Alkylamines Market by Types (Methylamines, Ethylamines, Propylamines, Butylamines, & Cyclohexylamines), by Application (Solvents, Agrochemicals, Rubber Processing, Water Treatment, Feed Additives, Paper, Pharma, & Others) - Global Forecasts to 2019

[116 Pages Report] The global alkylamines market is estimated to grow from $4,097.34 million in 2014 to $5,611.23 million by 2019, at a CAGR of 6.5% from 2014 to 2019. The Alkylamine Market, along with its end products, has witnessed an improved growth in the past few years. This is projected to remain the same in the next five years, especially in the Asia-Pacific and RoW regions. Leading manufacturers and their strategies, to balance the current demand-supply issues and newer applications developments across the vertical industries are expected to be the key influencing factors in the alkylamine market. The industry is expected to increase its emphasis on the use of different applications of alkylamine that is expected to significantly drive its consumption in the next five years.

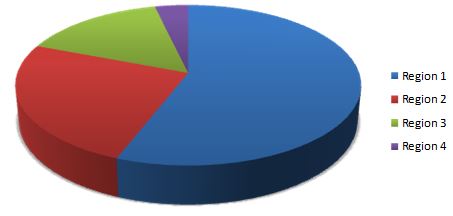

Asia-Pacific and RoW regions are witnessing considerable amount of investments by various market players to serve the end-user applications industry in the future. Asia-Pacific is the main alkylamines market, which accounted for more than half of market share of the total global demand in 2013. The rising demand from the major application industries such as solvents, agrochemicals, and water treatment applications are further expected to drive the demand in the next five years. The solvent application is the largest segment to consume alkylamines, which held more than one third of the total amines market. It is driven by the end use markets such as construction and automobile segments which are seeing an enhanced growth in the last two years. The agrochemicals market growth is supported by growing population in Asia-Pacific region and their needs towards the agro products.

This study aims to estimate the global market of alkylamines for 2012 and to project the expected demand of the same by 2019. This market research study provides a detailed qualitative and quantitative analysis of the global alkylamines market. We have used various secondary sources such as industry journals, directories, and other paid databases to identify and collect information useful for this extensive commercial study of the amines market. The primary sources experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess the future prospects of amines.

Competitive scenarios of the top players in the alkylamines market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include key amines manufacturers such as Taminco (Belgium), BASF SE (Germany), DuPont (U.S.), Arkema (France), Luxi Chemical Co., Ltd.(China), Feicheng Acid Chemicals Co. Ltd. (China), Shandong Huala Hengsheng Chemical Co. Ltd. (China), Koei Chemical Company (Japan), Mitsubishi Gas Chemical Company (Japan), Alkyl Amines Chemicals Ltd. (India), and Others.

Scope of the report:

This research report categorizes the global market for alkylamines on the basis of types, applications, and geography along with forecasting volumes, revenues, and analyzing trends in each of the submarkets.

On the basis of applications:

The alkylamines market is segmented on the basis of industry applications such as solvents, agrochemicals, rubber processing, water treatment, feed additives, paper chemicals, pharmaceuticals, others. Each application is further described in detail in the report with volume and revenue forecasts for each application.

On the basis of types:

The amines market is segmented on the basis of types Methylamines, Higher Alkylamines (ethylamines, propylamines, butylamines, & cyclohexylamines). Each type is further described in detail in the report with volume and revenue forecast.

On the basis of geography:

A detailed segmentation is done for amines for key regions that include Asia-Pacific, North America, Europe, and RoW and further for key countries in each region.

Alkylamines expecting 2,019.2 kilotons of market volume by 2019, signifies a firm compounded annual growth rate of over 4.7%.

The global alkylamines market, along with its end products, has witnessed a substantial growth in the past few years, and this growth is estimated to continue in the coming years. Industrial and consumer uses have created the upsurge in demand for alkylamines. Innovative production techniques and growing application base will be the key influencing factors for the global alkylamines market with the increased emphasis on different types and their applications. The global alkylamines market is estimated to grow $5,611.23 million by 2019, at a CAGR of 6.5% from 2014 to 2019.

