Homeland Security and Emergency Management Market by Vertical (Homeland Security, Emergency Management), Solution (Systems, Services), Installation (New Installation, Upgrade), End Use, Technology, and Region (2021-2026)

Update: 12/05/2024

Homeland Security & Emergency Management Market Size & Growth

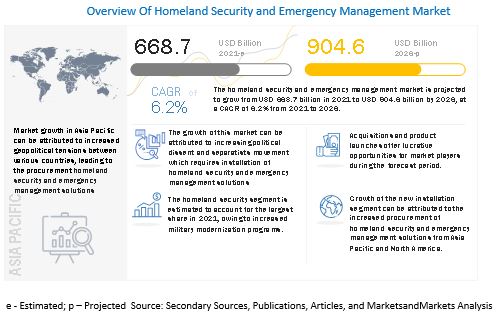

[395 Pages Report] The Global Homeland Security & Emergency Management Market Size was valued at USD 750,000 Million in 2023 and is estimated to reach USD 904,600 Million USD by 2026, growing at a CAGR of 6.2% during the forecast period. It is witnessing significant growth due to increasing political dissents and separatists’ movements The Asia Pacific region will dominate the Homeland Security & Emergency Management Industry due to the growing investments in Homeland Security & Emergency Management solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on market

The COVID-19 impact has been analyzed for three scenarios: realistic, optimistic, and pessimistic. The realistic scenario has been considered for further calculations. The manufacture of sophisticated sensors and related component lines has been impacted to some extent. However, continuous demand for surveillance and intelligence gathering systems in Homeland Security & Emergency Management has been observed due to the issuance of several product development contracts between January 2020 and July 2020.

Numerous countries, including the US and China, have restricted their respective budget allocations for Homeland Security & Emergency Management while diverting some funds for the preparations against a pandemic. Further, the supply chain on demand as well as supply side is witnessing huge impact, resulting in delays in order completion or cancellation.

Homeland Security & Emergency Management Market Trends

Driver: Political dissents and separatists’ movements

Various separatist movements across the world are still highly active and armed, creating hazardous situations for nations in which these are taking place. Countries in the Middle East, Europe, and the Asia Pacific are increasingly facing separatist movements. Governments are spending millions of dollars to equip their Homeland Security & Emergency Management personnel.

In the Middle East, where efforts are underway to reinstate democracy by overthrowing dictatorship, there has been a significant growth in the homeland security market of the countries in the region. Spending on Homeland Security & Emergency Management by countries such as Saudi Arabia, Bahrain, and Iran has increased significantly, where recent conflicts and decline in oil prices are major drivers. In the African region, countries such as Djibouti, Eritrea, Ethiopia, Kenya, and Somalia have been in armed violence for decades. More than state-based armed conflicts, African countries are affected by terrorist-based armed conflicts.

Restraints: Low prioritization of emergency management action plans

Disasters (natural/manmade) and their aftermaths have the significant potential to affect the political environment of a community, state, or nation. After a disaster, coordination and engagement by participants at all levels of the government are required to set overall priorities and objectives for disaster recovery. It becomes necessary to execute an emergency management action plan to overcome the critical situations arising due to critical incidents. However, a number of politicians are involved, and thus, slow response to operations can cause confusions in decision-making and delay the adoption of incident management solutions.

Due to various factors, disaster management is not given preference in various countries.

Low fund allocations, inadequate training, non-implementation of standard operating procedures (SOPs), and political pressure are a few factors that are leading to poor emergency management.

Opportunities: Rising adoption of cloud-based applications and services

The demand for cloud-based security solutions as the dominant delivery model to meet IT security needs is rapidly increasing. Various companies such as IBM, HPE, Symantec, McAfee, and Cisco, provide cybersecurity solutions on a Software-as-a-Service (SaaS)-based delivery model over the cloud. Such cloud-based platforms offer a centralized way to secure the web and mobile applications, and networks across the organization, throughout the development, production, and implementation phases. The SaaS-based approach is simpler and more efficient than the on-premises deployment mode as it offers greater flexibility and scalability for solution deployments. As more and more applications are being deployed on cloud, there is a shift from traditional on-premises cybersecurity solutions to cloud-based solutions across large enterprises and SMEs. For organizations having strict budgets on security investments, SaaS-based security solutions are expected to provide an opportunity during the next five years.

For instance, in October 2019 a USD 10 billion contracts has been awarded to Microsoft Inc. to build a cloud computing infrastructure for US defense and homeland security authorities.

Challenges: Rapidly increasing insider cyber threats

The insider in an organization is the one who can access an organization's assets, either physically or remotely. The insider can be an employee, vendor, business partner, or maintenance contractor who can access physical data such as hard copies of documents, electronic devices in the organization, and digital assets, including digital media, data in transit, and other information resources. Insider attacks are rapidly increasing and causing data breaches in organizations. According to a UK report, October 2020 was recorded as the month with the highest number of cyberattacks in history with over 117 publicly reported security breach incidents. Similarly, in December 2020, hackers broke into the data networks of US federal agencies including the treasury and commerce departments in attacks that were revealed just days after US officials warned that cyber hackers linked to the Russian government were looking for vulnerabilities to target the government’s sensitive data. The FBI and the Department of Homeland Security’s cybersecurity arm are investigating what experts and former officials say seems to be a large-scale penetration into US government agencies.

Past research indicates that 60% cybersecurity breaches have the involvement of insiders in some form. Insider attacks steal or modify data for personal gain, stealing trade secrets, and selling these to competitors. In addition, cybercriminals are targeting organizations’ databases to access confidential information regarding intellectual property, patents, and copyrights. In healthcare and pharmaceutical organizations, insider attacks are leading to the theft of the medical history of patients or IT sabotage. Industries are witnessing a shift from outsider attacks to insider attacks. Due to the expectation of increasing threats due to insider attacks, there is significant adoption of cutting-edge cybersecurity solutions.

Homeland Security & Emergency Management Market Segments

Based on solution, the systems segment is projected to grow at the highest CAGR during the forecast period

Due to increasing global threats, the systems segment is expected to lead the Homeland Security & Emergency Management market. The rising demand for non-lethal weapons used to control riot situations is one of the key factors contributing to the growth of the systems segment. Growth in the procurement of new homeland security systems by various law enforcement agencies across the globe is further propelling the segment growth.

Based on vertical, the homeland security segment is projected to grow at the highest CAGR during forecast period

The growth for this segment is attributed to various factors such as dynamic climatic conditions, rising natural calamities, government emphasis on safety policies, frequent terror attacks, and domestic violence. Homeland Security & Emergency Management agencies are looking for upgraded and technologically advanced solutions as the majority of existing installations have either become obsolete or are running on outdated technologies. The Homeland Security & Emergency Management market is presently ripe, with several Tier 1 companies offering technologically advanced and sophisticated solutions.

Based on end-use, cybersecurity segment is projected to grow at the highest CAGR during the forecast period

The increased deployment of web and mobile applications by organizations is expected to lead to the growth of the cybersecurity market. Advanced cybersecurity products provide comprehensive security to critical business applications and maintain confidentiality, integrity, and availability. In this report, cybersecurity solutions are categorized into six major types, namely, network security, endpoint security, application security, cloud security, wireless security, and others. Critical infrastructure is a prime target for cyberattacks, both from hostile governments and cyber-terrorist organizations.

In November 2020, NTT DATA Services Federal Government, a public sector subsidiary of NTT DATA Services, was awarded a $23.3 million task order under NTT DATA’s General Services Administration multiple award schedule contract to support the US Department of Homeland Security’s (DHS) Cybersecurity Infrastructure Security Agency (CISA) and Cybersecurity Division.

