Thermoelectric Generator Market Size, Share & Trends, 2025 To 2030

Thermoelectric Generator Market Type (Multistage, Single-stage), Temperature (<80, 80-500,> 500), Material (Bismuth Telluride, Lead Telluride), Application (Waste Heat, Energy Harvesting, Direct Power), Power, Industry - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

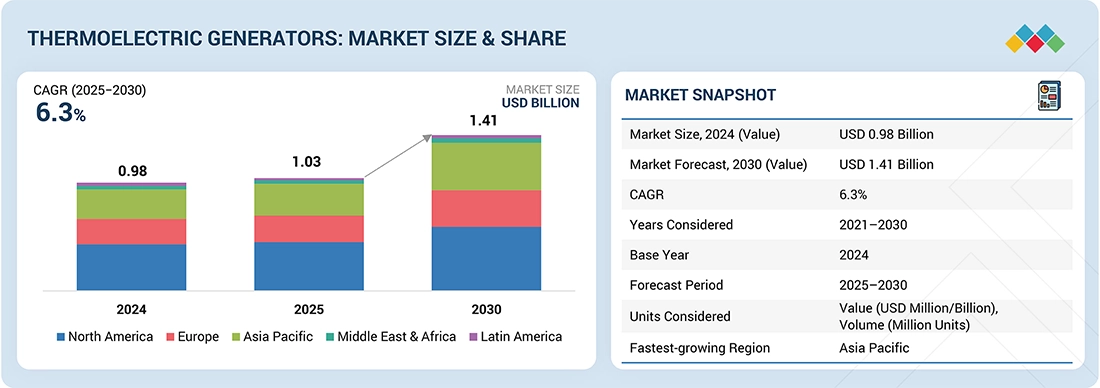

The thermoelectric generator market is estimated to be USD 1.03 billion in 2025 and is projected to reach USD 1.41 billion by 2030, registering a CAGR of 6.3% during the forecast period. The market is experiencing tremendous growth due to the rising demand for clean and sustainable energy solutions. TEGs convert waste heat into electricity, making them highly valuable in improving energy efficiency across automotive, aerospace, and manufacturing industries. With increasing global focus on energy conservation and emission reduction, TEGs offer a viable solution to harness untapped thermal energy. In addition, technological advancements have significantly improved the efficiency and cost-effectiveness of thermoelectric materials, making TEGs more practical for all automotive, industrial, and consumer applications

KEY TAKEAWAYS

-

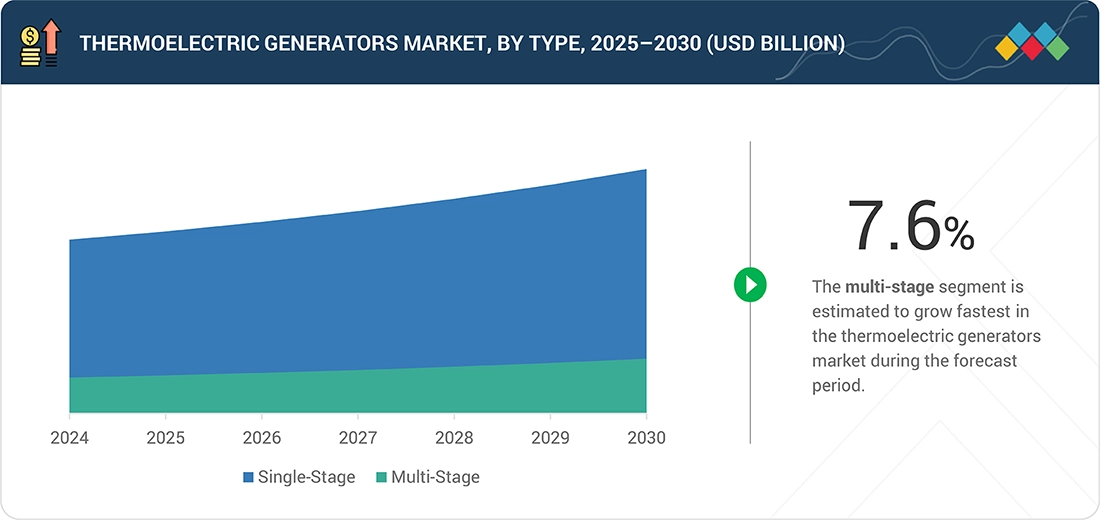

BY TYPEThe multistage segment in the thermoelectric generators market is growing the fastest due to its superior temperature differential handling and higher energy conversion efficiency. Its ability to deliver enhanced performance in high-temperature and industrial applications makes it increasingly preferred across automotive, aerospace, and power generation sectors.

