Blood Warmer Devices/Sample Warmer Market by Sample (Blood, Embryo, Ovum, Semen), End User (Hospital, Blood Bank, Transfusion Center, Tissue Bank), Region (North America, Europe, Asia Pacific) & Geography - Global Forecast to 2022

The global blood warmer devices market is projected to grow at a CAGR of 8.4%. The increasing burden of hypothermia cases, increasing number of surgeries, and growing number of trauma cases are the key factors driving the growth of this market.

The objectives of this study are as follows:

- To define, describe, segment, and forecast the blood warmer devices market by sample type, end user, and region

- To forecast revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To identify the micromarkets with respect to drivers, restraints, industry-specific challenges, opportunities, and trends affecting the growth of the market

- To analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, acquisitions; product launches; and research and development activities in the blood warmer device/sample warmer market

Research Methodology

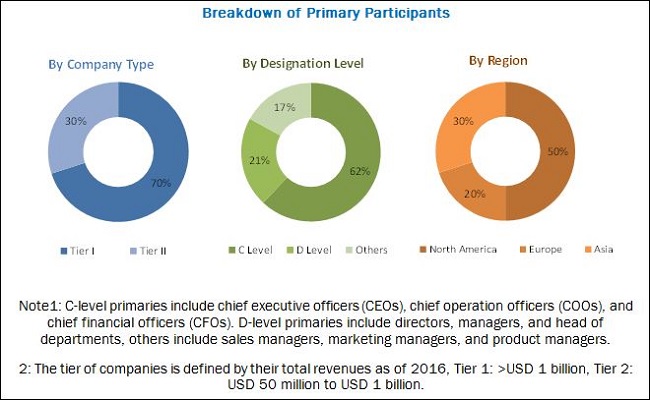

Top-down and bottom-up approaches were used to estimate and validate the size of the market and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual submarkets (mentioned in the market segmentation by sample type, end user, and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources such as World Health Organization, U.S. Food and Drug Administration, Centers for Disease Control and Prevention, the American National Red Cross have been used to identify and collect information useful for this extensive commercial study of the blood warmer device/sample warmer market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the blood warmer device/sample warmer market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the blood warmer devices market include 3M (US), Smiths Medical (US), BD (US), The 37Company (Netherlands), Geratherm Medical (Germany), Stryker (US), Sarstedt (Germany), Barkey (Germany), Stihler Electronic (Germany), Belmont Instrument (US), Biegler (Austria), and EMIT (US).

Target Audience for this Report:

- Blood warmer device/sample warmer manufacturers

- Blood warmer device/sample warmer dealers and suppliers

- Healthcare institutions (hospitals)

- Government institutions

- Blood and tissue banks

Scope of the Report:

This report categorizes the blood warmer devices market into the following segments:

-

Blood Warmer Devices Market, By Sample Type

-

Consumables

- Blood Samples

- Other Samples

-

Consumables

-

Blood Warmer Devices Market, By End User

- Hospitals

- Blood Banks and Transfusion Centers

- Tissue Banks

-

Blood Warmer Devices Market, By Region

-

North America

- US

- Canada

- Europe

- Asia Pacific

- Rest of the World

-

North America

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

The global blood warmer devices market is segmented by sample type, end user, and regions. By sample type, the market is segmented into blood samples and other samples. The blood samples segment is estimated to account for the largest market share of the market in 2017. Factors driving the growth of this segment include increasing demand for blood and blood products.

On the basis of end user, the market is classified into hospitals, blood banks & transfusion centers, and tissue banks. The hospitals segment is estimated to account for the largest share of the market during the next five years. The significant number of blood transfusions and high requirement of blood in surgical treatments across hospitals are driving the growth of this market.

