Ophthalmic Surgical Instruments Market by Product (Cataracts (IOL, OVD), Refractive (Femtosecond, Excimer Laser) Glaucoma, Vitreoretinal (Vitrectomy Machine & Packs) Surgical Microscope] End User (Hospital, Specialty Clinic) - Global Forecast to 2022

[272 Pages Report] The global ophthalmic surgical instruments market is expected to reach USD 11.18 Billion by 2022 from USD 7.87 Billion in 2016, at a CAGR of 6.0%. Growth in the global market is mainly driven by factors such as the increasing number of ophthalmic surgeries owing to the growth in geriatric population & related eye diseases, technological advancement in ophthalmic surgical devices, and government initiatives to increase the awareness about visual blindness across the globe.

Years considered for this report

- 2016 – Base Year

- 2017 – Estimated Year

- 2022 – Projected Year

Objectives of the Study

- To define, describe, and forecast the global ophthalmic surgical instruments market on the basis of product type, end users, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in this market and comprehensively analyze their market shares and core competencies2

- To forecast the market size of the global market with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as merger, acquisitions, product developments, agreements, partnerships, collaborations, expansions, and research & development activities in the market

Research Methodology

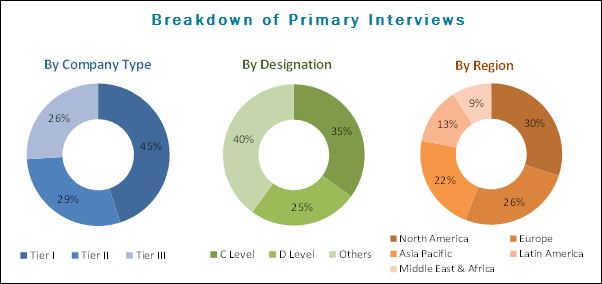

Top-down and bottom-up approaches were used to validate the size of the global ophthalmic surgical instruments market and estimate the size of various other dependent submarkets. Major players were identified through secondary research, and their market revenues were determined through primary and secondary research. Secondary research included the study of International Council of Ophthalmology (ICO), American Academy of Ophthalmology (AAO), All India Ophthalmological Society (AIOS), European Board of Ophthalmology (EBO), Asia Pacific Academy of Ophthalmology, and the annual & financial reports of top market players, whereas primary research included extensive interviews with the key opinion leaders such as CEOs, directors, and marketing executives. The percentage splits, shares, and breakdowns of the product markets were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global ophthalmic surgical instruments market are Alcon (Switzerland), Carl Zeiss Meditec (Germany), Johnson & Johnson Vision Care (US), Hoya Corporation (Japan), Bausch + Lomb (US), NIDEK (Japan), Topcon Corporation (Japan), Ellex Medical Lasers (Australia), IRIDEX Corporation (US), Lumenis (Israel), STAAR Surgical Company (US), and Ziemer Ophthalmic Systems (Switzerland).

Target Audience

- Ophthalmic surgical instrument manufacturers

- Suppliers and distributors of ophthalmology devices

- Original equipment manufacturers (OEMs)

- Ophthalmologists

- Healthcare service providers (including hospitals, independent physicians, and private eye care centers)

- Medical institutes

- Health insurance players

- Research and consulting firms

Scope of the Report

This research report categorizes the global market into the following segments:

Ophthalmic Surgical Instruments Market, By Product

-

Cataract Surgery Devices

-

Intraocular Lenses (IOLs)

- Standard IOL

- Premium IOL

-

Ophthalmic Viscoelastic Devices (OVDs)

- Cohesive OVDs

- Dispersive OVDs

- Combinational OVDs

- Phacoemulsification Devices

- Cataract Surgery Lasers

- IOL Injectors

- Cataract Surgery Instruments and Kits

-

Intraocular Lenses (IOLs)

-

Glaucoma Surgery Devices

- Glaucoma Drainage Devices (GDDS)

