Dual Chamber Prefilled Syringes Market by Material (Glass and Plastic), Indication (Hemophilia, Schizophrenia, Endometriosis, Erectile Dysfunction, and Diabetes), Product (Liquid/Powder, Liquid/Liquid), and Region - Global Forecast to 2025

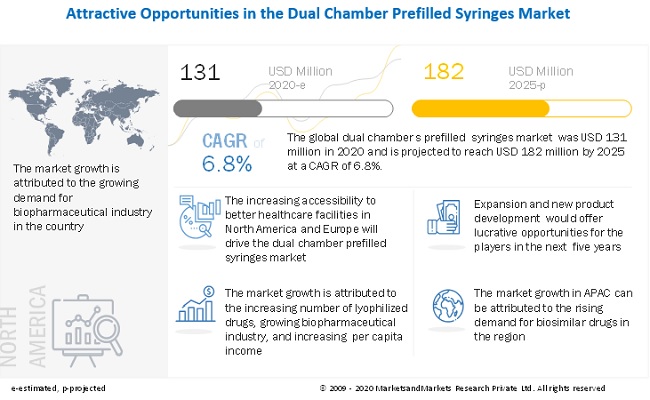

The global dual chamber prefilled syringes market size is projected to grow from USD 131 million in 2020 to USD 182 million by 2025, at a cagr 6.8% between 2020 and 2025. The factors promoting the growth of the market are the growth in lyophilized drugs, and the growing biopharmaceutical industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVD-19 Impact on the pharmaceutical industry supply chain

Dual chamber prefilled syringes market is not directly impacted by the COVID 19, but disruption in supply is expected to have implications in the near future:

- COVID-19 pandemic has caused global havoc in the first half of the year, and the economic and social situation does not seem to recover till next year, at least. It has put millions of people around the world under lockdown and has killed more than 660,000 people so far. However, the pharmaceutical industry is gearing up to fight COVID-19, with rapid development for new drugs and vaccines. At the same time, the industry has suffered immense damage due to the pandemic, mainly through the disruption in the supply chain. In order to prevent the spread of the virus, various countries have gone under lockdown, which has disrupted the supply chain of the industry.

- China is one of the sources of Active Pharmaceutical Ingredients (APIs) and was also the epicenter of the COVID-19 outbreak initially. The country was put under lockdown quite early, which led to the stoppage of manufacturing and hence a decline in the export. Although China has now relaxed its restriction, there are many other countries that have implemented export control measure that has impacted the pharmaceutical supply chain

- The only positive impact of COVID-19 could be that companies will look to spread their production to different markets in order to prevent any future disruptions. According to Chemical & Engineering News, in April 2020, Senator Tom Cotton (R-AR) and Representative Mike Gallagher introduced the Protecting Our Pharmaceutical Supply Chain from China Act that calls for terminating purchases of active pharmaceutical ingredients from China by 2022. A similar trend was observed in Europe.

- As per Chemical & Engineering News, in May 2020, Evonik announced that it would invest USD 27 million to increase its active pharmaceutical ingredients production capacity at its Rosenheim and Hanau sites in Germany. The expansion has to be completed by 2021, with further expansion planned in 2024. Steps have been taken to increase the domestic supply of drug chemicals and also to reduce sourcing insecurities and overdependence on China for supply

Dual chamber prefilled syringes Market Dynamics

Driver: Growing biopharmaceutical Industry

The biopharmaceutical industry is growing at a rapid pace in emerging economies. Advanced manufacturing processes, technological innovations, and increased integration of companies have resulted in the rapid growth of the industry. This growth of the pharmaceutical industry is driving the pharmaceutical packaging market. The growth is expected to be the highest in emerging economies such as China, India, and Brazil. Increasing income levels and growing awareness about the advantages of good healthcare systems with healthier lifestyles are supporting the growth of the market in these countries. The growth of biologics is expected to increase the use of lyophilized drugs, which requires advanced drug delivery devices such as dual chamber prefilled syringes.

