Seaweed Cultivation Market by Type (Red, Brown, Green), Method of Harvesting (Aquaculture, Wild Harvesting), Form (Liquid, Powder, Flakes, Sheets), Application (Food, Feed, Agriculture, Pharmaceuticals), and Region - Global Forecast to 2025

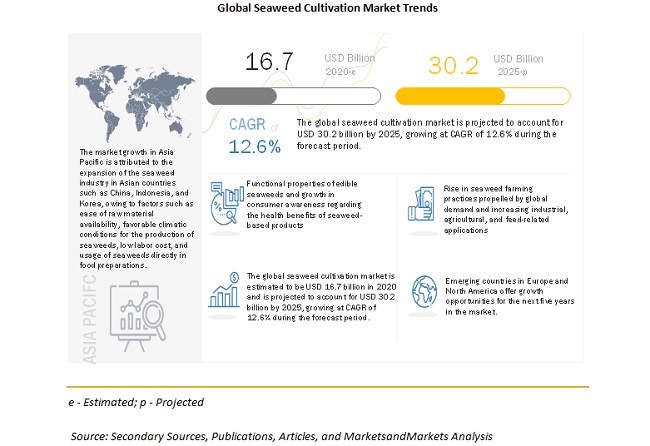

[210 Pages Report] According to MarketsandMarkets, the seaweed cultivation market size is estimated to be valued at USD 16.7 billion in 2020 and is projected to reach USD 30.2 billion by 2025, recording a CAGR of 12.6% during the forecast period, in terms of value. Factors such as the rise in seaweed farming practices propelled by global demand, increasing industrial, agricultural and feed-related applications and rising market for seaweed as snack product are projected to drive the growth of the seaweed cultivation industry during the forecast period. Asia Pacific segment is going to dominate the market, due to its ease of raw material availability, favorable climatic conditions and low labor cost for seaweed cultivation, whereas the European region is growing fastest owing to growth in consumer awareness regarding the health benefits of seaweed based-products.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rise in seaweed farming practices propelled by global demand

To uplift the socio-economic status of small-scale fishermen, raise the living standard of the coastal community, and to promote the sustainable usage of coastal and marine resources, seaweed farming has become an alternative livelihood option in tropical developing countries. Furthermore, seaweeds grow at a higher rate and do not require fresh water or land space. They also do not require industrial fertilizers and pesticides that pose a threat to the environment. As a result, economical harvesting practices, together with the ease in handling cultivated seaweeds, have further encouraged seaweed farming across key seaweed-producing countries.

Restraints: Natural calamities hindering the production of seaweeds

The biggest challenge for seaweed manufacturers is the occurrence of natural calamities, which affects the production of seaweeds in the coastal areas of seaweed-producing countries in the Asia Pacific and South American regions. Natural calamities, such as typhoons, floods, droughts, earthquakes, volcanic eruptions, and pests & diseases, affect the productivity of seaweed farming. The occurrence of such calamities is uncontrollable and poses a significant challenge to seaweed farmers. In response to such instances, seaweed farmers have shifted to building artificial ponds in off-marine areas (mariculture), requiring seawater. However, the adoption of such alternatives in cultivation techniques is associated with high costs that pose a financial challenge to the farmers, thereby affecting the scale of seaweed production.

Opportunities: Increase in technological developments

The cultivation of seaweed is majorly undertaken in the Asia Pacific region. After cultivation, this seaweed is then dried and exported to developed regions such as Europe and North America for further processing and to derive extracts to be used in end-user industries. Also, due to the lack in technology in the Asia Pacific region, labor engagement is higher, which adds to operational costs. Thus, to reduce labor engagement, implementation of new technologies, such as direct seeding technologies, automated harvesters, can be introduced in various Asian countries.

The industry is also moving forward toward the adoption of new trending technologies such as machine learning, IoT, and artificial intelligence, to help improve seaweed production and monitor seaweed biomass and habitat thus, driving the growth of the market.

Challenges: Toxicity associated with the consumption of seaweeds

The consumption of seaweed extracts and seaweed packaged products harvested from aquaculture has certain harmful effects due to toxic minerals, which lead to health concerns globally. Seaweed products that are sold commercially are majorly in the form of partially dried seaweeds that are packaged in plastic containers and sold in the form of tablets and powder. Seaweeds harvested from wild stock have safety concerns associated due to the presence of heavy metal residues such as arsenic and iodine. Higher intake of these heavy metals present in seaweeds can lead to medical complications, such as cancer, brain damage, gastrointestinal problems, and kidney diseases.

The consumption of excess seaweed increases the quantity of iodine above the required levels. This raises the levels of thyroid-stimulating hormone, thereby causing serious conditions such as goiter. These health concerns caused by the intake of seaweed products have restricted the consumption of seaweeds, thereby affecting the growth of this industry.

By form, flakes is the second-fastest growing segment in the market during the forecast period

Seaweeds such as kombu, dulse, kelp, hijiki, nori, and wakame are processed to make flakes. Seaweed flakes have applications mainly in food, as they are increasingly used as salt substitutes. These are mostly used as seasoning agents. In countries such as China and Japan, seaweed flakes are used in food preparations and are eaten raw. Seaweeds provide the human body with magnesium, zinc, vitamin B12, biotin, and iron. They also have medicinal properties to cure diseases such as lung cancer, prostate cancer, diabetes, and obesity.

By application, dairy sub-segment in the food segment is projected to account for the largest share in the seaweed cultivation market during the forecast period

The seaweeds used in the dairy products under the food segment dominates the application segment throughout the forecasted period. Seaweed extracts such as agar, carrageenan, and alginate have wide applications in the dairy industry. These extracts are used as a thickening and gelling agent in products such as cheese, creams, desserts, ice creams, dairy powder, and dairy drinks. Alginates are also used as stabilizers to improve the viscosity of milk drinks, such as chocolate milk drinks.

