Dimethylaminopropylamine (DMAPA) Market by Application (Personal Care, PU Catalyst, Water Treatment, Agriculture, Pharmaceuticals, and Others), by Region - Global Trends & Forecasts to 2020

The global DMAPA market was valued at USD 237.8 Million in 2014 and is expected to witness a CAGR of 5.4% between 2015 and 2020. Factors driving the market of DMAPA include increasing demand from emerging economies and end-use industries and the favorable properties of DMAPA-based products.

The DMAPA market is mainly segmented on the basis of application and region. The years considered for the report are:

- Base Year-2014

- Estimated Year-2015

- Projected Year-2020

- Forecast Period-2015-2020

The base year used for company profiles is 2014; where the information was not available for the base year, the prior year was taken into consideration.

The DMAPA market is experiencing strong growth and is mainly driven by regions, such as Asia-Pacific, North America, and Europe. Considerable amount of investments are made by different market players to serve the end-user applications of DMAPA. The global DMAPA market is segmented into major geographic regions, such as North America, Europe, Asia-Pacific, and Rest of the World (RoW). The market has also been segmented on the basis of application. On the basis of application, the market is sub-divided into Personal Care, PU Catalyst, Water Treatment, Agriculture, Pharmaceuticals, and Others.

Research Methodology:

Various secondary sources such as encyclopedia, directories, and databases have been referred to identify and collect information useful for this extensive, commercial study of the DMAPA market. The primary sources, which include experts from related industries as well as key suppliers, have been interviewed to obtain and verify critical information as well as to assess the future prospects of the DMAPA market.

The research methodology adopted in this report is explained below:

- The percentage splits for each country were analyzed and estimated for various applications of DMAPA.

- The market size, in terms of value, of the various application in each region was estimated by summing up the country level data.

- The global market size, by value, was estimated using the general consumption trends across end-use industries.

- The percentage splits for the DMAPA market were estimated for each industry at the global level.

- The market share of each industry at the regional levels were analyzed and derived to estimate the regional consumption.

- The market share of each application at country level was analyzed.

- The country level data has also been estimated through this process.

The data were triangulated by studying various factors and trends from the demand and supply sides and the market size was validated using both top-down and bottom-up approaches and were verified through primary interviews. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

Market Ecosystem:

The ecosystem for the DMAPA market consists of suppliers of key raw materials such as methanol, ammonia, propylene, and other chemical agents. Many companies such as BASF SE, Eastman Chemical Company, Huntsman Corporation, and others have a backward integrated network to meet their production demands. The growth of DMAPA market is largely due increasing demand for personal care products such as shampoos, hair gel, bath preparations; textile, PU foam, agrochemicals, and others.

Target Audience of the Report:

The target audience of the report includes:

- DMAPA manufacturers

- DMAPA traders, distributors, and suppliers

- End-use market participants of different segments of DMAPA

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

Scope of the report:

- By Application:

- Personal Care

- PU Catalyst

- Water Treatment

- Agriculture

- Pharmaceuticals

- Others

- Fuel Additive

- Corrosion Inhibitor

- Dyes

- Textile

- Coating Compositions

- By Region:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations:

The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of product portfolio of each company

Country Level Analysis

- Further breakdown of the global DMAPA market by major countries

Company Information

- Detailed analysis and profiling of additional market players

DMAPA: The global DMAPA market was valued at USD 237.8 Million in 2014 and is expected to reach USD 326 Million by 2020, at a CAGR of 5.4% from 2015 to 2020. Increasing demand from end-use industries such as personal care and automotive and increasing demand from emerging economies such as China, India, Brazil and the favorable properties of DMAPA-based products are some of the drivers for the growth of this market.

The end products of DMAPA include agricultural chemicals, antistatic agents, binding agents, carburetor detergents, water resistant textile fibers, dyes, ion exchange resins, fabric softeners, anti-shrinking agent for leathers, and others.