Homeland Security & Emergency Management Market Region

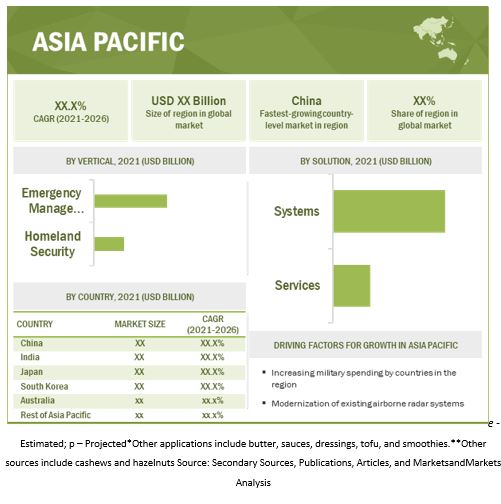

The Asia Pacific region is the fastest-growing in the Homeland Security & Emergency Management market in the forecast period

The Asia Pacific Homeland Security & Emergency Management market is projected to grow at the highest CAGR during the forecast period. The growth of the Asia Pacific Homeland Security & Emergency Management market is primarily driven by increasing focus on modernization of existing Homeland Security & Emergency Management systems by major economies in this region. In addition, factors including increasing geopolitical tensions and increased defense-related expenditure are expected to drive the demand for Homeland Security & Emergency Management in the region.

Homeland Security & Emergency Management Companies: Top Key Market Players

The Homeland Security & Emergency Management Companies are dominated by globally established players such as:

- Lockheed Martin Corporation (US)

- Northrop Grumman Corporation (US)

- Thales Group (France)

- BAE Systems (UK)

- Elbit Systems (Israel)

- Leidos (US)

- L3Harris Technologies (US)

Scope of the report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 668.7 Billion in 2021 |

|

Projected Market Size |

USD 904.6 Billion by 2026 |

|

Growth Rate |

CAGR 6.2% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Technology, By Solution, By End Use, By Vertical, By Installation |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), BAE Systems (UK), LEIDOS (US), Elbit Systems (Israel) and L3Harris Technologies (US). and others. Total 27 Market Players |

The study categorizes the Homeland Security & Emergency Management market based on technology, solution, end-use, installation, vertical, and region.

By Technology

- Facial Recognition Cameras

- Thermal Imaging Technology

- AI-based Solutions

- C2 Solutions

- Blockchain Solutions

- Others

By Vertical

- Homeland Security

- Emergency Management

By End-Use

- Cybersecurity

- Aviation Security

- Maritime Security

- Law Enforcement And Intelligence Gathering

- Critical Infrastructure Security

- Risk And Emergency Services

- Border Security

- Cbrne Security

By Installation

- New Installation

- Upgrade

By Solution

- Systems

- Services

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In February 2020, BAE Systems received a contract worth USD 212 Million from the US Navy’s Naval Air Warfare Center Aircraft Division (NAWCAD) to integrate the latter’s critical communication systems

- In January 2020, Raytheon received a contract worth USD 197 Million from the US Air Force to design a ground system that is expected to be used to collect and process data from missile warning satellites.

- In January 2020, The US Department of Homeland Security has awarded General Dynamics a contract to maintain one of its data centers in Mississippi. The USD 2.8 Million contract continues until the end of the year for the purpose of providing continued operations and maintenance (O&M) support.

- In January 2020, Leidos received a Transportation Security Administration’s (TSA) screening equipment contract. Under the contract, the company is expected to provide services that include: preventative, corrective, and depot maintenance; integrated logistics support, information technology infrastructure development and maintenance; and management of TSA’s Service Response Center.

Frequently Asked Questions (FAQ):

Which are the major systems considered in this study and which segments are projected to have a promising market share in future?

Intelligence and surveillance system is currently accounting for the dominant share in the Homeland Security & Emergency Management market, followed by detection and monitoring system and weapon system.

What are some of the drivers fuelling the growth of Homeland Security & Emergency Management market?

Global Homeland Security & Emergency Management market is characterized by following drivers:

Political dissents and separatists’ movements

Various separatist movements across the world are still highly active and armed, creating hazardous situations for nations in which these are taking place. Countries in the Middle East, Europe, and the Asia Pacific are increasingly facing separatist movements. Governments are spending millions of dollars to equip their Homeland Security & Emergency Management personnel.

In the Middle East, where efforts are underway to reinstate democracy by overthrowing dictatorship, there has been significant growth in the homeland security market of the countries in the region. Spending on Homeland Security & Emergency Management by countries such as Saudi Arabia, Bahrain, and Iran has increased significantly, where recent conflicts and decline in oil prices are major drivers. In the African region, countries such as Djibouti, Eritrea, Ethiopia, Kenya, and Somalia have been in armed violence for decades. More than state-based armed conflicts, African countries are affected by terrorist-based armed conflicts.

Occurrence of unpredictable natural disasters due to changing climatic conditions

Natural disasters affect not only individuals and communities but also domestic markets, governments, and economies globally. The number of disasters has increased in recent decades from approximately 100 to 150 a year in the early 1980s to an annual average of 394 between 2011 and 2020. Natural disasters are affecting developed as well as emerging countries, resulting in loss of lives and damage to economies as well as the environment.

The rise in disasters due to climate change is leading to an increasing need for new and technologically advanced emergency management solutions which could help mitigate losses that arise. Therefore, these increasing numbers of disasters and climatic changes are expected to fuel the implementation of new emergency response solutions. Various companies have started developing products and solutions that warn people about such disasters minutes before they reach those regions. Governments of many countries such as India are implementing new emergency management solutions, disaster alert applications, and services. Countries are also re-examining their current emergency preparedness and planning for the future. Hence, climatic changes and the increasing intensity of natural disasters are expected to be the major drivers for the growth of the Homeland Security & Emergency Management market, which in turn, is expected to generate a high demand for enhanced technologies and products.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Top down approach (Based on global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), BAE Systems (UK), Elbit Systems (Israel), Leidos (US), and L3Harris Technologies (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 51)

1.1 OBJECTIVE OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET: MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 56)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

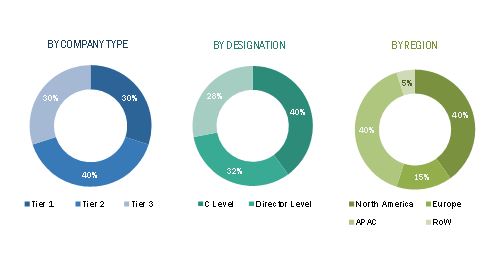

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.3 Primary details

2.1.2.4 Key industry insights

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Political dissent and separatists’ movements

2.2.2.2 Occurrence of unpredictable natural disasters due to ever-changing climatic conditions

2.3 MARKET DEFINITION & SCOPE

2.3.1 SEGMENT DEFINITIONS

2.3.1.1 Homeland security and emergency management market, by technology

2.3.1.2 Homeland security and emergency management market, by end use

2.3.1.3 Homeland security and emergency management market, by vertical

2.3.1.4 Homeland security and emergency management market, by solution

2.3.1.5 Homeland security and emergency management market, by installation

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 COVID-19 Impact on market

2.4.1.2 Global market size of homeland security and emergency management (HSEM) market

2.4.1.3 Market forecast

2.4.1.4 Regional & country analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.1.5 COVID-19 impact on market analysis

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET

2.6 MARKET SIZING & FORECASTING

2.7 RESEARCH ASSUMPTIONS

2.7.1 GROWTH RATE ASSUMPTIONS

2.7.2 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 69)

FIGURE 9 MARKET, BY VERTICAL, 2021 & 2026 (USD BILLION)

FIGURE 10 MARKET, BY END USE, 2021 & 2026 (USD BILLION)

FIGURE 11 MARKET, BY SOLUTION, 2021 & 2026 (USD BILLION)

FIGURE 12 MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 73)

4.1 ATTRACTIVE OPPORTUNITIES IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET

FIGURE 13 INCREASING TERRORIST THREATS AND BIOHAZARD ATTACKS ARE EXPECTED TO DRIVE THE MARKET DURING FORECAST PERIOD

4.2 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY SYSTEM

FIGURE 14 INTELLIGENCE AND SURVEILLANCE SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

