Digital Pharmacy Market by Drug (Rx, OTC), Product (Medicine, Personal Care, Vitamins & Supplements, Diabetes, CVD, Oncology), Platform (Apps, Websites), Business Model (Captive, Franchise, Aggregator), Geographic (Urban, Rural) - Global Forecast to 2027

Market Growth Outlook Summary

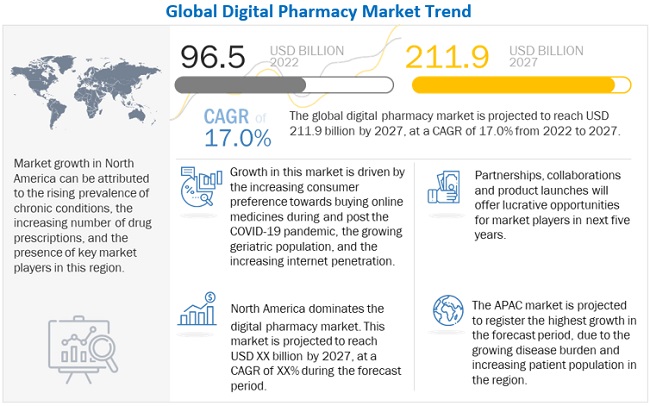

The global digital pharmacy market growth forecasted to transform from USD 96.5 billion in 2022 to USD 211.9 billion by 2027, driven by a CAGR of 17.0%. Key drivers include the rising consumer preference for online medicine purchases, especially during and after the COVID-19 pandemic, market consolidations, and the aging population. Challenges include the presence of illegal pharmacies and the lack of regulatory frameworks in certain regions, which hinder growth. Key players in this market include CVS Health, Cigna, Walgreens, Walmart, Amazon, and PharmEasy. Opportunities exist in emerging markets, especially in countries like China and India, with the elderly population driving demand. North America holds the largest market share due to its aging population and the presence of major market players.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Pharmacy Market Dynamics

Driver: How growth of consumer preference towards buying online medicines increased during and the post COVID-19?

COVID-19 is one of the leading social and health challenges of our time. The ongoing pandemic has forced a drastic transformation of life—at every level of society. The high infection rate of COVID-19 led to an increased demand for medication in hospitals and home care settings. COVID-19 has changed the way in which businesses are conducted. Consumer attitudes, behaviors, and purchasing habits have all changed—and many of these new patterns will remain post-pandemic. Nationwide lockdowns during the pandemic forced people to stay indoors. This pushed people to switch to online channels for the purchase of goods & services as well as to pay bills and consult with doctors. According to the FICCI 2020 report, more than 75% of all consumers cited that their online pharmacy purchases either increased or remained the same. This changing consumer behavior is expected to drive the market for digital pharmacy solutions in the coming years.

Restraint: How is growing illegal pharmacies restraining growth of the market?

Illegal internet pharmacies are often international operations with servers, shipping operations, and other parts of the business located in several countries. The WHO emphasizes that substandard and falsified products may result in patient harm and suboptimal treatment, leading to an overall mistrust of medications, healthcare providers, and the health system. In 2021, the FDA issued warning letters to website operators engaged in illegal activity in violation of the US Federal Food, Drug, and Cosmetic Act. Consumers seeking overseas options to obtain medicines also pose a threat to the pharmaceutical industry and pharmacists of the respective country. Such illegal buying behaviors can result in the loss of credibility and faith in online medicine and may hinder the greater adoption of digital pharmacy solutions globally

Challenge: Why is lack of strong national laws worldwide a critical challenging factor that is holding back growth of market?

According to the International Society for Pharmaceutical Engineering 2019, 66% of countries worldwide do not have laws that explicitly regulate or prohibit the online sales of medicinal products. As a result, regulatory authorities in these countries are only able to employ the “buyers beware” approach so that consumers remain vigilant when buying medicinal products online. The Federal Bureau of Investigation (FBI) estimated that there are more than 80,000 websites that allow individuals to place medication orders through illegal pharmacies. Customers choose to utilize online pharmacies over traditional brick-and-mortar pharmacies for a variety of reasons, including accessibility, time constraints, and potential cost savings. In Nigeria, the body responsible for licensing pharmacies, the Pharmacy Council of Nigeria, has developed rules to guide the regulatory process for e-pharmacies in 2016, but they have not yet been made public. Until an international legal framework is formed and agreed upon, illegal pharmacies will continue to expand and inappropriately dispense medications to consumers. This may hinder the growth of the digital pharmacy market in low-income and middle-income countries (LMICs).

Opportunity: What opportunities does increase in the emerging market?

