Data Visualization Tools Market by Tool (Standalone and Integrated), Organization Size, Deployment Mode, Business Function, Vertical (BFSI, Telecommunications and IT, Healthcare and Life Sciences, Government), and Region - Global Forecast to 2026

Data Visualization Tools Market Size - Growth, Trends & Forecast

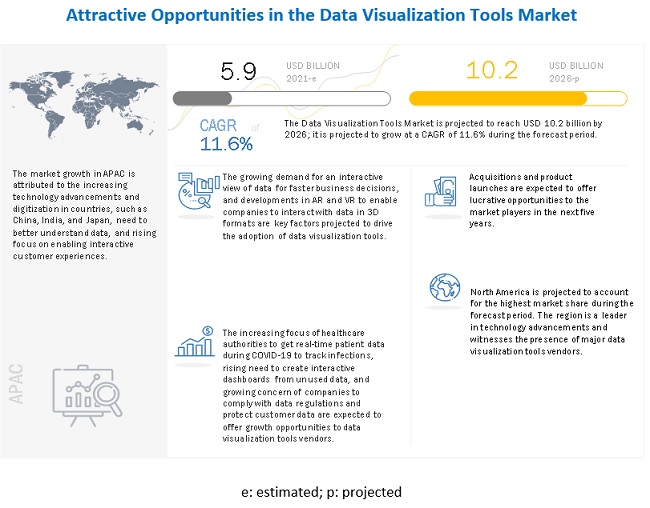

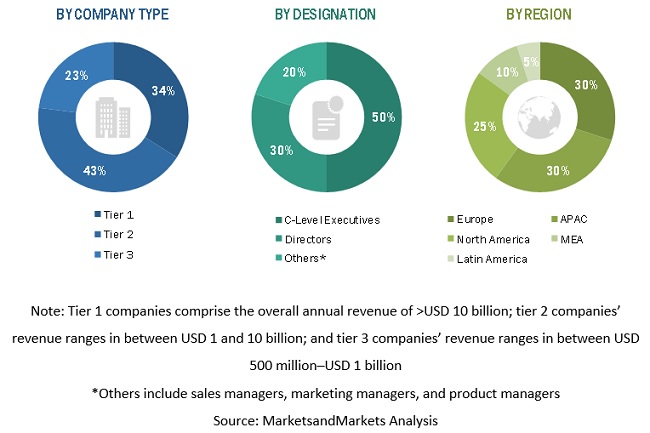

The global Data Visualization Tools Market size was reached $5.9 billion in 2021 and is anticipated to hit a revenue around $10.2 billion by 2026, registering CAGR of 11.6% during the forecast period (2021-2026). The base year for estimation is 2020 and the market size available for the years 2015 to 2026.

Data visualization tools industry growth includes the growing demand for an interactive view of data for faster business decisions and increasing developments in Augmented Reality (AR) and Virtual Reality (VR) to enable the interaction of companies with data in 3D formats.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Visualization Tools Market Growth Dynamics

Driver: Growing demand for an interactive view of data for faster business decisions

Today, most organizations are adopting a simplified process that consists of identifying, collecting, maintaining, and sharing a large amount of data. Data visualization tools are used for having a fast and simplified business decision-making process. The data should be provided with a standard visualization ability, which is used to identify customer preferences and tendencies, extract strategic insights, and help maintain a balance between the demand and supply of new and existing products. Companies across verticals adopt data visualization tools to understand data in an easy manner and derive actionable business insights. Data visualization tools in the cloud enable organizations to have a cost-effective and scalable way for data analysis. The data visualization capability helps companies identify business drivers and Key Performance Indicators (KPIs) through BI. Data visualization tools help companies eliminate unnecessary data to discover patterns, insights, trends, and usage strategies, which help leverage its growth in the market.

Restraint: Variation in data formats

Without data, there is no objective way to measure the success of efforts. Data is one of the most important elements of a business, which helps users in generating meaningful business insights. There is always variation in data, whether the data measures something as simple as the daily temperature or as complex as the success of a surgical procedure. Companies fail to analyze their data due to insufficient understanding. Employees may not know what data is, its storage, processing, importance, and sources. Data professionals may know what is going on, but others may not have a clear picture. As data has spread throughout society, one of the elements that have become evident is that there is a huge variation in the levels of understanding. This could even be in a high-powered business setting, where people who are used to seeing basic excel graphs do not understand anything more complex. The idea of interactivity within visualized data is not something they would ever feel necessary. However, there are others who would benefit from more complex visualizations, where they can see as much as possible in as smaller space as they can, through interactive design or just more complex features. It is, therefore, difficult for those designing visualizations to match up to the wide-ranging understanding of data and data visualizations.

