Anti-Corrosion Coating Market by Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc), Technology (Solvent borne, Waterborne, Powder-based), End-Use Industry (Marine, Oil & Gas, Industrial, Infrastructure, Power Generation), & Region - Global Forecast to 2028

Updated on : September 17, 2025

Anti-Corrosion Coating Market

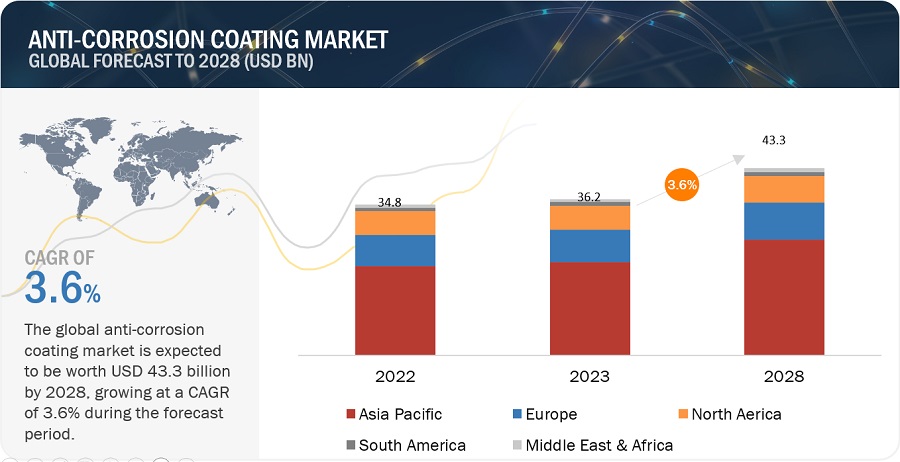

The global anti-corrosion coating market is projected to grow from USD 34.8 billion in 2022 to reach USD 43.3 billion by 2028, at a CAGR of 3.6% between 2023 and 2028. Increasing losses and damage due to corrosion is a major factor behind the growth of the market.

Anti-Corrosion Coatings Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Attractive Opportunities in the Anti-Corrosion Coatings Market

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Anti-Corrosion Coating Market Dynamics

Drivers: Increasing damage and losses due to corrosion

Corrosion is one of the serious problems in various end-use industries. Corrosion may attack the jacketing, the insulation hardware, or the underlying piping or equipment. The monetary losses caused by corrosion can be very high and directly threaten the well-being of general property and the life of people.

Significant monetary losses must be borne due to rust, corrosion, wear and tear, accidental damages, and other factors affecting the consumption of fixed capital (CFC). These losses lead to economic depreciation and are majorly seen in manufacturing and other industries.

Restraints: Environmental Regulations

Regulations were targeted at limit the volatile organic compounds (VOC) emissions from the coatings. REACH and LEED GreenSeal GC-03 2nd Ed., 1997 specifies that the VOC content in grams per liter (g/L) for anti-corrosion coatings. These regulations pressurized anti-corrosion coatings manufacturers to comply with the standards by reducing the VOC contents while maintaining the quality and performance of these coatings. The regulations have also impacted the price of anti-corrosion coating as the regulations brought a change in the technology which is used for the production of the coatings. Therefore, the regulations present a formidable short-term restraint for the growth of the anti-corrosion coating market.

Opportunities: Demand foe high-efficiency anti-corrosion coatings

Changes in operating circumstances in end-use sectors such as oil and gas and marine have created a demand for anti-corrosion coatings with improved characteristics and efficiency. For example, the rising usage of enhanced oil recovery (EOR) procedures in the oil and gas industry has created a demand for coatings that can withstand high temperatures and pressures while still ensuring long-term structural protection. Demand for high solid anti-corrosion coating from the oil and gas, maritime, and infrastructure industries has also stimulated R&D activity for the development of these coatings, which are appropriate for use in hostile environments. This is a short-term driver of the anti-corrosion coating industry, but it has the potential to become a long-term driver in the future. As a result, the increased demand for high-efficiency anti-corrosion coating is likely to create considerable prospects for market expansion.

