrial & domestic application.

COVID-19 Impact on the Fatty Alcohols Market

The global fatty alcohols market includes major Tier I and II suppliers like Wilmar International Ltd., Kuala Lumpur Kepong Berhad, Musim Mas Holdings, Godrej Industries Limited, and Procter & Gamble. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for fatty alcohols is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

Fatty Alcohols Market Dynamics

Driver: Increased demand for fatty alcohols in the home & personal care industry

Market penetration of natural fatty alcohols has risen in surfactant-based industries, such as personal care & cosmetics and soaps & detergents. Due to the COVID-19 outbreak, there is increased awareness regarding the use of home care and personal care products. The demand for surfactant-based products, such as detergents and washing soaps, has risen significantly. The demand for soaps, hand sanitizers, and other personal care products is increasing as a precautionary measure against the spread of coronavirus.

Fatty alcohols are basic precursors for the production of surfactants, which are produced from fatty alcohol ethoxylates and sulfates. Fatty alcohol ethoxylates are non-ionic surfactants that are widely consumed in detergents used for domestic and industrial applications. Ethoxylates are products formed from the ethoxylation process. In this process, natural or synthetic fatty alcohol groups, such as stearyl alcohol, oleyl alcohols, and lauryl alcohols, react with ethylene oxide to form ethoxylates. All these fatty alcohol products differ in physical properties in terms of cloud point, density, viscosity, and flashpoint, which depend on the degree of the ethoxylation process from which they are derived.

Fatty alcohol-based surfactants are used as cleaning and wetting agents in the agriculture, cosmetics, and pulp & paper industries. The main application of these fatty alcohol surfactants in the textile and cosmetic industries is as a solubilizing and emulsifying agent. These alcohol surfactants are used as lipophilic solubilizes in the pharmaceutical industry for lotions & ointments. These functions and properties of fatty alcohols are expected to drive their demand in the homecare and personal care industry.

Restraint: Surplus production of fatty alcohols leading to oversupply

Earlier, due to stringent regulations in developed countries, such as Japan, the US, and Germany, many manufacturers started the production of fatty alcohols to promote the use of environmentally friendly products. This resulted in large-scale manufacturing of oleochemicals in ASEAN countries, such as Malaysia, Singapore, and Indonesia, which used natural raw materials such as vegetable oil and fats to synthesize fatty alcohols. Easy and abundant availability of raw materials and numerous manufacturing facilities further augmented the production. This prompted regions, such as North America and Europe, to import the naturally-derived fatty alcohols on a large scale.

The forward integration of palm plantation players in fatty alcohol production and into the surfactants business resulted in the setting up of their manufacturing facilities, which led to an oversupply of fatty alcohols. The decline in prices of conventional petrochemical-based raw materials of fatty alcohols worsened the situation. Further, fluctuation in Crude Palm Kernel Oil (CPKO) prices – a key raw material used in the production of natural fatty alcohols – made consumers switch to alternative, low-cost, synthetically-derived fatty alcohol, leading to over-saturation of fatty alcohols. Therefore, the oversupply of fatty alcohols is expected to act as a restraining factor for the market growth of the fatty alcohols during the forecast period.

Opportunity: Increase in demand for bio-based and renewable resources-based products

Changing consumer preferences are observed to drive the demand for bio-based chemicals. Consumer awareness regarding the impact of hazardous petroleum-based products on the environment has increased exponentially over the past decade. Growing environmental concerns are encouraging consumers to use eco-friendly products. Such factors are impelling chemical manufacturers to use bio-based raw materials to manufacture their products.

Oleo-based fatty alcohols are recyclable and less toxic as compared to their conventional petroleum-based substitutes. They are preferred for producing personal care ingredients. These fatty alcohols reduce skin irritation and respiration problems and are the preferred choice in the pharmaceutical & personal care industries. Such attributes of natural fatty alcohols provide opportunities for producers to gain high-profit margins. Regulations from government agencies, such as REACH, related to environmental concerns associated with petrochemical-based products, are expected to support the market trend for the use of naturally-derived fatty alcohols.