-

BY MATERIALThe bismuth telluride segment dominates the thermoelectric generators market due to its high efficiency at low-to-medium temperature ranges and widespread availability. Its proven reliability in automotive, industrial, and consumer applications makes it the preferred choice for commercial TEG systems.

-

BY TEMPERATUREThe medium-temperature segment is set to dominate the TEG market as it aligns with the optimal operating range of most industrial and automotive waste-heat recovery applications, offering balanced efficiency and durability.

-

BY POWERThe medium power rating segment is expected to dominate the TEG market due to its suitability for widespread industrial, automotive, and remote power applications, balancing performance, cost, and integration ease.

-

BY APPLICATIONThe direct power generation segment will contribute significantly to the TEG market as it enables efficient, maintenance-free conversion of waste heat into electricity for industrial, automotive, and remote applications.

-

BY INDUSTRYThe industrial segment is set to contribute significantly to the TEG market due to high demand for waste heat recovery and energy efficiency solutions across manufacturing, power, and process industries.

-

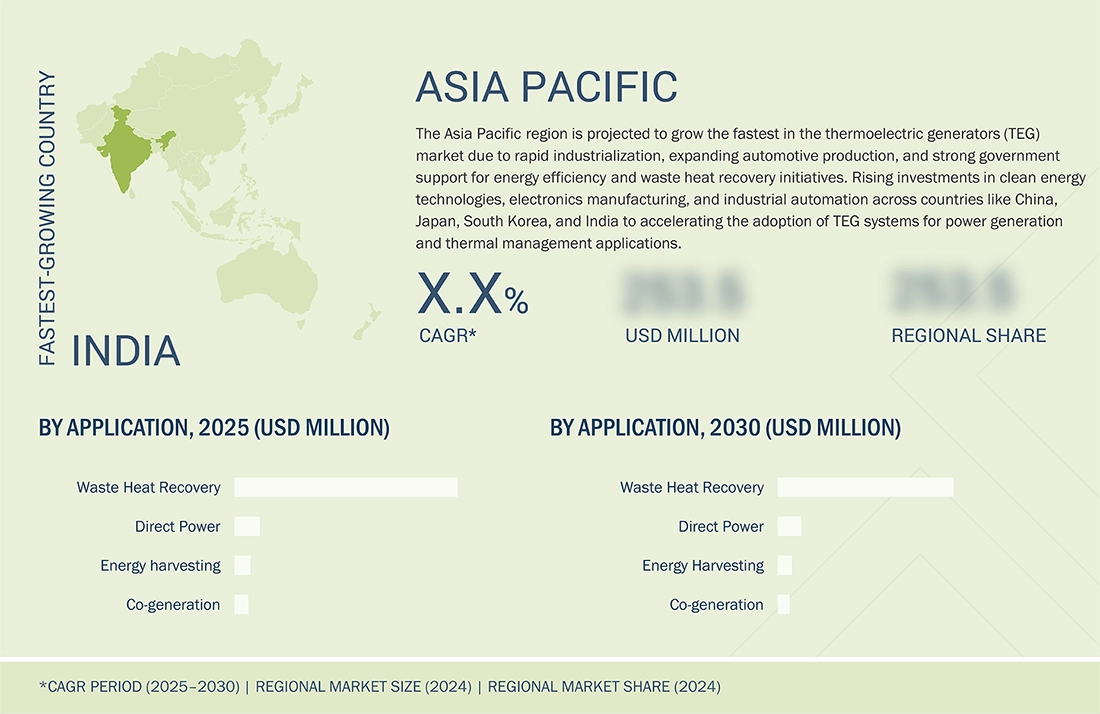

BY REGIONThe Asia Pacific region is projected to grow fastest in the TEG market, driven by rapid industrialization, expanding automotive production, and strong government support for energy-efficient technologies.

-

COMPETITIVE LANDSCAPEThe TEG market competitive landscape is shaped by technology leadership, strategic partnerships, and product innovation, with companies focusing on high-efficiency modules, turnkey solutions, and expansion into industrial and automotive applications.