Currently, Asia-Pacific is the largest consumer of alkylamines, globally. Among all the countries in the region China and India are the important consumers of alkylamines, volume wise China held more than three fourth of market in terms of volume market size in 2013. The demand is catered by Chinese as well as global players. The investments are coming from global players as well as different end-users in the Chinese market. In RoW, growing economies such as Brazil and The Middle East countries are projected to push the market in next five years.

More than half of volumetric share of alkylamines is been held by methylamines. Also, propylamines are expected to have a enhancing growth due to improved demand from the applications such as agrochemicals, water treatment, and pharmaceuticals. The Asia-Pacific and the RoW regions are the most active markets in terms of strategic initiatives, owing to their emerging demand. The growing population leads this rapid developments in the applications industry eventually pushing the demand of the alkylamines.

The important alkylamines manufacturers include Taminco (Belgium), BASF SE (Germany), DuPont (U.S.), Arkema (France), Luxi Chemical Co., Ltd.(China), Feicheng Acid Chemicals Co. Ltd. (China), Shandong Huala Hengsheng Chemical Co. Ltd. (China), Koei Chemical Company (Japan), Mitsubishi Gas Chemical Company (Japan), Alkyl Amines Chemicals Ltd. (India), and Others.

Alkylamines Market Share, by Geography, 2013

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

This report covers the alkylamines market by key regions and important countries in each region. It also provides a detailed segmentation of the alkylamines market on the basis of key applications and types, along with its projection till 2019.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Defination

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Year

1.3.3 Currency

1.3.4 Package Size

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Market Size Estimation

2.2 Market Crackdown & Data Triangulation

2.3 Market Share Estimation

2.4 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities in Alkylamines Market

4.2 Alkylamines Market- Major Types

4.3 Alkylamines Market in Asia-Pacific

4.4 China Dominates the Global Alkylamines Market

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Diversified Product Line

5.2.1.2 Huge Demand From Asia-Pacific

5.2.1.3 High-End Application Emergence

5.2.2 Restraint

5.2.2.1 Alkylamines Have to Be Transported Safely

5.2.3 Opportunities

5.2.3.1 Emerging Markets of Asean and the Middle East

5.2.3.2 Supply Agreement With Market Leading Customers

5.3 Challenges

5.3.1 Managing Gap Between Demand and Supply

5.3.2 Competition From Regional Players

6 Industry Trends (Page No. - 36)

6.1 Introduction

6.2 Value Chain

6.3 Porters Five Forces Analysis

6.3.1 Degree of Competition

6.3.2 Bargaining Power of Buyers

6.3.3 Bargaining Power of Suppliers

6.3.4 Threat of Substitutes

6.3.5 Threat of New Entrants

6.4 Price Analysis

7 Alkylamines Market, By Type (Page No. - 40)

7.1 Introduction

7.2 Methylamines

7.3 Ethylamines

7.4 Propylamines

7.5 Butylamines

7.6 Cyclohexylamines

8 Alkylamines Market, By Application (Page No. - 48)

8.1 Introduction

8.2 Solvents

8.3 Agrochemicals

8.4 Rubber Processing

8.5 Water Treatment

8.6 Feed Additives

8.7 Paper Chemicals

8.8 Pharmaceuticals

8.9 Other Industries

9 Alkylamines Market, Regional Analysis (Page No. - 58)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 Italy

9.3.3 U.K.

9.3.4 France

9.3.5 Others

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Southeast Asia

9.4.5 Others

9.5 ROW

9.5.1 Middle East

9.5.2 Brazil

9.5.3 Russia

9.5.4 Others

10 Competitive Landscape (Page No. - 79)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 Alkylamines Market Share Analysis, 2012

10.4 Investments & Expansions

10.5 Agreements, Partnerships, Collaborations & Joint Ventures

11 Company Profiles (Page No. - 84)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Introduction

11.2 BASF SE

11.3 Taminco

11.4 Mitsubishi Gas Chemical Company

11.5 Koei Chemical Company

11.6 Luxi Chemical Group Co., Ltd.

11.7 Feicheng Acid Chemicals Co. Ltd.

11.8 Alkyl Amines Chemicals Ltd.

11.9 Dupont

11.10 Arkema

11.11 Shandong Hualu-Hengsheng Chemical Co. Ltd.

11.12 OXEA GMBH

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 112)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Related Reports

List of Tables (70 Tables)

