Diameter Signaling Market by Offering (Hardware, Software & Solutions), Hardware Type (Process Systems, Analysis Systems), Connectivity Technology (3G, 4G, 5G), Applications, Standard Protocol and Region - Global Forecast to 2025

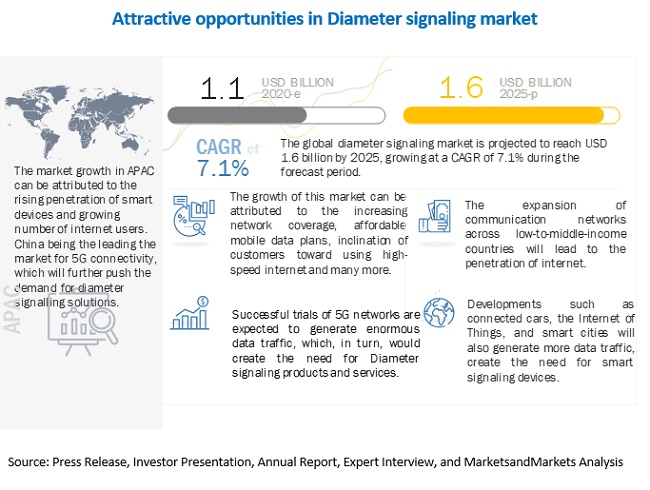

The Diameter Signaling Market is valued at USD 1.1 billion in 2020 and is projected to reach USD 1.6 billion by 2025; it is expected to grow at a CAGR of 7.1% from 2020 and 2025.

4G/LTE was the primary reason for mobile traffic growth in 2019, and it will remain dominant throughout the forecast period. Despite the arrival of 5G successor, LTE networks are anticipated to remain the most reliable networks as these networks cover numerous communication applications.

Diameter Signaling Market Dynamics

Driver: Increase in mobile data traffic due to rapid proliferation of smart connected devices

Mass penetration of smartphones and the rapid proliferation of smart devices, coupled with continuous adoption of 4G, have increased mobile data traffic. Also, click-to-connect type applications are growing tremendously, generating a significant amount of traffic. Increasing congestion puts additional strains on LTE networks worldwide and creates signaling mesh. Hence, to achieve optimum LTE network as well as ensure improved user experience, efficient routing of signaling information in 3G and 4G networks is highly essential. Diameter signaling products simplify the network structure and streamline and route all Diameter-based IP signaling communication networks. They also act as a controlling element for exchanging information between networks.

Restraints: Growing number of cyberattacks

Signaling protocols such as SS7, SIGTRAN, GTP, and Diameter are building a strong foundation for mobile telephone networks. However, these signaling protocols have severe security weakness that is exploited by attackers. Though these attacks do not take place on a very large scale, they can impact individual subscribers to a great extent.

Apart from signaling protocols, with a greater number of clients and more networks, mobile operators’ elements are exposed to external networks. Telecom providers, location service providers, and content providers are also using interconnecting access. Most of the cyberattacks take place at the provider level, and subscribers cannot do anything to protect themselves.

Opportunities: Development of Connected Cars

The automotive sector has been adopting 4G/LTE services for both drivers and passengers in vehicles with Wi-Fi zones for the collection of telematics data. With this, the industry is demonstrating new uses of technology, with autonomous cars being the growing trend.

Several countries are utilizing in-vehicle navigation systems for toll applications. The emergence of autonomous and connected vehicles and rollout of 5G networks will further enable faster communication and lower latency, thereby leading to heavy network traffics.

Challenges: Security-related challenges posed by unified controlling of signaling protocols

Although advanced communication technologies have been evolved, and carriers and subscribers are switching from 3G to 4G and now to 5G networks, the issues faced by the SS7 protocols are also replicated in the Diameter protocols. The Diameter protocol showcases the same security issues as showcased by SS7, and hence, Diameter signaling products are also prone to same types of cyberattacks

4G Connectivity technology segment to remain dominant throughout the forecast period for the global Diameter Signaling Market

Mobile has become primary access for internet consumption across numerous countries. Social media and networking have drastically influenced the penetration of mobiles and the internet. Also, affordable mobile data plans have significantly increased internet access. All these factors have a positive impact on the growth of the market for 4G cellular networks.

