Dimethylformamide (DMF) Market by Type (Reactant and Feedstock), End-use industries (Chemicals, Electronics, Pharmaceutical, and Agrochemical), and Region (Asia Pacific, Europe, North America, Europe, MEA and South America) - Global Forecast to 2027

Updated on : September 02, 2025

Dimethylformamide Market

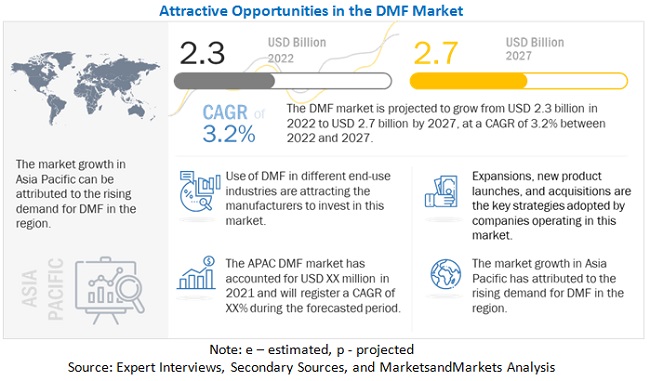

The dimethylformamide market was valued at USD 2.3 billion in 2022 and is projected to reach USD 2.7 billion by 2027, growing at 3.2% cagr from 2022 to 2027. The electronics, by end-use industry in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for DMF.

To know about the assumptions considered for the study, Request for Free Sample Report

Dimethylformamide Market Dynamics

Drivers: High demand in end-use industries

DMF is a universal solvent. It is used as a feedstock for the production of PU. PU is a key component used to manufacture consumer goods such as leather products and shoe soles. DMF as a feedstock is also used in the production of pharmaceutical and agrochemical products. It can also be used as an absorbing agent, mainly in electronics, acrylic fiber, and pharmaceutical products.

Restraints: Concerns regarding impact on health due to prolonged exposure

DMF is a universal solvent and is therefore used in many manufacturing companies. Hence, many people are exposed to it. DMF chemical is easily absorbed through the skin and can cause liver damage and other adverse health effects. It is also known to cause skin problems and alcohol intolerance. So, it is necessary for workers to avoid contact with DMF.

The National Institute for Occupational Safety and Health (NIOSH), Occupational Safety and Health Administration (OSHA), and the American Conference of Governmental Industrial Hygienists (ACGIH) recommended Permissible Exposure Limit (PEL) or threshold limit value for DMF, which is 10 parts of DMF per million parts of air or 30 milligrams of DMF per cubic meter of air (30 mg/m3). It is advised that workers should not be exposed to DMF solvent for more than eight hours due to the associated health risks.

Opportunities: Growing demand in automotive and electronic industries

DMF is commonly used in manufacturing extremely versatile PU elastomers. It offers high levels of elasticity, tensile strength, elongation, and shock-absorbing abilities while making shoes. PU also helps to make synthetic leather. Currently, synthetic leather is mostly used in the footwear industry and to some extent in the automobile industry. PU synthetic leather is light in weight; it looks classy and is comfortable. It is easy to maintain, water-resistant, abrasion-resistant, and can be dry-cleaned. Synthetic leather is a lower-cost alternative to real leather. Hence, it has more potential use in luxury cars in the automotive industry.

Challenges: Stringent regulations

Overexposure to DMF is hazardous to health and can cause skin, eye, nose, throat, and liver problems. DMF is manufactured using dimethylamine and carbon monoxide (CO). Breathing CO can cause headaches, dizziness, vomiting, and nausea. Hence, regulatory authorities such as Control of Substances Hazardous to Health (COSHH); European Union; Registration, Evaluation, Authorisation and Restriction of Chemicals; Globally Harmonized System (GHS); and the Environmental Protection Agency in Europe and North America regulate the use of this solvent in various applications.

Reactant type accounted for the largest segment of the DMF market between 2022 and 2027.

It is frequently used in chemical reactions and other applications, which require a high solvency power. DMF is soluble in both organic and inorganic substances. Polymers such as polyvinyl chloride, vinyl chloride, vinyl acetate copolymers, and some polyamides get easily dissolved in DMF. DMF is also used in epoxy-based formulations.

