Sinus Dilation Devices Market by Product (Balloon Dilation Devices, Endoscope (Rhinoscope, Sinoscope), Handheld), Procedure (Standalone, Hybrid), Patient Type (Adult, Pediatric) & Patient Care Setting (Hospitals & ASC, ENT Office) - Global Forecast to 2027

Market Growth Outlook Summary

The global sinus dilation devices market growth forecasted to transform from USD 2.8 billion in 2022 to USD 3.8 billion by 2027, driven by a CAGR of 6.6%. The expansion of this market is due in large part to the upsurge in cases of chronic sinusitis as well as growing healthcare spending. However, a lack of skilled ENT professionals is one of the challenges that may inhibit the growth of this market.

Sinus Dilation Devices Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Sinus Dilation Devices Market Dynamics

Driver: Up-surging Cases of Chronic Sinusitis

Sinusitis is a medical condition wherein the cavities around the nasal passages (sinuses) are inflamed or swollen for more than twelve weeks. Chronic sinusitis can be caused by an infection, growths in the sinuses (nasal polyps), or swelling of the lining of the sinuses. Nasal polyps affect an estimated 4–40% of the general population (Source: PubMed). Chronic sinusitis is one of the most common medical conditions and accounts for around USD 2.4 billion in annual healthcare costs (not including surgery or radiographic imaging) in the US (Source: NCBI 2022). According to Medscape 2022, sinusitis affects 1 out of every 7 adults in the United States, with more than 30 million individuals diagnosed each year. Similarly, rhinosinusitis affects an estimated 35 million people per year in the US and accounts for close to 16 million physician office visits per year. Like the US, chronic sinusitis is a highly prevalent condition in the UK and affects 10% of the adult population in the country (Source: NHS). According to the National Institute of Allergy and Infectious Diseases (NIAID), chronic sinusitis affects ~134 million people in India. Owing to the high prevalence of chronic sinusitis in several countries across the globe, the demand for various ENT treatments, such as endoscopic sinus surgeries, functional endoscopic sinus surgery (FESS), and balloon sinus dilation, is high. As a result, the high prevalence of chronic sinusitis is one of the major factors driving the growth of the global market.

Opportunity: Growing Healthcare Market in Emerging Economies.

Developing economies such as China, India, and Brazil are expected to offer significant growth opportunities for players operating in the global market. According to the OECD, the global middle-class population is estimated to increase from 1.8 billion in 2009 to 4.9 billion by 2030. Asia is expected to account for 66% of the global middle-class population by 2030. In countries such as China and India, the growth in purchasing power is enabling people to opt for technologically advanced ENT treatments, including sinus dilation, thereby fuelling the growth of the market.

Due to the presence of a large target patient population, these countries offer sinus dilation device manufacturers potential opportunities to expand their reach outside the US. The Asia Pacific market is considered a major growth market for sinus dilation devices. Factors such as less stringent regulatory policies and improving healthcare facilities in these countries are expected to create potential growth opportunities for market players in the coming years.

Challenge: Survival of Small Players And New Entrants

The global market is a capital-intensive market. Significant R&D investments are needed to ensure innovation in product offerings to cater to the changing needs of the customers. In this market, there are several well-established players that have successfully built a strong image, which makes it difficult for the new entrants to compete with them. Furthermore, lack of economies of scale, moderate market growth, and high manufacturing cost of devices are some of the challenges faced by start-ups and niche market players, at least in the initial years.

China is anticipated to account the largest share of APAC sinus dilation devices market

Based on the Apac region, the market is divided into China, Japan, and India. China is expected to account the largest share of this market., the growing investment in medical device sector due to rising geriatric population, technological improvement, and the development of clinic and hospital service are the key factor driving market growth in China.

UK is forecasted as the fastest growing region of sinus dilation devices market in Europe

Based on the Europe region, the market is divided into Germany, UK, Italy, Spain, France, and RoE. UK is forecasted to the fastest growing market of sinus dilation devices in Europe the government initiatives to improve the awareness in the field of otolaryngology and the high prevalence of chronic rhinosinusitis are the crucial factor thriving the market growth in UK.

