Europe Fresh Food Packaging Market Product Type (Vegetables & Fruits), Package material (Flexible Plastic, Paper & Board, Rigid Plastic, Metal & Others), Pack type (Flexible, Semi-Rigid & Rigid), Point of Sale (Retail & Bulk) - Trends and Forecast to 2020

[159 Pages Report] The primary roles of fresh food packaging market are to protect food products from environmental influencing conditions, physical damage, to contain the food, to provide consumers with ingredient and nutritional information and more importantly, maintain the quality of food as per the predetermined standards. Fresh food packaging is made with materials such as flexible plastic, paper & board, rigid plastic, and metal. The Europe Fresh Food Packaging Market mainly deals in two main segments of food: vegetables and fruits.

The need for efficient and eco-friendly technologies to supply fresh food has attracted significant demand in recent times. The primary goal of fresh food packaging, in many companies and countries, especially in European countries is emphasizing on reducing the waste material and tamper detection facility to ensure that the provided service meets the predetermined standard protocol.

The fresh food packaging market has been growing in accordance with the packaging industry. With increasing awareness about global warming and concerns about the environment, packaging industry is opting for eco-friendly techniques of packaging such as the use of recyclable packaging material, which has had an influencing impact on the Europe Fresh Food Packaging Market in terms of increasing demand of packaged fresh food.

This report estimates the market size of the Europe fresh food packaging market in terms of value (USD million). In this report, the market is broadly segmented on the basis of product type, package material, pack type, point of sale, and country. Market drivers, restraints, challenges, raw material, and product price trends are discussed in detail. Market share, by participant, for the overall market is discussed in detail. The Europe fresh food packaging market has grown exponentially in the last few years and this trend is expected to continue. Increasing awareness about the health concerns and innovations in eco-friendly packaging techniques drive the growth of the fresh food packaging market in Europe.

Scope of the Report

This research study categorizes the Europe fresh food packaging market based on product type, package material, pack type, point of sale, and country:

Based on Product Type:

- Vegetables

- Fruits

Based on Package Material:

- Flexible Plastic

- Paper & Board

- Rigid Plastic

- Metal

- Others (glass, wood, rubber, and textiles)

Based on Pack Type:

- Flexible Pack

- Semi-Rigid Pack

- Rigid pack

Based on Point of Sale:

- Retail

- Bulk

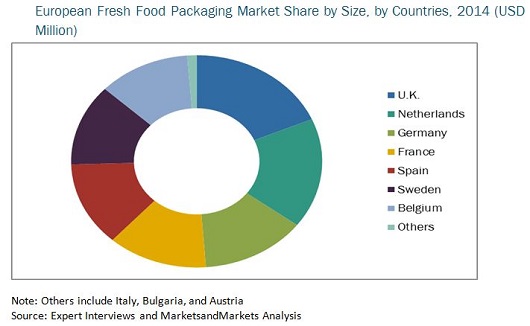

Based on Country:

- U.K.

- The Netherlands

- Germany

- France

- Spain

- Sweden

- Belgium

- Others (Italy, Bulgaria, and Austria)

The Europe fresh food packaging market is projected to reach USD 10,578.6 Million by 2020, at a CAGR of 2.13%, signifies a steady increase in the demand for packaged food.

The fresh food packaging market has been growing in accordance with the packaging industry. With increasing population, increasing incomes, increasing demand for convenience food, and the shelf life extension of packaged food are the main drivers for the fresh food packaging market.

The growth of the fresh food packaging market in Europe is primarily driven by the following factors:

- Demand for convenience food in the European region

- Shelf life extension of fresh produce

- Emerging markets in the European region

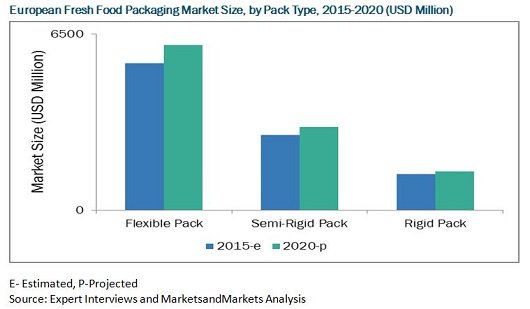

The flexible pack segment is projected to grow at the highest CAGR of 2.38% during the review period, that is, 2015-2020. The key players of fresh food packaging market prefer strategies such as agreements, contracts, joint ventures, and partnership strategies and expansions for global expansion.

