Artificial Intelligence in Accounting Market by Component, Deployment Mode, Technology, Enterprise Size, Application (Automated Bookkeeping, Fraud and Risk Management, and Invoice Classification and Approvals), and Region - Global Forecast to 2024

[146 Pages Report] The Artificial Intelligence in accounting market is expected to grow from USD 666 million in 2019 to USD 4,791 million by 2024, at a Compound Annual Growth Rate (CAGR) of 48.4% during the forecast period. The growing need to automate accounting processes, and support data-based advisory and decision making are major factors driving the growth of the AI in accounting market.

By technology, NLP segment to register a higher growth during the forecast period.

With an increase in the amount of accounting data, data management will become a challenge for accounting departments. One of the core concepts of Natural Language Processing (NLP) is the ability to understand human speech. It would be simply impossible to implement voice control over different systems without NLP. Moreover, NLP allows users to integrate, not only voice understanding into devices and sensors, but also localization features, leading to creative translation. The application of NLP includes machine translation, information extraction, report generation, question answering, acquiring data providing context, and identifying the intent of the user. In accounting, NLP finds applications in the areas of invoice classification and interpretation, and contract interpretation, among others. With the increasing variation in contract and invoice languages and formats, major AI in accounting vendors are focusing on offering NLP integrated solutions. With the strengthening regulatory and compliance landscape for data, the NLP technology in the AI in accounting is growing at a significant rate.

By component, services to grow at a higher growth rate during the forecast period

In the components segment, services are expected to grow at a higher growth rate in the Artificial Intelligence in Accounting Market. The growth of the services segment can be attributed to the increasing deployment of AI in accounting software tools and solutions, which is leading to an increased demand for pre- and post-deployment services. The solutions segment is estimated to hold a larger market size, driven by the ease of integrating pre-built solutions with existing accounting infrastructure. The growing number of innovations and partnerships in the accounting sector and the focus on automating repetitive accounting processes to enhance efficiency, are also the factors contributing to the adoption.

North America to account for the largest market size during the forecast period

North America is a major revenue generating region in the global Artificial Intelligence in Accounting Market. The region experiences maximum developments in the AI in accounting space. Majority of the AI-based solution providers across the region are constantly involved in product innovations and deployment of these AI-based accounting solutions and services. The vendors across the region are adopting various growth strategies, such as product enhancements and new launches, partnerships, and acquisitions, to strengthen their position in the AI in accounting market.

Key Artificial Intelligence in Accounting Market Players

The major AI in accounting vendors include Microsoft (US), AWS (US), Xero (New Zealand), Intuit (US), Sage (England), OSP (US), UiPath (US), Kore.ai (US), AppZen (US), YayPay (US), IBM (US), Google (US), EY (UK), Deloitte (US), PwC (UK), KPMG (Netherlands), SMACC (Germany), OneUp (US), Vic.ai (US), Hyper Anna (Australia), Botkeeper (US), MindBridge Analytics (Canada), and Bill.com (US). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations; new product launches and product enhancements; and acquisitions, to further expand their presence in the global AI in accounting market. New product launches and product enhancements have been the most dominating strategies adopted by the major players from 2017 to 2019, which has helped them to innovate on their offerings and broaden their customer base.

Please visit 360Quadrants to see the vendor listing of Accounting Software.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Deployment Mode, Technology, Enterprise Size, Application, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Microsoft (US), AWS (US), Xero (New Zealand), Intuit (US), Sage (England), OSP (US), UiPath (US), Kore.ai (US), AppZen (US), YayPay (US), IBM (US), Google (US), EY (UK), Deloitte (US), PwC (UK), KPMG (Netherlands), SMACC (Germany), OneUp (US), Vic.ai (US), Hyper Anna (Australia), Botkeeper (US), MindBridge Analytics (Canada), and Bill.com (US) |

This research report categorizes the AI in accounting market based on component, deployment mode, technology, enterprise size, application, and region.