Emerging economies are expected to become a focal point for growth in the digital pharmacy market. Developing countries possess a high geriatric population. In China, the population of individuals aged 65 years and above was estimated to be 131.4 million in 2015 and was expected to grow by 29.0% to reach 169.6 million by 2020 (Source: The United Nations Population Division Statistics). As the elderly are more susceptible to diseases, the rising geriatric population is expected to drive patient volumes in several countries across the globe. This, in turn, will increase the demand for digital pharmacy solutions. The developing economies, growing government support, rising life science research, and improving healthcare infrastructure in China, Korea, and India also compel pharmacies in these countries to opt for online platforms. Due to these factors, major players are investing in the Asia Pacific region.

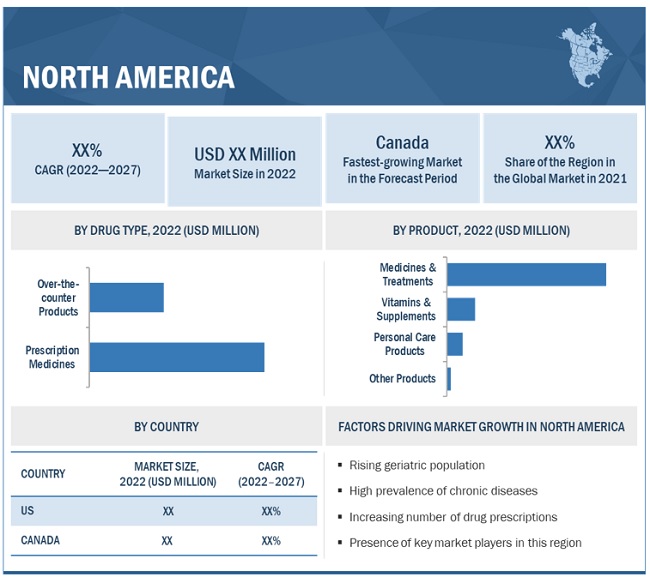

North America accounted for the largest share of the digital pharmacy market.

North America accounted for the largest share of the market. The increasing prevalence of chronic conditions, the rising number of drug prescriptions resulting from the rapidly growing aging population, and the presence of key market players in the region are the key factors driving the growth of the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players are CVS Health (US), Cigna (US), Optum, Inc. (Part of the UnitedHealth Group) (US), Walgreens Co. (US), Walmart Inc. (US), The Kroger Co. (US), Amazon.com, Inc. (US), GoodRx (US), Costco Wholesale Corporation (US), Rite Aid Corp. (US), Hims & Hers Health, Inc. (US), PharmEasy (India), Apollo Pharmacy (India), DocMorris (Netherlands), Giant Eagle Inc. (US), LloydsPharmacy (UK), Shop-apotheke.com (Netherlands), Tata 1mg (India), Netmeds.com (India), HealthWarehouse, Inc. (US), Pharmex Direct Inc. (Canada), Apex Pharmacy (UK), TELUS (Canada), RO Pharmacy (US), Rx Outreach (US), The Independent Pharmacy (UK), Rexall Pharmacy Group ULC (Canada), and NorthWestPharmacy.com (Canada). These players are increasingly focusing on product/service upgrades, acquisitions, partnerships, agreements, expansions, and collaborations to expand their product offerings in the digital pharmacy market

Scope of the Digital Pharmacy Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$96.5 billion |

|

Projected Revenue Size by 2027 |

$211.9 billion |

|

Industry Growth Rate |

poised to grow at a CAGR of 17.0% |

|

Growth Driver |

How growth of consumer preference towards buying online medicines increased during and the post COVID-19? |

|

Growth Opportunity |

What opportunities does increase in the emerging market? |

The study categorizes the Digital Pharmacy market to forecast revenue and analyze trends in each of the following submarkets:

By Drug Type

- Prescription Medicines

- Over-the-counter products

By Products

-

Medicines & Treatments, By Type

- Diabetes Care

- Heart Care

- Oncology

- Other Medicines & Treatments

- Personal Care Products

- Vitamins & Supplements

- Other Products

By Platform

- Apps

- Websites

By Business Model

- Captive

- Franchise

- Aggregator

By Geographic Coverage

- Urban Areas

- Rural Areas

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments:

- In 2021, Walgreens Co. (US) launched nationwide contactless same-day delivery services (in under two hours) for more than 24,000 products.

- In 2021, Rite Aid Corp. (US) partnered with Uber to deliver Rite Aid products nationwide through Uber Eats, allowing customers to conveniently order and receive essential healthcare and grocery items directly to their homes.

