Ophthalmic Lasers Market by Product Type (Femtosecond Lasers, Excimer Lasers, Nd:YAG Lasers, Diode Lasers, and Other Lasers), Application (Refractive Error Correction, Cataract Removal, Glaucoma Treatment, Diabetic Retinopathy Treatment, AMD Treatment, and Other Applications), & End User (Hospitals and Clinics and Ambulatory Surgery Centers (ASCs)- Global Forecast to 2021

The ophthalmic lasers market size is projected to grow at a CAGR of 5.1%. The growth of the market can be attributed to the increasing prevalence of chronic disorders, rising geriatric population, increasing regulatory approvals, and increasing initiatives to prevent vision impairment.

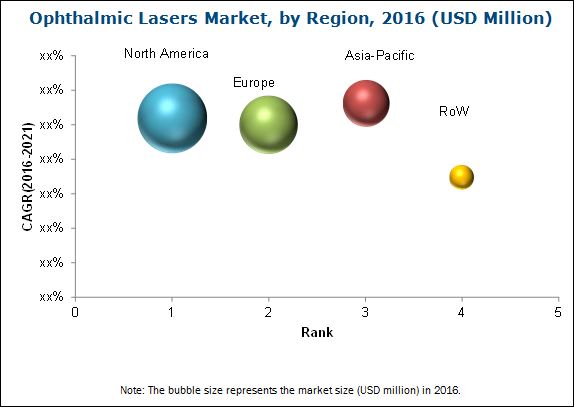

In the coming years, the ophthalmic lasers market is expected to witness the highest growth in the Asia-Pacific region. This can be attributed to factors such as high prevalence of ophthalmic disorders in several APAC countries, introduction of initiatives for the prevention of blindness and treatment projects for various ophthalmic disorders, and rising geriatric population.

North America accounted for the largest share of the global market. Growth in the North American market is primarily driven by the increasing prevalence of ophthalmic disorders, rising prevalence of chronic diseases, and increasing regulatory approvals.

This report segments the ophthalmic lasers market based on product types, applications, end users, and regions. On the basis of product type, the market is segmented into femtosecond lasers, excimer lasers, Nd:YAG lasers, diode lasers, and other lasers. On the basis of applications, the market is segmented into refractive error correction, cataract removal, glaucoma treatment, diabetic retinopathy treatment, age-related macular degeneration treatment (AMD), and other applications.

The femtosecond lasers segment is expected to account for the largest share of the global market and is projected to grow at the highest CAGR during the forecast period. This can be attributed to factors such as increasing prevalence of refractive errors and cataract, technological advancements in femtosecond lasers, expanding applications of femtosecond lasers, and increasing regulatory approvals.

The refractive error correction segment is expected to command the largest share of the global ophthalmic lasers market, by application. This can be attributed to the increasing incidence of refractive errors and better clinical outcomes due to technological advancements in ophthalmic lasers. However, the cataract removal segment is projected to grow at the highest CAGR. Automation of several steps performed manually during cataract surgery by femtosecond lasers is expected to augment the demand for ophthalmic lasers in this application.

On the basis of end users, the ophthalmic lasers market is segmented into hospitals and clinics & ambulatory surgery centers (ASCs). The hospitals segment is projected to command the largest share of the global market, by end user. This can be attributed to factors such as the introduction of new technologies in hospitals and increasing number of hospitals in emerging economies.

The key players in ophthalmic lasers market includes Alcon Laboratories, Inc. (U.S.), Abbott Medical Optics, Inc. (U.S.), Carl Zeiss Meditec AG (Germany), Bausch & Lomb Incorporated (U.S.), Ellex Medical Lasers Limited (Australia), Topcon Corporation (Japan), Ziemer Ophthalmic Systems AG (Switzerland), IRIDEX Corporation (U.S.), NIDEK Co., Ltd. (Japan), and Lumenis Ltd. (Israel).

