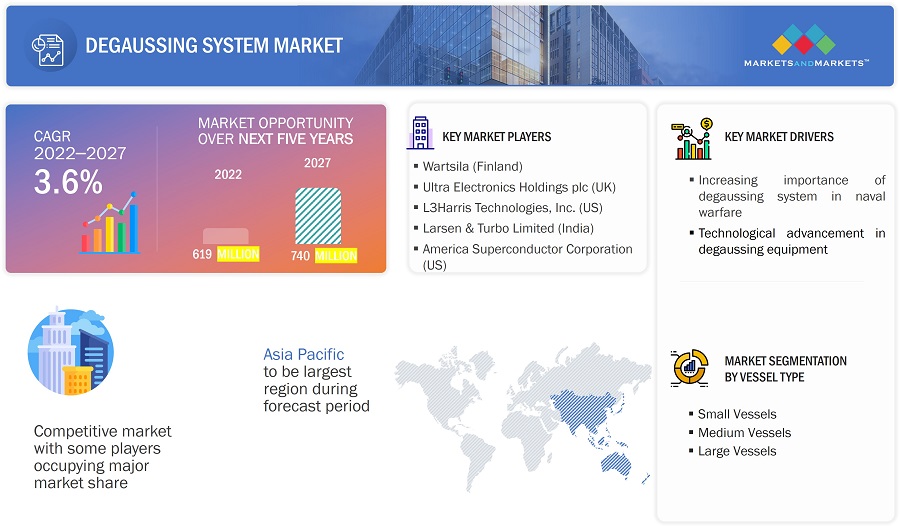

Degaussing System Market by Vessel Type (Small Vessel, Medium Vessel, Large Vessel), Solution (Ranging, Degaussing, Deperming), End User (OEM, Aftermarket & Services) and Region- Global Forecast to 2027

The Degaussing Systems Market size is projected to grow from USD 619 Million in 2022 to USD 740 Million by 2027, at a CAGR of 3.6% from 2022 to 2027.

A degaussing system enables neutralizing the ship's magnetic field and ensures that the magnetic field close to the ship is, as nearly as possible, just the same if the ship were not there. This, in turn, reduces the possibility of being targeted and increases the security of the ship and personnel.

Present day warships have built-in degaussing systems. The degaussing system aboard a naval vessel consists of interconnected coils of electrical cables in different locations within the hull, with a direct power source to energize the coils and a control system, via switchboards, to control the amount and polarity of current through the coils.

Degaussing System Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Degaussing systems Market Dynamics:

Driver: Increasing importance of degaussing systems in naval warfare

Naval tactics, distinct from naval strategies, are methods to engage and defeat enemy ships in sea battles. The central concept of naval warfare is the battlespace, a zone around the naval force within which the commander can confidently detect, track, engage, and destroy threats before they pose a danger.

Ships and warships are detected due to their easy visibility and magnetic signatures. Submarines play a strategic role in naval tactics and are more vulnerable to mines, as they operate underwater where mines are placed. This vulnerability has increased the demand for degaussing and deperming systems used to demagnetize the magnetic signatures of submarines. There has been an increase in submarine deliveries in developing countries, such as India, China, and South Korea, which, in turn, has led to the increased use of degaussing and deperming systems. In June 2021, the defense ministry of India intended to execute an old plan to procure six units of conventional submarines. This proposed plan will expect to create a competition among leading shipbuilders namely Larsen & Toubro Ltd (India) and Mazagon Dock Shipbuilders Limited (India).

Restraint: Use of composite materials in warships

Traditionally, warships were made of stainless steel. New carbon fiber composite superstructures imported from the Kockums shipyard (Sweden) assist in developing lightweight warships. However, the enemy easily detects such lightweight warships. Stealth is the most important feature of composite materials, as they are less susceptible to detection, unlike steel. Warships that are likely to use new nonmagnetic materials include offshore patrol vessels (OPVs), fast attack crafts (FACs), and corvettes.

The use of composite materials in building warships hinders the influence of the Earth’s magnetic field, thereby restricting the ability of sea mines to detect these vessels. Thus, using composite materials is likely to restrain the growth of the Degaussing System Industry.

Opportunity: Increase in maritime warfare exercises

A maritime war exercise trains naval forces to explore the warfare effects or test strategies without actual combat. It is a full-scale rehearsal of navy maneuvers as a warfare practice. A maritime war exercise is a joint or combined exercise practiced between or more nations. Over the last decade, the number of maritime warfare exercises has been increasing exponentially, owing to the need to strengthen the combat capabilities of naval forces. For instance, in June 2022, Rim of the Pacific (RIMPAC), the world’s largest international biennial maritime warfare exercise, witnessed participation from 27 countries, including India. Such exercises have increased the use of degaussing, ranging, and deperming systems to demagnetize or nullify the magnetic field of naval vessels and protect them from sea mines.