DMF is used in the pharmaceutical industry as a reaction and crystallization solvent because of its exceptional solvency. Inorganic and organic residual fluxes are highly soluble in DMF; therefore, this solvent is used as a cleaner to clean hot-dip tinned parts. This solvent acts as a reactant for the extraction of butadiene and other solvents. It also acts as a reactant for the dispersion of denatured Carbon Nanotubes (CNTs). DMF is also used as a carrier for inks and dyes in various printing and fiber-dyeing applications. In the petrochemical industry, DMF is used as an industrial solvent to produce petrochemical products, including butadiene. It is also used as a solvent to produce acrylic fibers.

To know about the assumptions considered for the study, download the pdf brochure

APAC is the fastest-growing DMF market.

Asia Pacific is the largest DMF market in terms of value and volume and is projected to be the fastest-growing market during the forecast period. The region has witnessed significant economic growth over the last decade.

Dimethylformamide Market Players

Shandong Hualu Hengsheng (China), Jiutian Chemical Group Limited (Singapore), Luxi Chemical Group Co., Ltd. (China), Shaanxi Xinghua Chemistry (China), and Shandong Jinmei Riyue Chemical Co., Ltd. (China) are the key players in the global DMF market.

Luxi Chemical manufactures, sells, and distributes chemical products. Its products include urea, compound fertilizer, ammonium phosphorous, alkali, liquid chlorine, DMF, methyl alcohol, chloride, potassium sulfate, hydrochloric acid, sulfuric acid, and ammonium bicarbonate. The company operates in five segments: chemicals, fertilizers, new energy equipment, Luxi R&D, and equipment. The company supplies its products to domestic as well as overseas markets, such as the US, Canada, Mexico, Pakistan, Germany, Russia, Australia, and others. The company competes with Mitsubishi Gas Chemical Company (Japan), BASF SE (Germany), and others.

Dimethylformamide Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2017-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Ton) |

|

Segments |

By Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Shandong Huala Hengsheng (China), Jiutian Chemical Group Limited (Singapore), Luxi Chemical Group Co., Ltd. (China), Shaanxi Xinghua Chemistry (China), and Shandong Jinmei Riyue Chemical Co., Ltd. (China). A total of 21 players have been covered. |

This research report categorizes the DMF market based on type, end-use industry, and region.

By Resin:

- Reactant

- Feedstock

By End-use industry:

- Chemicals

- Electronics

- Pharmaceutical

- Agrochemical

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of DMF?

The global DMF market is driven by the high demand in end-use industries such as chemicals, electronics, pharmaceuticals, agrochemicals, and others.

What are the major end-use industries for DMF?

The major end-use industries of DMF are chemicals, electronics, pharmaceuticals, agrochemicals, and others.

Who are the major manufacturers?

Shandong Hualu Hengsheng (China), jiutian Chemical Group Limited (China), Luxi Chemical Group Co., Ltd. (China), Shaanxi Xinghua Chemistry (China), and Shandong Jinmei Riyue Chemical Co., Ltd. (China) are some of the leading players operating in the global DMF market.

Why DMF are gaining market share?

The growth of this market is attributed to the growing demand in Asia Pacific and the increasing demand of DMF in the electronics industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 DMF MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 DMF MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS & LIMITATIONS

TABLE 1 RESEARCH ASSUMPTIONS

TABLE 2 RESEARCH LIMITATIONS

TABLE 3 RISK ANALYSIS

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 35)

TABLE 4 DMF MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 5 CHEMICAL END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

FIGURE 6 ASIA PACIFIC TO LEAD DMF MARKET DURING FORECAST PERIOD (USD MILLION)

FIGURE 7 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING DMF MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN DMF MARKET

FIGURE 8 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 DMF MARKET, BY END-USE INDUSTRY

FIGURE 9 CHEMICALS INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE

4.3 DMF MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 10 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.4 DMF MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 11 DMF MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