- In 2021, PharmEasy (India) acquired Medlife to become the largest healthcare delivery platform in India.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 DIGITAL PHARMACY MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DIGITAL PHARMACY MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.5.1 SCOPE-RELATED LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key industry insights

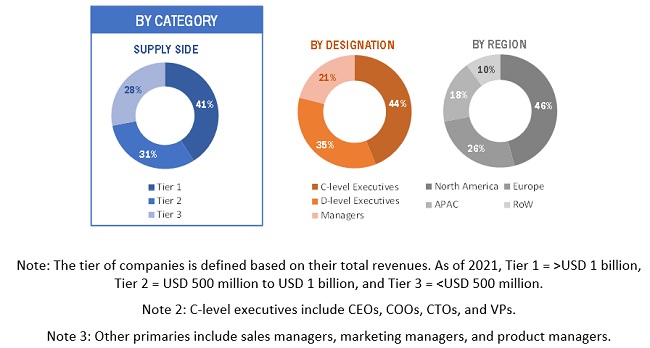

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET ESTIMATION

2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

2.2.2 APPROACH: REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION FOR CVS HEALTH

2.2.3 TOP-DOWN APPROACH: CONTRIBUTION-BASED MARKET SIZE ESTIMATION

FIGURE 7 DIGITAL PHARMACY MARKET: TOP-DOWN APPROACH

2.2.4 GROWTH FORECAST

FIGURE 8 IMPACT OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ON MARKET GROWTH & CAGR

FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: DIGITAL PHARMACY MARKET

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 11 DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY PLATFORM, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY BUSINESS MODEL, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY GEOGRAPHIC COVERAGE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THE DIGITAL PHARMACY MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 DIGITAL PHARMACY MARKET OVERVIEW

FIGURE 17 GROWING GERIATRIC POPULATION TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY PRODUCT

FIGURE 18 MEDICINES & TREATMENTS ACCOUNTED FOR THE LARGEST SHARE OF THE DIGITAL PHARMACY MARKET IN 2021

4.3 NORTH AMERICA: MARKET, BY DRUG & COUNTRY (2021)

FIGURE 19 PRESCRIPTION MEDICINES ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2021

4.4 GEOGRAPHICAL SNAPSHOT OF THE MARKET

FIGURE 20 ASIA PACIFIC MARKET TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.5 MARKET DYNAMICS

FIGURE 21 DIGITAL PHARMACY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

4.5.1 DRIVERS

4.5.1.1 Increasing consumer preference toward buying online medicines during and post the COVID-19 pandemic

TABLE 2 TOTAL NUMBER OF CONFIRMED CORONAVIRUS CASES, BY REGION (AS OF JANUARY 7, 2022)

4.5.1.2 Consolidation in the market and partnerships

4.5.1.3 Growing geriatric population

TABLE 3 GLOBAL OVERVIEW OF THE RISE IN THE AGING POPULATION (MILLION)

4.5.2 RESTRAINTS

4.5.2.1 Growing number of illegal pharmacies

4.5.2.2 Risk of counterfeit drugs

4.5.2.3 Increased risk of drug abuse

4.5.3 OPPORTUNITIES

4.5.3.1 Emerging markets

4.5.3.2 Benefits of E-commerce

4.5.4 CHALLENGES

4.5.4.1 Challenges for patients relying on pharmacists for clinical support

4.5.4.2 Lack of strong national laws worldwide

4.5.4.3 Security and privacy concerns

4.6 VALUE CHAIN ANALYSIS

4.7 ECOSYSTEM ANALYSIS

4.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 DIGITAL PHARMACY MARKET: PORTER’S FIVE FORCES ANALYSIS

4.8.1 INTENSITY OF COMPETITIVE RIVALRY

4.8.2 BARGAINING POWER OF SUPPLIERS

4.8.3 BARGAINING POWER OF BUYERS

4.8.4 THREAT FROM SUBSTITUTES

4.8.5 THREAT FROM NEW ENTRANTS

4.9 PRICING & REIMBURSEMENT ANALYSIS

5 COMPARISON OF AVERAGE DISCOUNTED PRICES FOR A ONE-MONTH SUPPLY OF DRUGS

4.10 TECHNOLOGY ANALYSIS

4.10.1 MACHINE LEARNING

4.10.2 INTERNET OF THINGS

4.10.3 BLOCKCHAIN

4.10.4 CLOUD COMPUTING

4.11 INDUSTRY TRENDS

4.11.1 ONLINE PRESCRIPTION REFILL

4.11.2 VIRTUAL HEALTHCARE SERVICES

4.11.3 DIGITAL HEALTH DIAGNOSTIC TOOLS

4.12 KEY CONFERENCES & EVENTS IN 2021–2022

4.13 REGULATORY ANALYSIS

4.13.1 NORTH AMERICA

4.13.1.1 US

4.13.1.2 Canada

4.13.2 EUROPE

4.13.3 ASIA PACIFIC

4.13.4 REST OF THE WORLD

TABLE 6 APPROACHES OF REGULATORY AUTHORITIES (RA) WORLDWIDE TO CONTROL MEDICINAL PRODUCT ONLINE SALES

4.14 CASE STUDIES

4.14.1 MAGENTO 2 WEB APP MODERNIZATION

4.14.1.1 Use Case 1: Need to Revamp Online Store

4.14.2 WALMART REACT NATIVE PHARMACY

4.14.2.1 Use Case 2: Need to Rebuild Pharmacy App

4.15 IMPACT OF COVID-19 ON THE DIGITAL PHARMACY MARKET

5 DIGITAL PHARMACY MARKET, BY DRUG TYPE (Page No. - 70)

5.1 INTRODUCTION

TABLE 7 MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

5.2 PRESCRIPTION MEDICINES

5.2.1 GROWING GERIATRIC POPULATION AND SUBSEQUENT INCREASE IN CHRONIC DISEASES TO DRIVE THE DEMAND FOR PRESCRIPTION MEDICATION

