Flexible Insulation Market by Material (Fiberglass, Elastomer, Aerogel, Cross Linked Polyethylene) and Insulation Type (Thermal, Acoustic, Electrical) - Global Forecast to 2021

[156 Pages Report] The Flexible Insulation Market size was USD 7.77 Billion in 2015 and is projected to reach USD 10.84 Billion by 2021, at a CAGR of 5.54% from 2016 to 2021. In this study, 2015 has been considered the base year, and 20162021 the forecast period to estimate the market size of flexible insulation.

Objectives of the study:

- To analyze and forecast the market size of flexible insulation in terms value and volume

- To define, describe, and segment the global flexible insulation market by material, and insulation type

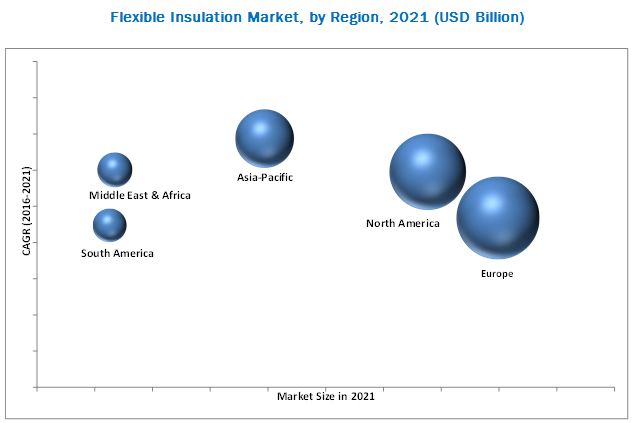

- To forecast the sizes of the market segments based on regions such as the Asia-Pacific, North America, Europe, South America, and Middle East & Africa

- To provide detailed information regarding the important factors influencing the growth of the market (drivers, restraints, challenges and opportunities)

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, joint ventures, agreements, acquisitions, and new product developments in the global flexible insulation market

- To strategically profile key players and comprehensively analyze their core competencies

Research Methodology:

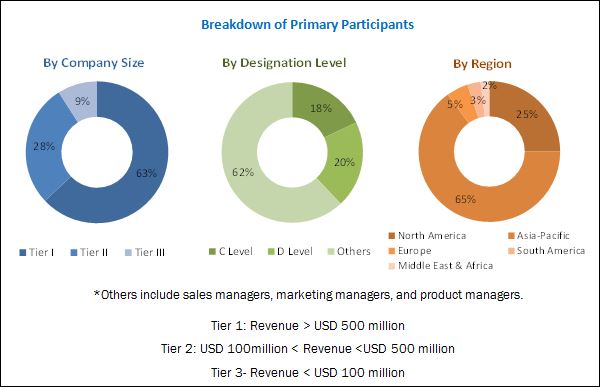

In this report, market sizes have been derived using both, bottom-up and top-down approaches. First, the market size for material (fiberglass, elastomer and others); insulation type (thermal, acoustic, and electrical) and for various regions (Asia-Pacific, North America, Europe, South America, Middle East & Africa) is identified through both, secondary and primary research. The overall flexible insulation market sizes for various regions and countries have been calculated by adding these individual market sizes. For future growth (CAGRs) trends of flexible insulation, the insulation typethermal, acoustic and electrical have been analyzed. The secondary resources include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and so on. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

