Corrosion Under Insulation (CUI) & Spray-on Insulation (SOI) Coatings Market by Type (Epoxy, Acrylic, Silicone, and Others), End-Use Industry Oil & Gas, and Petrochemical, Marine, Energy & Power) and Region - Global Forecast to 2027

Updated on : June 17, 2024

Corrosion Under Insulation and Spray-on Insulation Coatings Market

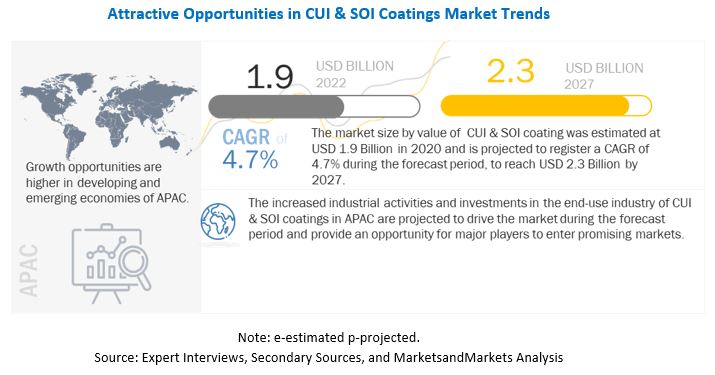

The corrosion under insulation (CUI) and spray-on insulation (SOI) coatings market was valued at USD 1.9 billion in 2022 and is projected to reach USD 2.3 billion by 2027, growing at 4.7% cagr from 2022 to 2027. The global market is growing due to the end-use industries such as marine; oil & gas, and petrochemical; energy & power; and other industries. Hence, the rapid growth of these industries is expected to contribute to the growth of the CUI & SOI coatings market. However, the market declined in 2020 due to the global COVID-19 pandemic.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on CUI & SOI Coatings Market

The outbreak of COVID-19 impacted the end-use industries of the CUI & SOI coatings market across the globe. The effect can be felt on the economy with lockdowns and suspension of manufacturing operations due to social distancing norms. Many companies have adopted short-term plans to keep their operations running amidst the COVID-19 pandemic. The companies started selling their products through online platforms with contactless delivery. Companies further reduced the staff by 50%, with the majority of their employees working from home.

The pandemic had been disrupting paints and coatings supply chains and dynamic demand patterns that have caused a notable impact on the price of raw materials. The instability in crude oil prices and the effect on global feedstock prices had further impacted the global CUI & SOI coatings market.

The CUI & SOI coatings market had to face the problem as it is mainly dependent on the oil & gas, and petrochemical; marine; energy & power industries. Governments notably reduced protective coating material tenders due to economic crises.

CUI & SOI Coatings Market Dynamics

Driver: Increasing need for efficient processes and longer life of the equipment

Corrosion protection coatings such as CUI & SOI coating are used for the protection of pipelines, equipment, reactors, and storage tanks in oil & gas and industrial sectors. These industries involve the use of hazardous and corrosive chemicals and processes that involve high temperatures and high heat. Also, this equipment is exposed to various climatic conditions which affect the reactor surface. The use of heavy-duty corrosion protection coatings in these areas may prevent or reduce the impact on the reactor surfaces. This results in the extended working life of the equipment.

Due to the competitive market, industries are in the process of cost reduction. Use of heavy-duty corrosion protection coatings for providing insulation results in reduced operating costs.

Restraint: Stringent environmental regulations

According to the standards set by the EU, any product which is to be used for the repair of concrete Regulations was targeted to reduce the volatile organic compounds (VOC) emissions from coatings. LEED GreenSeal GC-03 2nd Ed., 1997 and REACH specify the VOC content in grams per liter (g/l) for CUI & SOI coatings. These regulations have forced the coating manufacturers to act by the standards by reducing VOC contents. Also, manufacturers need to maintain the quality and performance of these regulated products. The impact of these regulations was seen on the price of CUI & SOI coating products as the regulations enabled the change in technology, which is used for the production of CUI & SOI coatings. The change in technology results in high investment due to the change in the production process, which further impacts the performance of CUI & SOI coatings. Therefore, the regulations present a short-term restraint on the growth of the market.