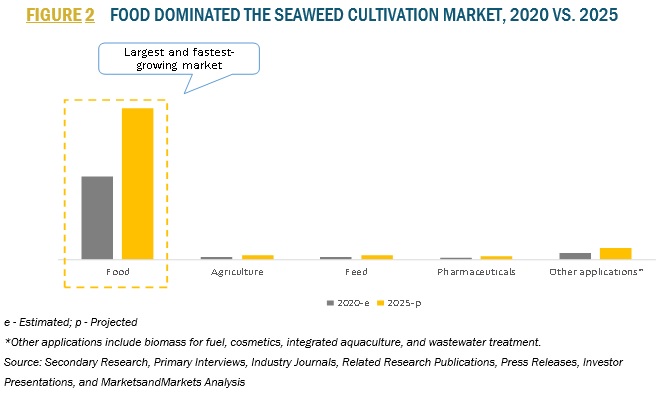

Increase in the application of seaweed extracts such as agar, carrageenan, and alginate in processed food driving the market

The food segment is estimated to dominate the market for seaweed cultivation, by application, in terms of value, in 2020. Seaweeds are widely regarded as a health food, owing to the presence of nutrients such as high iodine, calcium, magnesium, iron, vitamins, antioxidants, and fiber. This has been driving the market for seaweeds as a source of food in regions such as North America & Europe. In processed food, seaweeds have a wide range of applications: as a thickening and gelling agent in products, such as sausages, bread, creams, cheese, dairy drinks, and candies. Additionally, the use of seaweeds for the manufacturing of low-calorie ice creams and cakes is likely to fuel the market growth.

Geographical Prominence

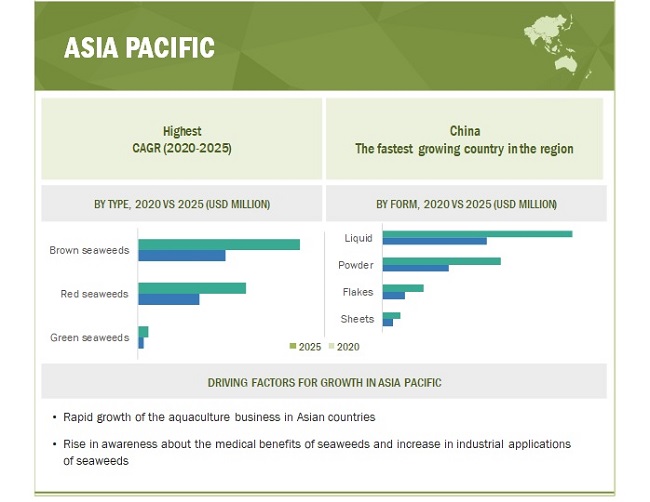

Asia Pacific is estimated to account for the largest market share in the seaweed cultivation market, in terms of value, in 2020. The large market size of the Asia Pacific for seaweed cultivation is attributed to the expansion of the seaweed industry in Asian countries such as China, Indonesia, Korea, and the Philippines, owing to factors such as ease of raw material availability, favorable climatic conditions for the production of seaweeds, low labor cost, and usage of seaweeds directly in food preparations. The North American and European seaweed industries are still developing and are projected to witness significant growth in the coming years. Awareness about the nutritional benefits of seaweeds, the presence of valuable nutrients such as iodine, calcium, magnesium, iron, vitamins, and antioxidants, and its growing usage in industrial applications drive the market for seaweeds in these regions.

The seaweed cultivation market is dominated, with a large number of players. Key players in the market include Cargill (US), DuPont (US), Groupe Roullier (France), CP Kelco U.S., Inc. (US), Qingdao Gather Great Ocean Algae Industry Group (China), and Qingdao Seawin Biotech Group Co. Ltd. (China), among others. Through strategies, such as expansions & investments, new product launches, acquisitions, and partnerships & agreements, companies are expanding their global presence and offering new products, which is projected to increase their operational capabilities in the market.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is projected to account for the largest market share during the forecast period

The Asia Pacific market is estimated to account for the largest share in 2019. This is primarily attributed to factors such as large-scale production and domestic consumption of edible seaweeds in the region, which is fueled by the processed food industry. In addition, the expansion of the seaweed cultivation market in the Asian countries such as China, Indonesia, South Korea, and the Philippines is attributed to factors such as availability of the raw materials, favorable climatic conditions for the production of seaweeds, and availability of cheap labor.

Key Market Players:

Cargill, Incorporated (US), DuPont (US), Groupe Roullier (France), CP Kelco U.S., Inc. (US), Acadian Seaplants (US), Qingdao Gather Great Ocean Algae Industry Group (China), Qingdao Seawin Biotech Group Co. Ltd. (China), Qingdao Bright Moon Seaweed Group Co. (China), Seaweed Energy Solutions AS (Norway), The Seaweed Company (Netherlands), Algea (Norway), Seasol (Australia), Gelymar (Chile), Algaia (France), CEAMSA (Spain), COMPO EXPERT (Germany), Leili (China), Irish Seaweeds (Ireland) and AtSeaNova (Belgium).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) & Volume (KT) |

|

Segments covered |

Process, type, method of harvesting, form, application, and region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Target Audience:

- Seaweed cultivators

- Seedling centers, nurseries, and hatcheries

- Commercial seaweed manufacturers and processors

- Intermediate suppliers such as traders and distributors of commercial seaweed

- Manufacturers of food & beverages ingredients, processed food manufacturers, and livestock feed manufacturers

- Other manufacturing industries, such as biomass for fuel, personal care, energy, integrated aquaculture, and wastewater treatment

- Government and research organizations

- Agricultural fertilizers manufacturers, processors, distributors, and traders

Report Scope:

This research report categorizes the seaweed cultivation market based on process, type, method of harvesting, form, application, and region.