Mobile network operators in several countries have already transited from 3G to 4G to achieve higher data transmission speed and high-capacity bands in a spectrum. Several countries have witnessed infrastructure development and the expansion of mobile broadband coverage. These operators are looking to improve network quality and broadband speeds.

Software segment to account for largest share in global Diameter Signaling Market

The market for software & solutions is driven by the requirement for controlling traffic congestion in the network and satisfying the increased demand for high-speed services by the customers. Further, it also safeguards the messages of user sessions providing simple and secure network interconnect

Process systems to remain dominat throughout the forecast period for the global Diameter signaling market

Process systems are integrated with Diameter Routing Agent (DRA), Diameter Edge Agent (DEA), Binding Support System (BSF), among others.Process systems simplify the LTE roaming and interworking of international Diameters for offering voice and data roaming services. Process systems also find applications in VoLTE session binding, address resolution, load balancing, STP modernization, SIP signaling and routing, and so on.

APAC to be fastest-growing region in Diameter Signaling Market from 2019 to 2025

The market in APAC is expected to grow at the highest CAGR during the forecast period. This is due to the development of network infrastructure in developing nations in APAC. For Instance, Indonesia is a huge country with major potential for the growth of the telecommunications sector. The country has been witnessing a growing number of 4G subscribers. Majority of the population of the Indonesian population is expected to use the internet by 2022, which was below half of the population in 2017. With this, mobile traffic is expected to increase six times from 2017 to 2022. Mobile video is gaining traction in the country; hence, IP video traffic is expected to grow tremendously in the coming years.

Key Market Players

The global Diameter signaling market is dominated by Huawei (China),Oracle(US), Ericsson (Sweden), Nokia (Finland), Cisco (US). The other key players in this market include companies such as Dialogic (US), BroadForward (Netherlands), Diametriq (US), and Sinch (Sweden) Syniverse Technologies (US), F5 Networks (US).

Diameter Signaling Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 1.1 billion in 2020 |

| Projected Value | USD 1.6 billion by 2025 |

| Growth Rate | CAGR of 7.1% |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Segments covered |

Offering, Hardware Types, Connectivity Technology and Geography |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Huawei (China),Oracle(US), Ericsson (Sweden), Nokia (Finland), Cisco (US ) A total of 25 major players have been covered. |

Based on Offering, the Diameter Signaling Market been Segmented as below:

- Hardware

- Software & Solutions

Based on Hardware Type, the Diameter Signaling Market been Segmented as below:

- Process Systems

- Analysis Systems

Based on Connectivity Technology, the Diameter Signaling Market been Segmented as below:

- 3G

- 4G

- 5G

- Others

Based on Geographic Analysis, the Diameter Signaling Market been Segmented as below:

- North America

- Europe

- Asia Pacific

- Rest of the World

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for diameter signaling market during 2020-2025?

The diameter signaling market is expected to record the CAGR of 7.1% during 2020–2025.

What is the COVID-19 impact on diameter signaling market?

Despite being hit by the CoVID-19,the telecom business is continuing as usual, and companies operating in this market are meeting the network demand that arises due to this pandemic. Social distancing has increased the bandwidth as the population is switching toward e-learning, work from home, and e-commerce options for daily necessities.

What are the driving factors for diameter signaling market?

Increase in mobile data traffic due to rapid proliferation of smart connected devices ,Strong inclination of customers toward advanced and personalized services demands improved signaling systems,

Which offering accounted for the largest share of market in 2019?

Software & Solutions accounted for the majority of the global Diameter signaling market share in 2020.

Which are the significant players operating in Diameter signaling market?

Huawei (China),Oracle(US), Ericsson (Sweden), Nokia (Finland), Cisco (US ) are some of the major companies operating in the Diameter signaling market.

How is the Diameter signaling market segmented?

