EMEA IoT Market by Component (Platform, Service, Software Solution), Application (Building & Home Automation, Smart Energy, Smart Manufacturing, Connected Logistics, Smart Retail, Connected Health), and Region (Europe and MEA) - Forecast to 2021

[139 Pages Report] The EMEA IoT market is projected to grow from USD 53.88 Billion in 2016 to USD 211.92 Billion by 2021, at a CAGR of 31.5% during the forecast period. The objective of the research study is to provide detailed segmentation of the market on the basis of component, application, and region. It also aims to provide information regarding key factors influencing market growth, and strategically analyze subsegments with respect to individual growth trends, future prospects, and contribution to the total market. The report helps analyze opportunities in the market for stakeholders, provide strategic profiles of key market players to comprehensively analyze core competencies, and draw a competitive landscape of the market. The base year considered for the study is 2015 and the forecast period is from 2016 to 2021.

The research methodology used to estimate and forecast the EMEA IoT market begins with obtaining data on key vendor revenues and the market size of individual segments through secondary sources, such as annual reports, press releases, investors’ presentations, white papers, and paid databases, which include Factiva and Bloomberg, among others. Vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall size of EMEA IoT market from the revenue of key players (companies) present in the market.

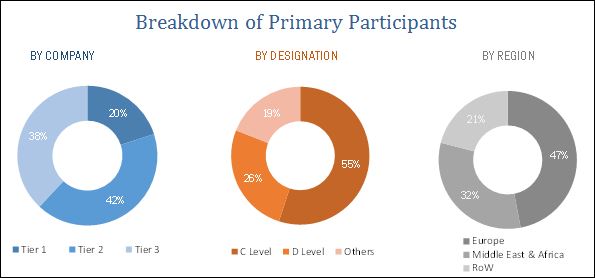

After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the EMEA IoT market comprises EMEA IoT solutions & service providers as well as system integrators. Key players of the market include IBM Corporation (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), Amazon Web Services (U.S.), Cisco Systems, Inc. (U.S.), and PTC Inc. (U.S.), among others.

Target Audience

- Semiconductor Companies

- Embedded Systems Companies

- Application Developers and Aggregators

- Managed Service Providers and Middleware Companies

- Wireless Infrastructure Providers and Service Providers

- Data Management and Predictive Analysis Companies

- Sensor, Location, and Detection Solution Providers

- Internet Identity Management, Privacy, and Security Companies

- Machine-to-Machine (M2M), IoT, and Telecommunications Companies

“The research study answers several questions for the stakeholders, primarily which market segments to focus on during the next two to five years for prioritizing the efforts and investments”

Scope of the Report

The research report categorizes the EMEA IoT market to forecast revenues and analyze trends in each of the following subsegments:

By Component

- Platform

- Device Management Platform

- Application Management Software

- Network Management Software

- Software Solution

- Real-time Stream Analytics

- Security Solution

- Data Management

- Remote Monitoring System

- Network Bandwidth Management

- Service

- Professional Services

- Managed Services

By Application

- Building & Home Automation

- Smart Energy

- Smart Manufacturing

- Connected Logistics

- Connected Health

- Smart Retail

- Smart Mobility & Transportation

- Security & Emergencies

- Smart Environment

- Others

By Region

- Europe

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the Europe IoT market

- Further breakdown of the Middle East & Africa IoT market

Company Information

- Detailed analysis and profiling of additional market players

The EMEA IoT market is projected to grow from USD 53.88 Billion in 2016 to USD 211.92 Billion by 2021, at a CAGR of 31.5% from 2016 to 2021. The market is projected to grow significantly, owing to the increasing number of smartphone users, rise in smart city projects, and availability of high speed network connections. Major telecom operators in the EMEA region collaborated with global IoT market players to offer IoT solutions and services to their existing client base. Some of the key players in the IoT market include IBM Corporation (U.S.), Microsoft Corporation (U.S.), Cisco Systems, Inc. (U.S.), Amazon Web Services (U.S.), SAP SE (Germany), and General Electric (U.S.).

The EMEA IoT market is segmented broadly into component and application. The component segment has been further segmented into platform, software solution, and service. The software solution segment is projected to grow at the highest CAGR during the forecast period. This segment’s growth is mainly due to the increase in deployment of IoT software solutions across organizations to increase productivity and quality of work. Among platforms, the device management platform segment is estimated to grow at the highest CAGR during the forecast period. The rise in adoption of device management platforms across industries is attributed to the increased use of personalized devices, such as smartphones and tablets.

Based on application, the smart mobility & transportation segment is projected to lead the market during the forecast period. The rapid growth in population and urbanization is expected to lead to growth of this segment across regions. With increasing population and the resultant increase in vehicles, maintaining smooth traffic flow will be essential, which will create a need for smarter technologies in the transportation domain.