On the basis of process:

- Seeding/Netting

- Open sea transplanting

- Harvesting

- Drying

- Processing

On the basis of type:

- Red seaweeds

- Brown seaweeds

- Green seaweeds

On the basis of method of harvesting:

- Aquaculture/Industrial

- Wild harvesting/Traditional

On the basis of form:

- Liquid

- Powder

- Flakes

- Sheets

On the basis of application:

-

Food

- Dairy

- Meat & poultry

- Bakery

- Confectionery

- Other food applications (soups, salads, and beverages)

- Feed

- Agriculture

- Pharmaceuticals

- Other applications (biomass for fuel, cosmetics, integrated aquaculture, and wastewater treatment)

On the basis of region:

- North America

- Europe

- Asia Pacific

- RoW (Brazil, Chile, South Africa, and Other South American, African and the Middle Eastern countries)

Recent Developments

- In December 2020, Qingdao Seawin Biotech Group Co. Ltd. (China) expanded its new industrial zone to start in Qingdao High-tech Industrial Development Zone, which would be dedicated to the production of marine tool enzymes and bio-stimulants from double seaweeds, marine bio-bactericide, marine protein peptides, etc. The new zone is located in the Jiaodong Peninsula, covering a total area of 520,000 square meters, and providing strong support and guarantee for industrial upgrading and future development of enterprises.

- In August 2020, CP Kelco and Biesterfeld expanded their long-term partnership in the food and nutrition sector in Europe. As part of this partnership, Biesterfeld is distributing CP Kelco’s nature-based pectin, carrageenan, xanthan gum, and citrus fiber in Germany, Poland, the Czech Republic, Slovakia, Hungary, Estonia, Lituania, and Latvia. This partnership will enhance the company’s strong presence in Europe.

- Algaia launched a new range of seaweed-based texturing solutions named VegAlg in January 2019, designed to contribute shape and structure, and add juiciness to plant-based burgers. This new product launch would strengthen its market position in the food industry.

- In January 2019, Gelymar announced a new long-term commercial and development agreement with its strategic partner, Algaia, an established global player in the field of alginate and specialty algae extracts. Both Gelymar and Algaia will market their products in North America through AIDP Inc., Algaia’s current US distributor. This agreement for North America will position Gelymar as a leading manufacturer of sustainable algae extracts for food, nutraceuticals, and personal care products, offering an extensive range of algae ingredients.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the seaweed cultivation market?

Asia Pacific accounted for the largest share of the seaweed cultivation market in 2019, owing to the availability of the raw materials, favorable climatic conditions for the production of seaweeds, availability of cheap labor and and usage of seaweeds directly in food preparations.

What is the current size of the global seaweed cultivation market?

The global seaweed cultivation market is estimated to USD 16.7 billion in 2020 and is projected to reach USD 30.2 billion by 2025, recording a CAGR of 12.6% during the forecast period, in terms of value.

How would COVID-19 impact the fluctuations in seaweed raw material prices?

Based on inputs from industry experts, the prices of different types of seaweed-based products such as carrageenan, alginates and agar were considered to be lower than their regular ranges due to the COVID-19 impact on the seaweed cultivation market.

Which are the key players in the market, and how intense is the competition?

Top companies in seaweed cultivation market are Cargill, Incorporated (US), DuPont (US), Groupe Roullier (France), CP Kelco U.S., Inc. (US), Acadian Seaplants (US), Qingdao Gather Great Ocean Algae Industry Group (China), Qingdao Seawin Biotech Group Co. Ltd. (China) and Qingdao Bright Moon Seaweed Group Co. (China). These companies cater to the requirements of the different end-user industries. Moreover, these companies have effective global manufacturing operations and supply chain strategies. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on the seaweed cultivation market?

Due to the increasing COVID-19 pandemic outbreak in various regions/countries, the seaweed cultivation market is observed to witness a growth in 2020 due to promising benefits from seaweed in treating coronavirus. Seaweeds contain significant quantities of complex structural sulphated polysaccharides that have been shown to inhibit the replication of enveloped viruses. Other compounds, both of red seaweed (the lectin griffithsin and the phycocolloid carrageenan), and other sulphated polysaccharides extracted from green seaweed (ulvans) and brown seaweed (fucoidans) could be potential antiviral therapeutic agents against COVID-19. Thus, positive growth in 2020 in the seaweed cultivation market is mainly due to the increasing demand for seaweeds, which may provide an indication into potential solutions to this global health problem in the near future and possibly forearm us for any future such pandemics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 INCLUSIONS & EXCLUSIONS

TABLE 1 SEAWEED CULTIVATION MARKET: INCLUSIONS & EXCLUSIONS

1.6 PERIODIZATION CONSIDERED

1.7 CURRENCY CONSIDERED

1.8 VOLUME UNIT CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2017-2019

1.9 STAKEHOLDERS

1.1 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 SEAWEED CULTIVATION: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

TABLE 3 SEAWEED CULTIVATION MARKET SNAPSHOT, (KT)

FIGURE 7 SEAWEED CULTIVATION MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION) , 2020 VS. 2025)

FIGURE 8 SEAWEED CULTIVATION MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 9 SEAWEED CULTIVATION MARKET, BY FORM, 2020 VS. 2025 (USD MILLION)

FIGURE 10 SEAWEED CULTIVATION MARKET, BY METHOD OF HARVESTING, 2020 VS. 2025 (USD MILLION)

FIGURE 11 SEAWEED CULTIVATION MARKET SHARE (VALUE) , BY REGION, 2020)

