ePrescribing Market by Product & Services (Solution (Integrated, Standalone), Services (Implementation, Network)), Delivery Mode (Web & Cloud based, On premise) End User (Hospitals, Physician Offices, Pharmacies) & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global ePrescribing market growth forecasted to transform from $1.2 billion in 2020 to $3.3 billion by 2025, driven by a CAGR of 23.3%. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Factors such as the increasing adoption of EHR solutions, government initiatives and incentive programs, rising focus on reducing the abuse of controlled substances, increasing focus on reducing medical errors, and the need to curtail the escalating healthcare costs are driving the growth of the e-prescribing market. Additionally, the onset of the COVID-19 pandemic has accelerated the use of telemedicine modules and telehealth consultations. This is further driving the adoption of e-prescribing solutions.

To know about the assumptions considered Request for Free Sample Report

ePrescribing Market Dynamics

Driver: Increased adoption of EHR solutions

Growing government support for the adoption of EHR solutions and the need to curtail the escalating healthcare costs are the major factors driving the demand for such solutions. In addition, the COVID-19 outbreak worldwide has led to a larger patient volume in hospitals and the need to better manage patient data. This is expected to further drive the demand for these solutions.

Restraint: High cost of deployment

Despite their benefits, end users remain hesitant to adopt e-prescribing solutions mainly due to the high costs involved. The costs are not limited to the one-time purchase of a system, but also include recurrent expenses such as those incurred by implementation services, maintenance and support services, integration of e-prescribing with EHR/EMR, and, in some instances, training and education. This restricts smaller hospitals and office-based physicians from investing in e-prescribing solutions, especially in the emerging APAC and Latin American markets.

Opportunity: Increased adoption of integrated telehealth solutions due to COVID-19

Even before the onset of the global pandemic, players in the EHR market had started integrating the telehealth feature with their existing solutions, due to advantages offered by telehealth consultations such as increased patient engagement in remote monitoring and reduction in overhead costs. However, the adoption of this feature increased significantly during the COVID-19 crisis.

Challenge: Lack of technology awareness among end users

E-prescribing solutions operate at maximum efficiency only when integrated with EHRs and a complementary suite of other HCIT solutions. However, most physicians and end-users lack the knowledge and technological expertise to understand how to make full use of e-prescribing. For instance, it may be difficult for end-users to select the most effective combination of hardware and software components while implementing any e-prescribing solution. This aspect carries weight, as using complementary components can help reduce overall costs incurred, while increasing workflow efficiency. However, limited access to expert opinion and trained IT professionals can pose challenges for end-users in selecting the appropriate e-prescribing solution for their practice. This has a direct impact on the end user’s decision to adopt an eprescribing solution in the first place.

The services segment is expected to grow the fastest during the forecast period. The services segment accounted for the highest CAGR of the e-prescribing market during the forecast period. This is attributed to the increasing adoption of e-prescribing, leading to the growing demand for training and education services, stringent regulations that have increased the application of implementation services for the validation and verification of hardware and software, and the need for frequent support and maintenance

By delivery mode, the web- and cloud- based solutions accounted for the largest share of the ePrescribing industry in 2019

The web- and cloud-based model offers improved performance and reliability by avoiding long deployment cycles. It also minimizes upfront investments without incurring high infrastructure costs as the user can access the software from any compatible system using an access ID or username and password. In this mode, the vendor offers a separate cloud-based server to customers in a subscription-based or pay-as-yougo pricing model. Community clouds are a recently emerging trend in the cloud industry and cater to the specific needs of large communities, such as research communities, which can share their data and store it on a dedicated research cloud. This mode of delivery is the most preferred in the industry as it reduces the upfront costs and does not require any complicated installation or implementation. As a result, the market is witnessing a shift from on-premise to the web-hosted deployment of e-prescribing solutions.