4.5 DMF MARKET, BY MAJOR COUNTRIES

FIGURE 12 INDIA TO REGISTER HIGHEST CAGR IN MARKET

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DMF MARKET

5.2.1 DRIVERS

5.2.1.1 High demand in end-use industries

5.2.1.2 High demand for DMF in Asia Pacific

5.2.2 RESTRAINTS

5.2.2.1 Concerns regarding impact on health due to prolonged exposure

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand in automotive and electronic industries

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations

5.3 PORTER'S FIVE FORCES ANALYSIS

TABLE 5 DMF MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 14 PORTER'S FIVE FORCES ANALYSIS: DMF MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACRO INDICATOR ANALYSIS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2019–2027

5.4.3 TRENDS IN ELECTRONICS INDUSTRY

FIGURE 15 ESTIMATED GROWTH RATES FOR GLOBAL ELECTRONICS INDUSTRY FROM 2020 TO 2022, BY REGION

5.4.4 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 7 AUTOMOTIVE PRODUCTION, BY COUNTRY, 2018–2021

5.4.5 TRENDS IN FOOTWEAR INDUSTRY

FIGURE 16 DISTRIBUTION OF FOOTWEAR PRODUCTION, BY REGION (QUANTITY), 2021

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 DMF: VALUE CHAIN ANALYSIS

FIGURE 18 DMF VALUE CHAIN: PLAYERS AT EACH NODE

5.6 PRICING ANALYSIS

FIGURE 19 AVERAGE PRICE COMPETITIVENESS IN DMF MARKET, BY REGION

5.7 DMF ECOSYSTEM AND INTERCONNECTED MARKET

TABLE 8 DMF MARKET: SUPPLY CHAIN

5.8 TRADE ANALYSIS

TABLE 9 COUNTRY-WISE IMPORT VALUE DATA, METHYLAMINE OR DIMETHYLAMINE OR TRIMETHYLAMINE AND THEIR SALTS, 2019–2021 (USD THOUSAND)

TABLE 10 COUNTRY-WISE EXPORT VALUE DATA, METHYLAMINE OR DIMETHYLAMINE OR TRIMETHYLAMINE AND THEIR SALTS, 2019–2021 (USD THOUSAND)

5.9 REGULATIONS AND GUIDELINES

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

TABLE 11 TOTAL NUMBER OF DOCUMENTS

FIGURE 20 NUMBER OF DOCUMENTS, 2011–2021

FIGURE 21 PUBLICATION TRENDS, 2011–2021

5.10.3 LEGAL STATUS OF PATENTS

FIGURE 22 LEGAL STATUS OF PATENTS

5.10.4 JURISDICTION ANALYSIS

FIGURE 23 PATENTS PUBLISHED BY JURISDICTION, 2011–2021

5.10.5 TOP APPLICANTS

FIGURE 24 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2011–2021

TABLE 12 LIST OF PATENTS

TABLE 13 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 14 DMF MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 DMF MARKET, BY TYPE (Page No. - 69)

6.1 INTRODUCTION

FIGURE 25 REACTANT TO BE DOMINANT TYPE IN DMF MARKET

TABLE 17 DMF MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 18 DMF MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 19 DMF MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 20 DMF MARKET SIZE, BY TYPE, 2022–2027 (TON)

6.2 REACTANT

6.2.1 DMF USED IN PHARMACEUTICAL INDUSTRY AS REACTION AND CRYSTALLIZATION SOLVENT FOR ITS SUPERIOR SOLVENCY

TABLE 21 DMF MARKET SIZE AS REACTANT, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 DMF MARKET SIZE AS REACTANT, BY REGION, 2022–2027 (USD MILLION)

TABLE 23 DMF MARKET SIZE AS REACTANT, BY REGION, 2018–2021 (TON)

TABLE 24 DMF MARKET SIZE AS REACTANT, BY REGION, 2022–2027 (TON)

6.3 FEEDSTOCK

6.3.1 DMF MAINLY USED AS FEEDSTOCK FOR PU PRODUCTION

TABLE 25 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2018–2021 (TON)

TABLE 28 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2022–2027 (TON)

7 DMF MARKET, BY END-USE INDUSTRY (Page No. - 75)

7.1 INTRODUCTION

TABLE 29 DMF: END-USE INDUSTRY AND APPLICATION

FIGURE 26 CHEMICAL TO BE DOMINANT END-USE INDUSTRY IN DMF MARKET

TABLE 30 DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 31 DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 32 DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 33 DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

