Substation Automation Market by Offering (Hardware, Software, Services), Type (Transmission, Distribution), Installation Type, End-use Industry, Component, Communication, and Region

Updated on : October 22, 2024

Substation Automation Market Size & Growth

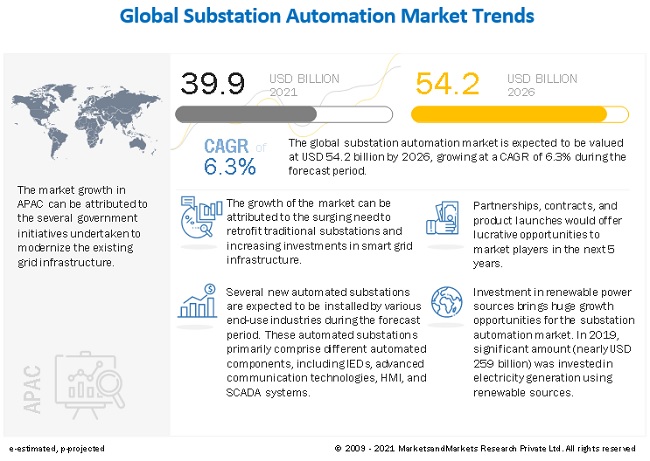

The Substation Automation Market size was estimated to be worth USD 39.9 billion in 2021 and is expected to reach USD 54.2 billion by 2026, growing at a CAGR of 6.3% during the forecast period from 2021 to 2026.

The substation automation market is witnessing substantial growth, driven by the increasing need for efficient and reliable power distribution in the face of rising energy demands and aging infrastructure. Substation automation enhances operational efficiency, improves grid reliability, and facilitates remote monitoring and control of electrical substations, making it essential for modern power systems. Key trends influencing the substation market include the integration of smart grid technologies, advancements in digital communication, and the growing emphasis on renewable energy sources, which require sophisticated management systems to ensure stability and efficiency. Additionally, regulatory mandates aimed at improving grid resilience and security are propelling investments in automation solutions. The adoption of Internet of Things (IoT) technologies and big data analytics in substation operations further enhances decision-making processes and predictive maintenance capabilities. As utilities and energy companies seek to modernize their infrastructure and improve service reliability, the substation automation market is poised for continued growth and innovation.

The growth of the substation automation market is fueled by surging requirement to retrofit conventional substations, rising use of digital technology to improve grid efficiency in smart cities, increasing demand for electric and hybrid vehicles, and increasing focus on upgrading IEC 61850 standard to resolve interoperability issue among intelligent electronic devices deployed in substations. Moreover, escalating demand for data centers to support rapidly expanding digital activities due to COVID-19-led lockdown globally.

Impact of AI on Substation Automation Market

Artificial Intelligence (AI) is significantly transforming the substation automation market by enhancing operational efficiency, enabling predictive maintenance, and improving grid reliability. Through real-time data analysis from smart sensors and Intelligent Electronic Devices (IEDs), AI allows utilities to detect anomalies, forecast equipment failures, and optimize energy distribution, especially critical with the growing integration of renewable sources. It also strengthens cybersecurity by identifying and responding to threats in real-time, while enabling condition-based monitoring that reduces downtime and extends asset life. As utilities modernize infrastructure and embrace smart grid technologies, AI is emerging as a key enabler driving the growth and evolution of the U.S. substation automation market.

To know about the assumptions considered for the study, Request for Free Sample Report

Substation Automation Market Analysis

The Substation Automation Market is witnessing robust growth driven by the increasing demand for efficient power management solutions. This market is crucial for modernizing the electrical grid, enhancing reliability, and integrating renewable energy sources. Key factors contributing to this growth include technological advancements in communication systems, the need for grid stability, and government initiatives promoting smart grid projects. Market analysis indicates a strong preference for intelligent electronic devices (IEDs), communication networks, and SCADA systems, which are essential for real-time monitoring and control of substations.

Substation Automation Market Trends

Several notable trends are shaping the Substation Automation Market, including the integration of IoT and AI technologies, which enhance the functionality and efficiency of automation systems through predictive maintenance, fault detection, and improved operational efficiency. The shift towards renewable energy integration is driving demand for advanced solutions to manage the intermittent nature of renewables and ensure grid stability. Additionally, increasing digitization emphasizes cybersecurity to protect infrastructure from cyber threats. Stringent regulations and standards for grid safety and reliability further propel the adoption of advanced automation solutions.

COVID-19 Impact on the Global Substation Automation Market

The substation automation market includes major Tier 1 and 2 suppliers like Hitachi ABB Power Grids, Siemens Energy, General Electric, Cisco, Schneider Electric, Eaton Corporation, Honeywell, Schweitzer Engineering Laboratories, NovaTech Automation, and CG Power and Industrial Solutions. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and RoW. Substation automation products and solutions supplied by these companies are used by end-user industries such as utilities, steel, oil & gas, mining and transportation. Covid-19 not only impacted the operations of the substation market players, but also affected the businesses of companies from the above-mentioned industries.

Governments worldwide have cut down their spending on various areas to focus more on improving healthcare infrastructure; therefore, the demand for substation automation products and solutions from national grid projects is expected to shrink. Also, as commercial spaces in most parts of the world would run at a significantly low capacity in 2020 and 2021; electricity consumption is expected to decline considerably, and electric utilities might observe a delay in upgrading their grid infrastructure. All these factors are expected to negatively impact the substation automation industry.

Substation Automation Market Dynamics

Driver: Increasing investments in smart cities and smart grid infrastructure development projects

Substation automation helps reduce operational and maintenance costs and increase plant productivity using enhanced technologies. It also ensures high performance, reliability, and safety of electrical power network performing interlocking and smart load shedding functions. Smart grids can reduce energy losses during transmission and distribution, improve reliability and productivity, manage energy demand smartly and cost-effectively. Considering all these benefits, heavy investments are being made for the development of smart grids across the world. For instance, in May 2018, Natural Resource Canada announced an investment of USD 949,000 for a next-generation smart grid project.

The grid project focuses on promoting the adoption of renewable sources of energy and the implementation of technology to integrate new sources of clean energy without compromising the stability and reliability of existing grids. The Government of Germany is making multiple initiatives to completely digitalize various operations in the railways sector; for example, the automatic operation of trains on the mainline network using automated substations. According to the International Railway Journal, the Government of Germany has invested USD 80 million in developing digital applications to increase the network capacity.

Restraint: High initial installation cost of IEDs in substations

The initial phase of automating the substation is capital-intensive, which may restrain the growth of the global substation automation market. The increasing use of advanced technologies such as microprocessor and service-oriented architecture (SOA) and the rising requirement to embed several IEDs in substations have increased the purchase costs of these substations. Additionally, an effective deployment of smart substations requires strong coordination across customary organizational boundaries, significant process change, and rigorous governance. High investments for fruitful deployment of smart substations could add to the governments’ economic burden. High operational and maintenance costs after the deployment are also a big concern for utility providers.