The Diameter signaling market has been segmented based on offerring, hardware types, connectivity technology and region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DIAMETER SIGNALING MARKET SEGMENTATION

FIGURE 2 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 5 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 MARKET, BY OFFERING, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MARKET, BY HARDWARE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 MARKET, BY CONNECTIVITY TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

FIGURE 11 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN DIAMETER SIGNALING MARKET

FIGURE 12 INCREASE IN MOBILE DATA GROWTH, COUPLED WITH INCLINATION OF CUSTOMERS FOR PERSONALISED, SERVICES, IS DRIVING MARKET GROWTH

4.2 MARKET, BY CONNECTIVITY TECHNOLOGY

FIGURE 13 5G CONNECTIVITY TECHNOLOGY TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY OFFERING

FIGURE 14 SOFTWARE & SOLUTIONS TO EXHIBIT HIGHER CAGR IN MARKET DURING 2020–2025

4.4 MARKET, BY HARDWARE TYPE

FIGURE 15 PROCESS SYSTEMS TO CONTINUE TO HOLD LARGER SHARE OF MARKET DURING FORECASTED PERIOD

4.5 MARKET IN APAC, BY CONNECTIVITY TECHNOLOGY AND COUNTRY

FIGURE 16 CHINA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2019

4.6 MARKET, BY REGION

FIGURE 17 APAC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 INCREASED MOBILE DATA TRAFFIC, COUPLED WITH RECENT DEVELOPMENTS IN 5G MARKET, WILL BOOST DEMAND FOR DIAMETER SIGNALING SOLUTIONS AND SERVICES

5.2.1 DRIVERS

5.2.1.1 Increase in mobile data traffic due to rapid proliferation of smart connected devices

FIGURE 19 GROWTH IN MOBILE DATA TRAFFIC, 2017–2022

5.2.1.2 Escalated need for Diameter signaling with emergence of new uses cases of LTE networks

5.2.1.3 Strong inclination of customers toward advanced and personalized services demands improved signaling systems

5.2.2 RESTRAINTS

5.2.2.1 Growing number of cyberattacks

5.2.3 OPPORTUNITIES

5.2.3.1 Implementation of IoT devices

5.2.3.2 Development of connected cars

5.2.4 CHALLENGES

5.2.4.1 Security-related challenges posed by unified controlling of signaling protocols

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 DIAMETER SIGNALING VALUE CHAIN

5.4 ECOSYSTEM ANALYSIS FOR TELECOM

5.5 USE CASES: DIAMETER SIGNALING

5.5.1 CONNECTED TRANSPORTATION

5.6 AVERAGE SELLING PRICE

5.7 DIAMETER SIGNALING STANDARDS

5.7.1 IETF

5.7.2 3GPP

5.7.3 GSMA

5.8 DIAMETER SIGNALING APPLICATIONS

5.8.1 POLICY MANAGEMENT AND CHARGING CONTROL:

FIGURE 21 MESSAGE PER SECOND (MPS) GENERATED BY POLICY MANAGEMENT, BY REGION, 2015 VS. 2020

5.8.2 VOICE OVER LTE

FIGURE 22 VOICE OVER LTE, BY REGION, (CAGR % 2015–2020)

5.8.3 BROADCASTING

5.8.4 OTHERS/MOBILITY

5.9 INDUSTRY TRENDS

5.9.1 IMS MULTIMEDIA

5.9.2 CONVERGENT SIGNALING NETWORKS FOR UNIFIED SIGNALING OF BOTH SS7 AND DIAMETER PROTOCOLS

5.9.3 NETWORK FUNCTION VISUALIZATION FOR AUTOMATION IN NETWORKS

5.9.4 ENTRY OF TECHNOLOGY COMPANIES IN TELECOMMUNICATIONS SECTOR

5.9.5 US–CHINA TRADE WAR AND ITS IMPACT ON HUAWEI

5.10 IMPACT OF COVID-19 ON DIAMETER SIGNALING MARKET

6 DIAMETER SIGNALING MARKET, BY OFFERING (Page No. - 61)

6.1 INTRODUCTION

FIGURE 23 MARKET, BY OFFERING

FIGURE 24 SOFTWARE & SOLUTIONS SEGMENT TO CONTINUE TO LEAD MARKET DURING 2020–2025

TABLE 1 MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 2 DIAMETER SIGNALING MARKET, BY OFFERING, 2020–2025 (USD MILLION)

6.2 HARDWARE

6.2.1 SURGING DEMAND FOR ROBUST SIGNALING ARCHITECTURE BOOST DEMAND FOR HARDWARE OFFERINGS

TABLE 3 MARKET FOR HARDWARE, BY REGION, 2016–2019 (USD MILLION)