Opportunity: Rising need to create interactive dashboards from unused data

Data is being generated on a large scale, be it Fitbit, Google, or Facebook, the use of data has evolved and is considered an integral part of the digital transformation of any business. The use of IoT continues to increase and the generation of insights from all incoming data is the need of the day. In today’s business environment, organizations use BI to make faster and more critical decisions. Through the internet, social media companies gather a large volume of data. It becomes difficult for them to distinguish whether a source of information is real or not. Most of the unstructured data obtained from various sources is not used. Unstructured data such as email correspondences account information, and old versions of related documents are not used to create value to help in making business decisions. Companies invest a lot in data collection to optimally use it. For instance, banks can pay heed to how online customers landed on the applications page, which would help to find measures on how to attract customers. The utilization of unused data can help companies gain valuable insights and drive their business. Data visualization tools come up with solutions to use all unused data. Hence, the increasing need for generating insights from unused data is expected to create an opportunity for the growth of the data visualization tools market.

Challenge: Lack of skilled professional workforce

Organizations often fail to identify where they need to allocate their resources, which results in deriving the full potential of data visualization. Most organizations still cannot harness the complete benefits of data visualization tools in the cloud due to the lack of awareness and professional expertise to utilize cloud-based data visualization tools optimally. Due to key factors, such as the shortage of skilled workforce or the complexity of data visualization tools, these organizations report problems in analyzing insights from a large volume of data. With the increasing demand for emerging technologies such as AI, ML, analytics, and IoT, businesses are looking for data scientists to be skilled with new-age technologies rather than older programming languages such as R, Ada, C, and Haskell. Currently, companies are looking for newer skills such as data visualization, ML, and AI, in order to make a more informed decision in this competitive landscape.

Among verticals, the healthcare and life science segment to grow at a the highest CAGR during the forecast period

The data visualization tools market is segmented on verticals into BFSI, government, healthcare and life sciences, retail and eCommerce, manufacturing, telecommunications and IT, transportation and logistics, and other verticals (education, media and entertainment, travel and hospitality, and energy and utilities). The BFSI vertical is expected to account for the largest market size during the forecast period. Moreover, the healthcare and life sciences vertical is expected to grow at the highest CAGR during the forecast period. To gain access to unstructured data such as output from medical devices, image reports, and lab reports is not useful to improve patient health. Healthcare providers are adopting data visualization tools that help them to gather real-time data insights to improve patient health.

The marketing and sales segment is expected to hold the larger market size during the forecast period

The data visualization tools market is segmented on the basis of business function into marketing and sales, human resources, operations, and finance. The marketing and sales business function segment is expected to account for the largest market size during forecast period. The growth can be attributed as data visualization tools enable sales managers to monitor sales performance against quarterly goals for revenue, the percentage of closed deals, and status of the deal stages in the sales funnel. Data visualization tools also help them in planning marketing strategies.

The on-premises segments is expected to hold the larger market size during the forecast period

The data visualization tools market by deployment mode has been segmented into on-premises and cloud. The cloud segment is expected to grow at a rapid pace during the forecast period. T The high CAGR of the cloud segment can be attributed to the availability of easy deployment options and minimal requirements of capital and time. These factors are supporting the current lockdown scenario of COVID-19 as social distancing, and online purchasing of goods hit the industry and are expected to drive the adoption of cloud-based data visualization tools. Highly secure data encryption and complete data visibility and enhanced control over data in terms of location and the real-time availability of data for extracting insights are responsible for the higher adoption of on-premises-based data visualization tools.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global data visualization tools market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The growing awareness for companies to uncover patterns from data silos in key countries, such as China, India, and Japan, is expected to fuel the adoption of data visualization tools. The commercialization of the AI and ML technology, giving rise to generate real-time data, and the need for further advancements to leverage its benefits to the maximum are expected to drive the adoption of data visualization tools in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The data visualization tools market vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market Salesforce (US), SAP (Germany), Microsoft (US), Oracle (US), IBM (US), AWS (US), Sisense (US), Alteryx (US), SAS Institute (US), Alibaba Cloud (China), Dundas (Canada), TIBCO Software (US), Qlik (US), GoodData (US), Domo (US), Klipfolio (Canada), Datafay (US), Zegami (England), Live Earth (US), Reeport (France), Cluvio (Germany), Whatagraph (The Netherlands), Databox (US), Datapine (Germany), Toucan Toco (France), and Chord (US). The study includes an in-depth competitive analysis of these key players in the data visualization tools market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Attributes |