Table 1 Alkylamines Market Size, By Region, 20122019 (000 Tons)

Table 2 Alkylamines Market Size, By Region, 20122019 ($Million)

Table 3 Rising Demand for Agrochemicals & Water Treatment is Driving the Growth of the Alkylamines Market

Table 4 Key Opportunities in the Alkylamines Market

Table 5 Competition From Regional Players

Table 6 Alkylamines Market Size, By Type, 20122019 ($Million)

Table 7 Alkylamines Market Size, By Type, 20122019 (000 Tons)

Table 8 Methylamines Market Size, By Region, 20122019 ($Million)

Table 9 Methylamines Market Size, By Region, 20122019 (000 Tons)

Table 10 Ethylamines Market Size, By Region, 20122019 ($Million)

Table 11 Ethylamines Market Size, By Region, 20122019 (000 Tons)

Table 12 Propylamines Market Size, By Region, 20122019 ($Million)

Table 13 Propylamines Market Size, By Region, 20122019 (000 Tons)

Table 14 Butylamines Market Size, By Region, 20122019 ($Million)

Table 15 Butylamines Market Size, By Region, 20122019 (000 Tons)

Table 16 Cyclohexylamines Market Size, By Region, 20122019 ($Million)

Table 17 Cyclohexylamines Market, By Region, 20122019 (000 Tons)

Table 18 Alkylamines in Solvents Market Size, By Region, 20122019 ($Million)

Table 19 Alkylamines in Solvents Market Size, By Region, 20122019 (000 Tons)

Table 20 Alkylamines in Agrochemicals Market Size, By Region, 20122019 ($Million)

Table 21 Alkylamines in Agrochemicals Market Size, By Region, 20122019 (000 Tons)

Table 22 Alkylamines in Rubber Processing Market Size, By Region, 20122019 ($Million)

Table 23 Alkylamines in Rubber Processing Market Size, By Region, 20122019 (000 Tons)

Table 24 Alkylamines in Water Treatment Market Size, By Region, 20122019 ($Million)

Table 25 Alkylamines in Water Treatment Market Size, By Region, 20122019 (000 Tons)

Table 26 Alkylamines in Feed Additives Market Size, By Region, 20122019 ($Million)

Table 27 Alkylamines in Feed Additives Market Size, By Region, 20122019 (000 Tons)

Table 28 Alkylamines in Paper Chemicals Market Size, By Region, 20122019 ($Million)

Table 29 Alkylamines in Paper Chemical Market Size, By Region, 20122019 (000 Tons)

Table 30 Alkylamines in Pharmaceuticals Market Size, By Region, 20122019 ($Million)

Table 31 Alkylamines in Pharmaceuticals Market Size, By Region, 20122019 (000 Tons)

Table 32 Alkylamines in Others industry Market Size, By Region, 20122019 ($Million)

Table 33 Alkylamines in Others Industry Market Size, By Region, 20122019 (000 Tons)

Table 34 Alkylamines Market Size, By Region, 20122019 ($Million)

Table 35 Alkylamines Market, By Region, 20122019 (000 Tons)

Table 36 North America: Alkylamines Market Size, By Country, 20122019 ($Million)

Table 37 North America: Alkylamines Market Size, By Country, 20122019 (000 Tons)

Table 38 North America: Alkylamines Market Size, By Type, 20122019 ($Million)

Table 39 North America: Alkylamines Market Size, By Type, 20122019 (000 Tons)

Table 40 U.S.: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 41 Canada: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 42 Mexico: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 43 Europe: Alkylamines Market Size, By Country, 20122019 ($Million)

Table 44 Europe: Alkylamines Market Size, By Country, 20122019 (000 Tons)

Table 45 Europe: Alkylamines Market Size, By Type, 20122019 ($Million)

Table 46 Europe: Alkylamines Market Size, By Type, 20122019 (000 Tons)

Table 47 Germany: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 48 Italy: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 49 U.K.: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 50 France: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 51 Others: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 52 Asia-Pacific: Alkylamines Market Size, By Country, 20122019 ($Million)

Table 53 Asia-Pacific: Alkylamines Market Size, By Country, 20122019 (000 Tons)

Table 54 Asia-Pacific: Alkylamines Market Size, By Type, 20122019 ($Million)