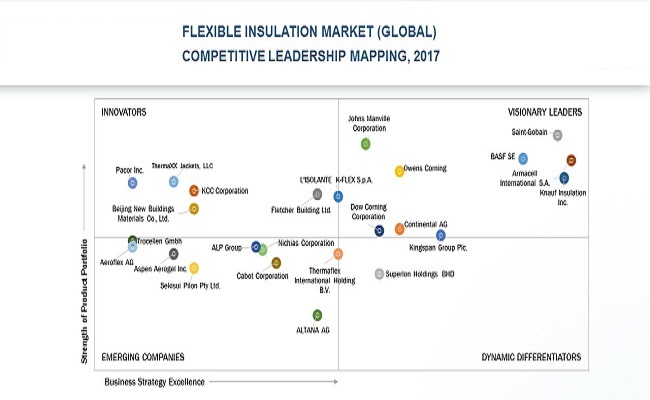

Companies producing flexible insulation include Saint-Gobain (France), Armacell International S.A. (Luxembourg), BASF SE (Germany), Johns Manville Corporation (U.S.), Owens Corning (U.S.), Knauf Insulation Inc. (U.S.) , Continental AG (Germany), Kingspan Group Plc. (Republic of Ireland), Dow Corning Corporation (U.S.), Superlon Holdings BHD (Malaysia), L'ISOLANTE K-FLEX S.p.A. (Italy), Fletcher Building Ltd. (New Zealand), KCC Corporation (South Korea), Thermaxx Jackets, LLC (U.S.), Beijing New Buildings Materials Co. Ltd. (China), Pacor Inc. (U.S.), Thermaflex International Holding B.V. (Netherlands), Nichias Corporation (Japan), ALP Group (India), ALTANA AG (Germany), Cabot Corporation (U.S.), Aspen Aerogel Inc. (U.S.), Trocellen GmbH (Germany), Aeroflex AG (Switzerland), and Sekisui Pilon Pty Ltd. (Australia).

Target Audience:

- Industrial flexible insulation manufacturers, dealers, and suppliers

- Government bodies

- End-use industries

- Feedstock suppliers

- Industry associations

- Large infrastructure companies

- Investment banks

- Consulting companies/consultants in chemical and material sectors

Thisstudy answers several questions for the stakeholders, primarily, which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

This report categorizes the global flexible insulation market based on material, insulation type, and region.

Market Segmentation, by Material:

- Fiberglass

- Elastomer

- Others (include aerogel and cross-linked polyethylene )

Market Segmentation, by Insulation Type:

- Thermal Insulation

- Acoustic Insulation

- Electrical Insulation

Market Segmentation, by Region:

- Asia-Pacific

- North America

- Europe

- South America

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional material, and/or insulation type

Company Information

- Detailed analysis and profiles of additional market players (Up to five)

The flexible insulation market is projected to reach USD 10.84 Billion by 2021, at a CAGR of 5.54% from 2016 to 2021.The global flexible insulation market is expected to be driven by the growing demand from end-use industries such as building & construction, heating, ventilation and air-conditioning (HVAC) and the transportation sector. Flexible insulations are those insulations which can be applied successfully or flexibly in those applications wherein other materials cannot be used. Flexible insulations are used to save energy, maintain process temperatures, provide fire & sound protection, and prevent condensation.

Fiberglass insulation accounts for the largest share in the material segment. The market for fiberglass insulation is estimated to witness significant growth owing to the increasing usage in various applications due to its lightweight, non-combustible, high tear strength and corrosion-resistant nature. Also, fiberglass finds usage in various applications such as thermal insulation for pipe work in HVAC industries, flexible air ducts, residential and commercial refrigerators & freezers, jet-engine ducting, aircraft component, and commercial construction.

Thermal insulation is estimated to witness the largest share in the insulation type market. This is because thermal insulation provides a comfortable and hygienic indoor climate at low ambient temperatures. Also, growing use of thermal insulation for low temperature, intermediate temperature, and high temperature insulations is expected to drive its demand.

The European region is the largest market for flexible insulation, in terms of both, value and volume. The strict building energy codes, accompanied by European Union Directives to improve efficiency in buildings is expected to drive the demand for flexible insulation in the region. Strong demand for flexible insulation from the housing sector in countries like Germany is another reason for the growth of the flexible insulation market.

Below mentioned MicroQuadrant identifies the leadership position and strengths of various players in the industry.

Lack of awareness about insulation in some of the countries of Africa, and Asia such as Libya, Western Sahara, Uzbekistan, Tajikistan, North Korea, and Nicaragua act as a restraint for the flexible insulation market.