Challenges: Fluctuating raw material prices

The major raw materials used for manufacturing fatty alcohols are palm oil, PK oil, tallow, and rapeseed oil, among others. Regions such as North America and Europe import these raw materials from APAC, as the latter’s geographic conditions support the production of raw materials for fatty alcohols. Due to this, prices may fluctuate often depending on the trading scenario between these regions.

In 2020, due to the COVID-19 pandemic across the globe, the prices of palm oil have dropped significantly. Due to the disruption in the global supply chain and lockdown condition in many Asian countries, there is a significant drop in the production of palm oil. In February 2020, Indonesia’s palm oil exports fell by 12% to 2.54 million tons compared to the previous year. Palm oil exports from Malaysia, the world’s second-largest palm oil producer, fell to 8.90 million tons, a 41.7% decrease compared to the previous year. China and India are the largest importers of palm oil. Due to the COVID-19 outbreak in China, the demand for palm oil has reduced significantly. Also, due to import restrictions placed on refined palm oil in India, the supply is reduced significantly. Thus, fluctuating prices of raw materials directly affect the final prices of fatty alcohols, acting as a major restraint for market growth.

Fatty Alcohols Market Ecosystem

By type, the pure and mid-cut segment is expected to be the largest market during the forecast period

The pure and mid-cut segment accounted for the larger share of the market during the forecast period. The market growth in this segment is attributed to their extensive use in manufacturing Sodium Laureth Sulfate (SLS) and Sodium Lauryl Ether Sulfate (SLES), which are present in various personal care products such as soaps, shampoos, toothpaste, and others. These factors are expected to increase demand during the forecast period.

By application, industrial & domestic cleaning segment is expected to be the largest market over the forecast period

The industrial & domestic cleaning segment is growing rapidly owing to improved standards of living and an increase in the purchasing power parity of low-income groups in emerging economies such as APAC. Furthermore, the demand for industrial & domestic cleaning is increasing as it uses fatty alcohols as a foam controller, emollient, antistatic agent, and a pacifier in powders and liquid products, to maintain a healthier and safer environment. The factors mentioned above are expected to drive demand during the forecast period.

APAC is estimated to account for the largest market share in the fatty alcohols market.

APAC is the largest and fastest-growing fatty alcohols market, owing to its increasing usage in various end-use applications, such as personal care and industrial & domestic cleaning application. The increase in demand is because of the growing population, rising disposable income, and economic growth in China, South Korea, and Taiwan. These factors are expected to fuel the demand for fatty alcohiols in the region during the forecast period.

Fatty Alcohols Market Players

Fatty alcohols is a diversified and competitive market with a large number of global players and few regional and local players. Wilmar International Ltd. (Singapore), Kao Corporation (Japan), Kuala Lumpur Kepong Berhad (Malaysia), Musim Mas Holdings (Singapore), Godrej Industries Limited (India), Procter & Gamble (US), VVF L.L.C. (India), Sasol (South Africa), Emery Oleo Chemicals (Malaysia), and Royal Dutch Shell Plc. (Netherlands) are some of the key players in the market.

Fatty Alcohols Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (Kiloton) |

|

Segments covered |

By Application, By Type, & By Region |

Fatty Alcohols Market by Type

- Short Chain

- Pure and Mid Cut

- Long Chain

- Higher Chain

Fatty Alcohols Market by Application

- Industrial & Domestic Cleaning

- Personal Care

- Plasticizers

- Lubricants

- Pharmaceutical Formulation

- Food & Nutrition

- Others

Fatty Alcohols Market by Region

- North America

- Asia Pacific

- Western Europe

- Central & Eastern Europe

- South America

- Middle East and Africa

Recent Developments

- In June 2019, Sasol started a new alkoxylation plant in Nanjing, Jiangsu Province, China. The new production unit is expected to revolutionize and expand the company’s current alkoxylation capacity, R&D facility, and technical support capability in Nanjing. This expansion is expected to help the company strengthen its position in China and meet the country’s growing demand for specialty chemicals. The project is expected to either use branched or linear alcohols to meet customer requirements in applications such as detergent, metalworking & lubrication, personal care, and others.