Table 55 Asia-Pacific: Alkylamines Market Size, By Type, 20122019 (000 Tons)

Table 56 China: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 57 India: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 58 Japan: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 59 South-East Asia: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 60 Others: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 61 ROW: Alkylamines Market Size, By Country, 20122019 ($Million)

Table 62 ROW: Alkylamines Market Size, By Country, 20122019 (000 Tons)

Table 63 ROW: Alkylamines Market Size, By Type, 20122019 ($Million)

Table 64 ROW: Alkylamines Market Size, By Type, 20122019 (000 Tons)

Table 65 Middle East: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 66 Brazil: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 67 Russia: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 68 Others: Alkylamines Market Size, By Volume & Value, 2012-2019

Table 69 Investments & Expansions, 20102014

Table 70 Agreements, Partnerships, Collaborations & Joint Ventures, 20102014

List of Figures (55 Figures)

Figure 1 Alkylamines Market: Research Methodology

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation & Region

Figure 5 Alkylamines Market: Data Triangulation

Figure 6 Key Data From Secondary Sources

Figure 7 Key Data From Primary Sources

Figure 8 Assumptions

Figure 9 Solvents and Agrochemicals Set to Drive the Global Alkylamines Market

Figure 10 Asia-Pacific Dominates the Global Alkylamines Market

Figure 11 Asia-Pacific is the Fastest-Growing Alkylamines Market

Figure 12 Emerging Economies Will offer Lucrative Growth Potential for Market Players

Figure 13 Propylamines is Expected to Grow the Fastest Among All Types

Figure 14 Solvents Applications Account for the Largest Share in Asia-Pacific

Figure 15 China Registered the Largest Share of the Ethyleneamines Market in 2013

Figure 16 Asia-Pacific Market Expected to Grow Rapidly in the Next Five Years

Figure 17 Alkylamines Market Segmentation, By Type

Figure 18 Alkylamines Market Segmentation, By Application

Figure 19 Alkylamines Market Segmentation, By Region

Figure 20 Drivers, Restraints, Opportunities & Challenges in the Alkylamines Industry

Figure 21 Alkylamines Value Chain

Figure 22 Porters Five forces Analysis

Figure 23 Methylamines Dominate the Alkylamines Market, By Type, 2014 vs. 2019 (000 Tons)

Figure 24 Main Drivers for End-User Applications

Figure 25 Regional Snapshot (2019) Rapid Growth Markets Are Emerging as New Hot Spots

Figure 26 Asia-Pacific An Attractive Destination for All Alkylamines

Figure 27 Future Growth for Alkylamines Applications Centered on Asia-Pacific

Figure 28 North America Market Snapshot: Demand Will Be Driven By End-User Industries

Figure 29 Asia-Pacific Market Snapshot Drivers of End-User Applications

Figure 30 Key Driving Factors of the Alkylamines Market in Asia-Pacific

Figure 31 Companies Adopted Investments & Expansions as the Key Growth Strategy Over the Last Three Years

Figure 32 Battle for Market Share: Investment & Expansion Was the Key Strategy (2010-2014)

Figure 33 Alkylamines Market Share, By Key Players, 2012

Figure 34 Geographical Revenue Mix of Top Market Players

Figure 35 SWOT Analysis

Figure 36 Taminco: Business Overview

Figure 37 SWOT Analysis

Figure 38 Mitsubishi Gas Chemical Company: Business Overview

Figure 39 SWOT Analysis

Figure 40 Koei Chemical Company: Business Overview

Figure 41 SWOT Analysis

Figure 42 Luxi Chemical Group: Business Overview

Figure 43 SWOT Analysis

Figure 44 Feicheng Acid Chemicals: Business Overview

Figure 45 SWOT Analysis

Figure 46 Alkyl Amines Chemicals: Business Overview

Figure 47 SWOT Analysis

Figure 48 Dupont: Business Overview

Figure 49 SWOT Analysis

Figure 50 Arkema: Business Overview

Figure 51 SWOT Analysis

Figure 52 Shandong Hualu-Hengsheng Chemical: Business Overview

Figure 53 SWOT Analysis

Figure 54 OXEA GMBH: Business Overview

Figure 55 SWOT Analysis

Growth opportunities and latent adjacency in Alkylamines Market