By Component, the Artificial Intelligence in Accounting Market has the following segments:

- Solutions

- Software Tools

- Platforms

- Services

- Professional Services

- Managed Services

By Deployment mode, the Artificial Intelligence in Accounting Market has the following segments:

- Cloud

- On-premises

By Technology, the Artificial Intelligence in Accounting Market has the following segments:

- Machine Learning (ML) and Deep Learning

- NLP

By Enterprise size, the Artificial Intelligence in Accounting Market has the following segments:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application, the Artificial Intelligence in Accounting Market has the following segments:

- Automated Bookkeeping

- Invoice Classification and Approvals

- Fraud and Risk Management

- Reporting

- Others (Expense and Auditing Management, and Tax and Revenue Filing)

By Region, the Artificial Intelligence in Accounting Market has the following segments:

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments

- In June 2019, Xero introduced new product enhancements to enable accountants and bookkeepers to efficiently run their businesses. The company’s new products and features include a revamped version of Xero App Marketplace and US integration with Novo to build Xero’s presence in the financial web. This integration would enable business owners to quickly access the financial data required for running businesses.

- In May 2019, Intuit acquired Origami Logic, a developer of an advanced data integration, ingestion, and analytics platform. The acquisition is in line with the company’s strategy to become an AI-driven expert platform. It would support the company’s aim at streamlining data structures and architectures to unlock opportunities.

- In March 2019, UiPath partnered with Bonitasoft, a provider of an open-source platform for business process automation, to drive a new level of integration of Robotic Process Automation (RPA) with Business Process Management (BPM). As per this partnership, the 2 companies would be able to build flexible and resilient automation solutions, even when the underlying application does not have an Application program Interface (API).

Critical Questions the Report Answers

- What are the current trends driving the Artificial Intelligence in Accounting Market?

- Where will all the developments take the industry in the mid- to long-term?

- Who are the top vendors in the AI in accounting market, and how is the competitive scenario among them?

- What are the drivers and challenges of the AI in accounting market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Artificial Intelligence in Accounting Market

4.2 Market Top 3 Applications

4.3 Market By Region

4.4 Market in North America, By Application and Deployment Mode

5 Artificial Intelligence in Accounting Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need to Automate Accounting Processes

5.2.1.2 Need for Enhanced Data-Based Advisory and Decision-Making

5.2.2 Restraints

5.2.2.1 Lack of Skillsets and Resistance to Change

5.2.2.2 Untapped Potential of AI in Accounting

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Intelligent Accounting Processes

5.2.3.2 Growing Focus on Innovation for Integrating AI in Accounting

5.2.4 Challenges

5.2.4.1 High Criticality of Data Volume and Quality

5.2.4.2 Investment Related Issues With Integration of AI in Accounting

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.3.4 Use Case: Scenario 4

5.3.5 Use Case: Scenario 5

5.3.6 Use Case: Scenario 6

5.4 Regulatory Implications

5.4.1 General Data Protection Regulation

5.4.2 International Financial Reporting Standards

5.4.3 Federal Trade Commission

5.4.4 International Organization for Standardization/International Electrotechnical Commission Standards

5.4.4.1 ISO/IEC JTC 1

5.4.4.2 ISO/IEC JTC 1/SC 42

6 Artificial Intelligence in Accounting Market By Component (Page No. - 44)

6.1 Introduction

6.2 Solutions

6.2.1 Software Tools

6.2.1.1 Growing Demand for Software Tools to Enable Easy Integration of AI in the Existing Accounting Architecture

6.2.2 Platforms

6.2.2.1 Platforms to Provide A Complete Foundation for Designing AI in Accounting Solutions in Various Applications

6.3 Services

6.3.1 Professional Services

6.3.1.1 Increase in Technicalities in the Deployment and Implementation of AI in Accounting Solutions to Drive the Demand for Professional Services

6.3.2 Managed Services

6.3.2.1 Growing Need for Organizations to Focus on Core Operations and Streamline Accounting Processes to Drive the Demand for Managed Services

