Diesel Exhaust Fluid Market by Component (SCR Catalysts, DEF Tanks, Injectors, Supply Modules, Sensors), OHV Market by Application, Aftermarket by Vehicle Type, Supply Mode (Cans, IBCs, Bulk & Pumps), End Use Market and Region - Global Forecast to 2027

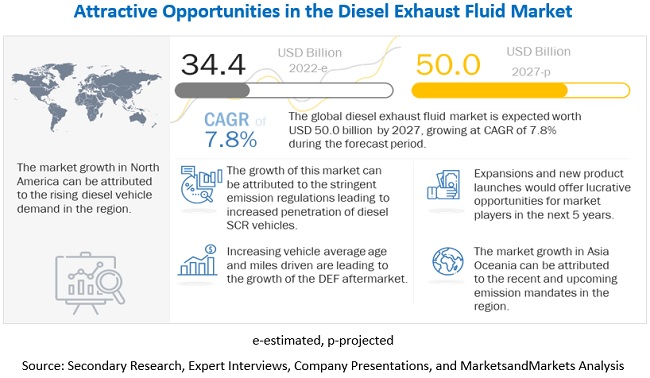

[212 Pages Report] The diesel exhaust fluid market size was valued at USD 34.4 billion in 2022 and is expected to reach USD 50.0 billion by 2027, at a CAGR of 7.8% during the forecast period 2022-2027. Stringent emission regulations leading to increased penetration of diesel SCR vehicles has fueled the growth of the market for diesel exhaust fluid. The increasing number of DEF pumps and increasing average age of vehicles and miles driven are leading to the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Increasing average age of vehicles and miles driven are leading to the growth of the DEF aftermarket

The demand in the DEF aftermarket is influenced by factors such as the increasing average age of vehicles, improving infrastructure, increasing number of vehicles on roads, average miles driven, replacement cycles of DEF, and rising concerns towards maintenance of vehicles. In North America, the average age of a vehicle has increased from 10.1 years to 11.8 years from 2005 to 2019. This is due to improved road infrastructure and safety features and technological developments. Due to the increasing average age of vehicles, the number of vehicles on the road is increasing. Additionally, factors such as stringent emission regulations implemented across countries are expected to generate demand for SCR globally. For example, under Euro VI norms, there is a drastic decline in NOx limits. Hence, Tier-1 and OEMs are employing SCR as an after-treatment technology. These factors together influence the demand for DEF in the aftermarket.

RESTRAINT: Decreasing diesel vehicle penetration

The diesel vehicle penetration is decreasing in most of the regions. Major factors hampering the diesel vehicle demand includes vehicle manufacturers shifting away from diesel technology in response to tighter NOX emission standards and real-driving emissions testing. Incidences like 2015 emissions scandal which changed the consumer choices in the wake of the defeat device scandal and manufacturers like Volvo to Nissan have vowed to phase out this fuel type, has hampered the diesel vehicles sales in the recent years. Diesel vehicles have broad implications for the cost of attaining CO2 emission targets and the magnitude of fleetwide NOX emissions further increasing the vehicles prices. Thus, increasing cost of diesel vehicles is also factor of concern for vehicle buyers.

Diesel exhaust fluid demand is directly related to the diesel vehicle sales, thus, decline in diesel vehicle sales is expected to limit the growth of the DEF market during the forecast period.

OPPORTUNITY: Rising demand for DEF in the construction equipment segment

The construction industry is booming; housing constitutes a major part of the construction industry. Asian countries and the US have seen significant improvements in economies, and with the rising population and standard of living, people are migrating to urban areas and spending on housing. According to the New Building Materials and Construction World Magazine ASEAN, a 10-country regional bloc comprising Philippines, Indonesia, Malaysia, Thailand, Vietnam, Cambodia, Myanmar, Singapore, Laos, and Myanmar, highlights a USD 250 billion potential in construction in 2019. Thus, the ASEAN construction market is expected to grow at 7.5% in the coming years. Hence, the demand for construction equipment is increasing, leading to the rise in demand for engine coolants used in construction equipment. Diesel Exhaust Fluid (DEF) was introduced in the construction equipment segment in 2010. In North America, the SCR technology started use in diesel equipment for off-highway equipment, and hence the consumption of DEF in the off-highway segment has increased. The increasing demand for DEF in the construction equipment segment is expected to create a growth opportunity for the diesel exhaust fluid market during the forecast period.

CHALLENGE: Fluctuations in the prices of urea

DEF is composed of urea and de-ionized water, and hence, urea prices affect DEF prices to an extent. The major application that globally impacts the price of urea is agriculture. Urea prices are influenced by the agriculture industry. The price of urea is highly unpredictable than that of diesel, as it is based on the supply and demand from the agriculture market.

In various countries of the northern hemisphere, crops are planted at the beginning of the year. Hence, urea prices are high. Once the crops are ready for harvesting in the winter season, urea prices drop. As the graph below depicts, prices of urea increase during the beginning of every year due to plantations increasing the demand for urea from the agriculture industry.

According to Yara International (Norway), in 2017, urea prices were at their lowest for over a decade. Urea is the main ingredient of diesel exhaust fluid, thus, fluctuations in the prices of urea affect the prices of DEF and thus pose a challenge for the global diesel exhaust fluid market.

“Globally, the HCV segment is estimated to lead the diesel exhaust fluid OE market in 2022”

Globally, the HCVs segment is estimated to lead the diesel exhaust fluid OE market, by volume. It is anticipated to grow from 33.2 million gallons in 2022 to 36.5 million gallons by 2027, at a CAGR of 1.9% during the forecast period. As the developing economies boom around the globe the demand for HCVs will increase. This demand is driven by increased business activities in the region. HCVs are driven by diesel fuel and due to the regulations introduced by the countries these vehicles have to comply with the emission norms. DEF helps reduce emissions and hence will observe a sharp increase in demand globally, especially in developing regions. Recent and upcoming emission regulations in countries such as India and China are expected to boost the demand for DEF.

“The DEF pump segment is expected to be the fastest-growing segment throughout the forecast period”

The diesel exhaust fluid market for pumps is projected to grow from USD 7,373.3 million in 2022 to USD 11,979.1 million by 2027, at a CAGR of 10.2% during the forecast period.