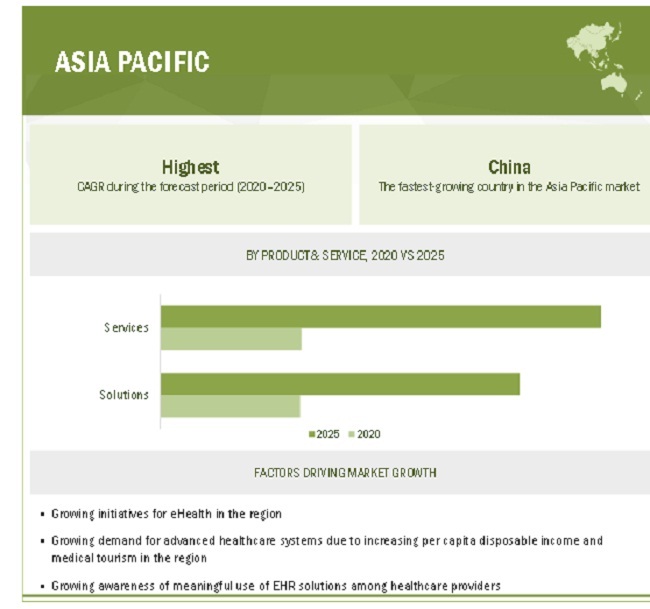

APAC region of the ePrescribing industry will grow at the fastest rate during the forecast period.

The ePrescribing market, by region, is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Currently, a number of healthcare organizations in the Asia Pacific region are actively moving towards digitization with a focus on streamlining their entire workflow and ensuring patient safety. Japan, Australia, Taiwan, South Korea, India, and China are the major countries in this region that are actively adopting e-prescribing solutions. In addition, government initiatives for the adoption of EMR solutions, the large volume of COVID-19 patients, the growth of the geriatric population, the rising prevalence of chronic diseases, increasing healthcare expenditure, and the growing purchasing power of consumers are also impacting the growth of this region in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

Epic Systems Corporation (US), Cerner Corporation (US), Allscripts Healthcare Solutions, Inc. (US), NextGen Healthcare (US), athenahealth, Inc. (US), RelayHealth, LLC (US), Henry Schein, Inc. (US), GE Healthcare (US), Computer Programs and Systems, Inc. (US), DrFirst, Inc. (US), Surescripts-RxHub, LLC (US), and Medical Information Technology, Inc. (MEDITECH, US).

Scope of the ePrescribing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

USD 1.2 billion |

|

Projected Revenue Size by 2025 |

USD 3.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 23.3% |

|

Market Driver |

Increased adoption of EHR solutions |

|

Market Opportunity |

Increased adoption of integrated telehealth solutions due to COVID-19 |

The research report categorizes the ePrescribing market to forecast revenue and analyze trends in each of the following submarkets:

By Type of Service

- Solutions

- Integrated solutions

- Standalone solutions

- Services

- Support & maintenance services

- Implementation services

- network services

- training and education services

By Delivery Mode

- Web and Cloud Based Solutions

- On Premise Solutions

By End User

- Hospitals

- Office Based Physicians

- Pharmacies

By Region

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Spain

- Netherlands

- Sweden

- Denmark

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- Australia

- China

- Rest of Asia Pacific (RoAPAC)

- Latin America

- The Middle East & Africa

Recent Developments of ePrescribing Industry

- In April 2020, DrFirst (US) partnered with ID.me (US) to help users of the company’s e-prescribe app to verify their identities within a few minutes. This is expected to speed up the process for clinicians to prescribe drugs.

- In July 2019, NextGen Healthcare(US) announced its partnership with Optimize Rx (US) to provide real-time access to critical financial information, allowing providers to help patients choose appropriate medication plans, as per their cover and budgets. This tool has been integrated with the company’s ehr workflow .

- In june 2019, Allscripts (US) acquired ZappRx (US) to help Veradigm’s e-prescribing solutions by integrating it with the automate prior authorization platform, thus adding value to its existing platform.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ePrescribing Market?