TABLE 8 MARKET FOR PRESCRIPTION MEDICINES, BY REGION, 2020–2027 (USD MILLION)

TABLE 9 NORTH AMERICA: MARKET FOR PRESCRIPTION MEDICINES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 10 EUROPE: MARKET FOR PRESCRIPTION MEDICINES, BY COUNTRY, 2020–2027 (USD MILLION)

5.3 OVER-THE-COUNTER PRODUCTS

5.3.1 EASE OF USE AND CONVENIENCE ASSOCIATED WITH OVER-THE-COUNTER PRODUCTS TO DRIVE MARKET GROWTH

TABLE 11 MARKET FOR OVER-THE-COUNTER PRODUCTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 NORTH AMERICA: DIGITAL PHARMACY MARKET FOR OVER-THE-COUNTER PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 13 EUROPE: MARKET FOR OVER-THE-COUNTER PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

6 DIGITAL PHARMACY MARKET, BY PRODUCT (Page No. - 76)

6.1 INTRODUCTION

TABLE 14 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 MEDICINES & TREATMENTS

TABLE 15 MARKET FOR MEDICINES & TREATMENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 16 NORTH AMERICA: MARKET FOR MEDICINES & TREATMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 17 EUROPE: MARKET FOR MEDICINES & TREATMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 ASIA PACIFIC: MARKET FOR MEDICINES & TREATMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 DIABETES CARE

6.2.1.1 Growing global diabetic population will ensure strong demand for diabetes care medicines & treatments

TABLE 20 MARKET FOR DIABETES CARE MEDICINES & TREATMENTS, BY REGION, 2020–2027 (USD MILLION)

6.2.2 HEART CARE

6.2.2.1 Rising incidence of cardiovascular diseases drives the demand for heart care medicines & treatments

TABLE 21 DIGITAL PHARMACY MARKET FOR HEART CARE MEDICINES & TREATMENTS, BY REGION, 2020–2027 (USD MILLION)

6.2.3 ONCOLOGY

6.2.3.1 Increasing prevalence of cancer is a major factor driving the growth of this market segment

TABLE 22 MARKET FOR ONCOLOGY MEDICINES & TREATMENTS, BY REGION, 2020–2027 (USD MILLION)

6.2.3.2 Other medicines & treatments

TABLE 23 MARKET FOR OTHER MEDICINES & TREATMENTS, BY REGION, 2020–2027 (USD MILLION)

6.3 PERSONAL CARE PRODUCTS

6.3.1 GROWING FOCUS ON PERSONAL HEALTH & HYGIENE TO DRIVE MARKET GROWTH

TABLE 24 DIGITAL PHARMACY MARKET FOR PERSONAL CARE PRODUCTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 EUROPE: MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 ASIA PACIFIC: MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 VITAMINS & SUPPLEMENTS

6.4.1 GROWING DEMAND FOR IMMUNITY-ASSOCIATED SUPPLEMENTS IN THE WAKE OF THE COVID-19 PANDEMIC TO DRIVE MARKET GROWTH

TABLE 28 DIGITAL PHARMACY MARKET FOR VITAMINS & SUPPLEMENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET FOR VITAMINS & SUPPLEMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 EUROPE: MARKET FOR VITAMINS & SUPPLEMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 ASIA PACIFIC: MARKET FOR VITAMINS & SUPPLEMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 OTHER PRODUCTS

TABLE 32 DIGITAL PHARMACY MARKET FOR OTHER PRODUCTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 EUROPE: MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 ASIA PACIFIC: MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

7 DIGITAL PHARMACY MARKET, BY PLATFORM (Page No. - 88)

7.1 INTRODUCTION

TABLE 36 MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

7.2 APPS

7.2.1 ADVANTAGES SUCH AS CONTACTLESS DELIVERY WILL DRIVE THE DEMAND FOR APPS

TABLE 37 DIGITAL PHARMACY APPS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: DIGITAL PHARMACY APPS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 39 EUROPE: DIGITAL PHARMACY APPS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 ASIA PACIFIC: DIGITAL PHARMACY APPS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 WEBSITES