4.3 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY INSTALLATION

FIGURE 15 NEW INSTALLATION SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

4.4 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, MAJOR COUNTRIES

FIGURE 16 CHINA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 76)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Political dissents and separatists’ movements

5.2.1.2 Occurrence of unpredictable natural disasters due to changing climatic conditions

5.2.1.3 Increasing terrorist threats and biohazard attacks

FIGURE 18 ATTACKS AND DEATHS DUE TO TERRORISM, BY REGION, 2002-2019

5.2.1.4 AI enhances public safety operations in smart cities

5.2.1.5 Increasing adoption of IoT in public safety

5.2.1.6 Increase in demand for AI-based homeland security solutions

5.2.1.7 Cyber threats leading to upgrade of IT systems

FIGURE 19 GLOBAL SECURITY V/S INVESTMENT, 2016-2020:

5.2.2 RESTRAINTS

5.2.2.1 Low prioritization of emergency management action plans

5.2.2.2 Limited security budgets

5.2.2.3 Slow adoption of security solutions and lack of proactive measures

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of cloud-based applications and services

5.2.3.2 Upgradation of outdated equipment and infrastructure

5.2.3.3 Emergence of big data analytics in public safety and security

5.2.3.4 Adoption of cloud computing technologies in the public safety industry

5.2.3.5 AI innovations in border security and public safety

5.2.4 CHALLENGES

5.2.4.1 Rapidly increasing insider cyber threats

5.2.4.2 Lack of competent security professionals

5.2.4.3 Integrating existing systems with new technologies

5.3 AVERAGE SELLING PRICE

TABLE 1 AVERAGE SELLING PRICES OF HOMELAND SECURITY AND EMERGENCY MANAGEMENT SUBSYSTEMS IN 2020 (USD)

TABLE 2 AVERAGE SELLING PRICES OF WEAPON SYSTEMS IN 2020 (USD)

TABLE 3 AVERAGE SELLING PRICE OF RADARS IN 2020 (USD MILLION)

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING ORIGINAL EQUIPMENT MANUFACTURING AND INTEGRATION PHASES

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 21 REVENUE SHIFT IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 22 MARKET ECOSYSTEM MAP: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET

TABLE 4 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET ECOSYSTEM

5.7 IMPACT OF COVID-19 ON THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET

FIGURE 23 IMPACT OF COVID-19 ON THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET

5.7.1 DEMAND-SIDE IMPACTS

5.7.1.1 Key developments from January 2020 to November 2020

TABLE 5 KEY DEVELOPMENTS IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, JANUARY 2020 TO DECEMBER 2020

5.7.2 SUPPLY-SIDE IMPACT

5.7.2.1 Key developments from January 2020 to December 2020

TABLE 6 KEY DEVELOPMENTS IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, JANUARY 2020 TO DECEMBER 2020

5.8 RANGES AND SCENARIOS

FIGURE 24 IMPACT OF COVID-19 ON THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET: THREE GLOBAL SCENARIOS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 HOMELAND SECURITY AND EMERGENCY MANAGEMENT SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 REGULATORY LANDSCAPE

5.10.1 NORTH AMERICA

5.10.2 EUROPE

5.10.3 ASIA PACIFIC

5.10.4 MIDDLE EAST

5.11 TRADE ANALYSIS

TABLE 8 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

TABLE 9 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 10 ELECTRIC SOUND OR VISUAL APPARATUS: COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 11 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

TABLE 12 FIRE EXTINGUISHING AND GRENADES COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

TABLE 13 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

5.12 FORECAST MARKET CAGR

5.12.1 LIST OF CURRENT/PAST TOP PROGRAMS

5.12.2 LIST OF FUTURE TOP PROGRAMS

5.12.3 TOP CUSTOMERS

6 INDUSTRY TRENDS (Page No. - 110)

6.1 INTRODUCTION

6.2 TECHNOLOGICAL TRENDS

6.2.1 BIG DATA & DATA ANALYTICS

6.2.2 UNMANNED SYSTEMS

6.2.3 ADVANCED SENSORS AND DETECTORS

6.2.4 AUTOMATED BORDER CONTROL

6.2.5 C2/C4ISR/C5ISR SYSTEMS

6.2.6 PORTABLE DETECTORS AND SAMPLING & TESTING KITS

6.2.7 SCANNING AND SCREENING SYSTEMS

6.2.8 CRITICAL COMMUNICATION NETWORKS

6.2.9 EMERGENCY AND DISASTER MANAGEMENT SYSTEMS

6.2.10 CYBER-PHYSICAL SECURITY SYSTEMS FOR HOMELAND SECURITY

6.3 USE CASE ANALYSIS

6.3.1 PLATINUM BUSINESS SERVICES TO SUPPORT THE CYBER ASSESSMENT AND RISK MANAGEMENT SUPPORT

6.3.2 CYBERSECURITY SOLUTIONS TO US FEDERAL GOVERNMENT X-FORCE BY IBM

6.4 TECHNOLOGY ANALYSIS

6.5 IMPACT OF MEGATRENDS

6.5.1 UNMANNED SYSTEMS IN EMERGENCY MANAGEMENT

6.5.2 AI IN CYBERSECURITY

6.5.3 AIRLINE INDUSTRY TO BENEFIT FROM ELECTRONIC BAGGAGE TAGS

6.5.4 DIGITALIZATION OF CROSS-BORDER SECURITY

6.5.5 INTEGRATED SECURITY AND INTELLIGENT FENCING FOR BORDER PROJECTION

6.6 INNOVATION & PATENT REGISTRATIONS

TABLE 14 IMPORTANT INNOVATION & PATENT REGISTRATIONS, 2001-2021

7 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL (Page No. - 120)

7.1 INTRODUCTION

FIGURE 25 HOMELAND SECURITY SEGMENT EXPECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 16 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

7.2 HOMELAND SECURITY

7.2.1 ADOPTION OF ADVANCED TECHNOLOGIES IN AIRPORT AND CRITICAL INFRASTRUCTURE SECURITY TO DRIVE THE SEGMENT

TABLE 17 HOMELAND SECURITY MARKET SIZE, BY REGION, 2018–2020 (USD BILLION)

TABLE 18 HOMELAND SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7.3 EMERGENCY MANAGEMENT

7.3.1 DYNAMIC CLIMATIC CONDITIONS & RISING NATURAL CALAMITIES TO DRIVE THE SEGMENT

TABLE 19 EMERGENCY MANAGEMENT MARKET SIZE, BY REGION, 2018–2020 (USD BILLION)

TABLE 20 EMERGENCY MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

8 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE (Page No. - )

8.1 INTRODUCTION

FIGURE 26 CYBERSECURITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 22 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE, 2021–2026 (USD BILLION)

8.2 CYBERSECURITY

TABLE 23 CYBERSECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 24 CYBERSECURITY MARKET, BY TYPE, 2021–2026 (USD BILLION)

8.2.1 NETWORK SECURITY

8.2.1.1 Increasing cyberattacks to drive demand

8.2.2 ENDPOINT SECURITY

8.2.2.1 Increasing need for deployment of SaaS-based solutions to drive demand

8.2.3 APPLICATION SECURITY

8.2.3.1 Increasing number of mobile devices to drive demand

8.2.4 WIRELESS SECURITY

8.2.4.1 Increasing number of mobile devices, laptops, and personal digital assistants to drive demand

8.2.5 CLOUD SECURITY

8.2.5.1 Increase in adoption of cloud-based services to drive demand

8.2.6 OTHERS

TABLE 25 OTHER CYBERSECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 26 OTHER CYBERSECURITY MARKET, BY TYPE, 2021–2026 (USD BILLION)

