Electric Vehicle Insulation Market by Product Type (TIM, Foamed Plastic, Ceramic), Application (Under the Bonnet & Battery Pack, Interior), Propulsion Type (BEV, PHEV), Insulation Type (Thermal, Electrical, Acoustic) and Region - Global Forecast to 2024

Updated on : June 18, 2024

Electric Vehicle Insulation Market

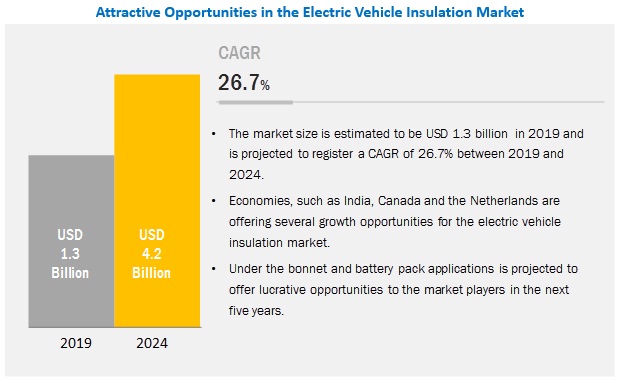

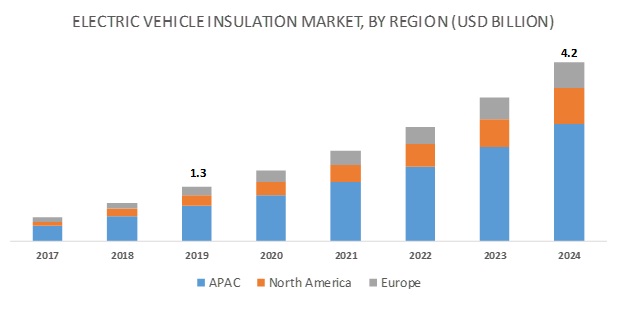

The global electric vehicle insulation market was valued at USD 1.3 billion in 2019 and is projected to reach USD 4.2 billion by 2024, growing at 26.7% cagr from 2019 to 2024. The increasing production of electric vehicle insulation in countries such as China, the US, and Germany, among other countries, is expected to drive the market growth. APAC was the largest market for electric vehicle insulation in 2018, followed by North America and Europe.

Electric Vehicle Insulation Market Dynamics

The foamed plastic segment is projected to be the largest product type of electric vehicle insulation during the forecast period

The foamed plastic segment is projected to lead the electric vehicle insulation market during the forecast period. This is owing to the growing demand for lightweight and impact-resistant insulation materials from the electric vehicles industry.

The BEV segment is projected to be the largest propulsion type of electric vehicle insulation during the forecast period

The BEV segment is projected to lead the electric vehicle insulation during the forecast period. This is owing to the growing production of BEV due to its emission-free technology. In addition, the large battery pack of BEV when compared to PHEV is estimated to drive the demand for electric vehicle insulation in the BEV segment.

The under the bonnet and battery pack segment is projected to be the largest application of electric vehicle insulation during the forecast period.

The under the bonnet and battery pack application segment is projected to lead the electric vehicle insulation during the forecast period. This is owing to the need to insulate battery and electric motor, among other components in case of BEVs; and internal combustion engine (ICE), battery, and electric motor, among other components in case of PHEVs.

The thermal insulation & management segment is projected to be the largest insulation type of electric vehicle insulation during the forecast period.

The thermal insulation & management application segment is projected to lead the overall electric vehicle insulation market during the forecast period. There is a growing demand for high capacity batteries which is driving the demand for thermal insulation & management in battery packs.

APAC is expected to be the largest market for electric vehicle insulation by 2024.

APAC is expected to account for the largest share of the electric vehicle insulation market during the forecast period. The presence of major electric vehicle manufacturers such as BYD, Geely, SAIC, Chery Automobile, JAC Motors, and Zotye Automobile, is estimated to have a positive impact on the market. Besides, the growing concern to reduce greenhouse gas emissions is increasing the demand for electric vehicle insulation in the region.