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 OPPORTUNITIES IN THE SEAWEED CULTIVATION MARKET

FIGURE 12 INCREASING INDUSTRIAL APPLICATIONS OF SEAWEED EXPECTED TO DRIVE THE MARKET

4.2 SEAWEED CULTIVATION MARKET: KEY COUNTRIES, 2020 (VALUE)

FIGURE 13 FRANCE PROJECTED TO GROW AT THE HIGHEST GROWTH RATE IN THE SEAWEED CULTIVATION MARKET IN 2020

4.3 SEAWEED CULTIVATION MARKET, BY TYPE & REGION, 2020 (VALUE)

FIGURE 14 ASIA PACIFIC REGION TO DOMINATE THE MARKET IN 2020

4.4 SEAWEED CULTIVATION MARKET, BY METHOD OF HARVESTING, 2020 (VALUE)

FIGURE 15 THE AQUACULTURE/INDUSTRIAL METHOD DOMINATED THE MARKET IN 2020

4.5 SEAWEED CULTIVATION MARKET, BY APPLICATION, 2020 (VALUE)

FIGURE 16 THE FOOD SEGMENT DOMINATED THE MARKET IN 2020

4.6 ASIA PACIFIC: SEAWEED CULTIVATION MARKET, BY FORM & COUNTRY, 2020 (VALUE)

FIGURE 17 CHINA ACCOUNTED FOR THE LARGEST SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.1.1 MACROECONOMIC INDICATORS

5.1.1.1 Trade Scenario: Seaweeds

TABLE 4 SEAWEED TRADE SCENARIO FOR HUMAN CONSUMPTION, BY REGION, 2018

5.1.1.2 Major seaweed importing countries

FIGURE 18 SEAWEED IMPORT, BY COUNTRY, 2016- 2017 (VALUE)

FIGURE 19 SEAWEED IMPORTS, BY COUNTRY, 2016-2017 (VOLUME)

5.1.1.3 Major seaweed exporting countries

FIGURE 20 SEAWEED EXPORTS, BY COUNTRY, 2016- 2017 (VALUE)

FIGURE 21 SEAWEED EXPORTS, BY COUNTRY, 2016-2017 (VOLUME)

5.2 SEAWEED CULTIVATION MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS: SEAWEED CULTIVATION MARKET

5.2.1 DRIVERS

5.2.1.1 Functional properties of edible seaweeds and growth in consumer awareness regarding the health benefits of seaweed-based products

TABLE 5 DRY MATTER COMPOSITION OF SEAWEED SPECIES IN PERCENTAGE

FIGURE 23 HEALTH CREDENTIALS OF SEAWEEDS

5.2.1.2 Rise in seaweed farming practices propelled by global demand

5.2.1.3 Increasing industrial, agricultural, and feed-related applications

5.2.1.4 Rising market for seaweed as a snack product

5.2.2 RESTRAINTS

5.2.2.1 Natural calamities hindering the production of seaweeds

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in technological developments

5.2.4 CHALLENGES

5.2.4.1 Lack of financial support, government engagement, and improper marine spatial plans

5.2.4.2 Toxicity associated with the consumption of seaweeds

5.3 VALUE CHAIN: FOOD, FEED, AND AGRICULTURAL PRODUCTS

FIGURE 24 SEAWEED CULTIVATION MARKET: VALUE CHAIN (FOOD, FEED, & AGRICULTURAL PRODUCTS

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

FIGURE 25 REVENUE SHIFT FOR THE SEAWEED CULTIVATION MARKET

5.5 PRICING ANALYSIS

FIGURE 26 PRICING ANALYSIS, 2018-2025 (USD/TON

TABLE 6 AVERAGE SELLING PRICE

5.6 MARKET MAP

5.7 TECHNOLOGY ANALYSIS

5.8 PATENT ANALYSIS

FIGURE 27 REGIONAL ANALYSIS: PATENT APPROVAL FOR SEAWEEDS, 2017-2020

TABLE 7 LIST OF IMPORTANT PATENTS PERTAINING TO SEAWEEDS, 2017-2020

5.9 CASE STUDY ANALYSIS

5.9.1 SAMPLE: SEAWEED CULTIVATION MARKET - GLOBAL FORECAST TO 2025

6 IMPACT OF COVID -19 ON THE SEAWEED CULTIVATION MARKET (Page No. - 60)

FIGURE 28 COVID-19: GLOBAL PROPAGATION

FIGURE 29 COVID-19 PROPAGATION: SELECT COUNTRIES

6.1 COVID-19 IMPACT ON THE SEAWEED CULTIVATION MARKET

FIGURE 30 CHART OF PRE- & POST-COVID SCENARIOS IN THE SEAWEED CULTIVATION MARKET

7 SEAWEED CULTIVATION MARKET, BY PROCESS (Page No. - 63)

7.1 INTRODUCTION

7.2 SEEDING/NETTING

7.3 OPEN SEA TRANSPLANTING

7.4 HARVESTING

7.5 DRYING

7.6 PROCESSING

7.7 VALUE CHAIN: SEAWEED CULTIVATION

TABLE 8 VALUE ADDITION AT DIFFERENT STAGES OF THE SEAWEED CULTIVATION PROCESS, USD MILLION, 2019

8 SEAWEED CULTIVATION MARKET, BY TYPE (Page No. - 66)

8.1 INTRODUCTION

FIGURE 31 SEAWEED CULTIVATION MARKET SHARE (VALUE)

TABLE 9 SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 10 SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

8.2 RED SEAWEEDS

8.2.1 RED SEAWEEDS ARE LARGELY USED IN VARIOUS FOOD PRODUCTS SUCH AS SOUPS, SALADS, SNACKS, AND SUSHI

TABLE 11 RED SEAWEEDS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 RED SEAWEEDS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (KT)

8.3 BROWN SEAWEEDS

8.3.1 BROWN SEAWEEDS ARE HIGHLY USED IN THE PRODUCTION OF HIGH-GRADE ALGINATES

TABLE 13 BROWN SEAWEEDS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 14 BROWN SEAWEEDS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (KT)

