Healthcare CRM Market by Component (Software, Service), Delivery (On premise, Cloud, Public, Private, Hybrid), End user (Hospital, ASC, Payers, Life Science), Functionality (CSS, Marketing, Sales, Digital Marketing, AI, Analytics) & Region – Global Forecasts to 2023

Inquire Now to get the global numbers on Healthcare CRM Market

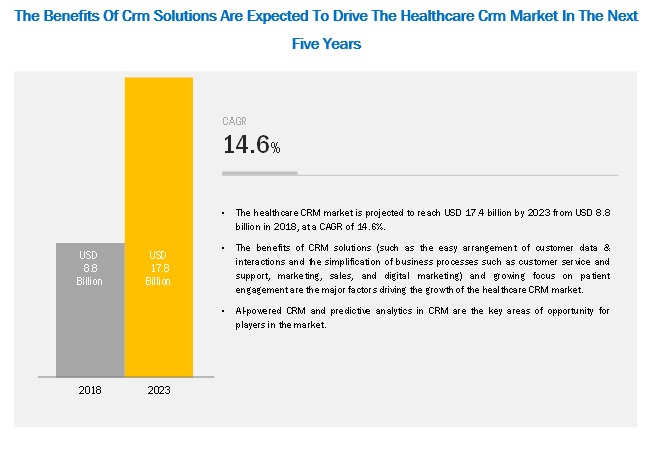

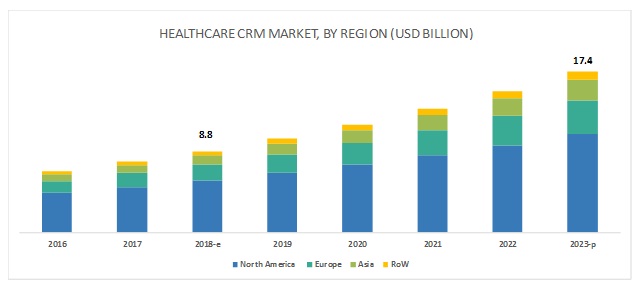

The healthcare CRM market is projected to reach USD 17.4 billion by 2023, growing at a CAGR of 14.6%.

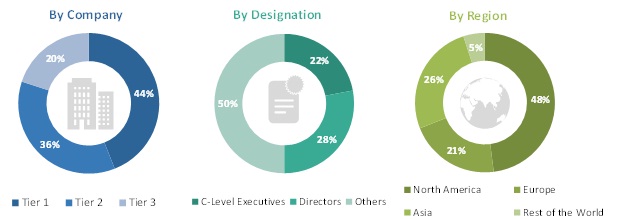

The study involved four major activities to estimate the current size of the healthcare CRM market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation strategies were used to estimate the size of the segments and subsegments in the market.

Secondary Research

Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographical markets, and key developments from both market- and technology-oriented perspectives. In the secondary research process, various secondary sources were referred to in order to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies, white papers, journals, certified publications, articles from recognized authors, gold-standard and silver-standard websites, disease-specific organizations, directories, and databases.

Primary Research

Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players. In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all the segments of this industry’s value chain.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess the future growth prospects in the global Healthcare CRM Industry.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare CRM market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated by leading players has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the healthcare CRM market by component, deployment model, functionality, end user, and region

- To provide detailed information about the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia, and the Rest of the World (RoW)2

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, expansions, and R&D activities in the healthcare CRM market

- Micromarkets are defined as the further segments and subsegments of the global healthcare CRM market included in the report.

- The RoW includes Pacific countries, the Middle East, Africa, and Latin America.

- Core competencies of companies are captured in terms of the key developments, SWOT analyses, and key strategies adopted to sustain their positions in the market.