Opportunity: Increasing demand for high-efficiency, high-performance CUI & SOI coatings

The changing operating conditions in the end-use industries such as oil & gas and marine have created a demand for CUI & SOI coatings with higher properties and efficiency. For example, the increasing use of enhanced oil recovery (EOR) methods in the oil & gas sector have created the requirement for coatings that can endure high temperatures and pressure efficiently and ensure long-term protection of structures. The demand for high-solid CUI coatings from the oil & gas, marine, and infrastructure sectors have also increased R&D activities for the development of these coatings, which are suitable for application in harsh conditions. This is a short-term driver but has the potential to evolve to be a long-term driver. Thus, the increase in demand for high-efficiency CUI & SOI coatings is expected to present significant opportunities for the growth of the market.

Challenge: Rising use of substitutes in the market

Anti-corrosion coatings and non-corrosive pipe materials are used in several end-user industries to provide resistance against corrosion. Therefore, to compete with these materials, coating manufacturers need to develop products with superior thermal insulation and corrosion resistance capabilities.

The existing CUI & SOI are relatively costlier. The technology used for coating application is also expensive, making the entire coating process high cost. The development of a low-cost CUI & SOI coating will help to reduce the overall cost of coating and increase the market attractiveness. Therefore, developing a cost-effective coating is a challenge for the market.

CUI & SOI Coatings Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Epoxy accounted for the largest share of the CUI & SOI coatings market during the forecast period

The different types of CUI & SOI coatings are epoxy, acrylic, silicone, and others. Epoxy is a major type of CUI & SOI coatings, which accounted for the largest share. This is mainly attributed to excellent protection from CUI, water resistance, and widespread applications of epoxy-based CUI coatings. In addition, epoxy-based CUI & SOI coatings can be used in multi-component coatings with other types.

Oil & gas, and petrochemical industry to lead the CUI & SOI coatings market during the forecast period

CUI & SOI coatings are widely used in end-use industries such as marine; oil & gas, and petrochemical; energy & power. Hence, the rapid growth of these industries is expected to contribute to the growth of the CUI & SOI coatings market. The oil & gas, and petrochemical industry dominated the CUI & SOI coatings market in 2021. This dominance is due to the high volume of CUI & SOI coatings used in this industry.

APAC to the fastest growing CUI & SOI coatings market during the forecast period.

The CUI & SOI coatings market in APAC is projected to register the highest CAGR, in terms of value, between 2022 and 2027. This growth is ascribed to the growing oil & gas, and petrochemical; marine; and power generation industries. The growth of these industries further drives the demand for CUI & SOI coatings market. The high growth of the economies in the region enables Asia pacific to be a lucrative market for CUI & SOI coatings manufacturers.

CUI & SOI Coatings Market Players

Akzo Nobel N.V. (Netherlands), PPG Industries, Inc., (US), Jotun A/S (Norway), The Sherwin-Williams Company (US), Hempel A/S (Denmark), Kansai Paint Co., Ltd (Japan), Nippon Paint Co., Ltd. (Japan), and RPM International Inc (US) are some of the major players operating in the global market.

CUI & SOI Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.9 billion |

|

Revenue Forecast in 2027 |

USD 2.3 billion |

|

CAGR |

4.7% |

|

Years Considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million) and Volume (tons) |

|

Segments |

Type, and End-Use Industry |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Akzo Nobel N.V. (Netherlands), PPG Industries, Inc., (US), Jotun A/S (Norway), The Sherwin-Williams Company (US), Hempel A/S (Denmark), Kansai Paint Co., Ltd (Japan), Nippon Paint Co., Ltd. (Japan), and RPM International Inc (US). |

This research report categorizes the CUI & SOI coatings market based on type, end-use industry, and region.

Based on type, the CUI & SOI coatings market has been segmented as follows:

- Epoxy

- Acrylic

- Silicone

- Others (multi-polymeric matrix, zinc silicate, oxide chemicals, titanium modified inorganic copolymer, and water-based CUI coatings)

Based on end-use industries, the CUI & SOI coatings market has been segmented as follows:

- Marine

- Oil & gas, and petrochemical

- Energy & Power

- Others (building & construction, food, pharmaceuticals, and automotive)

Based on the region, the CUI & SOI coatings market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In June 2021, AkzoNobel announced the acquisition of Colombia-based paints and coatings company Grupo Orbis.

- In November 2019, AkzoNobel opened a research and innovation hub at its site in Felling, Gateshead, UK, with an investment for product testing in simulations of the world's most extreme environments.