Electric Vehicle Insulation Market Players

The key market players profiled in the report include as BASF SE (Germany), 3M (US), Morgan Advanced Materials (UK), DuPont (US), Zotefoams plc (UK), Unifrax (US), Saint-Gobain (France), Von Roll Holding AG (Switzerland), Autoneum (Switzerland), Alder Pelzer Holding GmbH (Germany), Elmelin Ltd. (UK), Pyrophobic Systems Ltd. (Canada), Techman Advanced Material Engineers (UK), and Marian Inc. (US).

Autoneum is one of the leading players of electric vehicle insulation, globally. The company has a strong product portfolio when it comes to acoustic insulation. It offers electric vehicle insulation for acoustic and thermal insulation and management application. The company focuses on strategies such as new product launches, expansions, and joint ventures to remain competitive in the market.

Saint-Gobain is another dominant player in the electric vehicle insulation market when it comes to thermal insulation and management of batteries. The company has a strong product portfolio and offers foamed plastics and thermal interface materials (TIM) for the electric vehicle insulation market. The company focuses on R&D to meet the growing need for low-carbon emission from the mobility market by developing polymer components for electric vehicle batteries.

Electric Vehicle Insulation Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD million) |

|

Segments covered |

Product type, propulsion type, insulation type, application, region |

|

Regions covered |

APAC, North America, Europe |

|

Companies profiled |

BASF SE (Germany), Saint-Gobain (France), Autoneum (Switzerland), DuPont (US), Zotefoams plc (UK), Unifrax (US), 3M (US), Morgan Advanced Materials (UK), Alder Pelzer Holding GmbH (Germany), and Elmelin Ltd. (UK), among others.A total of 16 players are profiled in the report. |

This report categorizes the global electric vehicle insulation market based on product type, propulsion type, insulation type, application, and region.

On the basis of product type, the electric vehicle insulation market has been segmented as follows:

- Thermal interface materials

- Ceramic

- Foamed plastics

- Others

On the basis of propulsion type, the electric vehicle insulation market has been segmented as follows:

- BEV

- PHEV

On the basis of application, the electric vehicle insulation market has been segmented as follows:

- Under the bonnet and battery pack

- Interior

- Others

On the basis of insulation type, the electric vehicle insulation market has been segmented as follows:

- Thermal insulation & management

- Acoustic insulation

- Electrical insulation

On the basis of region, the electric vehicle insulation market has been segmented as follows:

- APAC

- North America

- Europe

Recent Developments

- In November 2019, Autoneum launched a new material, Hybrid-Acoustics PET. It is also flameproof and used in powertrain-mounted insulators for combustion engines.

- In July 2019, Autoneum launched Alpha-Liner, a multifunctional wheelhouse outer liner that reduces tire noise and makes vehicles quieter and lighter.

- In November 2018, Zotefoams plc increased the foam manufacturing capacity of ZOTEK HPP and the AZOTE polyolefin range of foam products at its UK plant by investing USD 15.5 million.

- In May 2018, Autoneum opened its first plant in Komárom, Hungary, to manufacture lightweight components for acoustic and thermal management for vehicles.

- In June 2016, ITW Inc. announced that its Formex brand of electrical insulation material (which was developed by the ITW Technology Center in 1985) is suitable for the insulation of battery in electric vehicles.

Key Questions addressed by the report

- What are the significant developments impacting the market?

- Where will all the developments take the industry in the mid to long term?

- What are the emerging applications of electric vehicle insulation?

- What are the major factors expected to impact market growth during the forecast period?