Opportunity: Huge prospects for substation automation market due to increasing investments in renewable energy projects to meet growing energy demand

Solar and wind are currently the mainstream options in the power sector, with most countries generating more than 20% of their electricity using solar and wind energy sources. According to the International Energy Agency (IEA), the share of renewable sources in world electricity generation reached 25% in 2019. By 2050, renewable power will be able to provide the bulk of global power demand, which would be approximately 86%.

Companies across the world are focusing on investing into sustainable energy infrastructure than that of in fossil fuels. According to the IEA’s World Energy Investment 2020report, total investment in renewable energy sources amounted to USD 259 billion and USD 226 billion in 2019 and 2020, respectively. The decline in 2020 was much because of the economic crisis due to the outbreak of the COVID-19 pandemic.

Countries worldwide are trying to come up with new renewable projects for electricity generation. They are also investing in solar and wind projects to meet the growing demand for electricity and minimize the environmental impacts, along with investments in generating power using non-renewable sources at the same time.

Challenges: Slowdown in power generation industry with outbreak of COVID-19

The pandemic of COVID-19 has slowed the growth of the power generation industry during 2020. Electricity demand has been depressed by 20% during periods of full lockdown in several countries. With this decrease in power demand, there has been very few investments from utilities for automating substations in 2020. Though utilities have started to function completely after the lockdown period, a slow growth in substation automation is expected during the first half of 2021 due to the economic crisis faced by various end-user industries. COVID-19 is having a negative impact on the renewables energy sector.

China was primarily impacted due to COVID-19 and is the main global producer of many clean energy technologies, such as solar panels, wind turbines, and batteries. Since COVID-19 has delayed deliveries from China, renewable energy companies are not able to comply with deadlines for equipment installation. For instance, in India alone, 3,000 MW of solar and wind energy projects are delayed due to the lockdown. BYD (China), the world’s leading producer of rechargeable batteries, was unable to test new models of rechargeable batteries due to the pandemic, and this has led to a reduction in delivery volumes of rechargeable batteries in the European substation automation market.

Substation Automation Market Segmentation

Hardware accounted for the largest market share of the substation automation market in 2020

The market growth can be attributed to the introduction of the IEC 61850 standard for substations, which enables the incorporation of all control, measurement, and monitoring functions in one protocol and facilitates interoperability between intelligent electronic devices (IEDs). The demand for substation automation systems is also driven by the increasing need to retrofit conventional substations for the incorporation of modern-day monitoring and control capabilities. Various government bodies and companies across the world are planning to install SCADA systems in their substations. SCADA systems are increasingly being adopted by utilities and heavy industries to achieve improved control and complete view of substations, leading to an increase in operational efficiency.

New installations expected to be the fastest growing segment of the substation automation market, by installation type in 2026

The substation automation market for new installations is expected to grow at a high CAGR as the demand for new power stations and smart grids in different industries is growing rapidly, and the need for automation, IEDs, advanced communication technologies, HMIs, and SCADA systems is also growing steadily.

New installations also offer greater operational safety and reliability and require lower maintenance. Leading companies have introduced several new installation projects in the substation market to boost the power flow, enhance electric reliability, improve the quality of energy supply, and upgrade the power infrastructure. For example, in July 2018, GE signed a contract with Botswana Power Corporation (BPC) for the design, supply, installation, testing, and commissioning of a SCADA/Energy Management system at the principal grid control centers in Botswana Power Corporation’s (BPC) headquarters in Gaborone and the backup control center in Francistown.

Utilities: The largest segment of substation automation market, by end-user industry

Utilities is the largest segment of the substation automation market at present, and a similar trend is likely to be observed in the near future. The market growth can be attributed to the increasing government initiatives towards modernization of power grids and growing investments towards power generation through renewable sources. According to the World Energy Investment 2020 report published by the International Energy Agency (IEA), total investment in renewable sources of power amounted to USD 259 billion and USD 226 billion for 2019 and 2020, respectively.

In the current scenario, the demand for substation automation solutions is more in the wind industry; government organizations and power generation companies join hands to bring automation in wind farm projects. In June 2019, General Electric (GE) signed a contract with DTEK to supply high-voltage equipment for the 150 kV central power distribution station and two 150/35/10 kV substations, which would ensure the transmission of electricity from the first stage of Prymorska wind farm (Zaporizhia region) to the Ukrainian power grid. The digital substation will be installed at the wind farm.

Regional Analysis - Substation Automation Market

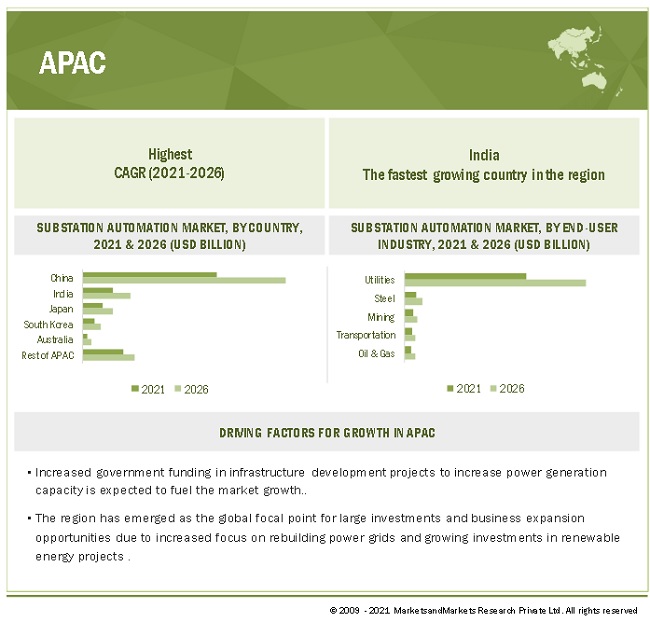

APAC is projected to be the fastest growing regional market between 2021 and 2026

APAC is expected to exhibit the highest CAGR in the substation automation market during the forecast period. Several initiatives have been taken by various governments in APAC countries to improve the power and energy sector, driving the growth of the market. The Government of India has launched several schemes to revive power distribution utilities and electrify villages. The Indian government is following the smart infrastructure vision in its country. The smart power infrastructure includes digitization of the grid, which helps distribute uninterrupted electricity to the industrial, residential, and commercial end users. Additionally, in 2020, the Government of China invested USD 31 billion to modernize its grid infrastructure by installing automated substations.

Similarly, countries such as Indonesia and South Korea are also investing in grid modernization projects. For instance, in November 2019, CG Power Systems Indonesia, a subsidiary of CG Power and Industrial Solutions (CG), was awarded a contract from the Indonesian state utility—PT PLN (Persero)—to manufacture and supply 25 units of power transformers valued at USD 24 million. The order will support PLN’s ambitious goal to enhance its transmission grid performance. All these factors are placing substation automation market in APAC towards a positive growth trajectory.

The outbreak of COVID-19 has disrupted the supply chain of IED manufacturers. The delays caused by the changed circumstances are likely to increase the cost of production of various power components during the forecast period as the price for procuring raw materials will increase due to the shortage of raw material supply.