Restraint: Risk of cross-contamination

There is a risk of cross-contamination of the two components; even if a minor amount of one-component enters into the other chamber during lyophilization, it can pose a serious medical hazard. During lyophilization, the entire syringe chamber is placed inside the freeze-drying equipment, and it is not a functional imperative that the part of the syringe constituting the second chamber be placed into the freezing equipment. This will result in the significant under-utilization of space in the freeze-drying chamber with immense cost implications regarding efficiency and productivity, which is a major factor in mass production. However, this cross-contamination can be avoided by the use of dual chamber prefilled syringes, where the chambers are separable. The separable type dual chamber prefilled syringe is a very niche product compared to a non-separable one.

Opportunities: Making the separable dual chamber prefilled syringes cost-effective.

In the separable dual chamber prefilled syringes, one detachment chamber can be made of glass and the other of polymer materials. The capability to choose the syringe chamber's material will totally depend on the specific requirement of the substance to be injected. The detached chamber facing the syringe head can be made of glass if it holds the freeze-dried component as glass has excellent barrier properties, which minimizes water vapor diffusion. The other chamber intended for holding solvent water could be made of plastic material; currently, water used for medical purposes is stored in vials made of polymer materials such as polypropylene and polycarbonate. This will make the separable dual chamber reduce its overall cost as plastic is cheaper compared to glass and will bring the overall cost of this kind of dual chamber prefilled syringe down for specific substances, where solvent water is used.

Challenges: Safeguarding against counterfeit products

Counterfeit or falsified pharmaceutical products have been an important concern for pharmaceutical manufacturers. In 2017, USD 25 million illicit and counterfeit drugs were seized by Interpol. Delay in approval of new drugs and their packaging due to the long product development cycles and costs are resulting in the increased availability of counterfeit drugs and fake packaging. These counterfeit products have negative effects on the human body in terms of allergic reactions, nausea, vomiting, and others. The WHO is constantly taking initiatives against counterfeiters by setting new standards for drug packaging.

All activities related to drug serialization that evolve in different countries are backed by global initiatives managed by the WHO. The governments of developed and developing economies are implementing stringent legislation, such as the US Code 2320, for tracking counterfeit products and related acts to prevent counterfeiting of pharmaceutical products. New technologies, such as induction seals, Near-Field Communication (NFC) tags, and blockchain, will further boost counterfeit protection and enable proper distribution. However, counterfeiters usually crack these systems in two-three years. This issue mandates complex and expensive upgradations by pharmaceutical packaging companies on a regular basis. Hence, fighting counterfeit products is a major challenge for pharmaceutical packaging companies, which include dual chamber syringe manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Glass segment projected to lead dual chamber prefilled syringes market from 2020 to 2025

The glass segment accounted for the largest share in the overall dual chamber prefilled syringes market. The property of glass to be non-reactive to drugs makes it the preferred choice of material for manufacturing the chambers of dual chamber prefilled syringes. Also, the price of glass syringes is relatively low compared to plastics. These factors will drive the glass in the dual chamber prefilled syringes market.

Hemophilia is estimated to be the largest indication of dual chamber prefilled syringes.

Hemophilia accounted for the largest share of the dual chamber prefilled syringes market. The increasing number of patients diagnosed with hemophilia in North America and Europe and having better access to healthcare are expected to drive the demand for dual chamber prefilled syringes in this segment. Also, biologics are the only type of drug that is used for the treatment of hemophilia; this drug is lyophilized and is available only as injections.