The global ePrescribing Market boasts a total revenue value of USD 3.3 billion by 2025.

What is the estimated growth rate (CAGR) of the global ePrescribing Market?

The global ePrescribing Market has an estimated compound annual growth rate (CAGR) of 23.3% and a revenue size in the region of USD 1.2 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 EPRESCRIBING MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

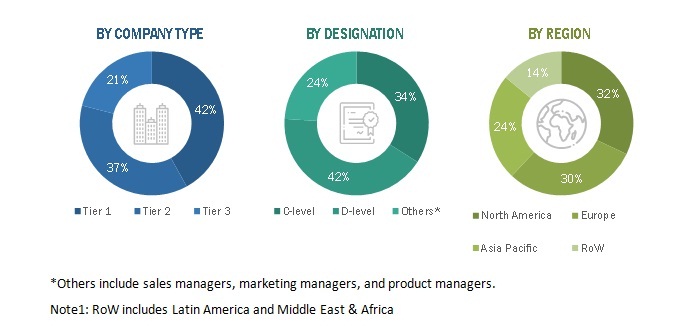

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 ILLUSTRATIVE REPRESENTATION OF PARENT MARKET ANALYSIS TO ARRIVE AT THE SIZE OF THE E-PRESCRIBING MARKET

FIGURE 6 ILLUSTRATIVE REPRESENTATION OF DEMAND-SIDE ANALYSIS BASED ON THE NUMBER OF PHYSICIANS

FIGURE 7 IMPACT OF COVID-19 ON THE GROWTH RATE (2019-2021)

FIGURE 8 TOP-DOWN APPROACH FOR SUBSEGMENT-LEVEL MARKETS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 10 EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 E-PRESCRIBING SERVICES MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 E-PRESCRIBING MARKET, BY DELIVERY MODE, 2020 VS. 2025 (USD MILLION)

FIGURE 13 E-PRESCRIBING MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF THE EPRESCRIBING INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 EPRESCRIBING MARKET OVERVIEW

FIGURE 15 E-PRESCRIBING MARKET IS PROJECTED TO WITNESS DOUBLE-DIGIT GROWTH RATE IN THE FORECAST PERIOD

4.2 ASIA PACIFIC: EPRESCRIBING INDUSTRY, BY PRODUCT & SERVICE AND COUNTRY (2019)

FIGURE 16 SOLUTIONS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC E-PRESCRIBING MARKET IN 2019

4.3 E-PRESCRIBING MARKET, BY REGION, 2020?2025

FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE THE E-PRESCRIBING MARKET IN 2025

4.4 E-PRESCRIBING MARKET: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 18 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 KEY MARKET DYNAMICS

FIGURE 19 EPRESCRIBING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing adoption of EHR solutions

5.2.1.2 Government initiatives & incentive programs

TABLE 1 KEY GOVERNMENT INITIATIVES FOR EMR ADOPTION

5.2.1.3 Rising focus on reducing the abuse of controlled substances

FIGURE 20 US: PERCENTAGE OF PRESCRIBERS AND PHARMACIES THAT HAVE ENABLED EPCS, 2017-2019

5.2.1.4 Increasing focus on reducing medical errors

5.2.1.5 Need to curtail the escalating healthcare costs

TABLE 2 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 High cost of deployment

5.2.2.2 Reluctance among healthcare professionals to adopt e-prescribing solutions

5.2.2.3 Concerns regarding security and workflow

TABLE 3 MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Increased adoption of integrated telehealth solutions due to COVID-19

5.2.3.2 Services industry to provide opportunities for revenue generation

5.2.3.3 Emerging APAC markets

TABLE 4 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Lack of technological awareness among end users