7.3.1 PROMOTIONS, DISCOUNTS, AND OFFERS PROVIDED BY WEBSITES TO DRIVE MARKET GROWTH

TABLE 41 DIGITAL PHARMACY WEBSITES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: DIGITAL PHARMACY WEBSITES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 EUROPE: DIGITAL PHARMACY WEBSITES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 ASIA PACIFIC: DIGITAL PHARMACY WEBSITES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 DIGITAL PHARMACY MARKET, BY BUSINESS MODEL (Page No. - 94)

8.1 INTRODUCTION

TABLE 45 MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

8.2 CAPTIVE

8.2.1 FLEXIBILITY, ACCESSIBILITY, AND AFFORDABILITY OF CAPTIVE MODELS—KEY FACTORS DRIVING MARKET GROWTH

TABLE 46 MARKET FOR CAPTIVE MODELS, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET FOR CAPTIVE MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: MARKET FOR CAPTIVE MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET FOR CAPTIVE MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 FRANCHISE

8.3.1 GROWING NUMBER OF PHARMACY FRANCHISES TO DRIVE MARKET GROWTH

TABLE 50 MARKET FOR FRANCHISE MODELS, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR FRANCHISE MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: MARKET FOR FRANCHISE MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET FOR FRANCHISE MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 AGGREGATOR

8.4.1 QUALITY SERVICES ASSOCIATED WITH AGGREGATOR MODELS TO DRIVE MARKET GROWTH

TABLE 54 MARKET FOR AGGREGATOR MODELS, BY REGION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET FOR AGGREGATOR MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: MARKET FOR AGGREGATOR MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET FOR AGGREGATOR MODELS, BY COUNTRY, 2020–2027 (USD MILLION)

9 DIGITAL PHARMACY MARKET, BY GEOGRAPHIC COVERAGE (Page No. - 102)

9.1 INTRODUCTION

TABLE 58 MARKET, BY GEOGRAPHIC COVERAGE, 2020–2027 (USD MILLION)

9.2 URBAN AREAS

9.2.1 RAPID INTERNET PENETRATION IN URBAN AREAS TO DRIVE MARKET GROWTH IN THIS SEGMENT

TABLE 59 MARKET IN URBAN AREAS, BY REGION, 2020–2027 (USD MILLION)

9.3 RURAL AREAS

9.3.1 GOVERNMENT INITIATIVES TO FUEL THE DEMAND FOR DIGITAL PHARMACIES IN RURAL AREAS

TABLE 60 MARKET IN RURAL AREAS, BY REGION, 2020–2027 (USD MILLION)

10 DIGITAL PHARMACY MARKET, BY REGION (Page No. - 106)

10.1 INTRODUCTION

TABLE 61 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 IMPACT OF COVID-19 ON THE NORTH AMERICAN MARKET

FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY GEOGRAPHIC COVERAGE, 2020–2027 (USD MILLION)

10.2.2 US

10.2.2.1 The US is the largest regional market for digital pharmacy, mainly due to the rising prevalence of chronic conditions and the growing number of prescriptions

TABLE 69 US: KEY MACROINDICATORS

TABLE 70 US: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 71 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 72 US: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 US: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 74 US: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

TABLE 75 US: MARKET, BY GEOGRAPHIC COVERAGE, 2020–2027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Rising drug expenditures to propel market growth in Canada

TABLE 76 CANADA: KEY MACROINDICATORS

TABLE 77 CANADA: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 78 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 79 CANADA: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 CANADA: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 81 CANADA: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

TABLE 82 CANADA: MARKET, BY GEOGRAPHIC COVERAGE, 2020–2027 (USD MILLION)

10.3 EUROPE

10.3.1 IMPACT OF COVID-19 ON THE EUROPEAN DIGITAL PHARMACY MARKET

TABLE 83 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Germany is the fastest-growing market for digital pharmacies in Europe

TABLE 89 GERMANY: KEY MACROINDICATORS

TABLE 90 GERMANY: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 92 GERMANY: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 94 GERMANY: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Rising initiatives to improve the safety of digital pharmacies to boost the market growth

TABLE 95 UK: KEY MACROINDICATORS

TABLE 96 UK: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 97 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 98 UK: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 UK: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 100 UK: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Rising geriatric population in the country to support market growth

TABLE 101 FRANCE: KEY MACROINDICATORS

TABLE 102 FRANCE: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 103 FRANCE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 104 FRANCE: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 FRANCE: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 106 FRANCE: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Growing burden of chronic diseases is driving the market growth in Italy

TABLE 107 ITALY: KEY MACROINDICATORS

TABLE 108 ITALY: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 109 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 110 ITALY: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 ITALY: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 112 ITALY: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.3.6 SPAIN

10.3.6.1 Increasing focus on improving the healthcare infrastructure in the country to support market growth

TABLE 113 SPAIN: KEY MACROINDICATORS

TABLE 114 SPAIN: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 115 SPAIN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 116 SPAIN: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 SPAIN: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 118 SPAIN: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.3.7 ROE