Challenges: Entry of local players in the market

The anti-corrosion coating market is dominated by a few major global players. Companies such as PPG Industries (U.S.), AkzoNobel (Netherlands), and Jotun (Norway) lead the market in terms of revenue and product development. The anti-corrosion coating market also comprises a number of small local players such as Diamond Vogel Paints (U.S.) and SK Formulations India Pvt. Ltd. (India) who lacks the financial or technological power to counter the global majors. The local players are slowly gaining an edge through increased R&D initiatives and focus on a limited geographic section. They can identify the needs and demands in the local area and can actively fulfill them with application-specific products. Companies such as Ancatt (U.S.) and Carboline (U.K.) are emerging competitors to the current leading market players.

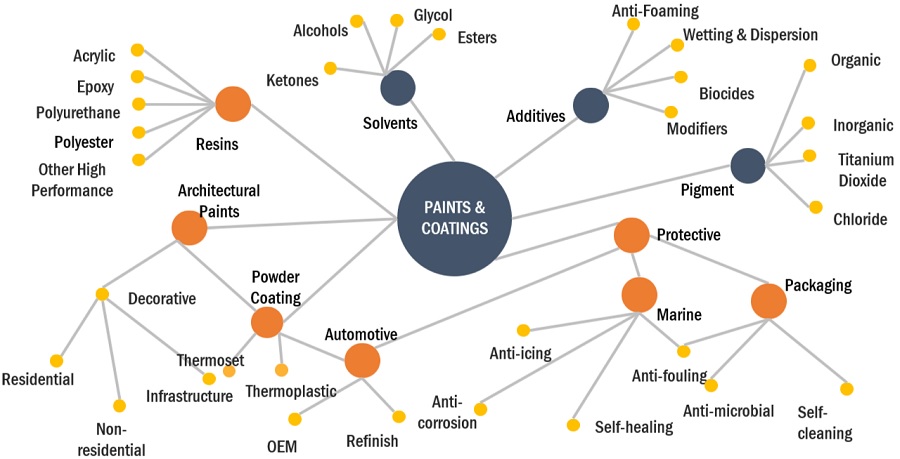

Anti-Corrosion Coating Market Ecosystem

The diagram below indicates MnM coverage of the paints & coatings ecosystem. Knowledgestore provides strategic insights on each of the nodes in the ecosystem through a cloud based, highly interactive market intellence platform.

Epoxy by type accounted for the largest growing segment of anti-corrosion coating market

Due to the epoxy's compatibility with other coating materials, the dominance of epoxy anti-corrosion coating is anticipated to persist during the forecast period. Also, it is the most used anti-corrosion coating. Additionally, the demand for epoxy anti-corrosion coating is rising across a range of end-use industries, including marine, infrastructure, oil & gas, and automotive & transportation.

To know about the assumptions considered for the study, download the pdf brochure

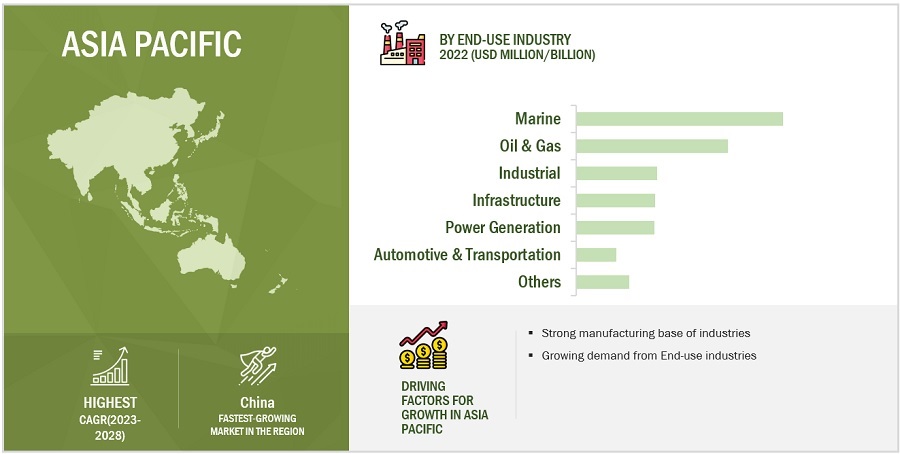

Asia Pacific is the largest growing anti-corrosion coating market.