8.4 GREEN SEAWEEDS

8.4.1 EMERGING USE OF GREEN SEAWEED IN BIOFUEL PRODUCTION AND WASTEWATER TREATMENT EXPECTED TO DRIVE MARKET GROWTH

TABLE 15 GREEN SEAWEEDS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 16 GREEN SEAWEEDS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (KT)

9 SEAWEED CULTIVATION MARKET, BY METHOD OF HARVESTING (Page No. - 73)

9.1 INTRODUCTION

FIGURE 32 SEAWEED CULTIVATION MARKET SIZE, BY METHOD OF HARVESTING, 2020 VS. 2025 (USD MILLION)

TABLE 17 SEAWEED CULTIVATION MARKET SIZE, BY METHOD OF HARVESTING, 2018-2025 (USD MILLION)

9.2 AQUACULTURE/INDUSTRIAL

9.2.1 RISE IN THE DEMAND FOR CARRAGEENAN, AGAR-AGAR, AND ALGINATES EXPECTED TO DRIVE THE GROWTH OF AQUACULTURE SEAWEEDS

TABLE 18 AQUACULTURE/INDUSTRIAL: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

9.3 WILD HARVESTING/TRADITIONAL

9.3.1 GROWTH OF WILD HARVESTED SEAWEEDS IS DECLINING, AS THESE ARE SUSCEPTIBLE TO EASY CONTAMINATION BY HARMFUL SUBSTANCES SUCH AS MERCURY AND ARSENIC

TABLE 19 WILD-HARVESTING/TRADITIONAL: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10 SEAWEED CULTIVATION MARKET, BY FORM (Page No. - 78)

10.1 INTRODUCTION

FIGURE 33 SEAWEED CULTIVATION MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

TABLE 20 SEAWEED CULTIVATION MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

10.2 LIQUID

10.2.1 VARIED APPLICATIONS OF LIQUID SEAWEEDS IN AGRICULTURE, PHARMACEUTICALS, COSMETICS, ANIMAL FEED, AND OTHERS

TABLE 21 LIQUID: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.3 POWDER

10.3.1 USE OF POWDERED SEAWEEDS IN COSMETICS DUE TO THE PRESENCE OF VITAMINS AND B12 AND E

TABLE 22 POWDER: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.4 FLAKES

10.4.1 INCREASE IN USAGE AS A SEASONING AGENT EXPECTED TO DRIVE THE SEGMENT

TABLE 23 FLAKES: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.5 SHEETS

10.5.1 LOW SHELF LIFE DUE TO SUSCEPTIBILITY TO MOISTURE RETENTION

TABLE 24 SHEETS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11 SEAWEED CULTIVATION MARKET, BY APPLICATION (Page No. - 83)

11.1 INTRODUCTION

FIGURE 34 SEAWEED CULTIVATION MARKET SIZE (VALUE)

TABLE 25 SEAWEED CULTIVATION MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

11.2 FOOD

11.2.1 INCREASING APPLICATION OF SEAWEED EXTRACTS SUCH AS AGAR, CARRAGEENAN, AND ALGINATE IN PROCESSED FOOD DRIVING THE MARKET

TABLE 26 FOOD: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 27 FOOD: SEAWEED CULTIVATION MARKET SIZE, BY SUB-APPLICATION, 2018-2025 (USD MILLION)

11.2.2 DAIRY

TABLE 28 DAIRY: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.2.3 MEAT & POULTRY

TABLE 29 MEAT & POULTRY: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.2.4 BAKERY

TABLE 30 BAKERY: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.2.5 CONFECTIONERY

TABLE 31 CONFECTIONERY: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.2.6 OTHER FOOD APPLICATIONS

TABLE 32 OTHER FOOD APPLICATIONS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.3 FEED

11.3.1 SEAWEEDS ARE SIGNIFICANTLY USED AS A SOURCE OF FEED DUE TO THEIR HIGH PROTEIN CONTENT

TABLE 33 FEED: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.4 AGRICULTURE

11.4.1 PRESENCE OF HORMONES SUCH AS AUXINS & GIBBERELLINS IN SEAWEEDS DRIVING THE MARKET FOR SEAWEEDS AS AGRICULTURAL FERTILIZERS

TABLE 34 AGRICULTURE: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.5 PHARMACEUTICALS

11.5.1 BROWN SEAWEEDS HAVE WIDER USAGE IN THE PHARMACEUTICAL INDUSTRY

TABLE 35 PHARMACEUTICALS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.6 OTHER APPLICATIONS

11.6.1 INCREASING USAGE OF SEAWEEDS IN BIO-FUEL, INTEGRATED AQUACULTURE, AND WASTEWATER TREATMENT DUE TO HIGH NUTRIENT CONTENT

TABLE 36 OTHER APPLICATIONS: SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

12 SEAWEED CULTIVATION MARKET, BY REGION (Page No. - 93)

12.1 INTRODUCTION

FIGURE 35 SEAWEED CULTIVATION MARKET SHARE (VALUE)

TABLE 37 SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 38 SEAWEED CULTIVATION MARKET SIZE, BY REGION, 2018-2025 (KT))

12.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MAJOR FARMED SEAWEED PRODUCERS (2012-2016

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

12.2.1 REGULATORY FRAMEWORKS

12.2.2 TRADE ANALYSIS

12.2.2.1 Import scenario of seaweeds in Asia Pacific countries

FIGURE 38 SEAWEED IMPORTS, BY KEY COUNTRY, 2018 (VALUE)

FIGURE 39 SEAWEED IMPORTS, BY KEY COUNTRY, 2018 (VOLUME)

12.2.2.2 Export scenario of seaweeds in Asia Pacific countries

FIGURE 40 SEAWEED EXPORTS, BY KEY COUNTRY, 2018 (VALUE)

FIGURE 41 SEAWEED EXPORTS, BY KEY COUNTRY, 2018 (VOLUME)

TABLE 39 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 40 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (KT)

TABLE 41 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 42 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