|

Market Size in 2021 |

$5.9 billion |

|

Revenue Forecast in 2026 |

$10.2 billion |

|

Growth Rate (2021-2026) |

11.6% |

|

Key Market Opportunities |

Rising need to create interactive dashboards from unused data |

|

Key Market Growth Drivers |

Growing demand for an interactive view of data for faster business decisions |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

USD Million |

|

Market Segmentation |

Tool, organization size, deployment mode, business function, vertical, and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Salesforce(US), SAP(Germany), Microsoft (US), Oracle (US), IBM (US), AWS (US), Sisense (US), Alteryx (US), SAS Institute (US), Alibaba Cloud (China), Dundas (Canada), TIBCO Software (US), Qlik (US), GoodData (US), Domo (US), Klipfolio (Canada), Datafay (US), Zegami (England), Live Earth (US), Reeport (France), Cluvio (Germany), Whatagraph (The Netherlands), Databox (US), Datapine (Germany), Toucan Toco (France), and Chord (US) |

This research report categorizes the global Data Visualization Tools Market based on tool, deployment mode, organization size, business function, application, vertical, and region.

Data Visualization Tools Market by tool:

- Standalone

- Integrated

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment mode:

- On-premises

- Cloud

By business function:

- Marketing and Sales

- Human Resources

- Operations

- Finance

By vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail and eCommerce

- Manufacturing

- Transportation and Logistics

- Telecommunications and IT

- Other Verticals (Media and Entertainment, Travel and Hospitality, Energy and Utilities, and Education)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2021, Alteryx partnered with Tech Data, an APA company that automates analytics, data science, and processes to accelerate business outcomes. The partnership aims at providing Tech Data and its partners access to the Alteryx unified platform that simplifies analytics, data science, and process automation to accelerate digital transformation for customers.

- In March 2021, Tableau launched a new dedicated region in London, UK, to harvest data insights using its fully hosted SaaS offering, Tableau Online. This region would be dedicated to offer Tableau’s customers enhanced performance and more choice in data locality. The SaaS offering would be hosted by AWS’ infrastructure in London. Tableau Online enables its fast-growing European customer base to instantly access, analyze, and share data through visualization.

- In January 2021, Salesforce launched Vaccine Cloud that would help government agencies, healthcare organizations, businesses, nonprofits, and educational institutions rapidly, safely, and efficiently deploy and manage their vaccine programs. It helps governments, healthcare organizations, businesses, and non-profit organizations to manage and deploy vaccine programs for delivering vaccines through the Salesforce Customer 360 platform, including mobility solutions, bots, analytics, and integration capabilities.

- In November 2019, Microsoft announced the launch of Azure Synapse Analytics, a new Azure solution for enterprises. The company describes the solution as the next evolution of Azure SQL Data Warehouse. It highlights the solution’s integration with Power BI, an easy-to-use BI and reporting tool, as well as Azure Machine Learning for building models. It aims at providing core capabilities for customers to collect and analyze data by breaking down data into silos for better understanding.

- In September 2019, Oracle launched Oracle Analytics for Fusion ERP, designed to provide line-of-business users and decision-makers with personalized analytics and improved cross-line-of-business analytics capabilities. It would include dashboards and visualizations via Oracle Analytics Cloud that would connect the entire enterprise and unify KPIs across functions for a holistic view of enterprise performance.

- In August 2019, Salesforce acquired Tableau Software. With this acquisition, Salesforce aims at competing with Microsoft in the area of Power BI and data visualization space. As a part of Salesforce, Tableau would be positioned to accelerate and extend its mission to help people see and understand data. Tableau would operate independently under the Tableau brand, driving forward its mission, customers, and community.

- In July 2019, IBM released a new, updated version of IBM Cognos Analytics on Cloud. It is equipped with a host of new ease-of-use features and a low price point. It is designed to extend the enterprise-grade business analytics suite to SMEs. IBM Cognos Analytics on Cloud 11.1.3 is offered in three distinct tiers: USD 15/user per month for Standard Edition, USD 35/user per month for Plus Edition, and USD 70/ user per month for Premium Edition.

