Customized Premixes Market by Type (Vitamins, Minerals, Amino Acids, Nucleotides, Antibiotics, Fibers), Application (Beverages, Dairy Products, Bakery & Confectionery Products, Nutraceuticals), Form, Function and Region - Global Forecast to 2027

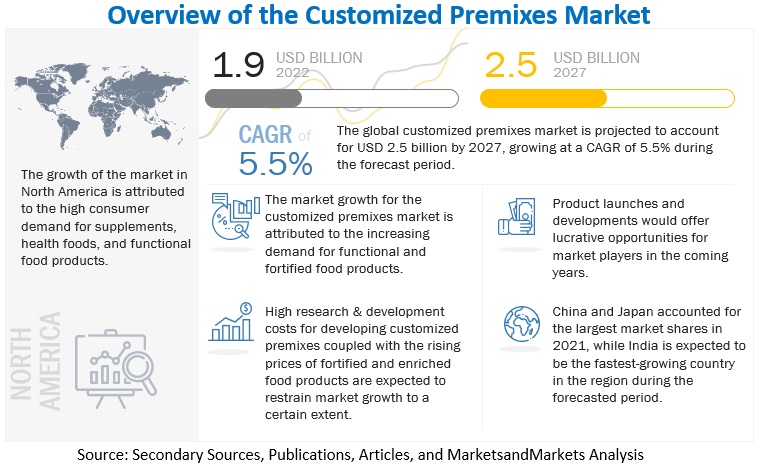

The customized premixes market size is predicted to grow at a CAGR of 5.5% between 2022 and 2027, reaching a value of $2.5 billion by 2027 from a projection of $1.9 billion in 2022. Customized premixes are dry or liquid custom blends of a wide array of vitamins, minerals, amino acids, nucleotides, antibiotics, and fibers used in food & beverage, pet food, and healthcare applications for enrichment or fortification purposes to enhance the nutritional value of products. Premixes can also be defined as custom-designed, complex blends of ingredients associated with the health and wellness attributes of products offered in the human & animal nutrition sector.

Customized premixes are available in two forms: dry and liquid, and are used for various functionalities. These include enhancing bone health, skin health, energy, immunity, and human digestion.

Customized premixes are used in food & beverage and healthcare products for enrichment or fortification to enhance the nutritional value of a product. Premixes can also be defined as tailor-made, requirement-based, or custom-designed, complex blends of ingredients associated with health and wellness attributes of products offered under the human and pet nutrition segment.

To know about the assumptions considered for the study, Request for Free Sample Report

Customized Premixes Market Dynamics

Drivers: Rise in demand for functional and fortified food

From a commercial aspect, regions such as North America and Europe have elevated demand for value-added products. This is because fast-paced lifestyles have persuaded people to reduce the consumption of a multiple-source nutrient-rich diet, which in turn has increased the dependency on enriched ready-to-eat (RTE) food items that act as a single nutrient source. In regions such as the Asia Pacific, the demand for fortified food is rising due to health concerns and frequent health crises, which increases demand for customized premix products.

The rise in pet humanization trends in Asia Pacific has increased the demand for premium pet food ingredients and products, which deliver multifunctional health benefits. The spending on health-focused pet food ingredients is rising, with the increasing awareness and disposable income among pet owners. As per a consumer survey conducted by DSM (Netherlands) in October 2022, the consumers from key geographical regions are actively seeking out fortified foods and beverages with nutrition-boosting ingredients on shop shelves. This increase in demand for fortified and functional food is fueling the growth in the usage of customized premixes market in various food & beverage products since they are a custom blend of multiple nutrients incorporated to create nutrient-rich food products.