- Glaucoma Stents and Implants

- Glaucoma Laser Systems

- Microinvasive Glaucoma Surgery Devices

- Glaucoma Surgery Instruments & Kits

-

Refractive Surgery Devices

- Femtosecond Lasers

- Excimer Lasers

- Other Lasers

- Refractive Surgery Instruments & Kits

-

Vitreoretinal Surgery Devices

- Vitreoretinal Packs

- Vitrectomy Machines

- Photocoagulation Lasers

- Illumination Devices

- Vitrectomy Probes

- Vitreoretinal Surgery Instruments & its

- Ophthalmic Microscopes

-

Accessories

- Tips & Handles

- Forceps

- Spatulas

- Scissors

- Macular Lenses

- Cannulas

- Others

Ophthalmic Surgical Instruments Market, By End User

- Hospitals

- Speciality Clinics and Ambulatory Surgical Centers (ASCs)

- Other End Users

Ophthalmic Surgical Instruments Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

APAC

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (RoLA)

- Middle East and Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Market Size Analysis

- Further breakdown of the RoAPAC ophthalmic surgical instruments market in South Korea, Australia, New Zealand, and other countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global ophthalmic surgical instruments market is estimated to reach USD 11.18 Billion by 2022 from USD 8.36 Billion in 2017, at a CAGR of 6.0%. Growing geriatric population and associated ophthalmic disorders, increasing number of ophthalmic surgeries owing to the rising prevalence of eye diseases, technological advancements, and rising government initiatives to increase the awareness of visual impairment are the major factors driving the growth of the market. However, the limited reimbursement for ophthalmic surgical procedures and high cost of these instruments may hinder the growth of this market. Furthermore, the lack of awareness and accessibility to eye care in low-income economies is a major challenge for the growth of the global market.

In this report, the market is segmented by product, end user, and region. By product, the ophthalmic surgical instruments market is majorly segmented into cataract surgery devices, refractive surgery devices, glaucoma surgery devices, vitreoretinal surgery devices, ophthalmic microscopes, and accessories. The cataract surgery devices segment accounted for the largest share of the market in 2016. The growth in this market is mainly attributed to the rising number of cataract surgeries performed across the globe owing to growing geriatric population and associated eye diseases such as age related macular degeneration (AMDs), diabetic retinopathy, and other eye disorders.

The glaucoma surgery devices segment will be the fastest-growing segment and based on its types, the glaucoma surgery devices market is segmented into glaucoma drainage devices, glaucoma laser systems, microinvasive glaucoma surgery devices, and glaucoma surgery instruments & kits. The glaucoma drainage devices segment accounted for the largest share of the market in 2016. The large share of this segment can primarily be attributed to the increasing use of glaucoma drainage implants for controlling surgical intraocular pressure (IOP) in patients with uncontrolled glaucoma.

On the basis of end user, the ophthalmic surgical instruments market is segmented into hospitals, specialty clinics & ambulatory surgery centers (ASCs), and other end users. In 2016, the hospitals segment accounted for the largest share of the global market. Factors such as increasing prevalence of eye disorders across the globe coupled with large patient pool treated at hospitals, high purchasing power of hospitals, and increasing number of hospitals in emerging countries are the key market drivers for this segment.

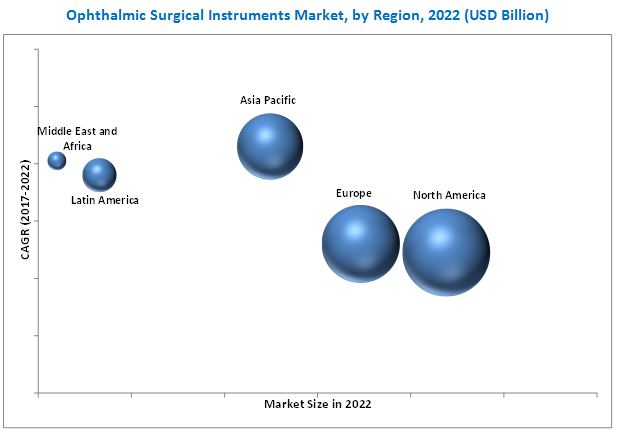

Geographically, North America represented the largest regional market in 2016, followed by Europe. Although, North America will continue to dominate the global ophthalmic surgical instruments market during the forecast period, the Asia Pacific (APAC) region is expected to be the fastest-growing market in the coming years. Growth in this region is driven by the growing geriatric population, rising prevalence of ocular diseases, increasing awareness about advanced surgical instruments, and rising healthcare expenditure in this region. Moreover, the growing medical tourism, increasing per capita income, and improving healthcare infrastructure is also supporting the growth of this market in Asia Pacific.