- In March 2019, SAP announced enhancements to the SAP Analytics Cloud solution, which includes augmented analytics, BI, enterprise planning workflows, and data integration capabilities. With this update, SAP aims at building a stronger unified solution. Designed for business users, the solution is intuitive and powerful with an end-to-end data and analytics approach, enabling confident, data-driven decisions and intelligent processes that power better business outcomes.

Frequently Asked Questions (FAQ):

What is the Data Visualization Tools Market Size?

What is the Data Visualization Tools Market Growth?

What are the key opportunities in the Data Visualization Tools Market?

Which are the leading Data Visualization Tools Companies?

Which region will offer most promising share in Data Visualization Tools Market?

How Data Visualization Tools Market Segmented in this report?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 6 DATA VISUALIZATION TOOLS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 DATA VISUALIZATION TOOLS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL DATA VISUALIZATION TOOLS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (DEMAND SIDE): SHARE OF DATA VISUALIZATION TOOLS THROUGH OVERALL DATA VISUALIZATION TOOLS SPENDING

FIGURE 11 VENDOR ANALYSIS: SALESFORCE: COMPANY REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 12 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION QUADRANT METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE MARKET

FIGURE 14 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 4 GLOBAL DATA VISUALIZATION TOOLS MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 15 STANDALONE SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 16 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 17 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 18 MARKETING AND SALES SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 19 BANKING, INSURANCE, AND FINANCIAL SERVICES VERTICAL TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 20 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 21 GROWING DEMAND FOR AN INTERACTIVE DATA VIEW FOR FASTER BUSINESS DECISIONS AND INCREASING DEVELOPMENTS IN AUGMENTED REALITY AND VIRTUAL REALITY TO DRIVE THE MARKET GROWTH

4.2 MARKET, TOP THREE BUSINESS FUNCTIONS

FIGURE 22 MARKETING AND SALES SEGMENT TO HOLD THE LARGEST MARKET SHARE FROM 2021 TO 2026

4.3 MARKET, BY REGION

FIGURE 23 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET IN 2021

4.4 NORTH AMERICAN DATA VISUALIZATION TOOLS MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 24 STANDALONE AND ON-PREMISES SEGMENTS TO ACCOUNT FOR LARGER MARKET SHARES IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 65)