Stakeholders in the Ophthalmic Lasers Market

- Ophthalmic Lasers Manufacturing Companies

- Suppliers and Distributors of Ophthalmic Lasers

- Research and Consulting Firms

- Healthcare Service Providers, including Hospitals, Specialty Clinics, and Ambulatory Surgery Centers (ASCs)

- Research Institutes

- Venture Capitalists

To know about the assumptions considered for the study, download the pdf brochure

Ophthalmic Lasers Market Report Scope

This research report categorizes the global market into the following segments:

By Product Type

- Femtosecond Lasers

- Excimer Lasers

- Nd:YAG Lasers

- Diode Lasers

- Other Lasers [Nd:YAG Lasers operating in green (532 NM) wavelength, solid-state lasers, optically pumped semiconductor lasers, and lasers with fiber technology]

By Application

- Refractive Error Correction

- Cataract Removal

- Glaucoma Treatment

- Diabetic Retinopathy Treatment

- AMD Treatment

- Other Applications (retinal vein occlusions, ocular tumors, central serous chorioretinopathy, retinal breaks and detachment, eye floaters, corneal dystrophies, corneal scarring, macular edema, and choroidal neovascularization)

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- Spain

- Rest of Europe (RoE)

-

Asia-Pacific

- China

- India

- Japan

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Portfolio Assessment

Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies in the market.

Company Information

Detailed Analysis and Profiling of additional market players (up to 3)

The global ophthalmic lasers market is segmented on the basis of product types, applications, end users, and regions. On the basis of product type, the global market is segmented into femtosecond lasers, excimer lasers, Nd:YAG lasers, diode lasers, and other lasers. The femtosecond lasers segment is expected to account for the largest share of the market and is projected to grow at the highest CAGR during the forecast period. This can be attributed to factors such as increasing prevalence of ophthalmic disorders, technological advancements, increasing regulatory approvals, and expanding applications of femtosecond lasers.

On the basis of applications, the market is segmented into refractive error correction, cataract removal, glaucoma treatment, diabetic retinopathy treatment, AMD treatment, and other applications. The refractive error correction segment is expected to account for the largest share of the global market; whereas, the cataract removal segment is expected to grow at the highest CAGR.

On the basis of end users, the market is segmented into hospitals and clinics & ambulatory surgery centers (ASCs). The clinics & ambulatory surgery centers segment is projected to grow at the highest CAGR, primarily due to the increasing number of clinics in emerging economies such as China and India and increasing government initiatives for the development of ambulatory surgery centers.

The ophthalmic lasers market is segmented into four major regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Among these regional segments, North America is expected to account for the largest share of the global market. However, the Asia-Pacific region is expected to grow at the highest CAGR during the forecast period. The high growth in this regional segment can be attributed to factors such as high prevalence of ophthalmic disorders, introduction of initiatives for the prevention of blindness and treatment projects for various ophthalmic disorders, and rising aging population.

Alcon Laboratories, Inc. (U.S.), Abbott Medical Optics, Inc. (U.S.), Carl Zeiss Meditec AG (Germany), Bausch & Lomb Incorporated (U.S.), Ellex Medical Lasers Limited (Australia), Topcon Corporation (Japan), Ziemer Ophthalmic Systems AG (Switzerland), IRIDEX Corporation (U.S.), NIDEK Co., Ltd. (Japan), and Lumenis Ltd. (Israel) are some of the key players in the ophthalmic lasers market.

Frequently Asked Questions (FAQ):

Ophthalmic Lasers Market

The global Ophthalmic Lasers Market size is growing at a CAGR of 5.1%

What are the major growth factors of Ophthalmic Lasers Market ?

The growth of the market can be attributed to the increasing prevalence of chronic disorders, rising geriatric population, increasing regulatory approvals, and increasing initiatives to prevent vision impairment.

Who all are the prominent players of Ophthalmic Lasers Market ?

The key players in the market include Alcon Laboratories, Inc. (U.S.), Abbott Medical Optics, Inc. (U.S.), Carl Zeiss Meditec AG (Germany), Bausch & Lomb Incorporated (U.S.), Ellex Medical Lasers Limited (Australia), Topcon Corporation (Japan), Ziemer Ophthalmic Systems AG (Switzerland), IRIDEX Corporation (U.S.), NIDEK Co., Ltd. (Japan), and Lumenis Ltd. (Israel). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.2 Primary Research

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Insights From Primary Sources

2.2.2.3 Key Industry Insights

2.3 Market Size Estimation Methodology

2.4 Market Data Validation and Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 28)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 33)

4.1 Global Market Overview

4.2 Geographic Analysis: Market, By Product

4.3 Geographic Snapshot: Market

4.4 Global Market, By Application (2016 vs 2021)

4.5 Global Market, By End User (2016 vs 2021)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Prevalence of Ophthalmic Disorders