7 Artificial Intelligence in Accounting Market By Deployment Mode (Page No. - 50)

7.1 Introduction

7.2 Cloud

7.2.1 Benefits of Cloud-Based Solutions to Drive Its Adoption in the Market

7.3 On-Premises

7.3.1 Data Integrity and Security Offered By On-Premises Solutions to Drive Its Adoption in the Market

8 Artificial Intelligence in Accounting Market By Technology (Page No. - 53)

8.1 Introduction

8.2 Machine Learning and Deep Learning

8.2.1 Growing Demand to Identify Patterns, Analyze Accounting Data, and Enhance Decision-Making to Drive the Adoption of Ml and Deep Learning in the Market

8.3 Natural Language Processing

8.3.1 Several Functionalities of Natural Language Processing to Drive Its Adoption in the Market

9 Artificial Intelligence in Accounting Market By Enterprise Size (Page No. - 57)

9.1 Introduction

9.2 Large Enterprises

9.2.1 Need to Manage Large Volumes of Accounting Data Being Generated From Multiple Business Units and Transactions to Drive the Adoption of the Market in Large Enterprises

9.3 Small and Medium-Sized Enterprises

9.3.1 Demand for Automating Mundane Accounting Tasks to Overcome the Lack of Skilled Workforce to Drive the Adoption of the Market in Small and Medium-Sized Enterprises

10 Artificial Intelligence in Accounting Market By Application (Page No. - 60)

10.1 Introduction

10.2 Automated Bookkeeping

10.2.1 Need to Automate Data Collection, Efficiently Handle Paperwork, Minimize Inconsistencies, and Extract Insights to Support Advisory to Drive the Adoption of the Market for the Automated Bookkeeping Application

10.3 Invoice Classification and Approvals

10.3.1 10.3.1 Analysis of Numerous Invoices and Contracts, While Ensuring Data Accuracy and Maintaining the Accounting Speed to Compel Organizations to Adopt AI in Accounting Solutions and Services

10.4 Fraud and Risk Management

10.4.1 Increasing Data Risks and the Need for Enhanced Data Accuracy and Protection to Drive the Adoption of the Market

10.5 Reporting

10.5.1 Need to Eliminate Time-Consuming Reporting Tasks and Comply By Regulatory Requirements to Drive the Adoption of AI in Reporting Applications

10.6 Others

11 Artificial Intelligence in Accounting Market By Region (Page No. - 65)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Need to Automate Monotonous Accounting Processes and Support Enhanced Decision-Making to Fuel the Demand for AI in Accounting in the US

11.2.2 Canada

11.2.2.1 Government Push to Integrate AI in Business Processes to Boost the Adoption of AI in Accounting Solutions and Services in Canada

11.3 Europe

11.3.1 Germany

11.3.1.1 Strong Infrastructure and Highly Skilled Workforce to Boost Investments in AI in Accounting in Germany

11.3.2 United Kingdom

11.3.2.1 Government’s Focus on Innovation and Research to Fuel the Adoption of AI in Accounting in the UK

11.3.3 France

11.3.3.1 Focus on R&D and Rapid Growth in AI in Accounting Startups to Drive the Growth of Market in France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Development of Relevant Policies and Regulations to Shape the Growth of Market in China

11.4.2 Japan

11.4.2.1 Rapid Decline in Labor Force and Limited Arrival of Immigrants to Drive Automation of Mundane Tasks and Create Growth Potential for AI in Accounting in Japan

11.4.3 India

11.4.3.1 Government Push for the Adoption of AI By Businesses and the Need for Automation of Business Processes to Drive the Adoption of AI in Accounting in India

11.4.4 Australia

11.4.4.1 Increasing Investments, Industrial Developments, and Focus on Elimination of Middleman in Accounting to Drive the Adoption of AI in Accounting in Australia

11.4.5 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 United Arab Emirates

11.5.1.1 Implementation of UAE AI 2031 Strategy to Encourage Organizations to Adopt AI in Accounting Solutions and Services

11.5.2 South Africa

11.5.2.1 Focus on R&D and Government Initiatives to Boost the Growth of Market in South Africa

11.5.3 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Public and Private Sectors’ Focus on the Development of AI to Drive the Adoption of AI in Accounting in Brazil

