Dual Chamber Syringe (DCS) Filling Machine Market by Type (Automatic, Semi-automatic, and Manual), by Application (Industrial Pharmacy and Hospital Pharmacy) and Region - Global Forecast to 2025

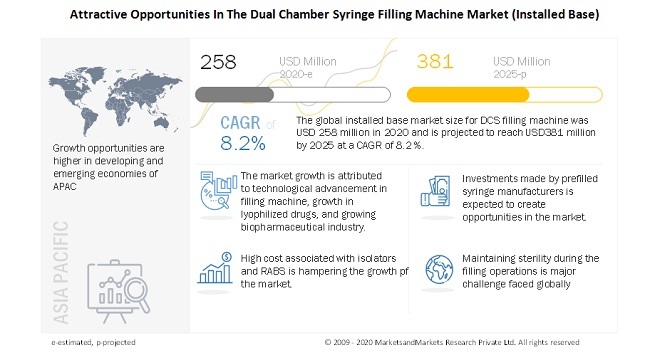

[113 Pages Report] The installed base global dual chamber syringe (DCS) filling machine market size is projected to grow from USD 258 million in 2020 to USD 381 million by 2025, at a CAGR of 8.2% between 2020 and 2025. The factors promoting the growth of the market are technological advancements in filling machines, growth in lyophilized drugs, and the growing biopharmaceutical industry.

To know about the assumptions considered Request for Free Sample Report

COVD-19 Impact on the pharmaceutical industry supply chain

Dual chamber syringe (DCS) filling machine market is not directly impacted by the COVID 19, but disruption in supply is expected to have implications in the near future:

- COVID-19 pandemic has caused global havoc in the first half of the year, and the economic and social situation does not seem to recover till next year, at least. It has put millions of people around the world under lockdown and has killed more than 660,000 people so far. However, the pharmaceutical industry is gearing up to fight COVID-19, with rapid development for new drugs and vaccines. At the same time, the industry has suffered immense damage due to the pandemic, mainly through the disruption in the supply chain. In order to prevent the spread of the virus, various countries have gone under lockdown, which has disrupted the supply chain of the industry.

- China is one of the sources of Active Pharmaceutical Ingredients (APIs) and was also the epicenter of the COVID-19 outbreak initially. The country was put under lockdown quite early, which led to the stoppage of manufacturing and hence a decline in the export. Although China has now relaxed its restriction, there are many other countries that have implemented export control measure that has impacted the pharmaceutical supply chain

- The only positive impact of COVID-19 could be that companies will look to spread their production to different markets in order to prevent any future disruptions. According to Chemical & Engineering News, in April 2020, Senator Tom Cotton (R-AR) and Representative Mike Gallagher introduced the Protecting Our Pharmaceutical Supply Chain from China Act that calls for terminating purchases of active pharmaceutical ingredients from China by 2022. A similar trend was observed in Europe.

- As per Chemical & Engineering News, in May 2020, Evonik announced that it would invest USD 27 million to increase its active pharmaceutical ingredients production capacity at its Rosenheim and Hanau sites in Germany. The expansion has to be completed by 2021, with further expansion planned in 2024. Steps have been taken to increase the domestic supply of drug chemicals and also to reduce sourcing insecurities and overdependence on China for supply

Dual chamber syringe (DCS) filling machine Market Dynamics

Driver: Technological advancements in filling machine manufacturing

Technological advancements in double chamber syringe filling machine involve the usage of isolators and Restricted Access Barrier Systems (RABS). The introduction of these technologies creates robust sterile manufacturing environments that effectively separate human operators from the fill-finish process. A large number of equipment manufacturers in the fill-finish manufacturing market are focusing on the development of barrier isolation systems, which are integrated fill-finish machines capable of carrying out all stages of fill-finish processes.

In contrast to barrier isolation systems, standalone equipment used in fill-finish operations is both time-consuming and expensive, thus making the entire process complex and prone to contamination. Additionally, in traditional filling machines, the conventional stainless steel systems require additional cleaning and sterilization (CIP/SIP), whereas a single-use system eliminates the critical steps of sterilization and further reduces the change-over-time by simplifying end-of-batch breakdown and decontamination operations. For instance, DARA Pharmaceutical Packaging has introduced such a filling machine for dual-chamber syringes. Due to these factors, many biopharmaceutical companies are adopting these machines in drug production facilities.