- In February 2020, PPG collaborated with Dow on Sustainable Future Program to reduce carbon impacts. The partnership focuses on advances in anti-corrosion coating products for steel designed to deliver reduced greenhouse gas (GHG) emissions through increased energy efficiency while helping to lessen the high maintenance costs of steel infrastructure.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of CUI & SOI coatings?

Yes the report covers the new applications of CUI & SOI coatings.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value.

What is the current competitive landscape in the CUI & SOI coatings market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK, and France are major countries considered in the report .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 CORROSION UNDER INSULATION (CUI), AND SPRAY-ON INSULATION (SOI) COATINGS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATION

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 CORROSION UNDER INSULATION (CUI) AND SPRAY-ON INSULATION (SOI) COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

FIGURE 3 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

FIGURE 4 KEY DATA FROM PRIMARY SOURCES

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.2.5 List of participant industry experts

2.2 MARKET SIZE ESTIMATION

2.2.1 ESTIMATING CUI & SOI COATINGS MARKET SIZE FROM KEY PLAYERS’ MARKET SHARE

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.2 TOP-DOWN MARKET SIZE ESTIMATION: FROM CORROSION PROTECTION COATING MARKET

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 CORROSION UNDER INSULATION AND SPRAY-ON INSULATION COATINGS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 8 THE CUI COATINGS SEGMENT TO DOMINATE THE MARKET BETWEEN 2022 AND 2027

FIGURE 9 THE EPOXY SEGMENT TO DOMINATE THE CUI & SOI COATINGS MARKET BETWEEN 2022 AND 2027

FIGURE 10 OIL & GAS AND PETROCHEMICAL IS EXPECTED TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

FIGURE 11 ASIA PACIFIC WAS THE LARGEST MARKET FOR CUI & SOI COATINGS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CORROSION UNDER INSULATION (CUI) & SPRAY-ON INSULATION (SOI) COATINGS MARKET

FIGURE 12 GROWING DEMAND FROM THE OIL & GAS, AND PETROCHEMICAL INDUSTRY TO DRIVE THE MARKET IN ASIA PACIFIC

4.2 APAC CUI & SOI COATINGS, BY TYPE AND COUNTRY, 2021

FIGURE 13 THE EPOXY SEGMENT AND CHINA ACCOUNTED FOR THE LARGEST SHARES OF THE ASIA PACIFIC CUI & SOI COATINGS MARKET

4.3 CUI & SOI MARKET, BY KEY COUNTRIES,2021

FIGURE 14 INDIA TO BE THE FASTEST-GROWING MARKET FOR COI & SOI COATINGS

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE CUI & SOI MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in damages and losses due to corrosion

5.2.1.2 Increased need for efficient processes and longer life of equipment

5.2.1.3 Growth in end-user industries, especially in emerging countries

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental regulations

5.2.2.2 High Prices of Raw Material

FIGURE 16 CRUDE OIL PRICES (USD/BARREL), JANUARY 021 TO FEBRUARY 2022

TABLE 1 PRICE COMPARISON OF OTHER RAW MATERIALS

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for high-efficiency and high-performance CUI & SOI coatings

5.2.3.2 Strong opportunities for growth in emerging regions

5.2.4 CHALLENGES

5.2.4.1 Rise in the use of substitutes in the market

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 CUI & SOI MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 2 CUI & SOI MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN OF CUI & SOI COATINGS MARKET

5.5 PRICING ANALYSIS

FIGURE 19 PRICING ANALYSIS (USD/TON) OF CUI & SOI COATINGS MARKET, BY REGION, 2020

5.6 KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 3 INTENSITY OF TRADE, BY KEY COUNTRIES

5.7 MACROECONOMIC INDICATORS

5.7.1 GLOBAL GDP OUTLOOK

TABLE 4 WORLD GDP PROJECTION (USD BILLION), 2019-2026

5.8 ADJACENT MARKET

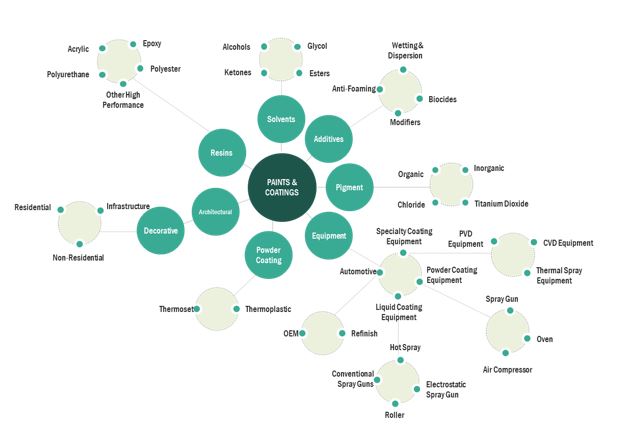

5.8.1 GLOBAL PAINTS & COATINGS MARKET

TABLE 5 PAINTS & COATINGS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 6 PAINTS & COATINGS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 7 PAINTS & COATINGS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 PAINTS & COATINGS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