11.6.2 Mexico

11.6.2.1 Government Initiatives to Drive the Adoption of AI in Accounting in Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Strength of Product Portfolio

12.4 Business Strategy Excellence

13 Company Profiles (Page No. - 103)

13.1 Introduction

(Business Overview, Products, Solutions, Platforms & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Microsoft

13.3 AWS

13.4 Xero

13.5 Intuit

13.6 Sage

13.7 OSP

13.8 UiPath

13.9 Kore.AI

13.1 AppZen

13.11 YayPay

13.12 IBM

13.13 Google

13.14 EY

13.15 Deloitte

13.16 PwC

13.17 KPMG

13.18 SMACC

13.19 OneUp

13.20 Vic.AI

13.21 Hyper Anna

13.22 Botkeeper

13.23 MindBridge Analytics

13.24 Bill.Com

*Details on Business Overview, Products, Solutions,Platforms & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 137)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (51 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Global Artificial Intelligence in Accounting Market Size and Growth Rate, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Market Size, By Component, 2017–2024 (USD Million)

Table 5 Solutions: Market Size By Type, 2017–2024 (USD Million)

Table 6 Services: Market Size By Type, 2017–2024 (USD Million)

Table 7 Artificial Intelligence in Accounting Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 8 Market Size By Technology, 2017–2024 (USD Million)

Table 9 Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 10 Market Size By Application, 2017–2024 (USD Million)

Table 11 Market Size By Region, 2017–2024 (USD Million)

Table 12 North America: Artificial Intelligence in Accounting Market Size, By Component, 2017–2024 (USD Million)

Table 13 North America: Market Size By Solution, 2017–2024 (USD Million)

Table 14 North America: Market Size By Service, 2017–2024 (USD Million)

Table 15 North America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 16 North America: Market Size By Technology, 2017–2024 (USD Million)

Table 17 North America: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 18 North America: Market Size By Application, 2017–2024 (USD Million)

Table 19 North America: Market Size By Country, 2017–2024 (USD Million)

Table 20 Europe: Artificial Intelligence in Accounting Market Size, By Component, 2017–2024 (USD Million)

Table 21 Europe: Market Size By Solution, 2017–2024 (USD Million)

Table 22 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 23 Europe: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 24 Europe: Market Size By Technology, 2017–2024 (USD Million)

Table 25 Europe: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 26 Europe: Market Size By Application, 2017–2024 (USD Million)

Table 27 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 28 Asia Pacific: Artificial Intelligence in Accounting Market Size, By Component, 2017–2024 (USD Million)

Table 29 Asia Pacific: Market Size By Solution, 2017–2024 (USD Million)

Table 30 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 31 Asia Pacific: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 32 Asia Pacific: Market Size By Technology, 2017–2024 (USD Million)

Table 33 Asia Pacific: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 34 Asia Pacific: Market Size By Application, 2017–2024 (USD Million)

Table 35 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 36 Middle East and Africa: Artificial Intelligence in Accounting Market Size, By Component, 2017–2024 (USD Million)

Table 37 Middle East and Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 38 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 39 Middle East and Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 40 Middle East and Africa: Market Size By Technology, 2017–2024 (USD Million)

Table 41 Middle East and Africa: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 42 Middle East: Market Size By Application, 2017–2024 (USD Million)

Table 43 Middle East: Market Size By Country, 2017–2024 (USD Million)

Table 44 Latin America: Artificial Intelligence in Accounting Market Size, By Component, 2017–2024 (USD Million)

Table 45 Latin America: Market Size By Solution, 2017–2024 (USD Million)

Table 46 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 47 Latin America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 48 Latin America: Market Size By Technology, 2017–2024 (USD Million)

Table 49 Latin America: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 50 Latin America: Market Size By Application, 2017–2024 (USD Million)

Table 51 Latin America: Market Size By Country, 2017–2024 (USD Million)

List of Figures (40 Figures)

Figure 1 Artificial Intelligence in Accounting Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Market Snapshot By Component