Standalone sinus dilation procedure in the procedure segment of sinus dilation devices market to witness the highest shares during the forecast period.

Based on the procedure, the market is classified into Standalone sinus dilation procedure and hybrid sinus dilation procedure. The Standalone sinus dilation procedure segment is expected to dominate because of its wider advantages such as fewer post procedural debridement episodes as opposed to FESS, reduced postoperative nasal bleeding, shorter recovery as well as medication for pain relief, and short-term symptom improvement. These are the key factors driving the growth of the Standalone sinus dilation procedure in the market.

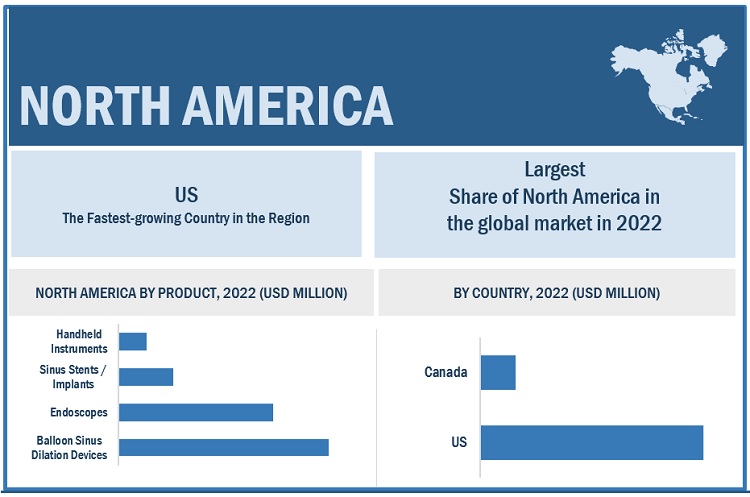

North America dominates the global sinus dilation devices market

Based on the region, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to dominate the global market. Growth in the North American market is mainly driven by rising healthcare spending, increasing cases of chronic sinusitis and availability of favourable healthcare reforms such as the Affordable Care Act and Medicare.

To know about the assumptions considered for the study, download the pdf brochure

Some of the players operating in the sinus dilation devices market are Acclarent, inc. (a subsidiary of Johnson & Johnson) (US), Entellus Medical Inc. (A Subsidiary of Stryker) (US), Intersect ENT, Inc. (US), SinuSys Corporation (US), Optim LLC (US), Sklar Surgical Instruments (US), Dalent Medical (US), Summit Medical LLC. (US), and Cook Medical (US)

Scope of the Sinus Dilation Devices Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$2.8 billion |

|

Projected Revenue Size by 2027 |

$3.8 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.6% |

|

Market Driver |

Up-surging Cases of Chronic Sinusitis |

|

Market Opportunity |

Growing Healthcare Market in Emerging Economies |

This research report categorizes the sinus dilation devices market to forecast revenue and analyze trends in each of the following submarkets

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Product

- Balloon sinus dilation devices

-

Endoscopes

- Sinuscopes

- Rhinoscopes

- Sinus stents/implants

- Handheld instruments

By Patient Type

-

Adult

- Pediatric

By Procedure

- Standalone sinus dilation procedures

- Hybrid sinus dilation procedures

By Patient Care Setting

- Hospitals and ambulatory surgery centers (ASCs)

- ENT clinics

Recent Developments

- In 2021, Intersect ENT (US) announced the launch of the new Straight Delivery System packaged with the PROPEL Mini Sinus Implant

- In 2019, XION GmbH (Germany) launched the stroboscopy-capable Spectar XN P pediatric video nasopharyngoscope and 2.7 mm thin 3D endoscopes for ENT applications

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the sinus dilation devices market?

The sinus dilation devices market boasts a total revenue value of $3.8 billion by 2027.

What is the estimated growth rate (CAGR) of the sinus dilation devices market?

