Energy Cloud Market by Solution (Customer Management, Reporting and Analytics Enterprise Asset Management), Service, Service Model (SaaS, PaaS, and IaaS), Deployment Model, Organization Size, and Region - Global Forecast to 2021

[145 Pages Report] The energy cloud market size is expected to grow from USD 5.12 Billion in 2016 to USD 15.18 Billion by 2021, at an estimated Compound Annual Growth Rate (CAGR) of 24.3%.

The energy cloud report aims at estimating the market size and future growth potential of the market across different segments, such as solutions, services, deployment models, service models, organization sizes, and regions. The primary objective of the report is to provide a detailed analysis of the major factors influencing the growth of this market (drivers, restraints, opportunities, industry-specific challenges, and burning issues), analyze the opportunities in the market for stakeholders, and details of the competitive landscape for market leaders.

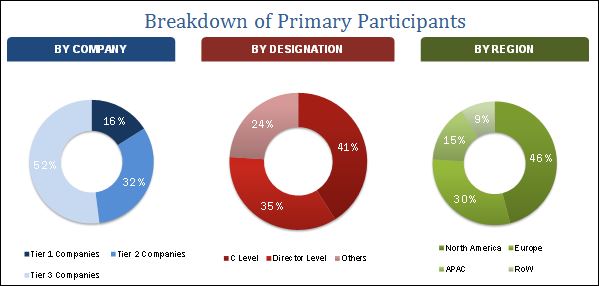

The research methodology used to estimate and forecast the energy cloud market begins with capturing data on key vendor revenues through secondary literature, such as annual reports, company websites, public databases, and MarketsandMarkets data repository. This research study involved the extensive usage of secondary sources, directories, and databases, such as Cloud Computing Association (CCA), Hoovers, Bloomberg, Businessweek, Factiva, and OneSource, to identify & collect information useful for this technical, market-oriented, and commercial study of the market. The vendors offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of key players in this market. After arriving at the overall market size, the total market was split into several segments & subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The breakdown of profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The energy cloud market comprises vendors, such as Accenture PLC (Chicago, Illinois, U.S.), IBM Corporation (New York, U.S.), HCL Technologies (Noida, India), SAP SE ( Walldorf, Germany), Cisco Systems, Inc. ( California, U.S.), Oracle Corporation (California, U.S.), Capgemini (Paris, France), TCS (Mumbai, India), HPE (California, U.S.), Microsoft Corporation (Washington, U.S.), and Brillio (California, U.S.).

Target Audience for Energy Cloud Market

- Energy and utilities industries

- Energy cloud vendors

- System integrators

- Consultancy firms/advisory firms

- Professional service providers

- Government agencies

- Investor and venture capitalists

The research study answers several questions for the stakeholders, primarily which market segments to focus in during the next two to five years for prioritizing the efforts and investments.

Scope of the Energy Cloud Market

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following sub-markets:

By Solution

- Enterprise asset management

- Supply chain management

- Customer Relationship Management (CRM)

- Risk and compliance management

- Workforce management

- Reporting and analytics

- Others

By Service

- Professional services

- Managed services

By Service Model

- Software-as-a-Service (SaaS)

- Platform-as-a-Service (PaaS)

- Infrastructure-as-a-Service (IaaS)

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Vendor Comparison Analysis

- Vendor comparison analysis provides information about the major players, who offer energy cloud services & solutions and outline the findings & analysis, on how well each market vendor performs within our criteria.

Geographic Analysis

- Further breakdown of the North American energy cloud market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The energy cloud market is expected to grow from USD 5.12 Billion in 2016 to USD 15.18 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 24.3% during the forecast period. The demand for the market is driven by factors, such as rising aging infrastructure and grid security concerns. The growing need for enterprises to have Customer Relationship Management (CRM) is fueling the growth of the cloud energy market, globally.

The enterprise asset management solution segment is estimated to have the largest market share during the forecast period. The solution offers various benefits, such as real-time visibility into asset usage and govern them & improve the return on assets. Energy cloud players provide asset management solution, which helps in clear visibility and control over critical assets that affect the risk & compliance.

The managed services segment is expected to experience the highest growth during the forecast period. This service helps manage upstream and downstream oil & gas and nuclear & smart grid management of the energy and utility enterprises. Moreover, all the pre and post-deployment queries and needs of customers are addressed under managed services, for which, companies outsource services to offer customers on-time service delivery.