5.2.1.2 Rapid Growth in Geriatric Population

5.2.1.3 Technological Advancements and Increasing Regulatory Approvals for Ophthalmic Lasers

5.2.1.4 Rising Prevalence of Chronic Diseases Such as Diabetes

5.2.1.5 Increasing Initiatives to Control Visual Impairment

5.2.2 Restraint

5.2.2.1 High Cost of Equipment and Therapy

5.2.3 Opportunity

5.2.3.1 Growth Potential Offered By Emerging Economies

5.2.4 Threats

5.2.4.1 Availability of Alternative Therapies

5.2.5 Challenge

5.2.5.1 Unfavorable Reimbursements for Laser Eye Surgeries

6 Ophthalmic Lasers Market, By Product (Page No. - 44)

6.1 Introduction

6.2 Femtosecond Lasers

6.3 Excimer Lasers

6.4 ND:Yag Lasers

6.5 Diode Lasers

6.6 Others

7 Ophthalmic Lasers Market, By Application (Page No. - 52)

7.1 Introduction

7.2 Refractive Error Correction

7.3 Cataract Removal

7.4 Diabetic Retinopathy Treatment

7.5 Glaucoma Treatment

7.6 Age-Related Macular Degeneration Treatment

7.7 Others

8 Ophthalmic Lasers Market, By End User (Page No. - 61)

8.1 Introduction

8.2 Hospitals

8.3 Specialty Clinics and Ambulatory Surgery Centers

9 Ophthalmic Lasers Market, By Region (Page No. - 65)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 Rising Prevalence of Ophthalmic Disorders in the U.S.

9.2.1.2 Rising Prevalence of Chronic Diseases

9.2.1.3 Increasing Regulatory Approvals in the U.S.

9.2.2 Canada

9.2.2.1 Growing Burden of Ophthalmic Disorders in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Increasing Incidence of Severe Blindness and Visual Impairment

9.3.1.2 Increasing Awareness on Laser Therapy

9.3.2 France

9.3.2.1 Medical Tourism in France

9.3.3 Spain

9.3.3.1 Favorable Outlook for Market Growth

9.3.4 Rest of Europe (RoE)

9.3.4.1 Rising Aging Population

9.3.4.2 U.K.: Increasing Burden of Vision Impairment

9.3.4.3 Conferences and Symposiums

9.4 Asia-Pacific

9.4.1 China

9.4.1.1 High Prevalence of Target Diseases

9.4.1.2 Introduction of Blindness Prevention and Treatment Projects

9.4.2 India

9.4.2.1 Increasing Prevalence of Target Conditions in India

9.4.2.2 Rising Aging Population

9.4.3 Japan

9.4.3.1 Increasing Aging Population in Japan

9.4.4 Rest of Asia-Pacific (RoAPAC)

9.4.4.1 Rapid Increase in Refractive Surgeries in South Korea

9.4.4.2 Increasing Prevalence of Visual Impairment and Increasing Government Initiatives to Reduce the Disease Burden in Australia

9.4.4.3 Increasing Prevalence of Vision Impairment in Asia

9.5 Rest of the World

9.5.1 Rising Aging Population & Prevalence of Diabetes

10 Competitive Landscape (Page No. - 106)

10.1 Overview

10.2 Market Share Analysis

10.2.1 Introduction

10.2.2 Alcon Laboratories, Inc.

10.2.3 Abbott Medical Optics, Inc.

10.2.4 Carl Zeiss Meditec AG

10.2.5 Bausch & Lomb Incorporated

10.3 Competitive Situation and Trends

10.3.1 Product Approvals

10.3.2 New Product Launches

10.3.3 Agreements, Alliances, Partnerships, and Collaborations

10.3.4 Acquisitions

10.3.5 Expansions

10.3.6 Others

11 Company Profiles (Page No. - 116)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Introduction

11.2 Alcon Laboratories, Inc. (A Novartis AG Company)

11.3 Abbott Medical Optics, Inc. (A Subsidiary of Abbott)

11.4 Carl Zeiss Meditec AG

11.5 Bausch & Lomb Incorporated (A Valeant Pharmaceuticals International, Inc. Company)

11.6 Ellex Medical Lasers Limited

11.7 Topcon Corporation

11.8 Ziemer Ophthalmic Systems AG (A Subsidiary of Ziemer Group Holding AG)

11.9 Iridex Corporation

11.10 Nidek Co., Limited

11.11 Lumenis Ltd. (A XIO Group Company)

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 138)