The competitiveness of the flexible insulation market is increasing with expansions and new product launches. Strategic developments are mostly undertaken by major players such as Saint-Gobain (France), Armacell International S.A. (Luxembourg), BASF SE (Germany), Johns Manville Corporation (U.S.), Owens Corning (U.S.), Knauf Insulation Inc. (U.S.), Continental AG (Germany), Kingspan Group Plc. (Republic of Ireland), Dow Corning Corporation (U.S.), and Superlon Holdings BHD (Malaysia), L'ISOLANTE K-FLEX S.p.A. (Italy), Fletcher Building Ltd. (New Zealand), KCC Corporation (South Korea), Thermaxx Jackets, LLC (U.S.), Beijing New Buildings Materials Co. Ltd. (China), Pacor Inc. (U.S.), Thermaflex International Holding B.V. (Netherlands), Nichias Corporation (Japan), ALP Group (India), ALTANA AG (Germany), Cabot Corporation (U.S.), Aspen Aerogel Inc. (U.S.), Trocellen GmbH (Germany), Aeroflex AG (Switzerland), and Sekisui Pilon Pty Ltd. (Australia), among others.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Flexible Insulation Market

4.2 Flexible Insulation Market, By Region, 20162021

4.3 Flexible Insulation Market in Europe, By Material, and Country

4.4 Flexible Insulation Market Attractiveness

4.5 Flexible Insulation Market, By Insulation Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 History of Insulation

5.3 Market Dynamics

5.3.1 Short-, Medium-, and Long-Term Impact Analysis

5.3.2 Drivers

5.3.2.1 Growth in Green Buildings

5.3.2.2 Greenhouse Gas Emission Reduction

5.3.2.3 Presence of Stringent Building Energy Codes

5.3.2.4 Growth in End-Use Industries

5.3.3 Restraints

5.3.3.1 Lack of Awareness

5.3.4 Opportunities

5.3.4.1 High Energy Requirements

5.3.4.2 Growing Demand for Recycled Insulating Material

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Macroeconomic Indicators

5.5.1 GDP of Major Economies

5.5.2 Construction Industry Analysis

6 Flexible Insulation Market, By Material (Page No. - 47)

6.1 Introduction

6.1.1 Fiberglass

6.1.2 Elastomers

6.1.2.1 Nitrile Rubber

6.1.2.2 Silicone Rubber

6.1.2.3 EPDM Rubber

6.1.3 Others

6.1.3.1 XLPE

6.1.3.2 Aerogel

7 Flexible Insulation Market, By Insulation Type (Page No. - 56)

7.1 Introduction

7.2 Thermal Insulation

7.2.1.1 Low-Temperature Thermal Insulation

7.2.1.2 Intermediate Temperature Thermal Insulation

7.2.1.3 High-Temperature Thermal Insulation

7.3 Acoustic Insulation

7.4 Electrical Insulation

8 Flexible Insulation Market, By Region (Page No. - 64)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 India

8.2.4 South Korea

8.2.5 Thailand

8.2.6 Malaysia

8.2.7 Indonesia

8.2.8 Rest of Asia-Pacific

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 U.K.

8.3.4 Italy

8.3.5 Russia

8.3.6 Spain

8.3.7 Rest of Europe

8.4 North America

8.4.1 U.S.

8.4.2 Canada

8.4.3 Mexico

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 Turkey

8.5.3 Qatar

8.5.4 South Africa

8.5.5 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 105)