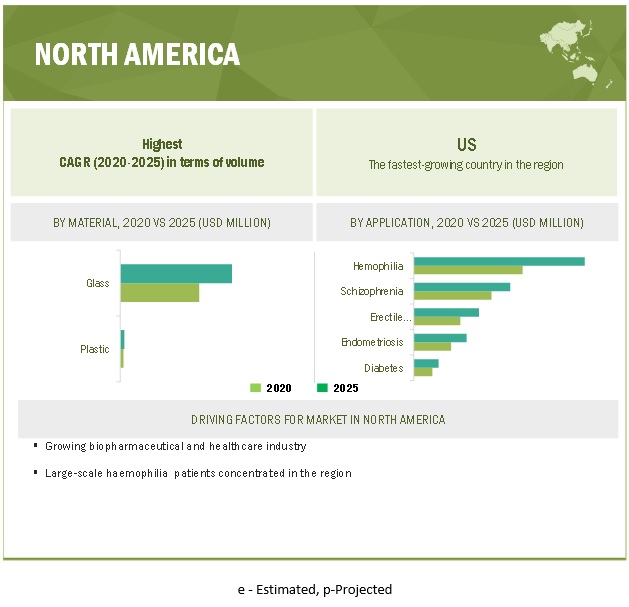

North America estimated to account for the highest share of the global dual chamber prefilled syringes market.

North America is estimated to have the largest share in the global dual chamber prefilled syringes market. The growing aging population, significant medical device manufacturing capacity, growing per capita healthcare spending, and increased health awareness in the country are driving the market in the region.

Key Market Players

Key players in the market are Nipro Corporation (Japan), Gerresheimer AG (Germany), Vetter Pharma (Germany), Credence Medsystems (US), MAEDA INDUSTRY (Japan), and Arte Corporation (Japan). Very few companies have adopted strategies to enhance their growth in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Unit) |

|

Segments covered |

Type, Product, , Indication Material, and Region |

|

Geographies covered |

North America, APAC, Europe, RoW |

|

Companies covered |

Nipro Corporation (Japan), Gerresheimer AG (Germany), Vetter Pharma (Germany), Credence Medsystems (US), MAEDA INDUSTRY (Japan), and Arte Corporation (Japan). |

This research report categorizes the dual chamber syringes market based on type, application, and region.

By Material

- Glass

- Plastic

By Application

- Liquid/Powder

- Liquid/Liquid

By Product

- <1 ml

- 1 ml-2.5 ml

- 2.5 ml-5.0 ml

- >5.0 ml

By Indication

- Hemophilia

- Schizophrenia

- Diabetes

- Erectile Dysfunction

- Endometriosis

- Others

By Region

- North America

- Europe

- APAC

- Rest of World (RoW)

Recent Developments

- In March 2019, Gerresheimer made an investment for a new plant in Skopje, North Macedonia. The plant will manufacture plastic systems, such as prefillable syringes, and will start operating from the second half of 2020. This investment will reinforce the company’s strategy for the expansion of the production network in Europe

Frequently Asked Questions (FAQ):

What is the difference between a conventional syringe and dual chamber prefilled syringes ?

The difference between dual chamber prefilled syringe and standard prefilled syringe is that at the start of the administration, the cap or needle shield of the dual chamber prefilled syringe should not be removed. The user should first push the plunger rod forward, forcing the content in the rear chamber into the front chamber. This mechanism does not support the rare cases where medication is intended to be delivered sequentially. This dual chamber delivery system reduces overfill and increases the precision in dosing as the drug and diluent are premeasured.

What are the major indications for which dual chamber prefilled syringes are used?

The major applications for dual chamber prefilled syringes include haemophilia. Schizophrenia, Endometriosis, erectile dysfunction and diabetes

What are the major types of dual chamber prefilled syringes available?

Dual chamber prefilled syringes are made using glass and plastic. The glass is the most preferred owing to its non-reactivity and low cost

What are the factors driving the growth of the dual chamber prefilled syringes market?

Some of the factors driving the demand for dual chamber prefilled syringes growth in lyophilized drugs, and the growing biopharmaceutical industry.

Are there any restraints faced by the players in the dual chamber prefilled syringes market?

