Massive MIMO Market by Technology (LTE Advanced, LTE Advanced Pro, 5G), Spectrum (TDD, FDD), Type of Antennas (8T8R, 16T16R & 32T32R, 64T64R, 128T128R & Above), and Geography (North America, Europe, Asia Pacific, Row) - Global Forecast to (2025-2035)

Massive MIMO Market Outlook 2025 - 2035

The Massive Multiple Input Multiple Output (Massive MIMO) market is set to witness exponential growth from 2025 to 2035, driven by the increasing adoption of 5G networks, rising mobile data traffic, and continuous advancements in wireless communication technology. Massive MIMO plays a crucial role in enhancing the capacity, coverage, and efficiency of modern cellular networks. It achieves this by leveraging multiple antennas at both the transmitter and receiver ends to improve spectral efficiency and reduce interference. As global demand for high-speed connectivity, ultra-low latency, and seamless communication continues to rise, Massive MIMO has emerged as a core technology enabling the evolution of next-generation networks.

The market is gaining traction across multiple industries, including telecommunications, defense, industrial automation, and smart city infrastructure. Governments and telecom operators around the world are making significant investments to deploy Massive MIMO systems that can handle growing network congestion and data-intensive applications.

The research methodology used to estimate and forecast this market begins with capturing data on key vendor revenues through secondary research such as IEEE journals, CTIA, FCC, GSA, and newsletters from leading players. Vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and executives of the companies in the massive MIMO industry. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of primaries has been depicted in the following figure:

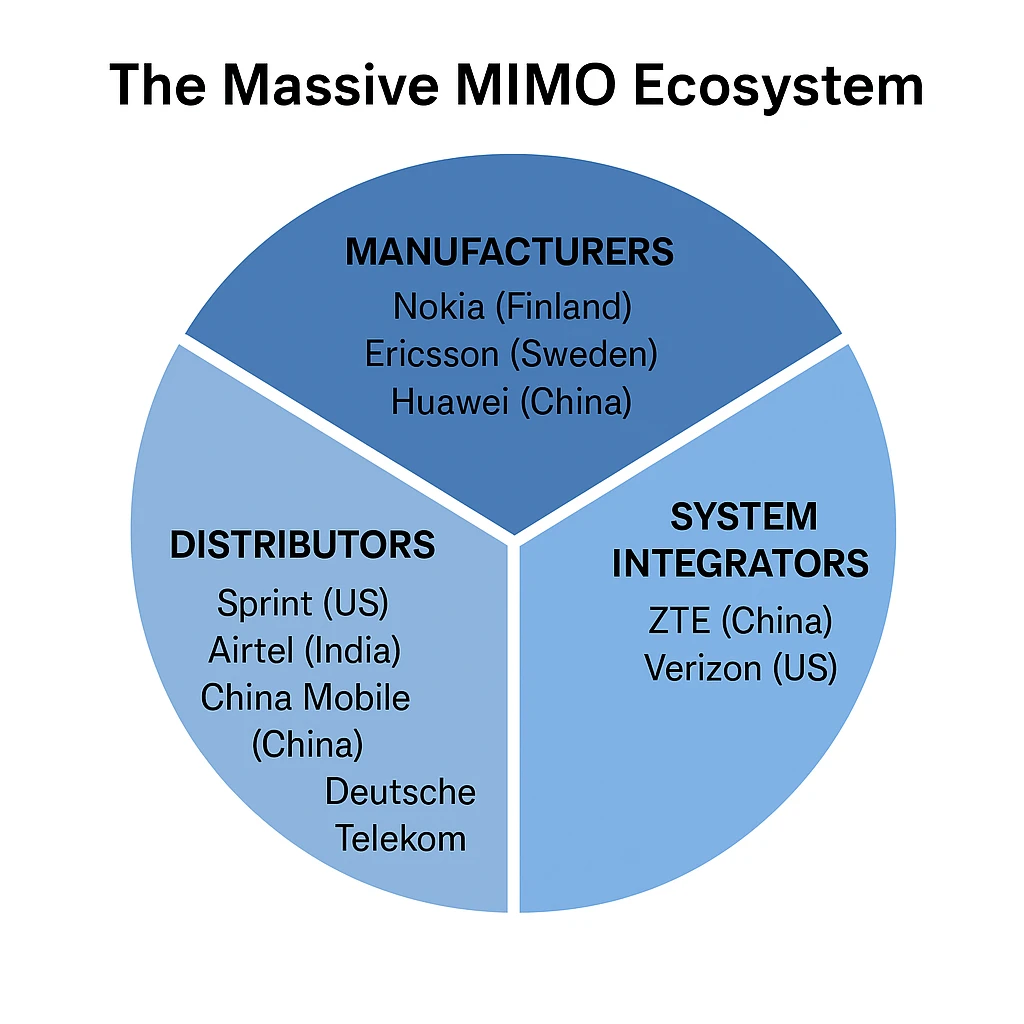

The massive MIMO ecosystem comprises manufacturers, system integrators, and distributors. The players involved in the development of massive MIMO include Nokia (Finland), Ericsson (Sweden), Huawei (China), ZTE (China), Verizon (US), Sprint (US), Airtel (India), China Mobile (China), and Deutsche Telekom (Germany).

Market Dynamics

The rapid rollout of 5G networks is one of the primary growth drivers for the Massive MIMO market. 5G technology relies heavily on MIMO architectures to achieve higher throughput and better spectrum utilization. As mobile operators expand 5G coverage in urban and rural areas, the deployment of advanced antenna systems becomes critical. Additionally, the surge in connected devices—ranging from smartphones to IoT sensors demands greater network efficiency, further fueling the adoption of Massive MIMO.

Another major factor propelling market growth is the continuous evolution of antenna technology. Modern Massive MIMO systems are equipped with advanced beamforming capabilities that focus signal energy precisely where it is needed. This ensures better user experience and lower power consumption for network operators. Moreover, ongoing research in millimeter-wave spectrum and open radio access network (O-RAN) architectures is fostering innovation and reducing deployment costs, which is encouraging widespread adoption.

However, the market faces certain challenges, such as high installation costs, power consumption, and complex system integration requirements. Despite these hurdles, technological advancements and declining hardware costs are expected to mitigate these concerns over time.

By Technology

LTE Advanced

LTE Advanced technology laid the foundation for Massive MIMO by introducing key concepts such as carrier aggregation, enhanced spectral efficiency, and improved data throughput. Telecom operators initially implemented MIMO configurations in LTE Advanced networks to boost 4G performance, allowing them to handle increasing user demand without expanding spectrum resources. Although 5G has taken center stage, LTE Advanced remains an essential backbone in many regions, especially in developing markets where 5G infrastructure is still emerging. The combination of LTE Advanced with Massive MIMO antennas continues to offer a cost-effective solution for high-capacity mobile broadband.

LTE Advanced Pro

LTE Advanced Pro represents a significant step toward 5G by integrating higher-order MIMO, enhanced carrier aggregation, and improved network coordination. This technology bridges the gap between 4G and 5G, allowing operators to deliver near-5G performance with existing LTE spectrum. Massive MIMO under LTE Advanced Pro enhances spectral efficiency and enables better user experience even under heavy network load. The ability to deploy Massive MIMO on existing LTE infrastructure is helping telecom providers extend network capacity and prepare for seamless 5G migration.

5G

5G technology is the key catalyst for the Massive MIMO market. Massive MIMO is integral to 5G’s performance, providing high data rates, ultra-reliable low-latency communication, and massive connectivity for IoT devices. The use of Massive MIMO in 5G allows for dynamic beamforming, spatial multiplexing, and higher-frequency utilization, which are essential for supporting data-heavy applications such as autonomous vehicles, virtual reality, and smart manufacturing. As 5G adoption accelerates across North America, Europe, and Asia, the demand for large-scale MIMO deployments will continue to rise sharply.

By Spectrum

Time Division Duplex (TDD)

The TDD spectrum segment dominates the Massive MIMO market due to its superior flexibility and efficiency in managing uplink and downlink transmissions. TDD-based systems are widely preferred for 5G deployments because they allow dynamic allocation of resources based on real-time traffic requirements. This adaptability makes TDD ideal for densely populated urban areas where data demand fluctuates rapidly. Moreover, many operators have shifted toward TDD due to its cost-effectiveness and ability to deliver high performance over limited spectrum bandwidths.