However, the high cost of ophthalmic surgical instruments and uncertainty in the reimbursement structure in the ophthalmology industry will limit the adoption of technologically advanced ophthalmic surgical devices among small- and mid-sized hospitals, thereby limiting the growth of the ophthalmic surgical instruments market in the coming years.

Major players in the Ophthalmic Surgical Instruments Market are continuously focusing on securing high market shares through product launches, expansions, agreements, partnerships, and acquisitions. The prominent players in the market are Alcon (Switzerland), Carl Zeiss Meditec (Germany), Johnson & Johnson Vision Care (US), Hoya Corporation (Japan), Bausch + Lomb (US), NIDEK (Japan), Topcon Corporation (Japan), Ellex Medical Lasers (Australia), IRIDEX Corporation (US), Lumenis (Israel), STAAR Surgical Company (US), and Ziemer Ophthalmic Systems (Switzerland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 40)

4.1 Ophthalmic Surgical Instruments Market: Overview

4.2 Asia Pacific: Market, By Product

4.3 Geographical Snapshot of the Global Market

4.4 Global Market: Regional Mix

4.5 Global Market, Developing vs Developed Countries

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Rising Prevalence of Eye Diseases

5.2.1.1.1 Cataract

5.2.1.1.2 Glaucoma

5.2.1.1.3 Obesity and Diabetes

5.2.1.1.4 Age-Related Macular Degeneration

5.2.1.2 Technological Advancements in Ophthalmic Surgical Instruments

5.2.1.3 Increasing Government Initiatives to Control Visual Impairment

5.2.2 Market Restraints

5.2.2.1 High Cost of Ophthalmic Surgical Instruments

5.2.2.2 Reimbursement Cuts for Ophthalmic Surgical Procedures

5.2.3 Market Opportunities

5.2.3.1 Lower Adoption of Phacoemulsification Devices and Premium IOLS in Emerging Regions Represents A Huge Market Opportunity