The primary factor restraining the dual chamber prefilled syringes market growth is the risk of cross-contamination, increasing overall packaging costs due to dynamic regulatory policies, and lack of awareness and access in emerging economies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 DUAL CHAMBER PREFILLED SYRINGES: MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

1.7 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 DUAL CHAMBER PREFILLED SYRINGES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 DUAL CHAMBER PREFILLED SYRINGES MARKET ANALYSIS THROUGH SECONDARY SOURCES

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

FIGURE 3 PRIMARY INTERVIEWS

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

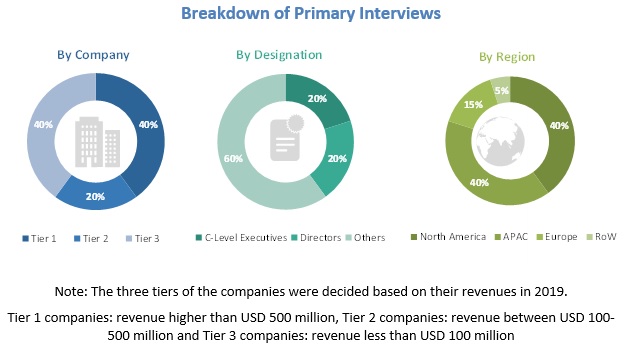

2.1.3.3 Breakdown of primary interviews

2.2 DUAL CHAMBER PREFILLED SYRINGES MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.3 MARKET SIZE ESTIMATION

2.3.1 BASED ON GLOBAL DUAL CHAMBER PREFILLED SYRINGES FILLING MACHINE INSTALLED BASE

FIGURE 4 MARKET SIZE ESTIMATION: BASED ON GLOBAL DUAL CHAMBER PREFILLED SYRINGES FILLING MACHINE INSTALLED BASE

2.3.2 BASED ON THE GLOBAL PREFILLED SYRINGES MARKET

FIGURE 5 MARKET SIZE ESTIMATION: BASED ON THE GLOBAL PREFILLED SYRINGES MARKET

2.4 DATA TRIANGULATION

FIGURE 6 DUAL CHAMBER PREFILLED SYRINGES MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 7 HEMOPHILIA ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 8 GLASS SEGMENT ACCOUNTED FOR THE LARGER SHARE IN 2019

FIGURE 9 NORTH AMERICA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

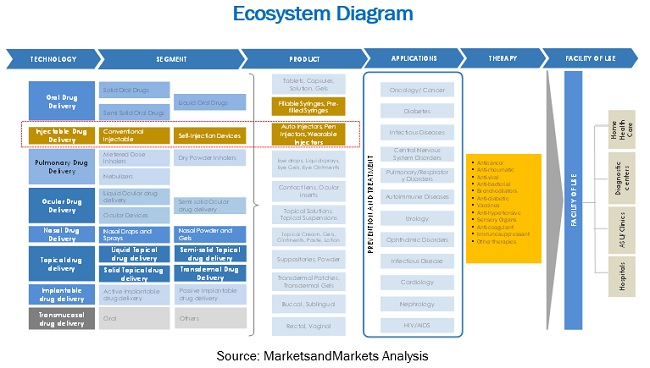

FIGURE 10 DRUG DELIVERY DEVICE ECOSYSTEM

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR DUAL CHAMBER PREFILLED SYRINGES MARKET

FIGURE 11 INCREASING NUMBER OF LYOPHILIZED DRUGS WILL DRIVE THE MARKET

4.2 NORTH AMERICA DUAL CHAMBER PREFILLED SYRINGES MARKET

FIGURE 12 THE US ACCOUNTED FOR THE LARGEST SHARE IN 2019

4.3 DUAL CHAMBER PREFILLED SYRINGES MARKET, BY COUNTRY

FIGURE 13 GERMANY TO REGISTER THE FASTEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE DUAL CHAMBER PREFILLED SYRINGES MARKET