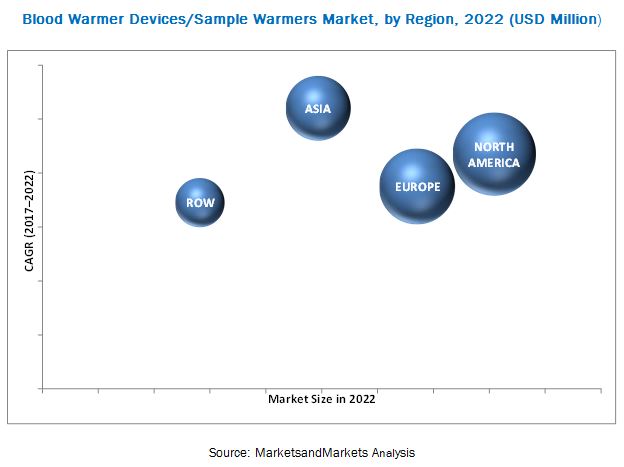

The market is dominated by North America, followed by Europe. North America will continue to dominate the market during the forecast period. However, Asia Pacific is expected to witness the highest CAGR from 2017 to 2022. Factors such as the high incidence of road accidents, increasing prevalence of cancer, and growing number of surgical procedures in several Asia Pacific countries are driving the growth of the market in this region.

The factors such as the high degree of consolidation, the high cost of instruments, and complex regulatory framework for the approval of new products may restrain market growth.

Major industry players launched products to maintain and improve their position in the market. 3M (US), Smiths Medical (US), BD (US), The 37Company (Netherlands), Geratherm Medical (Germany) have been identified as the key players in this market. These companies have a broad product portfolio with comprehensive features. These leaders have products for all end users in this market, a strong geographical presence, and focus on continuous product innovations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Secondary Data

2.1.1 Secondary Sources

2.2 Primary Data

2.2.1 Primary Sources

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 24)

4.1 Blood Warmer Device/Sample Warmer : Market Overview

4.2 North America: Blood Warmer Device/Sample Warmer Market, By Sample Type & By Country

4.3 Blood Warmer Device/Sample Warmer Market, By End User,

4.4 Geographical Snapshot of the Blood Warmer Device/Sample Warmer Market

5 Market Overview (Page No. - 27)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Burden of Hypothermia Cases

5.2.1.2 Increasing Number of Surgeries

5.2.1.3 Growing Number of Trauma Cases

5.2.2 Restraints

5.2.2.1 Availability of Alternative Methods for Blood and Fluid Warming

5.2.3 Challenges

5.2.3.1 Stringent Regulatory Framework and Time-Consuming Approval Process

5.2.4 Blood Warmer Device/Sample Warmer Systems Pricing Analysis (In USD Million)

6 Regulatory Outlook (Page No. - 32)

6.1 North America

6.1.1 Us

6.1.2 Canada

6.2 Europe

6.3 Asia Pacific

6.3.1 Japan

6.3.2 China

6.3.3 India

6.3.4 South Korea

6.4 Rest of the World

6.4.1 Latin America

6.4.1.1 Mexico

6.4.1.2 Brazil

7 Blood Warmer Device/Sample Warmer Market, By Sample Type (Page No. - 35)

7.1 Introduction

7.2 Blood Samples

7.3 Other Samples

8 Blood Warmer Device/Sample Warmer Market, By End User (Page No. - 39)

8.1 Introduction

8.2 Hospitals

8.3 Blood Banks & Transfusion Centers

8.4 Tissue Banks

9 Blood Warmer Device/Sample Warmer Market, By Region (Page No. - 44)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.4 Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 57)

10.1 Introduction

10.2 Market Overview

10.3 Market Ranking Analysis,2016

10.4 Competitive Scenario

10.4.1 Product Launches

10.4.2 Partnerships & Joint Ventures

10.4.3 Acquisitions

11 Company Profile (Page No. - 61)

(Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 3M

11.2 Smiths Medical

11.3 BD

11.4 Geratherm Medical

11.5 The 37 Company

11.6 Stryker

11.7 Sarstedt

11.8 Barkey

11.9 Stihler Electronic

11.10 Belmont Instrument

11.11 Biegler

11.12 Emit

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 88)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (25 Tables)