The global sinus dilation devices market has an estimated compound annual growth rate (CAGR) of 6.6% and a revenue size in the region of $2.8 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

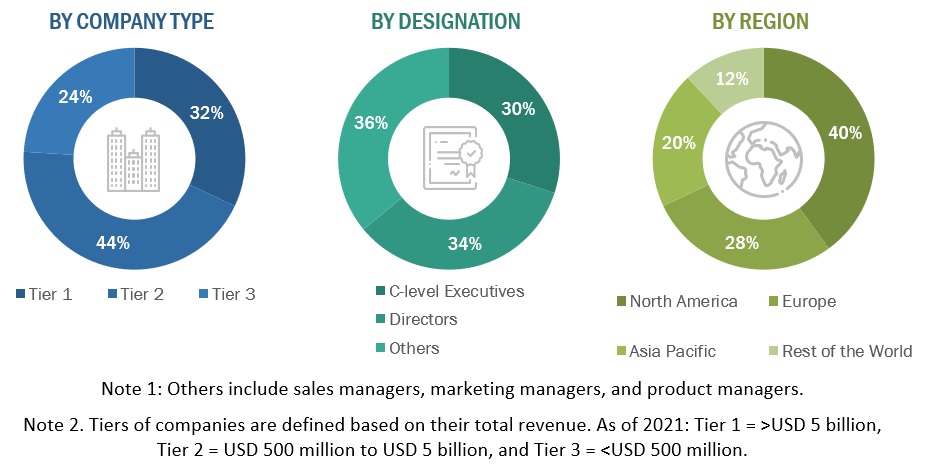

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION FOR JOHNSON & JOHNSON

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION FROM PARENT MARKET

2.2.1 GROWTH FORECAST

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 11 SINUS DILATION DEVICES MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 ENDOSCOPES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY PATIENT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY PATIENT CARE SETTING, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY PROCEDURE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 GEOGRAPHIC SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 SINUS DILATION DEVICES MARKET OVERVIEW

FIGURE 17 HIGH PREVALENCE OF CHRONIC SINUSITIS TO DRIVE MARKET

4.2 MARKET, BY PATIENT CARE SETTING, 2022–2027

FIGURE 18 HOSPITALS AND ASCS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY PRODUCT AND COUNTRY (2022)

FIGURE 19 BALLOON SINUS DILATION DEVICES SEGMENT TO DOMINATE ASIA PACIFIC MARKET IN 2022

4.4 GEOGRAPHIC SNAPSHOT OF MARKET

FIGURE 20 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High prevalence of chronic sinusitis

5.2.1.2 Benefits of balloon dilation procedures over traditional endoscopic sinus surgeries

5.2.1.3 Growing preference for minimally invasive surgeries

5.2.1.4 Rising healthcare expenditure

FIGURE 22 CURRENT HEALTH EXPENDITURE PER CAPITA

FIGURE 23 CURRENT HEALTH EXPENDITURE (% OF GDP)

5.2.1.5 Increasing availability of reimbursements

5.2.2 RESTRAINTS

5.2.2.1 Risks associated with sinus surgeries

5.2.2.2 Availability of non-surgical treatments for chronic sinusitis

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare market in emerging economies

FIGURE 24 GROWTH IN CURRENT HEALTHCARE EXPENDITURE PER CAPITA IN BRIC COUNTRIES, 2012–2019

5.2.4 CHALLENGES

5.2.4.1 Dearth of skilled otolaryngologists, ENT surgeons, and endoscopists

5.2.4.2 Survival of small players and new entrants

5.3 RANGES/SCENARIOS

FIGURE 25 PESSIMISTIC SCENARIO

FIGURE 26 OPTIMISTIC SCENARIO

FIGURE 27 REALISTIC SCENARIO

5.4 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 29 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.6 TECHNOLOGY ANALYSIS

TABLE 2 BENEFITS OF ENDOSCOPIC PROCEDURE

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 INTENSITY OF COMPETITIVE RIVALRY