5.8.2 INSULATION COATING MARKET

TABLE 9 INSULATION COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 INSULATION COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

5.9 CASE STUDY

5.9.1 CUI & SOI COATINGS USED FOR PIPELINE IN NUCLEAR POWER PLANT

5.10 PATENT ANALYSIS

5.11 INTRODUCTION

5.12 METHODOLOGY

5.13 DOCUMENT TYPE

5.14 PUBLICATION TRENDS LAST 10 YEARS

5.15 INSIGHTS

5.16 LEGAL STATUS OF THE PATENTS

5.17 JURISDICTION ANALYSIS

5.18 TOP COMPANIES/APPLICANTS

TABLE 11 LIST OF PATENTS BY SAUDI ARABIAN OIL COMPANY

TABLE 12 LIST OF PATENTS BY JOHNS MANVILLE

TABLE 13 TOP 10 PATENT OWNERS (US) IN THE LAST 10 YEARS

5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 20 TRENDS IN END-USE INDUSTRIES IMPACTING STRATEGIES OF COATING MANUFACTURERS

5.20 ECOSYSTEM MAP

5.21 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 14 ELECTRIC BUS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.22 KEY STAKEHOLDERS & BUYING CRITERIA

5.22.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.22.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR CUI & SOI COATINGS

TABLE 16 KEY BUYING CRITERIA FOR CUI & SOI COATINGS

5.23 FORECASTING FACTORS

5.24 REGULATORY LANDSCAPE

TABLE 17 CS-1, CS-3, CS-4, SS-1, SS-2, AND SS-3 CLASSIFICATION FOR CUI & SOI MARET

TABLE 18 STANDARD FOR CUI INSPECTION PRACTICES

5.25 TECHNOLOGY OVERVIEW

6 CORROSION UNDER INSULATION (CUI) AND SPRAY-ON INSULATION (SOI) COATINGS MARKET, BY TYPE (Page No. - 66)

6.1 INTRODUCTION

FIGURE 23 THE EPOXY SEGMENT TO LEAD THE CUI & SOI COATINGS MARKET FROM 2022 TO 2027

TABLE 19 CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 20 CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

6.2 EPOXY

6.2.1 SUPERIOR PROTECTIVE CHARACTERISTIC AND MODIFIABLE NATURE OF EPOXY HAS LED TO THEIR INCREASED DEMAND ACROSS END-USE INDUSTRIES

TABLE 21 EPOXY CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 EPOXY CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.3 ACRYLIC

6.3.1 SUPERIOR WEATHERING AND OXIDATION RESISTANCE PROPERTIES OF ACRYLIC CUI COATINGS TO BOOST MARKET GROWTH

TABLE 23 ACRYLIC CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 ACRYLIC CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.4 SILICONE

6.4.1 HIGH-PERFORMANCE CHARACTERISTICS AS COMPARED TO EPOXY PRODUCTS SUPPORT THE GROWTH OF THE SILICONE SEGMENT

TABLE 25 SILICONE CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 SILICONE CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.5 OTHERS

TABLE 27 OTHER CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 OTHER CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

7 CORROSION UNDER INSULATION (CUI) AND SPRAY-ON INSULATION (SOI) COATINGS MARKET, BY PRODUCT TYPE (Page No. - 73)

7.1 INTRODUCTION

FIGURE 24 CORROSION UNDER INSULATION (CUI) COATINGS TO LEAD THE MARKET FROM 2021 TO 2027

TABLE 29 CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 30 CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

7.2 SPRAY-ON INSULATION (SOI)

7.2.1 PERSONNEL PROTECTION CHARACTERISTIC OF SPRAY-ON INSULATION COATING HAS INCREASED THEIR DEMAND ACROSS INDUSTRIES

TABLE 31 SPRAY-ON INSULATION (SOI) COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 SPRAY-ON INSULATION COATINGS (SOI) MARKET SIZE, BY REGION, 2020–2027 (TON)