9.1 Introduction

9.1.1 Dynamic

9.1.2 Innovator

9.1.3 Vanguard

9.1.4 Emerging

9.2 Competitive Benchmarking

9.3 Product Offerings

9.4 Business Strategy

9.5 Market Share Analysis

9.5.1 Saint-Gobain SA

9.5.2 Owens Corning

9.5.3 BASF SE

10 Company Profiles (Page No. - 110)

10.1 BASF SE

10.1.1 Business Overview

10.1.2 Products Offered

10.1.2.1 Product Offering Scorecard

10.1.3 Business Strategy

10.1.3.1 Business Strategy Scorecard

10.1.4 Recent Developments

10.2 Continental AG

10.2.1 Business Overview

10.2.2 Products Offered

10.2.2.1 Product Offering Scorecard

10.2.3 Business Strategy

10.2.3.1 Business Strategy Scorecard

10.2.4 Recent Developments

10.3 Saint-Gobain Sa

10.3.1 Business Overview

10.3.2 Product Offered

10.3.2.1 Product Offering Scorecard

10.3.3 Business Strategy

10.3.3.1 Business Strategy Scorecard

10.3.4 Recent Developments

10.4 Owens Corning

10.4.1 Business Overview

10.4.2 Products Offered

10.4.2.1 Product Offering Scorecard

10.4.3 Business Strategy

10.4.3.1 Business Strategy Scorecard

10.4.4 Recent Developments

10.5 Kingspan Group PLC

10.5.1 Business Overview

10.5.2 Products Offered

10.5.2.1 Product Offering Scorecard

10.5.3 Business Strategy

10.5.3.1 Business Strategy Scorecard

10.5.4 Recent Developments

10.6 Johns Manville Corporation

10.6.1 Business Overview

10.6.2 Products Offered

10.6.2.1 Product Offering Scorecard

10.6.3 Business Strategy

10.6.3.1 Business Strategy Scorecard

10.6.4 Recent Developments

10.7 Knauf Insulation, Inc.

10.7.1 Business Overview

10.7.2 Products Offered

10.7.2.1 Product Offering Scorecard

10.7.3 Business Strategy

10.7.3.1 Business Strategy Scorecard

10.7.4 Recent Developments

10.8 Armacell International S.A.

10.8.1 Business Overview

10.8.2 Product Offered

10.8.2.1 Product Offering Scorecard

10.8.3 Business Strategy

10.8.3.1 Business Strategy Scorecard

10.8.4 Recent Developments

10.9 Aspen Aerogels, Inc.

10.9.1 Business Overview

10.9.2 Products Offered

10.9.2.1 Product Offering Scorecard

10.9.3 Business Strategy

10.9.3.1 Business Strategy Scorecard

10.9.4 Recent Developments

10.10 Cabot Corporation

10.10.1 Business Overview

10.10.2 Product Offered

10.10.2.1 Product Offering Scorecard

10.10.3 Business Strategy

10.10.3.1 Business Strategy Scorecard

10.10.4 Recent Developments

10.11 DOW Corning Corporation

10.11.1 Business Overview

10.11.2 Product Offered

10.11.2.1 Product Offering Scorecard

10.11.3 Business Strategy

10.11.3.1 Business Strategy Scorecard

10.11.4 Recent Developments

10.12 Other Key Market Players

10.12.1 Aeroflex AG

10.12.2 Altana AG

10.12.3 ALP Group

10.12.4 Beijing New Building Materials (Group) Co., Ltd.

10.12.5 Fletcher Building Limited

10.12.6 KCC Corporation

10.12.7 L'isolante K-Flex S.P.A.

10.12.8 Nichias Corporation

10.12.9 Pacor, Inc.

10.12.10 Sekisui Pilon Pty Ltd.

10.12.11 Superlon Holdings Bhd

10.12.12 Thermaflex International Holding B.V.

10.12.13 Thermaxx Jackets, LLC

10.12.14 Trocellen GmbH

11 Appendix (Page No. - 146)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (102 Tables)

Table 1 GDP of Major Countries, 2011-2015 (USD Billion)

Table 2 Trends and Forecast of Construction Industry, 20152021 (USD Billion)

Table 3 Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 4 Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 5 Fiberglass Material Market Size , By Region, 20142021 (Kiloton)

Table 6 Fiberglass Material Market Size, By Region, 20142021 (USD Million)

Table 7 Elastomer Material Market Size, By Region, 20142021 (Kiloton)

Table 8 Elastomer Material Market Size, By Region, 20142021 (USD Million)

Table 9 Other Materials Market Size, By Region, 20142021 (Kiloton)