- In May 2019, Kao Corporation completed a joint venture with Apical Group, one of the largest exporter of palm oil in Indonesia. A new factory, PT Apical Kao Chemical, will increase the production capacity of oleochemicals and strengthen its supply chain in Southeast Asia. This development will help the company in strengthening its position in the Asia-Pacific region.

- In October 2017, Kuala Lumpur Kepong Berhad announced that the company opened a research and development center, along with a reactor specialty ester plant, in Klang, Selangor. This R&D facility will enable the company to develop and support its global oleochemical business.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the Western European region?

The report includes the following Western European countries

- Germany

- France

- Spain

- UK

- Rest of Western Europe

Who are the winners in the global fatty alcohols market?

Companies such as Kao Corporation, Wilmar International Ltd., and Godrej International fall under the winners category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have multiple supply contracts with global OEMs and have effective supply chain strategies. Such advantages give these companies an edge over other companies that are fatty alcohols, product suppliers.

What is the COVID-19 impact on the fatty alcohols market?

Industry experts believe that COVID-19 would have a very low impact on fatty alcohols market as there is an increase in demand for fatty alcohols in various applications such as industrial & domestic cleaning, and personal care. Furthermore, they also believe that the market will rebound in Q4 in 202.

What are some of the benefits of fatty alcohols?

Fatty alcohols acts as a thickening agent, and they help to keep the skin more hydrated for a longer period of time. Unlike some other alcohols, fatty alcohols can be used on any type of skin as it does not cause any type of irritation to dry or oily skin. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 FATTY ALCOHOLS: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 1 FATTY ALCOHOLS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 2 PURE AND MID CUT TYPE TO DOMINATE FATTY ALCOHOLS MARKET

FIGURE 3 INDUSTRIAL & DOMESTIC CLEANING APPLICATION TO DOMINATE THE FATTY ALCOHOLS MARKET

FIGURE 4 APAC DOMINATED FATTY ALCOHOLS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE OPPORTUNITIES IN THE FATTY ALCOHOLS MARKET

FIGURE 5 GROWING USAGE OF FATTY ALCOHOLS IN PERSONAL CARE APPLICATION TO DRIVE THE MARKET

4.2 FATTY ALCOHOLS MARKET, BY REGION

FIGURE 6 APAC TO BE THE LARGEST MARKET BETWEEN 2020 AND 2025

4.3 FATTY ALCOHOLS MARKET IN APAC, BY COUNTRY AND APPLICATION

FIGURE 7 CHINA AND INDUSTRIAL & DOMESTIC CLEANING TO BE THE LARGEST SEGMENTS IN APAC

4.4 FATTY ALCOHOLS MARKET: MAJOR COUNTRIES

FIGURE 8 CHINA TO BE FASTEST-GROWING MARKET BETWEEN 2020 AND 2025

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE FATTY ALCOHOLS MARKET

5.2.1 DRIVERS

5.2.1.1 Increased demand for fatty alcohols in the home & personal care industry

5.2.1.2 Availability of raw material and growing consumption of fatty alcohols in emerging countries of APAC

5.2.2 RESTRAINTS

5.2.2.1 Surplus production of fatty alcohols leading to oversupply

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for bio-based and renewable resources-based products

5.2.3.2 Increasing demand for biopolymer instead of petroleum-based lubricants

5.2.4 CHALLENGES

5.2.4.1 Fluctuating raw material prices

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 10 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