Frequency Division Duplex (FDD)

FDD spectrum continues to hold a significant share of the market, particularly in legacy networks and regions where paired spectrum bands are still widely available. Massive MIMO systems designed for FDD enable continuous communication by using separate frequencies for uplink and downlink. While FDD has traditionally been used for 4G LTE networks, its integration with Massive MIMO is enhancing spectral efficiency and expanding network coverage in suburban and rural areas. With further advancements, hybrid FDD-TDD Massive MIMO systems are expected to optimize spectrum utilization and enhance overall network capacity.

By Type of Antennas

8T8R

The 8T8R antenna configuration is primarily deployed in LTE and LTE Advanced networks to improve spectral efficiency and capacity. It serves as an entry-level MIMO solution for operators seeking to upgrade existing infrastructure before transitioning to higher-order configurations. 8T8R systems are cost-effective and easier to integrate, making them ideal for medium-traffic regions and small-cell deployments.

16T16R and 32T32R

These configurations represent a balance between cost and performance. They are widely used in urban and semi-urban networks where data demand is high but spectrum resources are limited. 16T16R and 32T32R systems enhance throughput and enable better coverage without requiring substantial increases in infrastructure investment. As operators optimize their networks for 5G, these configurations serve as an important bridge toward large-scale antenna systems.

64T64R

The 64T64R configuration is the most widely deployed Massive MIMO setup in commercial 5G networks. It offers excellent performance in terms of spectral efficiency, data throughput, and user experience. By combining advanced beamforming and spatial multiplexing, 64T64R systems can support multiple users simultaneously, reducing congestion and improving signal quality. This configuration has become the standard for large-scale 5G rollouts by major telecom operators worldwide.

128T128R and Above

High-capacity networks and dense urban deployments are increasingly adopting 128T128R and higher configurations to meet the rising demand for ultra-fast connectivity. These advanced antenna systems are designed for millimeter-wave (mmWave) frequencies, offering exceptional throughput and low latency. Although the cost and complexity of deploying these systems are higher, they are essential for achieving the full potential of 5G and future 6G technologies.

By Geography

North America

North America leads the global Massive MIMO market due to early adoption of 5G and substantial investments by major operators such as Verizon Communications and AT&T. The United States, in particular, is focusing on upgrading network infrastructure with high-capacity antennas to deliver enhanced mobile broadband and fixed wireless access. Government initiatives to expand rural connectivity and smart city projects further support market growth. The region also benefits from strong presence of key technology providers such as Qualcomm and various infrastructure partners collaborating on next-generation MIMO solutions.

Europe

Europe represents another significant market, driven by the rollout of 5G across the United Kingdom, Germany, France, and the Nordic countries. Operators are integrating Massive MIMO to enhance network performance and comply with the European Union’s digital transformation goals. The growing focus on sustainable and energy-efficient communication infrastructure aligns with Massive MIMO’s ability to reduce power consumption per bit transmitted. European telecom giants such as Nokia and Ericsson are playing a crucial role in driving the region’s adoption through strategic partnerships and technology advancements.

Asia Pacific

Asia Pacific is expected to witness the fastest growth in the Massive MIMO market. China, Japan, South Korea, and India are aggressively deploying 5G networks supported by large-scale MIMO systems. Huawei Technologies and ZTE Corporation are leading suppliers of Massive MIMO infrastructure in the region, providing end-to-end 5G solutions to operators. The surge in mobile subscribers, increasing demand for ultra-high-speed data, and the proliferation of IoT applications are contributing to strong market momentum. Additionally, government initiatives promoting smart manufacturing and digital transformation are expanding the scope of Massive MIMO deployment.

Rest of the World

The Middle East, Africa, and Latin America are gradually embracing Massive MIMO technology as part of their 5G and broadband expansion plans. Countries such as the United Arab Emirates and Saudi Arabia are investing heavily in advanced communication systems to support smart city projects and industrial connectivity. In Latin America, telecom operators are modernizing infrastructure to enhance coverage and capacity, while African nations are exploring MIMO-enabled networks to bridge the digital divide.