7.3 CORROSION UNDER INSULATION (CUI)

7.3.1 SUPERIOR WEATHERING AND OXIDATION RESISTANCE PROPERTIES

TABLE 33 CORROSION UNDER INSULATION (CUI) COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 CORROSION UNDER INSULATION (CUI) COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

8 CORROSION UNDER INSULATION (CUI) AND SPRAY-ON INSULATION (SOI) COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 77)

8.1 INTRODUCTION

FIGURE 25 OIL & GAS AND PETROCHEMICALS TO LEAD THE MARKET BETWEEN 2022 AND 2027

TABLE 35 CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 36 CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

8.2 OIL & GAS, AND PETROCHEMICAL

8.2.1 INCREASED INVESTMENTS IN THE OIL & GAS AND PETROCHEMICAL SECTOR FOR EXPANSION WILL DRIVE THE DEMAND FOR CUI & SOI COATINGS

TABLE 37 OIL & GAS AND PETROCHEMICAL: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 38 OIL & GAS AND PETROCHEMICAL: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

8.3 ENERGY & POWER

8.3.1 STEADY GROWTH OF THE ENERGY AND POWER INDUSTRY WILL BOOST THE DEMAND

FIGURE 26 RENEWABLE POWER GENERATION (TERAWATT-HOURS), 2010-2020

TABLE 39 ENERGY & POWER: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 40 ENERGY & POWER: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

8.4 MARINE

8.4.1 RISING TRADE ACTIVITIES WILL DRIVE THE GROWTH INDUSTRY

TABLE 41 MARINE: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 42 MARINE: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

8.5 OTHERS

TABLE 43 OTHER: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 44 OTHER: CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

9 CUI & SOI COATINGS MARKET, BY REGION (Page No. - 84)

9.1 INTRODUCTION

FIGURE 27 INDIA TO BE THE FASTEST-GROWING CUI & SOI COATINGS MARKET DURING THE FORECAST PERIOD

TABLE 45 CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (TON)

TABLE 46 CUI & SOI COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: CUI & SOI COATINGS MARKET SNAPSHOT

TABLE 47 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 48 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 50 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 52 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 54 ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Rise in the expansions in the oil & gas and energy & power sectors to drive the demand in China

TABLE 55 CHINA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 56 CHINA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 CHINA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 58 CHINA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 59 CHINA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 60 CHINA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.2 INDIA

9.2.2.1 High investments in power and oil & gas sectors to boost the demand for CUI & SOI coatings in India

TABLE 61 INDIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 62 INDIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 INDIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 64 INDIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 INDIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 66 INDIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Growth in nuclear energy and energy sectors to lead to increased demand for CUI & SOI in Japan

TABLE 67 JAPAN: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 68 JAPAN: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 JAPAN: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 70 JAPAN: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 71 JAPAN: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 72 JAPAN: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Booming renewable energy demand drives the demand for CUI & SOI in South Korea

TABLE 73 SOUTH KOREA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 74 SOUTH KOREA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 SOUTH KOREA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 76 SOUTH KOREA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 77 SOUTH KOREA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 78 SOUTH KOREA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.5 MALAYSIA

9.2.5.1 Investments in the oil & gas and chemical industries will boost the market in Malaysia

TABLE 79 MALAYSIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 80 MALAYSIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 MALAYSIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 82 MALAYSIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 83 MALAYSIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 84 MALAYSIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.6 INDONESIA

9.2.6.1 Increasing investments to benefit the CUI & SOI coatings market in Indonesia

TABLE 85 INDONESIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 86 INDONESIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 INDONESIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 88 INDONESIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 89 INDONESIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 90 INDONESIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.7 VIETNAM

9.2.7.1 Growth in the automotive industry will boost the demand for CUI & SOI coatings in Vietnam

TABLE 91 VIETNAM: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 92 VIETNAM: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 VIETNAM: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 94 VIETNAM: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 95 VIETNAM: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 96 VIETNAM: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.2.8 REST OF ASIA PACIFIC

9.2.8.1 Increasing demand from the end-use industry to boost the demand for CUI & SOI coatings in Rest of Asia Pacific

TABLE 97 REST OF ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 98 REST OF ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 100 REST OF ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 102 REST OF ASIA PACIFIC: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA: CUI & SOI COATINGS MARKET SNAPSHOT