- How is the demand for electric vehicle insulation growing in various product types?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

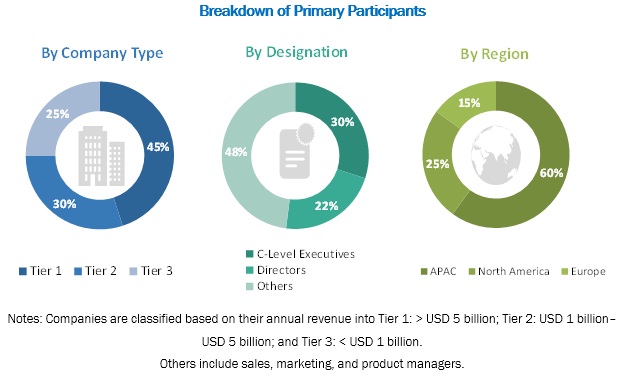

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Forecast Calculation Methodology

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Electric Vehicle Insulation Market

4.2 Electric Vehicle Insulation Market, By Region

4.3 APAC Electric Vehicle Insulation Market, By Application and Country (2018)

4.4 Electric Vehicle Insulation Market, By Major Countries

4.5 Electric Vehicle Insulation Market, By Application

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Thermal Runaway in Batteries

5.2.1.2 Favorable Government Policies and Subsidies

5.2.1.3 Campaigns for Promotion of Electric Vehicles

5.2.1.4 Growing Concerns Over Pollution

5.2.1.5 Heavy Investments From Automakers in Electric Vehicles

5.2.2 Restraints

5.2.2.1 Lack of Standardization of Charging Infrastructure

5.2.3 Opportunities

5.2.3.1 Scope for Growth of Autonomous Electric Vehicles

5.2.3.2 Scope for Further Development of Insulation Materials for Electric Vehicles

5.2.4 Challenges

5.2.4.1 Limited Range of Electric Vehicles

5.2.4.2 High Cost of Electric Vehicles in Comparison to Ice Vehicles

5.3 Shift in Revenue Streams Due to Megatrends in End-Use Industries

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of Substitutes

5.4.2 Threat of New Entrants

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

6 Government Regulations (Page No. - 43)

6.1 Introduction

6.2 Canada

6.3 China

6.4 Denmark

6.5 France

6.6 Austria

6.7 Germany

6.8 Spain

7 Electric Vehicle Insulation Market, By Product Type (Page No. - 49)

7.1 Introduction

7.2 Foamed Plastics

7.2.1 Growing Demand for Light-Weight and Impact Resistant Materials to Drive Foamed Plastics Market

7.2.2 Polyurethane

7.2.3 Polypropylene

7.2.4 Others

7.3 Thermal Interface Materials (TIM)

7.3.1 Need for Thermal Management and Electrical Insulation of Battery to Drive This Segment

7.4 Ceramic

7.4.1 Need for Prevention of Thermal Runaway Propagation in Batteries to Drive the Demand

7.5 Others

8 Electric Vehicle Insulation Market, By Propulsion Type (Page No. - 54)

8.1 Introduction

8.2 Battery Electric Vehicle

8.2.1 Requirement of Thermal Insulation & Management of Battery Pack to Drive the Market in BEV

8.3 Plug-In Hybrid Electric Vehicle

8.3.1 Need for Thermal, Electrical, and Acoustic Insulation is Key Factor for Growth of the Market in This Segment

8.4 Hybrid Electric Vehicle (HEV)

8.5 Fuel Cell Electric Vehicle (FCEV)

9 Electric Vehicle Insulation Market, By Application (Page No. - 61)

9.1 Introduction

9.2 Under the Bonnet and Battery Pack

9.2.1 Growing Production of BEV to Drive Under the Bonnet and Battery Pack Insulation Market

9.3 Interior

9.3.1 Need for Thermal, Electrical, and Acoustic Insulation Driving the Market in This Segment

9.4 Others

9.4.1 Growth in BEV to Drive the Demand in Other Applications Segment

10 Electric Vehicle Insulation Market, By Insulation Type (Page No. - 66)

10.1 Introduction

10.2 Thermal Insulation & Management

10.2.1 Growing Demand for Higher Battery CAPACity to Drive Thermal Insulation & Management Segment

10.3 Acoustic Insulation

10.3.1 BEV to Dominate Consumption of Acoustic Insulation

10.4 Electrical Insulation

10.4.1 Increased Power Density Requirement to Drive the Electrical Insulation Market