The thermoelectric market is projected to be valued at USD 1.03 billion in 2025 and reach USD 1.41 billion by 2030, growing at a CAGR of 6.3%. The thermoelectric generators (TEG) market is primarily driven by the rising demand for waste heat recovery, clean energy conversion, and energy efficiency across industrial and automotive sectors. Growing emphasis on reducing carbon emissions and improving fuel efficiency has led to increased integration of TEGs in vehicles and manufacturing processes. Additionally, the proliferation of IoT and remote sensing applications requiring maintenance-free power sources supports market expansion. Advances in semiconductor materials, such as bismuth telluride and skutterudites, are enhancing conversion efficiency and durability, further boosting adoption.

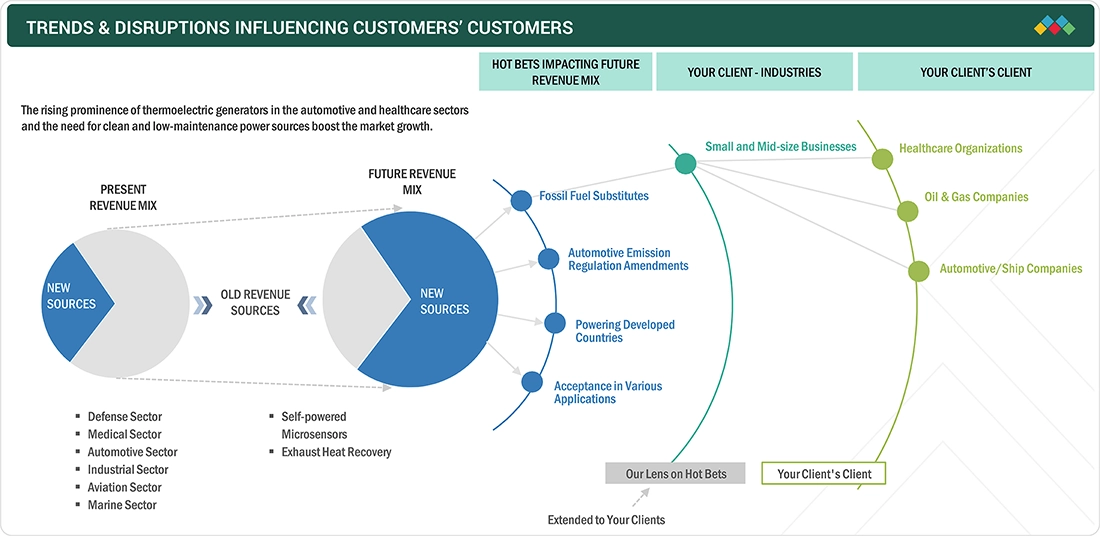

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The thermoelectric generators (TEG) market is witnessing trends such as the integration of multistage and high-efficiency modules, the adoption of advanced materials like bismuth telluride and skutterudites, and the growing use in waste heat recovery, automotive, and IoT applications. Key disruptions include emerging low-cost manufacturing techniques, innovations in hybrid TEG systems combined with solar or fuel cells, and the development of flexible or micro-TEG devices for wearable electronics and remote sensors. Additionally, government incentives for clean energy and increasing focus on carbon reduction are accelerating market transformation, driving both incumbents and new entrants to innovate rapidly.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High demand for waste heat recovery applications and direct power generation

-

Need for fuel efficiency amid stringent emission control

Level

-

Low efficiency of thermoelectric generators

-

High initial cost and lack of skilled personnel

Level

-

Ongoing research and development to enhance performance

-

Increasing adoption of thermoelectric generators across various sectors

Level

-

Availability of prominent substitutes and structural complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High demand for waste heat recovery applications and direct power generation

One of the strongest drivers of the thermoelectric generators (TEG) market is the worldwide quest for higher energy efficiency and sustainability. Many industrial processes, such as power plants, automotive production, steelmaking, and oil refining, waste a great deal of heat. Thermoelectric generators, which are capable of directly converting a temperature difference into electricity without using moving components, provide a potential means for utilizing this wasted energy. The technology allows industries to reclaim and put waste heat to use that would otherwise be emitted into the environment, thus enhancing overall energy efficiency and minimizing emissions. Governments worldwide enforce stronger regulations concerning energy conservation, greenhouse gas emissions, and fuel efficiency. This is most clearly seen in the transport industry, where car manufacturers are looking to technologies such as TEGs to address emissions and improve fuel efficiency with exhaust heat recovery.