8.2.6.1 Database security

8.2.6.1.1 Increasing number of regulations and penalties to drive demand

8.2.6.2 Web security

8.2.6.2.1 Increasing use of social networking and information transfer over the web to drive demand

8.3 AVIATION SECURITY

TABLE 27 AVIATION SECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 28 AVIATION SECURITY MARKET, BY TYPE, 2021–2026 (USD BILLION)

8.3.1 AIRPORT PROTECTION

8.3.1.1 Increasing air passenger traffic to drive demand

TABLE 29 AIRPORT PROTECTION MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 30 AIRPORT PROTECTION MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.3.1.1.1 Camera

8.3.1.1.2 Radar

8.3.1.1.3 Metal detector

8.3.1.1.4 Drug and explosives detector

8.3.1.1.5 X-ray detector

8.3.1.1.6 Perimeter intrusion detection system (PIDS)

8.3.2 PASSENGER AND LUGGAGE SCREENING

8.3.2.1 Need for X-ray screening systems and millimeter-wave scanning to drive demand

TABLE 31 PASSENGER AND LUGGAGE SCREENING MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 32 PASSENGER AND LUGGAGE SCREENING MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.3.2.1.1 Millimeter-wave scanning

8.3.2.1.2 Drug and explosives detector

8.3.2.1.3 Tomography systems

8.3.3 INCIDENT MANAGEMENT

8.3.3.1 Need to effectively counter unlawful incidents to drive demand

8.3.4 OTHERS

8.4 MARITIME SECURITY

TABLE 33 MARITIME SECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 34 MARITIME SECURITY MARKET, BY TYPE, 2021-2026 (USD BILLION)

8.4.1 PORT SECURITY

8.4.1.1 Need for integrated security infrastructure to drive demand

TABLE 35 PORT SECURITY MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 36 PORT SECURITY MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.4.2 VESSEL SECURITY

8.4.2.1 Threats to vessels from piracy, smuggling, and terrorism to drive demand

8.4.3 COASTAL SURVEILLANCE

8.4.3.1 Increasing need for securing coastal borders from unlawful activities to drive demand

TABLE 37 COASTAL SURVEILLANCE MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 38 COASTAL SURVEILLANCE MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.4.3.1.1 Radar

8.4.3.1.2 Optronic equipment

8.4.3.1.3 Radios

8.4.4 OTHERS

8.5 LAW ENFORCEMENT AND INTELLIGENCE GATHERING

TABLE 39 LAW ENFORCEMENT AND INTELLIGENCE GATHERING MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 40 LAW ENFORCEMENT AND INTELLIGENCE GATHERING MARKET, BY TYPE, 2021-2026 (USD BILLION)

8.5.1 PUBLIC MANAGEMENT

8.5.1.1 Requirement for surveillance systems at large scale events to drive demand

TABLE 41 PUBLIC MANAGEMENT MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 42 PUBLIC MANAGEMENT MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.5.1.1.1 Biometric reader

8.5.1.1.2 Thermal imagers

8.5.1.1.3 Access controllers/servers

8.5.2 VIP SECURITY

8.5.2.1 Increased need for protecting VIPs across the world to drive demand

8.5.3 RIOT CONTROL

8.5.3.1 Need to control riots during any situation to drive demand

TABLE 43 RIOT CONTROL MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 44 RIOT CONTROL MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.5.3.1.1 Gases & sprays

8.5.3.1.2 Ammunitions

8.5.3.1.3 Explosives

8.5.3.1.4 Riot gun

8.5.4 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

8.5.4.1 Need to gain information about enemy strategy to drive demand

TABLE 45 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR) MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 46 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR) MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.5.4.1.1 UAV

8.5.4.1.2 Helicopters

8.5.4.1.3 Sensors

8.5.4.1.4 Thermal imagers

8.5.5 ELECTION SECURITY

8.5.5.1 Importance of voter data protection to drive demand

8.5.6 OTHERS

8.6 CRITICAL INFRASTRUCTURE SECURITY

TABLE 47 CRITICAL INFRASTRUCTURE SECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 48 CRITICAL INFRASTRUCTURE SECURITY MARKET SIZE, BY TYPE, 2021-2026 (USD BILLION)

8.6.1 ENERGY AND POWER SECTOR

8.6.1.1 Requirement of round the clock security to drive demand

8.6.2 CRITICAL MANUFACTURING SECTOR

8.6.2.1 Need to mitigate national-level disruptions to drive demand

8.6.3 OTHERS

8.7 RISK AND EMERGENCY SERVICES

TABLE 49 RISK AND EMERGENCY SERVICES MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 50 RISK AND EMERGENCY SERVICES MARKET, BY TYPE, 2021-2026 (USD BILLION)

8.7.1 MEDICAL SERVICES

8.7.1.1 Need for medical facilities during a natural disaster or accident to drive demand

8.7.2 FIREFIGHTING SERVICES

8.7.2.1 Increasing demand to avoid major destruction to drive demand

8.7.3 DISASTER MANAGEMENT

8.7.3.1 Increasing need for effective communication and rescue & recovery system to drive demand

8.7.4 OTHERS

8.8 BORDER SECURITY

TABLE 51 BORDER SECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 52 BORDER SECURITY MARKET, BY TYPE, 2021-2026 (USD BILLION)

8.8.1 CUSTOMS AND BORDER PROTECTION

8.8.1.1 Rising threat of terrorist attacks on borders to drive demand

TABLE 53 CUSTOMS AND BORDER PROTECTION MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 54 CUSTOMS AND BORDER PROTECTION MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.8.2 IMMIGRATION SECURITY

8.8.2.1 Development of advanced border control security solutions to drive demand

8.8.3 QUARANTINE

8.8.3.1 Increasing need to avoid pandemic/epidemic outbreaks to drive demand

8.8.4 OTHERS

8.9 CBRNE SECURITY

TABLE 55 CBRNE SECURITY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 56 CBRNE SECURITY MARKET, BY TYPE, 2021-2026 (USD BILLION)

8.9.1 PLANNING AND PREPARATION

8.9.1.1 Need to protect entire infrastructure from CBRNE attacks to drive demand

8.9.2 DETECTION AND MONITORING

8.9.2.1 Increased use for detection of CBRNE contamination to drive demand

TABLE 57 DETECTION AND MONITORING MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 58 DETECTION AND MONITORING MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

8.9.3 PROTECTION AND DECONTAMINATION

8.9.3.1 Increased need to clear sites contaminated by CBRNE attacks to drive demand

8.9.4 RECOVERY AND MITIGATION

8.9.4.1 Focus on procurement of best mitigation techniques to drive demand

8.9.5 OTHERS

9 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY SOLUTION (Page No. - 154)

9.1 INTRODUCTION

FIGURE 27 SYSTEMS SEGMENT IS EXPECTED TO GROW AT HIGHER CAGR

TABLE 59 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2020 (USD BILLION)

TABLE 60 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET SIZE, BY SOLUTION, 2021-2026 (USD BILLION)

9.2 SYSTEMS

FIGURE 28 INTELLIGENCE AND SURVEILLANCE SYSTEM SEGMENT IS EXPECTED TO GROW AT THE HIGHEST CAGR

TABLE 61 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET SIZE, BY SYSTEM, 2018-2020 (USD BILLION)

TABLE 62 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET SIZE, BY SYSTEM, 2021-2026 (USD BILLION)

9.2.1 INTELLIGENCE AND SURVEILLANCE SYSTEM

TABLE 63 INTELLIGENCE AND SURVEILLANCE SYSTEM MARKET, BY COMPONENT, 2018-2020 (USD BILLION)