TABLE 4 MARKET FOR HARDWARE, BY REGION, 2020–2025 (USD MILLION)

TABLE 5 MARKET FOR HARDWARE, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 6 MARKET FOR HARDWARE, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

6.3 SOFTWARE & SOLUTIONS

6.3.1 GROWING NEED FOR SOFTWARE & SOLUTIONS WITH INCREASING COMPLEXITY OF NETWORKS

TABLE 7 MARKET FOR SOFTWARE & SOLUTIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 MARKET FOR SOFTWARE & SOLUTIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 9 MARKET FOR SOFTWARE & SOLUTIONS, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 10 MARKET FOR SOFTWARE & SOLUTIONS, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

7 DIAMETER SIGNALING MARKET, BY HARDWARE TYPE (Page No. - 67)

7.1 INTRODUCTION

FIGURE 25 DIAMETER SIGNALING HARDWARE MARKET, BY HARDWARE TYPE

FIGURE 26 PROCESS SYSTEMS WOULD CONTINUE TO LEAD DIAMETER SIGNALING MARKET FOR HARDWARE OFFERINGS DURING FORECAST PERIOD

TABLE 11 MARKET FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 MARKET FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

7.2 PROCESS SYSTEMS

7.2.1 GROWING NEED FOR CENTRALIZED ROUTING, DATA TRAFFIC MANAGEMENT, AND LOAD BALANCING BOOSTS DEMAND FOR PROCESS SYSTEMS

TABLE 13 MARKET FOR PROCESS SYSTEMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 MARKET FOR PROCESS SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

7.3 ANALYSIS SYSTEMS

7.3.1 INCREASING REQUIREMENT FOR LOAD MONITORING TO REDUCE ERRORS IN SIGNALING NETWORKS

TABLE 15 MARKET FOR ANALYSIS SYSTEMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 MARKET FOR ANALYSIS SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

8 DIAMETER SIGNALING MARKET, BY CONNECTIVITY TECHNOLOGY (Page No. - 72)

8.1 INTRODUCTION

FIGURE 27 MARKET, BY CONNECTIVITY TECHNOLOGY

FIGURE 28 4G COMMUNICATION TECHNOLOGY TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 17 MARKET, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 18 MARKET, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

8.2 3G

8.2.1 CONTINUOUS DECLINE IN 3G MARKET OWING TO SURGING ADOPTION OF OTHER WIRELESS ADVANCED NETWORKS

TABLE 19 MARKET FOR 3G, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MARKET FOR 3G, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 MARKET FOR 3G, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 22 MARKET FOR 3G, BY OFFERING, 2020–2025 (USD MILLION)

8.3 4G

8.3.1 4G WOULD REMAIN DOMINANT TECHNOLOGY IN MARKET THROUGHOUT FORECAST PERIOD

TABLE 23 MARKET FOR 4G, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 MARKET FOR 4G, BY REGION, 2020–2025 (USD MILLION)

TABLE 25 MARKET FOR 4G, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 26 MARKET FOR 4G, BY OFFERING, 2020–2025 (USD MILLION)

8.4 5G

8.4.1 ROLLOUT OF 5G NETWORKS WOULD LEAD TO INCREASE IN MOBILE DATA TRAFFIC

TABLE 27 MARKET FOR 5G, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 28 MARKET FOR 5G, BY OFFERING, 2020–2025 (USD MILLION)

8.5 OTHERS

8.5.1 USE OF IOT DEVICES WILL LEAD TO HEAVY INCREASE IN DATA VOLUME IN WIRELESS COMMUNICATION NETWORKS

TABLE 29 MARKET FOR OTHERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 MARKET FOR OTHERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 31 MARKET FOR OTHERS, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 32 MARKET FOR OTHERS, BY OFFERING, 2020–2025 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 81)

9.1 INTRODUCTION

FIGURE 29 DIAMETER SIGNALING MARKET, BY REGION

FIGURE 30 APAC TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 33 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 MARKET, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 35 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 36 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 37 MARKET IN NORTH AMERICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 38 MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 39 MARKET IN NORTH AMERICA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 40 MARKET IN NORTH AMERICA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 41 MARKET IN NORTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 42 MARKET IN NORTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Adoption of new technologies and development of connected cars to increase network traffic congestion