The Europe fresh food packaging market is marked with intense competition due to the presence of a large number of both, big and small firms. New product launches, mergers & acquisitions, and partnerships and expansions are the key strategies adopted by market players to ensure their growth in the market. The key players in the Europe fresh food packaging market are Amcor Limited (Australia), Coveris Holdings S.A (U.S.), Smurfit Kappa (Ireland), E. I. du Pont de Nemours and Company (U.S.), Mondi Group (South Africa), Bemis Company, Inc. (U.S.), International Paper Company (U.S.), DS Smith Plc (U.K.), Ultimate Packaging (U.K.), Univeg Group (Belgium), Schur Flexibles Group (Austria), PP Global (U.K.), and Temkin International Inc. (U.S).

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered for the Fresh Food Packaging Market

1.4 Currency

1.5 Package & Sizing

1.6 Stakeholders

1.7 Limitation

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.2.1 Key Segments in the Packaging Market

2.2.2.2 Country-Wise Distribution of Packaging Industry

2.2.2.3 Key Factors Influencing Parent Industry

2.2.3 Demand Side Analysis

2.2.3.1 Rising Population

2.2.3.2 Supply-Side Analysis

2.3 Market Size Estimation

2.4 Market Breakdown & Data Tringulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 30)

3.1 Introduction

3.2 Europe Fresh Food Packaging Market, By Material

3.3 Europe Fresh Food Packaging Market, By Product Type

3.4 Europe Fresh Food Packaging Market, By Country

3.5 Europe Fresh Food Packaging Market, By Pack Type

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Europe Fresh Food Packaging Market

4.2 Europe Fresh Food Packaging Market, By Product Type

4.3 Fresh Food Packaging Market in the European Region

4.4 U.K. Dominated the Europe Fresh Food Packaging Market in 2014

4.5 Fresh Food Packaging Market: Across Europe

4.6 Flexible Pack Accounted for the Largest Share in 2014

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 Europe Fresh Food Packaging, By Product Type, Vegetables

5.3.2 Europe Fresh Food Packaging By Product Type, Fruit

5.3.3 Europe Fresh Food Packaging, By Package Material

5.3.4 Europe Fresh Food Packaging, By Pack Type

5.3.5 Europe Fresh Food Packaging, By Point of Sales Channel

5.3.6 Europe Fresh Food Packaging, By Country

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Demand for Convenience Food

5.4.1.2 Shelf Life Extension of Fresh Produce

5.4.1.3 Emerging Markets

5.4.2 Restraints

5.4.2.1 The Economic Crisis

5.4.2.2 Rising Raw Material Prices

5.4.3 Opportunities

5.4.3.1 Innovations in Eco-Friendly Packaging

5.4.3.2 Consumer Awareness About Health Concerns Influence the Market

5.4.4 Challenges

5.4.4.1 Controlling Prices to Ensure Affordability

5.4.4.2 Managing Packaging Waste

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.1.1 Large Number of Established Players