TABLE 64 INTELLIGENCE AND SURVEILLANCE SYSTEM MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

9.2.1.1 Camera

9.2.1.1.1 Increased use of cameras in surveillance and security to drive demand

9.2.1.2 Radar

9.2.1.2.1 Increasing use of radars for airspace surveillance and early warning to drive demand

9.2.1.3 Optronic equipment

9.2.1.3.1 Need of optronic equipment in border and territory surveillance to protect sensitive areas to drive demand

9.2.1.4 Thermal imagers

9.2.1.4.1 Increased use of thermal imagers for efficient and reliable detection to drive demand

9.2.1.5 Others

9.2.2 DETECTION AND MONITORING SYSTEM

TABLE 65 DETECTION AND MONITORING SYSTEM MARKET, BY COMPONENT, 2018-2020 (USD BILLION)

TABLE 66 DETECTION AND MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

9.2.2.1 Sensor

9.2.2.1.1 Focus on enhanced security measures and sophisticated sensing technology to drive demand

9.2.2.2 Fire detectors

9.2.2.2.1 Increased use of fire detectors to provide information to emergency responders to drive demand

9.2.2.3 Screening test kit

9.2.2.3.1 Increased demand for detecting known bio-toxins and pathogens dispersed as solid powders to drive demand

9.2.2.4 Radiation detectors

9.2.2.4.1 Increasing use of radiation detectors to detect biological threats to drive demand

9.2.2.5 X-ray detectors

9.2.2.5.1 Growing usage by police, military, customs, and public safety agencies to drive demand

9.2.2.6 Metal detector

9.2.2.6.1 Increased use of metal detectors in detections of harmful and suspicious items to drive demand

9.2.2.7 Baggage screening and scanning systems

9.2.2.7.1 Increased need to secure public places to drive demand

9.2.2.8 Drug and explosives detector

9.2.2.8.1 Growing instances of drug trafficking to drive demand

9.2.2.9 Tomographic system

9.2.2.9.1 Demand for 3D and 4D tomographic solutions for obtaining volumetric dataset to drive demand

9.2.2.10 Perimeter intrusion detection systems

9.2.2.10.1 Development of modern detection and analytics technologies to drive demand

9.2.2.11 Millimeter-wave scanning

9.2.2.11.1 Increasing use of millimeter-wave scanning technology in airport and prisons to drive demand

9.2.2.12 Others

9.2.3 WEAPON SYSTEM

TABLE 67 WEAPON SYSTEM MARKET, BY TYPE, 2018-2020 (USD BILLION)

TABLE 68 WEAPON SYSTEM MARKET, BY TYPE, 2021-2026 (USD BILLION)

9.2.3.1 Lethal weapons

9.2.3.1.1 Increasing incidences of armed conflicts coupled with proliferation in sensor technologies to drive demand

9.2.3.2 Non-lethal weapons

9.2.3.2.1 Deployment to disperse the crowd during public management to drive demand

9.2.3.2.2 Gases & sprays

9.2.3.2.3 Ammunitions

9.2.3.2.4 Explosives

9.2.3.2.5 Riot gun

9.2.3.2.6 Others

9.2.4 ACCESS CONTROL SYSTEM

TABLE 69 ACCESS CONTROL SYSTEM MARKET, BY TYPE, 2018-2025 (USD BILLION)

TABLE 70 ACCESS CONTROL SYSTEM MARKET, BY TYPE, 2021-2026 (USD BILLION)

9.2.4.1 Access Controllers/Servers

9.2.4.1.1 Increasing use to protect company data to drive demand

9.2.4.2 Cards and readers

9.2.4.2.1 Increased use of cards and readers for proper identification process to drive demand

9.2.4.3 Biometric readers

9.2.4.3.1 Increase use of biometrics in wide range of applications to drive demand

9.2.4.4 Electronic locks

9.2.4.4.1 Need for access management and crowd control at critical infrastructures to drive demand

9.2.4.5 Electronic gates

9.2.4.5.1 Requirement for automated access control to drive demand

9.2.4.6 Multi-Technology readers

9.2.4.6.1 Use of multi-technology readers for proper identification process to drive demand

9.2.5 MODELING AND SIMULATION

TABLE 71 MODELING AND SIMULATION MARKET SIZE, BY COMPONENT, 2018-2020 (USD BILLION)

TABLE 72 MODELING AND SIMULATION MARKET SIZE, BY COMPONENT, 2021-2026 (USD BILLION)

9.2.5.1 Software and application

9.2.5.1.1 Increased use to check virtual experience of unusual sites to drive demand

9.2.5.2 Simulator

9.2.5.2.1 Increased use to provide agent-based simulation to all phases of incident response to drive demand

9.2.6 COMMUNICATION SYSTEM

TABLE 73 COMMUNICATION SYSTEM MARKET, BY COMPONENT, 2018-2020 (USD BILLION)

TABLE 74 COMMUNICATION SYSTEM MARKET, BY COMPONENT, 2021-2026 (USD BILLION)

9.2.6.1 Radios

9.2.6.1.1 Use for efficient and immediate communication in security systems to drive demand

9.2.6.2 Tactical headsets

9.2.6.2.1 Advanced systems having high-quality audio capabilities to replace the older systems to drive demand

9.2.6.3 Satellite assisted equipment

9.2.6.3.1 Advantages interception or jamming resistance to drive demand

9.2.6.4 Software and application

9.2.6.4.1 Need for effective communication to drive demand

9.2.6.5 Others

9.2.7 PLATFORMS

TABLE 75 PLATFORMS MARKET, BY TYPE, 2018-2020 (USD BILLION)

TABLE 76 PLATFORMS MARKET, BY TYPE, 2021-2026 (USD BILLION)

9.2.7.1 Armored Vehicles

9.2.7.1.1 Rise in instances of cross-border conflicts to drive demand

9.2.7.2 Patrolling ships

9.2.7.2.1 Increasing need to control drug trafficking to drive demand

9.2.7.3 Helicopters

9.2.7.3.1 Increased surveillance on borders for security purpose to drive demand

9.2.7.4 Unmanned platforms

TABLE 77 UNMANNED PLATFORMS MARKET, BY TYPE, 2018-2020 (USD BILLION)

TABLE 78 UNMANNED PLATFORMS MARKET, BY TYPE, 2021-2026 (USD BILLION)

9.2.7.5 Unmanned ground vehicle (UGV)

9.2.7.5.1 Increasing need for operational efficiency and reduced human intervention to drive demand

9.2.7.6 Unmanned aerial vehicle (UAV)

9.2.7.6.1 Increasing use in advanced patrolling of borders to drive demand

9.2.7.7 Unmanned maritime vehicle (UMV)

9.2.7.7.1 Increased usage for surveillance to drive demand

9.2.8 RESCUE AND RECOVERY SYSTEMS

9.2.8.1 Increase in search and rescue operations and rapid upgrade of recovery systems by governments to drive demand

9.2.9 COMMAND AND CONTROL SYSTEMS

9.2.9.1 Need for enhanced integrated situational awareness to support decision making to drive demand

9.2.10 COUNTERMEASURE SYSTEM

9.2.10.1 Increasing need for improving defensive capabilities to drive demand

9.2.11 OTHERS

9.3 SERVICE

TABLE 79 HOMELAND SECURITY AND MANAGEMENT MARKET, BY SERVICE, 2018—2020 (USD MILLION)

TABLE 80 HOMELAND SECURITY AND MANAGEMENT MARKET, BY SERVICE, 2021—2026 (USD MILLION)

9.3.1 MANAGED SERVICES

TABLE 81 MANAGED SERVICES: HOMELAND SECURITY AND EMERGENCY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 82 MANAGED SERVICES: HOMELAND SECURITY AND EMERGENCY MARKET, BY TYPE, 2021–2026 (USD BILLION)

9.3.1.1 Managed security services

9.3.1.1.1 Increased rate of cybercrime and importance of ecommerce to drive demand

9.3.1.2 Managed network services

9.3.1.2.1 Increased need for superior network security with greater network accessibility to drive demand

9.3.2 PROFESSIONAL SERVICES

TABLE 83 PROFESSIONAL SERVICES: HOMELAND SECURITY AND EMERGENCY MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 84 PROFESSIONAL SERVICES: HOMELAND SECURITY AND EMERGENCY MARKET, BY TYPE, 2021–2026 (USD BILLION)