The supply chain of electronic devices is complex and depends on several suppliers from disparate locations to be in synchronization with each other. The shortage of even a single component can hold up an entire production line, resulting in inventory and cashflow backlogs. Unless the entire supply chain of the IEDs market is operational and functioning smoothly, their production is challenged and constrained. This is expected to negatively impact the substation automation market.

To know about the assumptions considered for the study, download the pdf brochure

Substation Automation Market Key Players

The substation automation companies is dominated by key globally established players such as

- Hitachi ABB Power Grids (Switzerland),

- Siemens Energy (Germany),

- General Electric (US),

- Schneider Electric (France),

- Cisco (US).

These companies focus on adopting both organic and inorganic growth strategies, such as product launches and developments, partnerships, contracts, and mergers and acquisitions to strengthen their position in the substation automation market.

Substation Automation Market Overview

The substation automation market is experiencing robust growth driven by increasing demands for reliable power supply, integration of renewable energy sources, and the modernization of aging infrastructure. Intelligent electronic devices (IEDs), advanced communication networks, and SCADA systems are key components enhancing grid efficiency and reliability. Regulatory pressures and environmental concerns are further propelling the adoption of these technologies across utilities, industrial, and commercial sectors. North America, Europe, and Asia-Pacific are leading regions in this market, with major players like ABB, Siemens, and Schneider Electric spearheading innovations and strategic developments.

Substation Automation Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 39.9 Billion |

| Revenue Forecast in 2026 | USD 54.2 Billion |

| Growth Rate | 6.3% |

|

Market Size Available for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

|

Key Market Driver |

Increasing investments in smart cities and smart grid infrastructure development projects |

| Largest Growing Region | North America |

| Key Market Opportunity | Huge prospects for substation automation market due to increasing investments in renewable energy projects to meet growing energy demand |

| Largest Market Share Segment | New Installations |

This report categorizes the substation automation market based on offering, type, installation type, component, communication, end-user industry, and region

Substation Automation Market, by Offering:

- Hardware

- Software

- Services

Substation Automation Market, by Type:

- Transmission Substations

- Distribution Substations

Substation Automation Market, by Installation Type:

- New Installations

- Retrofit Installations

Substation Automation Market, by End-user Industry:

- Utilities

- Steel

- Oil & Gas

- Mining

- Transportation

Substation Automation Market, by Component:

- IEDs

- Communication Networks

- SCADA Systems

By Communication:

- Ethernet

- Power Line Communication

- Copper Wire Communication

- Optical Fiber Communication

Substation Automation Market, by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In January 2021, SEL launched the new SEL-3350 Automation Controller designed for applications that require midlevel I/O and computation. SEL-3350 can withstand harsh environments in utility substations, industrial control systems, and automation systems.

- In December 2020, Hitachi ABB Power Grids launched the new Remote Terminal Unit (RTU) 530 that extends the life of existing power distribution networks and supports the migration to modern technologies with enhanced security features, including secure communication, encryption, and security logging.

- In November 2020, Siemens Energy was contracted by Kuwait’s Ministry of Electricity and Water (MEW) to provide maintenance of 116 high-voltage substations. The advanced maintenance services provided to these substations will help maximize performance, lower operating costs, and deliver better and more reliable network operations for the Ministry of Electricity in Kuwait.

- In November 2020, Schneider Electric acquired a controlling stake in ETAP Automation Inc. (Dubai), the leading software platform for electrical power systems modeling and simulation, to accelerate and improve the integration of renewables, microgrids, fuel cells, and battery storage technologies to the power grid. The acquisition would pave the way for green data centers, resilient power grids, and decarbonized transport and energy generation.

- In September 2020, GE was awarded a substation equipment contract to help power the Arctic LNG 2 project in Russia. According to the contract, GE would supply a 110-kV F35 GIS for LNG trains. GE’s compact GIS will help ensure reliable power supply to the project’s production trains.

Frequently Asked Questions (FAQ):

How big substation automation market?

The global substation automation market is estimated to be USD 39.9 billion in 2021 and is projected to reach 54.2 billion by 2026, growing at a CAGR of 6.3% during the forecast period. The substation automation market exhibits a lucrative growth potential during the forecast period owing to the rising need to optimize assets and reduce operation costs in the long term.

Who are the winners in the global substation automation market?

Companies such as Hitachi ABB Power Grids (Switzerland), Siemens Energy (Germany), General Electric (US), Cisco (US), and Schneider Electric (France) fall under the winner’s category. These companies cater to the requirements of their customers by providing technologically advanced IEDs and software solutions with a presence in majority of countries. Moreover, these companies have a strong and reliable distribution network which gives them an edge over other industry players.

What are the opportunities for the existing players and for those who are planning to enter various stages of the substation automation value chain?

There are various opportunities for the existing players to enter the value chain of the substation automation industry. Some of these include the rising use of digital technology to improve grid efficiency in smart cities, increasing investments in renewable energy projects, and increasing demand for electric and hybrid vehicles.

What is the COVID-19 impact on substation automation market?

COVID-19 sent both demand-side and supply-side shocks across the global economy. Leading substation automation product and solution providers, such as Cisco (US) and Schneider Electric (France), have incurred significant losses owing to the pandemic. Both companies have reported a decline of approximately 15% and 13%, respectively, in their 2020 half-year revenue compared to the previous year. The impact of COVID-19 may last until June 2021. The situation is almost similar in both emerging and developed economies. As of January 2021, the US and India became the worst COVID-hit countries. Several renewable energy projects in the above-mentioned regions were delayed because of the reduction in power demand from various end-user industries. With the decrease in power demand, it is estimated that there would be negligible investments from the utilities for building new power plants.

What are some of the regulatory changes in the substation automation market?

Recently, in December 2020, the US Senate passed the American Energy Innovation Act (AEIA) that focuses on making modifications in the domestic energy laws, strengthening the country’s energy security, investing in clean energy technologies, and increasing its international competitiveness. Key provisions of the act include energy efficiency, renewable energy, energy storage, and grid modernization without compromising security. Also, the Federal Energy Regulatory Commission (FERC) proposes incentives for public utilities toward voluntary cybersecurity investments. Modernization of the grid infrastructure would create a demand for efficient IEDs and SCADA systems, thereby driving the substation automation market growth in North America. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 SUBSTATION AUTOMATION MARKET DEFINITION

1.2.1 GENERAL INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT COMPONENT LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT TYPE LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT INSTALLATION TYPE LEVEL

1.2.7 INCLUSIONS AND EXCLUSIONS AT COMMUNICATION LEVEL

1.2.8 INCLUSIONS AND EXCLUSIONS AT END-USER INDUSTRY LEVEL

1.2.9 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 SUBSTATION AUTOMATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key participants in primary processes across value chain of market

2.1.2.3 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM KEY MARKET PLAYERS IN MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYERS IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE)—BOTTOM-UP ESTIMATION OF MARKET, BY END-USER INDUSTRY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 7 SUBSTATION AUTOMATION MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET SHARE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