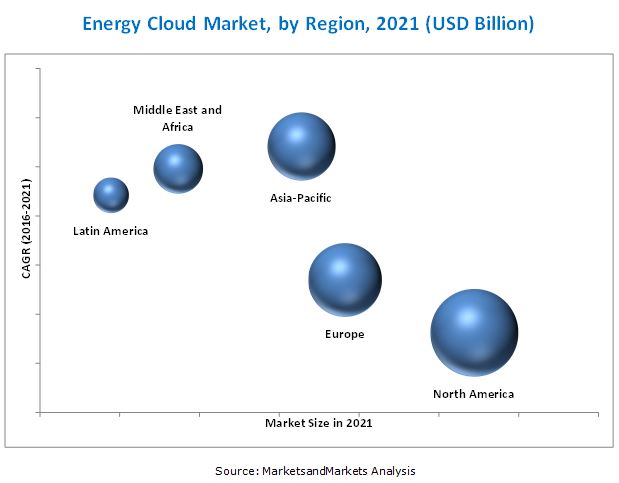

North America is expected to have the largest market share in 2016, whereas the Asia-Pacific (APAC) region is expected to grow at the highest CAGR from 2016 to 2021 in the energy cloud market. The U.S. and Canada are the major regions contributing to the North American region, due to the presence of large number of enterprises and higher adoption of advanced technologies.

Increasing amount of cyberattacks and stringent regulations & compliances are the challenges and restraints for the enterprises, such as energy and utilities.

The key vendors in the energy cloud market are Accenture PLC, IBM Corporation, HCL Technologies, SAP SE, Cisco Systems, Inc., and Oracle Corporation. These players have adopted various strategies, such as new product developments, acquisitions, and partnerships to serve the market. Continuous technology innovations is an area of focus for these players, in order to maintain their competitive positions in the market and promote customer satisfaction.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Deployment Model

4.3 Global Energy Cloud Market: Solution vs Region, 2016

4.4 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Ecosystem

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Service Model

5.3.3 By Deployment Model

5.3.4 By Organization Size

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Aging Infrastructure and Rising Grid Security Concerns

5.4.1.2 Need for Customer Relationship Management

5.4.2 Restraints

5.4.2.1 Stringent Regulation and Compliance

5.4.3 Opportunities

5.4.3.1 Big Data Analytics

5.4.3.2 Smart Energy Management and Internet of Things

5.4.4 Challenges

5.4.4.1 Increasing Amount of Cyberattacks

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Demand Overview

6.4 Strategic Benchmarking

7 Energy Cloud Market Analysis, By Type (Page No. - 46)

7.1 Introduction

8 Market Analysis, By Solution (Page No. - 48)

8.1 Introduction

8.2 Enterprise Asset Management

8.3 Supply Chain Management

8.4 Customer Relationship Management

8.5 Risk and Compliance Management

8.6 Workforce Management

8.7 Reporting and Analytics

8.8 Others

9 Energy Cloud Market Analysis, By Service (Page No. - 55)

9.1 Introduction

9.2 Professional Services

9.3 Managed Services

10 Market Analysis, By Service Model (Page No. - 59)

10.1 Introduction

10.2 Software as A Service

10.3 Platform as A Service

10.4 Infrastructure as A Service

11 Market Analysis, By Deployment Model (Page No. - 63)

11.1 Introduction

11.2 Public Cloud

11.3 Private Cloud

11.4 Hybrid Cloud

12 Energy Cloud Market Analysis, By Organization Size (Page No. - 67)

12.1 Introduction

12.2 Small and Medium Enterprises

12.3 Large Enterprises

13 Geographic Analysis (Page No. - 71)

13.1 Introduction

13.2 North America

13.3 Europe

13.4 Asia-Pacific

13.5 Middle East and Africa

13.6 Latin America

14 Competitive Landscape (Page No. - 91)

14.1 Overview

14.2 Energy Cloud Market: Vendor Comparison

14.3 Growth Strategies (20142017)

14.4 Competitive Situation and Trends

14.4.1 New Product Launches

14.4.2 Partnerships, Agreements, and Collaborations

14.4.3 Mergers and Acquisitions

14.4.4 Business Expansions

15 Company Profiles (Page No. - 100)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

15.1 Introduction

15.2 Accenture PLC

15.3 IBM Corporation

15.4 HCL Technologies Limited

15.5 SAP SE

15.6 Cisco Systems, Inc.

15.7 Oracle Corporation

15.8 Capgemini

15.9 Tata Consultancy Services

15.10 Hewlett Packard Enterprise

15.11 Microsoft Corporation

15.12 Brillio

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 132)