Healthcare CRM Market Scope

|

Report Metric |

Details |

|

Market Size (Years) |

2016–2023 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2023 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Component, Delivery Model, Functionality, End User, and Region |

|

Geographies Covered |

North America, Asia, Europe, and Rest of the World (RoW) |

|

Companies Covered |

Salesforce.com, Inc. (US), SAP SE (Germany), Oracle (US), Microsoft (US), IBM (US), Influence Health (US), SugarCRM (US), Accenture (Ireland), Healthgrades (US), and Infor, Inc. (US) |

This report categorizes the healthcare CRM market into the following segments and subsegments:

On the basis of component, the healthcare CRM market has been segmented into:

- Software

- Services

On the basis of deployment model, the healthcare CRM management market has been segmented into:

- On-premise Model

- Web/Cloud-based Model

On the basis of functionality, the healthcare CRM market has been segmented into:

- Customer Service and Support

- Marketing

- Sales

- Digital Marketing

- Other Functionalities

On the basis of end user, the healthcare CRM market has been segmented into:

- Healthcare Providers

- Healthcare Payers

- Life Sciences Industry

On the basis of region, the healthcare CRM market has been segmented into:

- North America

- Europe

- Asia

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per company-specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the European healthcare CRM market into the UK, Germany, France, and the Rest of Europe

Market growth can largely be attributed to the benefits of CRM solutions, such as the easy arrangement of customer data & interactions and the simplification of business processes such as customer service and support, marketing, sales, and digital marketing. On the other hand, concerns regarding patient data security and the high cost and complexity of the CRM implementation process may limit market growth to a certain extent during the forecast period.

Web/cloud-based model is expected to account for the largest market share in 2018

On the basis of deployment model, the healthcare CRM market is segmented into on-premise model and web/cloud-based model. In 2018, the web/cloud-based model segment is expected to account for a larger market share. This segment is also estimated to register a higher CAGR during the forecast period. Advantages such as low maintenance cost, robust security features, and improved accessibility and recoverability of data are driving the growth of the web/cloud-based model segment.

In 2018, customer service and support is expected to hold the largest market share in 2018

On the basis of functionality, the healthcare CRM market is segmented into customer service and support, marketing, sales, digital marketing, and other functionalities. In 2018, the customer service and support segment is expected to account for the largest market share. The growing focus on patient engagement, rising pressure on healthcare organizations to reduce costs, and the importance of ensuring customer satisfaction are major factors responsible for the large share of this segment. The other functionalities segment is expected to register the highest CAGR during the forecast period.

North America is expected to account for the largest market share during the forecast period

Based on region, the healthcare CRM market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). North America, segmented into the US and Canada, is estimated to hold the largest share of this market in 2018. However, the Asian market is expected to register the highest growth in the market during the forecast period. Market growth is mainly due to rising patient awareness, improvement of healthcare systems, growing medical tourism in Asian countries, and favorable government initiatives, among other factors.

The key players in the healthcare CRM market are Salesforce.com, Inc. (US), SAP SE (Germany), Oracle (US), Microsoft (US), IBM (US), Influence Health (US), SugarCRM (US), Accenture (Ireland), Healthgrades (US), and Infor, Inc. (US).

Salesforce (US) was the leading player in the healthcare CRM market, with a share of 22% in 2017. More than 100,000 companies have chosen Salesforce as their CRM solutions provider to streamline their business. The company has a strong cloud footprint with its SaaS offerings. Salesforce’s strength lies in its ability to deliver innovation and engage its customers effectively. The company sells its products via direct and indirect sales distribution channels. Salesforce’s growth strategy lies in cross-selling and upselling, extending existing services, expanding partner ecosystems, expanding its business into different regions, and entering into new markets.

SAP SE (Germany) was the second-largest player in the healthcare CRM market, with a share of 10% in 2017. Its robust product portfolio aids SAP in sustaining its leading position in the market. It helps to create valuable interaction with customers by offering solutions for commerce, revenue, sales, and services. SAP utilizes technologies, such as internet of things, artificial intelligence, and machine learning, to bring in innovation in various fields. The company has incorporated disrupting technologies like AI and Machine Learning to its cloud-based solution called SAP CRM. To incorporate these disruptive technologies into its software solutions, the company relaunched SAP Leonardo, its integration platform. In order to capitalize on the growth opportunities in the healthcare CRM market, the company emphasizes on adopting organic as well as inorganic growth strategies.

Recent Developments

- In 2018, Salesforce launched Salesforce Integration Cloud.

- In 2018, IBM partnered with Salesforce. This partnership aimed to bring together Cloud and Watson services from IBM with Salesforce Quip and Salesforce Service cloud Einstein to allow organizations to connect with their customers more effectively.

- In 2018, SAP acquired Caliduscloud (US) to strengthen its cloud-based customer relationship management solution.