5.1 INTRODUCTION

5.2 DATA VISUALIZATION: EVOLUTION OF THE MARKET

FIGURE 25 EVOLUTION OF THE DATA VISUALIZATION TOOLS MARKET

5.3 DATA VISUALIZATION: TYPES

FIGURE 26 TYPES OF DATA VISUALIZATION IN THE MARKET

5.4 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.4.1 DRIVERS

5.4.1.1 Growing demand for an interactive view of data for faster business decisions

5.4.1.2 Developments in AR and VR to enable the interaction of companies with data in 3D formats

5.4.2 RESTRAINTS

5.4.2.1 Variation in data formats

5.4.3 OPPORTUNITIES

5.4.3.1 Increasing focus of healthcare authorities to get real-time patient data during COVID-19 to track infections

5.4.3.2 Rising need to create interactive dashboards from unused data

5.4.3.3 Growing concern of companies to comply with data regulations and protect customer data

5.4.4 CHALLENGES

5.4.4.1 Lack of skilled professional workforce

5.4.4.2 Lack of data governance

5.4.5 CUMULATIVE GROWTH ANALYSIS

5.5 DATA VISUALIZATION TOOLS MARKET: ECOSYSTEM

FIGURE 28 DATA VISUALIZATION: ECOSYSTEM

5.6 CASE STUDY ANALYSIS

5.6.1 TVS CREDIT USES TABLEAU TO MONITOR NEEDS OF EMPLOYEES DURING COVID-19

5.6.2 EVERGREEN HEALTH DEPLOYED DUNDAS BI TO IMPROVE THE QUALITY OF PATIENT CARE

5.6.3 FLEETPRIDE TRANSFORMED SUPPLY CHAIN MANAGEMENT WITH IBM ANALYTICS

5.6.4 BOOKMYSHOW USES ALTERYX TO MAXIMIZE TICKET SALES FOR ENTERTAINMENT VENUES

5.6.5 ASIAN PAINTS USES SAS VISUAL ANALYTICS TO GET UP-TO-THE-DAY VISIBILITY OF OUTBOUND LOGISTICS AND FLEET PERFORMANCE

5.6.6 MERCEDES-AMG PETRONAS FORMULA ONE TEAM DEPLOYED TIBCO SPOTFIRE

5.6.7 GLOBAL MESSAGE SERVICES (GMS) ADOPTED DATABOX TO ENHANCE NETWORK CONNECTIVITY FOR MOBILE OPERATORS

5.6.8 HEATHROW AIRPORT ADOPTED POWER BI SOLUTION TO REDUCE PASSENGER TRAFFIC IN AIRPORT

5.6.9 UK POLICE FORCE VISUALIZES INCIDENT AND OPERATIONS DATA TO FIGHT CRIMES FASTER THROUGH QLIK SENSE

5.6.10 PACIFIC, GAS, AND ELECTRIC (PG&E) ADOPTED THE TERADATA VANTAGE PLATFORM TO SEGMENT CUSTOMER DATA

5.6.11 SALESFORCE HELPED PHILIPS DEVELOP NEW WAYS TO CATER TO NEEDS OF CUSTOMERS

5.7 DATA VISUALIZATION TOOLS MARKET: COVID-19 IMPACT

FIGURE 29 MARKET TO WITNESS A MINIMAL SLOWDOWN IN GROWTH IN 2021

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.8.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 30 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2010-2020

5.8.3.1 Top Applicants

FIGURE 31 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010-2021

TABLE 7 TOP EIGHT PATENT OWNERS (US) IN THE DATA VISUALIZATION TOOLS MARKET, 2010-2021

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 32 SUPPLY CHAIN ANALYSIS: MARKET

5.10 TECHNOLOGY ANALYSIS

5.10.1 VIRTUAL REALITY OR AUGMENTED REALITY AND DATA VISUALIZATION

5.10.2 BLOCKCHAIN AND DATA VISUALIZATION

5.10.3 ARTIFICIAL INTELLIGENCE AND DATA VISUALIZATION

5.10.4 SMART DEVICES AND DATA VISUALIZATION

5.11 PRICING MODEL ANALYSIS

TABLE 8 PRICING: DATA VISUALIZATION TOOLS

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 SCENARIO

TABLE 9 CRITICAL FACTORS TO IMPACT THE GROWTH OF THE MARKET

6 DATA VISUALIZATION TOOLS MARKET, BY TOOL (Page No. - 92)

6.1 INTRODUCTION

6.1.1 TOOLS: MARKET DRIVERS

6.1.2 TOOLS: COVID-19 IMPACT

FIGURE 34 INTEGRATED SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY TOOL, 2015–2020 (USD MILLION)

TABLE 11 MARKET SIZE, BY TOOL, 2021–2026 (USD MILLION)

6.2 STANDALONE

TABLE 12 STANDALONE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 13 STANDALONE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 INTEGRATED

TABLE 14 INTEGRATED: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 15 INTEGRATED: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 DATA VISUALIZATION TOOLS MARKET, BY ORGANIZATION SIZE (Page No. - 98)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 35 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

TABLE 18 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 19 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 20 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 DATA VISUALIZATION TOOLS MARKET, BY DEPLOYMENT MODE (Page No. - 104)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODES: MARKET DRIVERS

8.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 36 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 22 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 23 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 24 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 25 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

TABLE 26 CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 DATA VISUALIZATION TOOLS MARKET, BY BUSINESS FUNCTION (Page No. - 110)

9.1 INTRODUCTION

9.1.1 BUSINESS FUNCTIONS: MARKET DRIVERS

9.1.2 BUSINESS FUNCTIONS: COVID-19 IMPACT

FIGURE 37 MARKETING AND SALES SEGMENT TO RECORD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 29 MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

9.2 MARKETING AND SALES

TABLE 30 MARKETING AND SALES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 31 MARKETING AND SALES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 HUMAN RESOURCES

TABLE 32 HUMAN RESOURCES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 33 HUMAN RESOURCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 OPERATIONS

TABLE 34 OPERATIONS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 35 OPERATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 FINANCE

TABLE 36 FINANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 37 FINANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 DATA VISUALIZATION TOOLS MARKET, BY VERTICAL (Page No. - 118)

10.1 INTRODUCTION

10.1.1 VERTICALS: MARKET DRIVERS

10.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 38 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 39 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 40 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 GOVERNMENT

TABLE 42 GOVERNMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 43 GOVERNMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 HEALTHCARE AND LIFE SCIENCES

TABLE 44 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 45 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 RETAIL AND ECOMMERCE

TABLE 46 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 47 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 MANUFACTURING