Among the applications of DMAPA, the personal care segment is the biggest application segment. Betaine is manufactured from DMAPA, which is used in soaps, liquid soaps, hair care products, shampoos, bath care products, cosmetics, and so on. Because of its mild nature and effectiveness, DMAPA is widely substituting other additives which were earlier used as ingredient in personal and household care products. DMAPA is also used to produce an amphoteric surfactant which possesses great detergent and surfactant properties.

The personal care application segment is, so far, the biggest consumer of DMAPA. The major products in personal care include soap, liquid soap, hair care, bath preparations, shampoos, soft soaps, and so on. DMAPA is mild and skin friendly, and hence, it is used to produce soft soap and shampoos as it does not causes irritation to the skin and eye. The growing preference of consumers to use more skin friendly products is the major reason for the growth of this market.

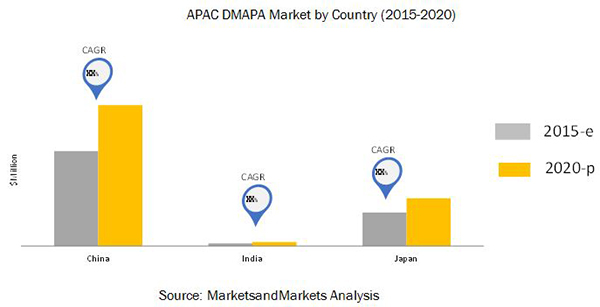

Asia-Pacific held the largest share in the global DMAPA market in 2014 and is expected to continue doing so during the forecast period. Asia-Pacific is also the fastest-growing market during the forecast period. Wide-scale industrialization, growing economy, and growing population are the main reasons for this high growth rate. Many global players are entering into the region due to cheap labor, easily availability of raw material, and favorable governmental rules and regulations.

In the production process of DMAPA, it may be possible that it is inadvertently released into the environment. The presence of DMAPA in water may be toxic to aquatic species. The production of DMAPA also involves the creation of many other bi-products which may be toxic to the environment as well as to human health. Cocamidopropyl betaine produced in the manufacturing of DMAPA is considered as a toxic material in many personal care products. Various environmental rules and regulations governing the production of DMAPA in many countries may act as a restraint to the growth of the DMAPA market.

The demand for DMAPA products across the globe is mainly catered to by regional manufacturers. There are, however, various multinational companies operating globally and producing DMAPA. Some of the major player in the DMAPA market are BASF SE (Germany), Eastman Chemical Company (U.S.), Huntsman Corporation (U.S.), Air Products and Chemicals (U.S.), Alkyl Amines Chemical Ltd. (India), and others. BASF is the biggest player, enjoying the largest market share of the global DMAPA market. Huntsman is mainly active in the European DMAPA market.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency and Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data From Secondary Sources

2.4.2 Key Data From Primary Sources

2.4.2.1 Key Industry Insights

2.5 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the DMAPA Market

4.2 DMAPA Market: Major Regions

4.3 DMAPA Market Share By Application and Region

4.4 DMAPA Market Attractiveness: Major Countries

4.5 DMAPA Market Fastest-Growing Countries

4.6 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Versatile and Unique Physical and Chemical Properties