Comapred to conventional cans and bottles supply mode the DEF pumps supply mode is cheaper but expensive than the Bulk supply mode due to the economic behind the economies of scale. Customers opt for DEF dispensing units as it provides convenience in DEF refilling for fleet and other vehicle owners. The percentage of DEF pumps in the overall automotive DEF supply mode increased from 14% in 2011 to 40% in 2019. This has prompted fuel providing companies to invest in installing such dispensing units at their fuel stations to attract more customers. FMT Swiss Ag, a leading supplier of specialty fluid storage and dispensing solutions, in 2017, launched a range of diesel exhaust fluid (DEF) dispensing unit product for its North American market. High growth of the installation of DEF pumps in Europe and North America is due to the easier refilling process which is majorly driving the growth of the DEF pump segment globally.

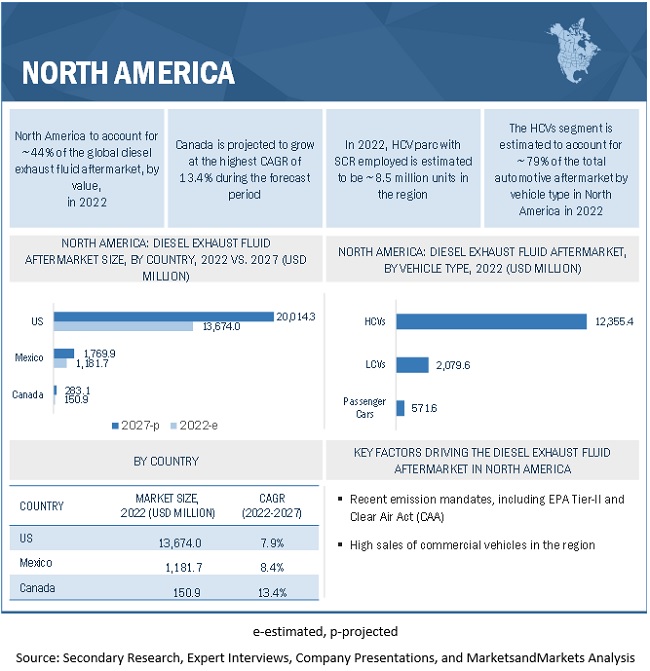

North America is estimated to be the largest market in 2022

The North American diesel exhaust fluid market is estimated to grow from USD 15,006.6 million in 2022 to USD 22,067.4 million by 2027, at a CAGR of 8.0% during the forecast period. The market in Asia Oceania is projected to grow from USD 11,840.4 million in 2022 to USD 17,240.8 million by 2027, at a CAGR of 7.8% during the forecast period. Over the years, the economic conditions in Mexico have improved. The economic conditions have made way for a better business environment which has driven the demand for diesel-powered vehicles and equipment. As the demand for diesel increases, the emission norms in the country will call for better solutions to improve air quality. This will increase the demand for DEF in the country. Canada, very similar to the US, has a high demand for diesel-powered vehicles. The demand for LCVs and HCVs in the country will see higher growth in the forecast years. As a result of this high demand, diesel fuel consumption will increase as well. Also, Canada has stricter norms when it comes to air quality, which will drive the demand for DEF to comply with these standards.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

TotalEnergies (France), Shell PLC (The Netherlands), BASF SE (Germany), Brenntag AG (Germany) and China Petrochemical Corporation (Sinopec) (China). These companies adopted expansion strategies and used mergers & acquisitions to gain traction in the diesel exhaust fluid market.

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 34.4 billion |

|

Estimated Value by 2027 |

USD 50.0 billion |

|

Growth Rate |

Poised to grow at a CAGR of 7.8% |

|

Market Segmentation |

By vehicle type, component, application, supply mode, end use market, and region |

|

Market Driver |

Increasing average age of vehicles and miles driven are leading to the growth of the DEF aftermarket |

|

Market Opportunity |

Rising demand for DEF in the construction equipment segment |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

The study categorizes the diesel exhaust fluid market based on vehicle type, component, application, supply mode, and region

Diesel Exhaust Fluid OE Market, By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

Diesel Exhaust Fluid OE Market, By Component

- SCR Catalysts

- DEF Tanks

- DEF Injectors

- DEF Supply Modules

- DEF Sensors

- NOx Sensors

Off-Highway Diesel Exhaust Fluid OE Market, By Application

- Construction Equipment

- Agricultural Tractors

Diesel Exhaust Fluid Aftermarket, By Supply Mode

- Cans & Bottles

- IBCs

- Bulk

- Pumps

End Use Market

- OE

- Aftermarket

Diesel Exhaust Fluid Aftermarket, By Region

- North America

- Europe

- Asia-Oceania

- Rest of the World (RoW)

Recent Developments

- In January 2022, TotalEnergies is expanding in Mozambique with the acquisition of BP’s retail network, wholesale fuel business and logistics assets. The transaction covers a network of 26 service stations, a portfolio of business customers and 50% in SAMCOL, the logistics company previously jointly owned by TotalEnergies and BP, which operates the Matola, Beira and Nacala fuel import terminals. This expansion will help in sales of the DEF product for the company.

- In August 2021, BASF and SINOPEC will further expand their Verbund site operated by BASF-YPC Co., Ltd., a 50-50 joint venture of both companies in Nanjing, China. It includes the capacity expansion of several downstream chemical plants, including a new tert-butyl acrylate plant to support the growing Chinese market. This expansion will help SINOPEC to increase distribution of DEF products.

- In September 2019, The Saudi Arabian Oil Company (Saudi Aramco) and Shell Saudi Arabia (Refining) Limited (Shell) announced that Saudi Aramco acquired Shell’s 50% share of the SASREF Joint Venture in Jubail Industrial City, in the Kingdom of Saudi Arabia, for USD 631 million.

- In September 2019, Cummins Inc. introduced innovations which are expected to achieve low Nitrogen Oxide (NOx) emissions in future and enable achieving a reduction in the carbon footprint, at the IAA Commercial Vehicles Show. This innovative system enables further reduction in NOx and PM emissions, while simultaneously improving fuel efficiency.