12.1 Discussion Guide

12.2 Company Developments

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (69 Tables)

Table 1 Some Recent Product Approvals in the Ophthalmic Lasers Market Have Been Mentioned Below

Table 2 Ophthalmic Lasers Market Size, By Product, 2014-2021 (USD Million)

Table 3 Femtosecond Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 4 Excimer Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 5 ND:Yag Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 6 Diode Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 7 Other Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 8 Ophthalmic Lasers Market Size, By Application, 2014-2021 (USD Million)

Table 9 Ophthalmic Lasers Market Size for Refractive Error Correction, By Region, 2014-2021 (USD Million)

Table 10 Ophthalmic Lasers Market Size for Cataract Removal, By Region, 2014-2021 (USD Million)

Table 11 Ophthalmic Lasers Market Size for Diabetic Retinopathy Treatment, By Region, 2014-2021 (USD Million)

Table 12 Ophthalmic Lasers Market Size for Glaucoma Treatment, By Region, 2014-2021 (USD Million)

Table 13 Ophthalmic Lasers Market Size for Age-Related Macular Degeneration Treatment, By Region, 2014-2021 (USD Million)

Table 14 Ophthalmic Lasers Market Size for Other Applications, By Region, 2014-2021 (USD Million)

Table 15 Ophthalmic Lasers Market Size, By End User, 2014-2021 (USD Million)

Table 16 Ophthalmic Lasers Market for Hospitals, By Region, 2014-2021 (USD Million)

Table 17 Ophthalmic Lasers Market Size for Clinics and Ambulatory Surgery Centers, By Region, 2014-2021 (USD Million)

Table 18 Ophthalmic Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 19 North America Ophthalmic Lasers Market Size, By Country, 2014-2021 (USD Million)

Table 20 North America: Ophthalmic Lasers Market Size, By Product, 2014-2021 (USD Million)

Table 21 North America: Ophthalmic Lasers Market Size, By Application, 2014-2021 (USD Million)

Table 22 North America: Ophthalmic Lasers Market Size, By End User, 2014-2021 (USD Million)

Table 23 U.S.: Ophthalmic Lasers Market Size, By Product, 2014-2021 (USD Million)

Table 24 U.S.: Ophthalmic Lasers Market Size, By Application, 2014-2021 (USD Million)

Table 25 U.S.: Ophthalmic Lasers Market Size, By End User, 2014-2021 (USD Million)

Table 26 Canada: Ophthalmic Lasers Market Size, By Product, 2014-2021 (USD Million)

Table 27 Canada: Ophthalmic Lasers Market Size, By Application, 2014-2021 (USD Million)

Table 28 Canada: Ophthalmic Lasers Market Size, By End User, 2014-2021 (USD Million)

Table 29 Europe: Ophthalmic Lasers Market Size, By Country, 2014-2021 (USD Million)

Table 30 Europe: Ophthalmic Lasers Market Size, By Product, 2014-2021 (USD Million)

Table 31 Europe: Ophthalmic Lasers Market Size, By Application, 2014-2021 (USD Million)

Table 32 Europe: Ophthalmic Lasers Market Size, By End User, 2014-2021 (USD Million)

Table 33 Germany: Ophthalmic Lasers Market Size, By Product, 2014-2021 (USD Million)

Table 34 Germany: Ophthalmic Lasers Market Size, By Application, 2014-2021 (USD Million)

Table 35 Germany: Market Size, By End User, 2014-2021 (USD Million)

Table 36 France: Market Size, By Product, 2014-2021 (USD Million)

Table 37 France: Market Size, By Application, 2014-2021 (USD Million)

Table 38 France: Market Size, By End User, 2014-2021 (USD Million)

Table 39 Spain: Market Size, By Product, 2014-2021 (USD Million)

Table 40 Spain: Market Size, By Application, 2014-2021 (USD Million)

Table 41 Spain: Market Size, By End User, 2014-2021 (USD Million)

Table 42 RoE: Market Size, By Product, 2014-2021 (USD Million)

Table 43 RoE: Market Size, By Application, 2014-2021 (USD Million)