5.2.1 DRIVERS

5.2.1.1 Growing biopharmaceutical industry

5.2.1.2 Growing demand for drug delivery devices for lyophilic drugs

5.2.1.3 Lesser risk of contamination

5.2.1.4 Growing health awareness and adoption of new regulatory standards

5.2.2 RESTRAINTS

5.2.2.1 Risk of cross-contamination

5.2.2.2 Increasing overall packaging costs owing to dynamic regulatory policies

5.2.2.3 Lack of access and awareness in emerging markets

5.2.3 OPPORTUNITIES

5.2.3.1 Making the separable dual chamber prefilled syringe cost-effective

5.2.4 CHALLENGES

5.2.4.1 Safeguarding against counterfeit products

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 DUAL CHAMBER PREFILLED SYRINGES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN OF THE DUAL CHAMBER PREFILLED SYRINGES

5.5 YC, YCC DRIVERS

5.5.1 CONSUMER PREFERENCE AND IMPACT OF INDUSTRY 4.0

FIGURE 16 YC AND YCC SHIFTS

FIGURE 17 OVERVIEW OF THE DRUG DELIVERY

5.5.2 EMERGING TRENDS AND TECHNOLOGIES IMPACTING MATERIALS IN THE PHARMACEUTICAL INDUSTRY

FIGURE 18 CONVENIENCE & SAFETY AND REDUCED API TO BE THE KEY FACTOR

5.6 ECOSYSTEM MAPPING

5.7 COVID-19 IMPACT ON VACCINES & DRUGS

5.7.1 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19: THE GLOBAL SCENARIO

FIGURE 20 COVID-19: THE GLOBAL PROPAGATION

5.7.2 COVID-19: ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.8 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

FIGURE 22 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 23 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

5.9 COVID-19: DEVELOPMENT OF VACCINES

5.9.1 CURRENT PIPELINE OF VACCINES

5.9.1.1 Viewpoint on the COVID-19 pipeline

FIGURE 24 PIPELINE OF COVID-19 VACCINE CANDIDATES, BY TECHNOLOGY PLATFORM

FIGURE 25 COVID-19 IMPACT ON VACCINE SUPPLY

5.1 POST-COVID-19 VACCINE APPROVAL SCENARIO

5.10.1 CHALLENGES IN VACCINE APPROVAL/PRODUCTION/SUPPLY

5.10.1.1 Are companies taking enough advantage of artificial intelligence (AI) to fast track vaccine/drug approval? (Medium Criticality)

5.10.1.2 Can production for pandemics be a challenge? (High Criticality)

5.10.1.3 The world needs a vaccine but who needs it the most? (Medium Criticality)

5.10.1.3.1 New strategies

5.10.1.4 New opportunities

5.10.1.4.1 Investments in real-world evidence by pharmaceutical companies

5.10.1.5 Trends

5.10.1.5.1 Changes in IPR to promote the supply of essential drugs and medical supplies

6 DUAL CHAMBER PREFILLED SYRINGES MARKET, BY APPLICATION (Page No. - 62)

6.1 INTRODUCTION

FIGURE 26 LIQUID/POWDER SEGMENT ACCOUNTED FOR THE MAJORITY SHARE IN 2019

TABLE 1 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 2 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNITS)

6.2 LIQUID/POWDER

6.3 LIQUID/LIQUID

7 DUAL CHAMBER PREFILLED SYRINGES MARKET, BY PRODUCT (Page No. - 65)

7.1 INTRODUCTION

FIGURE 27 2.5-5 ML SEGMENT ACCOUNTED FOR THE MAJORITY SHARE OF THE MARKET IN 2019

TABLE 3 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY PRODUCT, 2018–2025 (USD THOUSAND)

TABLE 4 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY PRODUCT, 2018–2025 (THOUSAND UNITS)

7.2 <1 ML

7.3 1-2.5 ML

7.4 2.5-5 ML

7.5 >5 ML

8 DUAL CHAMBER PREFILLED SYRINGES MARKET, BY MATERIAL (Page No. - 68)

8.1 INTRODUCTION

FIGURE 28 GLASS MATERIAL SEGMENT ACCOUNTED FOR THE MAJORITY SHARE OF THE MARKET IN 2019

TABLE 5 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 6 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