- In June 2019, Brenntag expanded its lubricants business in the US by acquiring the regional distributor, B&M Oil, headquartered in Tulsa, Oklahoma, US. The company is engaged in the sale, marketing, and distribution of lubricants to automotive, industrial, commercial, construction, and agricultural consumers throughout the state of Oklahoma.

- In January 2019, Brenntag entered into an agreement to acquire the lubricants division of Reeder Distributors, Inc. which is a regional, integrated lubricant distributor headquartered in Fort Worth, Texas, US

Frequently Asked Questions (FAQ):

How big is the diesel exhaust fluid market?

The global diesel exhaust fluid market was valued at USD 34.4 billion in 2022 and is expected to reach USD 50.0 billion by 2027 at a CAGR of 7.8 % during the forecast period 2022-2027.

Which are the leading countries for diesel exhaust fluid market?

US and China are the leading countries in terms of DEF consumption all over the world.

Many companies are operating in the diesel exhaust fluid market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

TotalEnergies (France), Shell PLC (The Netherlands), BASF SE (Germany), Brenntag SE (Germany), and China Petrochemical Corporation (Sinopec) (China). These companies adopted expansion strategies and used mergers & acquisitions to gain traction in the diesel exhaust fluid market.

How is the demand for diesel exhaust fluid varies by region?

The diesel exhaust fluid market's growth is majorly dependent on diesel vehicle sales and emission regulations in different regions. The highest commercial vehicle sales and presence of strict emission regulations driving SCR demand and DEF consumption are the factors driving the North America diesel exhaust fluid market. Asia Oceania region is expected to hold a substantial market share due to the recent and expected emission regulations and high commercial vehicle sales.

What drivers and opportunities for the diesel exhaust fluid supplier?

Stringent emission regulations leading to increased penetration of diesel SCR vehicles, the increasing number of DEF pumps and increasing average age of vehicles and miles driven has fueled the growth of the market for diesel exhaust fluid. Opportunity can be with respect to the rising demand for DEF in the construction equipment segment, Tier IV/Stage IV and Stage V emission regulations for off-highway engines. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 DIESEL EXHAUST FLUID MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED IN THE STUDY

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 DIESEL EXHAUST FLUID MARKET: RESEARCH DESIGN

FIGURE 2 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for base data

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 DIESEL EXHAUST FLUID OE MARKET, BY VEHICLE TYPE: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 DIESEL EXHAUST FLUID AFTERMARKET, BY SUPPLY MODE: TOP-DOWN APPROACH

2.3.3 RESEARCH DESIGN AND METHODOLOGY

FIGURE 7 RESEARCH APPROACH: MARKET

2.4 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

3.1 PRE- & POST-COVID-19 SCENARIO

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: DIESEL EXHAUST FLUID AFTERMARKET, 2018–2027 (USD MILLION)

TABLE 2 DIESEL EXHAUST FLUID AFTERMARKET: PRE- VS. POST-COVID-19 SCENARIO, 2018–2027 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 10 DIESEL EXHAUST FLUID AFTERMARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN DIESEL EXHAUST FLUID AFTERMARKET

FIGURE 11 STRINGENT EMISSION REGULATIONS LEADING TO INCREASED PENETRATION OF VEHICLES EQUIPPED WITH SCR

4.2 DIESEL EXHAUST FLUID OE MARKET, BY VEHICLE TYPE

FIGURE 12 HCVS WILL DOMINATE DIESEL EXHAUST FLUID OE MARKET BY 2027

4.3 DIESEL EXHAUST FLUID OE MARKET, BY COMPONENT

FIGURE 13 DEF SENSORS ARE PROJECTED TO REGISTER HIGHEST GROWTH FROM 2022 TO 2027

4.4 OFF-HIGHWAY DIESEL EXHAUST FLUID OE MARKET, BY APPLICATION

FIGURE 14 AGRICULTURAL TRACTORS TO WITNESS FASTEST GROWTH BETWEEN 2022 AND 2027

4.5 DIESEL EXHAUST FLUID AFTERMARKET, BY SUPPLY MODE

FIGURE 15 BULK SUPPLY MODE WILL CONTINUE TO DOMINATE MARKET TILL 2027

4.6 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET

FIGURE 16 AFTERMARKET ACCOUNTS FOR LARGER MARKET SHARE IN 2022

4.7 DIESEL EXHAUST FLUID AFTERMARKET, BY REGION

FIGURE 17 NORTH AMERICA IS LARGEST MARKET FOR DIESEL EXHAUST FLUID

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DIESEL EXHAUST FLUID: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent emission regulations are leading to increased penetration of vehicles equipped with SCR

FIGURE 19 MEDIUM AND HEAVY-DUTY TRUCK EMISSION REGULATIONS OUTLOOK, BY KEY COUNTRY, 2014-2025

TABLE 3 EURO NOX EMISSION LIMITS FOR ON-HIGHWAY VEHICLES, 2001 TO 2022

FIGURE 20 EMISSION LIMITS OF KEY POLLUTANT, WITH VS WITHOUT DEF

5.2.1.2 Increasing number of DEF pumps

FIGURE 21 EUROPE: DEF SUPPLY MODE, 2011 VS. 2016 VS. 2019

5.2.1.3 Increasing average age of vehicles and miles driven

FIGURE 22 GLOBAL VEHICLE PARC, 2018-2027 (THOUSAND UNITS)

5.2.2 RESTRAINTS

5.2.2.1 Increasing sales of electric vehicles

TABLE 4 FINANCIAL INCENTIVES FOR ELECTRIC VEHICLES, BY COUNTRY

FIGURE 23 ELECTRIC VEHICLE SALES, 2018 VS. 2030 (THOUSAND UNITS)

5.2.2.2 Decrease in share of light-duty diesel vehicles

FIGURE 24 EUROPE: DIESEL SHARE IN LIGHT-DUTY VEHICLE (PASSENGER CARS & LCVS) SALES (%), 2018–2027

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for DEF in construction equipment