TABLE 43 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY METHOD OF HARVESTING, 2018-2025 (USD MILLION)

TABLE 44 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 45 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 46 ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY FOOD SUB-APPLICATION, 2018-2025 (USD MILLION)

12.2.3 CHINA

12.2.3.1 Easy availability of raw materials and growth in the aquaculture industry propelling the market for seaweeds in China

TABLE 47 CHINA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 CHINA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.2.4 INDONESIA

12.2.4.1 Increase in usage of seaweeds as direct food products, and use of Eucheuma cottonii or Gracilaria into various food products

TABLE 49 INDONESIA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 50 INDONESIA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.2.5 PHILIPPINES

12.2.5.1 Multiple usages of seaweeds expected to drive the growth

TABLE 51 PHILIPPINES: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 52 PHILIPPINES: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.2.6 SOUTH KOREA

12.2.6.1 Rising market for seaweed as a snack product drives the growth of the market in the country

TABLE 53 SOUTH KOREA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 54 SOUTH KOREA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.2.7 JAPAN

12.2.7.1 Increase in demand for nori, wakame, and kombu from the food industry propelling the market growth

TABLE 55 JAPAN: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 56 JAPAN: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.2.8 REST OF ASIA PACIFIC

TABLE 57 REST OF ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 58 REST OF ASIA PACIFIC: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.3 NORTH AMERICA

12.3.1 INTRODUCTION

12.3.2 REGULATORY FRAMEWORK

12.3.2.1 US

12.3.2.2 Canada

12.3.3 TRADE ANALYSIS

TABLE 59 US IMPORT OF SEAWEED, 2014-2016 (TONS

TABLE 60 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 61 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (KT)

TABLE 62 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 63 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

TABLE 64 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY METHOD OF HARVESTING, 2018-2025 (USD MILLION)

TABLE 65 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 66 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 67 NORTH AMERICA: SEAWEED CULTIVATION MARKET SIZE, BY FOOD SUB-APPLICATION, 2018-2025 (USD MILLION)

12.3.4 US

12.3.4.1 Seaweed application in dairy products drives the demand for seaweeds in the US

TABLE 68 US: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 69 US: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.3.5 CANADA

12.3.5.1 Seaweeds in Canada are largely used as biostimulant extracts for crops as well as feed supplements

TABLE 70 CANADA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 71 CANADA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.3.6 MEXICO

12.3.6.1 Demand for carrageenan in Mexico in bakery, dairy, and confectionery applications expected to drive the growth of the market

TABLE 72 MEXICO: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 73 MEXICO: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.4 EUROPE

FIGURE 42 EUROPE: MARKET SNAPSHOT

12.4.1 REGULATORY FRAMEWORK

12.4.2 TRADE ANALYSIS

12.4.2.1 Import scenario of seaweeds in European countries

TABLE 74 EUROPE: IMPORT OF SEAWEEDS, 2012-2016 (TONNES

FIGURE 43 EUROPE: SEAWEED IMPORTS, BY KEY COUNTRY, 2018 (VALUE)

FIGURE 44 EUROPE: SEAWEED IMPORTS, BY KEY COUNTRY, 2018 (VOLUME)

12.4.2.2 Export scenario of seaweeds in European countries

TABLE 75 EUROPE: EXPORT OF SEAWEEDS, 2012-2016 (TONNES

FIGURE 45 EUROPE: SEAWEED EXPORTS, BY KEY COUNTRY, 2018 (VALUE)

TABLE 76 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 77 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (KT)

TABLE 78 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 79 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

TABLE 80 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY METHOD OF HARVESTING, 2018-2025 (USD MILLION)

TABLE 81 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 82 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 83 EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY FOOD SUB-APPLICATION, 2018-2025 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 Use of seaweeds in the processed food and confectionery segments fueling the growth of the seaweed cultivation market

TABLE 84 FRANCE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 85 FRANCE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.4.4 IRELAND

12.4.4.1 Demand for seaweeds for application in fertilizers and feed drives the market growth in the country

TABLE 86 IRELAND: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 87 IRELAND: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.4.5 NORWAY

12.4.5.1 Growing industrial & human food application of seaweeds drive the growth of the market in Norway

TABLE 88 NORWAY: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 89 NORWAY: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.4.6 SPAIN

12.4.6.1 Trend of consuming seaweed as sea vegetables growing rapidly in Spain

TABLE 90 SPAIN: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 91 SPAIN: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.4.7 REST OF EUROPE

TABLE 92 REST OF EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 93 REST OF EUROPE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.5 REST OF THE WORLD (ROW

12.5.1 INTRODUCTION

12.5.2 REGULATORY FRAMEWORK

12.5.3 TRADE ANALYSIS

TABLE 94 CHILE EXPORTS OF SEAWEED, 2014 TO 2016 (TONS

TABLE 95 ROW: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 96 ROW: SEAWEED CULTIVATION MARKET SIZE, BY COUNTRY, 2018-2025 (KT)

TABLE 97 ROW: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 98 ROW: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

TABLE 99 ROW: SEAWEED CULTIVATION MARKET SIZE, BY METHOD OF HARVESTING, 2018-2025 (USD MILLION)

TABLE 100 ROW: SEAWEED CULTIVATION MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 101 ROW: SEAWEED CULTIVATION MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 102 ROW: SEAWEED CULTIVATION MARKET SIZE, BY FOOD SUB-APPLICATION, 2018-2025 (USD MILLION)

12.5.4 BRAZIL

12.5.4.1 The country majorly imports seaweeds to meet the demand for the food processing industry

TABLE 103 BRAZIL: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 104 BRAZIL: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.5.5 CHILE

12.5.5.1 Surge in production as well as demand for Gracilaria is one of the key features of the Chilean seaweed cultivation market

TABLE 105 CHILE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 106 CHILE: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.5.6 SOUTH AFRICA