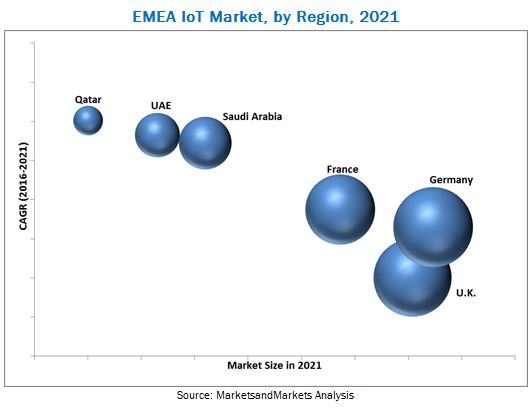

In the European region, the IoT market in France is projected to grow at the highest CAGR during the forecast period. This projected growth is driven by the increasing use of mobile phones and social media, and the exponential growth in deployment of high speed networks. In the Middle East & African region, the market in Qatar is projected to grow at the highest CAGR owing to the country’s infrastructure growth, such as in the banking and hospitality sectors, and rise in income levels. Slow economic growth and geopolitical conditions are the major hurdles for growth of the IoT market in Qatar.

Key players in this market, such as IBM Corporation, Microsoft Corporation, Cisco Systems, Amazon Web Services, SAP SE, and General Electric, have adopted agreements, collaborations, and partnerships as key strategies to enhance their client base and customer experience. Existing players, such as IBM Corporation, Microsoft Corporation, Cisco Systems, Amazon Web Services, and SAP SE, are constantly innovating and upgrading their products to enhance their market shares. Rising adoption of cloud platforms, development of cheaper and smarter sensors, and evolution of high speed networking technologies are expected to drive the growth of the EMEA IoT market. Industries across the EMEA region are undergoing a huge digital transformation to provide affordable, accessible, and quality services to their customers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the EMEA IoT Market

4.2 EMEA IoT Market, By Application and Software Solution

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 IoT Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rise in Smart City Projects

5.3.1.2 Increasing Requirement for Vertical/Industry Specific Solution

5.3.1.3 Increase in Number of Smartphone Users

5.3.2 Restraints

5.3.2.1 High Cost of IoT Solutions

5.3.3 Opportunities

5.3.3.1 Potential Growth Opportunities for IoT Service Providers

5.3.3.2 Increase in Internet Penetration and Network Connectivity

5.3.4 Challenges

5.3.4.1 Political Instability

5.4 Regulatory Implications

5.4.1 ISO Standards

5.4.1.1 ISO/IEC JTC 1

5.4.1.2 ISO/IEC JTC 1/SWG 5

5.4.1.3 ISO/IEC JTC 1/SC 31

5.4.1.4 ISO/IEC JTC 1/SC 27/WG 1

5.4.1.5 ISO/IEC JTC 1/WG 7 Sensors

5.4.2 IEEE

5.4.3 CEN/ISO

5.4.4 CEN/Cenelec

5.4.5 ETSI

5.4.6 ITU-T

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Pest Analysis

6.3.1 Political Factors

6.3.2 Economic Factors

6.3.3 Social Factors

6.3.4 Technological Factors

6.4 Strategic Benchmarking

7 EMEA Internet of Things (IoT) Market, By Component (Page No. - 44)

7.1 Introduction

7.2 EMEA IoT Market, By Platform

7.2.1 Introduction

7.2.2 Device Management Platform

7.2.3 Application Management Platform

7.2.4 Network Management Platform

7.3 EMEA IoT Market, By Software Solution

7.3.1 Introduction

7.3.2 Real-Time Streaming Analytics

7.3.3 Security Solution

7.3.4 Data Management

7.3.5 Remote Monitoring System

7.3.6 Network Bandwidth Management

7.4 EMEA IoT Market, By Service

7.4.1 Introduction

7.4.2 Professional Services

7.4.3 Managed Services

8 EMEA IoT Market, By Application (Page No. - 55)

8.1 Introduction

8.2 Building & Home Automation

8.3 Smart Energy

8.4 Smart Manufacturing

8.5 Connected Logistics

8.6 Connected Health

8.7 Smart Retail

8.8 Smart Mobility & Transportation

8.9 Security & Emergencies

8.10 Smart Environment

8.11 Others

9 Regional Analysis (Page No. - 69)

9.1 Introduction

9.2 Europe

9.2.1 U.K.

9.2.2 Germany

9.2.3 France

9.2.4 Rest of Europe

9.3 Middle East & Africa

9.3.1 Saudi Arabia

9.3.2 UAE

9.3.3 Qatar

9.3.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 IoT Market in EMEA: Vendor Analysis