Table 10 Other Materials Market Size, By Region, 20142021 (USD Million)

Table 11 Flexible Insulation Market Size, By Insulation Type, 2014-2021 (Kiloton)

Table 12 Flexible Insulation Market Size, By Insulation Type, 2014-2021 (USD Million)

Table 13 Thermal Insulation Market Size, By Region, 20142021 (Kiloton)

Table 14 Thermal Insulation Market Size, By Region, 2014-2021 (USD Million)

Table 15 Acoustic Insulation Market Size, By Region, 20142021 (Kiloton)

Table 16 Acoustic Insulation Market Size, By Region, 2014-2021 (USD Million)

Table 17 Electrical Insulation Market Size, By Region, 20142021 (Kiloton)

Table 18 Electrical Insulation Market Size, By Region, 20142021 (USD Million)

Table 19 Flexible Insulation Market Size, By Region, 20142021 (Kiloton)

Table 20 Flexible Insulation Market Size, By Region, 20142021 (USD Million)

Table 21 Asia-Pacific: Flexible Insulation Market Size, By Country, 20142021 (Kiloton)

Table 22 Asia-Pacific: Flexible Insulation Market Size, By Country, 20142021 (USD Million)

Table 23 Asia-Pacific: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 24 Asia-Pacific: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 25 Asia-Pacific: Flexible Insulation Market Size, By Insulation Type, 20142021 (Kiloton)

Table 26 Asia-Pacific: Flexible Insulation Market Size, By Insulation Type, 20142021 (USD Million)

Table 27 China: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 28 China: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 29 Japan: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 30 Japan: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 31 India: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 32 India: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 33 South Korea: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 34 South Korea: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 35 Thailand: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 36 Thailand: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 37 Malaysia: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 38 Malaysia: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 39 Indonesia: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 40 Indonesia: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 41 Rest of Asia-Pacific: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 42 Rest of Asia-Pacific: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 43 Europe: Flexible Insulation Market Size, By Country, 20142021 (Kiloton)

Table 44 Europe: Flexible Insulation Market Size, By Country, 20142021 (USD Million)

Table 45 Europe: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 46 Europe: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 47 Europe: Flexible Insulation Market Size, By Insulation Type, 20142021 (Kiloton)

Table 48 Europe: Flexible Insulation Market Size, By Insulation Type, 20142021 (USD Million)

Table 49 Germany: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 50 Germany: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 51 France: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 52 France: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 53 U.K.: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 54 U.K.: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 55 Italy: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 56 Italy: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 57 Russia: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 58 Russia: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 59 Spain: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 60 Spain: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 61 Rest of Europe: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 62 Rest of Europe: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 63 North America: Flexible Insulation Market Size, By Country, 20142021 (Kiloton)

Table 64 North America: Flexible Insulation Market Size, By Country, 20142021 (USD Million)

Table 65 North America: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 66 North America: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 67 North America: Flexible Insulation Market Size, By Insulation Type, 20142021 (Kiloton)

Table 68 North America: Flexible Insulation Market Size, By Insulation Type, 20142021 (USD Million)

Table 69 U.S.: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 70 U.S.: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 71 Canada: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 72 Canada: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 73 Mexico: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 74 Mexico: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 75 Middle East & Africa: Flexible Insulation Market Size, By Country, 20142021 (Kiloton)

Table 76 Middle East & Africa: Flexible Insulation Market Size, By Country, 20142021 (USD Million)

Table 77 Middle East & Africa: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 78 Middle East & Africa: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 79 Middle East & Africa: Flexible Insulation Market Size, By Insulation Type, 20142021 (Kiloton)

Table 80 Middle East & Africa: Flexible Insulation Market Size, By Insulation Type, 20142021 (USD Million)

Table 81 Saudi Arabia: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 82 Saudi Arabia: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 83 Turkey: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 84 Turkey: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 85 Qatar: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 86 Qatar: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 87 South Africa: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 88 South Africa: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 89 Rest of Middle East & Africa: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 90 Rest of Middle East & Africa: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 91 South America: Flexible Insulation Market Size, By Country, 20142021 (Kiloton)