FIGURE 25 SALES OF CONSTRUCTION EQUIPMENT, 2019 VS. 2027 (THOUSAND UNITS)

5.2.3.2 Tier IV/Stage IV and Stage V emission regulations for off-highway engines

FIGURE 26 COUNTRY-WISE NON-ROAD MOBILE MACHINERY REGULATIONS OVERVIEW, 2019-2030

5.2.3.3 Diesel exhaust fluid market offers growth opportunities to fuel tank manufacturers and material suppliers

5.2.4 CHALLENGES

5.2.4.1 Adulteration impacting the quality of DEF

TABLE 5 UREA SPECIFICATIONS FOR AUTOMOTIVE DEF

TABLE 6 DEIONIZED WATER SPECIFICATION FOR AUTOMOTIVE DEF

5.2.4.2 Fluctuating urea prices

FIGURE 27 FLUCTUATING UREA PRICES, 2015-2020 (USD PER METRIC TON)

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 MARKET

FIGURE 28 PORTER’S FIVE FORCES ANALYSIS: MARKET

TABLE 7 PORTER’S FIVE FORCES ANALYSIS

5.3.1.1 Intensity of competitive rivalry

5.3.1.2 Threat of new entrants

5.3.1.3 Threat of substitutes

5.3.1.4 Bargaining power of suppliers

5.3.1.5 Bargaining power of buyers

5.4 PATENT ANALYSIS

TABLE 8 GRANTED/APPLICATION PATENT

5.5 DIESEL EXHAUST FLUID AFTERMARKET- SCENARIO ANALYSIS

FIGURE 29 DIESEL EXHAUST FLUID AFTERMARKET SCENARIO, 2018–2027 (USD MILLION)

5.5.1 REALISTIC SCENARIO

TABLE 9 DIESEL EXHAUST FLUID AFTERMARKET (REALISTIC SCENARIO), BY REGION, 2018–2027 (USD MILLION)

5.5.2 LOW IMPACT SCENARIO

TABLE 10 DIESEL EXHAUST FLUID AFTERMARKET (LOW IMPACT SCENARIO), BY REGION, 2018–2027 (USD MILLION)

5.5.3 HIGH IMPACT SCENARIO

TABLE 11 DIESEL EXHAUST FLUID AFTERMARKET (HIGH IMPACT SCENARIO), BY REGION, 2018–2027 (USD MILLION)

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 30 DIESEL EXHAUST FLUID SUPPLY CHAIN

5.7 AVERAGE SELLING PRICE (ASP) ANALYSIS

5.7.1 ASP ANALYSIS, BY REGION, 2021 (USD PER GALLON)

TABLE 12 DIESEL EXHAUST FLUID AFTERMARKET, BY REGION, 2021 (USD PER GALLON)

5.7.2 ASP ANALYSIS, BY COMPONENT, 2021 (USD PER UNIT)

TABLE 13 DIESEL EXHAUST FLUID OE MARKET, BY COMPONENT, 2021 (USD PER UNIT)

5.8 REGULATORY ANALYSIS

TABLE 14 SAFETY REGULATIONS, BY COUNTRY/REGION

5.9 TRADE ANALYSIS

TABLE 15 IMPORT TRADE DATA, BY COUNTRY, 2021 (TONS)

TABLE 16 EXPORT TRADE DATA, BY COUNTRY, 2021 (TONS)

5.10 MARKET ECOSYSTEM

TABLE 17 DIESEL EXHAUST FLUID MARKET: ECOSYSTEM

6 DIESEL EXHAUST FLUID OE MARKET, BY VEHICLE TYPE (Page No. - 71)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

FIGURE 31 DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 18 DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 19 DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 20 DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 21 DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

6.2 PASSENGER CARS

TABLE 22 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 23 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 24 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 LIGHT COMMERCIAL VEHICLES

TABLE 26 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 27 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 28 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

6.4 HEAVY COMMERCIAL VEHICLES

TABLE 30 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 31 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 32 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

7 DIESEL EXHAUST FLUID OE MARKET, BY COMPONENT (Page No. - 80)

7.1 INTRODUCTION

FIGURE 32 WORKING PRINCIPLE OF EXHAUST SYSTEM WITH SCR AND DEF

7.1.1 RESEARCH METHODOLOGY

FIGURE 33 DIESEL EXHAUST FLUID OE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

7.2 DIESEL EXHAUST FLUID OE MARKET, BY COMPONENT

TABLE 34 DIESEL EXHAUST FLUID MARKET, BY COMPONENT, 2018–2020 (THOUSAND UNITS)

TABLE 35 DIESEL EXHAUST FLUID MARKET, BY COMPONENT, 2021–2027 (THOUSAND UNITS)

TABLE 36 DIESEL EXHAUST FLUID MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 37 DIESEL EXHAUST FLUID MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

7.3 SCR CATALYSTS

TABLE 38 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 39 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 40 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 41 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 DEF TANKS

TABLE 42 MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 43 MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 44 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 45 MARKET, BY REGION, 2021–2027 (USD MILLION)

7.5 DEF INJECTORS

TABLE 46 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 47 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 48 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 49 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

7.6 DEF SUPPLY MODULES

TABLE 50 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 51 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 52 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

7.7 DEF SENSORS

TABLE 54 DEF SENSORS OE MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 55 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 56 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 57 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

7.8 NOX SENSORS

TABLE 58 NOX SENSORS OE MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 59 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 60 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 61 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD MILLION)

8 DIESEL EXHAUST FLUID AFTERMARKET, BY SUPPLY MODE (Page No. - 95)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

FIGURE 34 DIESEL EXHAUST FLUID AFTERMARKET, BY SUPPLY MODE, 2022 VS. 2027 (USD MILLION)

8.2 DIESEL EXHAUST FLUID AFTERMARKET, BY SUPPLY MODE

TABLE 62 AFTERMARKET, BY SUPPLY MODE, 2018–2020 (MILLION GALLONS)

TABLE 63 AFTERMARKET, BY SUPPLY MODE, 2021–2027 (MILLION GALLONS)

TABLE 64 AFTERMARKET, BY SUPPLY MODE, 2018–2020 (USD MILLION)