16.1 Key Industry Insights

16.2 Other Key Developments

16.2.1 New Product Launches, 20152016

16.2.2 Partnerships, Agreements, and Collaborations, 20142017

16.2.3 Mergers and Acquisitions, 20142015

16.3 Discussion Guide

16.4 Knowledge Store: Marketsandmarkets Subscription Portal

16.5 Introducing RT: Real-Time Market Intelligence

16.6 Available Customizations

16.7 Related Reports

16.8 Author Details

List of Tables (65 Tables)

Table 1 Energy Cloud Market Size and Growth, 20142021 (USD Million, Y-O-Y %)

Table 2 Market Size, By Type, 20142021 (USD Million)

Table 3 Market Size, By Solution, 20142021 (USD Million)

Table 4 Enterprise Asset Management: Market Size, By Region, 20142021 (USD Million)

Table 5 Supply Chain Management: Market Size, By Region, 20142021 (USD Million)

Table 6 Customer Relationship Management: Market Size, By Region, 20142021 (USD Million)

Table 7 Risk and Compliance Management: Market Size, By Region, 20142021 (USD Million)

Table 8 Workforce Management: Market Size, By Region, 20142021 (USD Million)

Table 9 Reporting and Analytics: Market Size, By Region, 20142021 (USD Million)

Table 10 Others: Market Size, By Region, 20142021 (USD Million)

Table 11 Energy Cloud Market Size, By Service, 20142021 (USD Million)

Table 12 Professional Services: Market Size, By Region, 20142021 (USD Million)

Table 13 Managed Services: Market Size, By Region, 20142021 (USD Million)

Table 14 Market Size By Service Model, 20142021 (USD Million)

Table 15 Software as A Service: Market Size, By Region, 20142021 (USD Million)

Table 16 Platform as A Service: Market Size, By Region, 20142021 (USD Million)

Table 17 Infrastructure as A Service : Market Size, By Region, 20142021 (USD Million)

Table 18 Energy Cloud Market Size, By Deployment Model, 20142021 (USD Million)

Table 19 Public Cloud: Market Size, By Region, 20142021 (USD Million)

Table 20 Private Cloud: Market Size, By Region, 20142021 (USD Million)

Table 21 Hybrid Cloud: Market Size, By Region, 20142021 (USD Million)

Table 22 Market Size By Organization Size, 20142021 (USD Million)

Table 23 Small and Medium Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 24 Large Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 25 Energy Cloud Market Size, By Region, 20142021 (USD Million)

Table 26 North America: Market Size, By Type, 20142021 (USD Million)

Table 27 North America: Market Size, By Solution, 20142021 (USD Million)

Table 28 North America: Market Size, By Service, 20142021 (USD Million)

Table 29 North America: Market Size, By Deployment Model, 20142021 (USD Million)

Table 30 North America: Market Size, By Organization Size, 20142021 (USD Million)

Table 31 North America: Market Size, By Service Model, 20142021 (USD Million)

Table 32 North America: Market Size, By Country, 20142021 (USD Million)

Table 33 United States: Energy Cloud Market Size, By Solution, 20142021 (USD Million)

Table 34 United States: Market Size, By Service, 20142021 (USD Million)

Table 35 United States: Market Size, By Deployment Model, 20142021 (USD Million)

Table 36 United States: Market Size, By Organization Size, 20142021 (USD Million)

Table 37 United States: Market Size, By Service Model, 20142021 (USD Million)

Table 38 Europe: Energy Cloud Market Size, By Type, 20142021 (USD Million)

Table 39 Europe: Market Size, By Solution, 20142021 (USD Million)

Table 40 Europe: Market Size, By Service 20142021 (USD Million)

Table 41 Europe: Market Size, By Deployment Model, 20142021 (USD Million)

Table 42 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 43 Europe: Market Size, By Service Model, 20142021 (USD Million)

Table 44 Asia-Pacific: Energy Cloud Market Size, By Type, 20142021 (USD Million)

Table 45 Asia-Pacific: Market Size, By Solution, 20142021 (USD Million)

Table 46 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Deployment Model, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Service Model, 20142021 (USD Million)