5.2.3.2 Untapped Emerging Markets

5.2.4 Challenges

5.2.4.1 Lack of Awareness and Low Accessibility to Eye Care in Low-Income Economies

6 Industry Insights (Page No. - 56)

6.1 Introduction

6.2 Industry Trends

6.2.1 Femtosecond Lasers Based Cataract Surgery

6.2.2 Advanced Technology in IOLS

6.2.3 Advances in Refractive Surgery

6.2.4 Minimally Invasive Glaucoma Surgery (Migs)

6.3 Vendor Benchmarking

6.3.1 Product Portfolio Analysis: Ophthalmic Surgical Instruments Market

6.4 Regulatory Analysis

6.4.1 North America

6.4.1.1 US

6.4.1.2 Canada

6.4.2 Europe

6.4.3 Asia Pacific

6.4.3.1 Japan

6.4.3.2 China

6.4.3.3 India

7 Ophthalmic Surgical Instruments Market, By Product (Page No. - 66)

7.1 Introduction

7.2 Cataract Surgery Devices

7.2.1 Intraocular Lenses

7.2.1.1 Standard Intraocular Lenses

7.2.1.2 Premium Intraocular Lenses

7.2.2 Ophthalmic Viscoelastic Devices

7.2.2.1 Cohesive Ovds

7.2.2.2 Dispersive Ovds

7.2.2.3 Combinational Ovds

7.2.3 Phacoemulsification Devices

7.2.4 Cataract Surgery Instruments and Kits

7.2.5 Cataract Surgery Lasers

7.2.6 IOL Injectors

7.3 Glaucoma Surgery Devices

7.3.1 Glaucoma Drainage Devices

7.3.2 Microinvasive Glaucoma Surgery Devices

7.3.3 Glaucoma Laser Systems

7.3.4 Glaucoma Surgery Instruments and Kits

7.4 Refractive Surgery Devices

7.4.1 Femtosecond Lasers

7.4.2 Excimer Lasers

7.4.3 Refractive Surgery Instruments and Kits

7.4.4 Other Refractive Surgery Lasers

7.5 Vitreoretinal Surgery Devices

7.5.1 Vitreoretinal Packs

7.5.2 Vitrectomy Machines

7.5.3 Photocoagulation Lasers

7.5.4 Vitreoretinal Surgery Instruments and Kits

7.5.5 Illumination Devices

7.5.6 Vitrectomy Probes

7.6 Ophthalmic Microscopes

7.7 Ophthalmic Surgical Accessories

7.7.1 Ophthalmic Forceps

7.7.2 Ophthalmic Spatulas

7.7.3 Ophthalmic Tips and Handles

7.7.4 Ophthalmic Scissors

7.7.5 Macular Lenses

7.7.6 Other Ophthalmic Accessories

8 Ophthalmic Surgical Instruments Market, By End User (Page No. - 115)

8.1 Introduction

8.2 Hospitals

8.3 Specialty Clinics and Ambulatory Surgery Centers

8.4 Other End Users

9 Ophthalmic Surgical Instruments Market, By Region (Page No. - 121)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe (RoE)

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of Asia Pacific (RoAPAC)

9.5 Latin America

9.5.1 Brazil

9.5.2 Mexico

9.6 Rest of Latin America (RoLA)

9.7 Middle East & Africa

10 Competitive Landscape (Page No. - 224)

10.1 Introduction

10.2 Market Share Analysis

10.2.1 Cataract Surgery Devices Market

10.2.2 Glaucoma Surgery Devices Market

10.2.3 Refractive Surgery Devices Market

10.3 Competitive Scenario

10.4 Product Launches

10.5 Agreements/Partnerships/Collaborations

10.6 Acquisitions

10.7 Product Approvals

10.8 Expansions

11 Company Profiles (Page No. - 232)

11.1 Alcon

11.1.1 Business Overview

11.1.2 SWOT Analysis

11.1.3 Recent Developments

11.1.4 MnM View

11.2 Bausch + Lomb

11.2.1 Business Overview

11.2.2 SWOT Analysis

11.2.3 Recent Developments

11.2.4 MnM View

11.3 Carl Zeiss Meditec

11.3.1 Business Overview

11.3.2 SWOT Analysis

11.3.3 Recent Developments

11.3.4 MnM View

11.4 Johnson & Johnson

11.4.1 Business Overview

11.4.2 SWOT Analysis

11.4.3 Recent Developments

11.4.4 MnM View

11.5 Ellex Medical Lasers

11.5.1 Business Overview

11.5.2 Recent Developments

11.5.3 MnM View

11.6 Hoya

11.6.1 Business Overview

11.6.2 SWOT Analysis

11.6.3 Recent Developments

11.6.4 MnM View

11.7 Iridex

11.7.1 Business Overview

11.7.2 Recent Developments

11.7.3 MnM View

11.8 Lumenis

11.8.1 Business Overview

11.8.2 Recent Developments

11.8.3 MnM View

11.9 Nidek

11.9.1 Business Overview

11.9.2 Recent Developments

11.9.3 MnM View

11.10 Staar Surgical

11.10.1 Business Overview

11.10.2 Recent Developments

11.10.3 MnM View

11.11 Topcon

11.11.1 Business Overview

11.11.2 Recent Developments

11.11.3 MnM View

11.12 Ziemer Ophthalmic Systems

11.12.1 Business Overview

11.12.2 Recent Developments

11.12.3 MnM View

12 Appendix (Page No. - 260)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (286 Tables)

Table 1 Geriatric Population, By Region, 2000 vs 2015 vs 2030

Table 2 Total Number of Cataract Surgical Procedures Performed in 2014 and 2015, By Country

Table 3 Number of People With Diabetes, By Region, 2015 vs 2040 (Million Individuals)