Key Questions addressed by the report

- Where will all these developments take the industry in the mid to long run?

- Which are the key players in the market and how intense is the competition?

- Which are the recent contracts and agreements key players have signed?

Frequently Asked Questions (FAQs):

What is the size of Healthcare CRM Market?

The healthcare CRM market is projected to reach USD 17.4 billion by 2023, growing at a CAGR of 14.6%.

What are the major growth factors of Healthcare CRM Market?

Growth in this market is driven by increasing prevalence of cardiovascular diseases and technological advancements in devices.

Who all are the prominent players of Healthcare CRM Market?

Salesforce.com, Inc. (US), SAP SE (Germany), Oracle (US), Microsoft (US), IBM (US), Influence Health (US), SugarCRM (US), Accenture (Ireland), Healthgrades (US), and Infor, Inc. (US)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Healthcare CRM: Market Overview

4.2 Healthcare CRM Market, By Component (2018–2023)

4.3 Healthcare CRM Market, By Delivery Model, 2018 Vs. 2023 (USD Billion)

4.4 Healthcare CRM Market, By Functionality

4.5 Healthcare CRM Market, By End User, 2018 Vs. 2023 (USD Billion)

4.6 Healthcare CRM Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Benefits of CRM Software

5.2.1.2 Growing Focus on Patient Engagement

5.2.2 Restraints

5.2.2.1 Concerns Regarding Data Security

5.2.2.2 High Cost and Complexity of CRM Implementation

5.2.3 Opportunities

5.2.3.1 Ai-Powered CRM

5.2.3.2 Predictive Analytics in CRM

5.2.4 Challenges

5.2.4.1 Integration Challenges

6 Healthcare CRM Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Services

6.2.1 Services to Account for the Larger Share of the Healthcare CRM Market in 2018

6.3 Software

6.3.1 Ongoing Research & Launch of Advanced CRM Solutions Powered With Analytics and Artificial Intelligence to Drive Market Growth

7 Healthcare CRM Market, By Deployment Model (Page No. - 46)

7.1 Introduction

7.2 On-Premise Model

7.2.1 Greater Control Over Data and Cost Benefits Offered By On-Premise Solutions to Drive the Growth of This Segment

7.3 Web/Cloud-Based Model

7.3.1 Public Cloud

7.3.1.1 Affordability, Scalability and Flexibility of This Model to Enhance the Growth of This Segment

7.3.2 Private Cloud

7.3.2.1 Growing Concerns Over Data Security Likely to Boost the Growth of This Segment

7.3.3 Hybrid Cloud

7.3.3.1 Greater Control, Reduced Risk and Cost-Efficiency to Drive the Growth of This Segment

8 Healthcare CRM Market, By Functionality (Page No. - 53)

8.1 Introduction

8.2 Customer Service and Support

8.2.1 Growing Pressure to Ensure Patient Engagement and Retention Will Contribute to Market Growth in This Segment

8.3 Marketing

8.3.1 Benefits of Technology-Enabled Marketing to Enhance the Adoption of This Functionality

8.4 Sales

8.4.1 Opportunity Management Systems Will Ensure Streamlining of Sales Processes

8.5 Digital Marketing

8.5.1 Digital Marketing Will Provide Data-Backed Insights to Form Future Engagement Strategies

8.6 Other Functionalities

8.6.1 Ai-Powered CRM Will Have the Potential to Predict Customer Needs

9 Healthcare CRM Market, By End User (Page No. - 63)

9.1 Introduction

9.2 Healthcare Providers

9.2.1 Hospitals

9.2.1.1 Growing Patient Burden and Increasing Focus on Patient Engagement to Drive the Growth of This Segment

9.2.2 Ambulatory Surgery Centers(ASCS) and Clinics

9.2.2.1 Rising Need to Improve Care Delivery and Streamline Business Functions to Drive the Market for This Segment

9.2.3 Diagnostic Centers

9.2.3.1 The Growing Burden of Patients Owing to the Increasing Awareness of Patients for Early Diagnosis is a Major Factor Driving the Growth of This Segment