6.3.1.2 Strong Distribution Network Required

6.3.1.3 High Initial Capital Investment

6.3.2 Threat of Substitutes

6.3.2.1 Eco-Friendly Product Solutions

6.3.3 Bargaining Power of Suppliers

6.3.3.1 Highly Competitive Industry

6.3.3.2 Availability of Raw Material

6.3.4 Bargaining Power of Buyers

6.3.4.1 Wholesale Customers Hold A Higher Degree of Bargaining Power

6.3.4.2 Demand is Product Driven

6.3.5 Intensity of Competitive Rivalry

6.3.5.1 Increasing Market Share Acquisition

6.3.5.2 Large Number of Medium and Large Players

6.3.5.3 Extensive Product Portfolio

7 Fresh Food Packaging Market, By Product Type (Page No. - 49)

7.1 Introduction

7.1.1 Europe Fresh Food Packaging, By Vegetable

7.1.2 Europe Fresh Food Packaging Market, By Fruit

7.1.3 European Fresh Food Packaging, By Pack Type

8 Fresh Food Packaging Market, By Material (Page No. - 57)

8.1 Introduction

8.1.1 Europe Fresh Food Packaging Market Size, Material, By Pack Type

9 Europe Fresh Food Packaging Market, Pack Type (Page No. - 64)

9.1 Introduction

10 Europe Fresh Food Packaging Market, By Point of Sale (Page No. - 66)

10.1 Introduction

11 Europe Fresh Food Packaging Market, By Country (Page No. - 68)

11.1 Introduction

11.2 U.K

11.2.1 U.K.: Fresh Food Packaging Market, By Vegetable

11.2.1.1 Lettuce Packaging is Projected to Grow the Highest in the U.K. From 2015 to 2020

11.2.2 U.K. : Fresh Food Packaging Market Size, By Fruit

11.2.2.1 Citrus Fruits Packaging is Projected to Grow the Fastest in U.K. From 2015 to 2020

11.2.3 U.K.: Fresh Food Packaging Market, By Material

11.2.3.1 Rigid Plastic is Projected to Grow the Fastest in U.K. From 2015 to 2020

11.2.4 U.K.: Fresh Food Packaging Market, By Pack Type

11.2.4.1 Flexible Packaging is Projected to Grow the Fastest in the U.K. From 2015 to 2020

11.3 The Netherlands

11.3.1 The Netherlands: Fresh Food Packaging Market, By Vegetable

11.3.1.1 Mushroom Packaging is Projected to Grow the Fastest in the Netherlands From 2015 to 2020

11.3.2 The Netherlands: Fresh Food Packaging Market Size, By Fruit

11.3.2.1 Exotic Fruits Packaging is Projected to Grow the Fastest in the Netherlands From 2015 to 2020

11.3.3 The Netherlands: Fresh Food Packaging Market, By Material

11.3.3.1 Flexible Plastic is Projected to Grow the Fastest in the Netherlands From 2015 to 2020

11.3.4 The Netherlands: Fresh Food Packaging Market, By Pack Type

11.3.4.1 Flexible Packaging is Projected to Grow the Fastest in the Netherlands From 2015 to 2020

11.4 Germany

11.4.1 Germany: Fresh Food Packaging Market, By Vegetable

11.4.1.1 Mushroom Packaging is Projected to Grow the Fastest in Germany From 2015 to 2020

11.4.2 Germany: Fresh Food Packaging Market Size, By Fruit

11.4.2.1 Exotic Fruits Packaging is Projected to Grow the Fastest in Germany From 2015 to 2020

11.4.3 Germany: Fresh Food Packaging Market, By Material

11.4.3.1 Flexible Plastic is Projected to Grow the Fastest in Germany From 2015 to 2020

11.4.4 Germany: Fresh Food Packaging Market, By Pack Type

11.4.4.1 Flexible Pack is Projected to Grow the Fastest in Germany From 2015 to 2020

11.5 France

11.5.1 France: Fresh Food Packaging Market, By Vegetables

11.5.1.1 Mushroom Packaging is Projected to Grow the Fastest in France From 2015 to 2020

11.5.2 France: Fresh Food Packaging Market Size, By Fruit

11.5.2.1 Exotic Fruits Packaging is Projected to Grow the Fastest in France From 2015 to 2020

11.5.3 France: Fresh Food Packaging Market, By Material

11.5.3.1 Flexible Plastic is Projected to Grow the Fastest in France From 2015 to 2020

11.5.4 France: Fresh Food Packaging Market, By Pack Type

11.6 Spain

11.6.1 Spain : Fresh Food Packaging Market, By Vegetable

11.6.1.1 Mushroom Packaging is Projected to Grow the Fastest in Spain From 2015 to 2020

11.6.2 Spain: Fresh Food Packaging Market Size, By Fruit

11.6.2.1 Exotic Fruits Packaging is Projected to Grow the Fastest in Spain From 2015 to 2020

11.6.3 Spain: Fresh Food Packaging Market, By Material