Table 44 RoE: Market Size, By End User, 2014-2021 (USD Million)

Table 45 Asia-Pacific Market Size, By Country, 2014-2021 (USD Million)

Table 46 Asia-Pacific: Market Size, By Product, 2014-2021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 48 Asia-Pacific: Market Size, By End User, 2014-2021 (USD Million)

Table 49 China: Market Size, By Product, 2014-2021 (USD Million)

Table 50 China: Market Size, By Application, 2014-2021 (USD Million)

Table 51 China: Market Size, By End User, 2014-2021 (USD Million)

Table 52 India: Market Size, By Product, 2014-2021 (USD Million)

Table 53 India: Market Size, By Application, 2014-2021 (USD Million)

Table 54 India: Market Size, By End User, 2014-2021 (USD Million)

Table 55 Japan: Market Size, By Product, 2014-2021 (USD Million)

Table 56 Japan: Market Size, By Application, 2014-2021 (USD Million)

Table 57 Japan: Market Size, By End User, 2014-2021 (USD Million)

Table 58 RoAPAC: Market Size, By Product, 2014-2021 (USD Million)

Table 59 RoAPAC: Market Size, By Application, 2014-2021 (USD Million)

Table 60 RoAPAC: Market Size, By End User, 2014-2021 (USD Million)

Table 61 RoW: Market Size, By Product, 2014-2021 (USD Million)

Table 62 RoW: Market Size, By Application, 2014-2021 (USD Million)

Table 63 RoW: Market Size, By End User, 2014-2021 (USD Million)

Table 64 Recent Approvals, 2013–2016

Table 65 New Product Launches, 2013–2016

Table 66 Agreements, Alliances, Partnerships, and Collaborations, 2013–2016

Table 67 Acquisitions, 2013–2016

Table 68 Expansions, 2013-2016

Table 69 Others, 2013–2021

List of Figures (36 Figures)

Figure 1 Global Ophthalmic Lasers Market: Research Methodology Steps

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Primary Research - Current Sampling Frame

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Research Design

Figure 7 Data Triangulation Methodology

Figure 8 Femtosecond Lasers to Grow at the Highest CAGR in the Market, By Product, From 2016 to 2021

Figure 9 Refractive Error Correction Segment Dominates the Market

Figure 10 Hospitals Segment to Dominate the Global Ophthalmic Lasers Market in 2016

Figure 11 Asia-Pacific to Witness the Highest Market Growth During the Forecast Period

Figure 12 Increasing Prevalence of Ophthalmic Disorders Driving the Market Growth

Figure 13 Femtosecond Lasers Dominate the Market in 2016

Figure 14 Asia-Pacific Market to Witness the Highest Growth During the Forecast Period

Figure 15 Refractive Error Correction Commands the Largest Market Share

Figure 16 Hospitals to Dominate the Market During 2016–2021

Figure 17 Ophthalmic Lasers Market: Drivers, Restraints, Opportunities, & Challenges

Figure 18 Global Ophthalmic Lasers Market, By Product

Figure 19 Ophthalmic Lasers Market, By Application

Figure 20 Ophthalmic Lasers Market, By End User

Figure 21 North America to Command the Largest Share of the Ophthalmic Lasers Market in 2016

Figure 22 North America: Ophthalmic Lasers Market Snapshot

Figure 23 Europe: Ophthalmic Lasers Market Snapshot

Figure 24 Asia-Pacific: Ophthalmic Lasers Market Snapshot

Figure 25 RoW: Ophthalmic Lasers Market Snapshot

Figure 26 Ophthalmic Lasers Market, By Key Player, 2015

Figure 27 Growth Strategies, By Company

Figure 28 Companies Adopted New Product Launches as Their Key Growth Strategy Over the Last Three Years (2013-2016)

Figure 29 Geographic Revenue Mix of the Top Five Market Players

Figure 30 Company Snapshot: Novartis AG

Figure 31 Company Snapshot: Abbott

Figure 32 Company Snapshot: Carl Zeiss Meditec AG

Figure 33 Company Snapshot: Valeant Pharmaceuticals International, Inc.

Figure 34 Company Snapshot: Ellex Medical Lasers Limited

Figure 35 Company Snapshot: Topcon Corporation

Figure 36 Company Snapshot: Iridex Corporation

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ophthalmic Lasers Market