Restraint: High initial cost and lack of skilled personnel

Thermoelectric generators market require high upfront investment and has low energy conversion ratio. TEGs generally can only convert 5–8% of the heat energy into electricity, depending on the temperature differential and the material. Compared to other alternative renewable energy sources, such as solar or wind, this efficiency is typically not high enough, especially in scenarios where maximum power output is an issue. High-tech thermoelectric materials used to maximize efficiency, such as bismuth telluride, lead telluride, or skutterudites, are costly and not necessarily commonly found. Fabricating TEGs with such materials involves precision engineering and special equipment, and most often translates to high fabrication costs. This cost-effectiveness needs to be considered in cost-sensitive applications like consumer electronics or mass industrial rollouts.

Opportunity: Increasing adoption of thermoelectric generators across various sectors

The increasing adoption of thermoelectric generators (TEGs) across diverse sectors including automotive, industrial manufacturing, aerospace, oil & gas, and remote sensing, presents a significant growth opportunity for the market. Rising demand for waste heat recovery, energy-efficient power generation, and maintenance-free remote energy solutions is driving TEG integration in vehicles, industrial plants, pipelines, and off-grid equipment. Additionally, the expansion of IoT devices, wearable electronics, and renewable energy applications creates new avenues for low-power TEG deployment, making cross-sector adoption a key driver for market expansion and technological innovation.

Challenge: Availability of prominent substitutes and structural complexity

The thermoelectric generators (TEG) market faces restrictions due to the availability of prominent substitutes, such as conventional generators, fuel cells, and solar photovoltaic systems, which often offer higher efficiency or lower upfront costs for certain applications. Additionally, the structural and material complexity of TEG modules, including the need for high-precision fabrication, specialized thermoelectric materials, and thermal management systems limits large-scale adoption and increases production costs. These factors collectively pose challenges to widespread commercialization, particularly in cost-sensitive industries, despite the growing interest in waste-heat recovery and off-grid power solutions

Thermoelectric Generators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops integrated thermoelectric generation units to recover waste heat from heavy industrial machinery, incinerators, and manufacturing plants | Strong OEM integration and system design capabilities | Proven large-scale waste heat recovery experience | Improves plant energy efficiency and reduces emissions |

|

Manufactures precision thermoelectric modules (Peltier/TEG components) used in instrumentation, telecom, automotive battery thermal management, and low-power generation systems | High-quality module manufacturing with tight tolerances | Strong customization and volume scalability | Trusted supplier for OEMs developing TEG-enabled products |

|

Supplies high-performance thermoelectric devices for thermal management and TEG applications in mobility, industrial, and electronics sectors | Advanced material science and ceramic technology | Superior durability and thermal cycling performance | Automotive-grade reliability for harsh environments |

|

Modular single- and multi-stage TEG devices for powering remote sensors, instrumentation, and industrial equipment in high-temperature or off-grid oil & gas environments | Broad TEG module portfolio with high-temperature endurance | Strong engineering support and documentation | Reduces integration risks for industrial users |

|

Designs and manufactures complete TEG-based remote power systems for oil & gas telemetry, pipeline monitoring, and off-grid communications | Proven field reliability | Turnkey, maintenance-free off-grid power solutions | Long operational life ideal for remote or unattended applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The thermoelectric generator market has various players, including Coherent Inc. (US), Global Power Technologies (Canada), Ferrotec Holdings (Japan), Komatsu Ltd. (Japan), and Kyocera Corporation (Japan). The market also has numerous small and medium-sized vital enterprises. Many players offer thermoelectric generators, while others provide integration services required in various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Thermoelectric Generators Market, by Type

The single-stage thermoelectric generator (TEG) segment is expected to dominate the market due to its simpler design, lower manufacturing cost, and ease of integration across a wide range of applications. Single-stage TEGs efficiently convert low-to-medium temperature differentials into electricity, making them ideal for automotive waste heat recovery, small industrial equipment, and remote power systems. Their reliability, compactness, and lower maintenance requirements compared to multistage systems further enhance adoption, particularly in cost-sensitive and large-scale deployments, reinforcing their dominance in the global TEG market.