10.3 Competitive Situations and Trends

10.3.1 New Product Launches

10.3.2 Partnerships, Agreements and Collaborations

10.3.3 Mergers and Acquisitions

11 Company Profiles (Page No. - 98)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 IBM Corporation

11.2 Cisco Systems, Inc.

11.3 SAP SE

11.4 PTC, Inc.

11.5 General Electric

11.6 Microsoft Corporation

11.7 Symantec Corporation

11.8 Oracle Corporation

11.9 Bosch Software Innovations GmbH

11.10 Amazon Web Services, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 127)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customization

12.6 Related Reports

12.7 Author Details

List of Tables (81 Tables)

Table 1 EMEA IoT Market, By Component, 2015–2021 (USD Billion)

Table 2 Market, By Platform, 2015–2021 (USD Billion)

Table 3 Platform: Europe IoT Market, By Country, 2015–2021 (USD Billion)

Table 4 Platform: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 5 Market, By Software Solution, 2015–2021 (USD Billion)

Table 6 Software Solution: Europe IoT Market, By Country, 2015–2021 (USD Billion)

Table 7 Software Solution: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Billion)

Table 8 Market, By Service, 2015–2021 (USD Billion)

Table 9 Service: Europe IoT Market, By Country, 2015–2021 (USD Billion)

Table 10 Service: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 11 EMEA IoT Market, By Application, 2015–2021 (USD Billion)

Table 12 Building & Home Automation: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 13 Building & Home Automation: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 14 Smart Energy: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 15 Smart Energy: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 16 Smart Manufacturing: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 17 Smart Manufacturing: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 18 Connected Logistics: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 19 Connected Logistics: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 20 Connected Health: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 21 Connected Health: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 22 Smart Retail: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 23 Smart Retail: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 24 Smart Mobility & Transportation: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 25 Smart Mobility & Transportation: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 26 Security & Emergencies: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 27 Security & Emergencies: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 28 Smart Environment: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 29 Smart Environment: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 30 Others: Europe IoT Market, By Country, 2015–2021 (USD Million)

Table 31 Others: Middle East & Africa IoT Market, By Country, 2015–2021 (USD Million)

Table 32 EMEA IoT Market Size, By Region, 2015–2021 (USD Billion)

Table 33 Europe IoT Market, By Country, 2015–2021 (USD Billion)

Table 34 IoT Market in U.K., By Component, 2015-2021 (USD Billion)

Table 35 IoT Market in U.K., By Platform, 2015-2021 (USD Million)

Table 36 IoT Market in U.K., By Software Solution, 2015-2021 (USD Million)

Table 37 IoT Market in U.K., By Service, 2015-2021 (USD Billion)

Table 38 IoT Market in U.K., By Application, 2015-2021 (USD Million)

Table 39 IoT Market in Germany, By Component, 2015-2021 (USD Billion)

Table 40 IoT Market in Germany, By Platform, 2015-2021 (USD Million)

Table 41 IoT Market in Germany, By Software Solution, 2015-2021 (USD Million)

Table 42 IoT Market in Germany, By Service, 2015-2021 (USD Billion)

Table 43 IoT Market in Germany, By Application, 2015-2021 (USD Million)

Table 44 IoT Market in France, By Component, 2015-2021 (USD Billion)

Table 45 IoT Market in France, By Platform, 2015-2021 (USD Million)

Table 46 IoT Market in France, By Software Solution, 2015-2021 (USD Million)

Table 47 IoT Market in France, By Service, 2015-2021 (USD Billion)

Table 48 IoT Market in France, By Application, 2015-2021 (USD Million)

Table 49 IoT Market in Rest of Europe, By Component, 2015-2021 (USD Billion)

Table 50 IoT Market in Rest of Europe, By Platform, 2015-2021 (USD Billion)

Table 51 IoT Market in Rest of Europe, By Software Solution, 2015-2021 (USD Billion)

Table 52 IoT Market in Rest of Europe, By Service, 2015-2021 (USD Billion)

Table 53 IoT Market in Rest of Europe, By Application, 2015-2021 (USD Billion)

Table 54 Middle East & Africa IoT Market, By Country, 2015–2021 (USD Billion)

Table 55 IoT Market in Saudi Arabia, By Component, 2015-2021 (USD Billion)

Table 56 IoT Market in Saudi Arabia , By Platform, 2015-2021 (USD Million)

Table 57 IoT Market in Saudi Arabia, By Software Solution, 2015-2021 (USD Million)