3.1 SCENARIO ANALYSIS

FIGURE 9 COMPARISON OF PRE- AND POST-COVID-19 MARKET SIZE AND CAGR OF MARKET, BY SCENARIO, 2017–2026

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.4 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 10 HARDWARE OFFERINGS TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

FIGURE 11 MARKET, BY TYPE, 2021–2026 (USD BILLION)

FIGURE 12 MARKET FOR SOLAR ENERGY SOURCE EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 13 UTILITIES INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

FIGURE 14 APAC TO REGISTER HIGHEST CAGR IN MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SUBSTATION AUTOMATION MARKET

FIGURE 15 AUTOMATED SUBSTATIONS WILL BE ADOPTED AT HIGH RATE DURING FORECAST PERIOD

4.2 MARKET, BY END-USER INDUSTRY

FIGURE 16 UTILITIES INDUSTRY TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2021 TO 2026

4.3 MARKET, BY INSTALLATION TYPE

FIGURE 17 LARGER MARKET SHARE WILL BE CAPTURED BY RETROFIT INSTALLATIONS IN 2026

4.4 MARKET, BY UTILITIES INDUSTRY

FIGURE 18 RENEWABLES SEGMENT TO EXHIBIT HIGHER CAGR IN MARKET DURING FORECAST PERIOD

4.5 MARKET, BY OFFERING AND REGION

FIGURE 19 NORTH AMERICA AND APAC WOULD BE MOST FAVORABLE REGIONS FOR MARKET IN 2026

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 SUBSTATION AUTOMATION MARKET DYNAMICS

FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in smart cities and smart grid infrastructure development projects

5.2.1.2 Escalating demand for data centers to support rapidly expanding digital activities due to COVID-19-led lockdown globally

FIGURE 21 GLOBAL DATA CENTER TRAFFIC, 2016 VS. 2021 (ZETTABYTE)

FIGURE 22 ESTIMATED NUMBER OF HYPERSCALE DATA CENTERS, BY 2021

5.2.1.3 Surging requirement to retrofit conventional substations

5.2.1.4 Rising use of digital technology to improve grid efficiency in smart cities

5.2.1.5 Increasing focus on upgrading IEC 61850 standard to resolve interoperability issue among intelligent electronic devices deployed in substations

FIGURE 23 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 High initial installation cost of IEDs in substations

5.2.2.2 Huge requirement for tremendous capital investment for deployment of wireless sensor networks in substations for oil and gas facilities

FIGURE 24 MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Huge prospects for market due to increasing investments in renewable energy projects to meet growing energy demand

FIGURE 25 GLOBAL INVESTMENT IN POWER SECTOR, BY ENERGY SOURCE, 2019 VS. 2020 (USD BILLION)

5.2.3.2 Increasing demand for electric and hybrid vehicles

FIGURE 26 GLOBAL ELECTRIC VEHICLE SALES (2015–2020), MILLION UNITS

FIGURE 27 SUBSTATION AUTOMATION MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Vulnerability of smart substations to cyber attacks

5.2.4.2 Slowdown in power generation industry with outbreak of COVID-19

FIGURE 28 MARKET CHALLENGES: IMPACT ANALYSIS

5.3 PRICE TREND ANALYSIS

FIGURE 29 AVERAGE SELLING PRICES OF DIFFERENT HARDWARE COMPONENTS USED IN SUBSTATION AUTOMATION SYSTEMS, 2017–2026

5.4 REGULATORY UPDATE

TABLE 1 RECENT REGULATORY NORMS

5.5 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING TRANSMISSION PHASE

5.6 ECOSYSTEM ANALYSIS

FIGURE 31 KEY PLAYERS IN MARKET ECOSYSTEM

TABLE 2 SUBSTATION AUTOMATION MARKET: ECOSYSTEM

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 INTENSITY OF COMPETITIVE RIVALRY

FIGURE 33 INTENSITY OF COMPETITIVE RIVALRY: HIGHLY COMPETITIVE MARKET DUE TO PRESENCE OF SEVERAL GIANT PLAYERS

5.7.2 THREAT OF SUBSTITUTES

FIGURE 34 THREAT OF SUBSTITUTES LIKELY WOULD CONTINUE TO HAVE LOW IMPACT DURING FORECAST PERIOD DUE TO POOR QUALITY OF SUBSTITUTE PRODUCTS

5.7.3 BARGAINING POWER OF BUYERS

FIGURE 35 BARGAINING POWER OF BUYERS LIKELY TO BE LOW DUE TO PRESENCE OF LIMITED NUMBER OF SOLUTION PROVIDERS

5.7.4 BARGAINING POWER OF SUPPLIERS

FIGURE 36 BARGAINING POWER OF SUPPLIERS WOULD BE MODERATE DUE TO MODERATE PRODUCT DIFFERENTIATION

5.7.5 THREAT OF NEW ENTRANTS

FIGURE 37 THREAT OF NEW ENTRANTS WOULD HAVE LOW IMPACT ON MARKET DUE TO REQUIREMENT FOR HUGE CAPITAL

5.8 TECHNOLOGY ANALYSIS

TABLE 4 IMPORTANCE OF IEDS, SCADA SYSTEMS, AND COMMUNICATION NETWORKS

5.8.1 CONVENTIONAL VS. SMART SUBSTATIONS

TABLE 5 COMPARISON OF CONVENTIONAL AND SMART SUBSTATIONS

5.8.2 OVERVIEW OF INTERNATIONAL STANDARD COMMUNICATION PROTOCOLS

5.8.2.1 IEC 61850

5.8.2.2 IEC 61850-8-1

5.8.2.3 IEC 61850-9-2

5.9 PATENT ANALYSIS

5.9.1 DOCUMENT TYPE

TABLE 6 PATENTS FILED

FIGURE 38 PATENTS FILED BETWEEN 2011 AND 2020

5.9.2 PUBLICATION TREND

FIGURE 39 NO. OF PATENTS FILED EACH YEAR BETWEEN 2011 AND 2020

5.9.3 JURISDICTION ANALYSIS

FIGURE 40 JURISDICTION ANALYSIS

5.9.4 TOP PATENT OWNERS

FIGURE 41 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2020

TABLE 7 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

5.9.5 SCHWEITZER ENGINEERING LABORATORIES

TABLE 8 SOME KEY INNOVATIONS AND PATENT REGISTRATIONS FROM SEL

5.10 TRADE ANALYSIS

FIGURE 42 EXPORT FOR PRODUCTS CLASSIFIED UNDER HS CODE: 853720, BY KEY COUNTRIES, 2015-2019

TABLE 9 EXPORT SCENARIO FOR HS CODE: 853720-BASED PRODUCTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

FIGURE 43 IMPORT FOR PRODUCTS CLASSIFIED UNDER HS CODE: 853720, BY KEY COUNTRIES, 2015-2019

TABLE 10 IMPORT SCENARIO FOR HS CODE: 853720-BASED PRODUCTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

5.11 CASE STUDY ANALYSIS

5.11.1 HITACHI ABB POWER GRIDS FAST-TRACKS GRID CONNECTION TO SERVE DUBLIN’S DATA CENTER BOOM

5.11.2 HYDRO ONE LEADS WAY IN SMART METER DEPLOYMENT WITH TRILLIANT

6 COMPONENTS OF SUBSTATION AUTOMATION SYSTEM (Page No. - 91)

6.1 INTRODUCTION

FIGURE 44 SUBSTATION AUTOMATION MARKET, BY COMPONENT

6.2 INTELLIGENT ELECTRONIC DEVICES

6.2.1 HIGH DEMAND FOR IEDS CAN BE ATTRIBUTED TO INCREASING NUMBER OF SMART GRID INITIATIVES WORLDWIDE

6.3 COMMUNICATION NETWORKS

FIGURE 45 MARKET, BY COMMUNICATION NETWORK

6.3.1 WIRED COMMUNICATION

6.3.1.1 Fiber optic is preferred medium for networking in substation automation because of its flexibility and high speed