Restraints: High research and development costs for developing customized premixes

Customized premixes require high investment in product development and innovations. Industry players such as DSM (Netherlands) and Corbion (Netherlands) invest a substantial share of their revenues in R&D. Since customized premixes are customized as per customer requirements, every product has a different formulation and requires the trial of various combinations by custom premix manufacturers. This process incurs substantial costs. Although premix manufacturers are working on innovations and conducting specialized research for formulating these products to provide cost-effective solutions to food & beverage manufacturers, high R&D costs remain a major restraint for this market.

Opportunities: Rise in health consciousness and growing consumer inclination toward health food

The growing level of consumer understanding on nutrition intake and health issues due to deficiencies has led to a shift in the outlook for health food. As a result, a large number of consumers are focusing on comparing different brands and inculcating the habit of reading product labels to identify and compare nutritional content. This shift in consumer behavioral patterns worldwide has presented a significant opportunity for players operating in the health food manufacturing industry, including fortified food & beverage manufacturers and companies in customized premixes market providing customized premixes.

Challenges: Inaccurate labeling of food products

Nutritional benefits associated with the consumption of food products are used as a marketing tool by most food manufacturers to drive their sales revenues. According to a Food Labeling Survey conducted on the US population and published by the International Food Information Council Foundation in January 2019, 59% of respondents said they always read labels on a packaged food before buying it for the first time, and nearly all the surveyed consumers look for healthy options when shopping. Thus, consumers read food labels, especially in developed economies where awareness is high.

By type, minerals is likely to account for the significant growth rate during the forecast period.

Based on type, minerals account for the significant growing segment in the customized premixes market. The significant consumption of fortified food & beverage products can largely be attributed to the fact that most minerals cannot be synthesized by the human body and have to be consumed through food diets. Furthermore, their deficiency in the everyday diet of end consumers has led to consumer inclination toward mineral-enriched products, which is driving the industrial use of minerals in a wide range of food & beverage products.

By application, bakery and confectionery products segment occupies the second highest market share during the forecast period.

Based on application, bakery and confectionery products account for the second largest segment in the market. Fortifying bakery and confectionary products such as bread, muffins, cakes, candies, and chocolates with essential nutrients such as vitamins, minerals, and proteins is a common practice since these products form a part of the daily meal. As a result, there has been a gradual increase in the level of fortification & enrichment of confectionery products. Nutrients commonly used in the fortification of confectionery products include minerals, proteins, fibers, and others. All these factors together contribute to the growth of the customized premixes market for bakery & confectionery products.

By form, the liquid segment is projected to account for the significant growth rate over the forecast period

By form, liquid accounts for the significant growth rate over the forecasted period. Customized premixes in the liquid form can be largely classified into oily liquids and water-miscible liquids. These are usually used for the fortification of food products such as skimmed liquid milk, diet dairy products with low-fat content, flavored milk, ice creams, juices, custards, jams, and soft drinks. Moreover, the liquid blends have faster absorption rates, making the final product more effective. These factors drive the market for customized premixes in the liquid form.

By function, bone health segment is projected to witness the fastest growth rate during the forecast period.

Based on function, bone health segment is likely to account for the fastest growing segment in the customized premixes market. Bone health is essential for maintaining the overall health and well-being of the body. Ideal bone health is critical in preventing diseases related to the bones such as osteoporosis, arthritis, and rickets caused due to inadequate intake or deficiency of nutrients such as vitamins, minerals, proteins, Omega-3 fatty acids, prebiotics, and probiotics. The demand for vitamin D and calcium-based supplements as well as fortified food products is growing, thereby supporting the growth of the market for bone health.

To know about the assumptions considered for the study download the pdf brochure

By region, Asia Pacific is projected to witness the fastest growth rate during the forecast period.