TABLE 103 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 104 NORTH AMERICA: CUI & SOI COATINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 106 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 108 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 110 NORTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.3.1 THE US

9.3.1.1 Significant rise in the demand from end-use industries presence of major manufacturers to drive the market in the US

TABLE 111 US: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 112 US: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 US: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 114 US: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 115 US: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 116 US: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 The growth of major end-user industries to drive the market in Canada

TABLE 117 CANADA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 118 CANADA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 CANADA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 120 CANADA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 121 CANADA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 122 CANADA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Capital Investments in the oil & gas and energy & power sectors expected to create opportunities for the CUI & SOI coatings market

TABLE 123 MEXICO: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 124 MEXICO: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 MEXICO: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 126 MEXICO: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 127 MEXICO: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 128 MEXICO: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4 EUROPE

TABLE 129 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 130 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 131 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 132 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 134 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 135 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 136 EUROPE: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Growth of oil & gas, chemical, and power industries will boost the demand for CUI & SOI in the country

TABLE 137 GERMANY: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 138 GERMANY: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 GERMANY: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 140 GERMANY: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 141 GERMANY: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 142 GERMANY: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.2 ITALY

9.4.2.1 New LNG and pipeline projects in-country will propel the demand for CUI & SOI coatings in Italy

TABLE 143 ITALY: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 144 ITALY: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 ITALY: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 146 ITALY: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 147 ITALY: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 148 ITALY: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.3 SPAIN

9.4.3.1 Expansion of power capacities will boost the demand for CUI & SOI coatings in Spain

TABLE 149 SPAIN: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 150 SPAIN: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 SPAIN: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 152 SPAIN: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 153 SPAIN: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 154 SPAIN: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.4 UK

9.4.4.1 Initiation of new oil & gas pipeline projects will the fuel demand for CUI & SOI coatings in the UK

TABLE 155 UK: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 156 UK: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 UK: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 158 UK: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 159 UK: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 160 UK: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.5 RUSSIA

9.4.5.1 The US and EU sanction has adversely impacted the oil & gas sector in Russia

TABLE 161 RUSSIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 162 RUSSIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 163 RUSSIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 164 RUSSIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 165 RUSSIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 166 RUSSIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.6 FRANCE

9.4.6.1 Increased demand for CUI & SOI coatings in the power market will drive the market in France

TABLE 167 FRANCE: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 168 FRANCE: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 169 FRANCE: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 170 FRANCE: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 171 FRANCE: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 172 FRANCE: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 173 REST OF EUROPE: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 174 REST OF EUROPE: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 REST OF EUROPE: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 176 REST OF EUROPE: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 177 REST OF EUROPE: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 178 REST OF EUROPE: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 179 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 180 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 182 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 184 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 186 MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 High energy and oil & gas output to drive the demand for CUI & SOI coating in Saudi Arabia

TABLE 187 SAUDI ARABIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 188 SAUDI ARABIA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 SAUDI ARABIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 190 SAUDI ARABIA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 191 SAUDI ARABIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 192 SAUDI ARABIA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.5.2 SOUTH AFRICA

9.5.2.1 Growth of the oil & gas sector will drive the demand for CUI & SOI coatings

TABLE 193 SOUTH AFRICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 194 SOUTH AFRICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 SOUTH AFRICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 196 SOUTH AFRICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 197 SOUTH AFRICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 198 SOUTH AFRICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.5.3 REST OF THE MIDDLE EAST AND AFRICA

TABLE 199 REST OF THE MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 200 REST OF THE MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 REST OF THE MIDDLE EAST & AFRICA: CUI & SOI COATINGS, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 202 REST OF THE MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 203 REST OF THE MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 204 REST OF THE MIDDLE EAST & AFRICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 205 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (TON), BY COUNTRY, 2020–2027 (TON)

TABLE 206 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 207 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 208 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 210 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 211 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 212 SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Rising year-on-year oil & gas product throughput will drive the demand for CUI&SOI coatings in Brazil

TABLE 213 BRAZIL: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 214 BRAZIL: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 215 BRAZIL: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 216 BRAZIL: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 217 BRAZIL: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 218 BRAZIL: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Expected growth in the oil & gas and petrochemical industry in the country to drive the market

TABLE 219 ARGENTINA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 220 ARGENTINA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 221 ARGENTINA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 222 ARGENTINA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 223 ARGENTINA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 224 ARGENTINA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 225 REST OF SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 226 REST OF SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 227 REST OF SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 228 REST OF SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 229 REST OF SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