TABLE 48 MANUFACTURING: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 49 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY

TABLE 50 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 51 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 TRANSPORTATION AND LOGISTICS

TABLE 52 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 53 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.9 OTHER VERTICALS

TABLE 54 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 DATA VISUALIZATION TOOLS MARKET, BY REGION (Page No. - 132)

11.1 INTRODUCTION

FIGURE 39 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 40 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 56 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 57 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: DATA VISUALIZATION TOOLS MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Health Insurance Portability and Accountability Act of 1996

11.2.3.2 California Consumer Privacy Act

11.2.3.3 Gramm–Leach–Bliley Act

11.2.3.4 Health Information Technology for Economic and Clinical Health Act

11.2.3.5 Sarbanes Oxley Act

11.2.3.6 Federal Information Security Management Act

11.2.3.7 Payment Card Industry Data Security Standard

11.2.3.8 Federal Information Processing Standards

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: MARKET SIZE, BY TOOL, 2015–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY TOOL, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

11.2.5 CANADA

11.3 EUROPE

11.3.1 EUROPE: DATA VISUALIZATION TOOLS MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

11.3.3.1 General Data Protection Regulation

11.3.3.2 European Committee for Standardization

11.3.3.3 European Technical Standards Institute

TABLE 70 EUROPE: MARKET SIZE, BY TOOL, 2015–2020 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY TOOL, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.5 GERMANY

11.3.6 FRANCE

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: DATA VISUALIZATION TOOLS MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 Privacy Commissioner for Personal Data

11.4.3.2 Act on the Protection of Personal Information

11.4.3.3 Critical Information Infrastructure

11.4.3.4 International Organization for Standardization 27001

11.4.3.5 Personal Data Protection Act

FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY TOOL, 2015–2020 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY TOOL, 2021–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

11.4.5 JAPAN

11.4.6 INDIA

11.4.7 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: DATA VISUALIZATION TOOLS MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework

11.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

11.5.3.4 Protection of Personal Information Act

TABLE 94 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TOOL, 2015–2020 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TOOL, 2021–2026 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2025 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

11.5.5 UNITED ARAB EMIRATES

11.5.6 SOUTH AFRICA

11.5.7 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: DATA VISUALIZATION TOOLS MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 106 LATIN AMERICA: MARKET SIZE, BY TOOL, 2015–2020 (USD MILLION)

TABLE 107 LATIN AMERICA: MARKET SIZE, BY TOOL, 2021–2026 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 109 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 110 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 113 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 115 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

11.6.5 MEXICO

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 180)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 MARKET SHARE, 2020

FIGURE 43 SALESFORCE TO LEAD THE DATA VISUALIZATION TOOLS MARKET IN 2020

12.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 44 REVENUE ANALYSIS OF KEY MARKET PLAYERS

12.5 COMPANY EVALUATION QUADRANT, 2020

12.5.1 STAR

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 PARTICIPANTS

FIGURE 45 MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

12.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF KEY PLAYERS IN THE MARKET

12.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE ANALYSIS OF KEY PLAYERS IN THE MARKET

12.8 RANKING OF KEY MARKET PLAYERS IN THE MARKET, 2020

FIGURE 48 RANKING OF KEY PLAYERS, 2020

12.9 COMPANY (MAJOR PLAYERS) PRODUCT FOOTPRINT ANALYSIS

TABLE 118 COMPANY (MAJOR PLAYERS) PRODUCT FOOTPRINT

TABLE 119 COMPANY (MAJOR PLAYERS) VERTICAL FOOTPRINT – PART 1

TABLE 120 COMPANY (MAJOR PLAYERS) VERTICAL FOOTPRINT – PART 2

TABLE 121 COMPANY (MAJOR PLAYERS) REGION FOOTPRINT

12.1 STARTUP/SME EVALUATION QUADRANT, 2020

12.10.1 PROGRESSIVE COMPANIES

12.10.2 RESPONSIVE COMPANIES

12.10.3 DYNAMIC COMPANIES

12.10.4 STARTING BLOCKS

FIGURE 49 DATA VISUALIZATION TOOLS MARKET (GLOBAL), STARTUP/SME EVALUATION QUADRANT, 2021

12.11 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF KEY STARTUPS IN THE MARKET