11.6.3.1 Flexible Plastic is Projected to Grow the Fastest in Spain From 2015 to 2020

11.6.4 Spain: Fresh Food Packaging Market, By Pack Type

11.6.4.1 Flexible Pack is Projected to Grow the Fastest in Spain From 2015 to 2020

11.7 Sweden

11.7.1 Sweden : Fresh Food Packaging Market, By Vegetables

11.7.1.1 Fruity Vegetables Packaging is Projected to Grow the Fastest in Sweden From 2015 to 2020

11.7.2 Sweden: Fresh Food Packaging Market Size, By Fruit

11.7.2.1 Exotic Fruits Packaging is Projected to Grow the Fastest in Sweden From 2015 to 2020

11.7.3 Sweden: Fresh Food Packaging Market, By Material

11.7.3.1 Flexible Plastic is Projected to Grow the Fastest in Sweden From 2015 to 2020

11.7.4 Sweden: Fresh Food Packaging Market, By Pack Type

11.7.4.1 Flexible Pack is Projected to Grow the Fastest in Sweden From 2015 to 2020

11.8 Belgium

11.8.1 Belgium : Fresh Food Packaging Market, By Vegetables

11.8.1.1 Mushrooms Packaging is Projected to Grow the Fastest in Belgium From 2015 to 2020

11.8.2 Belgium: Fresh Food Packaging Market Size, By Fruit

11.8.2.1 Citrus Fruits Packaging is Projected to Grow the Fastest in Belgium From 2015 to 2020

11.8.3 Belgium: Fresh Food Packaging Market, By Material

11.8.3.1 Flexible Plastic is Projected to Grow the Fastest in Belgium From 2015 to 2020

11.8.4 Belgium: Fresh Food Packaging Market, By Pack Type

11.8.4.1 Flexible Pack is Projected to Grow the Fastest in Belgium From 2015 to 2020

11.9 Rest of the Europe (RoE)

11.9.1 RoE : Fresh Food Packaging Market, By Vegetables

11.9.1.1 Fruity Vegetables Packaging is Projected to Grow the Fastest in RoE From 2015 to 2020

11.9.2 RoE: Fresh Food Packaging Market Size, By Fruit

11.9.2.1 Stone Fruits Packaging is Projected to Grow the Fastest in RoE From 2015 to 2020

11.9.2.2 RoE: Fresh Food Packaging, By Material

11.9.3 RoE: Fresh Food Packaging Market, By Pack Type

11.9.3.1 Flexible Pack is Projected to Be the Fastest Growing Segment in RoE From 2015 to 2020

12 Competitive Landscape (Page No. - 110)

12.1 Introduction

12.2 Market Share Analysis: Europe Fresh Food Packaging

12.2.1 Market Share Analysis

12.2.2 Competitive Situations & Trends

12.2.3 Mergers & Acquisitions

12.2.4 Expansions & Investments

12.2.5 New Product Launches & Developments

12.2.6 Joint Ventures, Collaboration & Partnerships

13 Company Profiles (Page No. - 120)

13.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.2 Amcor Limited

13.3 Coveris Holdings S.A.

13.4 Smurfit Kappa

13.5 Dupont

13.6 Mondi Group PLC

13.7 Bemis Company, Inc.

13.8 International Paper Company

13.9 DS Smith PLC

13.10 Ultimate Packaging

13.11 Univeg Group

13.12 PP Global

13.13 Schur Flexibles Group

13.14 Temkin International Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 150)

14.1 Industry Insights

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Recent Developments

List of Tables (103 Tables)

Table 1 Fresh Food Product Type, By Category & Vegetables

Table 2 Fresh Food Product Type, By Category & Fruits

Table 3 Fresh Food Packaging Material & Their Descriptions

Table 4 Fresh Food Pack Type & Their Description

Table 5 Fresh Food Packaging Point of Sales Channel & Their Description

Table 6 Europe: Fresh Food Packaging Market Size, By Product, 2013-2020 (USD Million)

Table 7 Europe: Fresh Food Packaging Market Size, By Product, 2013-2020 (Million Tons)

Table 8 Europe: Fresh Food Packaging Market Size, By Vegetable, 2013-2020 (USD Million)

Table 9 Europe: Fresh Food Packaging Market Size, By Vegetable, 2013-2020 (Million Tons)

Table 10 Europe: Fresh Food Packaging Market Size, By Fruit, 2013-2020 (USD Million)

Table 11 Europe: Fresh Food Packaging Market Size, By Fruit, 2013-2020 (Million Tons)

Table 12 Europe: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 13 Europe: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (Million Tons)

Table 14 Europe: Fresh Vegetable Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 15 Europe: Fresh Vegetable Packaging Market Size, By Pack Type, 2013–2020 (Million Tons)