TABLE 230 REST OF SOUTH AMERICA: CUI & SOI COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 148)

10.1 INTRODUCTION

FIGURE 30 NEW PRODUCT LAUNCH WAS KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2019 AND 2021

10.2 MARKET SHARE ANALYSIS

FIGURE 31 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 231 CUI & SOI COATINGS MARKET: DEGREE OF COMPETITION

10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 232 STRATEGIC POSITIONING OF KEY PLAYERS

10.4 COMPANY EVALUATION MATRIX

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 32 CUI & SOI COATINGS MARKET: COMPANY EVALUATION MATRIX, 2021

10.5 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.5.1 RESPONSIVE COMPANIES

10.5.2 DYNAMIC COMPANIES

10.5.3 STARTING BLOCKS

FIGURE 33 CUI & SOI COATINGS MARKET: STARTUP AND SMES MATRIX, 2020

10.6 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 34 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST 3 YEARS

10.7 COMPETITIVE BENCHMARKING

TABLE 233 CUI & SOI MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 234 CUI & SOI MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES

10.8 KEY MARKET DEVELOPMENTS

10.8.1 DEALS

10.8.2 OTHERS

10.8.3 NEW PRODUCT LAUNCHES

11 COMPANY PROFILES (Page No. - 160)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 PPG INDUSTRIES, INC.

TABLE 235 PPG INDUSTRIES: BUSINESS OVERVIEW

FIGURE 35 PPG INDUSTRIES: COMPANY SNAPSHOT

TABLE 236 PPG INDUSTRIES: NEW PRODUCT LAUNCHES

TABLE 237 PPG INDUSTRIES: DEALS

FIGURE 36 PPG INDUSTRIES' CAPABILITY IN CUI & SOI MARKET

11.2 AKZONOBEL N.V.

TABLE 238 AKZONOBEL N.V.: BUSINESS OVERVIEW

FIGURE 37 AKZONOBEL N.V.: COMPANY SNAPSHOT

TABLE 239 AKZO NOBEL N.V.: PRODUCT OFFERINGS

TABLE 240 AKZONOBEL N.V.: DEALS

TABLE 241 AKZONOBEL N.V.: OTHERS

FIGURE 38 AKZONOBEL’S CAPABILITY IN CUI & SOI MARKET

11.3 THE SHERWIN-WILLIAMS COMPANY

TABLE 242 THE SHERWIN-WILLIAMS COMPANY BUSINESS OVERVIEW

FIGURE 39 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

TABLE 243 THE SHERWIN-WILLIAMS COMPANY: DEALS

FIGURE 40 THE SHERWIN-WILLIAMS COMPANY ‘S CAPABILITY IN THE CUI & SOI MARKET

11.4 JOTUN GROUP

TABLE 244 JOTUN GROUP: BUSINESS OVERVIEW

FIGURE 41 JOTUN GROUP: COMPANY SNAPSHOT

TABLE 245 JOTUN GROUP: OTHERS

FIGURE 42 JOTUN'S CAPABILITY IN CUI AND SOI MARKET

11.5 HEMPEL A/S

TABLE 246 HEMPEL A/S: BUSINESS OVERVIEW

FIGURE 43 HEMPEL A/S: COMPANY SNAPSHOT

TABLE 247 HEMPEL A/S: DEALS

TABLE 248 HEMPEL A/S: OTHERS

FIGURE 44 HEMPEL'S CAPABILITY IN CUI & SOI MARKET

11.6 KANSAI PAINTS CO. LTD.

TABLE 249 KANSAI PAINTS CO.LTD.: BUSINESS OVERVIEW

FIGURE 45 KANSAI PAINTS CO. LTD.: COMPANY SNAPSHOT

TABLE 250 KANSAI PAINTS CO., LTD.: DEALS

FIGURE 46 KANSAI PAINTS' CAPABILITY IN CUI & SOI MARKET

11.7 NIPPON PAINT HOLDINGS CO., LTD.

TABLE 251 NIPPON PAINT HOLDINGS CO.LTD.: BUSINESS OVERVIEW

FIGURE 47 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY SNAPSHOT

TABLE 252 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

FIGURE 48 NIPPON PAINT' CAPABILITY IN CUI & SOI MARKET

11.8 RPM INTERNATIONAL INC.

TABLE 253 RPM INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 49 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 254 RPM INTERNATIONAL INC.: DEALS