11 Electric Vehicle Insulation Market, By Region (Page No. - 70)

11.1 Introduction

11.2 APAC

11.2.1 China

11.2.2 Japan

11.2.3 South Korea

11.2.4 India

11.3 North America

11.3.1 US

11.3.2 Canada

11.4 Europe

11.4.1 Germany

11.4.2 France

11.4.3 UK

11.4.4 Netherlands

11.4.5 Norway

11.4.6 Sweden

11.4.7 Denmark

11.4.8 Austria

11.4.9 Switzerland

11.4.10 Spain

12 Competitive Landscape (Page No. - 92)

12.1 Overview

12.2 Competitive Leadership Mapping, 2018

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Emerging Companies

12.3 Strength of Product Portfolio

12.4 Business Strategy Excellence

12.5 Market Ranking of Electric Vehicle Insulation Manufacturers

12.6 Competitive Situation and Trends

12.6.1 Expansion

12.6.2 New Product Launch

12.6.3 Joint Venture

12.6.4 Investment

12.6.5 New Technology Development

12.6.6 Acquisition

13 Company Profiles (Page No. - 101)

13.1 Saint-Gobain

13.1.1 Business Overview

13.1.2 Products Offered

13.1.3 SWOT Analysis

13.1.4 Saint-Gobain: Winning Imperative

13.1.5 Current Focus and Strategies

13.1.6 Threat From Competition

13.1.7 Saint-Gobain’s Right to Win

13.2 Autoneum

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 SWOT Analysis

13.2.5 Autoneum: Winning Imperative

13.2.6 Current Focus and Strategies

13.2.7 Threat From Competition

13.2.8 Autoneum’s Right to Win

13.3 BASF SE

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 SWOT Analysis

13.3.5 BASF SE: Winning Imperative

13.3.6 Current Focus and Strategies

13.3.7 Threat From Competition

13.3.8 Basf’s Right to Win

13.4 ITW Inc.

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 SWOT Analysis

13.4.5 ITW Inc.: Winning Imperative

13.4.6 Current Focus and Strategies

13.4.7 Threat From Competition

13.4.8 ITW’s Right to Win

13.5 Zotefoams Plc

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.6 Von Roll Holding AG

13.6.1 Business Overview

13.6.2 Products Offered

13.7 Unifrax

13.7.1 Business Overview

13.7.2 Products Offered

13.8 DuPont

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.9 3M

13.9.1 Business Overview

13.9.2 Products Offered

13.10 Morgan Advanced Materials

13.10.1 Business Overview

13.10.2 Products Offered

13.11 Alder Pelzer Holding Gmbh

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 Recent Developments

13.12 Elmelin Ltd.

13.12.1 Business Overview

13.12.2 Products Offered

13.13 Pyrophobic Systems Ltd.

13.13.1 Overview

13.13.2 Products Offered

13.14 Techman Advanced Material Engineers

13.14.1 Business Overview

13.14.2 Products Offered

13.15 Marian Inc.

13.15.1 Business Overview

13.15.2 Products Offered

13.16 Hilti

13.16.1 Business Overview

13.16.2 Products Offered

13.16.3 Recent Developments

14 Appendix (Page No. - 129)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (70 Tables)

Table 1 Existing Subsidies and Tax Structure, Canada (2018)

Table 2 Existing Charging Station Standards in China

Table 3 Existing Subsidies and Tax Structure, China (2018)

Table 4 Existing Subsidies and Tax Structure, Denmark (2018)

Table 5 Existing Subsidies and Tax Structure, France (2018)

Table 6 Existing Subsidies and Tax Structure, Austria (2018)

Table 7 Existing Subsidies and Tax Structure, Germany (2018)

Table 8 Existing Subsidies and Tax Structure, Spain (2018)

Table 9 Insulation Materials Used in Batteries

Table 10 Insulation Materials Used in Engine, Motors, Hvac, Tires, and Power System Application