Competitive Landscape

The Massive MIMO market is highly competitive, with several global players investing in research and development to strengthen their market positions. Huawei Technologies Co. Ltd. (China) continues to lead in the development of advanced antenna systems and 5G infrastructure. The company focuses on innovation and partnerships with operators worldwide to expand its footprint in the telecom equipment industry.

Nokia Corporation (Finland) is leveraging its strong R&D capabilities to enhance Massive MIMO product portfolios. Its AirScale radio platform integrates intelligent antenna systems that support both LTE and 5G technologies. Nokia’s collaborations with telecom operators across Europe and North America are aimed at accelerating large-scale deployments.

Verizon Communications Inc. (US) is one of the leading service providers implementing Massive MIMO in its 5G networks to deliver faster connectivity and improved user experience. The company is focusing on infrastructure modernization and partnerships with technology vendors to maintain a competitive edge.

ZTE Corporation (US) is actively developing advanced MIMO technologies to enhance network efficiency and reduce deployment costs. Its products emphasize modular design and high integration, catering to diverse network environments.

Ericsson AB (Sweden) continues to expand its portfolio with innovative Massive MIMO solutions that optimize performance across multiple frequency bands. The company’s focus on sustainable and energy-efficient network technologies has strengthened its leadership position in the global telecom equipment market.

Future Outlook

The Massive MIMO market will continue to grow as the demand for high-speed connectivity, seamless streaming, and reliable communication intensifies. The transition toward 6G and the increasing use of artificial intelligence in network optimization are expected to further enhance the capabilities of Massive MIMO systems. As more industries integrate digital technologies, Massive MIMO will play a central role in enabling next-generation connectivity for smart cities, autonomous systems, and industrial automation.

With continued innovation and collaboration among leading telecom players, the global Massive MIMO market is set to redefine the wireless communication landscape, paving the way for a more connected and data-driven future.

Target Audience of the Report:

- Raw Material and Manufacturing Equipment Suppliers

- Telecom Infrastructure Vendors

- Device Manufacturers

- Telecom Network Operators

- Technology Investors

- Telecom Software Solution Providers

- Chipset Manufacturers

- Telecom System Integrators

- Research Institutes and Organizations

- Associations and Regulatory Authorities Related to Plant Maintenance

- Government Bodies, Venture Capitalists, and Private Equity Firms

“This study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the report:

This research report categorizes the global market on the basis of spectrum, technology, type of antennas, and geography.

Massive MIMO Market, by Spectrum:

- TDD

- FDD

- Others

Massive MIMO Market, by Technology:

- LTE Advanced

- LTE Advanced Pro

- 5G

Massive MIMO Market, by Type of Antennas:

- 8T8R

- 16T16R & 32T32R

- 64T64R

- 128T128R & Above

Massive MIMO Market, by Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Company information:

Detailed analysis and profiling of additional market players (up to 5)

The 64T64R type of antennas segment led the market in 2017, as most companies in the market use the 64T64R type of antenna in their testing and deployment, which is the major factor for the large market size of this segment. With massive MIMO radios using 64T64R antennas, Sprint can drive the capacity of massive MIMO beyond 1 Gbps to reach 3-6 Gbps per sector.

The LTE Advanced technology segment accounted for the largest share market in 2017, as this technology helps resolve bandwidth issues, which occur mainly due to the presence of millions of users on a single carrier service. The 5G technology segment is expected to witness the fastest growth during the forecast period, as it is expected to enable new high-frequency bands that suffer high propagation path losses to deliver similar coverage as low frequencies. Moreover, 5G is expected to offer significant gains to accommodate more users at higher data rates with better reliability while consuming less power.

The lack of standardization of spectrum allocation is one of the major restraints for themarket. The standardization of spectrum allocation across regions is extremely important for the development of the massive MIMO infrastructure, as it has a huge impact on the economies of scale and offers clarity to equipment vendors to develop products.

