Digital Fault Recorder Market by Type (Dedicated and Multifunctional), Installation (Generation, Transmission, and Distribution), Station (Nonautomated and Automated), Voltage (Less Than 66 kV, 66220 kV, and Above 220 kV) - Global Forecast to 2023

[105 Pages Report] The global digital fault recorder market was valued at USD 350.2 million in 2017 and is expected to reach USD 458.2 million by 2023, at a CAGR of 4.76% during the forecast period.

The years considered for the study are as follows:

- Base year: 2017

- Estimated year: 2018

- Projected year: 2023

- Forecast period: 20182023

The base year considered for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study:

- To define and segment the digital fault recorder market with respect to type, installation, voltage, station, and region

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts and agreements, and product developments in the market

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related markets; newsletters and databases such as D&B, Bloomberg, Businessweek, and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the global variable speed generator market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of the major players providing digital fault recorder

- Assessment of future trends and growth of industries

- Assessment of the market with respect to installation, voltage, and station

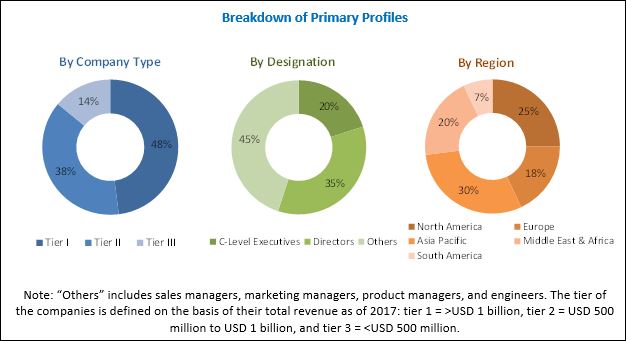

After arriving at the overall market size, the total market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

AMETEK.Inc. (US), DUCATI Energia Spa (Italy), ERLPhase Power Technologies Ltd. (Canada), Elspec LTD (Israel), General Electric Company (US), KoCoS Messtechnik AG (UK), Kinkei System Corporation (Japan), LogicLab s.r.l. (Italy), Prosoft-Systems Ltd. (Russia), Qualitrol Company LLC (US), and Siemens AG (Germany) are the major players operating in the market.

Target Audience:

- Intelligent equipment device manufacturers

- Power utility companies

- Communication network providers

- Research organizations

- Energy generators

- SCADA solution providers

Scope of the Report

- Dedicated DFR

- Multifunctional DFR

- Generation

- Transmission

- Distribution

- Less than 66 kV

- 66220 kV

- Above 220 kV

- Nonautomated

- Automated

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

By Type:

By Installation:

By Voltage:

By Station:

By Region:

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

- More companies can be profiled along with their competitive situation in each region

- Additional country markets for regions such as the Asia Pacific and Europe

- Cross-segmentation of markets

The global digital fault recorder market is projected to reach USD 458.2 million by 2023, growing at a CAGR of 4.76% from an estimated USD 363.1 million in 2018. The growth of this market can be attributed to the growth in maximizing the reliability of power system and monitoring of electricity network.

On the basis of installation, the digital fault recorder market is segmented into generation, transmission and distribution. Transmission held the largest share of digital fault recorder in 2017. According to the IEA World Energy Outlook 2017, between 2017 and 2020, China plans to invests around USD 27.9 billion in the developement of its transmission network. Such increase investments in transmssion network is likely to drive the growth of this segment during the forecast period.

The digital fault recorder is segmented, by voltage, into less than 66 kV, 66220 kV, and above 220 kV. 66220 kV segment held the largest share of digital fault recorder market in 2017. 66220 kV substations are used to transmit power over long distances. Asia Pacific is expected to grow at the highest CAGR during the forecast period in the 66220 kV segment. The growth of the market in Asia Pacific is driven by the growing demand for electricity in countries such as India and China. For instance, according to IBEF, electricity consumption in India is projected to reach 15,280 TWh by 2040 from 4926 TWh in 2012.