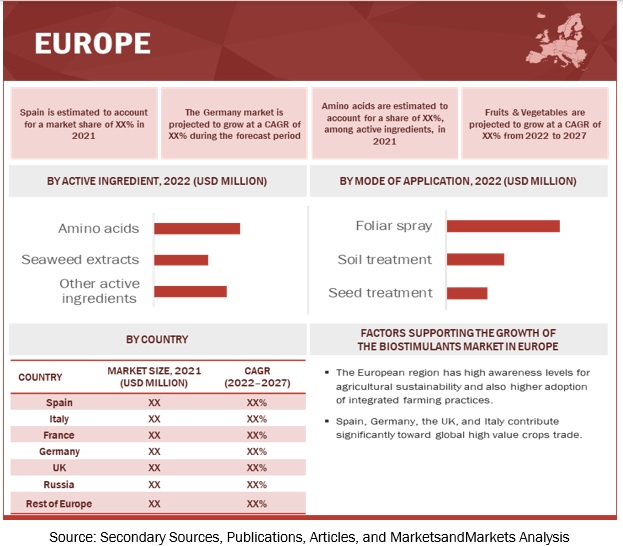

Asia Pacific accounted for the fastest growing region for the customized premixes market during the forecast period. Underdeveloped and developing countries in the Asia Pacific region are more prone to nutritional deficiencies, resulting in malnourishment and undernourishment. The adoption of a hectic lifestyle has increased lifestyle-related diseases, further boosting the sales of fortified food and subsequently customized premixes in the region. As a result, the fortified food industry and customized premixes industry is expected to grow at a fast pace in the Asia Pacific due to the rise in consumer demand.

Top Companies in the Customized Premixes Market:

Key players in this market include DSM (The Netherlands), Glanbia PLC (Ireland), Corbion (The Netherlands), Vitablend Nederland BV (The Netherlands), SternVitamin GmbH & Co. KG (Germany), Jubilant Ingrevia Limited (India), Hexagon Nutrition Limited (India), Prinova Group LLC (US), ADM (US), Cargill, Incorporated (US), Wrights Enrichment Inc. (US), Farbest-Tallman Foods Corporation (US), Piramal Enterprises Limited (India), Hellay Australia Pty. Ltd. (Australia), CFL Chemische Fabrik Lehrte GmbH & Co. KG (Germany), Nutreco (The Netherlands), Utrix S.A.L (Lebanon), Pristine Organics Private Limited (India), Innovad NV/SA (Belgium), Flexiblending (Czech Republic), LANI (US), Amesi Group (South Africa), AB Agri Ltd. (UK), The MIAVIT GmbH (Germany), and Bar-Magen Ltd. (Israel).

Customized Premixes Market Report Scope

|

Report Metrics |

Details |

| Market size value in 2022 | USD 1.9 billion |

| Market size value in 2027 | USD 2.5 billion |

| Market Growth Rate | CAGR of 5.5% |

| Market size estimation | 2019–2027 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD Million) and Volume (KT) |

| Segments covered | Type, Application, Form, and Function |

| Regions covered | North America, Europe, Asia Pacific, South America and RoW |

| Companies studied |

|

Target Audience:

- Key companies engaged in customized premixes manufacturing

- Key manufacturers of customized premixes

- Traders, distributors, and suppliers in the customized premixes market

- Traders and suppliers of raw materials to the customized premixes industry

- Fortified food and beverages manufacturers

-

Related government authorities, commercial R&D institutions, and other regulatory bodies

- Food and Drug Administration (FDA)

- The European Food Safety Authority (EFSA)

- Food Safety and Standards Authority of India (FSSAI)

- Pet Food Manufacturers’ Association (PFMA)

Customized Premixes Market Report Segmentation:

This research report categorizes the customized premixes market based on type, application, form, function, and region

|

Segment |

Subsegment |

| Market By Type |

|

| Market By application |

|

| Market By Form |

|

| Market By Function |

|

| Market By Region |

|

Frequently Asked Questions (FAQ):

What is the projected market value of the global customized premixes market?

The global customized premixes market is estimated to be valued at USD 1.9 billion in 2022. It is projected to reach USD 2.5 billion by 2027, with a CAGR of 5.5%, in terms of value between 2022 and 2027.

What are the major revenue pockets in the customized premixes market currently?