Challenge: High cost of retrofit, installation, and calibration services

Naval vessels are high-technology platforms. Degaussing systems in these vessels encompass high-technology components and subcomponents, including degaussing control units, magnetometers, bipolar amplifiers, DC generators, and sensors. These components and subcomponents contribute to the high cost of degaussing systems.

Rapid technological developments have led to the obsolescence of older technologies. The retrofitting of naval vessels involves extensive system checks and replacement of older components with newer ones. During its life cycle, a naval vessel undergoes various refits and upgrades. Additionally, retrofit, installation, and calibration services are done annually, contributing to increased expenditure. Countries allocate huge budgets for retrofit costs to maintain their technological lead and extend the life of their naval vessels.

Based on Solution, the ranging segment witness strong growth during 2022-2027

Based on solution, the degaussing systems market has been segmented into ranging, degaussing and deperming. Ranging segment further subdivided into fixed and onboard. The onboard offering subsegment of the ranging solution segment has been classified into aerial ranging devices, transmitted data buoys, sensors, magnetometers, coils, software, and monitors. Onboard ranging of naval vessels is performed away from onshore.

Based on End User, Aftermarket witness significant growth during forecast period

Based on end user, the degaussing systems market has been segmented into OEM, aftermarket and services. In the aftermarket, companies offer complete maintenance, repair, and overhaul services for degaussing systems. These companies specialize in both, metallic and composite repair techniques used in degaussing systems. For instance, damaged components of degaussing systems such as conductors and degaussing coils are sent to service centers for maintenance, repair, and overhaul. Aftermarket also offers over-the-counter products in cases, wherein components of degaussing systems are damaged beyond repair.

Based on end user, OEM segment registered largest share in base year

Based on end user, the degaussing systems market has been classified into OEM, aftermarket, and services. Original Equipment Manufacturers (OEMs) offer line-fit and retrofit options for naval vessels, thereby saving the time consumed in the installation of degaussing systems in ships post their delivery. They also eliminate the requirement to maintain a separate workforce for the installation of retrofit components in naval vessels.

The North America region is projected to Grow at highest CAGR during the forecast period

The growth of the North America degaussing system market can be attributed to increased investments in defense equipment and naval warfare capabilities and the implementation of network-centric infrastructure across this region. Among American countries, the US is projected to lead the degaussing system market in the North American region. The growth of the degaussing system market in the US can be attributed to increased military spending by the US government and the expansion of the shipbuilding industry. The US government is broadening its defense capabilities by funding new technologies, which include ship protection equipment, UAVs, and drone systems that safeguard the US naval fleet.

Degaussing System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

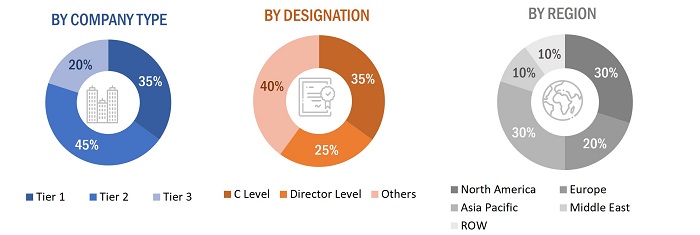

The break-up of the profiles of primary participants in the Degaussing systems Market is as follows:

- By Company Type: Tier 1–35%; Tier 2–45%; and Tier 3–20%

- By Designation: C Level Executives–35%; Directors–25%; and Others–40%

- By Region: Asia Pacific–30%; North America–30%; Europe–20%; Middle East–10%; and Rest of the World–10%

Key Market Players

The major players in the Degaussing Systems Companies are Wartsila (Finland), Larsen & Turbo Limited (India), Ultra Electronics Holdings plc (UK), L3Harris Technologies, Inc. (US), and American Superconductor Corporation (US). These players have adopted various growth strategies such as contracts, acquisitions, agreements, expansions, investments, and new product launches to further expand their presence in the degaussing systems market.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

3.6% |

|

Estimated Market Size in 2022 |

USD 619 Million |

|

Projected Market Size in 2027 |

USD 740 Million |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Vessel Type, By Solution, By End User, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Wartsila (Finland), Ultra Electronics Holdings plc (UK), L3Harris Technologies, Inc. (US), Larsen & Turbo Limited (India), and American Superconductor Corporation (US) |

|

Companies covered (Degaussing systems market start-ups and degaussing system market ecosystem) |

ECA Group (France), Dayatech Merin Sdn Bhd, IFEN S.p.A. (Italy), STL Systems AG (Switzerland), DA-Group (Finland) |

Degaussing System Market Highlights

This research report categorizes the degaussing system market based on vessel type, solution, end user, and region

|

Aspect |

Details |

|

By Vessel Type |

|

|

By Solution |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In January 2022, Larsen & Turbo Limited announced the development of advanced defense technologies for Indian defense forces. The company degausses the hulls of cargo and oil tanker vessels and also provides repair and installation services.