TABLE 5 MARKET CHALLENGES: IMPACT ANALYSIS

5.3 ADJACENT & RELATED MARKETS

TABLE 6 ADJACENT AND RELATED MARKETS TO THE E-PRESCRIBING MARKET

6 INDUSTRY INSIGHTS (Page No. - 60)

6.1 INDUSTRY TRENDS

FIGURE 21 GROWING DEMAND FOR EPCS-BASED SOLUTIONS IS

THE MAJOR TREND IN THIS MARKET 60

6.1.1 IMPACT OF COVID-19 ON THE ADOPTION OF E-PRESCRIBING SOLUTIONS

FIGURE 22 IMPACT OF COVID-19 ON THE EPRESCRIBING MARKET

TABLE 7 STRATEGIES ADOPTED BY SOME OF THE EMR/EHR VENDORS DURING COVID-19

6.1.2 ADOPTION OF TOOLS TO AID THE E-PRESCRIBING OF CONTROLLED SUBSTANCES

6.1.3 SPECIALTY PRESCRIBING

6.1.4 GROWING DEMAND FOR MOBILE-BASED EHR SOLUTIONS

6.1.5 GROWING DEMAND FOR CLOUD-BASED SOLUTIONS

6.2 HCIT ADOPTION TRENDS

6.2.1 US

6.2.2 REST OF THE WORLD

6.3 EVOLUTION OF E-PRESCRIBING IN THE US

FIGURE 23 E-PRESCRIBING: RULES, LAWS, REGULATIONS, & INCENTIVES (2007-2020)

6.4 REGULATORY ANALYSIS

6.4.1 NORTH AMERICA

6.4.1.1 US

6.4.1.2 Canada

6.4.2 EUROPE

6.4.3 ASIA PACIFIC

7 EPRESCRIBING MARKET, BY PRODUCT & SERVICE (Page No. - 71)

7.1 INTRODUCTION

FIGURE 24 SERVICES TO WITNESS THE HIGHEST GROWTH IN THE E-PRESCRIBING MARKET DURING THE FORECAST PERIOD

TABLE 8 EPRESCRIBING INDUSTRY, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

7.2 SOLUTIONS

TABLE 9 E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 10 E-PRESCRIBING SOLUTIONS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.1 INTEGRATED SOLUTIONS

7.2.1.1 Integrated solutions will register the highest growth in the forecast period

TABLE 11 INTEGRATED E-PRESCRIBING SOLUTIONS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.2 STANDALONE SOLUTIONS

7.2.2.1 Standalone solutions are mostly deployed by small clinical practices

TABLE 12 STANDALONE E-PRESCRIBING SOLUTIONS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3 SERVICES

TABLE 13 E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 14 E-PRESCRIBING SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.1 SUPPORT & MAINTENANCE SERVICES

7.3.1.1 Support & maintenance services accounted for the largest share of the e-prescribing services market

TABLE 15 SUPPORT & MAINTENANCE SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.2 IMPLEMENTATION SERVICES

7.3.2.1 COVID-19 pandemic has increased the demand for implementation services

TABLE 16 IMPLEMENTATION SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.3 NETWORK SERVICES

7.3.3.1 Network services work as intermediaries between existing pharmacy management and EHR systems

TABLE 17 NETWORK SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.4 TRAINING & EDUCATION SERVICES

7.3.4.1 The EMR industry relies heavily on service providers for training and education purposes

TABLE 18 TRAINING & EDUCATION SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8 EPRESCRIBING MARKET, BY DELIVERY MODE (Page No. - 82)

8.1 INTRODUCTION

FIGURE 25 WEB- & CLOUD-BASED SOLUTIONS SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE E-PRESCRIBING MARKET DURING THE FORECAST PERIOD

TABLE 19 EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

8.2 WEB- & CLOUD-BASED SOLUTIONS

8.2.1 WEB- & CLOUD-BASED SOLUTIONS HELP HEALTHCARE ORGANIZATIONS SHARE AND INTEGRATE INFORMATION FROM DISPARATE LOCATIONS IN REAL-TIME