Restraint: The high cost of isolators and RABS

Isolators and Restricted Access Barrier System (RABS) are equipped with advanced features and functionalities and are therefore priced at premium rates, as compared to standalone systems. The average cost of isolators and RABS is around USD 4.0 million to USD 8.0 million, which is five times that of standalone systems. This severely restricts their accessibility, especially for small companies. Therefore, the adoption of isolators and RABS is very low as compared to standalone systems in underdeveloped or developing countries, including China and India. Furthermore, research institutes find it difficult to afford such instruments, as they have restricted budgets for the purchase of such instruments. Standalone systems are, however, still used in small pharma and biopharma companies, R&D laboratories, and academic institutes.

Opportunities: Investments made by prefilled syringe manufacturers.

In 2018, Nipro Corporation invested USD 14 million in its Japan and Germany plant to increase the production capacity of prefilled syringes. The company is also focusing on the development of dual chamber prefilled syringes for treating patients with prostate cancer and breast cancer. This type of development will create opportunities for DCS filling machine manufacturers to capture the market

Challenges: Maintaining sterility during the filling operations

Aseptic filling operations, which are used in filling syringes, carry more risk than non-sterile processes. It requires careful planning, trained personnel, and specialized facilities & machines to properly execute the process. Ensuring sterility is of utmost importance as any failure can lead to massive financial losses and can also have life-threatening effects on patients.

All the components used in the filling processes must be sterilized before use. Sterilization with pressurized steam, irradiation, or hydrogen peroxide must be performed in a manner that does not affect the stability of the drug. This indicates the need for careful designing of cleanroom facilities to ensure sterility, thereby incurring high costs. Sterile lyophilizing requires investments for specialized equipment and facilities. For those products that require lyophilizing, strict steps must be taken to ensure that the risk of contamination is minimized during the loading and unloading processes.

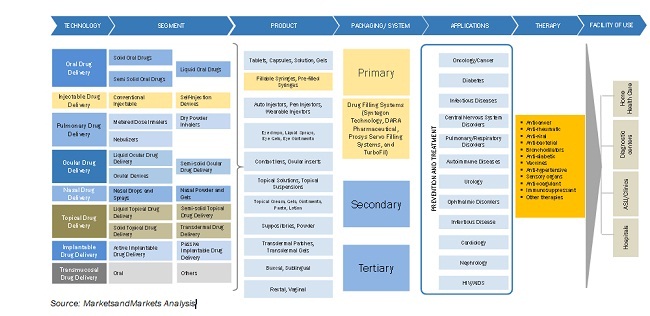

ECOSYSTEM DIAGRAM

To know about the assumptions considered for the study, download the pdf brochure

Source: MarketsandMarkets Analysis

Automatic type segment projected to lead dual chamber syringe (DCS) filling machine market from 2020 to 2025

The automatic segment accounted for the largest share in the overall dual chamber syringe (DCS) filling machine market. Automatic filling machines are used by companies with large-scale operations and high-production requirements. These types of machines are the Food and Drug Association (FDA) approved because most of the operations in automatic machines do not have human involvement, which decreases the chances of drug contamination

The industrial pharmacy is estimated to be the largest application of a dual chamber syringe (DCS) filling machine .

The industrial pharmacy led the overall dual chamber syringe (DCS) filling machine market in 2019, both in terms of value and volume. The reason for the industrial segment leading the market is it involves research, production, packaging, quality control, marketing, and sales of pharmaceutical goods. A dual chamber syringe is used for the delivery of two drugs or for the ease of use it provides with lyophilized injectable drug products. The pharmaceutical industry is looking to offer convenient products to patients for self-administration.