The Asia Pacific is the largest anti-corrosion coating market, in terms of both, value and volume, and is projected to be the fastest-growing market during the forecast period. Economic development is credited to Asia Pacific, which is followed by major investment in areas such as automotive and transportation, infrastructure, power generation, and industrial. Asia Pacific is the most promising market and will remain such in the foreseeable future. Furthermore, multinational corporations are relocating production facilities to Asia Pacific to take advantage of reduced labour costs and meet local market demand.

Anti-Corrosion Coating Market Players

PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (US), Jotun A/S (Norway), Kansai Paints Co., Ltd. (Japan) are the key players in the global anti-corrosion coating market.

PPG Industries, Inc. manufactures and distributes coatings, paints, optical products, and specialty materials. The company operates in two segments, namely, performance coatings, and industrial coatings. The company offers anti-corrosion coatings through the Performance Coatings segment. It also provides industrial and automotive coatings to the manufacturing industries; adhesives and sealants to the automotive industry; metal pretreatments and related chemicals for the industrial & automotive applications; and packaging coatings to aerosol and food & beverage container manufacturers.

Anti-Corrosion Coating Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2020-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Type |

|

Regions covered |

Asia Pacific, Europe, North America, South America, Middle East & Africa |

|

Companies profiled |

PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (US), Jotun A/S (Norway), Kansai Paints Co., Ltd. (Japan). A total of 25 players have been covered. |

This research report categorizes the anti-corrosion coating market based on Type, Technology, End-use Industry, and Region.

By Type:

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Chlorinated Rubber

- Others

By Technology:

- Solvent borne

- Waterborne

- Powder-based coating

- Others

By End-use Industry:

- Marine

- Oil & Gas

- Industrial

- Infrastructure

- Power Generation

- Automotive & Transportation

- Others

By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2022, PPG has launched AMERLOCK 600 multipurpose epoxy coating for applicators looking for maximum versatility. The AMERLOCK coatings family is known for its excellent corrosion protection in tough environments.

- In February 2021, PPG Industries launched a PPG HI-TEMP 1027 HD corrosion protection coating in North America. The product is used in various sectors including oil & gas, chemical processing, power generation, and industries such as paper mills and steel mills that rely on insulated pipelines.

Frequently Asked Questions (FAQ):

What are the growth driving factors of anti-corrosion coating?

Increasing damage and losses due to corrosion is the major factor for driving anti-corrosion coating market.

What are the major end-use for anti-corrosion coating?

The major end-use industries of anti-corrosion coating are marine, oil & gas, industrial, and infrastructure.

Who are the major manufacturers?

PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (US), Jotun A/S (Norway), Kansai Paints Co., Ltd. (Japan), are some of the leading players operating in the global anti-corrosion coating market.

What are the reasons behind anti-corrosion coating gaining market share?

Anti-corrosion coating are gaining market share due to increasing loses and damage from coreosion.

Which is the largest region in the anti-corrosion coating market?

Asia Pacific is the largest region in anti-corrosion coating market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 VALUE CHAIN ANALYSIS

-

5.3 MARKET DYNAMICSDRIVERS- Increasing losses and damages due to corrosion- Increasing need for efficient processes and longer life of equipment- Innovation in modern structures- Growth in end-use industriesRESTRAINTS- Stringent environmental regulations- High price of raw materials and energyOPPORTUNITIES- Demand for high-efficiency and high-performance anti-corrosion coatings- Significant growth opportunities in emerging countriesCHALLENGES- Increasing competition from local players- Rise in use of substitutes