7.2 CHEMICAL

7.2.1 LARGEST END-USE INDUSTRY OF DMF

7.2.2 POLYURETHANE (PU)

7.2.3 OTHERS

TABLE 34 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 37 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2022–2027 (TON)

7.3 ELECTRONICS

7.3.1 INCREASED USE OF DMF AS A SOLVENT WHILE MANUFACTURING ELECTRONIC PRODUCTS

TABLE 38 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 41 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (TON)

7.4 PHARMACEUTICAL

7.4.1 USED AS REACTION AND EXTRACTION SOLVENT FOR PHARMACEUTICAL PREPARATIONS

TABLE 42 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 45 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2022–2027 (TON)

7.5 AGROCHEMICAL

7.5.1 IMPORTANT CONSTITUENT FOR SYNTHESIS OF PESTICIDES

TABLE 46 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 49 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2022–2027 (TON)

7.6 OTHERS

TABLE 50 DMF MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 DMF MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 DMF MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (TON)

TABLE 53 DMF MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (TON)

8 DMF MARKET, BY REGION (Page No. - 87)

8.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC TO LEAD DMF MARKET BY 2027

TABLE 54 DMF MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 DMF MARKET SIZE, BY REGION, 2022–2027(USD MILLION)

TABLE 56 DMF MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 57 DMF MARKET SIZE, BY REGION, 2022–2027 (TON)

8.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: DMF MARKET SNAPSHOT

TABLE 58 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 60 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 61 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 62 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 63 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 64 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 65 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 66 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 69 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

8.2.1 CHINA

8.2.1.1 Largest DMF market in Asia Pacific

TABLE 70 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 71 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 72 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 73 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.2 JAPAN

8.2.2.1 Different end-use industries to boost demand

TABLE 74 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 75 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 76 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 77 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.3 SOUTH KOREA

8.2.3.1 Increased industrialization to drive demand

TABLE 78 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 79 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 80 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 81 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.4 INDIA

8.2.4.1 Government initiative to boost country’s economy contributes to market growth

TABLE 82 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 83 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 84 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 85 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.5 INDONESIA

8.2.5.1 Changing FDI policies likely to drive market

TABLE 86 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 87 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 88 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 89 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.6 THAILAND

8.2.6.1 Growth in synthetic leather industry to drive market

TABLE 90 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 91 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 92 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 93 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.7 AUSTRALIA AND NEW ZEALAND

8.2.7.1 Pharmaceutical industry to have high impact on market

TABLE 94 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 97 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.8 REST OF ASIA PACIFIC

TABLE 98 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 101 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA: DMF MARKET SNAPSHOT

TABLE 102 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 105 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 106 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 107 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 109 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 110 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 113 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

8.3.1 US

8.3.1.1 Growth in major end-use industries to boost demand

TABLE 114 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 115 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 116 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 117 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.2 CANADA

8.3.2.1 Automotive sector to play major role in driving demand

TABLE 118 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 119 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 120 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 121 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.3 MEXICO

8.3.3.1 Electronics industry to drive market in Mexico

TABLE 122 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 123 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 124 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 125 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4 EUROPE

TABLE 126 EUROPE: DMF MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 127 EUROPE: DMF MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 EUROPE: DMF MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 129 EUROPE: DMF MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 130 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 131 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 132 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 133 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 134 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 135 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 136 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 137 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

8.4.1 GERMANY

8.4.1.1 Developments in automotive industry likely to boost demand

TABLE 138 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 139 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 140 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 141 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.2 FRANCE

8.4.2.1 Multiple end-use industries to boost demand

TABLE 142 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 143 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 144 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 145 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.3 ITALY

8.4.3.1 Numerous motor manufacturing companies shifting production facilities to Italy, creating growth opportunities

TABLE 146 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 147 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 148 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 149 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.4 UK

8.4.4.1 Innovative and energy-efficient technology in household appliances to increase demand

TABLE 150 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 151 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 152 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 153 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.5 SPAIN

8.4.5.1 Investment in various end-use industries to boost demand

TABLE 154 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 155 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 156 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 157 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.6 NETHERLANDS