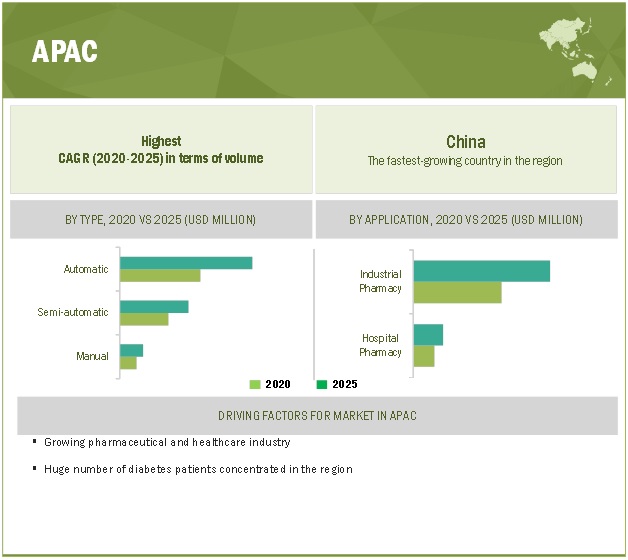

APAC estimated to account for the highest share of the global dual chamber syringe (DCS) filling machine market in terms of volume.

APAC is projected to have the largest share in the global dual chamber syringe (DCS) filling machine market, in terms of volume, from 2020 to 2025. The growing aging population, significant medical device manufacturing capacity, growing per capita healthcare spending, and increased health awareness in the country are driving the market in the region.

Key Market Players

Key players in the market are Syntegon Technology (Germany), Prosys Servo Filling Systems (US), DARA Pharmaceutical (Spain), TurboFil Packaging Machines (US),. Very few companies have adopted strategies to enhance their growth in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Unit) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, RoW |

|

Companies covered |

Syntegon Technologies (Germany), Prosys Servo Filling Systems (US), Dara Pharmaceutical Packaging (Spain), TurboFil Packaging Machines (US), and Optima Machinery Corporation (Germany), Dymax Corporation (US), Inno4Life (the Netherlands), Ashby Cross (US), Wenzhou Zhonghuan Packaging Machinery (China), Mutual Corporation (Japan), Shanghai Packaging Machinery (China) are the top players in the market. |

This research report categorizes the dual chamber syringe (DCS) filling machine market based on type, application, and region.

By Type

- Automatic

- Semi-automatic

- Manual

By Application

- Industrial Pharmacy

- Hospital Pharmacy

By Region

- North America

- Europe

- APAC

- Rest of World (RoW)

Recent Developments

- In February 2019, DARA Pharmaceutical launched new equipment for the processing of dual chamber syringes.

- In January 2019, DARA Pharmaceutical launched model NFL / 2 DC, a new machine for the filling and closing of vials, cartridges, and double chamber syringes.

Frequently Asked Questions (FAQ):

What is the importance of a dual chamber syringe (DCS) filling machine ?

DCS filling machine is an equipment that is used for filling double chamber or cartridge syringes. These machines are specifically designed for filling double-chamber syringes with different products, which can either be liquid or powder.

What are the major applications for dual chamber syringe (DCS) filling machine ?

The major applications for dual chamber syringe (DCS) filling machines are industrial pharmacy and hospital pharmacy. dual chamber syringe (DCS) filling machine is used for filling dual chamber prefilled syringes with a combination of drugs.

What are the major types of dual chamber syringe (DCS) filling machines available?

Dual chamber syringe (DCS) filling machine is mainly of three types, namely automatic filling machine, semi-automatic filling machine, and manual filling machine. The automatic and semi-automatic filling is mostly used for commercial drugs.

What are the factors driving the growth of the dual chamber syringe (DCS) filling machine market?

Some of the factors driving the demand for dual chamber syringe (DCS) filling machines are the technological advancements in filling machines, growth in lyophilized drugs, and the growing biopharmaceutical industry.

Are there any restraints faced by the players in the dual chamber syringe (DCS) filling machine market?

The primary factor restraining the dual chamber syringe (DCS) filling machine market growth is the high cost associated with the isolators and Restricted Access Barrier System (RABS). Due to this, their accessibility is severely restricted for small pharma companies and research institutes that have a limited budget for purchasing such equipment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1 Market Scope