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

-

5.6 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTSTRENDS AND FORECASTS OF GLOBAL MARINE INDUSTRYTRENDS AND FORECASTS OF GLOBAL OIL & GAS INDUSTRYTRENDS AND FORECASTS OF GLOBAL AUTOMOTIVE INDUSTRY

- 5.7 REGULATORY LANDSCAPE AND STANDARDS

-

5.8 TARIFFS & REGULATIONSCOATING STANDARD

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE, BY KEY PLAYER

-

5.10 ECOSYSTEM MAPPING

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.12 EXPORT AND IMPORT (EXIM) TRADE STATISTICSKEY COUNTRIESEXPORT TRADE DATAIMPORT TRADE DATA

-

5.13 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHGLOBAL IMPACT OF RECESSION- North America- Europe- Asia Pacific

-

5.14 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSLEGAL STATUS OF PATENTSTOP JURISDICTIONTOP APPLICANTS

-

5.15 CASE STUDYCASE STUDY 1: ANTI-CORROSION COATING FOR CATHODIC PROTECTION SYSTEMSCASE STUDY 2: STEEL SHEET CORROSION PROTECTION WITH DENSO’S COAL TAR EPOXYCASE STUDY 3: PIPELINE RTD SENSOR CORROSION PROTECTION

- 5.16 TECHNOLOGY ANALYSIS

- 5.17 KEY CONFERENCES & EVENTS (2023–2024)

- 5.18 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 EPOXYSUPERIOR PROTECTIVE CHARACTERISTICS AND MODIFIABLE NATURE TO DRIVE MARKET

-

6.3 POLYURETHANEGROWING DEMAND FOR POLYURETHANE RESINS IN HIGH-PERFORMANCE APPLICATIONS TO DRIVE MARKET

-

6.4 ACRYLICSUPERIOR WEATHERING AND OXIDATION RESISTANCE PROPERTIES TO DRIVE MARKET

-

6.5 ALKYDLENIENT ENVIRONMENTAL REGULATIONS AND GROWTH OF END-USE INDUSTRIES TO DRIVE MARKET

-

6.6 ZINCHIGH-CORROSION RESISTANCE PROPERTIES TO DRIVE MARKET

-

6.7 CHLORINATED RUBBERSLOW GROWTH DUE TO VOC REGULATIONS IN NORTH AMERICA AND EUROPE

- 6.8 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 SOLVENTBORNE ANTI-CORROSION COATINGSEXCELLENT PROPERTIES TO DRIVE DEMAND

-

7.3 WATERBORNE ANTI-CORROSION COATINGSLOW TOXICITY DUE TO LOW-VOC LEVELS TO INCREASE DEMAND

-

7.4 POWDER-BASED ANTI-CORROSION COATINGSSUPERIOR PERFORMANCE AND EXCELLENT PROPERTIES TO DRIVE DEMAND

- 7.5 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 MARINEDEMAND FOR LARGE VOLUMES OF COATINGS TO DRIVE MARKETBOOT TOPS AND DECKSOTHER MARINE APPLICATIONS

-

8.3 OIL & GASRAPID GROWTH IN BIO-FUEL INDUSTRY TO DRIVE MARKETOIL & GAS PIPELINESOTHER OIL & GAS APPLICATIONS

-

8.4 INDUSTRIALHIGH DEMAND FOR HEAVY INDUSTRIAL EQUIPMENT TO DRIVE MARKETCHEMICAL & FERTILIZEROTHER INDUSTRIAL APPLICATIONS

-

8.5 INFRASTRUCTUREGROWING INVESTMENT IN INFRASTRUCTURE SECTOR TO DRIVE MARKET

-

8.6 POWER GENERATIONGROWING POWER GENERATION INDUSTRIES TO DRIVE MARKETPOWER PLANTSOLAR ENERGYWIND TURBINES

-

8.7 AUTOMOTIVE & TRANSPORTATIONHIGH DEMAND FOR AUTOMOBILES AND MAINTENANCE TO DRIVE MARKETPASSENGER VEHICLESOTHER AUTOMOTIVE & TRANSPORTATION APPLICATIONS