Table 11 Electric Vehicle Insulation Market Size, By Product Type, 2017–2024 (USD Million)

Table 12 Electric Vehicle Insulation Market Size, By Propulsion Type, 2017–2024 (USD Million)

Table 13 Electric Vehicle Sales Market, By Propulsion Type, 2017–2030 (Thousand Units)

Table 14 Electric Vehicle Insulation Market Size in BEV, By Application, 2017–2024 (USD Million)

Table 15 Electric Vehicle Insulation Market Size in BEV, By Insulation Type, 2017–2024 (USD Million)

Table 16 BEV Sales, By Region 2017–2030 (Thousand Units)

Table 17 Electric Vehicle Insulation Market Size in PHEV, By Application, 2017–2024 (USD Million)

Table 18 Electric Vehicle Insulation Market Size in PHEV, By Insulation Type, 2017–2024 (USD Million)

Table 19 PHEV Sales, By Region 2017–2030 (Thousand Units)

Table 20 FCEV Sales, By Region 2017–2030 (Thousand Units)

Table 21 Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 22 Battery Supply Chain of Major Electric Vehicle Models

Table 23 Electric Vehicle Insulation Market Size in Under the Bonnet and Battery Pack Application, By Propulsion Type, 2017–2024 (USD Million)

Table 24 Electric Vehicle Insulation Market Size in Interior Application, By Propulsion Type, 2017–2024 (USD Million)

Table 25 Electric Vehicle Insulation Market Size in Other Applications, By Propulsion Type, 2017–2024 (USD Million)

Table 26 Electric Vehicle Insulation Market Size, By Insulation Type, 2017–2024 (USD Million)

Table 27 Thermal Insulation & Management Market Size, By Propulsion Type, 2017–2024 (USD Million)

Table 28 Acoustic Insulation Market Size, By Propulsion Type, 2017–2024 (USD Million)

Table 29 Electrical Insulation Market Size, By Propulsion Type, 2017–2024 (USD Million)

Table 30 Electric Vehicle Insulation Market Size, By Region, 2017–2024 (USD Million)

Table 31 Electric Vehicle Sales, By Region, 2017–2030 (Thousand Units)

Table 32 APAC: Electric Vehicle Insulation Market Size, By Country, 2017–2024 (USD Million)

Table 33 APAC: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 34 APAC: Sales of Passenger Electric Car, By Country, 2017–2030 (Units)

Table 35 China: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 36 China: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 37 Japan: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 38 Japan : Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 39 South Korea: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 40 South Korea : Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 41 India: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 42 North America: Electric Vehicle Insulation Market Size, By Country, 2017–2024 (USD Million)

Table 43 North America: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 44 North America: Sales of Passenger Electric Car, By Country, 2017–2030 (Units)

Table 45 US: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 46 US: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 47 Canada: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 48 Canada: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 49 Europe: Electric Vehicle Insulation Market Size, By Country, 2017–2024 (USD Million)

Table 50 Europe: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 51 Europe: Sales of Passenger Electric Car, By Country, 2017–2030 (Units)

Table 52 Germany: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 53 Germany: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 54 France: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 55 France: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 56 UK: Electric Vehicle Insulation Market Size, By Application, 2017–2024 (USD Million)

Table 57 UK: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 58 Netherlands: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 59 Norway: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 60 Sweden: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 61 Denmark: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 62 Austria: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 63 Switzerland: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 64 Spain: Sales of Passenger Electric Car, By Propulsion Type, 2017–2030 (Units)

Table 65 Expansion, 2016–2019

Table 66 New Product Launch, 2016–2019

Table 67 Joint Venture, 2016–2019

Table 68 Investment, 2016–2019

Table 69 New Technology Development, 2016–2019

Table 70 Acquisition, 2016–2019

List of Figures (46 Figures)

Figure 1 Electric Vehicle Insulation Market Definition

Figure 2 Electric Vehicle Insulation Market Segmentation

Figure 3 Electric Vehicle Insulation Market: Research Design

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Electric Vehicle Insulation Market Forecast Calculation Methodology