12.5.6.1 Seaweeds are widely used in generating biomass for biofuel production in South Africa

TABLE 107 SOUTH AFRICA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 108 SOUTH AFRICA: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

12.5.7 OTHERS IN ROW

TABLE 109 OTHERS IN ROW: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 110 OTHERS IN ROW: SEAWEED CULTIVATION MARKET SIZE, BY TYPE, 2018-2025 (KT)

13 COMPETITIVE LANDSCAPE (Page No. - 138)

13.1 OVERVIEW

13.2 MARKET RANKING

FIGURE 46 TOP FIVE COMPANIES IN THE SEAWEED CULTIVATION MARKET, 2019

13.2.1 MARKET SHARE ANALYSIS

FIGURE 47 SEAWEED CULTIVATION MARKET: COMPANY MARKET SHARE OF KEY PLAYERS, 2020

13.2.2 MARKET EVALUATION FRAMEWORK

FIGURE 48 SEAWEED CULTIVATION MARKET: TRENDS IN COMPANY STRATEGIES, 2017-2020 140

13.3 COMPETITIVE SCENARIO

13.3.1 EXPANSIONS & INVESTMENTS

TABLE 111 EXPANSIONS & INVESTMENTS, 2017-2020

13.3.2 ACQUISITIONS

TABLE 112 ACQUISITIONS, 2016-2017

13.3.3 NEW PRODUCT LAUNCHES

TABLE 113 NEW PRODUCT LAUNCHES, 2017-2019

13.3.4 AGREEMENTS, JOINT VENTURES, COLLABORATIONS, & PARTNERSHIPS

TABLE 114 AGREEMENTS, JOINT VENTURES, COLLABORATIONS, & PARTNERSHIPS, 2017-2020

13.4 COVID-19 SPECIFIC COMPANY RESPONSE

14 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 146)

14.1 COMPANY EVALUATION MATRIX (OVERALL MARKET

14.1.1 STARS

14.1.2 PERVASIVE PLAYERS

14.1.3 EMERGING LEADERS

FIGURE 49 SEAWEED CULTIVATION MARKET: COMPANY EVALUATION MATRIX, 2019

14.2 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES

14.2.1 PROGRESSIVE COMPANIES

14.2.2 STARTING BLOCKS

14.2.3 RESPONSIVE COMPANIES

14.2.4 DYNAMIC COMPANIES

FIGURE 50 SEAWEED CULTIVATION MARKET: COMPANY EVALUATION MATRIX, 2019

14.3 COMPANY PROFILES

(Business overview, Products offered, Recent developments & MnM View

14.3.1 DUPONT

FIGURE 51 DUPONT: COMPANY SNAPSHOT

14.3.2 CARGILL, INCORPORATED

FIGURE 52 CARGILL: COMPANY SNAPSHOT

14.3.3 GROUPE ROULLIER

14.3.4 CP KELCO U.S., INC.

14.3.5 ACADIAN SEAPLANTS

14.3.6 QINGDAO GATHER GREAT OCEAN ALGAE INDUSTRY GROUP

14.3.7 ATSEANOVA

14.3.8 THE SEAWEED COMPANY

14.3.9 SEAWEED ENERGY SOLUTIONS AS

14.3.10 ALGEA

14.3.11 GELYMAR

14.3.12 SEASOL

14.3.13 CEAMSA

14.3.14 QINGDAO SEAWIN BIOTECH GROUP CO. LTD.

14.3.15 COMPO EXPERT GMBH

14.3.16 ALGAIA

14.3.17 IRISH SEAWEEDS

14.3.18 BEIJING LEILI AGRICULTURAL CO. LTD.

14.3.19 MARA SEAWEED

14.3.20 AQUAGRI PROCESSING PVT. LTD.

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS (Page No. - 184)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 ALGAE PRODUCTS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.4 ALGAE PRODUCTS MARKET, BY APPLICATION

15.4.1 INTRODUCTION

TABLE 115 ALGAE PRODUCTS MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

15.4.2 FOOD & BEVERAGES

TABLE 116 ALGAE PRODUCTS MARKET SIZE IN FOOD & BEVERAGES, BY REGION, 2016-2023 (USD MILLION)

15.4.3 NUTRACEUTICALS & DIETARY SUPPLEMENTS

TABLE 117 ALGAE PRODUCTS MARKET SIZE IN NUTRACEUTICALS & DIETARY SUPPLEMENTS, BY REGION, 2016-2023 (USD MILLION)

15.4.4 FEED

TABLE 118 ALGAE PRODUCTS MARKET SIZE IN FEED, BY REGION, 2016-2023 (USD MILLION)

15.4.5 PERSONAL CARE PRODUCTS

TABLE 119 ALGAE PRODUCTS MARKET SIZE IN PERSONAL CARE PRODUCTS, BY REGION, 2016-2023 (USD MILLION)

15.4.6 PHARMACEUTICALS

TABLE 120 ALGAE PRODUCTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2016-2023 (USD MILLION)

15.4.7 OTHER APPLICATIONS

TABLE 121 ALGAE PRODUCTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2023 (USD MILLION)

15.5 ALGAE PRODUCTS MARKET, BY REGION

15.5.1 NORTH AMERICA

TABLE 122 NORTH AMERICA: ALGAE PRODUCTS MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 123 NORTH AMERICA: ALGAE PRODUCTS MARKET SIZE, BY SOURCE, 2016-2023 (USD MILLION)

TABLE 124 NORTH AMERICA: ALGAE PRODUCTS MARKET SIZE, BY FORM, 2016-2023 (USD MILLION)

TABLE 125 NORTH AMERICA: ALGAE PRODUCTS MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

15.5.2 EUROPE

TABLE 126 EUROPE: ALGAE PRODUCTS MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 127 EUROPE: ALGAE PRODUCTS MARKET SIZE, BY SOURCE, 2016-2023 (USD MILLION)