Table 92 South America: Flexible Insulation Market Size, By Country, 20142021 (USD Million)

Table 93 South America: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 94 South America: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 95 South America: Flexible Insulation Market Size, By Insulation Type, 20142021 (Kiloton)

Table 96 South America: Flexible Insulation Market Size, By Insulation Type, 20142021 (USD Million)

Table 97 Brazil: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 98 Brazil: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 99 Argentina: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 100 Argentina: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

Table 101 Rest of South America: Flexible Insulation Market Size, By Material, 20142021 (Kiloton)

Table 102 Rest of South America: Flexible Insulation Market Size, By Material, 20142021 (USD Million)

List of Figures (39 Figures)

Figure 1 Flexible Insulation : Market Segmentation

Figure 2 Flexible Insulation Market: Research Design

Figure 3 Flexible Insulation Market: Data Triangulation

Figure 4 Flexible Insulation Market to Be Driven By Increasing Penetration of Fiberglass Between 2016 and 2021 (USD Million)

Figure 5 Thermal Insulation Segment to Dominate Flexible Insulation Market Between 2016 and 2021

Figure 6 Europe Was Largest Flexible Insulation Market in 2015

Figure 7 Growth in Flexible Insulation Market, 20162021

Figure 8 Europe Estimated to Be Largest Market for Flexible Insulation Between 2016 and 2021

Figure 9 Germany Accounted for Maximum Share of European Flexible Insulation Market in 2015

Figure 10 Asia-Pacific to Be Fastest-Growing Flexible Insulation Market Between 2016 and 2021

Figure 11 Europe Accounted for Maximum Share of Acoustic Insulation Market in 2015

Figure 12 Evolution of Insulation

Figure 13 Overview of Factors Governing Flexible Insulation Market

Figure 14 Increase in Green Buildings in U.S.

Figure 15 Growth in HVAC Market

Figure 16 Porters Five Forces Analysis of Flexible Insulation Market

Figure 17 Global Infrastructural Investments, By 2030

Figure 18 Fiberglass to Dominate Flexible Insulation Market During Forecast Period

Figure 19 Europe Projected to Be Largest Market for Fiberglass Between 2016 and 2021 (USD Million)

Figure 20 North America Projected to Be Largest Market for Elastomers Between 2016 and 2021

Figure 21 North America Projected to Be Largest Market for Other Flexible Insulation Materials Between 2016 and 2021

Figure 22 Thermal Insulation to Dominate Flexible Insulation Market Between 2016 and 2021

Figure 23 Europe to Be Largest Flexible Insulation Market for Thermal Insulation During Forecast Period

Figure 24 Middle East & Africa to Be Fastest-Growing Flexible Insulation Market for Acoustic Insulation Between 2016 and 2021

Figure 25 Asia-Pacific to Be Largest Electrical Insulation Market Between 2016 and 2021

Figure 26 India to Be the Fastest-Growing Market During the Forecast Period

Figure 27 European Flexible Insulation Market Snapshot: U.K. to Register High Growth Between 2016 and 2021

Figure 28 North American Flexible Insulation Market Snapshot: Italy to Register High Growth Between 2016 and 2021

Figure 29 Dive Chart

Figure 30 Market Share Analysis of Key Players in Flexible Insulation Market: 2016

Figure 31 BASF SE: Company Snapshot

Figure 32 Continental AG : Company Snapshot

Figure 33 Saint-Gobain Sa: Company Snapshot

Figure 34 Owens Corning: Company Snapshot

Figure 35 Kingspan Group PLC: Company Snapshot

Figure 36 Johns Manville Corporation: Company Snapshot

Figure 37 Armacell International S.A.: Company Snapshot

Figure 38 Aspen Aerogels, Inc.: Company Snapshot

Figure 39 Cabot Corporation: Company Snapshot

Growth opportunities and latent adjacency in Flexible Insulation Market