- 8.8 OTHER END-USE INDUSTRIES

-

9.1 INTRODUCTIONGLOBAL RECESSION OVERVIEW

-

9.2 ASIA PACIFICRECESSION IMPACTCHINA- Significant growth of oil & gas and petrochemical industries to drive marketINDIA- High investment in manufacturing sector to fuel marketJAPAN- Presence of well-established industries to drive marketSOUTH KOREA- Growth of marine sector to drive marketSINGAPORE- Low labor and raw material costs to fuel demand for anti-corrosion coatingsINDONESIA- Rise in foreign direct investments to drive marketTHAILAND- Manufacturing industry to contribute significantly to market growthMALAYSIA- Investment in power & energy industry to drive marketREST OF ASIA PACIFIC

-

9.3 EUROPERECESSION IMPACTGERMANY- Presence of leading machinery and chemical manufacturers to drive marketUK- Use of sustainable and quality products to drive marketITALY- New project finance rules and investment policies to fuel marketFRANCE- Technological advancements to drive marketRUSSIA- Growth of epoxy industry to drive marketTURKEY- Population growth and robust economy to fuel demandREST OF EUROPE

-

9.4 NORTH AMERICARECESSION IMPACTUS- High demand for crude oil to drive marketCANADA- Rising GDP and increase in construction activities to fuel demandMEXICO- Private investments in energy sector to fuel economic growth

-

9.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Easy availability of raw materials to drive marketARGENTINA- New developments in infrastructure & construction industry to drive marketVENEZUELA- Large oil & gas reserves to boost marketREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Growth of solar power industry to drive marketUAE- Increasing focus on regulatory mechanisms and R&D to fuel demandIRAN- Demand for high-end vehicles to drive market growthSOUTH AFRICA- Growth of oil & gas sector to drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.3 PRODUCT FOOTPRINT (25 COMPANIES)

-

10.4 SMALL AND MEDIUM-SIZED ENTERPRISES MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.5 COMPETITIVE BENCHMARKING

- 10.6 COMPETITIVE SCENARIO

- 10.7 MARKET SHARE ANALYSIS

- 10.8 MARKET RANKING ANALYSIS

-

10.9 REVENUE ANALYSISPPG INDUSTRIES, INC.AKZONOBEL N.V.THE SHERWIN-WILLIAMS COMPANYAXALTA COATING SYSTEMS LTD.BASF SE

- 10.10 COMPETITIVE SCENARIO

-

11.1 KEY COMPANIESPPG INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewAKZONOBEL N.V.- Business overview- Products offered- Recent developments- MnM viewTHE SHERWIN-WILLIAMS COMPANY- Business overview- Products offered- Recent developments- MnM viewJOTUN- Business overview- Products offered- Recent developments- MnM viewKANSAI PAINT CO., LTD- Business overview- Products offered- Recent developments- MnM viewAXALTA COATING SYSTEMS LTD.- Business overview- Products offered- Recent developmentsBASF SE- Business overview- Products offered- Recent developmentsHEMPEL A/S- Business overview- Products offered- Recent developmentsRPM INTERNATIONAL INC.- Business overview- Products offered- Recent developmentsNIPPON PAINT HOLDINGS CO., LTD.- Business overview- Products offered- Recent developments

-

11.2 OTHER COMPANIESNYCOTE LABORATORIES, INC.- Products offeredDIAMOND VOGEL- Products offeredEONCOAT, LLC- Products offeredTHE DOW CHEMICAL COMPANY- Products offeredADVANCED NANOTECH LAB- Products offered3M- Products offeredHEUBACH COLOR- Products offeredTHE MAGNI GROUP, INC.- Products offeredWACKER CHEMIE AG- Products offeredSK FORMULATIONS INDIA PVT. LTD.- Products offeredNOROO PAINT & COATINGS- Products offeredANCATT INC.- Products offeredGREENKOTE PLC- Products offered- Recent developmentsRENNER HERRMANN SA- Products offeredSECOA METAL FINISHING- Products offered