TABLE 20 PLAYERS OFFERING WEB- & CLOUD-BASED E-PRESCRIBING SOLUTIONS

TABLE 21 E-PRESCRIBING MARKET FOR WEB- & CLOUD-BASED SOLUTIONS, BY COUNTRY, 2018-2025 (USD MILLION)

8.3 ON-PREMISE SOLUTIONS

8.3.1 ON-PREMISE SOLUTIONS REDUCE THE RISK OF DATA BREACHES AND OTHER SECURITY ISSUES

TABLE 22 E-PRESCRIBING MARKET FOR ON-PREMISE SOLUTIONS, BY COUNTRY, 2018-2025 (USD MILLION)

9 EPRESCRIBING MARKET, BY END USER (Page No. - 87)

9.1 INTRODUCTION

FIGURE 26 HOSPITALS WILL CONTINUE TO DOMINATE THE E-PRESCRIBING MARKET IN THE FORECAST PERIOD

TABLE 23 EPRESCRIBING INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

9.2 HOSPITALS

9.2.1 HOSPITALS ARE THE MAJOR END USERS OF E-PRESCRIBING SOLUTIONS

TABLE 24 E-PRESCRIBING MARKET FOR HOSPITALS, BY COUNTRY, 2018-2025 (USD MILLION)

9.3 OFFICE-BASED PHYSICIANS

9.3.1 OFFICE-BASED PHYSICIANS ARE THE MAJOR ADOPTERS OF STANDALONE E-PRESCRIBING SOLUTIONS

TABLE 25 E-PRESCRIBING MARKET FOR OFFICE-BASED PHYSICIANS, BY COUNTRY, 2018-2025 (USD MILLION)

9.4 PHARMACIES

9.4.1 E-PRESCRIBING SOLUTIONS HAVE REDUCED THE NUMBER OF MEDICATION ERRORS AMONG PHARMACIES

TABLE 26 E-PRESCRIBING MARKET FOR PHARMACIES, BY COUNTRY, 2018-2025 (USD MILLION)

10 EPRESCRIBING MARKET, BY REGION (Page No. - 93)

10.1 INTRODUCTION

TABLE 27 EPRESCRIBING MARKET, BY REGION, 2018-2025 (USD MILLION)

FIGURE 27 EPRESCRIBING INDUSTRY: GEOGRAPHICAL GROWTH OPPORTUNITIES

10.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: EPRESCRIBING MARKET SNAPSHOT

TABLE 28 NORTH AMERICA: E-PRESCRIBING MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 29 NORTH AMERICA: E-PRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 30 NORTH AMERICA: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 31 NORTH AMERICA: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 32 NORTH AMERICA: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 33 NORTH AMERICA: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.2.1 US

10.2.1.1 The US accounts for the largest share of the e-prescribing market

FIGURE 29 US: HOSPITAL EHR ADOPTION (2007-2018)

FIGURE 30 US: OFFICE-BASED PHYSICIAN EHR ADOPTION (2004-2017)

TABLE 34 US: TOP 5 AND BOTTOM 5 STATES THAT PRESCRIBED CONTROLLED SUBSTANCES ELECTRONICALLY IN 2019

TABLE 35 US: MACROECONOMIC INDICATORS

TABLE 36 US: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 37 US: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 38 US: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 39 US: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 40 US: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Launch of new government initiatives is expected to drive the adoption of e-prescriptions in the country

FIGURE 31 CANADA: EMR ADOPTION BY PRIMARY CARE PHYSICIANS (IN TERMS OF PERCENTAGE OF THE TOTAL NUMBER OF PHYSICIANS), 2012-2017

TABLE 41 CANADA: MACROECONOMIC INDICATORS

TABLE 42 CANADA: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 43 CANADA: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 44 CANADA: E-PRESCRIBING SERVICES MARKET, BY TYPE,2018-2025 (USD MILLION)