5.4.1 VALUE CHAIN OF FATTY ALCOHOLS

5.4.2 IMPACT OF COVID-19 ON THE SUPPLY CHAIN

5.5 MACROECONOMIC INDICATORS

5.5.1 TRENDS AND FORECAST OF GDP

TABLE 1 TRENDS AND FORECAST OF GDP, 2017-2024 (USD MILLION)

5.5.2 TRENDS OF PALM OIL & CRUDE OIL PRICES

TABLE 2 PALM OIL & CRUDE OIL PRICES, WORLDWIDE (2014-2030)

6 FATTY ALCOHOLS MARKET, BY TYPE (Page No. - 47)

6.1 INTRODUCTION

FIGURE 11 PURE AND MID CUT TO BE THE MOST USED TYPE OF FATTY ALCOHOL DURING THE FORECAST PERIOD

TABLE 3 FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

6.2 SHORT CHAIN

6.2.1 INCREASED DEMAND FOR PLASTICIZERS IN PVC TO DRIVE THE DEMAND

TABLE 5 SHORT CHAIN FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 SHORT CHAIN FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.3 PURE AND MID CUT

6.3.1 INCREASED DEMAND FOR SURFACTANTS IN DETERGENTS & SOAPS TO BOOST THE MARKET

TABLE 7 PURE AND MID CUT FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 PURE AND MID CUT FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.4 LONG CHAIN

6.4.1 INCREASING DEMAND FROM PHARMACEUTICAL AND COSMETIC INDUSTRIES TO DRIVE THE MARKET

TABLE 9 LONG CHAIN FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 LONG CHAIN FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.5 HIGHER CHAIN

6.5.1 GROWING USE OF FATTY ALCOHOLS IN WATER TREATMENT APPLICATIONS TO DRIVE THE DEMAND

TABLE 11 HIGHER CHAIN FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 HIGHER CHAIN FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7 FATTY ALCOHOLS MARKET, BY APPLICATION (Page No. - 54)

7.1 INTRODUCTION

FIGURE 12 INDUSTRIAL & DOMESTIC CLEANING APPLICATION DOMINATED THE FATTY ALCOHOLS MARKET

TABLE 13 FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

7.2 INDUSTRIAL & DOMESTIC CLEANING

7.2.1 INCREASE IN USE OF SURFACTANTS DUE TO COVID-19 PANDEMIC TO DRIVE THE DEMAND

TABLE 14 FATTY ALCOHOLS MARKET SIZE IN INDUSTRIAL & DOMESTIC CLEANING APPLICATION, BY REGION, 2018–2025 (USD MILLION)

7.3 PERSONAL CARE

7.3.1 INCREASED DEMAND FOR ORGANICALLY-DERIVED AND SKIN-FRIENDLY PERSONAL CARE PRODUCTS TO BOOST THE MARKET

TABLE 15 FATTY ALCOHOLS MARKET SIZE IN PERSONAL CARE APPLICATION, BY REGION, 2018–2025 (USD MILLION)

7.4 LUBRICANTS

7.4.1 INCREASE IN THE USE OF LUBRICANTS IN VARIOUS END-USE INDUSTRIES TO DRIVE THE DEMAND

TABLE 16 FATTY ALCOHOLS MARKET SIZE IN LUBRICANTS APPLICATION, BY REGION, 2018–2025 (USD MILLION)

7.5 PLASTICIZERS

7.5.1 IMPROVED PHYSICAL-MECHANICAL PROPERTIES OF FATTY ALCOHOLS-BASED PLASTICIZERS TO DRIVE THE DEMAND

TABLE 17 FATTY ALCOHOLS MARKET SIZE IN PLASTICIZERS APPLICATION, BY REGION, 2018–2025 (USD MILLION)