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 CORROSION PROTECTION COATINGSMARKET DEFINITIONMARKET OVERVIEW

- 12.4 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE

-

12.5 EPOXYSUPERIOR PROTECTIVE CHARACTERISTICS AND MODIFIABLE NATURE OF EPOXY

-

12.6 POLYURETHANEGROWING DEMAND FOR POLYURETHANE RESINS IN HIGH-PERFORMANCE APPLICATIONS

-

12.7 ACRYLICSUPERIOR WEATHERING AND OXIDATION RESISTANCE PROPERTIES

-

12.8 ALKYDLENIENT ENVIRONMENTAL REGULATIONS AND GROWTH OF END-USE INDUSTRIES IN ASIA PACIFIC

-

12.9 ZINCSTRINGENT REGULATIONS TO LIMIT USE OF ZINC-BASED COATINGS

-

12.10 CHLORINATED RUBBERSLOW GROWTH DUE TO VOC REGULATIONS IN NORTH AMERICA AND EUROPE

- 12.11 OTHER RESIN TYPES

- 12.12 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY

-

12.13 SOLVENT-BASED CORROSION PROTECTION COATINGSSUPERIOR PROPERTIES TO DRIVE DEMAND

-

12.14 WATER-BASED CORROSION PROTECTION COATINGSLOW TOXICITY DUE TO LOW-VOC LEVELS TO INCREASE DEMAND

-

12.15 POWDER-BASED CORROSION PROTECTION COATINGSSUPERIOR PERFORMANCE AND EXCELLENT PROPERTIES TO DRIVE DEMAND

- 12.16 OTHER TECHNOLOGIES

- 12.17 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY

-

12.18 MARINEDEMAND FOR LARGE VOLUMES OF COATINGS

-

12.19 OIL & GASRAPIDLY GROWING BIO-FUEL INDUSTRY

-

12.20 PETROCHEMICALINDIA AND CHINA DRIVING FORCES FOR MARKET

-

12.21 INFRASTRUCTUREASIA PACIFIC TO BE STRATEGIC INFRASTRUCTURE MARKET

-

12.22 POWER GENERATIONPOWER GENERATION AMONG FASTEST-GROWING INDUSTRIES IN ASIA PACIFIC

-

12.23 WATER TREATMENTINCREASING CONCERNS REGARDING WATER DISPOSAL AND WATER CONSERVATION

- 12.24 OTHER END-USE INDUSTRIES

-

12.25 CORROSION PROTECTION COATINGS MARKET, BY REGIONASIA PACIFICEUROPENORTH AMERICAMIDDLE EAST & AFRICASOUTH AMERICA

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ANTI-CORROSION COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 2 SUPPLY CHAIN ECOSYSTEM

- TABLE 3 GLOBAL RESIN PRICES, 2022

- TABLE 4 ANTI-CORROSION COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR ANTI-CORROSION COATINGS

- TABLE 7 GDP TRENDS AND FORECASTS, BY COUNTRY, PERCENTAGE CHANGE

- TABLE 8 CS-1, CS-3, CS-4, SS-1, SS-2, AND SS-3 CLASSIFICATIONS FOR ANTI-CORROSION COATINGS MARKET

- TABLE 9 STANDARDS FOR CORROSION INSPECTION PRACTICES

- TABLE 10 BASIC COATING SYSTEM REQUIREMENTS FOR DEDICATED SEAWATER BALLAST TANKS OF ALL TYPES OF SHIPS AND DOUBLE-SIDE SKIN SPACES OF BULK CARRIERS OF 150 M AND UPWARD

- TABLE 11 INTENSITY OF TRADE, BY KEY COUNTRY

- TABLE 12 EXPORT DATA IN USD THOUSAND (2018–2022)

- TABLE 13 IMPORT DATA IN USD THOUSAND (2018–2022)