Table 4 Prevalence of Age-Related Macular Degeneration, By Country, 2013–2023

Table 5 US: Population With Ocular Conditions, 2000–2020 (Million Individuals)

Table 6 Projected Disability-Adjusted Life Years Across Various Regions, By Ophthalmic Disease, 2015 vs 2030 (Million Years)

Table 7 Market Drivers: Impact Analysis

Table 8 Percentage Changes to Medicare Physician Fee Schedule in 2015

Table 9 Reimbursement Cuts for Vitrectomy in 2015

Table 10 Market Restraints: Impact Analysis

Table 11 Market Opportunities: Impact Analysis

Table 12 Market Challenges: Impact Analysis

Table 13 Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 14 Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 15 Cataract Surgery Devices Market, By Country, 2015–2022 (USD Million)

Table 16 Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 17 Intraocular Lenses Market, By Country, 2015–2022 (USD Million)

Table 18 Standard/Monofocal Intraocular Lenses Offered By Key Market Players

Table 19 Standard Intraocular Lenses Market, By Country, 2015–2022 (USD Million)

Table 20 Premium Intraocular Lenses Offered By Key Market Players

Table 21 Premium Intraocular Lenses Market, By Country, 2015–2022 (USD Million)

Table 22 Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 23 Ophthalmic Viscoelastic Devices Market, By Country, 2015–2022 (USD Million)

Table 24 Cohesive Ophthalmic Viscoelastic Devices Offered By Key Market Players

Table 25 Cohesive Ophthalmic Viscoelastic Devices Market, By Country, 2015–2022 (USD Million)

Table 26 Dispersive Ophthalmic Viscoelastic Devices Offered By Key Market Players

Table 27 Dispersive Ophthalmic Viscoelastic Devices Market, By Country, 2015–2022 (USD Million)

Table 28 Combinational Ophthalmic Viscoelastic Devices Offered By Key Market Players

Table 29 Combinational Ophthalmic Viscoelastic Devices Market, By Country, 2015–2022 (USD Million)

Table 30 Phacoemulsification Devices Offered By Key Market Players

Table 31 Phacoemulsification Devices Market, By Country, 2015–2022 (USD Million)

Table 32 Cataract Surgery Instruments and Kits Market, By Country, 2015–2022 (USD Million)

Table 33 Cataract Surgery Lasers Market, By Country, 2015–2022 (USD Million)

Table 34 IOL Injectors Offered By Key Market Players

Table 35 IOL Injectors Market, By Country, 2015–2022 (USD Million)

Table 36 Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 37 Glaucoma Surgery Devices Market, By Country, 2015–2022 (USD Million)

Table 38 Glaucoma Drainage Devices Offered By Key Market Players

Table 39 Glaucoma Drainage Devices Market, By Country, 2015–2022 (USD Million)

Table 40 Microinvasive Glaucoma Surgery Devices Offered By Key Market Players

Table 41 Microincision Glaucoma Surgery Devices Market, By Country, 2015–2022 (USD Million)

Table 42 Glaucoma Laser Systems Offered By Key Market Players

Table 43 Glaucoma Laser Systems Market, By Country, 2015–2022 (USD Million)

Table 44 Glaucoma Surgery Instruments and Kits Market, By Country, 2015–2022 (USD Million)

Table 45 Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 46 Refractive Surgery Devices Market, By Country, 2015–2022 (USD Million)

Table 47 Femtosecond Lasers Offered By Key Market Players

Table 48 Femtosecond Lasers Market, By Country, 2015–2021 (USD Million)

Table 49 Excimer Lasers Offered By Key Market Players

Table 50 Excimer Lasers Market, By Country, 2015–2022 (USD Million)

Table 51 Refractive Surgery Instruments and Kits Market, By Country, 2015–2022 (USD Million)

Table 52 Other Refractive Surgery Lasers Market, By Country, 2015–2022 (USD Million)

Table 53 Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 54 Vitreoretinal Surgery Devices Market, By Country, 2015–2022 (USD Million)

Table 55 Vitreoretinal Packs Offered By Key Market Players

Table 56 Vitreoretinal Packs Market, By Country, 2015–2022 (USD Million)