7.6 PHARMACEUTICAL FORMULATIONS

7.6.1 INCREASING USE OF FATTY ALCOHOLS IN VARIOUS PHARMACEUTICAL PRODUCTS TO BOOST THE MARKET

TABLE 18 FATTY ALCOHOLS MARKET SIZE IN PHARMACEUTICAL FORMULATIONS APPLICATION, BY REGION, 2018–2025 (USD MILLION)

7.7 FOOD & NUTRITION

7.7.1 INCREASING USE OF FATTY ALCOHOLS IN VARIOUS FOOD PRODUCTS TO DRIVE THE DEMAND

TABLE 19 FATTY ALCOHOLS MARKET SIZE IN FOOD & NUTRITION APPLICATION, BY REGION, 2018–2025 (USD MILLION)

7.8 OTHERS

TABLE 20 FATTY ALCOHOLS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8 FATTY ALCOHOLS MARKET, BY REGION (Page No. - 62)

8.1 INTRODUCTION

FIGURE 13 APAC TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 21 FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 22 FATTY ALCOHOLS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

8.2 APAC

8.2.1 IMPACT OF COVID-19 ON THE FATTY ALCOHOLS MARKET IN APAC

FIGURE 14 APAC: FATTY ALCOHOLS MARKET SNAPSHOT

TABLE 23 APAC: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 APAC: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 25 APAC: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 26 APAC: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 27 APAC: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.2 CHINA

8.2.2.1 High demand from personal care segment to drive the market

TABLE 28 CHINA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 29 CHINA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 30 CHINA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.3 JAPAN

8.2.3.1 Rising demand for surfactants & lubricants is fueling the growth

TABLE 31 JAPAN: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 32 JAPAN: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 33 JAPAN: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.4 INDIA

8.2.4.1 Increasing demand from the personal care segment to drive the market

TABLE 34 INDIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 35 INDIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 36 INDIA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.5 INDONESIA

8.2.5.1 World’s largest producer of palm oil

TABLE 37 INDONESIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 38 INDONESIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 39 INDONESIA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.6 MALAYSIA

8.2.6.1 Strong presence of fatty alcohol producers in the country to drive the demand

TABLE 40 MALAYSIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 MALAYSIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 42 MALAYSIA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.7 REST OF APAC

TABLE 43 REST OF APAC: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 REST OF APAC: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 45 REST OF APAC: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3 NORTH AMERICA

8.3.1 IMPACT OF COVID-19 ON FATTY ALCOHOLS MARKET IN NORTH AMERICA

FIGURE 15 NORTH AMERICA: FATTY ALCOHOLS MARKET SNAPSHOT

TABLE 46 NORTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 48 NORTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 50 NORTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.2 US

8.3.2.1 Increase in demand for liquid soaps & detergents to drive the market

TABLE 51 US: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 52 US: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 53 US: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.3 CANADA

8.3.3.1 Rapid modernization and developing industrial segment to propel the market

TABLE 54 CANADA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 CANADA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 56 CANADA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.4 MEXICO

8.3.4.1 Increasing use of fatty alcohols in lubricants to drive the market

TABLE 57 MEXICO: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 MEXICO: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 59 MEXICO: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4 WESTERN EUROPE

8.4.1 IMPACT OF COVID-19 ON THE FATTY ALCOHOLS MARKET IN EUROPE

FIGURE 16 WESTERN EUROPE: FATTY ALCOHOLS MARKET SNAPSHOT

TABLE 60 WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 62 WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 64 WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.2 GERMANY

8.4.2.1 Growth of the chemical manufacturing sector will drive the demand

TABLE 65 GERMANY: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 GERMANY: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 67 GERMANY: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.3 UK

8.4.3.1 Industrial & domestic cleaning segment will drive the market

TABLE 68 UK: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 UK: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 70 UK: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.4 FRANCE

8.4.4.1 Growing demand for household products to drive the market

TABLE 71 FRANCE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 FRANCE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 73 FRANCE: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.5 ITALY