Table 16 Europe: Fresh Fruit Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 17 Europe: Fresh Fruit Packaging Market Size, By Pack Type, 2013–2020 (Million Tons)

Table 18 Europe: Fresh Food Packaging Market Size, By Material, 2013-2020 (USD Million)

Table 19 Europe: Fresh Food Packaging Market Size, By Material, 2013-2020 (Million Tons)

Table 20 Flexible Plastic in Europe Fresh Food Packaging Market, By Pack Type, 2013-2020 (USD Million)

Table 21 Flexible Plastic in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 22 Paper & Board in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 23 Paper & Board in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 24 Rigid Plastic in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 25 Rigid Plastic in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 26 Metal in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 27 Metal in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 28 Others in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 29 Others in Europe Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 30 Europe: Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (USD Million)

Table 31 Europe: Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 32 Europe: Fresh Food Packaging Market Size, By Point of Sale, 2013–2020 (USD Million)

Table 33 Europe: Fresh Food Packaging Market Size, By Point of Sale, 2013–2020 (Million Tons)

Table 34 Europe: Fresh Food Pacakging Market Size, By Country, 2013–2020 ( USD Million)

Table 35 Europe: Fresh Food Pacakging Market Size, By Country, 2013–2020 (Million Tons)

Table 36 U.K.: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 37 U.K.: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 38 U.K.: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 39 U.K.: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 40 U.K.: Fresh Food Packaging Market Size, By Material, 2013-2020 (USD Millions)

Table 41 U.K.: Fresh Food Packaging Market Size, By Material, 2013-2020 (Million Tons)

Table 42 U.K.: Fresh Food Pacakging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 43 U.K.: Fresh Food Pacakging Market Size, By Pack Type, 2013–2020 (Million Tons)

Table 44 The Netherlands.: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 45 The Netherlands: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 46 The Netherlands: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 47 The Netherlands: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 48 The Netherlands: Fresh Food Pacakging Market Size, By Material, 2013–2020 (USD Million)

Table 49 The Netherlands: Fresh Food Pacakging Market Size, By Material, 2013–2020 (Million Tons)

Table 50 The Netherlands.: Fresh Food Pacakging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 51 The Netherlands: Fresh Food Pacakging Market Size, By Pack Type, 2013–2020 (Million Tons)

Table 52 Germany: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 ( USD Million)

Table 53 Germany: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 54 Germany: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 55 Germany : Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 56 Germany : Fresh Food Pacakging Market Size, By Material, 2013–2020 (USD Million)

Table 57 Germany : Fresh Food Pacakging Market Size, By Material, 2013–2020 (Million Tons)

Table 58 Germany : Fresh Food Pacakging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 59 Germany : Fresh Food Pacakging Market Size, By Pack Type, 2013–2020 (Million Tons)

Table 60 France: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 61 France: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 62 France: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 63 France : Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 64 France: Fresh Food Packaging Market Size, By Material, 2013–2020 (USD Million)

Table 65 France: Fresh Food Packaging Market Size, By Material, 2013–2020 (Million Tons)

Table 66 France: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 67 France: Fresh Food Packaging, By Pack Type, 2013-2020 (Million Tons)

Table 68 Spain: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 69 Spain: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 70 Spain: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 71 Spain: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 72 Spain: Fresh Food Packaging Market Size, By Material, 2013–2020 (USD Million)

Table 73 Spain: Fresh Food Packaging Market Size, By Material, 2013–2020 (Million Tons)

Table 74 Spain: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 75 Spain: Fresh Food Packaging, By Pack Type, 2013-2020 (Million Tons)

Table 76 Sweden: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 77 Sweden: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 78 Sweden: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 79 Sweden: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 80 Sweden: Fresh Food Packaging Market Size, By Material, 2013–2020 (USD Million)

Table 81 Sweden: Fresh Food Packaging Market Size, By Material, 2013–2020 (Million Tons)

Table 82 Sweden: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 83 Sweden: Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 84 Belgium: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 85 Belgium: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 86 Belgium: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 87 Belgium: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 88 Belgium: Fresh Food Packaging Market Size, By Material, 2013–2020 (USD Million)

Table 89 Belgium: Fresh Food Packaging Market Size, By Material, 2013–2020 (Million Tons)

Table 90 Belgium: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 91 Belgium: Fresh Food Packaging Market Size, By Pack Type, 2013-2020 (Million Tons)