TABLE 43 MARKET IN US, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 44 MARKET IN US, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 45 MARKET IN US FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 46 MARKET IN US FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 47 MARKET IN US, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 48 MARKET IN US, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Canada was second-largest market for Diameter signaling in 2019

TABLE 49 MARKET IN CANADA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 50 MARKET IN CANADA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 51 MARKET IN CANADA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 52 MARKET IN CANADA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 53 MARKET IN CANADA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 54 MARKET IN CANADA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Emergence of LTE networks in Mexico to drive market growth

TABLE 55 MARKET IN MEXICO, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 56 MARKET IN MEXICO, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 57 MARKET IN MEXICO FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 58 MARKET IN MEXICO FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 59 MARKET IN MEXICO, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 60 MARKET IN MEXICO, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3 EUROPE

FIGURE 32 EUROPE: SNAPSHOT OF MARKET

TABLE 61 DIAMETER SIGNALING MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 62 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 64 MARKET IN EUROPE, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 65 MARKET IN EUROPE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 66 MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 67 MARKET IN EUROPE FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 68 MARKET IN EUROPE FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

9.3.1 UK

9.3.1.1 UK government is pushing growth of connected cars and IoT

TABLE 69 MARKET IN UK, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 70 MARKET IN UK, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 71 MARKET IN UK FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 MARKET IN UK FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 73 MARKET IN UK, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 74 MARKET IN UK, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Presence of large telecom service providers to fuel new developments

TABLE 75 MARKET IN GERMANY, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 76 MARKET IN GERMANY, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 77 MARKET IN GERMANY FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 78 MARKET IN GERMANY FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 79 MARKET IN GERMANY, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 80 MARKET IN GERMANY, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Increasing data traffic congestion due to development of connected cars and 5G to boost demand for Diameter signaling solutions

TABLE 81 MARKET IN FRANCE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 82 MARKET IN FRANCE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 83 MARKET IN FRANCE FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 84 MARKET IN FRANCE FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 85 MARKET IN FRANCE, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 86 MARKET IN FRANCE, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Telecommunication companies pushing the development of 5G will drive growth for the market in Spain

TABLE 87 MARKET IN SPAIN, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 88 MARKET IN SPAIN, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 89 MARKET IN SPAIN FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 90 MARKET IN SPAIN FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 91 MARKET IN SPAIN, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 92 MARKET IN SPAIN, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Increase in data traffic with establishment of intelligent transportation systems to accelerate demand for signaling solutions

TABLE 93 MARKET IN ITALY, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 94 MARKET IN ITALY, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 95 MARKET IN ITALY FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 96 MARKET IN ITALY FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 97 MARKET IN ITALY, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 98 MARKET IN ITALY, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3.6 POLAND

9.3.6.1 Ongoing trials for 5G will create new opportunities

TABLE 99 MARKET IN POLAND, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 100 DIAMETER SIGNALING MARKET IN POLAND, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 101 MARKET IN POLAND FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 102 MARKET IN POLAND FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 103 MARKET IN POLAND, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 104 MARKET IN POLAND, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.3.7 REST OF EUROPE

9.4 APAC

FIGURE 33 APAC: SNAPSHOT OF MARKET

TABLE 105 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 106 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 107 MARKET IN APAC, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 108 MARKET IN APAC, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 109 MARKET IN APAC, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 110 MARKET IN APAC, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 111 MARKET IN APAC FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 112 MARKET IN APAC FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China would continue to account for largest share of Diameter signaling market throughout forecast period

TABLE 113 MARKET IN CHINA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 114 MARKET IN CHINA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 115 MARKET IN CHINA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 116 MARKET IN CHINA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 117 MARKET IN CHINA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 118 MARKET IN CHINA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Government collaborations with companies to support development of 5G in Japan to foster market growth

TABLE 119 MARKET IN JAPAN, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 120 MARKET IN JAPAN, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 121 MARKET IN JAPAN FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 122 MARKET IN JAPAN FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 123 MARKET IN JAPAN, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 124 MARKET IN JAPAN, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.4.3 INDONESIA