Table 1 Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 2 Blood Warmer Device/Sample Warmer Market, By Region, 2015–2022 (USD Million)

Table 3 Other Blood Warmer Device/Sample Warmer Systems Market, By Region, 2015–2022 (USD Million)

Table 4 Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 5 Blood Warmer Device/Sample Warmer Market for Hospitals, By Region, 2015–2022 (USD Million)

Table 6 Blood Warmer Device/Sample Warmer Market for Blood Banks & Transfusion Centers, By Region, 2015–2022 (USD Million)

Table 7 Blood Warmer Device/Sample Warmer Market for Tissue Banks, By Region, 2015–2022 (USD Million)

Table 8 Blood Warmer Device/Sample Warmer Market, By Region, 2015–2022 (USD Million)

Table 9 North America: Blood Warmer Device/Sample Warmer Market, By Country, 2015–2022 (USD Million)

Table 10 North America: Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 11 North America: Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 12 US: Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 13 US: Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 14 Canada: Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 15 Canada: Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 16 Europe: Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 17 Europe: Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 18 Asia Pacific: Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 19 Asia Pacific: Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 20 RoW: Blood Warmer Device/Sample Warmer Market, By Sample Type, 2015–2022 (USD Million)

Table 21 RoW: Blood Warmer Device/Sample Warmer Market, By End User, 2015–2022 (USD Million)

Table 22 Rank of Companies in the Global Blood Warmer Device/Sample Warmer Market. 2016

Table 23 Product Launches, 2014–2017

Table 24 Partnerships & Joint Ventures, 2014–2017

Table 25 Acquisitions, 2014–2017

List of Figures (30 Figures)

Figure 1 Research Methodology

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Blood Warmer Device/Sample Warmer Market, By Sample Type, 2017 vs 2022 (USD Million)

Figure 7 Blood Warmer Device/Sample Warmer Market, By End User, 2017 vs 2022 (USD Million)

Figure 8 Blood Warmer Device/Sample Warmer Market, By Region, 2017 vs 2022 (USD Million)

Figure 9 Growing Number of Hypothermia Cases & Surgical Procedures–Key Drivers of the Blood Warmer Device/Sample Warmer Market During the Forecast Period

Figure 10 Blood Samples Segment to Command the Largest Market Share in 2017

Figure 11 Hospitals to Register the Highest CAGR During the Forecast Period

Figure 12 Asia to Register the Highest CAGR Between 2017 & 2022

Figure 13 Blood Warmer Device/Sample Warmer Market: Drivers, Restraints, and Challenges

Figure 14 UK: Diagnosis of Hypothermia, By Age Group (2005–2014)

Figure 15 Calendar Days From Submission to FDA Clearance (Traditional 510(K) Only)

Figure 16 Calendar Days From Submission to FDA Clearance (Abbreviated and Special 510(K) Only)

Figure 17 Number of 510(K) Submissions Cleared, 2012–2016

Figure 18 Global Blood Warmer Device/Sample Warmer Market, By Sample Type, 2017 vs 2022 (USD Million)

Figure 19 Global Blood Warmer Device/Sample Warmer Market, By End User, 2017 vs 2022 (USD Million)

Figure 20 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 21 North America: Blood Warmer Device/Sample Warmer Market Snapshot

Figure 22 Europe: Blood Warmer Device/Sample Warmer Market Snapshot

Figure 23 Asia Pacific: Blood Warmer Device/Sample Warmer Market Snapshot

Figure 24 RoW: Blood Warmer Device/Sample Warmer Market Snapshot

Figure 25 Product Launches is the Most Adopted Growth Strategy From 2014 to 2017

Figure 26 3M : Company Snapshot

Figure 27 Smiths Medical: Company Snapshot

Figure 28 BD: Company Snapshot

Figure 29 Geratherm Medical: Company Snapshot

Figure 30 Stryker: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Warmer Devices/Sample Warmer Market