9.3.2.1 Design and consulting

9.3.2.1.1 Need for identifying and mitigating risks to drive demand

9.3.2.2 Installation and integration

9.3.2.2.1 Increasing cyberattacks to drive demand

9.3.2.3 Support and maintenance

9.3.2.3.1 Usage in uninterrupted missions to drive demand

9.3.2.4 Training and education

9.3.2.4.1 Need for improving overall security to drive demand

10 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY INSTALLATION (Page No. - 183)

10.1 INTRODUCTION

FIGURE 29 NEW INSTALLATION SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 85 MARKET SIZE, BY INSTALLATION, 2018—2020 (USD BILLION)

TABLE 86 MARKET SIZE, BY INSTALLATION, 2021—2026 (USD BILLION)

10.2 NEW INSTALLATION

10.2.1 DEVELOPMENT OF NEW-GENERATION SENSING TECHNOLOGIES TO DRIVE THE SEGMENT

TABLE 87 NEW INSTALLATION: MARKET, BY REGION, 2018—2020 (USD BILLION)

TABLE 88 NEW INSTALLATION: MARKET, BY REGION, 2021—2026 (USD BILLION)

10.3 UPGRADE

10.3.1 FREQUENT UPGRADES OF OLD SECURITY SYSTEMS WITH ADVANCED HOMELAND SECURITY SYSTEMS TO DRIVE THE SEGMENT

TABLE 89 UPGRADE: MARKET, BY REGION, 2018—2020 (USD BILLION)

TABLE 90 UPGRADE: MARKET, BY REGION, 2021—2026 (USD BILLION)

11 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY TECHNOLOGY (Page No. - 189)

11.1 INTRODUCTION

11.2 FACIAL RECOGNITION CAMERAS

11.3 THERMAL IMAGING TECHNOLOGY

11.4 AI-BASED SOLUTIONS

11.4.1 ROBOTS

11.4.2 DISINFECTING DRONES

11.4.3 AI-BASED OBJECT RECOGNITION

11.5 C2 SYSTEM SOLUTIONS

11.6 BLOCKCHAIN SOLUTIONS

11.7 BORDER SECURITY SOLUTIONS

11.8 OTHERS

12 REGIONAL ANALYSIS (Page No. - 194)

12.1 INTRODUCTION

FIGURE 30 REGIONAL SNAPSHOT

TABLE 91 INDUSTRY SIZE, BY REGION, 2018–2020 (USD BILLION)

TABLE 92 INDUSTRY SIZE, BY REGION, 2021–2026 (USD BILLION)

12.2 NORTH AMERICA

12.2.1 COVID-19 IMPACT ON NORTH AMERICA

12.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: SNAPSHOT

TABLE 93 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 94 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 95 NORTH AMERICA: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 96 NORTH AMERICA: MARKET, BY END USE, 2021–2026 (USD BILLION)

TABLE 97 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 98 NORTH AMERICA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 99 NORTH AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 100 NORTH AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

TABLE 101 NORTH AMERICA: MARKET, BY INSTALLATION, 2018–2020 (USD BILLION)

TABLE 102 NORTH AMERICA: MARKET, BY INSTALLATION, 2021–2026 (USD BILLION)

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD BILLION)

TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

12.2.3 US

12.2.3.1 Improvement of data security in federal agencies to drive the market

TABLE 105 US: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 106 US: INDUSTRY, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 107 US: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 108 US: INDUSTRY, BY END USE, 2021–2026 (USD BILLION)

TABLE 109 US: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 110 US: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 111 US: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 112 US: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.2.4 CANADA

12.2.4.1 Strengthening of cybersecurity infrastructure to drive the market

TABLE 113 CANADA: BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 114 CANADA: BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 115 CANADA: BY END USE, 2018–2020 (USD BILLION)

TABLE 116 CANADA: BY END USE, 2021–2026 (USD BILLION)

TABLE 117 CANADA: BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 118 CANADA: BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 119 CANADA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 120 CANADA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3 EUROPE

12.3.1 COVID-19 IMPACT ON EUROPE

12.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE: SNAPSHOT

TABLE 121 EUROPE: BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 122 EUROPE: BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 123 EUROPE: BY END USE, 2018–2020 (USD BILLION)

TABLE 124 EUROPE: BY END USE, 2021–2026 (USD BILLION)

TABLE 125 EUROPE: BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 126 EUROPE: BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 127 EUROPE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 128 EUROPE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

TABLE 129 EUROPE: BY INSTALLATION, 2018–2020 (USD BILLION)

TABLE 130 EUROPE: BY INSTALLATION, 2021–2026 (USD BILLION)

TABLE 131 EUROPE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY COUNTRY, 2018–2020 (USD BILLION)

TABLE 132 EUROPE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

12.3.3 RUSSIA

12.3.3.1 Constant terrorist threats to drive the market

TABLE 133 RUSSIA: BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 134 RUSSIA: BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 135 RUSSIA: BY END USE, 2018–2020 (USD BILLION)

TABLE 136 RUSSIA: BY END USE, 2021–2026 (USD BILLION)

TABLE 137 RUSSIA: BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 138 RUSSIA: BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 139 RUSSIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 140 RUSSIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3.4 UK

12.3.4.1 Increased use of advanced baggage screening and explosive detection systems to drive the market

TABLE 141 UK: BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 142 UK: BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 143 UK: MARKET SIZE, BY END USE, 2018–2020 (USD BILLION)

TABLE 144 UK: BY END USE, 2021–2026 (USD BILLION)

TABLE 145 UK: BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 146 UK: BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 147 UK: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 148 UK: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3.5 FRANCE

12.3.5.1 Rise in adoption of physical and cybersecurity systems to drive the market

TABLE 149 FRANCE: BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 150 FRANCE: BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 151 FRANCE: BY END USE, 2018–2020 (USD BILLION)

TABLE 152 FRANCE: BY END USE, 2021–2026 (USD BILLION)

TABLE 153 FRANCE: MARKET SIZE, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 154 FRANCE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 155 FRANCE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 156 FRANCE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3.6 GERMANY

12.3.6.1 Increased demand for aviation protection systems to drive the market

TABLE 157 GERMANY: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 158 GERMANY: INDUSTRY, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 159 GERMANY: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 160 GERMANY: INDUSTRY, BY END USE, 2021–2026 (USD BILLION)

TABLE 161 GERMANY: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 162 GERMANY: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 163 GERMANY: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM 2018–2020 (USD BILLION)

TABLE 164 GERMANY: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3.7 ITALY

12.3.7.1 Concerns over North African immigrants & ISIL threats to drive demand

TABLE 165 ITALY: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 166 ITALY: MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 167 ITALY: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 168 ITALY: MARKET, BY END USE, 2021–2026 (USD BILLION)

TABLE 169 ITALY: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 170 ITALY: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 171 ITALY: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 172 ITALY: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3.8 SPAIN

12.3.8.1 ISIS terror attacks of 2017 to drive the market

TABLE 173 SPAIN: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 174 SPAIN: MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 175 SPAIN: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 176 SPAIN: MARKET, BY END USE, 2021–2026 (USD BILLION)

TABLE 177 SPAIN: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 178 SPAIN MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 179 SPAIN: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 180 SPAIN: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.3.9 REST OF EUROPE

TABLE 181 REST OF EUROPE: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 182 REST OF EUROPE: INDUSTRY, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 183 REST OF EUROPE: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 184 REST OF EUROPE: INDUSTRY, BY END USE, 2021–2026 (USD BILLION)

TABLE 185 REST OF EUROPE: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 186 REST OF EUROPE: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 187 REST OF EUROPE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 188 REST OF EUROPE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4 ASIA PACIFIC