- In November 2021, The Marine Electrical Systems, a division of Wartsila SAM Electronics GmbH, received a contract under the F126 project from Damen (Netherland) to deliver degaussing system, switchgear, lighting system, power distribution system, and special equipment for an energy supply

Frequently Asked Questions (FAQ):

What is the current size of the degaussing systems market?

The degaussing systems market is projected to grow from USD 619 Million in 2022 to USD 740 Million by 2027, at a CAGR of 3.6% from 2022 to 2027.

Who are the winners in the degaussing systems market?

Wartsila (Finland), Larsen & Turbo Limited (India), Ultra Electronics Holdings plc (UK), L3Harris Technologies, Inc. (US), and American Superconductor Corporation (US).

What are some of the technological advancements in the market?

Multi influence range system, onboard aerial ranging device, HTS material, copper coil are some technological advancement in the degaussing system market

What are the factors driving the growth of the market?

Increasing importance of degaussing systems in naval warfare and technological advancements in degaussing equipment

What region holds the largest share of the market in 2021?

Asia Pacific registered the largest share of 46.78% in global degaussing systems market in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

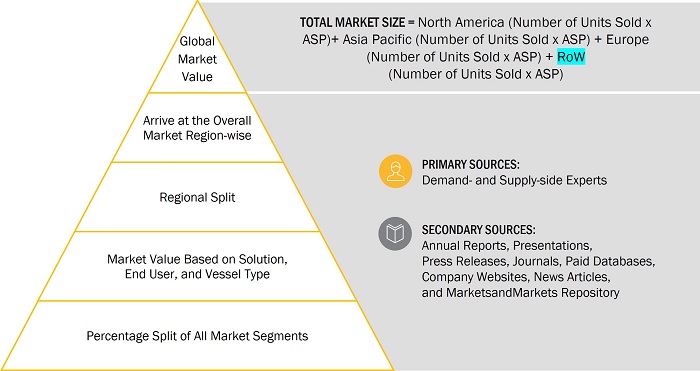

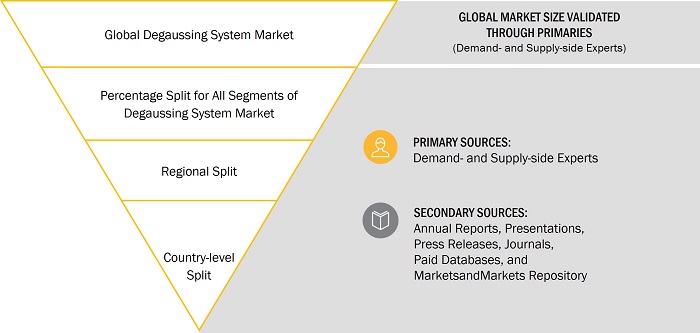

This research study on the degaussing system market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the degaussing system market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the degaussing system market included financial statements of companies offering degaussing system and solutions along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the degaussing system market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to vessel type, solution, end user, and regions. Stakeholders from the demand side include naval forces, government agencies, and ship-building companies who are willing to adopt degaussing systems to enhance ship protection and warfare capabilities. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the hardware systems and software solutions, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution adoption by vessel type, solution, and end user segments of the market for key regions such as North America, Europe, Asia Pacific, and Rest of the world.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the degaussing system market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study. The research methodology used to estimate the market size also includes the following details.

- Key players in the market were identified through secondary research, and their market values were determined through primary and secondary research. These included a study of annual and financial reports of top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were considered, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, added with detailed inputs, and analyzed and presented in this report.

This data was compiled, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size Estimation Methodology: Bottom-up Approach

Market size Estimation Methodology: Top- Down approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Data was triangulated by studying various factors from the demand- and supply sides. In addition, the market size was validated using top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and data triangulation procedure implemented in the market engineering process for developing this report.

Report Objectives

- To define, describe, segment, and forecast the degaussing system market based on end user, solution, vessel type, and region

- To identify and analyze key drivers, restraints, opportunities, and industry-specific challenges influencing the market growth

- To identify industry, market, and technology trends that prevail in the degaussing system market

- To analyze micromarkets concerning individual growth trends, prospects, and their market contribution

- To forecast the size of different market segments with respect to various regions, including North America, Europe, Asia Pacific, and Rest of the World, in addition to key countries in each of these regions

- To profile leading market players based on their product portfolios, financial positions, and key growth strategies

- To analyze the degree of competition in the degaussing system market by identifying key growth strategies, such as contracts, acquisitions, agreements, expansions, investments, and new product launches adopted by leading market players

- To provide a detailed competitive landscape of the market, in addition to the rank analysis of key players

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

- To strategically profile key market players and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Degaussing System Market

Hello, I am performing a feasibility study on a degaussing system as part of a life extension and am interested in reviewing the content found in the free brochure to assist in making the business case to purchase the full report. Thank you. Kind Regards, Geoff Lowe

Trying to have a good overview of the different opportunities on this degaussing subject. Cost / performances / functionalities.