6.3.2 WIRELESS COMMUNICATION

6.3.2.1 Wireless communication is possible through microwaves, radio waves, satellites, and general packet radio services

6.4 SCADA SYSTEMS

6.4.1 SURGED DEMAND FOR INDUSTRIAL MOBILITY SOLUTIONS TO EFFICIENTLY MANAGE PROCESS INDUSTRIES TO FOSTER MARKET GROWTH

7 SUBSTATION AUTOMATION MARKET, BY OFFERING (Page No. - 94)

7.1 INTRODUCTION

FIGURE 46 MARKET, BY OFFERING

TABLE 11 MARKET, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 12 MARKET, BY OFFERING, 2021–2026 (USD BILLION)

7.2 HARDWARE

FIGURE 47 MARKET, BY HARDWARE

TABLE 13 MARKET, BY HARDWARE, 2017–2020 (USD BILLION)

TABLE 14 MARKET, BY HARDWARE, 2021–2026 (USD BILLION)

FIGURE 48 SHIPMENTS FOR PROTECTIVE RELAYS, RECLOSER CONTROLLERS, AND CAPACITOR BANKS, 2020 VS. 2026 (THOUSAND UNITS)

TABLE 15 MARKET FOR HARDWARE, BY REGION, 2017–2020 (USD BILLION)

TABLE 16 SUBSTATION AUTOMATION MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD BILLION)

7.2.1 SMART METERS

7.2.1.1 Increasing demand for smart meters to regulate energy consumption at utilities

7.2.2 PROGRAMMABLE LOGIC CONTROLLERS

7.2.2.1 Rising adoption of PLCs to meet growing need to monitor crucial process parameters and accordingly adjust process operations

7.2.3 PROTECTIVE RELAYS

7.2.3.1 Surging demand for protective relays from smart substations to detect faults

7.2.4 LOAD TAP CHANGERS

7.2.4.1 Growing requirement of load tap changers to ensure smooth operation of substations

7.2.5 RECLOSER CONTROLLERS

7.2.5.1 Accelerating need for recloser controllers to ensure reliable and safe power operations in substations

7.2.6 CAPACITOR BANKS

7.2.6.1 Escalating demand for automated capacitor banks that are compatible with IEC 61850 communication protocol

7.2.7 OTHERS

7.3 SOFTWARE

FIGURE 49 MARKET, BY SOFTWARE

TABLE 17 MARKET FOR SOFTWARE, BY REGION, 2017–2020 (USD BILLION)

TABLE 18 MARKET FOR SOFTWARE, BY REGION, 2021–2026 (USD BILLION)

7.3.1 ASSET MANAGEMENT

7.3.1.1 Asset management software improves reliability and reduces operational risks

7.3.2 PRODUCTION MANAGEMENT

7.3.2.1 Production management software reduces overall production costs

7.3.3 PERFORMANCE MANAGEMENT

7.3.3.1 Performance management software protects assets from theft and damage

7.4 SERVICES

FIGURE 50 SUBSTATION AUTOMATION MARKET, BY SERVICE

TABLE 19 MARKET FOR SERVICES, BY REGION, 2017–2020 (USD BILLION)

TABLE 20 MARKET FOR SERVICES, BY REGION, 2021–2026 (USD BILLION)

7.4.1 TRAINING AND DEVELOPMENT

7.4.1.1 Training and development enhance workers’ skills related to operations of power grids

7.4.2 UPGRADES AND RETROFITS

7.4.2.1 Upgrade and retrofit services enable substation owners and operators to seek benefits from technological advancements

7.4.3 INSTALLATION AND COMMISSIONING

7.4.3.1 Commissioning process helps utilities deal with potentially volatile situations occurring during substation installation

7.4.4 REPAIR, TESTING, AND MAINTENANCE

7.4.4.1 Maintenance of assets is critical to achieve reliable supply of electricity and ensure compliance with regulations

8 SUBSTATION AUTOMATION MARKET, BY TYPE (Page No. - 106)

8.1 INTRODUCTION

FIGURE 51 MARKET, BY TYPE

TABLE 21 MARKET, BY TYPE, 2017–2020 (USD BILLION)

TABLE 22 MARKET, BY TYPE, 2021–2026 (USD BILLION)

8.2 TRANSMISSION SUBSTATIONS

8.2.1 TRANSMISSION SUBSTATIONS TO ACCOUNT FOR LARGER MARKET SHARE IN 2026

TABLE 23 MARKET FOR TRANSMISSION SUBSTATIONS, BY REGION, 2017–2020 (USD BILLION)

TABLE 24 MARKET FOR TRANSMISSION SUBSTATIONS, BY REGION, 2021–2026 (USD BILLION)

8.3 DISTRIBUTION SUBSTATIONS

8.3.1 DISTRIBUTION SUBSTATIONS TO WITNESS INCREASED DEMAND FROM APAC FROM 2021 TO 2026

TABLE 25 MARKET FOR DISTRIBUTION SUBSTATIONS, BY REGION, 2017–2020 (USD BILLION)

TABLE 26 MARKET FOR DISTRIBUTION SUBSTATIONS, BY REGION, 2021–2026 (USD BILLION)

9 SUBSTATION AUTOMATION MARKET, BY INSTALLATION TYPE (Page No. - 112)

9.1 INTRODUCTION

FIGURE 52 RETROFIT INSTALLATIONS TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 27 MARKET, BY INSTALLATION TYPE, 2017–2020 (USD BILLION)

TABLE 28 MARKET, BY INSTALLATION TYPE, 2021–2026 (USD BILLION)

9.2 RETROFIT INSTALLATIONS

9.2.1 INCREASED NEED TO UPGRADE CONVENTIONAL SUBSTATIONS TO IMPROVE OPERATIONAL EFFICIENCY

TABLE 29 MARKET FOR RETROFIT INSTALLATIONS, BY REGION, 2017–2020 (USD BILLION)

TABLE 30 MARKET FOR RETROFIT INSTALLATIONS, BY REGION, 2021–2026 (USD BILLION)