The digital fault recorder market, by station, is segmented into automated and nonautomated. Automated segment held the largest market share of digital fault recorder in. This segment enables to remotely monitor, control, and coordinate the transmission and distribution components installed in the substation. The growth of this automated segment is likely to be driven by an increase in demand for retrofitting the conventional substations to upgrade the aging infrastructure.

The digital fault recorder, by type, is segmented into dedicated and multifunctional. Multifunctional segment held the largest market share of digital fault recorder in 2017. Growing adoption of multifunctional DFR in the electricity network and power generation is expected to be the drive the demand for multifunctional DFR segment.

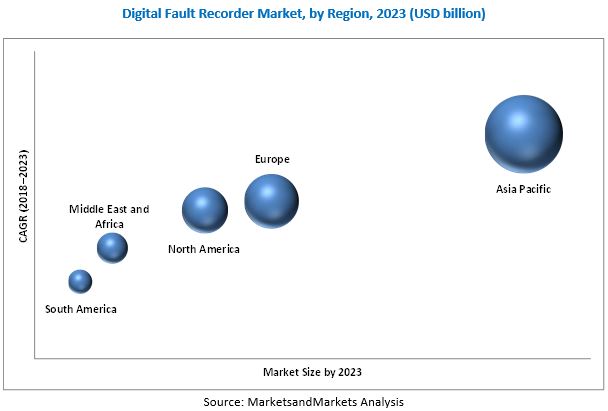

In this report, the digital fault recorder market has been analyzed with respect to 5 regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific is expected to account for the largest market share of the global digital faults recorder market in 2018. Government investments in power grid infrastructure for maximizing the reliability of power system are among the major factors that are likely to drive this market. As per Asia Development Bank (ADB), an investment of about USD 944 billion is planned in Asia Pacific by 2020 to meet energy efficiency targets. China accounted for the largest market share in 2017 for digital fault recorder market in Asia Pacific. The government of China is planning to invest USD 315 billion in improving its power grid infrastructure between 2015 and 2020. Such investments would positively impact the growth of digital faults recorder market during the forecast period.

High initial investment act as a restraint for the global digital fault recorder market. AMETEK.Inc. (US), DUCATI Energia Spa (Italy), ERLPhase Power Technologies Ltd. (Canada), Elspec LTD (Israel), General Electric Company (US), KoCoS Messtechnik AG (UK), Kinkei System Corporation (Japan), LogicLab s.r.l. (Italy), Prosoft-Systems Ltd. (Russia), Qualitrol Company LLC (US), and Siemens AG (Germany) are the leading players in the market. Contracts and agreements were the most commonly adopted strategies by the top players. This was followed by product developments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Digital Fault Recorder Market During the Forecast Period

4.2 Digital Fault Recorder, By Installation

4.3 Digital Fault Recorder, By Station

4.4 Digital Fault Recorder, By Voltage

4.5 Asia Pacific Digital Fault Recorder Market Size, By Station & Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need for Reliable Power Supply System

5.2.1.2 Growing Demand for Digital Substations

5.2.2 Restraint

5.2.2.1 High Initial Investment

5.2.3 Opportunity

5.2.3.1 Growing Adoption of IEC 61850

5.2.3.2 Growing Investments in Renewable Energy Projects in Asia Pacific

5.2.4 Challenges

5.2.4.1 Cyber Security Issues for Processor Based Devices

5.2.4.2 Inadequate Data Management

6 Digital Fault Recorder Market, By Voltage (Page No. - 35)

6.1 Introduction

6.2 Less Than 66 kV

6.3 66 220kv

6.4 Above 220 kV

7 Digital Fault Recorder Market, By Installation (Page No. - 40)

7.1 Introduction

7.2 Generation

7.3 Transmission

7.4 Distribution

8 Digital Fault Recorder Market, By Station (Page No. - 44)

8.1 Introduction

8.2 Nonautomated

8.3 Automated

9 Digital Fault Recorder Market, By Region (Page No. - 48)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.2 India

9.2.3 Australia

9.2.4 Japan

9.2.5 South Korea

9.2.6 Rest of Asia Pacific

9.3 North America

9.3.1 US

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Russia

9.4.3 UK

9.4.4 France

9.4.5 Norway

9.4.6 Turkey

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 Egypt

9.5.3 UAE

9.5.4 Iran

9.5.5 South Africa

9.5.6 Kuwait

9.5.7 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Ranking of Players & Industry Concentration, 2016