TABLE 65 AFTERMARKET, BY SUPPLY MODE, 2021–2027 (USD MILLION)

8.3 CANS & BOTTLES

TABLE 66 AFTERMARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 67 AFTERMARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 68 AFTERMARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 69 AFTERMARKET, BY REGION, 2021–2027 (USD MILLION)

8.4 INTERMEDIATE BULK CONTAINERS (IBCS)

TABLE 70 INTERMEDIATE BULK CONTAINERS (IBCS): DIESEL EXHAUST FLUID AFTERMARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 71 AFTERMARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 72 AFTERMARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 73 AFTERMARKET, BY REGION, 2021–2027 (USD MILLION)

8.5 BULK

TABLE 74 BULK: DIESEL EXHAUST FLUID AFTERMARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 75 AFTERMARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 76 AFTERMARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 77 AFTERMARKET, BY REGION, 2021–2027 (USD MILLION)

8.6 PUMPS

TABLE 78 PUMPS: DIESEL EXHAUST FLUID AFTERMARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 79 AFTERMARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 80 AFTERMARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 81 AFTERMARKET, BY REGION, 2021–2027 (USD MILLION)

9 DIESEL EXHAUST FLUID OE MARKET FOR OFF-HIGHWAY VEHICLES, BY APPLICATION (Page No. - 106)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

FIGURE 35 OFF-HIGHWAY DIESEL EXHAUST FLUID OE MARKET, BY APPLICATION, 2022 VS. 2027 (USD THOUSAND)

TABLE 82 DIESEL EXHAUST FLUID MARKET, BY APPLICATION, 2018–2020 (THOUSAND GALLONS)

TABLE 83 DIESEL EXHAUST FLUID MARKET, BY APPLICATION, 2021–2027 (THOUSAND GALLONS)

TABLE 84 DIESEL EXHAUST FLUID MARKET, BY APPLICATION, 2018–2020 (USD THOUSAND)

TABLE 85 DIESEL EXHAUST FLUID MARKET, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.2 CONSTRUCTION EQUIPMENT

9.2.1 CONSTRUCTION EQUIPMENT DIESEL EXHAUST FLUID OE MARKET, BY POWER OUTPUT

TABLE 86 DIESEL EXHAUST FLUID MARKET, BY POWER OUTPUT, 2018–2020 (THOUSAND GALLONS)

TABLE 87 DIESEL EXHAUST FLUID MARKET, BY POWER OUTPUT, 2021–2027 (THOUSAND GALLONS)

TABLE 88 DIESEL EXHAUST FLUID MARKET, BY POWER OUTPUT, 2018–2020 (USD THOUSAND)

TABLE 89 DIESEL EXHAUST FLUID MARKET, BY POWER OUTPUT, 2021–2027 (USD THOUSAND)

9.2.2 80-100 HP

TABLE 90 80-100 HP CONSTRUCTION EQUIPMENT DIESEL EXHAUST FLUID OE MARKET, BY REGION, 2018–2020 (THOUSAND GALLONS)

TABLE 91 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND GALLONS)

TABLE 92 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 93 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD THOUSAND)

9.2.3 101-200 HP

TABLE 94 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (THOUSAND GALLONS)

TABLE 95 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND GALLONS)

TABLE 96 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 97 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD THOUSAND)

9.2.4 201-400 HP

TABLE 98 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (THOUSAND GALLONS)

TABLE 99 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND GALLONS)

TABLE 100 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 101 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD THOUSAND)

9.2.5 >400 HP

TABLE 102 >400 HP CONSTRUCTION EQUIPMENT DIESEL EXHAUST FLUID OE MARKET, BY REGION, 2018–2020 (THOUSAND GALLONS)

TABLE 103 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND GALLONS)

TABLE 104 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 105 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD THOUSAND)

9.3 AGRICULTURAL TRACTORS

TABLE 106 AGRICULTURAL TRACTORS DIESEL EXHAUST FLUID OE MARKET, BY REGION, 2018–2020 (THOUSAND GALLONS)

TABLE 107 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (THOUSAND GALLONS)

TABLE 108 DIESEL EXHAUST FLUID MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 109 DIESEL EXHAUST FLUID MARKET, BY REGION, 2021–2027 (USD THOUSAND)

10 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET (Page No. - 121)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

FIGURE 36 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 110 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET, 2018–2020 (MILLION GALLONS)

TABLE 111 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET, 2021–2027 (MILLION GALLONS)

TABLE 112 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET, 2018–2020 (USD MILLION)

TABLE 113 DIESEL EXHAUST FLUID MARKET, BY END-USE MARKET, 2021–2027 (USD MILLION)

10.2 OE

TABLE 114 OE: DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 115 OE: DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 116 OE: DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 117 OE: DIESEL EXHAUST FLUID MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.3 AFTERMARKET

TABLE 118 AFTERMARKET: MARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 119 AFTERMARKET: MARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 120 AFTERMARKET: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 121 AFTERMARKET: MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11 DIESEL EXHAUST FLUID AFTERMARKET, BY REGION (Page No. - 128)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

FIGURE 37 AFTERMARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 122 AFTERMARKET, BY REGION, 2018–2020 (MILLION GALLONS)

TABLE 123 AFTERMARKET, BY REGION, 2021–2027 (MILLION GALLONS)

TABLE 124 AFTERMARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 125 AFTERMARKET, BY REGION, 2021–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: AFTERMARKET SNAPSHOT

TABLE 126 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2018–2020 (MILLION GALLONS)

TABLE 127 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2021–2027 (MILLION GALLONS)

TABLE 128 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 129 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 130 US: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 131 US: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 132 US: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 133 US: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.2.1 MEXICO

TABLE 134 MEXICO: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 135 MEXICO: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 136 MEXICO: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 137 MEXICO: AFTERMARKET, BY VEHICLE TYPE, 2021–2027(USD MILLION)

11.2.2 CANADA

TABLE 138 CANADA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 139 CANADA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 140 CANADA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 141 CANADA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.3 EUROPE