TABLE 119 ROE: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 120 ROE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 121 ROE: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 ROE: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 123 ROE: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 IMPACT OF COVID-19 ON THE ASIA PACIFIC DIGITAL PHARMACY MARKET

FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Increasing consumer demand for OTC products to drive the market for digital pharmacy in China

TABLE 128 CHINA: KEY MACROINDICATORS

TABLE 129 CHINA: DIGITAL PHARMACY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 130 CHINA: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 131 CHINA: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Rising healthcare expenditures and the growing burden of non-communicable diseases (NCDs) to drive market growth in Japan

TABLE 132 JAPAN: KEY MACROINDICATORS

TABLE 133 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 135 JAPAN: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Favorable government initiatives and high density of rural population to support market growth in India

TABLE 136 INDIA: KEY MACROINDICATORS

TABLE 137 INDIA: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 138 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 139 INDIA: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 INDIA: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 141 INDIA: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 142 ROAPAC: DIGITAL PHARMACY MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 143 ROAPAC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 144 ROAPAC: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 145 ROAPAC: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 GROWING INTERNET USERS WILL FAVOR MARKET GROWTH IN LATAM

10.5.1.1 Impact of COVID-19 on the Latin American digital pharmacy market

TABLE 146 LATIN AMERICA: KEY MACROINDICATORS

TABLE 147 LATIN AMERICA: MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING DEMAND FOR ONLINE PHARMACEUTICAL PRODUCTS WILL DRIVE THE MARKET IN THE MEA

10.6.1.1 Impact of COVID-19 on the Middle East & Africa digital pharmacy market

TABLE 152 MEA: MARKET, BY DRUG TYPE, 2020–2027 (USD MILLION)

TABLE 153 MEA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 154 MEA: MARKET FOR MEDICINES & TREATMENTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 MEA: MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 156 MEA: MARKET, BY BUSINESS MODEL, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 154)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE DIGITAL PHARMACY MARKET

11.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

11.4 MARKET RANKING

FIGURE 24 US DIGITAL PHARMACY MARKET RANKING, BY KEY PLAYER, 2021

11.5 COMPETITIVE BENCHMARKING

11.5.1 OVERALL COMPANY FOOTPRINT

TABLE 157 OVERALL COMPANY FOOTPRINT

11.5.2 COMPANY DRUG TYPE FOOTPRINT

TABLE 158 COMPANY DRUG TYPE FOOTPRINT

11.5.3 COMPANY PRODUCT FOOTPRINT

TABLE 159 COMPANY PRODUCT FOOTPRINT

11.5.4 COMPANY PLATFORM FOOTPRINT

TABLE 160 COMPANY PLATFORM FOOTPRINT

11.5.5 COMPANY REGIONAL FOOTPRINT

TABLE 161 COMPANY REGIONAL FOOTPRINT

TABLE 162 DIGITAL PHARMACY MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 25 DIGITAL PHARMACY MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

11.7 COMPETITIVE LEADERSHIP MAPPING: START-UPS/SMES

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 26 COMPETITIVE LEADERSHIP MAPPING: START-UP/SME MATRIX MARKET

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT/SERVICE UPGRADES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 167)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 CVS HEALTH

TABLE 163 CVS HEALTH: BUSINESS OVERVIEW

FIGURE 27 CVS HEALTH: COMPANY SNAPSHOT (2021)

12.1.2 CIGNA

TABLE 164 CIGNA: BUSINESS OVERVIEW

FIGURE 28 CIGNA: COMPANY SNAPSHOT (2021)

12.1.3 OPTUM, INC. (PART OF THE UNITEDHEALTH GROUP)

TABLE 165 OPTUM, INC.: BUSINESS OVERVIEW

FIGURE 29 OPTUM, INC.: COMPANY SNAPSHOT (2021)

12.1.4 WALGREEN CO.

TABLE 166 WALGREEN CO.: BUSINESS OVERVIEW

FIGURE 30 WALGREEN CO.: COMPANY SNAPSHOT (2021)

12.1.5 WALMART INC.

TABLE 167 WALMART INC.: BUSINESS OVERVIEW

FIGURE 31 WALMART INC.: COMPANY SNAPSHOT (2021)

12.1.6 THE KROGER CO.

TABLE 168 THE KROGER CO.: BUSINESS OVERVIEW

FIGURE 32 THE KROGER CO.: COMPANY SNAPSHOT (2020)

12.1.7 GIANT EAGLE, INC.

TABLE 169 GIANT EAGLE, INC.: BUSINESS OVERVIEW

12.1.8 AMAZON.COM, INC.

TABLE 170 AMAZON.COM, INC.: BUSINESS OVERVIEW

FIGURE 33 AMAZON.COM, INC.: COMPANY SNAPSHOT (2020)