12.12 BUSINESS STRATEGY EXCELLENCE

FIGURE 51 BUSINESS STRATEGY EXCELLENCE ANALYSIS OF KEY STARTUPS IN THE MARKET

12.13 COMPANY (STARTUPS/ SMES) PRODUCT FOOTPRINT ANALYSIS

TABLE 122 COMPANY (STARTUPS/ SMES) PRODUCT FOOTPRINT

TABLE 123 COMPANY (STARTUPS/ SMES) VERTICAL FOOTPRINT – PART 1

TABLE 124 COMPANY (STARTUPS/ SMES) VERTICAL FOOTPRINT – PART 2

TABLE 125 COMPANY (STARTUPS/ SMES) REGION FOOTPRINT

12.14 COMPETITIVE SCENARIO

12.14.1 NEW SOLUTION LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 126 NEW SOLUTION LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2019

12.14.2 DEALS

TABLE 127 DEALS, 2018–2021

12.14.3 OTHERS

TABLE 128 OTHERS, 2019–2021

13 COMPANY PROFILES (Page No. - 200)

13.1 INTRODUCTION

13.2 MAJOR PLAYERS

(Business overview, Recent developments, COVID-19 Developments, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses and competitive threats)*

13.2.1 SALESFORCE

TABLE 129 SALESFORCE: BUSINESS OVERVIEW

FIGURE 52 SALESFORCE: FINANCIAL OVERVIEW

TABLE 130 SALESFORCE: TOOLS OFFERED

TABLE 131 SALESFORCE: DATA VISUALIZATION TOOLS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 132 SALESFORCE: MARKET: DEALS

TABLE 133 SALESFORCE: MARKET: OTHERS

13.2.2 SAP

TABLE 134 SAP: BUSINESS OVERVIEW

FIGURE 53 SAP: FINANCIAL OVERVIEW

TABLE 135 SAP: TOOLS OFFERED

TABLE 136 SAP: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 137 SAP: MARKET: DEALS

13.2.3 MICROSOFT

TABLE 138 MICROSOFT: BUSINESS OVERVIEW

FIGURE 54 MICROSOFT: FINANCIAL OVERVIEW

TABLE 139 MICROSOFT: TOOLS OFFERED

TABLE 140 MICROSOFT: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 141 MICROSOFT: MARKET: DEALS

TABLE 142 MICROSOFT: MARKET: OTHERS

13.2.4 ORACLE

TABLE 143 ORACLE: BUSINESS OVERVIEW

FIGURE 55 ORACLE: COMPANY SNAPSHOT

TABLE 144 ORACLE: TOOLS OFFERED

TABLE 145 ORACLE: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 146 ORACLE: MARKET: DEALS

13.2.5 IBM

TABLE 147 IBM: BUSINESS OVERVIEW

FIGURE 56 IBM: FINANCIAL OVERVIEW

TABLE 148 IBM: TOOLS OFFERED

TABLE 149 IBM: DATA VISUALIZATION TOOLS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 150 IBM: MARKET: DEALS

TABLE 151 IBM: MARKET: OTHERS

13.2.6 AWS

TABLE 152 AWS: BUSINESS OVERVIEW

FIGURE 57 AWS: COMPANY SNAPSHOT

TABLE 153 AWS: TOOLS OFFERED

TABLE 154 AWS: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 155 AWS: MARKET: OTHERS

13.2.7 ALTERYX

TABLE 156 ALTERYX: BUSINESS OVERVIEW

FIGURE 58 ALTERYX: COMPANY SNAPSHOT

TABLE 157 ALTERYX: TOOLS OFFERED

TABLE 158 ALTERYX: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 159 ALTERYX: DATA VISUALIZATION TOOLS MARKET: DEALS

13.2.8 ALIBABA CLOUD

TABLE 160 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 59 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 161 ALIBABA CLOUD: TOOLS OFFERED

TABLE 162 ALIBABA CLOUD: MARKET: DEALS

TABLE 163 ALIBABA CLOUD: MARKET: OTHERS

13.2.9 SAS INSTITUTE

TABLE 164 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 60 SAS INSTITUTE: COMPANY SNAPSHOT

TABLE 165 SAS INSTITUTE: TOOLS OFFERED

TABLE 166 SAS INSTITUTE: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 167 SAS INSTITUTE: MARKET: DEALS

13.2.10 DUNDAS

TABLE 168 DUNDAS: BUSINESS OVERVIEW

TABLE 169 DUNDAS: TOOLS OFFERED

TABLE 170 DUNDAS: DATA VISUALIZATION TOOLS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