5.3.1.2 Increasing Demand From End-Use Industries

5.3.1.3 Increasing Demand From Emerging Economies

5.3.2 Restraints

5.3.2.1 Stringent Governmental and Environmental Regulations

5.3.2.2 Fluctuation in Raw Material Prices

5.3.3 Opportunities

5.3.3.1 Scope for Small Businesses to Expand

5.3.4 Challenges

5.3.4.1 More Cheaper Alternative of Betaine

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Material Supplier

6.2.2 DMAPA Manufacturers/Formulators

6.2.3 DMAPA Distributor

6.2.4 End-Use Industries

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

7 DMAPA Market, By Application (Page No. - 42)

7.1 Introduction

7.2 Personal Care

7.3 PU Catalyst

7.4 Water Treatment

7.5 Agriculture

7.6 Pharmaceuticals

7.7 Others

8 Regional Analysis (Page No. - 54)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 India

8.3 Europe

8.3.1 U.K.

8.3.2 Germany

8.3.3 France

8.3.4 Italy

8.4 North America

8.4.1 U.S.

8.4.2 Canada

8.4.3 Mexico

8.5 Rest of the World

8.5.1 Brazil

8.5.2 Middle-East

9 Competitive Landscape (Page No. - 82)

9.1 Introduction

9.2 Competitive Situations and Trends

9.3 Mergers & Acquisitions

9.4 Expansions & Investments

10 Company Profiles (Page No. - 86)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Introduction

10.2 BASF SE

10.3 Eastman Chemical Company

10.4 Air Products & Chemicals Inc.

10.5 Alkyl Amines Chemical Ltd.

10.6 Huntsman Corporation

10.7 Solvay S.A.

10.8 Hans Group Ltd.

10.9 Realet Chemical Technology Co Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 103)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (58 Tables)

Table 1 DMAPA Market Size, By Application, 20152020 (USD Million)

Table 2 DMAPA Market Size, By Application, 20152020 (KT)

Table 3 DMAPA Market Size in Personal Care, By Region, 20132020 (USD Million)

Table 4 DMAPA Market Size in Personal Care, By Region, 20132020 (KT)

Table 5 DMAPA Market Size in PU Catalyst, By Region, 20132020 (USD Million)

Table 6 DMAPA Market Size in PU Catalyst, By Region, 20132020 (KT)

Table 7 DMAPA Market Size in Water Treatment, By Region, 20132020 (USD Million)

Table 8 DMAPA Market Size in Water Treatment, By Region, 20132020 (KT)

Table 9 DMAPA Market Size in Agriculture, By Region, 20132020 (USD Million)

Table 10 DMAPA Market Size in Agriculture, By Region, 20132020 (KT)

Table 11 DMAPA Market Size in Pharmaceuticals, By Region, 20132020 (USD Million)

Table 12 DMAPA Market Size in Pharmaceuticals, By Region, 20132020 (KT)

Table 13 DMAPA Market Size in Others Segment, By Region, 20132020 (USD Million)

Table 14 DMAPA Market Size in Others Segment, By Region, 20132020 (KT)

Table 15 DMAPA Market Size, By Region, 20132020 (KT)

Table 16 DMAPA Market Size, By Region, 20132020 (USD Million)

Table 17 Asia-Pacific: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 18 Asia-Pacific: DMAPA Market Size, By Application, 20132020 (KT)

Table 19 China: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 20 China: DMAPA Market Size, By Application, 20132020 (KT)

Table 21 Japan: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 22 Japan: DMAPA Market Size, By Application, 20132020 (KT)

Table 23 India: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 24 India: DMAPA Market Size, By Application, 20132020 (KT)

Table 25 Europe: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 26 Europe: DMAPA Market Size, By Application, 20132020 (KT)

Table 27 U.K.: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 28 U.K.: DMAPA Market Size, By Application, 20132020 (KT)

Table 29 Germany: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 30 Germany: DMAPA Market Size, By Application, 20132020 (KT)

Table 31 France: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 32 France: DMAPA Market Size, By Application, 20132020 (KT)

Table 33 Italy: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 34 Italy: DMAPA Market Size, By Application, 20132020 (KT)

Table 35 North America: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 36 North America: DMAPA Market Size, By Application, 20132020 (KT)

Table 37 U.S.: DMAPA Market Size, By Aplication, 20132020 (USD Million)

Table 38 U.S.: DMAPA Market Size, By Application, 20132020 (KT)

Table 39 Canada: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 40 Canada: DMAPA Market Size, By Application, 20132020 (KT)

Table 41 Mexico: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 42 Mexico: DMAPA Market Size, By Application, 20132020 (KT)

Table 43 RoW: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 44 RoW: DMAPA Market Size, By Application, 20132020 (KT)

Table 45 Brazil: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 46 Brazil: DMAPA Market Size, By Application, 20132020 (KT)

Table 47 Middle-East: DMAPA Market Size, By Application, 20132020 (USD Million)

Table 48 Middle-East: DMAPA Market Size, By Application, 20132020 (KT)