8.4.6.1 Pharmaceutical industry to boost demand

TABLE 158 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 159 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 160 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 161 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.7 TURKEY

8.4.7.1 Use of DMF in manufacturing of drugs to drive demand

TABLE 162 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 163 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 164 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 165 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.8 REST OF EUROPE

TABLE 166 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 167 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 168 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 169 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5 SOUTH AMERICA

TABLE 170 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 171 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 173 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 174 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 175 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 176 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 177 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 178 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 179 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 180 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 181 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

8.5.1 BRAZIL

8.5.1.1 One of the fastest-growing manufacturing hubs globally

TABLE 182 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 183 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 184 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 185 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.2 ARGENTINA

8.5.2.1 Strategic Industrial Plan 2020 supporting DMF market

TABLE 186 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 187 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 188 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 189 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.3 CHILE

8.5.3.1 Low market growth for DMF

TABLE 190 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 191 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 192 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 193 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.4 PERU

8.5.4.1 Automotive, pharmaceutical, and electronic solution industries are driving market

TABLE 194 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 195 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 196 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 197 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.5 REST OF SOUTH AMERICA

TABLE 198 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 199 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 200 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 201 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6 MIDDLE EAST & AFRICA

TABLE 202 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 205 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 206 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 209 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 210 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 213 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

8.6.1 AFRICA

8.6.1.1 Growing construction and automotive industries will impact market growth

TABLE 214 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 215 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 216 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 217 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6.2 SAUDI ARABIA

8.6.2.1 Increased local car sales to support market growth

TABLE 218 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 219 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 220 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 221 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6.3 IRAN

8.6.3.1 Different end-use industries likely to drive market

TABLE 222 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 223 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 224 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 225 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 226 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 227 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 228 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 229 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9 COMPETITIVE LANDSCAPE (Page No. - 160)

9.1 OVERVIEW

TABLE 230 OVERVIEW OF STRATEGIES ADOPTED BY KEY DMF PLAYERS

9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

9.2.1 STAR COMPANIES

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE COMPANIES

9.2.4 PARTICIPANTS

FIGURE 30 DMF MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

9.3 STRENGTH OF PRODUCT PORTFOLIO

9.4 SME MATRIX, 2021

9.4.1 RESPONSIVE COMPANIES

9.4.2 PROGRESSIVE COMPANIES

9.4.3 STARTING BLOCKS

9.4.4 DYNAMIC COMPANIES

FIGURE 31 DMF MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES COMPETITIVE LEADERSHIP MAPPING, 2021

9.5 MARKET SHARE ANALYSIS

FIGURE 32 MARKET SHARE, BY KEY PLAYERS (2021)

9.6 REVENUE ANALYSIS

9.6.1 SHANDONG HUALU HENGSHENG

9.6.2 JIUTIAN CHEMICAL GROUP LIMITED

9.6.3 LUXI CHEMICAL GROUP CO., LTD

9.6.4 SHAANXI XINGHUA CHEMISTRY

9.6.5 SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.

9.7 COMPETITIVE BENCHMARKING

TABLE 231 DMF MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 232 DMF MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

9.8 MARKET RANKING ANALYSIS

TABLE 233 MARKET RANKING ANALYSIS 2021

9.8.1 COMPETITIVE SITUATIONS AND TRENDS

TABLE 234 DMF MARKET: PRODUCT LAUNCHES, 2016–2022

TABLE 235 DMF MARKET: DEALS, 2016–2022

10 COMPANY PROFILES (Page No. - 171)

(Business overview, Products offered, Recent developments & MnM View)*

10.1 MAJOR PLAYERS

10.1.1 SHANDONG HUALU HENGSHENG

TABLE 236 SHANDONG HUALU HENGSHENG: COMPANY OVERVIEW

10.1.2 JIUTIAN CHEMICAL GROUP LIMITED

TABLE 237 JIUTIAN CHEMICAL GROUP LIMITED: COMPANY OVERVIEW

FIGURE 33 JIUTIAN CHEMICAL GROUP LIMITED: COMPANY SNAPSHOT

10.1.3 LUXI CHEMICAL GROUP CO., LTD

TABLE 238 LUXI CHEMICAL: COMPANY OVERVIEW

10.1.4 SHAANXI XINGHUA CHEMISTRY CO., LTD.

TABLE 239 SHAANXI XINGHUA CHEMISTRY: COMPANY OVERVIEW

10.1.5 SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.

TABLE 240 SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.: COMPANY OVERVIEW