8.4.5.1 Growing demand for lubricants from manufacturing & automobile segment to drive the market

TABLE 74 ITALY: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 ITALY: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 76 ITALY: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.6 NETHERLANDS

8.4.6.1 Growing demand for biodegradable and environmental-friendly products to drive the market

TABLE 77 NETHERLANDS: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 NETHERLANDS: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 79 NETHERLANDS: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.7 REST OF WESTERN EUROPE

TABLE 80 REST OF WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 REST OF WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 82 REST OF WESTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5 CENTRAL & EASTERN EUROPE

TABLE 83 CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 85 CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 87 CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.1 RUSSIA

8.5.1.1 Increased demand for surfactants in exploration activities will drive the demand

TABLE 88 RUSSIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 RUSSIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 90 RUSSIA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.2 TURKEY

8.5.2.1 Rising demand from industrial & domestic cleaning segment will drive the demand

TABLE 91 TURKEY: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 TURKEY: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 93 TURKEY: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.3 REST OF CENTRAL & EASTERN EUROPE

TABLE 94 REST OF CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 REST OF CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 96 REST OF CENTRAL & EASTERN EUROPE: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

8.6.1 IMPACT OF COVID-19 ON FATTY ALCOHOLS MARKET IN THE MIDDLE EAST & AFRICA

TABLE 97 MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 99 MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 101 MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.2 SAUDI ARABIA

8.6.2.1 Crude oil production to boost the growth of synthetically-derived fatty alcohols

TABLE 102 SAUDI ARABIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 SAUDI ARABIA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 104 SAUDI ARABIA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.3 UAE

8.6.3.1 Industrial & domestic cleaning to drive the demand for fatty alcohols

TABLE 105 UAE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 UAE: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 107 UAE: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.4 SOUTH AFRICA

8.6.4.1 Increased demand for surfactants in industrial & domestic applications to drive the demand

TABLE 108 SOUTH AFRICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 SOUTH AFRICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 110 SOUTH AFRICA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 111 REST OF MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 REST OF MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 113 REST OF MIDDLE EAST & AFRICA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.7 SOUTH AMERICA

8.7.1 IMPACT OF COVID-19 ON FATTY ALCOHOLS MARKET

TABLE 114 SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 116 SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 118 SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.7.2 BRAZIL

8.7.2.1 Biggest market for fatty alcohols in South America

TABLE 119 BRAZIL: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 120 BRAZIL: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 121 BRAZIL: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.7.3 ARGENTINA

8.7.3.1 Presence of potential oilfields in the country to drive the demand for fatty alcohols

TABLE 122 ARGENTINA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 ARGENTINA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 124 ARGENTINA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.7.4 REST OF SOUTH AMERICA

TABLE 125 REST OF SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 126 REST OF SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 127 REST OF SOUTH AMERICA: FATTY ALCOHOLS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 115)

9.1 OVERVIEW

FIGURE 17 COMPANIES PRIMARILY ADOPTED EXPANSIONS AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

9.2 MARKET RANKING ANALYSIS

FIGURE 18 MARKET RANKING OF KEY PLAYERS, 2019

9.3 COMPETITIVE SCENARIO

9.3.1 EXPANSION

TABLE 128 EXPANSION, 2017–2019

9.3.2 AGREEMENT & JOINT VENTURE

TABLE 129 JOINT VENTURE, 2017-2019

10 COMPANY PROFILES (Page No. - 119)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 KAO CORPORATION

FIGURE 19 KAO CORPORATION: COMPANY SNAPSHOT

FIGURE 20 KAO CORPORATION: SWOT ANALYSIS

10.2 WILMAR INTERNATIONAL LTD

FIGURE 21 WILMAR INTERNATIONAL LTD: COMPANY SNAPSHOT

FIGURE 22 WILMAR INTERNATIONAL LTD: SWOT ANALYSIS

10.3 KUALA LUMPUR KEPONG BERHAD

FIGURE 23 KUALA LUMPUR KEPONG BERHAD: COMPANY SNAPSHOT

FIGURE 24 KUALA LUMPUR KEPONG BERHAD: SWOT ANALYSIS

10.4 SASOL

FIGURE 25 SASOL: COMPANY SNAPSHOT

FIGURE 26 SASOL: SWOT ANALYSIS

10.5 GODREJ INDUSTRIES LIMITED

FIGURE 27 GODREJ INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 28 SOLVAY: SWOT ANALYSIS