12.1.9 PHARMEASY

TABLE 171 PHARMEASY: BUSINESS OVERVIEW

12.1.10 APEX PHARMACY

TABLE 172 APEX PHARMACY: BUSINESS OVERVIEW

12.1.11 APOLLO PHARMACY

TABLE 173 APOLLO PHARMACY: BUSINESS OVERVIEW

FIGURE 34 APOLLO HOSPITAL: COMPANY SNAPSHOT (2021)

12.1.12 RITE AID CORP

TABLE 174 RITE AID CORP.: BUSINESS OVERVIEW

FIGURE 35 RITE AID CORP.: COMPANY SNAPSHOT (2021)

12.1.13 COSTCO WHOLESALE CORPORATION

TABLE 175 COSTCO WHOLESALE CORPORATION: BUSINESS OVERVIEW

FIGURE 36 COSTCO WHOLESALE CORPORATION: COMPANY SNAPSHOT (2021)

12.2 SHOP-APOTHEKE.COM

12.2.1 NETMEDS.COM

12.2.2 DOCMORRIS

12.2.3 TATA 1MG

12.2.4 LLOYDSPHARMACY

12.2.5 GOODRX, INC.

12.2.6 HEALTHWAREHOUSE.COM

12.2.7 TELUS HEALTH

12.2.8 PHARMEX DIRECT INC.

12.2.9 HIMS & HERS HEALTH, INC.

12.2.10 RO PHARMACY

12.2.11 RX OUTREACH

12.2.12 THE INDEPENDENT PHARMACY

12.2.13 REXALL PHARMACY GROUP ULC

12.2.14 NORTHWESTPHARMACY.COM

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 217)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Digital Pharmacy market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the digital pharmacy market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, AMA,CDC and HIMSS. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global digital pharmacy market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global digital pharmacy market scenario through secondary research. Several primary interviews were conducted with market experts from supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. The primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Both top-down and bottom-up approaches were used to estimate to estimate and validate the size of the global digital pharmacy market and various dependent submarkets .The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of digital pharmacy products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the digital pharmacy market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from supply sides in the digital pharmacy market.

Report Objectives

- To define, describe, segment, analyze, and forecast the digital pharmacy market based on drug type, product, platform, business model, geographic coverage, and region

- To provide detailed information regarding the drivers, restraints, opportunities, challenges, and industry trends influencing the growth of the digital pharmacy market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the digital pharmacy for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global digital pharmacy market with respect to five main regions (along with countries)—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product/service upgrades, acquisitions, partnerships, agreements, expansions, and collaborations in the digital pharmacy market during the forecast period

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Top 10 companies operating in online pharmacy market

- Amazon Pharmacy

- Walgreens Boots Alliance

- CVS Health

- Walmart Pharmacy

- Rite Aid

- Express Scripts

- PillPack

- Medlife

- Netmeds

- 1mg

Newer applications of online pharmacy that CVS Health is targeting in the future

Telehealth: CVS Health has been expanding its telehealth services, which allow patients to connect with healthcare providers remotely. Through its MinuteClinic and HealthHUBs, CVS Health is offering virtual visits with nurse practitioners and physician assistants, as well as video consultations with physicians.

Medication adherence: CVS Health has been developing digital tools to help patients stay on track with their medications. For example, its ScriptPath Prescription Schedule allows patients to see all of their medications in one place and receive reminders when it's time to take them.

Chronic disease management: CVS Health is targeting the online pharmacy market to help manage chronic diseases such as diabetes, heart disease, and asthma. It has been developing programs that combine medication management, coaching, and monitoring to help patients better manage their conditions.

Specialty pharmacy: CVS Health has been expanding its specialty pharmacy services, which provide medications for complex and chronic conditions such as cancer, HIV, and multiple sclerosis. These services are often delivered through online channels and can include personalized support and education for patients.

Overall, CVS Health is focusing on a range of newer applications for online pharmacy that aim to improve patient outcomes, increase access to care, and reduce healthcare costs.

Facts and operational details for CVS health in online pharmacy market

CVS Health operates one of the largest pharmacy chains in the United States, with over 9,900 retail locations across the country.

In addition to its retail pharmacies, CVS Health operates an online pharmacy, CVS.com, which offers a range of prescription medications, over-the-counter products, and health and wellness items.

CVS Health acquired the online pharmacy PillPack in 2018, which specializes in delivering medications to patients with complex medication regimens.

CVS Health has been expanding its telehealth services through its MinuteClinic and HealthHUBs, which offer virtual visits with healthcare providers.

CVS Health's ScriptPath Prescription Schedule is a digital tool that helps patients manage their medications by providing a personalized schedule of when and how to take them.

CVS Health offers a range of services for patients with chronic conditions, including diabetes, heart disease, and asthma. These services can include personalized support, education, and medication management.

CVS Health also operates a specialty pharmacy business, CVS Specialty, which provides medications for complex and chronic conditions such as cancer, HIV, and multiple sclerosis. These services can be delivered through online channels.