Table 92 RoE: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (USD Million)

Table 93 RoE: Fresh Food Pacakging Market Size, By Vegetable, 2013–2020 (Million Tons)

Table 94 RoE: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (USD Million)

Table 95 RoE: Fresh Food Pacakging Market Size, By Fruit, 2013–2020 (Million Tons)

Table 96 RoE: Fresh Food Packaging Market Size, By Material, 2013–2020 (USD Million)

Table 97 RoE : Fresh Food Packaging Market Size, By Material, 2013–2020 (Million Tons)

Table 98 RoE: Fresh Food Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 99 RoE : Fresh Food Packaging, By Pack Type, 2013-2020 (Million Tons)

Table 100 Mergers & Acquisitions, 2011 2015

Table 101 Expansions and Investments, 2011-2015

Table 102 New Products Launches & Developments, 2011-2015

Table 103 Joint Ventures, Collaboration, and Partnership, 2011-2015

List of Figures (45 Figures)

Figure 1 Fresh Food Packaging Market: Research Design

Figure 2 Breakdown of Primaries: By Company Type, Designation & Region

Figure 3 Poultry, Seafood & Meat Products Packaging Accounted for the Largest Share in the European Food Packaging in 2014

Figure 4 Key Factors Influencing the Packaging Industry

Figure 5 Population Projected By 2050 in Europe

Figure 6 Market Size Estimation Methodolgy: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Assumptions of the Research Study

Figure 10 Limitations of the Research Study

Figure 11 Europe Fresh Food Packaging Market Size, By Material, 2015-2020 (USD Million)

Figure 12 Europe: Fresh Food Packaging Market Size, By Product Type, 2015-2020 (USD Million)

Figure 13 Europe: Fresh Food Packaging Market Share, By Country, 2014

Figure 14 Europe: Fresh Food Packaging Market Size, By Pack Type, 2015-2020 (USD Million)

Figure 15 Emerging Economies Offer Attractive Opportunities in the Fresh Food Packaging Market During 2015-2020

Figure 16 Fruit Type to Grow at the Highest Rate During 2015-2020

Figure 17 Flexible Pack Captured the Largest Share in the European Market in 2014

Figure 18 U.K. is Projected to Be the Fastest-Growing Country-Level Market for European Fresh Food Pacakging During 2015-2020

Figure 19 U.K. is Expected to Be the Leading Market in European Fresh Food Packaing During the Review Period

Figure 20 Flexible Pack Led the Eurpean Fresh Food Packaging Industry in 2014

Figure 21 Evolution of Food Packaging Industry

Figure 22 Fresh Food Packaging Market Segmentation

Figure 23 Strong Demand for Convenience Food in the European Region is the Key Driver of the Fresh Food Packaging Market

Figure 24 Fresh Food Packaging Market Value Chain Analysis

Figure 25 Porter’s Five Forces Analysis

Figure 26 Geographic Snapshot (2015–2020): the Markets in the U.K. is Projected to Register the Highest Growth Rate

Figure 27 The U.K. Accounted to Be the Largest Market, in 2020

Figure 28 Companies Preferred Mergers & Acquisitions Strategy Over the Last Five Years

Figure 29 Mergers & Acquisitions Have Fuelled Growth

Figure 30 Mergers & Acquisitions: The Key Growth Strategy

Figure 31 Annual Developments in the Europe Fresh Food Packaging Market, 2011-2015

Figure 32 Geographical Revenue Mix of Top Five Players

Figure 33 Amcor Limited: Company Snapshot

Figure 34 Amcor Limited: SWOT Analysis

Figure 35 Coveris Holdings S.A.: Company Snapshot.

Figure 36 Coveris Holdings S.A: SWOT Analysis

Figure 37 Smurfit Kappa: Company Snapshot

Figure 38 Smurfit Kappa: SWOT Analysis

Figure 39 Dupont: Company Snapshot

Figure 40 Dupont : SWOT Analysis

Figure 41 Mondi Group PLC : Company Snapshot

Figure 42 Mondi Group PLC : SWOT Analysis

Figure 43 Bemis Company, Inc.: Company Snapshot

Figure 44 International Paper Company: Company Snapshot

Figure 45 DS Smith PLC: Comapny Snapshot

Growth opportunities and latent adjacency in Europe Fresh Food Packaging Market