Europe Cloud CRM Market by Vertical (Nonprofit and Higher Education), Nonprofit (Education, Research and Innovation, Social Affairs, Children and Youth, Art & Culture, and Others), and country (UK, Germany, France, and Switzerland) - Global Forecast to 2024

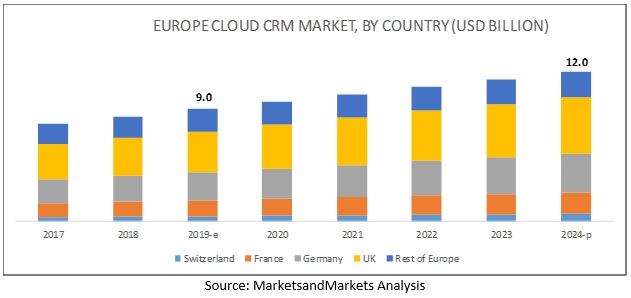

[131 Pages Report] The Europe cloud CRM market size is expected to grow from USD 9.0 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 5.86% during the forecast period.

The increasing number of online courses is driving the Europe CRM market growth. Massive Open Online Courses (MOOCs) is one of the areas where most of the Swiss universities are focusing on. The courses offered are Autonomous Mobile Robots and Teaching Science at University by ETH Zürich; Particle Physics: An introduction by University of Geneva; and Exploring Possible Futures: Modeling in Environmental and Energy Economics; and Statistical Shape Modelling: Computing the Human Anatomy by University of Basel.

Among the nonprofit vertical, the children and youth sub-vertical to record the highest CAGR during the forecast period

Nonprofit Organizations (NPOs) working in the children and youth sector are increasingly using digital tools for managing customer relationships. The younger generation is more accustomed to digital communication channels as compared to older generations, it is a critical factor for NPO working in the children and youth sector to use the CRM software for the CRM process. The increased use of social media and digital payment systems is driving NPOs toward digitization. NPOs are not willing to pay for CRM due to limited funding and availability of free as well as open source CRM solutions. They prefer inexpensive and customized CRM solutions that provides free maintenance of on-premises CRM software.

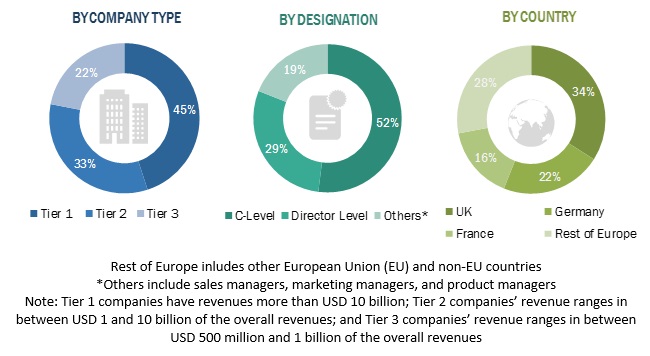

Among countries in Europe, the UK to account for the largest market size during the forecast period

The UK is expected to be the main revenue contributor to the Europe cloud CRM market. The growth of the CRM market in the UK is expected to grow, as GDPR compliance in the UK would present huge demand for cloud CRM software in the UK.

The GDPR compliance in the UK is expected to boost the demand for CRM software in the UK. The GDPR compliance requires certain precautions to be taken; some of the modern CRM software come with features that help organizations adhere to the GDPR compliances. Strict GDPR compliance in the UK is expected to boost the demand for the CRM software during the forecast period.

Key Europe Cloud CRM Market Players

In the Europe cloud CRM market, the key and emerging market players include Zayo Group (US), Nokia (Finland), Verizon (US), GTT (US), CenturyLink (Louisiana), AT&T (US), Sprint (US), Comcast (US), Colt Technology Solution (UK), Crown Castle (US), Windstream Enterprises (US), Charter Communications (US), Cox Communications (US), and Jaguar Network (France). These players have adopted various strategies to grow in the market. They have adopted organic and inorganic strategies, such as new product launches, acquisitions, business expansions, and partnerships, to expand their business reach and drive their business revenue growth. Moreover, various Europe cloud CRM providers are adopting various strategies, including venture capital funding, funding through Initial Coin Offering (ICO), new product launches, acquisitions, and partnerships and collaborations, to expand their presence in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Vertical (nonprofit and higher education), Nonprofit (education, research and innovation, social affairs, children and youth, art and culture, and others), and Country (UK, Germany, France, and Switzerland) - Europe Forecast to 2024 |

|

Geographies covered |

Europe |

|

Companies covered |

Microsoft (US), PeopleSoft (US), ELCA (Switzerland), 1CRM (Canada), Cirrus Shield (France), Zoho (Chennai), SAP (Germany), Hubspot (US) Unit4 (Netherlands), Cocomore (Switzerland), Curexus GmbH (Germany), ALISTON Consulting (France), Absys Cyborg (France), SugarCRM Inc. (US), Vtiger (India), Bexio (Switzerland), Bpm’Online (US), TYPO3 (Germany), and eWay CRM (US) |