Table 57 Vitrectomy Machines Offered By Key Market Players

Table 58 Vitrectomy Machines Market, By Country, 2015–2022 (USD Million)

Table 59 Photocoagulation Lasers Offered By Key Market Players

Table 60 Photocoagulation Lasers Market, By Country, 2015–2022 (USD Million)

Table 61 Vitreoretinal Surgery Instruments & Kits Market, By Country, 2015–2022 (USD Million)

Table 62 Illumination Devices Market, By Country, 2015–2022 (USD Million)

Table 63 Vitrectomy Probes Offered By Key Market Players

Table 64 Vitrectomy Probes Market, By Country, 2015–2022 (USD Million)

Table 65 Ophthalmic Microscopes Offered By Key Market Players

Table 66 Ophthalmic Microscopes Market, By Country, 2015–2022 (USD Million)

Table 67 Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 68 Ophthalmic Surgical Accessories Market, By Country, 2015–2022 (USD Million)

Table 69 Ophthalmic Forceps Market, By Country, 2015–2022 (USD Million)

Table 70 Ophthalmic Spatulas Market, By Country, 2015–2022 (USD Million)

Table 71 Ophthalmic Tips and Handles Market, By Country, 2015–2022 (USD Million)

Table 72 Ophthalmic Scissors Market, By Country, 2015–2022 (USD Million)

Table 73 Macular Lenses Market, By Country, 2015–2022 (USD Million)

Table 74 Other Ophthalmic Accessories Market, By Country, 2015–2022 (USD Million)

Table 75 Global Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 76 Global Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 77 Global Market for Specialty Clinics and Ambulatory Surgery Centers, By Country, 2015–2022 (USD Million)

Table 78 Global Market for Other End Users, By Country, 2015–2022 (USD Million)

Table 79 Ophthalmic Surgical Instruments Market, By Region, 2015–2022 (USD Million)

Table 80 North America: Ophthalmic Surgical Instruments Market, By Country, 2015–2022 (USD Million)

Table 81 North America: Market, By Product, 2015–2022 (USD Million)

Table 82 North America: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 83 North America: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 84 North America: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 85 North America: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 86 North America: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 87 North America: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 88 North America: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 89 North America: Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 90 US Population With Ocular Conditions: 2000-2020 (Million)

Table 91 US: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 92 US: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 93 US: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 94 US: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 95 US: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 96 US: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 97 US: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 98 US: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 99 US: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 100 US: Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 101 Prevalence of Blindness in Canada, By Cause, 2006-2032 (%Population)

Table 102 Canada: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 103 Canada: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 104 Canada: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 105 Canada: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 106 Canada: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 107 Canada: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 108 Canada: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 109 Canada: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 110 Canada: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 111 Canada: Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 112 Prevalence of Amd in Population Aged 50 Years & Above, By Country, 2013-2023, (Number of Individuals)

Table 113 Europe: Ophthalmic Surgical Instruments Market, By Country, 2015–2022 (USD Million)

Table 114 Europe: Market, By Product, 2015–2022 (USD Million)

Table 115 Europe: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 116 Europe: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 117 Europe: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 118 Europe: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 119 Europe: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 120 Europe: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 121 Europe: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 122 Europe: Market, By End User, 2015–2022 (USD Million)

Table 123 Germany: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 124 Germany: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 125 Germany: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 126 Germany: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 127 Germany: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 128 Germany: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 129 Germany: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 130 Germany: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 131 Germany: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 132 Germany: Market, By End User, 2015–2022 (USD Million)

Table 133 France: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 134 France: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 135 France: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 136 France: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 137 France: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 138 France: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 139 France: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 140 France: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 141 France: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 142 France: Market, By End User, 2015–2022 (USD Million)

Table 143 Number of People Living With Sight Loss in the UK, 2015

Table 144 Eye Health Statistics in 2016 in the UK

Table 145 UK: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 146 UK: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 147 UK: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 148 UK: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 149 UK: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 150 UK: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 151 UK: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 152 UK: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 153 UK: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 154 UK: Market, By End User, 2015–2022 (USD Million)