8.2 GLASS

8.3 PLASTIC

9 DUAL CHAMBER PREFILLED SYRINGES MARKET, BY INDICATION (Page No. - 71)

9.1 INTRODUCTION

FIGURE 29 HEMOPHILIA TO LEAD THE DUAL CHAMBER PREFILLED SYRINGES MARKET DURING THE FORECAST PERIOD

FIGURE 30 HEMOPHILIA SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2019

TABLE 7 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 8 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

9.2 HEMOPHILIA

9.3 SCHIZOPHRENIA

9.4 DIABETES

9.5 ERECTILE DYSFUNCTION

9.6 ENDOMETRIOSIS

9.7 OTHERS

10 DUAL CHAMBER PREFILLED SYRINGES MARKET, BY REGION (Page No. - 76)

10.1 INTRODUCTION

TABLE 9 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 10 DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

10.2 APAC

TABLE 11 APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 12 APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 13 APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 14 APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 15 APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 16 APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.2.1 CHINA

10.2.1.1 Growth of the medical device industry favorable for the market

TABLE 17 CHINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 18 CHINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 19 CHINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 20 CHINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.2.2 JAPAN

10.2.2.1 Strong production capacity, coupled with rising demand for advanced products, to drive the market

TABLE 21 JAPAN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 22 JAPAN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 23 JAPAN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 24 JAPAN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.2.3 INDIA

10.2.3.1 The demand for medical devices is likely to grow

TABLE 25 INDIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 26 INDIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 27 INDIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 28 INDIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.2.4 AUSTRALIA

10.2.4.1 New product development and growing adoption help to drive the market

TABLE 29 AUSTRALIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 30 AUSTRALIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 31 AUSTRALIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 32 AUSTRALIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.2.5 REST OF APAC

TABLE 33 REST OF APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 34 REST OF APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 35 REST OF APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 36 REST OF APAC: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3 EUROPE

FIGURE 31 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SNAPSHOT

TABLE 37 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 38 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 39 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 40 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 41 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 42 EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.1 GERMANY

10.3.1.1 Germany is expected to witness the highest growth during the forecast period

TABLE 43 GERMANY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 44 GERMANY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 45 GERMANY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 46 GERMANY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.2 FRANCE

10.3.2.1 Developments in drugs for Type 2 diabetes will drive the market

TABLE 47 FRANCE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 48 FRANCE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 49 FRANCE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 50 FRANCE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.3 UK

10.3.3.1 Automatic type segment to witness the highest growth during the forecast period

TABLE 51 UK: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 52 UK: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 53 UK: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 54 UK: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.4 RUSSIA

10.3.4.1 Pharma-2030 will be the key driver for the market

TABLE 55 RUSSIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 56 RUSSIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 57 RUSSIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 58 RUSSIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.5 SPAIN

10.3.5.1 Government initiatives in the healthcare sector will boost the demand

TABLE 59 SPAIN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 60 SPAIN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 61 SPAIN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 62 SPAIN: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.6 ITALY

10.3.6.1 The growing pharmaceutical industry is the key driver

TABLE 63 ITALY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 64 ITALY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 65 ITALY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 66 ITALY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.3.7 REST OF EUROPE

TABLE 67 REST OF EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 68 REST OF EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 69 REST OF EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 70 REST OF EUROPE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.4 NORTH AMERICA

FIGURE 32 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 72 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 73 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 74 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 75 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 76 NORTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.4.1 US

10.4.1.1 Increasing R&D activities in the biopharmaceutical industry to drive the market

TABLE 77 US: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 78 US: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 79 US: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 80 US: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.4.2 CANADA

10.4.2.1 Presence of local and global drug manufacturers to drive the market

TABLE 81 CANADA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 82 CANADA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 83 CANADA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 84 CANADA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.4.3 MEXICO

TABLE 85 MEXICO: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 86 MEXICO: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 87 MEXICO: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 88 MEXICO: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.5 MIDDLE EAST & AFRICA