The research report categorizes the Europe cloud CRM market to forecast the revenues and analyze trends in each of the following sub segments:

By Vertical

- Nonprofit

- Higher Education

- Others (Banking, Financial Services and Insurance (BFSI), Consumer Goods and Retail, Healthcare, Telecom and IT, Energy and Utilities, and Transportation and Logistics)

By Nonprofit Sub Vertical

- Education

- Research and Innovation

- Social Affairs

- Children and Youth

- Art and Culture

- Others

By Country

- UK

- Germany

- France

- Switzerland

- Rest of Europe

Recent Developments

- In April 2019, Microsoft Dynamics 365 announced new capabilities to its Dynamics 365 Customer Service Insights. The new capabilities include features: view related cases in a topic, give feedback to cases in a topic, move cases to another topic, rename topics, set topic granularity, refresh dashboards on demand, persist filters across dashboards, and improved experience in the website header.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming trends in Europe cloud CRM market?

- What are the competitive developments, such as mergers and acquisitions, new product developments, and business expansion activities, in the market.?

- How major factors, such as drivers, restraints, opportunities, and challenges, influence the growth of the market?

- What are the key roles of major players in the Europe cloud CRM market?

Frequently Asked Questions (FAQ):

What does cloud CRM mean?

Cloud CRM is defined as the Customer Relationship Management (CRM) that is deployed on the cloud. It is delivered to its end-users via SaaS based model

What are the cloud CRM best practices?

Some of the best practices of the cloud CRM solutions are as follows:

- The company must know its business goals and requirements

- Organizations must try to automate most of the repetitive tasks

- The company must always keep the customer database and information updated

- The company deploying cloud CRM should foster a supportive board and senior management team

What is the Europe cloud CRM market size?

The Europe cloud CRM market size is expected to grow from USD 9.0 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 5.86% during the forecast period

Which country have the highest market share in the Europe cloud CRM market?

The UK is expected to be the main revenue contributor to the Europe cloud CRM market. The growth of the CRM market in the UK is expected to grow, as GDPR compliance in the UK would present huge demand for cloud CRM software in the UK.

Who are the major vendors in the Europe cloud CRM market?

In the Europe cloud CRM market, the key and emerging market players include Zayo Group, Nokia, Verizon, GTT, CenturyLink, AT&T, Sprint, Comcast, Colt Technology Solution, Crown Castle, Windstream Enterprises, Charter Communications, Cox Communications, and Jaguar Network.

Which vertical is expected to witness high adoption in coming years?

The Non-profit vertical, the children and youth sub-vertical to record the highest CAGR during the forecast period. Non-profit Organizations (NPOs) working in the children and youth sector are increasingly using digital tools for managing customer relationships. The younger generation is more accustomed to digital communication channels as compared to older generations, it is a critical factor for NPO working in the children and youth sector to use the CRM software for the CRM process. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Market Introduction

1.2 Objectives of the Study

1.3 Market Definition

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Assumptions

1.7 Limitations

1.8 Stakeholders

Research Methodology

2.1 Research Data

2.1.1 Research Methodology

2.1.1 Breakup of Primary Profiles

2.2 Data Triangulation

2.3 Top-Down and Bottom-Up Approach

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities in the Europe Cloud CRM Market