FIGURE 39 EUROPE: AFTERMARKET SNAPSHOT

TABLE 142 EUROPE: AFTERMARKET, BY COUNTRY, 2018–2020 (MILLION GALLONS)

TABLE 143 EUROPE: AFTERMARKET, BY COUNTRY, 2021–2027 (MILLION GALLONS)

TABLE 144 EUROPE: AFTERMARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 145 EUROPE: AFTERMARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.3.1 GERMANY

TABLE 146 GERMANY: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 147 GERMANY: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 148 GERMANY: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 149 GERMANY: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.3.2 FRANCE

TABLE 150 FRANCE: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 151 FRANCE: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 152 FRANCE: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 153 FRANCE: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.3.3 UK

TABLE 154 UK: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 155 UK: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 156 UK: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 157 UK: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.3.4 RUSSIA

TABLE 158 RUSSIA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 159 RUSSIA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 160 RUSSIA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 161 RUSSIA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.4 ASIA OCEANIA

TABLE 162 ASIA OCEANIA: AFTERMARKET, BY COUNTRY, 2018–2020 (MILLION GALLONS)

TABLE 163 ASIA OCEANIA: AFTERMARKET, BY COUNTRY, 2021–2027 (MILLION GALLONS)

TABLE 164 ASIA OCEANIA: AFTERMARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 165 ASIA OCEANIA: AFTERMARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.4.1 CHINA

TABLE 166 CHINA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 167 CHINA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 168 CHINA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 169 CHINA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.4.2 JAPAN

TABLE 170 JAPAN: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 171 JAPAN: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 172 JAPAN: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 173 JAPAN: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.4.3 SOUTH KOREA

TABLE 174 SOUTH KOREA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 175 SOUTH KOREA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 176 SOUTH KOREA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 177 SOUTH KOREA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.4.4 INDIA

TABLE 178 INDIA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 179 INDIA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 180 INDIA: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 181 INDIA: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11.5 ROW

TABLE 182 ROW: AFTERMARKET, BY COUNTRY, 2018–2020 (MILLION GALLONS)

TABLE 183 ROW: AFTERMARKET, BY COUNTRY, 2021–2027 (MILLION GALLONS)

TABLE 184 ROW: AFTERMARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 185 ROW: AFTERMARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.5.1 BRAZIL

TABLE 186 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (MILLION GALLONS)

TABLE 187 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (MILLION GALLONS)

TABLE 188 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 189 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 159)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS

TABLE 190 DIESEL EXHAUST FLUID MARKET RANKING, 2021

FIGURE 40 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

12.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

12.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 43 DIESEL EXHAUST FLUID MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

12.5 COMPETITIVE EVALUATION QUADRANT – DIESEL EXHAUST FLUID MANUFACTURERS

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 PARTICIPANTS

12.6 COMPETITIVE SCENARIO

12.6.1 DEALS

TABLE 191 DEALS, 2019–2022

12.6.2 OTHER DEVELOPMENTS, 2019–2022

TABLE 192 OTHER DEVELOPMENTS, 2019–2022

12.7 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2022

FIGURE 44 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES FROM 2019 TO 2022

13 COMPANY PROFILES (Page No. - 169)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 SHELL PLC

TABLE 193 SHELL PLC: BUSINESS OVERVIEW

FIGURE 45 SHELL PLC: COMPANY SNAPSHOT

TABLE 194 SHELL PLC: PRODUCTS OFFERED

TABLE 195 SHELL PLC: DEALS

13.1.2 TOTALENERGIES

TABLE 196 TOTALENERGIES: BUSINESS OVERVIEW

FIGURE 46 TOTALENERGIES: COMPANY SNAPSHOT

TABLE 197 TOTALENERGIES: PRODUCTS OFFERED

TABLE 198 TOTALENERGIES: OTHER DEVELOPMENTS

13.1.3 CHINA PETROCHEMICAL CORPORATION (SINOPEC)

TABLE 199 CHINA PETROCHEMICAL CORPORATION (SINOPEC): BUSINESS OVERVIEW

FIGURE 47 CHINA PETROCHEMICAL CORPORATION (SINOPEC): COMPANY SNAPSHOT

TABLE 200 CHINA PETROCHEMICAL CORPORATION (SINOPEC): PRODUCTS OFFERED

TABLE 201 CHINA PETROCHEMICAL CORPORATION (SINOPEC): DEALS

TABLE 202 CHINA PETROCHEMICAL CORPORATION (SINOPEC): OTHER DEVELOPMENTS

13.1.4 BASF SE

TABLE 203 BASF SE: BUSINESS OVERVIEW

FIGURE 48 BASF SE: COMPANY SNAPSHOT

TABLE 204 BASF SE: PRODUCTS OFFERED

TABLE 205 BASF SE: DEALS

13.1.5 BRENNTAG SE

TABLE 206 BRENNTAG SE: BUSINESS OVERVIEW

FIGURE 49 BRENNTAG SE: COMPANY SNAPSHOT

TABLE 207 BRENNTAG SE: PRODUCTS OFFERED

TABLE 208 BRENNTAG SE: DEALS

TABLE 209 BRENNTAG SE: OTHER DEVELOPMENTS

13.1.6 INDIAN OIL CORPORATION LIMITED

TABLE 210 INDIAN OIL CORPORATION LIMITED: BUSINESS OVERVIEW

FIGURE 50 INDIAN OIL CORPORATION LIMITED: COMPANY SNAPSHOT

TABLE 211 INDIAN OIL CORPORATION LIMITED: PRODUCTS OFFERED

TABLE 212 INDIAN OIL CORPORATION LIMITED: DEALS

13.1.7 MITSUI CHEMICALS

TABLE 213 MITSUI CHEMICALS: BUSINESS OVERVIEW

FIGURE 51 MITSUI CHEMICALS: COMPANY SNAPSHOT

TABLE 214 MITSUI CHEMICALS: PRODUCTS OFFERED

13.1.8 CF INDUSTRIES HOLDINGS, INC.

TABLE 215 CF INDUSTRIES HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 52 CF INDUSTRIES HOLDINGS, INC.: COMPANY SNAPSHOT