Walmart Pharmacy growth strategies in online pharmacy market

Walmart Pharmacy has been expanding its online prescription delivery services. The company offers free home delivery for eligible prescriptions, with no membership required. In addition, Walmart Pharmacy has partnered with third-party delivery services, such as DoorDash and Postmates, to offer same-day prescription delivery in select markets.

Walmart Pharmacy has been investing in its mobile app and website to make it easier for customers to manage their prescriptions online. The app allows customers to refill and transfer prescriptions, track their order status, and receive reminders for when to take their medications. Customers can also use the app to find the nearest Walmart Pharmacy location and check store hours.

Walmart Pharmacy has been partnering with telehealth providers to offer virtual visits with healthcare providers. For example, the company has partnered with Doctor On Demand to offer telehealth appointments for general medical care, mental health counseling, and other services.

Walmart Pharmacy has been offering a range of health and wellness products through its online store, including over-the-counter medications, vitamins and supplements, and personal care items. The company has also been expanding its selection of medical equipment and supplies, such as blood pressure monitors and diabetes testing supplies.

Medlife distribution channels growth strategies in online pharmacy business

Medlife has partnered with local pharmacies to expand its reach. The company has tied up with thousands of independent pharmacies across India, allowing customers to place orders online and pick up their medications from a nearby pharmacy.

Medlife has built a network of warehouses and distribution centers to enable fast and reliable delivery. The company has a presence in over 4,000 cities and towns in India, and it offers same-day and next-day delivery for many orders.

Medlife has launched a subscription service called Medlife Essentials, which delivers essential health and wellness products, such as vitamins and supplements, directly to customers' doorsteps on a recurring basis. This has helped the company build a loyal customer base and increase recurring revenue.

Medlife has developed a mobile app that makes it easy for customers to manage their medications and order refills. The app also allows customers to book lab tests and consult with healthcare providers online.

Medlife has expanded into telemedicine and e-consultations. The company has launched a platform called Medlife e-Consult that connects patients with healthcare providers for online consultations, prescriptions, and lab tests.

Growth drivers for online pharmacy business from macro to micro

Macro-level growth drivers of online pharmacy market

Increasing prevalence of chronic diseases: The rising incidence of chronic diseases such as diabetes, heart disease, and cancer is driving demand for medications and healthcare services.

Aging population: The aging population is increasing demand for medications and healthcare services, particularly in developed countries.

Growing healthcare costs: Healthcare costs are increasing globally, leading to a greater focus on cost-effective alternatives such as online pharmacies.

Digitalization of healthcare: The increasing use of digital technology in healthcare is making it easier for patients to access medications and healthcare services online.

Micro-level growth drivers of online pharmacy market

Convenience and accessibility: Online pharmacies offer convenience and accessibility to patients who may have difficulty accessing traditional brick-and-mortar pharmacies, such as those who are elderly, disabled, or live in rural areas.

Cost savings: Online pharmacies can offer lower prices due to lower overhead costs, which can make medications more affordable for patients.

Personalized healthcare: Online pharmacies can offer personalized healthcare services such as medication reminders, consultations with healthcare professionals, and customized treatment plans.

Increased patient engagement: Online pharmacies can improve patient engagement by providing educational resources and tools to help patients manage their health conditions.

Overall, the online pharmacy business is driven by the growing demand for convenient, cost-effective, and personalized healthcare services. As technology continues to advance and more patients turn to online platforms for healthcare, the online pharmacy market is expected to continue to grow.

Impact of recession on online pharmacy market

Increased demand for cost-effective healthcare solutions: During a recession, people tend to become more price-conscious and look for cost-effective healthcare solutions. This can lead to increased demand for online pharmacies, which often offer lower prices compared to traditional brick-and-mortar pharmacies.

Reduced healthcare spending: In a recession, some people may reduce their healthcare spending, which could result in decreased demand for online pharmacies and other healthcare services.

Impact on supply chains: A recession can disrupt global supply chains, which can impact the availability of medications and other healthcare products sold by online pharmacies.

Changes in healthcare policies: During a recession, there may be changes in healthcare policies that could impact the online pharmacy market. For example, changes in insurance coverage or reimbursement policies could affect the demand for online pharmacies.

Specific examples of how a recession can impact the online pharmacy market include

During the COVID-19 pandemic, the online pharmacy market experienced increased demand due to lockdowns and social distancing measures. However, economic uncertainty and job losses may have also led to reduced spending on healthcare products.

In 2008, during the global financial crisis, online pharmacy sales increased as people looked for ways to save money on healthcare expenses.

However, it is likely that demand for cost-effective healthcare solutions will continue to drive growth in the online pharmacy market during times of economic uncertainty.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Pharmacy Market

Which market segment is expected to shape the future of the Digital Pharmacy Market?

How emerging markets offering revenue expansion opportunities in Digital Pharmacy Market?

What are the major tailwinds and headwinds for the Digital Pharmacy Market?