12.4.1 COVID-19 IMPACT ON ASIA PACIFIC

12.4.2 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 33 ASIA PACIFIC SNAPSHOT

TABLE 189 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 190 ASIA PACIFIC: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 191 ASIA PACIFIC: MARKET, BY INSTALLATION, 2018–2020 (USD BILLION)

TABLE 192 ASIA PACIFIC: MARKET, BY INSTALLATION, 2021-2026 (USD BILLION)

TABLE 193 ASIA PACIFIC: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 194 ASIA PACIFIC: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 195 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 196 ASIA PACIFIC: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 197 ASIA PACIFIC: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 198 ASIA PACIFIC: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

TABLE 199 ASIA PACIFIC: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY COUNTRY, 2018–2020 (USD BILLION)

TABLE 200 ASIA PACIFIC: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

12.4.3 CHINA

12.4.3.1 Increased national security spending to drive the market

TABLE 201 CHINA: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 202 CHINA: INDUSTRY, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 203 CHINA: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 204 CHINA: INDUSTRY, BY END USE, 2021-2026 (USD BILLION)

TABLE 205 CHINA: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 206 CHINA: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 207 CHINA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 208 CHINA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4.4 INDIA

12.4.4.1 Developments in pharmaceuticals and chemicals to drive the market

TABLE 209 INDIA: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 210 INDIA: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 211 INDIA: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 212 INDIA: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 213 INDIA: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 214 INDIA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 215 INDIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 216 INDIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4.5 JAPAN

12.4.5.1 Investments in deployment of security systems & devices to drive the market

TABLE 217 JAPAN: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 218 JAPAN: INDUSTRY, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 219 JAPAN: NDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 220 JAPAN: INDUSTRY, BY END USE, 2021-2026 (USD BILLION)

TABLE 221 JAPAN: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 222 JAPAN: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 223 JAPAN: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 224 JAPAN: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4.6 AUSTRALIA

12.4.6.1 Increasing investments in biometric screening gates and baggage screening services to drive the market

TABLE 225 AUSTRALIA: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 226 AUSTRALIA: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 227 AUSTRALIA: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 228 AUSTRALIA: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 229 AUSTRALIA: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 230 AUSTRALIA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 231 AUSTRALIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 232 AUSTRALIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4.7 SINGAPORE

12.4.7.1 Increased spending on cutting-edge cybersecurity to drive the market

TABLE 233 SINGAPORE: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 234 SINGAPORE: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 235 SINGAPORE: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 236 SINGAPORE: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 237 SINGAPORE: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 238 SINGAPORE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 239 SINGAPORE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 240 SINGAPORE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4.8 SOUTH KOREA

12.4.8.1 Increased spending on maritime security and critical infrastructure protection to drive the market

TABLE 241 SOUTH KOREA: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 242 SOUTH KOREA: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 243 SOUTH KOREA: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 244 SOUTH KOREA: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 245 SOUTH KOREA: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 246 SOUTH KOREA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 247 SOUTH KOREA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 248 SOUTH KOREA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.4.9 REST OF ASIA PACIFIC

TABLE 249 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 250 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 251 REST OF ASIA PACIFIC: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 252 REST OF ASIA PACIFIC: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 253 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 254 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 255 REST OF ASIA PACIFIC: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 256 REST OF ASIA PACIFIC: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.5 MIDDLE EAST

12.5.1 MIDDLE EAST COVID-19 IMPACT

12.5.2 PESTLE ANALYSIS: MIDDLE EAST& AFRICA

FIGURE 34 MIDDLE EAST INDUSTRYSNAPSHOT

TABLE 257 MIDDLE EAST: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 258 MIDDLE EAST: INDUSTRY, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 259 MIDDLE EAST: INDUSTRY, BY INSTALLATION, 2018–2020 (USD BILLION)

TABLE 260 MIDDLE EAST: INDUSTRY, BY INSTALLATION, 2021-2026 (USD BILLION)

TABLE 261 MIDDLE EAST: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 262 MIDDLE EAST: INDUSTRY, BY END USE, 2021-2026 (USD BILLION)

TABLE 263 MIDDLE EAST: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 264 MIDDLE EAST: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 265 MIDDLE EAST: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 266 MIDDLE EAST: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

TABLE 267 MIDDLE EAST: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY COUNTRY, 2018–2020 (USD BILLION)

TABLE 268 MIDDLE EAST: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 Regional tensions with Iran and rising terrorism to drive demand

TABLE 269 SAUDI ARABIA: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 270 SAUDI ARABIA: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 271 SAUDI ARABIA: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 272 SAUDI ARABIA: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 273 SAUDI ARABIA: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 274 SAUDI ARABIA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 275 SAUDI ARABIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 276 SAUDI ARABIA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.5.4 ISRAEL

12.5.4.1 Focus on developing machine vision and AI for national security to drive the market

TABLE 277 ISRAEL: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 278 ISRAEL: INDUSTRY, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 279 ISRAEL: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 280 ISRAEL: INDUSTRY, BY END USE, 2021-2026 (USD BILLION)

TABLE 281 ISRAEL: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 282 ISRAEL: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 283 ISRAEL: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 284 ISRAEL: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.5.5 TURKEY

12.5.5.1 Increasing demand for protection from terrorism to drive the market

TABLE 285 TURKEY: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 286 TURKEY: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 287 TURKEY: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 288 TURKEY: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 289 TURKEY: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 290 TURKEY: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 291 TURKEY: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 292 TURKEY: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.5.6 UAE

12.5.6.1 Increased spending on critical infrastructure security to drive the market

TABLE 293 UAE: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 294 UAE: INDUSTRY, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 295 UAE: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 296 UAE: INDUSTRY, BY END USE, 2021-2026 (USD BILLION)

TABLE 297 UAE: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 298 UAE: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 299 UAE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 300 UAE: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.5.7 REST OF MIDDLE EAST

TABLE 301 REST OF MIDDLE EAST: MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 302 REST OF MIDDLE EAST: MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 303 REST OF MIDDLE EAST: MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 304 REST OF MIDDLE EAST: MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 305 REST OF MIDDLE EAST: MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 306 REST OF MIDDLE EAST: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 307 REST OF MIDDLE EAST: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 308 REST OF MIDDLE EAST: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.6 REST OF THE WORLD

TABLE 309 REST OF THE WORLD: INDUSTRY, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 310 REST OF THE WORLD: INDUSTRY, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 311 REST OF THE WORLD: INDUSTRY, BY INSTALLATION, 2018–2020 (USD BILLION)

TABLE 312 REST OF THE WORLD: INDUSTRY, BY INSTALLATION, 2021-2026 (USD BILLION)

TABLE 313 REST OF THE WORLD: INDUSTRY, BY END USE, 2018–2020 (USD BILLION)

TABLE 314 REST OF THE WORLD: INDUSTRY, BY END USE, 2021-2026 (USD BILLION)

TABLE 315 REST OF THE WORLD: INDUSTRY, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 316 REST OF THE WORLD: INDUSTRY, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 317 REST OF THE WORLD: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 318 REST OF THE WORLD: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

TABLE 319 REST OF THE WORLD: INDUSTRY, BY REGION, 2018–2020 (USD BILLION)

TABLE 320 REST OF THE WORLD: INDUSTRY, BY REGION, 2021-2026 (USD BILLION)

12.6.1 LATIN AMERICA

12.6.1.1 Increasing investments in surveillance and security to drive the market

12.6.2 COVID-19 IMPACT ON LATIN AMERICA

TABLE 321 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 322 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 323 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 324 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 325 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 326 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 327 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 328 LATIN AMERICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

12.6.3 AFRICA

12.6.3.1 Need for robust cybersecurity and healthcare to drive the market

TABLE 329 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2018–2020 (USD BILLION)

TABLE 330 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET,BY VERTICAL, 2021-2026 (USD BILLION)