TABLE 216 CF INDUSTRIES HOLDINGS, INC.: PRODUCTS OFFERED

13.1.9 VALVOLINE

TABLE 217 VALVOLINE: BUSINESS OVERVIEW

FIGURE 53 VALVOLINE: COMPANY SNAPSHOT

TABLE 218 VALVOLINE: PRODUCTS OFFERED

TABLE 219 VALVOLINE: DEALS

TABLE 220 VALVOLINE: OTHER DEVELOPMENTS

13.1.10 NISSAN CHEMICAL INDUSTRIES, LTD.

TABLE 221 NISSAN CHEMICAL INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 54 NISSAN CHEMICAL INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 222 NISSAN CHEMICAL INDUSTRIES, LTD.: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 CASTROL LIMITED

TABLE 223 CASTROL LIMITED: BUSINESS OVERVIEW

13.2.2 CUMMINS FILTRATION

TABLE 224 CUMMINS FILTRATION: BUSINESS OVERVIEW

13.2.3 YARA INTERNATIONAL

TABLE 225 YARA INTERNATIONAL: BUSINESS OVERVIEW

13.2.4 MCPHERSON OIL

TABLE 226 MCPHERSON OIL: BUSINESS OVERVIEW

13.2.5 DYNO NOBEL

TABLE 227 DYNO NOBEL: BUSINESS OVERVIEW

13.2.6 STOCKMEIER GROUP

TABLE 228 STOCKMEIER GROUP: BUSINESS OVERVIEW

13.2.7 TERSUS DEF

TABLE 229 TERSUS DEF: BUSINESS OVERVIEW

13.2.8 DAKOTA GASIFICATION COMPANY

TABLE 230 DAKOTA GASIFICATION COMPANY: BUSINESS OVERVIEW

13.2.9 COLONIAL CHEMICAL

TABLE 231 COLONIAL CHEMICAL: BUSINESS OVERVIEW

13.2.10 AZOTAL S.P.A.

TABLE 232 AZOTAL S.P.A.: BUSINESS OVERVIEW

14 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 203)

14.1 NORTH AMERICA IS KEY AFTERMARKET FOR DIESEL EXHAUST FLUID

14.2 RISING INSTALLATION OF DEF PUMPS - KEY FOCUS AREAS

14.3 CONCLUSION

15 APPENDIX (Page No. - 204)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.4.1 DIESEL EXHAUST FLUID MARKET FOR ORIGINAL EQUIPMENT, BY COUNTRY & VEHICLE TYPE

15.4.2 DIESEL EXHAUST FLUID OE MARKET, BY TANK SIZE & COUNTRY

15.4.2.1 2.0-3.0 gallons

15.4.2.2 >3.0- 5.0 gallons

15.4.2.3 >5.0 gallons

15.4.3 DIESEL EXHAUST FLUID OE MARKET, BY TANK MATERIAL & REGION

15.4.3.1 Stainless steel

15.4.3.2 Plastic

15.4.3.3 Titanium

15.4.3.4 EPDM

15.4.4 DIESEL EXHAUST FLUID OE MARKET IN CONSTRUCTION EQUIPMENT, BY COUNTRY

15.4.5 DIESEL EXHAUST FLUID OE MARKET IN AGRICULTURAL EQUIPMENT, BY POWER OUTPUT & REGION

15.4.5.1 30 HP

15.4.5.2 31-100 HP

15.4.5.3 101-200 HP

15.4.5.4 >200 HP

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the diesel exhaust fluid market.

- Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market.

- The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research.

- The bottom-up and top-down approaches were employed to estimate the complete market size.

- Thereafter, market breakdown and data triangulation processes were used to estimate segments and subsegments' market size.

Secondary Research

Secondary sources referred for this research study include the International Organization of Motor Vehicle Manufacturers (OICA), Emission Controls Association (ECA), Engine Manufacturers Association (EMA), Association for Emissions Control by Catalyst (AECC), Society of Indian Automobile Manufacturers (SIAM), China Association of Automobile Manufacturers (CAAM), Korea Automobile Manufacturers Association (KAMA), Japan Automobile Manufacturers Association (JAMA), Emission Control Manufacturers Association (ECMA), and European Automobile Manufacturers Association (EAMA), Databases such as Factiva and Bloomberg, and corporate filings (such as annual reports, investor presentations, and financial statements). Secondary data was collected and analyzed to arrive at the overall market size, validated further through primary research.

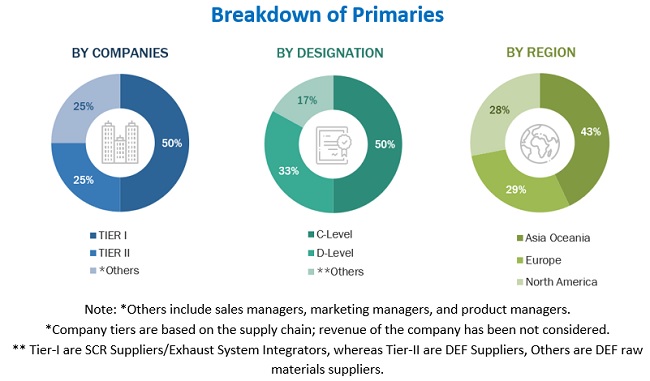

Primary Research

Extensive primary research was conducted after understanding the diesel exhaust fluid market through secondary research. Several primary interviews were conducted with market experts from both the demand- (automotive OEM’s Fleet companies, DEF pump companies) and supply-side (diesel exhaust fluid manufacturers) players across five major regions—namely, North America, Europe, Asia Oceania, and RoW. Approximately 60% and 40% of primary interviews were conducted from both the demand and supply sides. The primary data was collected through questionnaires, e-mails, and telephonic interviews.