9.3 NEW INSTALLATIONS

9.3.1 GREATER OPERATIONAL SAFETY AND RELIABILITY AND LOWER MAINTENANCE REQUIREMENT OFFERED BY NEW INSTALLATIONS

TABLE 31 MARKET FOR NEW INSTALLATIONS, BY REGION, 2017–2020 (USD BILLION)

TABLE 32 MARKET FOR NEW INSTALLATIONS, BY REGION, 2021–2026 (USD BILLION)

10 COMMUNICATION TECHNOLOGIES USED IN SUBSTATION AUTOMATION SYSTEMS (Page No. - 117)

10.1 INTRODUCTION

FIGURE 53 COMMUNICATION TECHNOLOGIES USED IN SUBSTATION AUTOMATION SYSTEMS

10.2 ETHERNET

10.2.1 ETHERNET SWITCHES MANAGE DATA TRAFFIC AND REDUCE DATA TRANSMISSION CRASHES

10.3 POWER LINE COMMUNICATION

10.3.1 PLC SOLUTIONS TRANSFORM DISTRIBUTION SYSTEM OPERATORS’ ASSETS INTO HIGHLY CAPABLE SMART GRID INFRASTRUCTURE

10.4 COPPER WIRE COMMUNICATION

10.4.1 COPPER WIRE COMMUNICATION NETWORKS ARE VULNERABLE TO INTRA-SUBSTATION ELECTROMAGNETIC AND RADIOFREQUENCY, GROUND POTENTIAL RISE, AND SIGNAL GROUND LOOP

10.5 OPTICAL FIBER COMMUNICATION

10.5.1 OPTICAL FIBER CABLES ARE USED IN SUBSTATIONS FOR FAST AND SECURE COMMUNICATION

11 SUBSTATION AUTOMATION MARKET, BY END-USER INDUSTRY (Page No. - 120)

11.1 INTRODUCTION

FIGURE 54 MARKET, BY END-USER INDUSTRY

FIGURE 55 UTILITIES INDUSTRY TO LEAD MARKET FROM 2021 TO 2026

TABLE 33 MARKET, BY END-USER INDUSTRY, 2017–2020 (USD BILLION)

TABLE 34 MARKET, BY END-USER INDUSTRY, 2021–2026 (USD BILLION)

11.2 UTILITIES

FIGURE 56 MARKET FOR UTILITIES INDUSTRY, BY ENERGY SOURCE

TABLE 35 MARKET FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 36 MARKET FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2021–2026 (USD BILLION)

TABLE 37 MARKET FOR UTILITIES INDUSTRY, BY REGION, 2017–2020 (USD BILLION)

TABLE 38 MARKET FOR UTILITIES INDUSTRY, BY REGION, 2021–2026 (USD BILLION)

11.2.1 NON-RENEWABLES

11.2.1.1 Larger share of non-renewable power sources for utilities segment creating need for digital substations

11.2.2 RENEWABLES

11.2.2.1 Low-cost energy generation using renewable sources leading to adoption of automated substations

FIGURE 57 SUBSTATION AUTOMATION MARKET, BY RENEWABLE

TABLE 39 MARKET FOR UTILITIES INDUSTRY, BY RENEWABLE ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 40 MARKET FOR UTILITIES INDUSTRY, BY RENEWABLE ENERGY SOURCE, 2021–2026 (USD BILLION)

11.2.2.2 Solar

11.2.2.3 Wind

11.3 STEEL

11.3.1 AUTOMATED SUBSTATION SYSTEMS ARE INCREASINGLY BEING USED IN STEEL INDUSTRY TO ENSURE IMPROVED QUALITY AND UNINTERRUPTED POWER SUPPLY

TABLE 41 MARKET FOR STEEL INDUSTRY, BY REGION, 2017–2020 (USD BILLION)

TABLE 42 MARKET FOR STEEL INDUSTRY, BY REGION, 2021–2026 (USD BILLION)

11.4 MINING

11.4.1 MINING PLANTS WITNESS SURGED DEPLOYMENT OF SUBSTATION AUTOMATION SOLUTIONS TO ENSURE ENERGY EFFICIENCY IMPROVEMENT AND COST SAVING

TABLE 43 MARKET FOR MINING INDUSTRY, BY REGION, 2017–2020 (USD BILLION)

TABLE 44 MARKET FOR MINING INDUSTRY, BY REGION, 2021–2026 (USD BILLION)

11.5 OIL & GAS

11.5.1 REDUCED OIL PRICES ARE DISCOURAGING OIL & GAS COMPANIES IN DEVELOPED NATIONS TO INVEST IN DIGITAL SUBSTATIONS

TABLE 45 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2017–2020 (USD BILLION)

TABLE 46 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2021–2026 (USD BILLION)

11.6 TRANSPORTATION

11.6.1 ACCELERATED IMPLEMENTATION OF AUTOMATED SUBSTATIONS IS OBSERVED IN TRANSPORTATION INDUSTRY TO ENSURE UNINTERRUPTED POWER SUPPLY FOR RAILWAYS AND METROS

TABLE 47 MARKET FOR TRANSPORTATION INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR TRANSPORTATION INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

12 SUBSTATION AUTOMATION MARKET, BY REGION (Page No. - 133)

12.1 INTRODUCTION

FIGURE 58 GEOGRAPHIC SNAPSHOT OF MARKET, 2021–2026

FIGURE 59 NORTH AMERICA TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 49 MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 50 MARKET, BY REGION, 2021–2026 (USD BILLION)

12.2 NORTH AMERICA

FIGURE 60 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 61 CANADA WOULD BE FASTEST-GROWING MARKET FOR SUBSTATION AUTOMATION FROM 2021 TO 2026

TABLE 51 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD BILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD BILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD BILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD BILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY INSTALLATION TYPE, 2017–2020 (USD BILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY INSTALLATION TYPE, 2021–2026 (USD BILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 60 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 61 MARKET IN NORTH AMERICA, BY COMMUNICATION NETWORK, 2017–2020 (USD BILLION)

TABLE 62 MARKET IN NORTH AMERICA, BY HARDWARE, 2017–2020 (USD BILLION)

TABLE 63 MARKET IN NORTH AMERICA, BY HARDWARE, 2021–2026 (USD BILLION)

TABLE 64 MARKET IN NORTH AMERICA FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 65 MARKET IN NORTH AMERICA FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2021–2026 (USD BILLION)

TABLE 66 MARKET IN NORTH AMERICA IN UTILITIES INDUSTRY, BY RENEWABLE ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 67 MARKET IN NORTH AMERICA FOR UTILITIES INDUSTRY, BY RENEWABLE ENERGY SOURCE, 2021–2026 (USD BILLION)

12.2.1 US

12.2.1.1 Utilization of renewable sources for power generation

12.2.2 CANADA

12.2.2.1 Need for replacement of aging electricity infrastructure

12.2.3 MEXICO

12.2.3.1 Liberalization in electricity generation market leading to high competition among energy producers

12.2.4 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

FIGURE 62 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN NORTH AMERICA

12.3 EUROPE

FIGURE 63 EUROPE: SNAPSHOT OF MARKET

FIGURE 64 GERMANY TO CAPTURE LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 68 SUBSTATION AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 69 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 70 MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD BILLION)