Market players such as Huawei Technologies Co. Ltd. (China), Nokia Corporation (Finland), Verizon Communications Inc. (US), ZTE Corporation (US), and Ericsson AB (Sweden) are focusing on product/solution launches and developments, partnerships and collaborations to enhance their product offerings and expand their business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

2.1.3.2 Breakdown of Primaries

2.1.3.3 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share Through Bottom-Up Analysis (Demand-Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share Through Top-Down Analysis (Supply-Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the MasMarket

4.2 Market, By Technology

4.3 Market, By Type of Antennas

4.4 Market, By Spectrum

4.5 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for A Large Amount of Data at High Speed at A Given Time

5.2.1.2 Increasing Importance of Software Implementation in Communication Network

5.2.1.3 High Signal to Noise Ratio and Link Reliability

5.2.2 Restraints

5.2.2.1 Lack of Standardization of Spectrum Allocation

5.2.3 Opportunities

5.2.3.1 Growing Requirement for High Throughput and Long-Range Applications

5.2.3.2 Rapid Advancements in 4G LTE & 4.5G Data Models

5.2.4 Challenges

5.2.4.1 Complex Set-Up and Requirement for Rich Diversity of Signal Paths Between Transmitter and Receiver

6 Global Massive MIMO Market, By Technology (Page No. - 38)

6.1 Introduction

6.2 LTE Advanced

6.3 LTE Advanced Pro

6.4 5G

7 Global Massive MIMO Market, By Type of Antennas (Page No. - 42)

7.1 Introduction

7.2 8T8R

7.3 16T16R & 32T32R

7.4 64T64R

7.5 128T128R & Above

8 Global Massive MIMO Market, By Spectrum (Page No. - 47)

8.1 Introduction

8.2 FDD

8.3 TDD

8.4 Others (FBMC, OFDM)

9 Geographic Analysis (Page No. - 51)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Rest of North America

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 Rest of Europe

9.4 Asia Pacific (APAC)

9.4.1 China

9.4.2 Japan

9.4.3 Rest of APAC

9.5 RoW

10 Competitive Landscape (Page No. - 66)

10.1 Overview

10.2 Market Ranking Analysis: Market

10.3 Competitive Situation and Trends

10.3.1 Solution Launches and Developments

10.3.2 Collaborations and Partnerships

11 Company Profiles (Page No. - 71)

11.1 Introduction

11.2 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)

11.2.1 Nokia

11.2.2 Ericsson

11.2.3 Huawei

11.2.4 Verizon Communications

11.2.5 ZTE

11.2.6 Sprint

11.2.7 China Mobile

11.2.8 Samsung

11.2.9 Airtel

11.2.10 Deutsche Telekom

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

11.3 Other Key Players

11.3.1 Smartone

11.3.2 T-Mobile

11.3.3 China Unicom

11.3.4 Reliance Jio

11.3.5 Idea

11.3.6 Vodafone

11.3.7 Telefonica

11.3.8 Singtel

11.3.9 Smartfren

11.3.10 Telstra

11.3.11 Commscope

11.3.12 Kathrein

11.3.13 Comba

12 Appendix (Page No. - 101)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (33 Tables)

Table 1 Global Market, By Technology, 2017–2026 (USD Million)

Table 2 LTE Advanced Massive MIMO , By Region, 2017–2026 (USD Million)

Table 3 LTE Advanced Pro Massive MIMO , By Region, 2017–2026 (USD Million)

Table 4 5G Market, By Region, 2017–2026 (USD Million)

Table 5 Market, By Type of Antennas, 2017–2026 (USD Million)

Table 6 8t8r Massive MIMO , By Region, 2017–2026 (USD Million)

Table 7 16T16R & 32t32r Massive MIMO , By Region, 2017–2026 (USD Million)

Table 8 64T64R Massive MIMO , By Region, 2017–2026 (USD Million)

Table 9 128T128R & Above Massive MIMO By Region, 2017–2026 (USD Million)

Table 10 Global Market, By Spectrum, 2017–2026 (USD Million)

Table 11 FDD Massive MIMO , By Region, 2017–2026 (USD Million)