After interacting with industry participants, brief sessions with highly experienced independent consultants were conducted to reinforce primaries' findings. This, along with the in-house subject matter experts’ opinions, has led to the findings described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

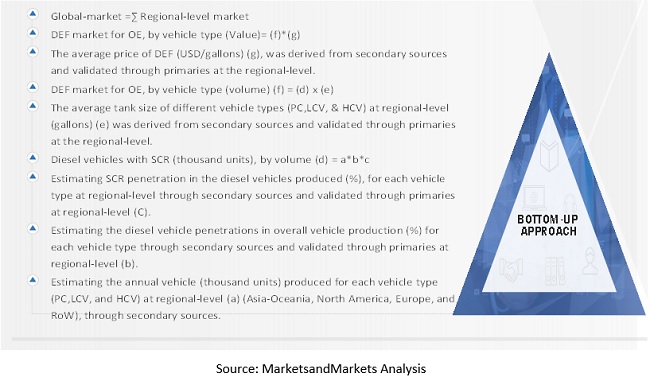

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the global market and various other dependent sub-markets of the overall diesel exhaust fluid market, by vehicle type. The research methodology used to estimate the market size includes the following details.

The bottom-up approach has been used to estimate and validate the size of the diesel exhaust fluid market by vehicle type. To determine the market size, in terms of volume of the market, by vehicle type (PCs, LCVs, and HCVs), the regional-level production numbers of each vehicle type (Passenger Cars, LCVs, and HCVs) in million units was derived. This volume was multiplied by the diesel vehicle penetrations and in overall vehicle production and SCR penetration in the diesel vehicles produced to get the regional- level diesel vehicles in the SCR market in terms of volume (million units) by vehicle type.

Secondary research was used to get the average tank size of different vehicle types (PCs, LCVs, and HCVs) at regional level (gallons), and this information was validated from primary respondents. The multiplication of the average tank size (gallons) with regional-level diesel vehicles with SCR in terms of volume (million units) by vehicle type gave the volume of the market by vehicle type at the regional-level (million gallons).

Bottom-up approach: by vehicle type

To know about the assumptions considered for the study, Request for Free Sample Report

ASP of average price of DEF (USD/gallons) for each region was derived from secondary research and validated with primary sources. The ASP of diesel exhaust fluid (USD/gallons) on the regional-level was multiplied with the volume numbers to derive the regional-level market in terms of value (USD million).

The addition of regional-level value gave the global diesel exhaust fluid market, by vehicle type, which was validated by primary respondents.

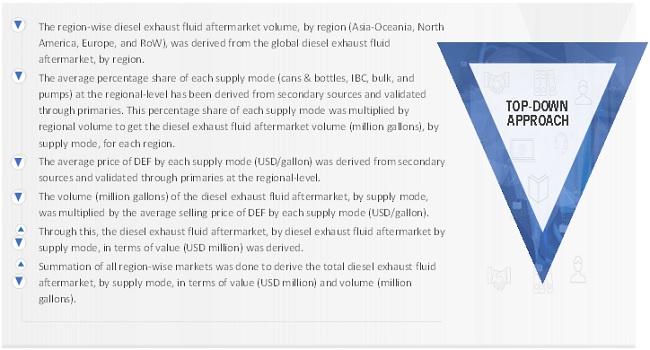

Top-down approach: by supply mode

The top-down approach was used to estimate and validate the market size of the diesel exhaust fluid aftermarket, by supply mode, by volume, and value. To derive the market size for diesel exhaust fluid aftermarket, by supply mode (million gallons) the region-wise automotive fluid aftermarket volume (million gallons) is multiplied by the average percentage share of each supply mode (cans & bottles, IBC, bulk, and pumps) at the regional-level estimated from secondary research and validated by primary respondents. diesel exhaust fluid aftermarket, by supply mode, by volume, is further multiplied with the average price of DEF by each supply mode (USD/gallon) derived at the regional level, providing the diesel exhaust fluid aftermarket, by supply mode, by value.

Report Objectives

- To define, describe, and forecast the size of the diesel exhaust fluid market, in terms of volume (million gallons) and value (USD million)

- To forecast the market size, by volume and value with respect to

- Vehicle Type (Passenger Cars, LCVs, and HCVs)

- Component (SCR Catalyst, DEF Tank, DEF Injector, DEF Supply Module, DEF Sensor, and NOx Sensor)

- Off-highway diesel exhaust fluid OE market, By Application (Construction Equipment and Agricultural Tractors)

- Aftermarket by Supply Mode (Cans & Bottles, IBCs, Bulk, and Pumps)

- By End Use Market (OE & Aftermarket)

- Region (North America, Europe, Asia-Oceania, and the Rest of the World (RoW))

- To understand market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market ranking of key players operating in the market

- To analyze the competitive landscape and company profiles of global players operating in the market

- To analyze the key players in the market evolution framework, for their respective positioning in the market with respect to each other

- To strategically analyze the market with patent analysis, trade analysis, and Covid-impact.

- To analyze recent developments, mergers & acquisitions, expansions, and other activities carried out by key industry participants in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Diesel Exhaust Fluid Market For Original Equipment, By Country & Vehicle Type

(Countries to be studied are Asia-Oceania: China, India, Japan, and South Korea; Europe: Germany, France, and UK; North America: US, Canada, and Mexico; RoW: Brazil and Russia)

Diesel Exhaust Fluid Oe Market, By Tank Size & Country

(Countries to be studied are Asia-Oceania: China, India, Japan, and South Korea; Europe: Germany, France, and UK; North America: US, Canada, and Mexico; RoW: Brazil and Russia)

- 2.0-3.0 gallons

- >3.0- 5.0 gallons

- >5.0 gallons

Diesel Exhaust Fluid Oe Market, By Tank Material & Region

(Regions to be studied are Asia-Oceania, Europe, North America, and RoW)

- Stainless Steel

- Plastic

- Titanium

- EPDM

Diesel Exhaust Fluid Oe Market In Construction Equipment, By Country

(Countries to be studied are Asia-Oceania: China, India, Japan, and South Korea; Europe: Germany, France, and UK; North America: US, Canada, and Mexico; RoW: Brazil and Russia)

Diesel Exhaust Fluid Oe Market In Agricultural Equipment, By Power Output & Region

(Regions to be studied are Asia-Oceania, Europe, North America, and RoW)

- 30 HP

- 31-100 HP

- 101-200 HP

- >200 HP

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Diesel Exhaust Fluid Market

I would like to gain insights into DEF distributors. Can you assist me?