9.3 Life Sciences Industry

9.3.1 CRM Solutions Will be Mainly Used to Streamline CSS, Sales, and Marketing Processes

9.4 Healthcare Payers

9.4.1 Growing Need for Efficient Customer Management to Drive Demand for CRM Solutions in the Healthcare Payers Segment

10 Healthcare CRM Market, By Region (Page No. - 72)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 The Shift Toward Value-Based Care Will Boost the Adoption of Healthcare CRM in the US

10.2.2 Canada

10.2.2.1 Growing Focus on Improving the Quality of Healthcare in the Country Will Support Market Growth

10.3 Europe

10.3.1 Government Initiatives for Ehealth Technologies to Drive the Growth of This Segment

10.4 Asia

10.4.1 Rising Patient Awareness, Improving Healthcare Systems and Growing Medical Tourism to Boost the Growth of This Segment

10.5 Rest of the World

11 Competitive Landscape (Page No. - 91)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Scenario

11.3.1 Partnerships and Agreements (2015–2018)

11.3.2 Product Launches (2015–2018)

11.3.3 Acquisitions (2015–2018)

11.3.4 Expansions (2015–2018)

12 Company Profiles (Page No. - 96)

(Business Overview, Products and Services Offered, Recent Developments, MnM View)*

12.1 Saleforce.Com, Inc.

12.2 Oracle

12.3 Microsoft

12.4 IBM

12.5 SAP SE

12.6 Influence Health, Inc.

12.7 SugarCRM

12.8 Accenture

12.9 Healthgrades

12.10 Infor, Inc.

*Business Overview, Products and Services Offered, Recent Developments, MnM View Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 114)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (62 Tables)

Table 1 Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 2 Healthcare CRM Services Market, By Region, 2016–2023 (USD Million)

Table 3 North America: Healthcare CRM Services Market, By Country, 2016–2023 (USD Million)

Table 4 Healthcare CRM Software Market, By Region, 2016–2023 (USD Million)

Table 5 North America: Healthcare CRM Software Market, By Country, 2016–2023 (USD Million)

Table 6 Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 7 Healthcare CRM Market for On-Premise Model, By Region, 2016–2023 (USD Million)

Table 8 North America: Healthcare CRM Market for On-Premise Model, By Country, 2016–2023 (USD Million)

Table 9 Healthcare CRM Market for Web/Cloud-Based Model, By Region, 2016–2023 (USD Million)

Table 10 North America: Healthcare CRM Market for Web/Cloud-Based Model, By Country, 2016–2023 (USD Million)

Table 11 Web/Cloud Based Models Market, By Type, 2016–2023 (USD Million)

Table 12 Healthcare CRM Market for Public Cloud, By Region, 2016–2023 (USD Million)

Table 13 Healthcare CRM Market for Private Cloud, By Region, 2016–2023 (USD Million)

Table 14 Healthcare CRM Market for Hybrid Cloud, By Region, 2016–2023 (USD Million)

Table 15 Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 16 Healthcare CRM Market for Customer Service and Support, By Region, 2016–2023 (USD Million)

Table 17 North America: Healthcare CRM Market for Customer Service and Support, By Country, 2016–2023 (USD Million)

Table 18 Healthcare CRM Market for Marketing, By Region, 2016–2023 (USD Million)

Table 19 North America: Healthcare CRM Market for Marketing , By Country, 2016–2023 (USD Million)

Table 20 Healthcare CRM Market for Sales, By Region, 2016–2023 (USD Million)

Table 21 North America: Healthcare CRM Market for Sales, By Country, 2016–2023 (USD Million)

Table 22 Healthcare CRM Market for Digital Marketing, By Region, 2016–2023 (USD Million)

Table 23 North America: Healthcare CRM Market for Digital Marketing, By Country, 2016–2023 (USD Million)

Table 24 Healthcare CRM Market for Other Functionalities, By Region, 2016–2023 (USD Million)

Table 25 North America: Healthcare CRM Market for Other Functionalities, By Country, 2016–2023 (USD Million)

Table 26 Healthcare CRM Market, By End User, 2016–2023 (USD Million)

Table 27 Healthcare CRM Market for Healthcare Providers, By Region, 2016–2023 (USD Million)

Table 28 North America: Healthcare CRM Market for Healthcare Providers, By Country, 2016–2023 (USD Million)

Table 29 Healthcare Providers Market, By Type, 2016–2023 (USD Million)