Table 155 Italy: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 156 Italy: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 157 Italy: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 158 Italy: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 159 Italy: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 160 Italy: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 161 Italy: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 162 Italy: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 163 Italy: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 164 Italy: Market, By End User, 2015–2022 (USD Million)

Table 165 Spain: Key Macroindicators for Ophthalmic Surgical Instruments Market

Table 166 Spain: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 167 Spain: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 168 Spain: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 169 Spain: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 170 Spain: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 171 Spain: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 172 Spain: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 173 Spain: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 174 Spain: Market, By End User, 2015–2022 (USD Million)

Table 175 Rest of Europe: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 176 Rest of Europe: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 177 Rest of Europe: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 178 Rest of Europe: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 179 Rest of Europe: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 180 Rest of Europe: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 181 Rest of Europe: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 182 Rest of Europe: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 183 Rest of Europe: Market, By End User, 2015–2022 (USD Million)

Table 184 Asia Pacific: Ophthalmic Surgical Instruments Market, By Country, 2015–2022 (USD Million)

Table 185 Asia Pacific: Market, By Product, 2015–2022 (USD Million)

Table 186 Asia Pacific: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 187 Asia Pacific: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 188 Asia Pacific: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 189 Asia Pacific: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 190 Asia Pacific: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 191 Asia Pacific: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 192 Asia Pacific: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 193 Asia Pacific: Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 194 Japan: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 195 Japan: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 196 Japan: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 197 Japan: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 198 Japan: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 199 Japan: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 200 Japan: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 201 Japan: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 202 Japan: Market, By End User, 2015–2022 (USD Million)

Table 203 China: Key Macroindicators for the Ophthalmic Surgical Instruments Market

Table 204 China: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 205 China: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 206 China: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 207 China: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 208 China: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 209 China: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 210 China: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 211 China: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 212 China: Market, By End User, 2015–2022 (USD Million)

Table 213 India: Key Macroindicators for the Ophthalmic Surgical Instruments Market

Table 214 India: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 215 India: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 216 India: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 217 India: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 218 India: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 219 India: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 220 India: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 221 India: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 222 India: Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 223 RoAPAC: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 224 RoAPAC: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 225 RoAPAC: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 226 RoAPAC: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 227 RoAPAC: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 228 RoAPAC: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 229 RoAPAC: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 230 RoAPAC: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 231 RoAPAC: Market, By End User, 2015–2022 (USD Million)

Table 232 Latin America: Ophthalmic Surgical Instruments Market, By Country, 2015–2022 (USD Million)

Table 233 Latin America: Market, By Product, 2015–2022 (USD Million)

Table 234 Latin America: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 235 Latin America: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 236 Latin America: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 237 Latin America: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 238 Latin America: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 239 Latin America: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 240 Latin America: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 241 Latin America: Ophthalmic Surgical Instruments Market, By End User, 2015–2022 (USD Million)

Table 242 Brazil: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 243 Brazil: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 244 Brazil: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 245 Brazil: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 246 Brazil: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 247 Brazil: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 248 Brazil: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 249 Brazil: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 250 Brazil: Market, By End User, 2015–2022 (USD Million)

Table 251 Prevalence of Blindness and Eye Diseases in Mexico (2013)

Table 252 Mexico: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 253 Mexico: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 254 Mexico: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 255 Mexico: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 256 Mexico: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 257 Mexico: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 258 Mexico: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 259 Mexico: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 260 Mexico: Market, By End User, 2015–2022 (USD Million)

Table 261 RoLA: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 262 RoLA: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 263 RoLA: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 264 RoLA: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 265 RoLA: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 266 RoLA: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 267 RoLA: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 268 RoLA: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 269 RoLA: Market, By End User, 2015–2022 (USD Million)

Table 270 Middle East & Africa: Ophthalmic Surgical Instruments Market, By Product, 2015–2022 (USD Million)

Table 271 Middle East & Africa: Cataract Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 272 Middle East & Africa: Intraocular Lenses Market, By Type, 2015–2022 (USD Million)

Table 273 Middle East & Africa: Ophthalmic Viscoelastic Devices Market, By Type, 2015–2022 (USD Million)