Thermoelectric Generators Market, by Industry

Based on industry, the thermoelectric generator market is segmented into automotive, medical, consumer, telecom, industrial, and others. The automotive industry is estimated to lead the market due to the industry's urgent need for energy efficiency, emission reduction, and waste heat recovery. Traditional internal combustion engine (ICE) vehicles waste 60% of fuel energy as heat, particularly in exhaust systems. TEGs provide an excellent opportunity to reclaim and utilize this heat as sound electrical energy, improving overall fuel economy and reducing alternator and battery loading. This is accompanied by global trends compelling firms to adopt stricter fuel economy and carbon emissions regulations, especially in Europe, the US, and China. Automotive manufacturers invest billions of dollars in technologies like TEGs to ensure regulatory compliance while improving vehicle performance and sustainability. TEGs are solid-state, small, and feature no moving parts, making them perfectly suitable for automotive applications where space and reliability are critical. As demand for electric and hybrid vehicles grows, TEGs are also being developed for battery thermal energy recovery and battery management. As companies invest in light and efficient technology and governments continue to promote cleaner transportation, TEGs in the automotive industry are expected to contribute a significant share during the forecast period.

REGION

Asia Pacific to be fastest-growing region in global TEG market during forecast period

The Asia Pacific region is poised to experience the fastest growth in the thermoelectric generator market through the forecast period. Intensive industrialization in China, India, South Korea, and Japan fuels high demand for energy-efficient technologies and waste heat recovery systems. The region's dominant position in the automotive, electronics, and manufacturing industries holds significant potential for adopting TEGs in exhaust systems, industrial equipment, and wearable technology. Governments are also encouraging clean energy programs, energy efficiency regulations, and carbon-emission reduction policies, which are propelling the public and private sectors toward adopting TEG technologies at a faster pace. Additionally, Asia Pacific has the world's largest electronics and semiconductor industries, which will serve as a solid base for creating and bulk producing thermoelectric materials such as bismuth telluride. The market growth is also supported by lowering production costs, increasing research and development efforts, and a growing consumer base for new IoT and smart wearables applications. With continuous infrastructure development and a transition towards sustainable energy solutions, Asia Pacific is expected to contribute significantly to the overall thermoelectric generator market during the forecast period.