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 New Product Developments

10.3.3 Awards and Recognition

11 Company Profile (Page No. - 87)

11.1 Benchmarking

(Business Overview, Products Offered)*

11.2 GE

11.3 Siemens

11.4 Ametek

11.5 Qualitrol

11.6 Erlphase

11.7 Ducati Energia

11.8 Elspec

11.9 E-Max Instruments

11.10 Kinkei

11.11 Kocos

11.12 Logiclab

11.13 Mehta Tech

11.14 Procom Systems

11.15 Prosoft Systems

*Business Overview, Products Offered Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 105)

12.1 Insights of Industry Experts

12.2 Discussion Guide:

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (62 Tables)

Table 1 Digital Fault Recorder Market Snapshot

Table 2 Market, By Voltage, 20162023 (USD Million)

Table 3 Less Than 66 kV: Market Size, By Region, 20162023 (USD Million)

Table 4 66220 kV: Market Size, By Region, 20162023 (USD Million)

Table 5 Above 220 kV: Market Size, By Region, 20162023 (USD Million)

Table 6 Market Size, By Installation, 20162023 (USD Million)

Table 7 Generation: Market Size, By Region, 20162023 (USD Million)

Table 8 Transmission: Market Size, By Region, 20162023 (USD Million)

Table 9 Distribution: Market Size, By Region, 20162023 (USD Million)

Table 10 Market Size, By Station, 20162023 (USD Million)

Table 11 Nonautomated: Market Size, By Installation, 20162023 (USD Million)

Table 12 Nonautomated: Market Size, By Region, 20162023 (USD Million)

Table 13 Automated: Market Size, By Installation, 20162023 (USD Million)

Table 14 Automated: Market Size, By Region, 20162023 (USD Million)

Table 15 Market, By Region, 20162023 (USD Million)

Table 16 Asia Pacific: Digital Fault Recorder Market Size, By Installation, 20162023 (USD Million)

Table 17 Asia Pacific: Market Size, By Station, 20162023 (USD Million)

Table 18 Asia Pacific: Market Size, By Voltage, 20162023 (USD Million)

Table 19 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 20 China: Market Size, By Installation, 20162023 (USD Million)

Table 21 India: Market Size, By Installation, 20162023 (USD Million)

Table 22 Australia: Market Size, By Installation, 20162023 (USD Million)

Table 23 Japan: Market Size, By Installation, 20162023 (USD Million)

Table 24 South Korea: Market Size, By Installation, 20162023 (USD Million)

Table 25 Rest of Asia Pacific: Market Size, By Installation, 20162023 (USD Million)

Table 26 North America: Digital Fault Recorder Market Size, By Installation, 20162023 (USD Million)

Table 27 North America: Market Size, By Station, 20162023 (USD Million)

Table 28 North America: Market Size, By Voltage, 20162023 (USD Million)

Table 29 North America: Market Size, By Country, 20162023 (USD Million)

Table 30 US: Market Size, By Installation, 20162023 (USD Million)

Table 31 Canada: Market Size, By Installation, 20162023 (USD Million)

Table 32 Mexico: Market Size, By Installation, 20162023 (USD Million)

Table 33 Europe: Digital Fault Recorder Market Size, By Installation, 20162023 (USD Million)

Table 34 Europe: Market Size, By Station, 20162023 (USD Million)

Table 35 Europe: Market Size, By Voltage, 20162023 (USD Million)

Table 36 Europe: Market Size, By Country, 20162023 (USD Million)