10.6 MUSIM MAS HOLDINGS

10.7 EMERY OLEOCHEMICALS

10.8 PROCTER & GAMBLE

FIGURE 29 PROCTER & GAMBLE: COMPANY SNAPSHOT

10.9 VVF LTD.

10.10 ROYAL DUTCH SHELL PLC

FIGURE 30 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

10.11 OTHER COMPANY PROFILES

10.11.1 OXITENO

10.11.2 ECOGREEN OLEOCHEMICALS

10.11.3 TIMUR OLEOCHEMICALS

10.11.4 TECK GUAN HOLDINGS

10.11.5 BERG + SCHMIDT GMBH & CO. KG

10.11.6 OLEON NV

10.11.7 GLOBAL GREEN CHEMICALS PUBLIC COMPANY LIMITED

10.11.8 JARCHEM INDUSTRIES INC.

10.11.9 CREMER OLEO GMBH & CO. KG

10.11.10 KH NEOCHEM CO. LTD

10.11.11 SABIC

10.11.12 ARKEMA S. A.

10.11.13 BASF SE

10.11.14 NEW JAPAN CHEMICAL CO. LTD

10.11.15 ZHEJIANG JIAHUA ENERGY CHEMICAL INDUSTRY CO. LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 147)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

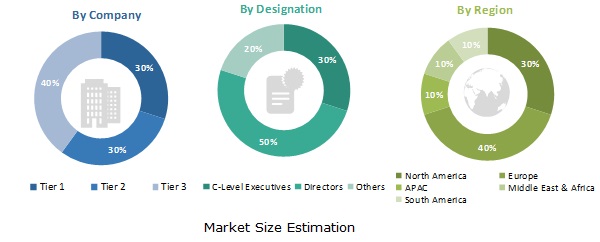

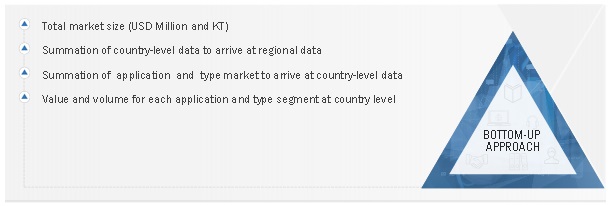

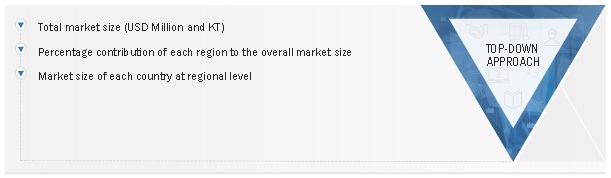

The study involved four major activities in estimating the size of the fatty alcohols market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

The fatty alcohols market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the fatty alcohols market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fatty alcohols market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Fatty Alcohols: Bottom-Up Approach

Global Fatty Alcohols: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the fatty alcohols market.

Report Objectives

- To define, describe, and forecast the fatty alcohols market size in terms of value and volume.

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the fatty alcohols market size based on application, type, and region

- To project the market size of the key regions, namely, North America, Asia Pacific (APAC), Western Europe, Central & Eastern Europe, Middle East & Africa, and South America

- To strategically analyze the market for individual growth trends, prospects, and their contribution to the overall market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe fatty alcohols market into Norway and Denmark

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Fatty Alcohols Market