TABLE 71 MARKET IN EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD BILLION)

TABLE 72 MARKET IN EUROPE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 73 MARKET IN EUROPE, BY TYPE, 2021–2026 (USD BILLION)

TABLE 74 MARKET IN EUROPE, BY INSTALLATION TYPE, 2017–2020 (USD BILLION)

TABLE 75 MARKET IN EUROPE, BY INSTALLATION TYPE, 2021–2026 (USD BILLION)

TABLE 76 MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 77 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 78 MARKET IN EUROPE, BY HARDWARE, 2017–2020 (USD BILLION)

TABLE 79 MARKET IN EUROPE, BY HARDWARE, 2021–2026 (USD BILLION)

TABLE 80 MARKET IN EUROPE FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 81 MARKET IN EUROPE FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2021–2026 (USD BILLION)

TABLE 82 MARKET IN EUROPE, BY RENEWABLE ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 83 SUBSTATION AUTOMATION MARKET IN EUROPE, BY RENEWABLE ENERGY SOURCE, 2021–2026 (USD BILLION)

12.3.1 UK

12.3.1.1 Strong need to improve grid efficiency and reliability of substation solutions creating demand for automation in utilities

12.3.2 GERMANY

12.3.2.1 Government investment toward modernization of existing grid infrastructure

12.3.3 FRANCE

12.3.3.1 High focus on generating energy using renewable sources to boost demand for substation automation

12.3.4 REST OF EUROPE

12.3.5 IMPACT OF COVID-19 ON MARKET IN EUROPE

FIGURE 65 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN EUROPE

12.4 APAC

FIGURE 66 APAC: SNAPSHOT OF SUBSTATION AUTOMATION MARKET

FIGURE 67 INDIA TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 84 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 85 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 86 MARKET IN APAC, BY END-USER INDUSTRY, 2017–2020 (USD BILLION)

TABLE 87 MARKET IN APAC, BY END-USER INDUSTRY, 2021–2026 (USD BILLION)

TABLE 88 MARKET IN APAC, BY TYPE, 2017–2020 (USD BILLION)

TABLE 89 MARKET IN APAC, BY TYPE, 2021–2026 (USD BILLION)

TABLE 90 MARKET IN APAC, BY INSTALLATION TYPE, 2017–2020 (USD BILLION)

TABLE 91 MARKET IN APAC, BY INSTALLATION TYPE, 2021–2026 (USD BILLION)

TABLE 92 MARKET IN APAC, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 93 MARKET IN APAC, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 94 MARKET IN APAC, BY HARDWARE, 2017–2020 (USD BILLION)

TABLE 95 MARKET IN APAC, BY HARDWARE, 2021–2026 (USD BILLION)

TABLE 96 SUBSTATION AUTOMATION MARKET IN APAC FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 97 MARKET IN APAC FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2021–2026 (USD BILLION)

TABLE 98 MARKET IN APAC, BY RENEWABLE ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 99 MARKET IN APAC, BY RENEWABLE ENERGY SOURCE, 2021–2026 (USD BILLION)

12.4.1 CHINA

12.4.1.1 Rapid development in renewable energy projects

12.4.2 JAPAN

12.4.2.1 Increased focus on rebuilding power grids and substations

12.4.3 SOUTH KOREA

12.4.3.1 High focus on digitalization of grids

12.4.4 INDIA

12.4.4.1 Increased government funding to enhance renewable power generation capacity

12.4.5 AUSTRALIA

12.4.5.1 High focus of country on installation of digital substations in long run

12.4.6 REST OF APAC

12.4.7 IMPACT OF COVID-19 ON MARKET IN APAC

FIGURE 68 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN APAC

12.5 ROW

TABLE 100 SUBSTATION AUTOMATION MARKET IN ROW, BY REGION, 2017–2020 (USD BILLION)

TABLE 101 MARKET IN ROW, BY REGION, 2021–2026 (USD BILLION)

TABLE 102 MARKET IN ROW, BY END-USER INDUSTRY, 2017–2020 (USD BILLION)

TABLE 103 MARKET IN ROW, BY END-USER INDUSTRY, 2021–2026 (USD BILLION)

TABLE 104 MARKET IN ROW, BY TYPE, 2017–2020 (USD BILLION)

TABLE 105 MARKET IN ROW, BY TYPE, 2021–2026 (USD BILLION)

TABLE 106 MARKET IN ROW, BY INSTALLATION TYPE, 2017–2020 (USD BILLION)

TABLE 107 MARKET IN ROW, BY INSTALLATION TYPE, 2021–2026 (USD BILLION)

TABLE 108 MARKET IN ROW, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 109 MARKET IN ROW, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 110 MARKET IN ROW, BY HARDWARE, 2017–2020 (USD BILLION)

TABLE 111 MARKET IN ROW, BY HARDWARE, 2021–2026 (USD BILLION)

TABLE 112 MARKET IN ROW FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 113 MARKET IN ROW FOR UTILITIES INDUSTRY, BY ENERGY SOURCE, 2021–2026 (USD BILLION)

TABLE 114 SUBSTATION AUTOMATION MARKET IN ROW, BY RENEWABLE ENERGY SOURCE, 2017–2020 (USD BILLION)

TABLE 115 MARKET IN ROW, BY RENEWABLE ENERGY SOURCE, 2021–2026 (USD BILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Growing need for high-voltage substations in Middle East and Africa

12.5.2 SOUTH AMERICA

12.5.2.1 High dependence of region on hydropower projects for electricity generation

12.5.3 IMPACT OF COVID-19 ON MARKET IN ROW

FIGURE 69 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN ROW

13 COMPETITIVE LANDSCAPE (Page No. - 171)

13.1 INTRODUCTION

FIGURE 70 KEY GROWTH STRATEGIES OF LEADING PLAYERS IN MARKET BETWEEN JANUARY 2017 AND JANUARY 2021

13.2 HISTORICAL REVENUE ANALYSIS OF MAJOR PLAYERS IN MARKET

FIGURE 71 REVENUE ANALYSIS FOR KEY COMPANIES FROM 2015 TO 2019 (USD BILLION)

13.3 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2020

TABLE 116 MARKET: DEGREE OF COMPETITION

TABLE 117 SHARE OF LEADING PLAYERS IN MARKET, 2020

TABLE 118 MARKET RANKING ANALYSIS: SUBSTATION AUTOMATION MARKET, 2020

13.4 COMPETITIVE SCENARIO

FIGURE 72 PRODUCT LAUNCHES EMERGED AS KEY STRATEGY ADOPTED BY PLAYERS IN MARKET BETWEEN JANUARY 2017 AND JANUARY 2021

13.4.1 PRODUCT LAUNCHES

TABLE 119 MARKET: PRODUCT LAUNCHES, JANUARY 2017–JANUARY 2021

13.4.2 DEALS

TABLE 120 MARKET: DEALS, JANUARY 2017–JANUARY 2021

13.5 COMPANY EVALUATION MATRIX, 2020

13.5.1 STAR

13.5.2 PERVASIVE

13.5.3 PARTICIPANT

13.5.4 EMERGING LEADER

FIGURE 73 MARKET (GLOBAL), COMPANY EVALUATION MATRIX (2020)