FIGURE 50 RPM INTERNATIONAL'S CAPABILITY IN CUI & SOI MARKET

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.9 OTHER PLAYERS

11.9.1 MASCOAT

TABLE 255 MASCOAT: COMPANY OVERVIEW

11.9.2 SYNEFFEX INC.

TABLE 256 SYNEFFEX INC.: COMPANY OVERVIEW

11.9.3 TEMP-COAT L.L.C.

TABLE 257 TEMP-COAT L.L.C.: COMPANY OVERVIEW

11.9.4 LINCOLN INDUSTRIES, INC.

TABLE 258 LINCOLN INDUSTRIES, INC.: COMPANY OVERVIEW

11.9.5 SPI COATINGS, INC.

TABLE 259 SPI COATINGS, INC.: COMPANY OVERVIEW

11.9.6 POLYGUARD PRODUCTS, INC.

TABLE 260 POLYGUARDS PRODUCTS, INC.: COMPANY OVERVIEW

11.9.7 EONCOAT LLC

TABLE 261 EONCOAT: COMPANY OVERVIEW

11.9.8 APLIKA CONTROL CORROSION S.A.S

TABLE 262 APLIKA CONTROL CORROSION S.A.S: COMPANY OVERVIEW

11.9.9 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

TABLE 263 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.: COMPANY OVERVIEW

11.9.10 THE PRESSERV GROUP

TABLE 264 THE PRESERVE GROUP: COMPANY OVERVIEW

11.9.11 SHARPSHELL ENGINEERING (PTY)LTD

TABLE 265 SHARPSHELL ENGINEERING (PTY) LTD: COMPANY OVERVIEW

11.9.12 TEKNOS GROUP OY

TABLE 266 TEKNOS GROUP OY: COMPANY OVERVIEW

11.9.13 NOROO PAINT & COATINGS

TABLE 267 NOROO PAINT & COATINGS: COMPANY OVERVIEW

11.9.14 RENNER HERRMANN SA

TABLE 268 RENNER HERRMANN SA: COMPANY OVERVIEW

11.9.15 O3 GROUP

TABLE 269 O3 GROUP: COMPANY OVERVIEW

11.9.16 DAI NIPPON TORYO CO., LTD

TABLE 270 DAI NIPPON TORYO CO., LTD: COMPANY OVERVIEW

12 APPENDIX (Page No. - 200)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of corrosion under insulation (CUI) and Spray-on insulation (SOI) coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the CUI & SOI coatings market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

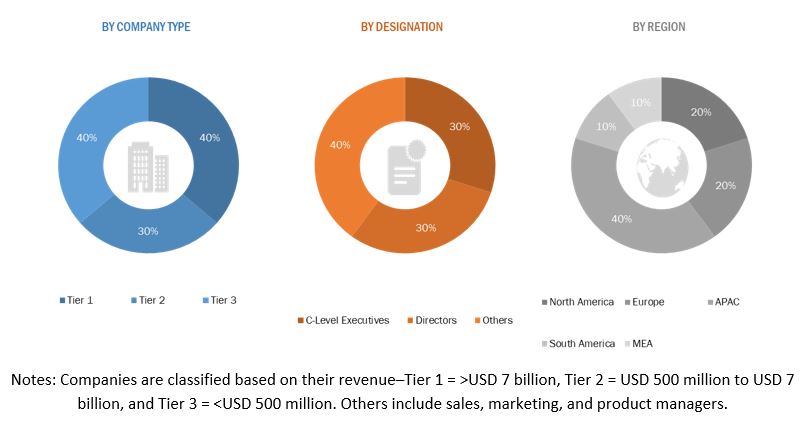

The CUI & SOI coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the marine, oil & gas, and petrochemical, energy & power, and other end-use industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Supply-side and Demand-side approaches have been used to estimate and validate the total size of the CUI & SOI coatings market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The CUI & SOI coatings industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall size of the CUI & SOI coatings market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both supply-side and demand-side approaches.

Report Objectives

- To define, describe, and forecast the size of the CUI & SOI coatings market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market based on type, and end-use industry

- To analyze and forecast the market based on key regions, such as North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micro-markets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product launches, collaboration, and expansion

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Corrosion Under Insulation (CUI) & Spray-on Insulation (SOI) Coatings Market