TABLE 45 CANADA: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 46 CANADA: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3 EUROPE

TABLE 47 EUROPE: EPRESCRIBING MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 48 EUROPE: E-PRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 49 EUROPE: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 50 EUROPE: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 51 EUROPE: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.1 UK

10.3.1.1 The UK has a well-established electronic prescription system in primary care settings

TABLE 53 UK: MACROECONOMIC INDICATORS

TABLE 54 UK: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 55 UK: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 56 UK: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 UK: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 58 UK: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Rolling out of nationwide EHRs and expansion of telemedicine to support market growth

TABLE 59 FRANCE: MACROECONOMIC INDICATORS

TABLE 60 FRANCE: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 61 FRANCE: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 62 FRANCE: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 63 FRANCE: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 64 FRANCE: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Growing demand for effective patient management to significantly impact the growth of the e-prescribing market in the country

TABLE 65 GERMANY: MACROECONOMIC INDICATORS

TABLE 66 GERMANY: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 67 GERMANY: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 68 GERMANY: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 69 GERMANY: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 70 GERMANY: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 The use of e-prescriptions is common among GPs in Spain

TABLE 71 SPAIN: MACROECONOMIC INDICATORS

TABLE 72 SPAIN: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 73 SPAIN: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 74 SPAIN: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 75 SPAIN: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 76 SPAIN: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.5 NETHERLANDS

10.3.5.1 The Netherlands is working towards establishing a national system for the electronic exchange of prescriptions

TABLE 77 ELECTRONIC HEALTH RECORD USERS: THE NETHERLANDS (2014)

TABLE 78 NETHERLANDS: MACROECONOMIC INDICATORS

TABLE 79 NETHERLANDS: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 80 NETHERLANDS: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 81 NETHERLANDS: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 82 NETHERLANDS: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 83 NETHERLANDS: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.6 SWEDEN

10.3.6.1 Sweden is among the early adopters of e-prescribing solutions

TABLE 84 SWEDEN: MACROECONOMIC INDICATORS

TABLE 85 SWEDEN: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 86 SWEDEN: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 87 SWEDEN: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 88 SWEDEN: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 89 SWEDEN: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.7 DENMARK

10.3.7.1 A number of cross-country electronic prescribing projects are currently in progress in Denmark

TABLE 90 DENMARK: MACROECONOMIC INDICATORS

TABLE 91 DENMARK: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 92 DENMARK: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 93 DENMARK: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 94 DENMARK: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 95 DENMARK: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.3.8 REST OF EUROPE

TABLE 96 REST OF EUROPE: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 97 REST OF EUROPE: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 98 REST OF EUROPE: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 99 REST OF EUROPE: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 100 REST OF EUROPE: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: EPRESCRIBING MARKET SNAPSHOT

TABLE 101 ASIA PACIFIC: E-PRESCRIBING MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 102 ASIA PACIFIC: E-PRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 103 ASIA PACIFIC: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan is the largest market for e-prescribing in the Asia Pacific

TABLE 107 JAPAN: MACROECONOMIC INDICATORS

TABLE 108 JAPAN: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 109 JAPAN: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 110 JAPAN: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 111 JAPAN: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 112 JAPAN: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.4.2 AUSTRALIA

10.4.2.1 Favorable government initiatives to support market growth in the country

TABLE 113 AUSTRALIA: MACROECONOMIC INDICATORS

TABLE 114 AUSTRALIA: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 115 AUSTRALIA: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 116 AUSTRALIA: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 117 AUSTRALIA: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 118 AUSTRALIA: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Absence of a patient-centered model may challenge the adoption of e-prescriptions