Table 12 TDD Massive MIMO , By Region, 2017–2026 (USD Million)

Table 13 Global Massive MIMO Market, By Geography, 2017–2026 (USD Million)

Table 14 Market in North America, By Type of Antennas, 2017–2026 (USD Million)

Table 15 Market in North America, By Technology, 2017–2026 (USD Million)

Table 16 Market in North America, By Spectrum, 2017–2026 (USD Million)

Table 17 Market in North America, By Country, 2017–2026 (USD Million)

Table 18 Market in US, By Type of Antennas, 2017–2026 (USD Million)

Table 19 Market in Europe, By Type of Antennas, 2017–2026 (USD Million)

Table 20 Market in Europe, By Technology, 2017–2026 (USD Million)

Table 21 Market in Europe, By Spectrum, 2017–2026 (USD Million)

Table 22 Market in Europe, By Country, 2017–2026 (USD Million)

Table 23 Market in APAC, By Type of Antennas, 2017–2026 (USD Million)

Table 24 Market in APAC, By Technology, 2017–2026 (USD Million)

Table 25 Market in APAC, By Spectrum, 2017–2026 (USD Million)

Table 26 Market in APAC, By Country, 2017–2026 (USD Million)

Table 27 Market in China, By Type of Antennas, 2017–2026 (USD Million)

Table 28 Market in RoW, By Type of Antennas, 2017–2026 (USD Million)

Table 29 Market in RoW, By Technology, 2017–2026 (USD Million)

Table 30 Market in RoW, By Spectrum, 2017–2026 (USD Million)

Table 31 Ranking of the Key Players in the Market

Table 32 Product/Solution Launches and Developments, January 2015 – January 2018

Table 33 Collaborations and Partnerships, January 2015–January 2018

List of Figures (40 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for the Research Study

Figure 7 Global Market, 2017–2026 (USD Billion)

Figure 8 Based on Type of Antennas, the 64t64r Segment is Expected to Lead the Market During the Forecast Period

Figure 9 TDD Spectrum Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 5G Technology Segment is Expected to Account for the Largest Share of the Market in 2026

Figure 11 Market in APAC is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Demand for Massive MIMO in Asia Pacific is Expected to Drive Market Growth

Figure 13 5G Technology Segment is Expected to Account for the Largest Share of the Massive MIMO Market in 2026

Figure 14 128T128R Segment is Projected to Grow at the Highest CAGR Between 2018 and 2026

Figure 15 TDD Spectrum Segment is Expected to Account for the Largest Share of the Market in 2026

Figure 16 Market in APAC is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Increasing Importance of Software Implementation in Communication Network is Expected to Drive the Market

Figure 18 Data Traffic Generation By Various Mobile Applications

Figure 19 5G Technology Segment is Expected to Lead the Market During the Forecast Period

Figure 20 Market, By Type of Antennas

Figure 21 Based on Type of Antennas, the 128t128r Segment is Expected to Grow at the Highest CAGR Between 2018 and 2026

Figure 22 Market, By Spectrum

Figure 23 TDD Spectrum Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 MaMarket, By Geography

Figure 25 Geographic Snapshot of the Market

Figure 26 North America Massive MIMO Market Snapshot

Figure 27 Europe Massive MIMO Snapshot

Figure 28 APAC Massive MIMO Snapshot

Figure 29 Product/Solution Launches and Development Emerged as the Key Growth Strategy Adopted By the Companies Between January 2015 and January 2018

Figure 30 Product/Solution Launches and Developments Was the Key Strategy Adopted By the Market Players Between January 2015 and January 2018

Figure 31 Nokia: Company Snapshot

Figure 32 Ericsson: Company Snapshot

Figure 33 Huawei: Company Snapshot

Figure 34 Verizon Communications: Company Snapshot

Figure 35 ZTE: Company Snapshot

Figure 36 Sprint: Company Snapshot

Figure 37 China Mobile: Company Snapshot

Figure 38 Samsung: Company Snapshot

Figure 39 Airtel: Company Snapshot

Figure 40 Deutsche Telekom: Company Snapshot

Growth opportunities and latent adjacency in Massive MIMO Market