Table 37 Germany: Market Size, By Installation, 20162023 (USD Million)

Table 38 Russia: Market Size, By Installation, 20162023 (USD Million)

Table 39 UK: Market Size, By Installation, 20162023 (USD Million)

Table 40 France: Market Size, By Installation, 20162023 (USD Million)

Table 41 Norway: Market Size, By Installation, 20162023 (USD Million)

Table 42 Turkey : Market Size, By Installation, 20162023 (USD Million)

Table 43 Rest of Europe: Market Size, By Installation, 20162023 (USD Million)

Table 44 Middle East & Africa: Digital Fault Recorder Market Size, By Installation, 20162023 (USD Million)

Table 45 Middle East & Africa: Market Size, By Station, 20162023 (USD Million)

Table 46 Middle East & Africa: Market Size, By Voltage, 20162023 (USD Million)

Table 47 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 48 Saudi Arabia: Market Size, By Installation, 20162023 (USD Million)

Table 49 Egypt: Market Size, By Installation, 20162023 (USD Million)

Table 50 UAE: Market Size, By Installation, 20162023 (USD Million)

Table 51 Iran: Market Size, By Installation, 20162023 (USD Million)

Table 52 South Africa: Market Size, By Installation, 20162023 (USD Million)

Table 53 Kuwait: Market Size, By Installation, 20162023 (USD Million)

Table 54 Rest of Middle East & Africa: Market Size, By Installation, 20162023 (USD Million)

Table 55 South America: Digital Fault Recorder Market Size, By Installation, 20162023 (USD Million)

Table 56 South America: Market Size, By Station, 20162023 (USD Million)

Table 57 South America: Market Size, By Voltage, 20162023 (USD Million)

Table 58 South America: Market Size, By Country, 20162023 (USD Million)

Table 59 Brazil: Market Size, By Installation, 20162023 (USD Million)

Table 60 Argentina: Market Size, By Installation, 20162023 (USD Million)

Table 61 Rest of South America: Market Size, By Installation, 20162023 (USD Million)

Table 62 Ge, the Most Active Player in the Market, 20152017

List of Figures (25 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Asia Pacific Held the Largest Share of the Digital Fault Recorder Industry in 2017

Figure 5 Transmission Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 6 Automated Segment is Expected to Lead the Digital Fault Recorder Market, By Station , During the Forecast Period

Figure 7 66 220 kV Segment is Expected to Grow at the Highest CAGR, During the Forecast Period

Figure 8 Growing Need for Reliable Power Supply System Drives the Digital Fault Recorder Market, 20182023

Figure 9 Transmission Segment Held the Largest Share of the Digital Fault Recorder Industry in 2017

Figure 10 Automated Segment Led the Digital Fault Recorder Industry in 2017

Figure 11 66220 kV Segment is Expected to Lead the Digital Fault Recorder Industry During Forecast Period

Figure 12 Asia Pacific Multifunctional Segment Led the Digital Fault Recorder Industry in 2017

Figure 13 Growing Need for Reliable Power Supply System is Expected to Drive the Digital Fault Recorder Industry During the Forecast Period

Figure 14 The 66220 kV Voltage Segment is Expected to Have the Largest Market Share During the Forecast Period

Figure 15 Transmission Segment Dominates the Digital Fault Recorder Industry in 2023

Figure 16 Automated Segment Dominates the Digital Fault Recorder Industry in 2018

Figure 17 Regional Snapshot: the Market in Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Digital Fault Recorder Market Share, By Region, 2017

Figure 19 Asia Pacific: Digital Fault Recorder Industry Snapshot

Figure 20 Europe: Digital Fault Recorder Industry Snapshot

Figure 21 Key Developments in the Digital Fault Recorder Market, 20152018

Figure 22 GE Led the Digital Fault Recorder Industry in 2017

Figure 23 GE: Company Snapshot

Figure 24 Siemens: Company Snapshot

Figure 25 Ametek: Company Snapshot

Growth opportunities and latent adjacency in Digital Fault Recorder Market