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 THREAT OF SUBSTITUTES

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR END USERS

TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

5.8.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR END USERS

TABLE 4 KEY BUYING CRITERIA FOR END USERS

5.9 REGULATORY LANDSCAPE

TABLE 5 REGULATORY AUTHORITIES GOVERNING GLOBAL MARKET

5.10 PATENT ANALYSIS

5.11 KEY CONFERENCES AND EVENTS

TABLE 6 LIST OF CONFERENCES AND EVENTS, 2022–2023

5.12 PRICING ANALYSIS

TABLE 7 PRICE RANGE FOR SINUS DILATION DEVICES

5.13 TRADE ANALYSIS

TABLE 8 NUMBER OF EXPORTS AND IMPORTS RELATED TO ENDOSCOPY EQUIPMENT

5.14 ECOSYSTEM ANALYSIS

TABLE 9 ROLE IN ECOSYSTEM

FIGURE 32 KEY PLAYERS OPERATING IN GLOBAL MARKET

5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6 SINUS DILATION DEVICES MARKET, BY PRODUCT (Page No. - 82)

6.1 INTRODUCTION

TABLE 10 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 BALLOON SINUS DILATION DEVICES

6.2.1 INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO SUPPORT MARKET

TABLE 11 BALLOON MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 ENDOSCOPES

TABLE 12 ENDOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 13 ENDOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 SINUSCOPES

6.3.1.1 Largest and fastest-growing segment of endoscopes market

TABLE 14 SINUSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 RHINOSCOPES

6.3.2.1 Primarily used to examine nasal cavity and passage

TABLE 15 RHINOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 SINUS STENTS/IMPLANTS

6.4.1 SINUS STENTS/IMPLANTS ARE USED POSTOPERATIVELY FOLLOWING AN ENDOSCOPIC SINUS SURGERY

TABLE 16 SINUS STENTS/IMPLANTS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 HANDHELD INSTRUMENTS

6.5.1 HANDHELD INSTRUMENTS ARE WIDELY USED IN ALMOST ALL KINDS OF SURGERIES

TABLE 17 HANDHELD INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

7 SINUS DILATION DEVICES MARKET, BY PROCEDURE (Page No. - 90)

7.1 INTRODUCTION

TABLE 18 MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

7.2 STANDALONE SINUS DILATION PROCEDURES

7.2.1 STANDALONE SINUS DILATION PROCEDURES ARE WIDELY USED FOR SINUS DILATION

TABLE 19 STANDALONE SINUS DILATION PROCEDURES MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 HYBRID SINUS DILATION PROCEDURES

7.3.1 HYBRID SINUS DILATION PROCEDURES ARE MORE INVASIVE IN NATURE COMPARED TO STANDALONE PROCEDURES

TABLE 20 NUMBER OF SINUS PROCEDURES PERFORMED IN ENGLAND BETWEEN 2010 AND 2019

TABLE 21 HYBRID SINUS DILATION PROCEDURES MARKET, BY REGION, 2020–2027 (USD MILLION)

8 SINUS DILATION DEVICES MARKET, BY PATIENT TYPE (Page No. - 94)

8.1 INTRODUCTION

TABLE 22 MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

8.2 ADULT PATIENTS

8.2.1 ADULT PATIENTS DOMINATE MARKET

FIGURE 33 THE PERCENTAGE DISTRIBUTION OF CHRONIC SINUSITIS BY AGE GROUP.

TABLE 23 ADULT MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 PEDIATRIC PATIENTS

8.3.1 HIGH PREVALENCE OF SINUSITIS IN CHILDREN TO DRIVE MARKET

FIGURE 34 TIME OF ONSET OF CRS TO THE FIRST SURGICAL INTERVENTION FOR ENDOSCOPIC SINUS SURGERY PATIENTS.