9.4.3.1 Indonesia shows tremendous opportunities for market with growing number of 4G subscribers

TABLE 125 DIAMETER SIGNALING MARKET IN INDONESIA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 126 MARKET IN INDONESIA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 127 MARKET IN INDONESIA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 128 MARKET IN INDONESIA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 129 MARKET IN INDONESIA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD THOUSAND)

TABLE 130 MARKET IN INDONESIA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD THOUSAND)

9.4.4 INDIA

9.4.4.1 Exploding data consumption to fuel internet traffic

TABLE 131 MARKET IN INDIA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 132 MARKET IN INDIA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 133 MARKET IN INDIA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 134 MARKET IN INDIA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 135 MARKET IN INDIA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 136 DIAMETER SIGNALING MARKET IN INDIA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.4.5 AUSTRALIA

9.4.5.1 Strong presence of telecommunication companies and government initiatives for high-speed network connectivity to boost 5G deployment

TABLE 137 MARKET IN AUSTRALIA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 138 MARKET IN AUSTRALIA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 139 MARKET IN AUSTRALIA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 140 MARKET IN AUSTRALIA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 141 MARKET IN AUSTRALIA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 142 MARKET IN AUSTRALIA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.4.6 REST OF APAC

9.5 ROW

FIGURE 34 ROW: SNAPSHOT OF MARKET

TABLE 143 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 144 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 145 MARKET IN ROW, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 146 MARKET IN ROW, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD THOUSAND)

TABLE 147 MARKET IN ROW, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 148 MARKET IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 149 MARKET IN ROW FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 150 MARKET IN ROW FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

9.5.1 MIDDLE EAST

TABLE 151 ARKET IN MIDDLE EAST, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 152 MARKET IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 153 MARKET IN MIDDLE EAST, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 154 MARKET IN MIDDLE EAST, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD THOUSAND)

TABLE 155 MARKET IN MIDDLE EAST, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 156 MARKET IN MIDDLE EAST, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 157 MARKET IN MIDDLE EAST FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 158 MARKET IN MIDDLE EAST FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

9.5.1.1 Saudi Arabia

9.5.1.1.1 Government efforts to establish 5G networks will foster market growth

TABLE 159 DIAMETER SIGNALING MARKET IN SAUDI ARABIA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 160 MARKET IN SAUDI ARABIA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 161 MARKET IN SAUDI ARABIA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 162 MARKET IN SAUDI ARABIA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 163 MARKET IN SAUDI ARABIA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 164 MARKET IN SAUDI ARABIA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD THOUSAND)

9.5.1.2 UAE

9.5.1.2.1 5G development plans, along with smart cities projects, will accelerate demand for Diameter signaling

TABLE 165 MARKET IN UAE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 166 MARKET IN UAE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 167 MARKET IN UAE FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 168 MARKET IN UAE FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 169 MARKET IN UAE, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 170 MARKET IN UAE, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD THOUSAND)

9.5.2 AFRICA

TABLE 171 MARKET IN AFRICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 172 MARKET IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 173 MARKET IN AFRICA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 174 MARKET IN AFRICA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD THOUSAND)

TABLE 175 MARKET IN AFRICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 176 MARKET IN AFRICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 177 MARKET IN AFRICA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 MARKET IN AFRICA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

9.5.2.1 South Africa

9.5.2.1.1 Increased mobile data traffic in country to create need for signaling solutions

TABLE 179 MARKET IN SOUTH AFRICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 180 MARKET IN SOUTH AFRICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 181 MARKET IN SOUTH AFRICA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 182 MARKET IN SOUTH AFRICA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 183 MARKET IN SOUTH AFRICA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 184 DIAMETER SIGNALING MARKET IN SOUTH AFRICA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

9.5.3 SOUTH AMERICA

TABLE 185 MARKET IN SOUTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 186 MARKET IN SOUTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 187 MARKET IN SOUTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 188 MARKET IN SOUTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 189 MARKET IN SOUTH AMERICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 190 MARKET IN SOUTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 191 MARKET IN SOUTH AMERICA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 192 MARKET IN SOUTH AMERICA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