TABLE 128 EUROPE: ALGAE PRODUCTS MARKET SIZE, BY FORM, 2016-2023 (USD MILLION)

TABLE 129 EUROPE: ALGAE PRODUCTS MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

15.5.3 ASIA PACIFIC

TABLE 130 ASIA PACIFIC: ALGAE PRODUCTS MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 131 ASIA PACIFIC: ALGAE PRODUCTS MARKET SIZE, BY SOURCE, 2016-2023 (USD MILLION)

TABLE 132 ASIA PACIFIC: ALGAE PRODUCTS MARKET SIZE, BY FORM, 2016-2023 (USD MILLION)

TABLE 133 ASIA PACIFIC: ALGAE PRODUCTS MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

15.5.4 REST OF THE WORLD (ROW

TABLE 134 ROW: ALGAE PRODUCTS MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 135 ROW: ALGAE PRODUCTS MARKET SIZE, BY SOURCE, 2016-2023 (USD MILLION)

TABLE 136 ROW: ALGAE PRODUCTS MARKET SIZE, BY FORM, 2016-2023 (USD MILLION)

TABLE 137 ROW: ALGAE PRODUCTS MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

15.6 AQUACULTURE PRODUCTS MARKET

15.6.1 LIMITATIONS

15.6.2 MARKET DEFINITION

15.6.3 MARKET OVERVIEW

15.6.4 AQUACULTURE PRODUCTS MARKET, BY SPECIES

TABLE 138 AQUACULTURE PRODUCTS MARKET SIZE, BY SPECIES, 2016-2023 (USD MILLION)

15.6.4.1 Aquatic animals

TABLE 139 AQUACULTURE PRODUCTS MARKET SIZE, BY AQUATIC ANIMAL, 2016-2023 (USD MILLION)

15.6.4.2 Aquatic plants

TABLE 140 AQUACULTURE PRODUCTS MARKET SIZE, BY AQUATIC PLANT, 2016-2023 (USD MILLION)

15.6.5 AQUACULTURE PRODUCTS MARKET, BY REGION

TABLE 141 AQUACULTURE PRODUCTS MARKET SIZE, BY REGION, 2016-2023 (USD BILLION

15.6.5.1 North America

TABLE 142 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET SIZE, BY SPECIES, 2016-2023 (USD MILLION)

15.6.5.2 Europe

TABLE 143 EUROPE: AQUACULTURE PRODUCTS MARKET SIZE, BY SPECIES, 2016-2023 (USD MILLION)

15.6.5.3 Asia pacific

TABLE 144 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET SIZE, BY SPECIES, 2016-2023 (USD MILLION)

15.6.5.4 South America

TABLE 145 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET SIZE, BY SPECIES, 2016-2023 (USD MILLION)

15.6.5.5 Rest of the World (ROW

TABLE 146 ROW: AQUACULTURE PRODUCTS MARKET SIZE, BY SPECIES, 2016-2023 (USD MILLION)

16 APPENDIX (Page No. - 203)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

16.5 AUTHOR DETAILS

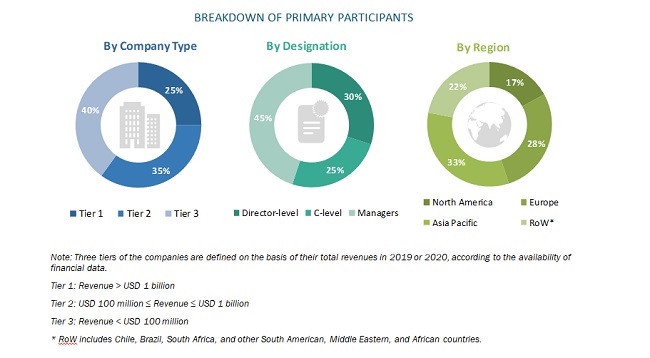

The study involved four major activities in estimating the seaweed cultivation market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), Food and Agriculture Organization (FAO), The World Bank, The Seaweed Industry Association of Philippines (SIAP), and Southeast Asian Fisheries Development Centre/Aquaculture Department (SEAFDEC/AQD) were referred to, to identify and collect information for this study. The secondary sources also included seaweeds manufacturers’ annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and paid databases.

Primary Research

The market comprises several stakeholders in the supply chain, which include suppliers, manufacturers, and end-use product manufacturers. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include manufacturers of food & beverage products, feed, agricultural fertilizers, cosmetics and personal care, pharmaceuticals, energy, and research institutions involved in R&D; and government agencies. The primary sources from the supply side include seaweed manufacturers, suppliers, distributors, importers, and exporters.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of Primary participants

Note: Three tiers of the companies are defined on the basis of their total revenues in 2019 or 2020, according to the availability of financial data.

Tier 1: Revenue > USD 1 billion

Tier 2: USD 100 million ≤ Revenue ≤ USD 1 billion

Tier 3: Revenue < USD 100 million

* RoW includes Chile, Brazil, South Africa, and other South American, Middle Eastern, and African countries.

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the seaweed cultivation market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The seaweed cultivation value chain and market size in terms of both value and volume have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the seaweed cultivation market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall seaweed cultivation market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the seaweed cultivation market, in terms of process, type, method of harvesting, form, application, and region

- To describe and forecast the seaweed cultivation market, in terms of value and volume, by region–North America, Europe, Asia Pacific, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the seaweed cultivation market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the seaweed cultivation market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as acquisitions & partnerships, expansions, product launches & approvals, and agreements, in the seaweed cultivation market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market into Poland, the UK, Italy, and Germany

- Further breakdown of the Rest of Asia Pacific market into India, Vietnam, Malaysia, and Thailand

- Further breakdown of the RoW market into Chile, Brazil, South Africa, and other South American, Middle Eastern, and African countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Seaweed Cultivation Market