1.1.1 Market Definition

1.1.2 Market Covered

1.1.2.1 DCS Filling Machine Installed Base Market, By Type

1.1.2.2 DCS Filling Machine Installed Base Market, By Application

1.1.2.3 DCS Filling Machine Installed Base Market, By Region

1.1.3 Years Considered for The Study

1.1.4 Currency

1.1.5 Inclusion & Exclusion

1.1.6 Package size

1.1.7 Limitations

1.1.8 Stakeholders

2 Research Methodology

2.1 Market Size Estimation

2.1.1 Bottom-Up Approach

2.1.2 Top-Down Approach

2.2 Market Share Estimation

2.2.1 Key Data from Secondary Sources

2.2.2 Key Data from Primary Sources

2.2.2.1 Key Industry Insights

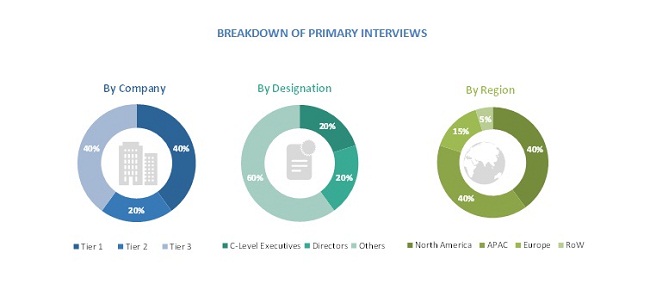

2.2.2.2 Breakdown of Primary Interviews

2.3 Data Triangulation

2.3.1 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities for DCS Filling Machine Installed Base Market

4.2 Top Region for DCS Filling Installed Base Market, By Type and Country

4.3 DCS Filling Machine Installed Base Market, By Key Countries

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Porter’s Five Forces

5.4 Ecosystem/Market Map

5.5 Supply Chain Analysis

5.6 Forecast Factors Impacting Growth

5.7 YC, YCC Shift

5.8 COVID19 Impact on Pharmaceutical Supply Chain

5.9 Macro-economic Indicators

6 DCS Filling Machine Installed Base Market, By Type – Forecast till 2025 ( in Units and USD Million)

6.1 Introduction

6.2 Automatic

6.3 Semi-Automatic

6.4 Manual

7 DCS Filling Machine Installed Base Market, By Application– Forecast till 2025 (in Units and USD Million)

7.1 Introduction

7.2 Industrial Pharmacy

7.3 Hospital Pharmacy

8 DCS Filling Machine Installed Base Market, By Region – Forecast till 2025 ( in Units and USD Million)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Rest of North America

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Rest of the Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 Rest of APAC

8.5 Rest of World

8.5.1 Brazil

8.5.2 Others

9 Competitive Landscape

9.1 Introduction

9.2 Company Evaluation Matrix Definition And Technology

9.2.1 Market Share & Industry Tier Structure Analysis

9.2.2 Product Footprint

9.2.3 Star

9.2.4 Emerging Leader

9.2.5 Pervasive

9.3 Company Evaluation Matrix 2019

9.4 Competitive Scenario

9.4.1 Expansions

9.4.2 Acquisitions

9.4.3 New Product launches

9.4.4 Market Strategy Analysis

9.4.5 Revenue Analysis of Top Players

10 Company Profiles

(Business Overview, Financials, Impact of Covid-19 on Business Segment, Products & Services, Winning imperatives, Right to Win, Key Strategy, Operational Growth, and Recent Developments)*

10.1.1 Syntegon Technology

10.1.2 Prosys Servo Filling Systems

10.1.3 Dara Pharmaceutical Packaging

10.1.4 TurboFil Packaging Machine

10.1.5 Dymax Corporation

10.1.6 Ashby Cross

10.1.7 Wenzhou Zhonguan Packaging Machinery

10.1.8 Optima Machinery Corporation

10.1.9 Mutual Corporation

10.1.10 Shanghai Packaging Machinery

10.1.11 Inno4Life

11 APPENDIX

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Related Reports

11.4 Author Details

The study involved four major activities for estimating the current size of the global dual chamber syringe (DCS) filling machine installed base market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of dual chamber syringe (DCS) filling machine through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the dual chamber syringe (DCS) filling machine market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the dual chamber syringe (DCS) filling machine market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the dual chamber syringe (DCS) filling machine market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the dual chamber syringe (DCS) filling machine industry. The primary sources from the demand-side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global dual chamber syringe (DCS) filling machine installed base market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the dual chamber syringe (DCS) filling machine installed base market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the dual chamber syringe (DCS) filling machine installed base market in terms of value and volume based on type, application, and region

- To project the size of the market and its segments with respect to the four main regions, namely, North America, Europe, APAC, Rest of World (RoW).

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the dual chamber syringe (DCS) filling machine market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the dual chamber syringe (DCS) filling machine report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the dual chamber syringe (DCS) filling machine market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Dual Chamber Syringe (DCS) Filling Machine Market