9.5.3.1 Brazil

9.5.3.1.1 Brazilian market for Diameter signaling devices is triggered by mobile IP data and voice services

TABLE 193 MARKET IN BRAZIL, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 194 MARKET IN BRAZIL, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 195 MARKET IN BRAZIL FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 196 MARKET IN BRAZIL FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 197 MARKET IN BRAZIL, BY CONNECTIVITY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 198 MARKET IN BRAZIL, BY CONNECTIVITY TECHNOLOGY, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 140)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS, 2019

TABLE 199 MARKET SHARE OF KEY PLAYERS IN MARKET, 2019

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 VISIONARY LEADERS

10.3.2 INNOVATORS

10.3.3 DYNAMIC DIFFERENTIATORS

10.3.4 EMERGING COMPANIES

FIGURE 35 DIAMETER SIGNALING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11 COMPANY PROFILES (Page No. - 144)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1.1 HUAWEI

FIGURE 36 HUAWEI: COMPANY SNAPSHOT

11.1.2 ERICSSON

FIGURE 37 ERICSSON: COMPANY SNAPSHOT

11.1.3 F5 NETWORKS

FIGURE 38 F5 NETWORKS: COMPANY SNAPSHOT

11.1.4 NOKIA CORPORATION

FIGURE 39 NOKIA CORPORATION: COMPANY SNAPSHOT

11.1.5 ORACLE

FIGURE 40 ORACLE: COMPANY SNAPSHOT

11.1.6 CISCO

FIGURE 41 CISCO: COMPANY SNAPSHOT

11.1.7 ENGHOUSE SYSTEMS

FIGURE 42 ENGHOUSE SYSTEMS: COMPANY SNAPSHOT

11.1.8 TNS INC.

11.1.9 BROADFORWARD

11.1.10 RIBBON COMMUNICATIONS

FIGURE 43 RIBBON COMMUNICATIONS: COMPANY SNAPSHOT

*Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 SQUIRE TECHNOLOGIES

11.2.2 PACKETFORCE

11.2.3 DIAMETRIQ

11.2.4 SYNIVERSE TECHNOLOGIES

11.2.5 SINCH

11.2.6 EXFO

11.2.7 TIETOEVRY CORPORATION

11.2.8 MARBEN

11.2.9 COMPUTARIS

11.2.10 CELLUSYS

12 APPENDIX (Page No. - 167)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORT

12.6 AUTHOR DETAILS

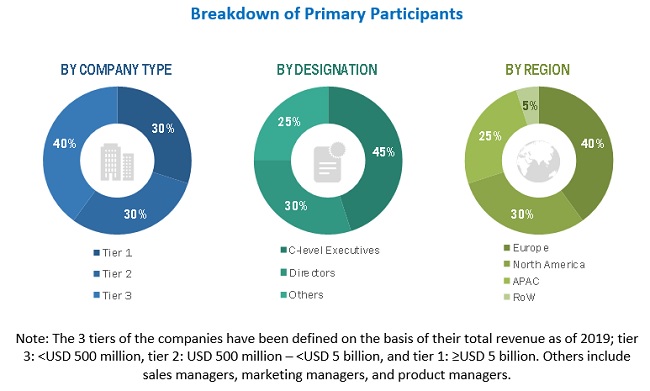

The study involved 4 major activities in estimating the current market size for the diameter signaling market. Exhaustive secondary research has been done to collect information on the current market, the peer market, and the parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the overall market size. After that, the market breakdown and data triangulation approaches have been used to estimate the market size of segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories and databases; and SEC filings; among others.

The impact and implication of COVID-19 on telecom industry have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations and more.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, product users, and related executives from major companies and organizations operating in the diameter signaling market

In the primary research process, various key persons have been interviewed to obtain the qualitative and quantitative information relevant to this report. The impact and implication of COVID-19 on telecom industries have also been discussed in this section. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, business development executives, application users, and related executives from various key companies and organizations operating in the ecosystem of the diameter signaling market. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the diameter signaling market, as well as that of the other dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the following:

- The study of annual and financial reports of top players, as well as interviews with experts for key insights

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the global diameter signaling market by offering, hardware type, connectivity solutions and geography in terms of value

- To describe and forecast the market size for various segments by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the diameter signaling market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenue and core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Diameter Signaling Market