TABLE 24 PEDIATRIC MARKET, BY REGION, 2020–2027 (USD MILLION)

9 SINUS DILATION DEVICES MARKET, BY PATIENT CARE SETTING (Page No. - 99)

9.1 INTRODUCTION

TABLE 25 MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

9.2 HOSPITALS AND AMBULATORY SURGERY CENTERS

9.2.1 LARGEST AND FASTEST-GROWING END USERS OF SINUS DILATION DEVICES

TABLE 26 MARKET FOR HOSPITALS AND AMBULATORY SURGERY CENTERS, BY REGION, 2020–2027 (USD MILLION)

9.3 ENT CLINICS

9.3.1 FASTER RECOVERY TIME AND COST-EFFECTIVENESS ARE SUPPORTING SEGMENT GROWTH

TABLE 27 MARKET FOR ENT CLINICS, BY REGION, 2020–2027 (USD MILLION)

10 SINUS DILATION DEVICES MARKET, BY REGION (Page No. - 102)

10.1 INTRODUCTION

TABLE 28 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: ENDOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Favorable reimbursement scenario for sinus dilation procedures

TABLE 35 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 36 US: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 37 US: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising geriatric population and associated increase in prevalence of CRS to support market growth

TABLE 38 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 39 CANADA: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 40 CANADA: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 41 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 43 EUROPE: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: ENDOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 EUROPE: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising geriatric population and increasing R&D—key factors driving market

TABLE 47 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 48 GERMANY: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 49 GERMANY: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Fastest-growing market for sinus dilation devices in Europe

TABLE 50 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 51 UK: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 52 UK: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 High burden of chronic sinusitis to drive market

TABLE 53 FRANCE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 54 FRANCE: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 55 FRANCE: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growing geriatric population to support adoption of sinus dilation devices

TABLE 56 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 57 ITALY: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 58 ITALY: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising healthcare expenditure to support market for sinus dilation devices

TABLE 59 SPAIN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 60 SPAIN: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 61 SPAIN: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 62 REST OF EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 63 REST OF EUROPE: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 64 REST OF EUROPE: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 65 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: ENDOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Fastest-growing market for sinus dilation devices

TABLE 71 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 72 CHINA: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 73 CHINA: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Large geriatric population to aid market growth

TABLE 74 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 75 JAPAN: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 76 JAPAN: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 High prevalence of sinusitis will drive demand for sinus dilation devices

TABLE 77 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 INDIA: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 79 INDIA: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 80 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 81 REST OF ASIA PACIFIC: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 83 REST OF THE WORLD: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 84 REST OF THE WORLD: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 85 REST OF THE WORLD: ENDOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 REST OF THE WORLD: MARKET, BY PATIENT CARE SETTING, 2020–2027 (USD MILLION)

TABLE 87 REST OF THE WORLD: MARKET, BY PATIENT TYPE, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 131)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 88 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SINUS DILATION MARKET

11.3 REVENUE SHARE ANALYSIS

FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN SINUS DILATION MARKET

11.4 MARKET SHARE ANALYSIS

TABLE 89 MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 38 COMPANY EVALUATION QUADRANT: SINUS DILATION MARKET

11.6 COMPANY EVALUATION QUADRANT FOR SMES/STARTUPS

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 39 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS: SINUS DILATION MARKET

11.7 COMPANY FOOTPRINT ANALYSIS

TABLE 90 FOOTPRINT OF COMPANIES IN SINUS DILATION MARKET

TABLE 91 REGIONAL FOOTPRINT OF COMPANIES

TABLE 92 PRODUCT FOOTPRINT OF COMPANIES

11.8 COMPETITIVE BENCHMARKING

TABLE 93 SINUS DILATION MARKET: LIST OF KEY STARTUPS/SMES

11.9 COMPETITIVE SCENARIO

11.9.1 PRODUCT LAUNCHES/APPROVALS

TABLE 94 KEY PRODUCT LAUNCHES

11.9.2 DEALS

TABLE 95 KEY DEALS

11.9.3 OTHER DEVELOPMENTS

TABLE 96 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 148)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 ENTELLUS MEDICAL, INC. (SUBSIDIARY OF STRYKER)