The Asia Pacific region experienced the highest growth in the customized premixes market throughout the projected period. This is primarily due to the prevalence of nutritional deficiencies in underdeveloped and developing countries within the region, leading to issues of malnourishment and undernourishment. The increased prevalence of lifestyle-related diseases, driven by a fast-paced lifestyle, has further contributed to the demand for fortified food and, consequently, customized premixes. Consequently, the fortified food industry and customized premixes industry are anticipated to witness rapid expansion in the Asia Pacific region, driven by growing consumer demand.

What are some of the drivers fuelling the growth of the customized premixes market?

Global customized premixes market is characterized by the following drivers:

Drivers: Rising importance of shortening lead time, streamlining production processes, and reducing costs

Shortening lead time, streamlining production processes, and reducing inventory costs to attain maximum efficiency is the goal of every manufacturing plant. Customized premixes offer these advantages to manufacturers. They act as a single source for multiple nutrients, and thus it becomes easier for manufacturers to incorporate premixes in their products as compared to adding segregated nutrients that are difficult to incorporate and blend in products homogeneously. This helps manufacturers save time involved in production activities, reduce inventory costs (as the need for storing multiple nutrients is eliminated), and reduce lead time.

Since premixes are used in various applications such as cereals, bakery & confectionery, infant nutrition, sports nutrition, nutraceuticals, dietary supplements, and pet food, customization is regarded as a better choice for manufacturers as they can customize the premix as per the desired specifications of their food product applications. Manufacturers can also save costs on labor and raw material testing, thereby streamlining their overall production process. Owing to the above-mentioned benefits, manufacturer preference for customized premixes is increasing.

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market are DSM (The Netherlands), Glanbia PLC (Ireland), Corbion (The Netherlands), Vitablend Nederland BV (The Netherlands), SternVitamin GmbH & Co. KG (Germany), Jubilant Ingrevia Limited (India), Hexagon Nutrition Limited (India), Prinova Group LLC (US), ADM (US), and Cargill, Incorporated (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

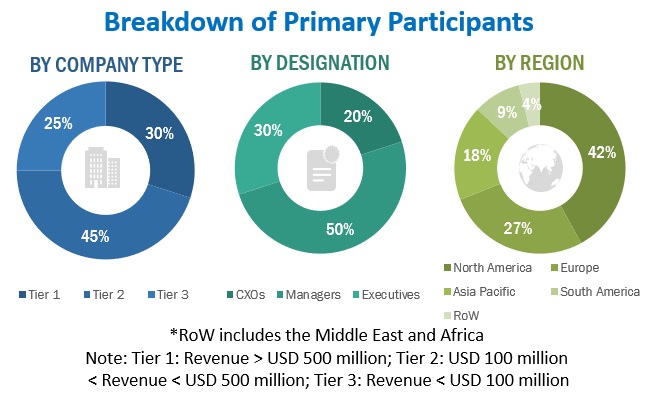

The study is focused on estimating customized premixes market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to, to identify and collect information. various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), and academic references pertaining to customized premixes market, were referred to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the customized premixes market.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of customized premixes supplied by different market players, and key market dynamics such as drivers, restraints, opportunities, burning issues, industry trends, and key player strategies.

In the complete market engineering process, top-down (supply side) and bottom-up approaches were extensively used along with several data triangulation methods to conduct market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Customized Premixes Market Size Estimation

Both the top-down (supply side) and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the customized premixes market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall customized premixes market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Customized Premixes Market Report Objectives

- To describe and forecast the market, in terms of type, application, form, function, and region.

- To describe and forecast the market, in terms of value, by region– North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- 1To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the customized premixes market.

Available Customizations:

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European customized premixes market into EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific market into Singapore, the Philippines, Malaysia, and other countries in Asia Pacific

- Further breakdown of the Rest of South American market into Peru, Chile, and Colombia.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customized Premixes Market