TABLE 119 CHINA: MACROECONOMIC INDICATORS

TABLE 120 CHINA: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 121 CHINA: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 122 CHINA: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 123 CHINA: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 124 CHINA: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 125 REST OF ASIA PACIFIC: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 126 REST OF ASIA PACIFIC: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 128 REST OF ASIA PACIFIC: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 129 REST OF ASIA PACIFIC: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 LATIN AMERICA HAS A LOWER ADOPTION RATE OF EHR AND EMR SOLUTIONS

TABLE 130 LATIN AMERICA: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 131 LATIN AMERICA: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 132 LATIN AMERICA: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 133 LATIN AMERICA: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 134 LATIN AMERICA: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 IMPLEMENTATION OF E-PRESCRIPTIONS ACROSS THE PRIVATE SECTOR HAS BEEN EXTREMELY SLOW-PACED

TABLE 135 MIDDLE EAST & AFRICA: EPRESCRIBING MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: E-PRESCRIBING SOLUTIONS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: E-PRESCRIBING SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: EPRESCRIBING INDUSTRY, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: EPRESCRIBING MARKET, BY END USER, 2018-2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 145)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 33 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS, AGREEMENTS, & COLLABORATIONS WERE THE MOST WIDELY ADOPTED STRATEGIES

11.3 COMPETITIVE SITUATIONS & TRENDS

11.3.1 PRODUCT LAUNCHES

TABLE 140 KEY PRODUCT LAUNCHES (JANUARY 2017-JUNE 2020)

11.3.2 PARTNERSHIPS, AGREEMENTS, & COLLABORATIONS

TABLE 141 KEY PARTNERSHIPS, AGREEMENTS, & COLLABORATIONS (JANUARY 2017- JUNE 2020)

11.3.3 ACQUISITIONS

TABLE 142 KEY ACQUISITIONS (JANUARY 2017- JUNE 2020)

12 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 148)

12.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

12.1.1 MARKET SHARE ANALYSIS

FIGURE 34 EPRESCRIBING MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

12.1.2 PRODUCT FOOTPRINT

FIGURE 35 PRODUCT MATRIX, BY COMPANY

12.1.3 STAR

12.1.4 EMERGING LEADERS

12.1.5 PERVASIVE

12.1.6 EMERGING COMPANIES

12.2 COMPANY EVALUATION MATRIX

FIGURE 36 EPRESCRIBING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.3 COMPANY PROFILES

12.3.1 OVERVIEW

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.3.2 CERNER CORPORATION

FIGURE 37 CERNER CORPORATION: COMPANY SNAPSHOT (2019)

12.3.3 EPIC SYSTEMS CORPORATION

12.3.4 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

FIGURE 38 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2019)

12.3.5 ATHENAHEALTH, INC.

12.3.6 NEXTGEN HEALTHCARE, INC.

FIGURE 39 NEXTGEN HEALTHCARE, INC.: COMPANY SNAPSHOT (2020)

12.3.7 MEDICAL INFORMATION TECHNOLOGY, INC.

FIGURE 40 MEDICAL INFORMATION TECHNOLOGY, INC.: COMPANY SNAPSHOT (2019)

12.3.8 RELAYHEALTH CORPORATION

12.3.9 SURESCRIPTS-RXHUB, LLC

12.3.10 COMPUTER PROGRAMS AND SYSTEMS, INC.

FIGURE 41 COMPUTER PROGRAMS AND SYSTEMS, INC.: COMPANY SNAPSHOT (2019)

12.3.11 HENRY SCHEIN, INC.

FIGURE 42 HENRY SCHEIN, INC.: COMPANY SNAPSHOT (2019)

12.3.12 DRFIRST, INC.

12.3.13 EMDS, INC.

12.3.14 GREENWAY HEALTH, LLC

12.3.15 GE HEALTHCARE

FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

12.3.16 ECLINICALWORKS

12.3.17 OTHER PLAYERS OPERATING IN THE EPRESCRIBING MARKET

12.3.17.1 ADVANCEDMD

12.3.17.2 DRCHRONO

12.3.17.3 MDTOOLBOX

12.3.17.4 DOSESPOT

12.3.17.5 AMAZINGCHARTS

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKET CHAPTERS (Page No. - 181)