TABLE 97 STRYKER: BUSINESS OVERVIEW

FIGURE 40 STRYKER: COMPANY SNAPSHOT (2021)

12.1.2 MEDTRONIC PLC

TABLE 98 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 41 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

12.1.3 ACCLARENT, INC. (SUBSIDIARY OF JOHNSON & JOHNSON)

TABLE 99 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 42 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

12.1.4 SMITH & NEPHEW PLC

TABLE 100 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

FIGURE 43 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2021)

12.1.5 INTERSECT ENT, INC.

TABLE 101 INTERSECT ENT, INC.: BUSINESS OVERVIEW

FIGURE 44 INTERSECT ENT, INC.: COMPANY SNAPSHOT (2021)

12.1.6 OLYMPUS CORPORATION

TABLE 102 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 45 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2022)

12.1.7 SINUSYS CORPORATION

TABLE 103 SINUSYS CORPORATION: BUSINESS OVERVIEW

12.1.8 INNACCEL TECHNOLOGIES PVT LTD.

TABLE 104 INNACCEL TECHNOLOGIES PVT LTD.: BUSINESS OVERVIEW

12.1.9 MERIL LIFE SCIENCES PVT. LTD.

TABLE 105 MERIL LIFE SCIENCES PVT. LTD.: BUSINESS OVERVIEW

12.1.10 OPTIM LLC

TABLE 106 OPTIM LLC: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 JILIN CORONADO MEDICAL LTD.

TABLE 107 JILIN CORONADO MEDICAL LTD.: BUSINESS OVERVIEW

12.2.2 DALENT MEDICAL

TABLE 108 DALENT MEDICAL: BUSINESS OVERVIEW

12.2.3 EMOS TECHNOLOGY GMBH

TABLE 109 EMOS TECHNOLOGY GMBH: BUSINESS OVERVIEW

12.2.4 SKLAR SURGICAL INSTRUMENTS

TABLE 110 SKLAR SURGICAL INSTRUMENTS: BUSINESS OVERVIEW

12.2.5 KARL STORZ

TABLE 111 KARL STORZ: BUSINESS OVERVIEW

12.2.6 PENTAX MEDICAL

TABLE 112 PENTAX MEDICAL: BUSINESS OVERVIEW

12.2.7 ANGIPLAST PVT. LTD.

TABLE 113 ANGIPLAST PVT. LTD.: BUSINESS OVERVIEW

12.2.8 SUMMIT MEDICAL LLC

TABLE 114 SUMMIT MEDICAL LLC: BUSINESS OVERVIEW

12.2.9 RICHARD WOLF GMBH

TABLE 115 RICHARD WOLF GMBH: BUSINESS OVERVIEW

12.2.10 ENTERMED

TABLE 116 ENTERMED: BUSINESS OVERVIEW

12.2.11 SCHÖLLY FIBEROPTIC GMBH

TABLE 117 SCHÖLLY FIBEROPTIC GMBH: BUSINESS OVERVIEW

12.2.12 XION GMBH

TABLE 118 XION GMBH: BUSINESS OVERVIEW

12.2.13 COOK MEDICAL

TABLE 119 COOK MEDICAL: BUSINESS OVERVIEW

12.2.14 MAXER ENDOSCOPY GMBH

TABLE 120 MAXER ENDOSCOPY GMBH: BUSINESS OVERVIEW

12.2.15 ESC MEDICAMS

TABLE 121 ESC MEDICAMS: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 192)

13.1 INDUSTRY INSIGHTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the sinus dilation devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Doctors, Surgeons) and supply sides (sinus dilation device manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the sinus dilation devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the sinus dilation devices industry.

Report Objectives

- To define, describe, and forecast the global sinus dilation devices market based on product, procedure, Patient type, Patient care setting, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies

- To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the sinus dilation devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the European sinus dilation devices market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sinus Dilation Devices Market