Table 50 Middle East and Africa: Energy Cloud Market Size, By Type, 20142021 (USD Million)

Table 51 Middle East and Africa: Market Size, By Solution, 20142021 (USD Million)

Table 52 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 53 Middle East and Africa: Market Size, By Deployment Model, 20142021 (USD Million)

Table 54 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 55 Middle East and Africa: Market Size, By Service Model, 20142021 (USD Million)

Table 56 Latin America: Energy Cloud Market Size, By Type, 20142021 (USD Million)

Table 57 Latin America: Market Size, By Solution, 20142021 (USD Million)

Table 58 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 59 Latin America: Market Size, By Deployment Model, 20142021 (USD Million)

Table 60 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 61 Latin America: Market Size, By Service Model, 20142021 (USD Million)

Table 62 New Product Launches, 2016

Table 63 Partnerships, Agreements, and Collaborations, 2017

Table 64 Mergers and Acquisitions, 2016

Table 65 Business Expansions, 20152017

List of Figures (55 Figures)

Figure 1 Global Market Segmentation

Figure 2 Energy Cloud Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 The Demand for Reporting and Analytics Segment is Increasing in the Energy Cloud Market During the Period of 20162021

Figure 7 Professional Services Segment is Expected to Grow During the Period of 20162021

Figure 8 Small and Medium Enterprises Segment has High Demand for Energy Cloud and is Expected to Grow During the Period of 20162021

Figure 9 North America is Expected to Lead the Market Followed By Europe

Figure 10 Emergence of Big Data and Internet of Things Can Be Major Opportunities for the Market to Grow

Figure 11 Hybrid Deployment Model is Expected to Witness the Highest Growth Rate During the Period of 20162021

Figure 12 Enterprise Asset Management is Expected to Account for the Largest Market Share in the Energy Cloud Market and Asia-Pacific is Expected to Grow at the Highest CAGR

Figure 13 Energy Cloud Market Regional Lifecycle: Asia-Pacific Exhibits Potential Growth During the Forecast Period

Figure 14 Energy Cloud Market Ecosystem

Figure 15 Market Segmentation By Type

Figure 16 Market Segmentation By Solution

Figure 17 Market Segmentation By Service

Figure 18 Market Segmentation By Service Model

Figure 19 Market Segmentation By Deployment Model

Figure 20 Market Segmentation By Organization Size

Figure 21 Market Segmentation By Region

Figure 22 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Value Chain

Figure 24 Strategic Benchmarking

Figure 25 Enterprise Asset Management Solutions Segment is Expected to Have the Largest Market Size in 2016

Figure 26 Professional Services Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 27 Infrastructure as A Service Segment is Expected to Hold the Largest Market Size in 2016

Figure 28 Public Cloud Deployment Model is Expected to Hold the Largest Market Size in 2016

Figure 29 Large Enterprises Segment is Expected to Hold the Larger Market Size in 2016

Figure 30 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 31 North America: Market Snapshot

Figure 32 Asia-Pacific: Market Snapshot

Figure 33 Business Offerings Comparison

Figure 34 Business Strategy Comparison

Figure 35 Companies Adopted New Product Launch as the Key Growth Strategy

Figure 36 Product Portfolio Comparison of the Top Five Companies

Figure 37 Market Evaluation Framework

Figure 38 Battle for Market Share: New Product Launch is the Key Strategy

Figure 39 Geographic Revenue Mix of Top Market Players

Figure 40 Accenture PLC: Company Snapshot

Figure 41 Accenture PLC: SWOT Analysis

Figure 42 IBM Corporation: Company Snapshot

Figure 43 IBM Corporation: SWOT Analysis

Figure 44 HCL Technologies Limited: Company Snapshot

Figure 45 HCL Technologies: SWOT Analysis

Figure 46 SAP SE: Company Snapshot

Figure 47 SAP SE: SWOT Analysis

Figure 48 Cisco Systems, Inc.: Company Snapshot

Figure 49 Cisco Systems, Inc.: SWOT Analysis

Figure 50 Oracle Corporation.: Company Snapshot

Figure 51 Capgemini: Company Snapshot

Figure 52 Tata Consultancy Services: Company Snapshot

Figure 53 Hewlett Packard Enterprise: Company Snapshot

Figure 54 Microsoft Corporation: Company Snapshot

Figure 55 Brillio: Company Snapshot

Growth opportunities and latent adjacency in Energy Cloud Market