TABLE 89 MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 90 MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 91 MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 92 MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 93 MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 94 MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.5.1 TURKEY

10.5.1.1 Increasing cases of hemophilia will be a key driver for the growth of the market

TABLE 95 TURKEY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 96 TURKEY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 97 TURKEY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 98 TURKEY: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.5.2 SAUDI ARABIA

10.5.2.1 Government initiatives to develop the healthcare sector to drive the demand

TABLE 99 SAUDI ARABIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 100 SAUDI ARABIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 101 SAUDI ARABIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 102 SAUDI ARABIA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.5.3 UAE

10.5.3.1 Healthcare spending to drive the demand in the country

TABLE 103 UAE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 104 UAE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 105 UAE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 106 UAE: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.5.4 SOUTH AFRICA

10.5.4.1 Increasing penetration in the medical & healthcare sector to support market growth

TABLE 107 SOUTH AFRICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 108 SOUTH AFRICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 109 SOUTH AFRICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 110 SOUTH AFRICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 111 REST OF MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 112 REST OF MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 113 REST OF MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 114 REST OF MEA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.6 SOUTH AMERICA

TABLE 115 SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 116 SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 117 SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 118 SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 119 SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 120 SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.6.1 BRAZIL

10.6.1.1 Brazil is expected to maintain its leading position in the regional market

TABLE 121 BRAZIL: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 122 BRAZIL: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 123 BRAZIL: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 124 BRAZIL: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.6.2 ARGENTINA

10.6.2.1 Healthcare spending to drive the demand for dual chamber prefilled syringes

TABLE 125 ARGENTINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 126 ARGENTINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 127 ARGENTINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 128 ARGENTINA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

10.6.3 REST OF SOUTH AMERICA

TABLE 129 REST OF SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 130 REST OF SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY MATERIAL, 2018–2025 (THOUSAND UNITS)

TABLE 131 REST OF SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (USD THOUSAND)

TABLE 132 REST OF SOUTH AMERICA: DUAL CHAMBER PREFILLED SYRINGES MARKET SIZE, BY INDICATION, 2018–2025 (THOUSAND UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 127)

11.1 INTRODUCTION

TABLE 133 BRIEF ANALYSIS OF DUAL CHAMBER PREFILLED SYRINGES MANUFACTURERS’ POSITIONING IN THE MARKET

11.2 MARKET SHARE ANALYSIS

FIGURE 33 MARKET SHARE OF TOP DUAL CHAMBER PREFILLED SYRINGES MANUFACTURERS, 2019

11.3 COMPANY EVALUATION MATRIX

11.3.1 PERVASIVE

11.3.2 EMERGING LEADERS

11.3.3 STAR

11.3.4 EMERGING PLAYERS

FIGURE 34 COMPANY EVALUATION MATRIX OF KEY PLAYERS IN THE DUAL CHAMBER PREFILLED SYRINGES MARKET

12 COMPANY PROFILE (Page No. - 131)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 GERRESHEIMER AG

FIGURE 35 GERRESHEIMER AG: COMPANY SNAPSHOT

12.2 VETTER PHARMA

12.3 NIPRO CORPORATION

FIGURE 36 NIPRO CORPORATION: COMPANY SNAPSHOT

12.4 CREDENCE MEDSYSTEMS

12.5 MAEDA INDUSTRY

12.6 ARTE CORPORATION

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 140)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities for estimating the current size of the global dual chamber syringes market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of dual chamber syringes through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the dual chamber syringes market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the dual chamber syringes market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the dual chamber syringes market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the dual chamber syringes industry. The primary sources from the demand-side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global dual chamber syringes market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the dual chamber syringes market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the dual chamber syringes market in terms of value and volume based on type,product,material, Indication, and region

- To project the size of the market and its segments with respect to the four main regions, namely, North America, Europe, APAC, Rest of World (RoW).

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the dual chamber syringes market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the dual chamber syringes report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the dual chamber syringes market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Dual Chamber Prefilled Syringes Market