Table 49 Mergers & Acquisitions, 20112015

Table 50 Expansions & Investments, 20112015

Table 51 BASF SE: Products and Their Description

Table 52 Eastman Chemical Company: Products and Their Description

Table 53 Air Products & Chemicals Inc.: Products and Their Description

Table 54 Alkyl Amines Chemical Ltd.: Products and Their Description

Table 55 Huntsman Corporation: Products and Their Description

Table 56 Solvay S.A.: Products and Their Description

Table 57 Hans Group Ltd.: Products and Their Description

Table 58 Realet Chemical Technology Co Ltd.: Products and Their Description

List of Figures (51 Figures)

Figure 1 DMAPA Market Segmentation

Figure 2 DMAPA Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Asia-Pacific Was the Largest Market of DMAPA in 2014

Figure 8 Personal Care Application to Dominate DMAPA Market Between 2015 and 2020

Figure 9 DMAPA Market in Asia-Pacific to Register Highest Growth During Forecast Period

Figure 10 DMAPA Market Size, By Value

Figure 11 Asia Pacific to Be Fastest-Growing Region Between 2015 and 2020

Figure 12 Personal Care and Asia-Pacific Commands Major Market Share in 2014

Figure 13 China Was the Fastest-Growing Market for DMAPA in 2014

Figure 14 DMAPA: Top 5 Countries in Terms of CAGR (20152020)

Figure 15 High Growth Potential in Asia-Pacific and RoW Regions for DMAPA

Figure 16 DMAPA Market, By Application

Figure 17 DMAPA Market, By Region

Figure 18 Drivers, Restraints, Opportunities, and Challenges in the DMAPA Market

Figure 19 Overview of DMAPA Value Chain

Figure 20 Porters Five Forces Analysis

Figure 21 Personal Care Expected to Drive DMAPA Market, 2015 vs 2020

Figure 22 Europe: the Largest Market for DMAPA in Personal Care By Value, 2014

Figure 23 Asia-Pacific: the Fastest Growing Region for DMAPA in PU Catalyst Application, 2014

Figure 24 APAC: the Largest Market for DMAPA in Water Treatment, (20152020)

Figure 25 APAC: the Largest Market for DMAPA in Agriculture Segment (20152020)

Figure 26 Asia-Pacific to Witness Fastest Growth Rate in DMAPA Pharmaceuticals Market Between 2015 and 2020

Figure 27 DMAPA Market, By Region, 2014 (Value)

Figure 28 DMAPA Market in Different Application, By Region, 20152020

Figure 29 DMAPA Asia-Pacific Market Snapshot, 20142020

Figure 30 China DMAPA Market, By Application, 2015 vs 2020 (USD Million)

Figure 31 DMAPA Europe Market Snapshot, 20142020

Figure 32 UK DMAPA Market, By Application, 2015 vs 2020 (USD Million)

Figure 33 Germany DMAPA Market, By Application, 2015 vs 2020

Figure 34 North America DMAPA Market Snapshot, 20142020

Figure 35 US DMAPA Market, By Application, 2015 vs 2020 (USD Million)

Figure 36 Mexico DMAPA Market, By Application, 2015 vs 2020

Figure 37 RoW DMAPA Market Snapshot, 20142020

Figure 38 Brazil DMAPA Market, By Application, 2015 vs 2020 (USD Million)

Figure 39 Expansion: Most Preferred Strategy By Key Companies, 20112015

Figure 40 Regional Revenue Mix of Top 5 Market Players

Figure 41 BASF SE : Company Snapshot

Figure 42 BASF SE: SWOT Analysis

Figure 43 Eastman Chemical Company: Company Snapshot

Figure 44 Eastman Chemical Company: SWOT Analysis

Figure 45 Air Products & Chemicals Inc.: Company Snapshot

Figure 46 Air Products & Chemicals Inc.: SWOT Analysis

Figure 47 Alkyl Amines Chemical Ltd: Company Snapshot

Figure 48 Alkyl Amines Chemical Ltd.: SWOT Analysis

Figure 49 Huntsman Corporation : Company Snapshot

Figure 50 Huntsman Corporation: SWOT Analysis

Figure 51 Solvay S.A.: Company Snapshot

Growth opportunities and latent adjacency in Dimethylaminopropylamine (DMAPA) Market