Figure 7 Electric Vehicle Insulation Market: Base Number Calculation Methodology

Figure 8 Electric Vehicle Insulation Market: Demand Side Approach

Figure 9 Primary Insights on Electric Vehicle Insulation Market

Figure 10 Electric Vehicle Insulation Market: Data Triangulation

Figure 11 Thermal Insulation & Management Accounted for the Largest Share of the Market in 2018

Figure 12 BEV to Be Leading Consumer of Electric Vehicle Insulation

Figure 13 APAC Accounted for the Largest Market Share in 2018

Figure 14 Growing Demand for Electric Vehicles to Drive the Market

Figure 15 North America to Be Fastest-Growing Electric Vehicle Insulation Market

Figure 16 Under the Bonnet and Battery Pack Segment Accounted for the Largest Market Share

Figure 17 US to Be the Fastest-Growing Electric Vehicle Insulation Market

Figure 18 Under the Bonnet and Battery Pack Was Largest Application of Electric Vehicle Insulation in 2018

Figure 19 Drivers, Restraints, Opportunities, and Challenges in the Electric Vehicle Insulation Market

Figure 20 YC and YCC Shift

Figure 21 Porter’s Five Forces Analysis: Electric Vehicle Insulation Market

Figure 22 Foamed Plastics Segment to Lead the Electric Vehicle Insulation Market

Figure 23 Battery Electric Vehicle Propulsion Type to Lead Overall Electric Vehicle Insulation Market

Figure 24 Under the Bonnet and Battery Pack Application to Lead the Electric Vehicle Insulation Market

Figure 25 Structure of Electric Vehicle Battery

Figure 26 Thermal Insulation & Management Segment to Lead the Overall Electric Vehicle Insulation Market

Figure 27 APAC to Be the Largest Market for Electric Vehicles Insulation During the Forecast Period

Figure 28 APAC: Electric Vehicle Insulation Market Snapshot

Figure 29 North America: Electric Vehicle Insulation Market Snapshot

Figure 30 Europe: Electric Vehicle Insulation Market Snapshot

Figure 31 Competitive Leadership Mapping, 2018

Figure 32 Expansion Was the Key Growth Strategy Adopted By the Market Players Between 2016 and 2019

Figure 33 Top 3 Players in 2018

Figure 34 Saint-Gobain: Company Snapshot

Figure 35 Saint-Gobain: SWOT Analysis

Figure 36 Autoneum: Company Snapshot

Figure 37 Autoneum: SWOT Analysis

Figure 38 BASF SE: Company Snapshot

Figure 39 BASF SE: SWOT Analysis

Figure 40 ITW Inc.: Company Snapshot

Figure 41 ITW Inc.: SWOT Analysis

Figure 42 Zotefoams Plc.: Company Snapshot

Figure 43 Von Roll Holding AG: Company Snapshot

Figure 44 DuPont: Company Snapshot

Figure 45 3M: Company Snapshot

Figure 46 Morgan Advanced Materials: Company Snapshot

The study involved four major activities for estimating the market size for the electric vehicle insulation market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate the findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

Secondary sources used in this study includes annual reports, sustainability reports, press releases, and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard and silver standard websites; such as Factiva, ICIS, Bloomberg, United Nations Statistical Commission, United States International Trade Commission (USITC), and International Council on Clean Energy Transportation (ICCT), the findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The electric vehicle insulation market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of under the bonnet and battery pack, interior, and other applications. The supply side is characterized by advancements in technology and diverse end-use applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the electric vehicle insulation market. These methods were also used extensively to estimate the size of the market in each application. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the electric vehicle insulation market in terms of value

- To provide detailed information regarding key factors such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the electric vehicle insulation market based on application, propulsion type, insulation type, and product type

- To forecast the size of the market for regions such as APAC, North America, and Europe

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and investigate opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, acquisition, joint venture, and new technology development, and investment in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Electric Vehicle Insulation Market