4.2 Market By Vertical, 2019–2024

4.3 Market By Nonprofit, 2019–2024

4.4 Market By Higher Education, 2019–2024

4.5 Market By Nonprofit Sub-Vertical, 2019–2024

4.6 Market Growth Across Countries, 2019

5 Market Overview and Industry Trends

5.1 Nonprofit

5.2 Pestle Analysis

5.3 Higher Education

5.4 Pestle Analysis

6 Europe Cloud CRM Market: Vendor and Partner Ecosystem

6.1 CRM Vendors

6.2 System Integrators

6.3 CRM-Based App Developers

7 Europe Cloud CRM Market, Nonprofit By Sub-Verticals

7.1 Nonprofit: By Sub-Vertical

7.2 Education

7.3 Research and Innovation

7.4 Social Affairs

7.5 Children and Youth

7.6 Art and Culture

7.7 Others

8 Europe Cloud CRM Market, Country Analysis

8.1 United Kingdom

8.2 Germany

8.3 France

8.4 Switzerland

8.5 Rest of Europe

9 Company Profiles

9.1 Higher Education and Nonprofit Segments

9.1.1 Microsoft

9.1.2 Peoplesoft

9.1.3 Hubspot

9.1.4 SAP

9.1.5 ELCA

9.1.6 1CRM

9.1.7 Gmrit Solutions

9.1.8 Cirrus Shield

9.1.9 Zoho

9.2 Higher Education

9.2.1 Otrs

9.2.2 Cas Software AG

9.2.3 Hubspotcrm

9.2.4 Jenzabar

9.2.5 Ambit

9.2.6 Dotbase

9.2.7 Unit4

9.2.8 Academyfive

9.2.9 Hobsons CRM

9.2.10 Cosmoconsult

9.2.11 Best Practice It Solutions GmbH

9.2.12 Wisys

9.2.13 Saba Learning System

9.2.14 Infoclip

9.2.15 Academyfive

9.2.16 ALISTON Consulting

9.2.17 Coheris

9.2.18 Student Recruitment System

9.3 Nonprofit

9.3.1 Nexellgmbh

9.3.2 Cocomore

9.3.3 SugarCRM

9.3.4 Vtiger

9.3.5 Bexio

9.3.6 Curexus

9.3.7 Konica Minolta Business Solutions Germany

9.3.8 Wicecrm

9.3.9 Bpm’online

9.3.10 eWay CRM

9.3.11 TYPO3

9.3.12 Absyscyborg

9.3.13 Oracle

9.3.14 ALISTON Consulting

10 Appendix

10.1 Discussion Guide

10.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.3 Related Reports

10.4 Author Details

10.5 Disclaimer

List of Tables (9 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2018

Table 2 Nonprofit: Europe Cloud CRM Market, By Sub-Vertical, 2019–2024 (Usd Million)

Table 3 Nonprofit : Market By Country, 2019–2024 (Usd Million)

Table 4 Nonprofit : Education Sub-Vertical, By Country, 2019–2024 (Usd Million)

Table 5 Nonprofit : Research and Innovation Sub-Vertical, By Country, 2019–2024 (Usd Million)

Table 6 Nonprofit : Social Affairs Sub-Vertical, By Country, 2019–2024 (Usd Million)

Table 7 Nonprofit : Children and Youth Sub-Vertical, By Country, 2019–2024 (Usd Million)

Table 8 Nonprofit : Art and Culture Sub-Vertical, By Country, 2019–2024 (Usd Million)

Table 9 Nonprofit: Others Sub-Vertical, By Country, 2019–2024 (Usd Million)

List of Figures (12 Figures)

Figure 1 Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Research Design

Figure 4 Research Methodology

Figure 5 Breakup of Primary Profiles

Figure 6 Data Triangulation

Figure 7 Opportunities in Europe Cloud CRM Market

Figure 8 Market By Vertical, 2019–2024

Figure 9 Market By Nonprofit, 2019–2024

Figure 10 Market By Higher Education, 2019–2024

Figure 11 Market By Nonprofit, 2019–2024

Figure 12 Market By Country, 2019–2024

The study involved 4 major activities to estimate the current market size of the Europe cloud Customer Relationship Management (CRM) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments of the Europe cloud CRM market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; crypto asset management technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both the supply and demand sides of the Europe cloud CRM market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide Europe cloud CRM services and associated solution providers operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For estimating and forecasting the Europe cloud CRM market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the Europe cloud CRM market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Europe cloud CRM market by vertical (nonprofit and higher education), nonprofit (education, research and innovation, social affairs, children and youth, art and culture, and others), and country (UK, Germany, France, and Switzerland) - Europe Forecast to 2024.

- To provide detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the market’s sub segments with respect to the individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market’s segments with respect to 4 major European countries, namely, UK, Germany, France, and Switzerland

- To profile the key players and comprehensively analyze their recent developments and positioning in the Europe cloud CRM market

- To analyze the competitive developments, such as mergers and acquisitions, new product developments, and R&D activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

CRM Software Analysis

- CRM software detailed information and comparisons

Geographic Analysis

- Further breakup of the other EU and non-EU countries for cloud CRM market

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Europe Cloud CRM Market

Interested in European CRM market