13.6 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 74 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN MARKET

13.7 MARKET SHARE/RANK

FIGURE 75 MARKET SHARE/RANK ANALYSIS OF TOP PLAYERS IN MARKET

13.8 STARTUP/SME EVALUATION MATRIX, 2020

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 DYNAMIC COMPANIES

13.8.4 STARTING BLOCKS

FIGURE 76 SUBSTATION AUTOMATION MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX (2020)

13.9 COMPETITIVE BENCHMARKING

TABLE 121 COMPANY INDUSTRY FOOTPRINT

TABLE 122 COMPANY REGION FOOTPRINT

TABLE 123 COMPANY FOOTPRINT

14 COMPANY PROFILES (Page No. - 196)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

14.2.1 HITACHI ABB POWER GRIDS

TABLE 124 HITACHI ABB POWER GRIDS: BUSINESS OVERVIEW

14.2.2 SIEMENS ENERGY

TABLE 125 SIEMENS ENERGY: BUSINESS OVERVIEW

FIGURE 77 SIEMENS ENERGY: COMPANY SNAPSHOT

14.2.3 GENERAL ELECTRIC

TABLE 126 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 78 GENERAL ELECTRIC: COMPANY SNAPSHOT

14.2.4 CISCO

TABLE 127 CISCO: BUSINESS OVERVIEW

FIGURE 79 CISCO: COMPANY SNAPSHOT

14.2.5 SCHNEIDER ELECTRIC

TABLE 128 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 80 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

14.2.6 EATON CORPORATION

TABLE 129 EATON CORPORATION: BUSINESS OVERVIEW

FIGURE 81 EATON CORPORATION: COMPANY SNAPSHOT

14.2.7 HONEYWELL

TABLE 130 HONEYWELL: BUSINESS OVERVIEW

FIGURE 82 HONEYWELL: COMPANY SNAPSHOT

14.2.8 SCHWEITZER ENGINEERING LABORATORIES

TABLE 131 SEL: BUSINESS OVERVIEW

14.2.9 NOVATECH AUTOMATION

TABLE 132 NOVATECH AUTOMATION: BUSINESS OVERVIEW

14.2.10 CG POWER AND INDUSTRIAL SOLUTIONS

TABLE 133 CG POWER AND INDUSTRIAL SOLUTIONS: BUSINESS OVERVIEW

FIGURE 83 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY SNAPSHOT

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.3 OTHER IMPORTANT PLAYERS

14.3.1 ITRON

14.3.2 IGRID T&D

14.3.3 CADILLAC AUTOMATION AND CONTROLS

14.3.4 TEKVEL

14.3.5 TRILLIANT

14.3.6 ENCORE NETWORKS

14.3.7 CROSS CANYON ENGINEERING

14.3.8 POWER SYSTEM ENGINEERING

14.3.9 VENSON ELECTRIC

14.3.10 SAE-IT SYSTEMS

14.3.11 ARTECHE

14.3.12 SISCO

14.3.13 MB CONTROL AND SYSTEMS

14.3.14 TESLATECH

14.3.15 SELTA

15 APPENDIX (Page No. - 238)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

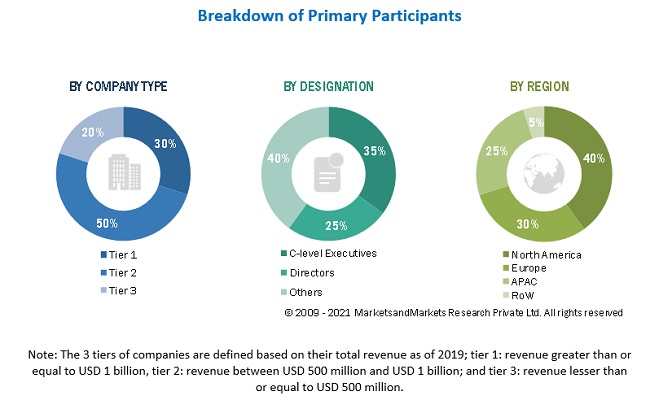

The study involved four major activities in estimating the size of the substation automation market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market’s size. After that, market breakdown and data triangulation were used to estimate the market sizes of segments and sub-segments.

Secondary Research

In the substation automation market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the substation automation market, along with other dependent submarkets. The key players in the market have been identified through secondary research, and their market ranks have been determined through primary and secondary research. This entire research methodology involved studying annual and financial reports of the top players and interviewing experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that may affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Primary Research

The substation automation market supply chain comprises several stakeholders, such as IED manufacturers, system integrators, consulting service providers, distribution channels, and end-users. The demand side of this market is characterized by utilities and heavy industries; while the supply side is characterized by IED manufacturers, system integrators, and consulting service providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of substation automation market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the substation automation market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to substation automation supply chain, including IED manufacturers, system integrators, and end-users.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the substation automation market.

Report Objectives

- To describe and forecast the global substation automation market size, by offering, type, installation type, end-user industry, and region, in terms of value

- To describe and forecast the market size for various segments of the market with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the substation automation market

- To provide a value chain analysis of the global substation automation ecosystem, along with critical information about price and technology trend, market map, Porter’s five forces analysis, international and communication protocols, patent and jurisdiction analysis, and case studies

- To describe the impact of COVID-19 on the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze growth opportunities for stakeholders in the substation automation market

- To strategically profile key players and comprehensively analyze their position in the market in terms of their market share and core competencies and provide details of the competitive landscape for market leaders

- To analyze various developments such as partnerships, contracts, mergers and acquisitions, and product launches, along with research and development activities, in the global substation automation market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Information

- Additional country-level analysis of substation automation market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Substation Automation Market

Id like to understand how growth in transmission& distribution at a global level will create opportunities in the substation automation market? What are the requirements/specifications for substations and how are they changing? Channels through which substation systems are purchased and how this might evolve supply chain model of substation system (e.g, product packages, system packages, turnkey solutions) and how this may evolve supply models and channels covered by major players in the system integration market?

Id like to know more details about market players/vendors in this market (market share, major products, value proposition, etc.); typical job-titles/designations of decision makers in-charge of purchasing industrial computers for substations; and trends in the substation automation market.

We would be interested in understanding the size of the substation automation market in the US (and forecast for next 3-5 years); Industry regulations that impact the industrial computers/control systems used in this sector?

I am interested to know key providers of Substation automation solutions in the Europe market and their market share and recent activities in terms of organic and inorganic developments?

My specific interest is RTU , SCADA market. Please let me know what level of information report has specific to this? Also, if possible, please send the sample copy of the report. Thank you!