13.1 INTRODUCTION

13.2 HOSPITAL EMR SYSTEMS MARKET

13.2.1 MARKET DEFINITION

13.2.2 LIMITATIONS

13.2.3 MARKET OVERVIEW

13.3 HOSPITAL EMR SYSTEMS MARKET, BY REGION

TABLE 143 HOSPITAL EMR SYSTEMS MARKET, BY REGION, 2018-2025 (USD MILLION)

13.4 HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT

TABLE 144 HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

13.4.1 SERVICES

TABLE 145 HOSPITAL EMR SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

13.4.2 SOFTWARE

TABLE 146 HOSPITAL EMR SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

13.4.3 HARDWARE

TABLE 147 HOSPITAL EMR HARDWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

13.5 HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE

TABLE 148 HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

13.5.1 ON-PREMISE

TABLE 149 ON-PREMISE HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

13.5.2 CLOUD-BASED

TABLE 150 CLOUD-BASED HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

14 APPENDIX (Page No. - 188)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the global ePrescribing market. Exhaustive secondary research was done to collect information on the utilization of different solutions and their regional utilization trends. Industry experts further validated the data obtained through secondary research through primary research. Furthermore, the market size estimates and forecast provided in this study are derived through a mix of the bottom-up approach (country-level adoption of various EHR solutions and utilization of ePrescribing funcitonality) and top-down approach (assessment of utilization/adoption/penetration trends, by type of product& service, delivery mode, end user, and region). After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources such as the World Health Organization (WHO), Healthcare Information and Management Systems Society (HIMSS), National Association of Healthcare Quality, California Association of Public Hospitals and Health Systems (CAPH), Centers for Medicare and Medicaid Services (CMS), RAND Europe, Australian Digital Health Agency, annual reports/SEC filings as well as investor presentations and press releases of key players have been used to identify and collect information useful for the study of this market.

Primary Research

Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors, and key opinion leaders. Primary sources from the demand side include personnel from hospitals, ambulatory care centers, clinics, and pharmacies.

To know about the assumptions considered for the study, download the pdf brochure

*Others include sales managers, marketing managers, and product managers.

Note1: RoW includes Latin America and Middle East & Africa

ePrescribing Market Size Estimation

The total market size for the ePrescribing market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach 1: Parent Market Analysis

In this report, the global market size for the Revenues of individual companies providing EHR solutions with the integrated e-prescribing module was gathered from public sources and databases. Shares of the EHR market provided by leading players were gathered from secondary sources to the extent available. Individual shares or revenue estimates were validated through expert interviews

Approach 2: Demand Side Analysis

In the case of demand-side analysis, the total number of physicians utilizing the e-prescribing module was studied using secondary and primary research. All the responses were collated to derive a probabilistic estimate of the market size based on the annual and implementation costs per physician per year.

Data Triangulation

After arriving at the overall ePresciribng market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global e-prescribing market on the basis of product and service, delivery mode, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the e-prescribing market with respect to five main regions (along with countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players in the global e-prescribing market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, collaborations, agreements, partnerships, and R&D activities of the leading players in the globale-prescribing market

Target Audience:

- Providers of e-prescribing systems and solutions

- E-prescribing service providers

- EHR and EMR vendors

- Hospitals and clinics

- Pharmacies

- Pharmacy benefit managers

- Pharmacy system vendors

- Healthcare insurance providers

- Regulators and associations

- Market research and consulting firms

- Venture capitalists and investors

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of European ePrescribing market into the Belgium, Russia, Switzerland, and other countries

- Further breakdown of the Rest of Asia Pacific ePrescribing market into India, New Zealand, and other countries

- Further breakdown of the Latin America ePrescribing market into Argentina, Brazil, Columbia, and other countries

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ePrescribing Market