Table 274 Middle East & Africa: Glaucoma Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 275 Middle East & Africa: Refractive Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 276 Middle East & Africa: Vitreoretinal Surgery Devices Market, By Type, 2015–2022 (USD Million)

Table 277 Middle East & Africa: Ophthalmic Surgical Accessories Market, By Type, 2015–2022 (USD Million)

Table 278 Middle East & Africa: Market, By End User, 2015–2022 (USD Million)

Table 279 Cataract Surgery Devices: Market Ranking Analysis

Table 280 Glaucoma Surgery Devices: Market Ranking Analysis

Table 281 Refractive Surgery Devices: Market Ranking Analysis

Table 282 Product Launches, January 2014 to October 2017

Table 283 Agreements/Partnerships/Collaborations

Table 284 Acquisitions,

Table 285 Product Approvals

Table 286 Expansions

List of Figures (44 Figures)

Figure 1 Global Ophthalmic Surgical Instruments Market

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Ophthalmic Surgical Instruments Market, By Product, 2017 vs 2022 (USD Million)

Figure 7 Cataract Surgery Devices Market, By Type, 2017 vs 2022 (USD Million)

Figure 8 IOL Market, By Type, 2017 vs 2022 (USD Million)

Figure 9 Ophthalmic Viscoelastic Devices Market, By Type, 2017 vs 2022 (USD Million)

Figure 10 Glaucoma Surgery Devices Market, By Type, 2017 vs 2022 (USD Million)

Figure 11 Refractive Surgery Devices Market, By Type, 2017 vs 2022 (USD Million)

Figure 12 Vitreoretinal Surgery Devices Market, By Type, 2017 vs 2022 (USD Million)

Figure 13 Ophthalmic Surgical Accessories Market, By Type, 2017 vs 2022 (USD Million)

Figure 14 Ophthalmic Surgical Instruments Market, By End User, 2017 vs 2022 (USD Million)

Figure 15 Geographical Snapshot of the Ophthalmic Surgical Instruments Market

Figure 16 Rapid Growth in the Geriatric Population & Associated Increase in Eye Disorders is the Major Factor Driving Market Growth

Figure 17 Cataract Surgery Devices Accounted for the Largest Market Share in 2016

Figure 18 The US Accounted for the Largest Share of the Global Ophthalmic Surgical Instruments Market in 2016

Figure 19 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 20 Developing Countries to Register A Higher Growth Rate During the Forecast Period

Figure 21 Global Market: Drivers, Restraints, Opportunities, & Challenges

Figure 22 Geriatric Population as A Percentage of Total Population, By Region, 2015 vs 2030

Figure 23 Global Market: Vendor Benchmarking

Figure 24 Glaucoma Surgery Devices Segment to Witness the Highest Growth During the Forecast Period

Figure 25 Specialty Clinics and Ascs Segment to Register the Highest CAGR During the Forecast Period

Figure 26 North America to Dominate the Market in 2022

Figure 27 Geographic Snapshot of the Global Market

Figure 28 North America: Market Snapshot

Figure 29 Europe: Market Snapshot

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Japan: Key Macroindicators for the Ophthalmic Surgical Instruments Market

Figure 32 Players Mainly Adopted the Strategy of Product Launches Between January 2014 and October 2017

Figure 33 Global Market Share Analysis, By Key Player, 2016

Figure 34 Battle for Market Share: New Product Launches Was the Key Growth Strategy Adopted By Market Players

Figure 35 Alcon: Company Snapshot (2016)

Figure 36 Valeant Pharmaceuticals International: Company Snapshot (2016)

Figure 37 Carl Zeiss Meditec: Company Snapshot (2016)

Figure 38 Johnson & Johnson: Company Snapshot (2016)

Figure 39 Ellex Medical Lasers: Company Snapshot (2016)

Figure 40 Hoya: Company Snapshot (2016)

Figure 41 Iridex: Company Snapshot (2016)

Figure 42 Nidek Co. Ltd: Company Snapshot (2016)

Figure 43 Staar Surgical: Company Snapshot (2016)

Figure 44 Topcon: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ophthalmic Surgical Instruments Market