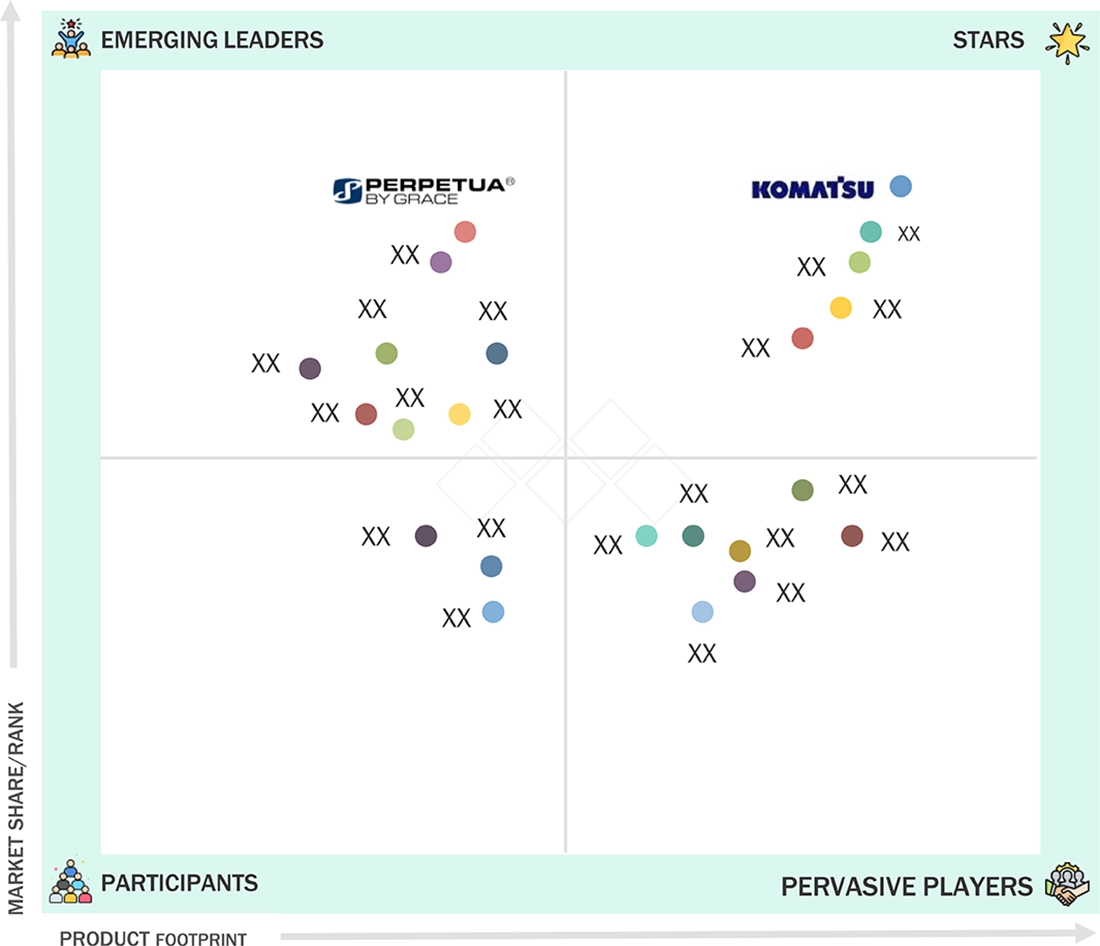

Thermoelectric Generators Market: COMPANY EVALUATION MATRIX

In the thermoelectric generators market, Komatsu Ltd is positioned as a star player due to its strong OEM integration, large-scale industrial waste-heat solutions, and established global presence.While Perpetua Power by Grace is an emerging competitor, gaining traction with innovative, small-to-medium-scale TEG systems and niche applications in remote and off-grid power, highlighting a market landscape of established leaders alongside agile new entrants

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.98 Billion |

| Market Forecast in 2030 (Value) | USD 1.41 Billion |

| Growth Rate | CAGR of 6.3% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, Middle East, Africa, South America |

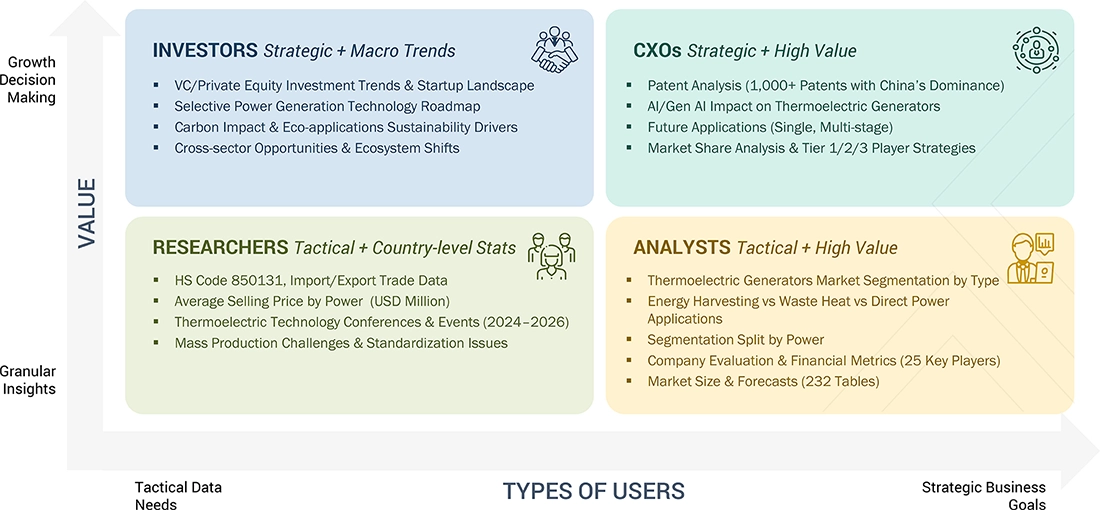

WHAT IS IN IT FOR YOU: Thermoelectric Generators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based TEG Adoption |

|

|

| European Manufacturer |

|

|

| North American End -use company |

|

|

| Japan-based Stakeholder for industrial, automotive, transportation, water-pumps, communication and so on. |

|

|

| Material Provider |

|

|

RECENT DEVELOPMENTS

- January 2025 : Same Sky Devices introduced a line of thermoelectric generator modules. These modules generate power ranging from 5.4W to 21.6W and are designed for industrial waste heat recovery applications.

- May 2023 : Coherent Corp and Mitsubishi Electric Corporation announced that they have signed a memorandum of understanding (MOU) to collaborate on a program to scale the manufacturing of SiC power electronics on a 200 mm technology platform.