Table 58 IoT Market in Saudi Arabia, By Service, 2015-2021 (USD Million)

Table 59 IoT Market in Saudi Arabia, By Application, 2015-2021 (USD Million)

Table 60 IoT Market in UAE, By Component, 2015-2021 (USD Million)

Table 61 IoT Market in UAE, By Platform, 2015-2021 (USD Million)

Table 62 IoT Market in UAE, By Software Solution, 2015-2021 (USD Million)

Table 63 IoT Market in UAE, By Service, 2015-2021 (USD Million)

Table 64 IoT Market in UAE, By Application, 2015-2021 (USD Million)

Table 65 IoT Market in Qatar, By Component, 2015-2021 (USD Million)

Table 66 IoT Market in Qatar, By Platform, 2015-2021 (USD Million)

Table 67 IoT Market in Qatar, By Software Solution, 2015-2021 (USD Million)

Table 68 IoT Market in Qatar, By Service, 2015-2021 (USD Million)

Table 69 IoT Market in Qatar, By Application, 2015-2021 (USD Million)

Table 70 IoT Market in Rest of Middle East & Africa, By Component, 2015-2021 (USD Million)

Table 71 IoT Market in Rest of Middle East & Africa, By Platform, 2015-2021 (USD Million)

Table 72 IoT Market in Rest of Middle East & Africa, By Software Solution, 2015-2021 (USD Million)

Table 73 IoT Market in Rest of Middle East & Africa, By Service, 2015-2021 (USD Million)

Table 74 IoT Market in Rest of Middle East & Africa, By Application, 2015-2021 (USD Million)

Table 75 Developments in the EMEA IoT Market, 2014 – 2016

Table 76 New Product Launches, 2014–2016

Table 77 Partnerships, Agreements, and Collaborations, 2014–2016

Table 78 Mergers and Acquisitions, 2014–2016

Table 79 New Product Launches/Developments, 2014-2016

Table 80 Mergers& Acquisitions, 2014-2016

Table 81 Agreements, Partnerships and Collaborations, 2014-2016

List of Figures (46 Figures)

Figure 1 IoT Market in EMEA: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Platform Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 6 Smart Mobility & Transportation Projected to Be the Largest Application Segment By 2021

Figure 7 Germany is Projected to Lead the IoT Market in Europe By 2021

Figure 8 Saudi Arabia Leads the MEA IoT Market

Figure 9 Lucrative Market Prospects in the EMEA IoT Market Due to Higher Adoption of Connected and Smart Devices

Figure 10 By Component, the Platform Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 By Platform, the Device Management Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 By Software Solution, the Security Solution Segment is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 13 By Service, the Managed Services Segment is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 14 Smart Mobility & Transport is Estimated to Account for the Largest Market Share in 2016

Figure 15 Evolution of IoT

Figure 16 IoT Market: Drivers, Restraints, Opportunities & Challenges

Figure 17 IoT Market: Value Chain Model

Figure 18 IoT Market: Strategic Benchmarking

Figure 19 Software Solution Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 20 Device Management Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 Network Bandwidth Management Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 22 Professional Services Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 23 Smart Mobility & Transportation Segment is Estimated to Hold the Largest Market Size in 2016

Figure 24 Middle East & Africa Emerging as A Lucrative Market for Investment From 2016 to 2021

Figure 25 Europe IoT Market Snapshot

Figure 26 Middle East & Africa IoT Market Snapshot

Figure 27 Companies Adopted Partnerships and Collaborations as the Key Growth Strategy From 2014-2016

Figure 28 Vendor Analysis, By Product Offering

Figure 29 Vendor Analysis, By Business Strategy

Figure 30 Battle for Market Share: Partnerships and Collaborations Were the Key Strategy in the IoT Market

Figure 31 IBM Corporation: Company Snapshot

Figure 32 IBM Corporation: SWOT Analysis

Figure 33 Cisco Systems, Inc.: Company Snapshot

Figure 34 Cisco Systems, Inc.: SWOT Analysis

Figure 35 SAP SE: Company Snapshot

Figure 36 SAP SE: SWOT Analysis

Figure 37 PTC, Inc.: Company Snapshot

Figure 38 PTC, Inc.: SWOT Analysis

Figure 39 General Electric: Company Snapshot

Figure 40 General Electric: SWOT Analysis

Figure 41 Microsoft Corporation: Company Snapshot

Figure 42 Microsoft Corporation: SWOT Analysis

Figure 43 Symantec Corporation: Company Snapshot

Figure 44 Symantec Corporation: SWOT Analysis

Figure 45 Oracle Corporation: Company Snapshot

Figure 46 Oracle: SWOT Analysis

Growth opportunities and latent adjacency in EMEA IoT Market