Table 30 Healthcare CRM Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 31 Healthcare CRM Market for Ambulatory Surgery Centers and Clinics, By Region, 2016–2023 (USD Million)

Table 32 Healthcare CRM Market for Diagnostic Centers, By Region, 2016–2023 (USD Million)

Table 33 Healthcare CRM Market for the Life Sciences Industry, By Region, 2016–2023 (USD Million)

Table 34 North America: Healthcare CRM Market for the Life Sciences Industry, By Country, 2016–2023 (USD Million)

Table 35 Healthcare CRM Market for Healthcare Payers, By Region, 2016–2023 (USD Million)

Table 36 North America: Healthcare CRM Market for Healthcare Payers, By Country, 2016–2023 (USD Million)

Table 37 Healthcare CRM Market, By Region, 2016–2023 (USD Million)

Table 38 North America: Healthcare CRM Market, By Country, 2016–2023 (USD Million)

Table 39 North America: Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 40 North America: Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 41 North America: Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 42 North America: Healthcare CRM Market, By End User, 2016–2023 (USD Million)

Table 43 US: Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 44 US: Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 45 US: Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 46 US: Healthcare CRM Market, By End User, 2016–2023 (USD Million)

Table 47 Canada: Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 48 Canada: Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 49 Canada: Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 50 Canada: Healthcare CRM Market, By End User, 2016–2023 (USD Million)

Table 51 Europe: Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 52 Europe: Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 53 Europe: Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 54 Europe: Healthcare CRM Market, By End User, 2016–2023 (USD Million)

Table 55 Asia: Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 56 Asia: Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 57 Asia: Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 58 Asia: Healthcare CRM Market, By End User, 2016–2023 (USD Million)

Table 59 RoW: Healthcare CRM Market, By Component, 2016–2023 (USD Million)

Table 60 RoW: Healthcare CRM Market, By Deployment Model, 2016–2023 (USD Million)

Table 61 RoW: Healthcare CRM Market, By Functionality, 2016–2023 (USD Million)

Table 62 RoW: Healthcare CRM Market, By End User, 2016–2023 (USD Million)

List of Figures (34 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Healthcare CRM Market, By Component, 2018 Vs. 2023 (USD Billion)

Figure 7 Healthcare CRM Market, By Deployment Model, 2018 Vs. 2023 (USD Billion)

Figure 8 Healthcare CRM Market, By Functionality Model, 2018 Vs. 2023

Figure 9 Healthcare CRM Market, By End User, 2018 Vs. 2023 (USD Billion)

Figure 10 Healthcare CRM Market: Geographical Snapshot

Figure 11 Healthcare CRM Market to Witness Double-Digit Growth Rate During the Forecast Period

Figure 12 Services Segment to Register the Highest Growth During the Forecast Period

Figure 13 Web/Cloud-Based Model to Dominate the Healthcare CRM Market During the Forecast Period

Figure 14 Customer Service and Support to Account for the Largest Share of the Healthcare CRM Market in 2018

Figure 15 Healthcare Providers Will Continue to Dominate the Healthcare CRM Market in 2023

Figure 16 Healthcare CRM Market in Asia to Register the Highest Growth Between 2018 & 2023

Figure 17 Healthcare CRM Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Services Segment to Dominate the Healthcare CRM Market During the Forecast Period

Figure 19 Web/Cloud-Based Model Segment Will Continue to Dominate the Healthcare CRM Market During the Forecast Period

Figure 20 Customer Service and Support Will Continue to Dominate the Healthcare CRM Market During the Forecast Period

Figure 21 Healthcare Providers Segment Will Dominate the Market During the Forecast Period

Figure 22 Asia to Witness Highest Growth During the Forecast Period (2018–2023)

Figure 23 North America: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 Key Developments in the Market From 2015 to 2018

Figure 26 Market Evolution Framework

Figure 27 Healthcare CRM Market Share Analysis, By Key Player (2017)

Figure 28 Salesforce: Company Snapshot

Figure 29 Oracle: Company Snapshot

Figure 30 Microsoft: Company Snapshot

Figure 31 IBM: Company Snapshot

Figure 32 SAP SE: Company Snapshot

Figure 33 Accenture: Company Snapshot

Figure 34 Infor: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare CRM Market