TABLE 331 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE, 2018–2020 (USD BILLION)

TABLE 332 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY END USE, 2021-2026 (USD BILLION)

TABLE 333 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, BY SOLUTION, 2018–2020 (USD BILLION)

TABLE 334 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 335 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2018–2020 (USD BILLION)

TABLE 336 AFRICA: HOMELAND SECURITY AND EMERGENCY MANAGEMENT SOLUTION MARKET, BY SYSTEM, 2021–2026 (USD BILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 306)

13.1 INTRODUCTION

13.2 COMPETITIVE OVERVIEW

TABLE 337 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET BETWEEN 2018 AND 2020

FIGURE 35 MARKET EVALUATION FRAMEWORK: CONTRACTS IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS

13.2.1 COMPETITIVE LEADERSHIP MAPPING

13.2.1.1 Star

13.2.1.2 Emerging leader

13.2.1.3 Pervasive

13.2.1.4 Participant

FIGURE 36 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET : COMPETITIVE LEADERSHIP MAPPING, 2020

13.2.2 COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SMES)

13.2.2.1 Progressive companies

13.2.2.2 Responsive companies

13.2.2.3 Dynamic companies

13.2.2.4 Starting blocks

FIGURE 37 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET: COMPETITIVE LEADERSHIP MAPPING, (STARTUPS/SME) 2020

13.3 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2020

FIGURE 38 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT, 2020

FIGURE 39 MARKET SHARE ANALYSIS OF TOP PLAYERS IN AVIATION/PASSENGER LUGGAGE SCREENING MARKET, 2020

13.4 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2020

FIGURE 40 RANKING OF TOP PLAYERS IN THE HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET, 2020

FIGURE 41 REVENUE ANALYSIS OF HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET PLAYERS, 2016-2020

13.5 COMPANY EVALUATION QUADRANT – PRODUCT FOOTPRINT

TABLE 338 COMPANY PRODUCT FOOTPRINT

TABLE 339 COMPANY INDUSTRY FOOTPRINT

TABLE 340 COMPANY APPLICATION FOOTPRINT

TABLE 341 COMPANY REGION FOOTPRINT

13.6 COMPETITIVE SCENARIO

13.6.1 NEW PRODUCT LAUNCHES

TABLE 342 NEW PRODUCT LAUNCHES, 2018-2021

13.6.2 DEALS, 2017–2021

TABLE 343 DEALS, 2017–2021

13.6.3 OTHERS

TABLE 344 OTHERS, 2017-2021

14 COMPANY PROFILES (Page No. - 327)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 KEY PLAYERS

14.1.1 LOCKHEED MARTIN

FIGURE 42 LOCKHEED MARTIN: COMPANY SNAPSHOT

TABLE 345 LOCKHEED MARTIN BUSINESS OVERVIEW

14.1.2 RAYTHEON COMPANY

FIGURE 43 RAYTHEON COMPANY: COMPANY SNAPSHOT

TABLE 346 RAYTHEON COMPANY BUSINESS OVERVIEW

14.1.3 NORTHROP GRUMMAN

FIGURE 44 NORTHROP GRUMMAN: COMPANY SNAPSHOT

TABLE 347 NORTHROP GRUMMAN: BUSINESS OVERVIEW

14.1.4 THALES GROUP

FIGURE 45 THALES GROUP: COMPANY SNAPSHOT

TABLE 348 THALES GROUP: BUSINESS OVERVIEW

14.1.5 LEIDOS

FIGURE 46 LEIDOS: COMPANY SNAPSHOT

TABLE 349 LEIDOS: BUSINESS OVERVIEW

14.1.6 IBM

FIGURE 47 IBM: COMPANY SNAPSHOT

TABLE 350 IBM: BUSINESS OVERVIEW

14.1.7 FLIR SYSTEMS

FIGURE 48 FLIR SYSTEMS: COMPANY SNAPSHOT

TABLE 351 FLIR SYSTEMS: BUSINESS OVERVIEW

14.1.8 BAE SYSTEMS

FIGURE 49 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 352 BAE SYSTEMS: BUSINESS OVERVIEW

14.1.9 GENERAL DYNAMICS

FIGURE 50 GENERAL DYNAMICS: COMPANY SNAPSHOT

TABLE 353 GENERAL DYNAMICS: BUSINESS OVERVIEW

14.1.10 UNISYS

FIGURE 51 UNISYS: COMPANY SNAPSHOT

TABLE 354 UNISYS: BUSINESS OVERVIEW

14.1.11 ELBIT SYSTEMS

FIGURE 52 ELBIT SYSTEMS: COMPANY SNAPSHOT

TABLE 355 ELBIT SYSTEMS: BUSINESS OVERVIEW

14.1.12 SAIC

FIGURE 53 SAIC: COMPANY SNAPSHOT

TABLE 356 SAIC: BUSINESS OVERVIEW

14.1.13 L3HARRIS TECHNOLOGIES

FIGURE 54 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 357 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

14.1.14 BOEING

FIGURE 55 BOEING: COMPANY SNAPSHOT

TABLE 358 BOEING: BUSINESS OVERVIEW

14.1.15 CACI INTERNATIONAL

FIGURE 56 CACI INTERNATIONAL: COMPANY SNAPSHOT

TABLE 359 CACI INTERNATIONAL: BUSINESS OVERVIEW

14.1.16 HEWLETT-PACKARD

FIGURE 57 HEWLETT-PACKARD: COMPANY SNAPSHOT

TABLE 360 HEWLETT-PACKARD: BUSINESS OVERVIEW

14.1.17 BOOZ ALLEN HAMILTON

FIGURE 58 BOOZ ALLEN HAMILTON: COMPANY SNAPSHOT

TABLE 361 BOOZ ALLEN HAMILTON: BUSINESS OVERVIEW

14.1.18 MOTOROLA SOLUTIONS

FIGURE 59 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

TABLE 362 MOTOROLA SOLUTIONS: BUSINESS OVERVIEW

14.1.19 HONEYWELL INTERNATIONAL

FIGURE 60 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 363 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

14.1.20 ECA GROUP

FIGURE 61 ECA GROUP: COMPANY SNAPSHOT

TABLE 364 ECA BUSINESS OVERVIEW

14.1.21 BOSCH SECURITY SYSTEMS

TABLE 365 BOSCH SECURITY SYSTEMS: BUSINESS OVERVIEW

14.1.22 SIEMENS

TABLE 366 SIEMENS: BUSINESS OVERVIEW

14.1.23 SMITHS DETECTION GROUP

TABLE 367 SMITHS: DETECTION GROUP BUSINESS OVERVIEW

14.1.24 RAPISCAN SYSTEMS

TABLE 368 RAPISCAN SYSTEMS: BUSINESS OVERVIEW

14.1.25 AXIS COMMUNICATIONS

TABLE 369 AXIS COMMUNICATIONS BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 389)

15.1 DISCUSSION GUIDE

FIGURE 62 HOMELAND SECURITY AND EMERGENCY MANAGEMENT MARKET SEGMENTATION

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

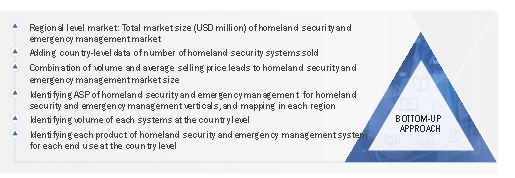

The study involved various activities in estimating the market size for homeland security and emergency management. Exhaustive secondary research was undertaken to collect information on the homeland security and emergency management market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the homeland security and emergency management market.

Secondary Research

The market share of companies was determined by using the secondary data acquired through paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included government sources, such as the US Department of Homeland Security (DHS); federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to arrive at the overall size of the homeland security and emergency management market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the current scenario of the homeland security and emergency management market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW). Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the homeland security and emergency management market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the homeland security and emergency management market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.