Figure 4 Market Snapshot By Solution

Figure 5 Artificial Intelligence in Accounting Market Snapshot By Service

Figure 6 Market Snapshot By Deployment Mode

Figure 7 Market Snapshot By Technology

Figure 8 Market Snapshot By Enterprise Size

Figure 9 Market Snapshot By Application

Figure 10 Market Snapshot By Region

Figure 11 Growing Demand for Automation of Accounting Processes and the Need for Enhanced Data-Based Advisory and Decision Making to Drive the Overall Growth of the Artificial Intelligence in Accounting Market During the Forecast Period

Figure 12 Fraud and Risk Management Application to Grow at the Highest CAGR During the Forecast Period

Figure 13 North America to Hold the Highest Market Share in 2019

Figure 14 Automated Bookkeeping Application and Cloud Deployment Mode to Dominate the North American Market in 2019

Figure 15 Artificial Intelligence in Accounting Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 Platforms Segment to Grow at A Higher CAGR During the Forecast Period

Figure 18 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 Cloud Segment to Register A Higher CAGR as Compared to the On-Premises Segment During the Forecast Period

Figure 20 Natural Language Processing Segment to Register A Higher CAGR During the Forecast Period

Figure 21 Small and Medium-Sized Enterprises Segment to Register A Higher CAGR During the Forecast Period

Figure 22 Fraud and Risk Management Segment to Witness the Highest Growth Rate During the Forecast Period

Figure 23 North America to Hold the Largest Market Size During the Forecast Period

Figure 24 Australia AI in Accounting Market to Register the Highest CAGR Among All Countries During the Forecast Period

Figure 25 Asia Pacific AI in Accounting Market to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America: Artificial Intelligence in Accounting Market Snapshot

Figure 27 Fraud and Risk Management Application in North America to have the Highest CAGR During the Forecast Period

Figure 28 Fraud and Risk Management Application in Europe to Grow at the Highest CAGR During the Forecast Period

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Fraud and Risk Management Application to Grow at the Highest CAGR in Asia Pacific During the Forecast Period

Figure 31 Automated Bookkeeping Application to Register the Largest Market Size During Forecast Period

Figure 32 Fraud and Risk Management Application to Grow at the Highest CAGR in Latin America During the Forecast Period

Figure 33 Artificial Intelligence in Accounting Market (Global) Competitive Leadership Mapping, 2018

Figure 34 Microsoft: Company Snapshot

Figure 35 Microsoft: SWOT Analysis

Figure 36 AWS: Company Snapshot

Figure 37 AWS: SWOT Analysis

Figure 38 Xero: Company Snapshot

Figure 39 Intuit: Company Snapshot

Figure 40 Sage: Company Snapshot

The study involved 4 major activities to estimate the current market size for Artificial Intelligence (AI) in accounting. An exhaustive secondary research was done to collect information on market, peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard and silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

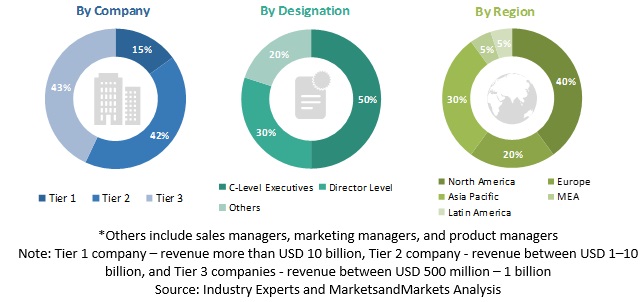

Primary Research

Various primary sources from both supply and demand sides of the Artificial Intelligence in Accounting Market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors of AI in accounting solutions, associated service providers, and system integrators operating in the targeted regions. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Artificial Intelligence in Accounting Market Size Estimation

For making market estimates and forecasting the AI in accounting market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global AI in accounting market using the revenue of key companies and their offerings in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global Artificial Intelligence in Accounting Market size

- To understand the structure of the Market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 4 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements in the Artificial Intelligence in Accounting Market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Artificial Intelligence in Accounting Market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Artificial Intelligence in Accounting Market