13.3 OTHER PLAYERS

13.3.1 SISENSE

13.3.2 TIBCO SOFTWARE

13.3.3 QLIK

13.3.4 DOMO

13.3.5 GOODDATA

13.3.6 KLIPFOLIO

13.4 STARTUP/SME PROFILES

13.4.1 DATAFAY

13.4.2 ZEGAMI

13.4.3 LIVE EARTH

13.4.4 REEPORT

13.4.5 CLUVIO

13.4.6 WHATAGRAPH

13.4.7 DATABOX

13.4.8 DATAPINE

13.4.9 CHORD

13.4.10 TOUCAN TOCO

*Details on Business overview, Recent developments, COVID-19 Developments, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 249)

14.1 INTRODUCTION

14.2 BUSINESS INTELLIGENCE MARKET - GLOBAL FORECAST TO 2025

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

TABLE 171 BUSINESS INTELLIGENCE MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y %)

TABLE 172 BUSINESS INTELLIGENCE MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

14.2.2.1 Business intelligence market, by component

TABLE 173 BUSINESS INTELLIGENCE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 174 BUSINESS INTELLIGENCE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

14.2.2.2 Business intelligence market, by deployment mode

TABLE 175 BUSINESS INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 176 BUSINESS INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

14.2.2.3 Business intelligence market, by organization size

TABLE 177 BUSINESS INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 178 BUSINESS INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.2.2.4 Business intelligence market, by business function

TABLE 179 BUSINESS INTELLIGENCE MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 180 BUSINESS INTELLIGENCE MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

14.2.2.5 Business intelligence market, by industry vertical

TABLE 181 BUSINESS INTELLIGENCE MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2025 (USD MILLION)

TABLE 182 BUSINESS INTELLIGENCE MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

14.2.2.6 Business intelligence market, by region

TABLE 183 BUSINESS INTELLIGENCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 184 BUSINESS INTELLIGENCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

14.3 BIG DATA MARKET - GLOBAL FORECAST TO 2025

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 185 GLOBAL BIG DATA MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION AND Y-O-Y %)

14.3.2.1 Big data market, by component

TABLE 186 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

14.3.2.2 Big data market, by deployment mode

TABLE 187 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

14.3.2.3 Big data market, by organization size

TABLE 188 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

14.3.2.4 Big data market, by business function

TABLE 189 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

14.3.2.5 Big data market, by industry

TABLE 190 BIG DATA MARKET SIZE, BY INDUSTRY, 2018–2025 (USD MILLION)

14.3.2.6 Big data market, by region

TABLE 191 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 260)

15.1 INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of data visualization tools market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the data visualization tools market.

Secondary Research

In the secondary research process, various secondary sources, such as Data Science Journal, Journal of Visualization, Information Visualization, International Journal of Data Science and Analytics, Analytics India magazine, Smashing magazine, and other magazines have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from data visualization tools vendors, system integrators, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the data visualization tools market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global data visualization tools market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the data visualization tools market by tool (standalone and integrated), organization size, deployment mode, business function, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the data visualization tools market

- To analyze the impact of the COVID-19 pandemic on the data visualization tools market

COVID-19 Impact

The data visualization tools market has witnessed several advancements in terms of tools offered by the industry players. Verticals such as manufacturing, retail, and energy and utilities have witnessed a moderate slowdown, whereas BFSI, government, and healthcare and life sciences verticals have witnessed a minimal impact. The COVID-19 pandemic has given rise to increased use of line charts, bar charts, and choropleth maps in the news. Simple data visualizations have become the key to communicating vital information about the coronavirus pandemic to the public. While these terms might not be familiar to all, the visualizations themselves certainly are. One of the most interesting developments due to the current COVID-19 crisis is that organizations that excel at the developments of dashboards centralize analytics and decision-making approaches and scale them exponentially across all connected channels.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American data visualization tools market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Visualization Tools Market

The need for powerful data visualisation tools is anticipated to increase significantly as data becomes more crucial to decision-making across a range of industries. The data visualisation market, however, may face a number of difficulties in the future. Several of these difficulties include:

Competition will increase as more businesses enter the market and as demand for data visualisation tools rises. Businesses must differentiate themselves in order to succeed by offering distinctive features or offering top-notch customer service.

Data security and privacy: As more data is shared, worries about data security and privacy will grow. Companies that specialise in data visualisation will need to make sure that their equipment is safe and complies with privacy laws.

What will be key challenges for growing Data Visualization Tools business in the future Market?