- January 2023 : Global Power Technologies launched the Sentinel, a natural gas-powered thermoelectric generator providing up to 8W DC continuous power. It was designed for mission-critical applications, particularly in hazardous locations

- October 2022 : Global Power Technologies (GPT), Inc., announced the launch of its new MX PrimeGen Power Generator, its latest offering in ultra-reliable, uninterrupted power with efficient fuel consumption and low emissions. The MX draws from GPT’s decades of experience, starting with its TEG technology used by NASA for the Apollo space mission and installed on one of the most remote off-grid environments: the moon.

- July 2020 : Ferrotec Holdings Co., Ltd. acquired a 78% stake in RMT Ltd., a Russian manufacturer specializing in micro-thermoelectric modules. This acquisition aimed to enhance Ferrotec's product lineup and technological capabilities in the thermoelectric module sector.

Table of Contents

Methodology

The study utilized four major activities to estimate the thermoelectric generator market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the thermoelectric generator market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. Secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

List of Key Secondary Sources

|

Source |

Web Link |

|

The International Organization of Motor Vehicle Manufacturers |

https://www.oica.net/ |

|

Technology & Services Industry Association (TSIA). |

|

|

U.S. Department of Energy (DOE) |

https://www.energy.gov |

|

IEA (International Energy Agency) |

https://www.iea.org |

|

Japan’s New Energy and Industrial Technology Development Organization (NEDO) |

https://www.nedo.go.jp |

|

Process Equipment Manufacturers' Association (PEMA) |

www.pemanet.org/ |

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technologies, types, end-uses, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using thermoelectric generator offerings, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of thermoelectric generators, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Thermoelectric Generator Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the thermoelectric generator market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both the top-down and bottom-up approaches.

Market Definition

A thermoelectric generator (TEG) is a solid-state device that converts heat directly into electricity using the Seebeck effect. It captures waste heat from sources like engines or industrial processes and transforms it into electrical energy, enabling energy recovery and improved efficiency in various applications.

The thermoelectric generator (TEG) market refers to the industry focused on the production, development, and commercialization of devices that convert heat energy directly into electrical energy using the Seebeck effect. TEGs are solid-state devices that harvest waste heat from various sources, such as automotive engines, industrial processes, and renewable energy systems, and transform it into usable electricity. This market encompasses thermoelectric materials, modules, and integrated systems used across the automotive, aerospace, industrial, and consumer sectors. Growing demand for energy-efficient, sustainable power solutions and advancements in thermoelectric technology are key drivers of the expanding TEG market worldwide.

The report study covers a comprehensive analysis of the thermoelectric generator market based on type, power, temperature, material, application, industry, and region. The market is consolidated with the presence of key players such as Coherent Inc. (US), Global Power Technologies (Canada), Ferrotec Holdings (Japan), Komatsu Ltd. (Japan), and Kyocera Corporation (Japan).

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Pharmaceutical manufacturers

- Components suppliers

- Thermoelectric generator distributors and suppliers

- Research organizations and consulting companies

- Government bodies, such as regulating authorities and policymakers

- Venture capitalists, private equity firms, and startup companies

- Forums, alliances, and associations related to thermal management and energy

- Financial institutions, analysts, and strategic business planners

- Existing end users and prospective ones

- System integrators and technology consultants

Report Objectives

- To describe and forecast the thermoelectric generator market size by type, power, temperature, material, application, industry, and region in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and market contributions

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the thermoelectric generator supply chain

- To strategically analyze key technologies, indicative selling price trend, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies about the market under study

- To strategically profile key players in the thermoelectric generator market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the thermoelectric generator market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the thermoelectric generator market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the thermoelectric generator market.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Thermoelectric Generator Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Thermoelectric Generator Market

John

Jul, 2019

We are looking to understand the thermoelectric generators market. We are looking for: A break down of companies and market share and any forecasts of total market and the split between suppliers, Key performance parameters for each product type in the market, Key factors creating growth or slow down, Breakdown by region, Breakdown by application, Breakdown by military vs commercial, Competing technologies that are not thermoelectric, Industry revenues and profit margins, Government versus industry investment, Government programs for technology and developments, by country, Amount for TEGs - power density and energy conversion efficiency trends and drivers, Other key market drivers and data that is standard in your reports. .