10.1.6 BASF

TABLE 241 BASF: COMPANY OVERVIEW

FIGURE 34 BASF: COMPANY SNAPSHOT

TABLE 242 BASF: PRODUCT LAUNCHES

TABLE 243 BASF: OTHERS

10.1.7 EASTMAN CHEMICAL COMPANY

TABLE 244 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 35 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 245 EASTMAN CHEMICAL COMPANY: DEALS

10.1.8 HAOHUA JUNHUA GROUP CO., LTD.

TABLE 246 HAOHUA JUNHUA GROUP CO., LTD.: COMPANY OVERVIEW

10.1.9 CHINA XLX FERTILISER LTD.

TABLE 247 CHINA XLX FERTILISER LTD.: COMPANY OVERVIEW

10.1.10 MERCK KGAA

TABLE 248 MERCK KGAA: COMPANY OVERVIEW

FIGURE 36 MERCK KGAA: COMPANY SNAPSHOT

TABLE 249 MERCK KGAA: OTHERS

10.1.11 MITSUBISHI GAS CHEMICAL COMPANY

TABLE 250 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 37 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 251 MITSUBISHI GAS CHEMICAL COMPANY: DEALS

10.1.12 ZHEJIANG JIANGSHAN CHEMICAL CO., LTD.

TABLE 252 ZHEJIANG JIANGSHAN CHEMICAL CO., LTD.: COMPANY OVERVIEW

10.1.13 CHEMANOL

TABLE 253 CHEMANOL: COMPANY OVERVIEW

10.1.14 BALAJI AMINES

TABLE 254 BALAJI AMINES: COMPANY OVERVIEW

FIGURE 38 BALAJI AMINES: COMPANY SNAPSHOT

10.2 OTHER COMPANIES

10.2.1 AK-KIM

TABLE 255 AK-KIM: COMPANY OVERVIEW

10.2.2 PHARMCO PRODUCTS

TABLE 256 PHARMCO PRODUCTS: COMPANY OVERVIEW

10.2.3 ALPHA CHEMIKA

TABLE 257 ALPHA CHEMIKA: COMPANY OVERVIEW

10.2.4 HELM AG

TABLE 258 HELM AG: COMPANY OVERVIEW

10.2.5 JOHNSON MATTHEY DAVY TECHNOLOGIES

TABLE 259 JOHNSON MATTHEY DAVY TECHNOLOGIES: COMPANY OVERVIEW

10.2.6 CCL INTERNATIONAL CHEMICAL COMPANY

TABLE 260 CCL INTERNATIONAL CHEMICAL COMPANY: COMPANY OVERVIEW

10.2.7 EMCO DYESTUFF PVT. LTD.

TABLE 261 EMCO DYESTUFF PVT. LTD.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 200)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHORS DETAILS

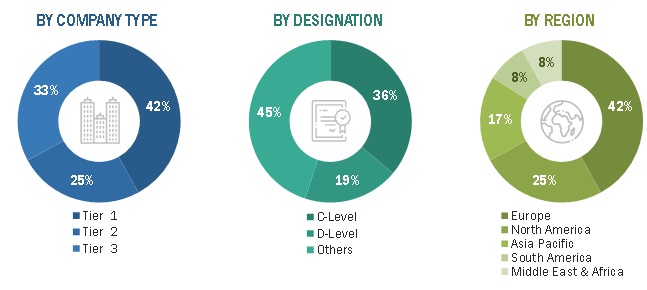

The study involves four major activities in estimating the current market size of DMF. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The DMF market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use indsutries, such as chemicals, electronics, pharmaceutical, agrochemical, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the DMF market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global DMF Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the Dimethylformamide (DMF) market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the DMF market by type, end-use industry, and region

- To forecast the DMF market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the DMF market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the DMF market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the DMF market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dimethylformamide (DMF) Market