- TABLE 14 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- TABLE 15 TOP 10 PATENT OWNERS DURING LAST FEW YEARS

- TABLE 16 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 22 ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 24 ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 25 CHARACTERISTICS OF EPOXY ANTI-CORROSION COATINGS

- TABLE 26 EPOXY ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 27 EPOXY ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 EPOXY ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 29 EPOXY ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 30 PROPERTIES OF POLYURETHANE ANTI-CORROSION COATINGS

- TABLE 31 POLYURETHANE ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 32 POLYURETHANE ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 POLYURETHANE ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 34 POLYURETHANE ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 35 CHARACTERISTICS OF ACRYLIC ANTI-CORROSION COATINGS

- TABLE 36 ACRYLIC ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 37 ACRYLIC ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 ACRYLIC ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 39 ACRYLIC ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 CHARACTERISTICS OF ALKYD ANTI-CORROSION COATINGS

- TABLE 41 ALKYD ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 42 ALKYD ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 ALKYD ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 44 ALKYD ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 45 CHARACTERISTICS OF ZINC ANTI-CORROSION COATINGS

- TABLE 46 ZINC ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 47 ZINC ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 ZINC ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 49 ZINC ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 50 CHARACTERISTICS OF CHLORINATED RUBBER ANTI-CORROSION COATINGS

- TABLE 51 CHLORINATED RUBBER ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 52 CHLORINATED RUBBER ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 CHLORINATED RUBBER ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 54 CHLORINATED RUBBER ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 55 OTHER ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 56 OTHER ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 58 OTHER ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 59 ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 60 ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 61 ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 62 ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 63 SOLVENTBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 64 SOLVENTBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 SOLVENTBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 66 SOLVENTBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 67 WATERBORNE ANTI-CORROSION COATINGS, BY REGION, 2020–2022 (USD MILLION)

- TABLE 68 WATERBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 WATERBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 70 WATERBORNE ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 71 POWDER-BASED ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 72 POWDER-BASED ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 POWDER-BASED ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 74 POWDER-BASED ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 75 OTHER TECHNOLOGIES: ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 76 OTHER TECHNOLOGIES: ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OTHER TECHNOLOGIES: ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 78 OTHER TECHNOLOGIES: ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 79 ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 80 ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 81 ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 82 ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 83 ANTI-CORROSION COATINGS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 84 ANTI-CORROSION COATINGS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ANTI-CORROSION COATINGS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 86 ANTI-CORROSION COATINGS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 87 ANTI-CORROSION COATINGS MARKET IN OIL & GAS END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 88 ANTI-CORROSION COATINGS MARKET IN OIL & GAS END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 ANTI-CORROSION COATINGS MARKET IN OIL & GAS END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 90 ANTI-CORROSION COATINGS MARKET IN OIL & GAS END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 91 ANTI-CORROSION COATINGS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 92 ANTI-CORROSION COATINGS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 ANTI-CORROSION COATINGS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 94 ANTI-CORROSION COATINGS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 95 ANTI-CORROSION COATINGS MARKET IN INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 96 ANTI-CORROSION COATINGS MARKET IN INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 ANTI-CORROSION COATINGS MARKET IN INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 98 ANTI-CORROSION COATINGS MARKET IN INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 99 ANTI-CORROSION COATINGS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 100 ANTI-CORROSION COATINGS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 ANTI-CORROSION COATINGS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 102 ANTI-CORROSION COATINGS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 103 ANTI-CORROSION COATINGS MARKET IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 104 ANTI-CORROSION COATINGS MARKET IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 ANTI-CORROSION COATINGS MARKET IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 106 ANTI-CORROSION COATINGS MARKET IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 107 ANTI-CORROSION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 108 ANTI-CORROSION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 ANTI-CORROSION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2022 (KILOTON)

- TABLE 110 ANTI-CORROSION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 111 ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 112 ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 ANTI-CORROSION COATINGS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 114 ANTI-CORROSION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 115 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 118 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 119 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 122 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 123 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 126 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 127 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 130 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 131 CHINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 132 CHINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 CHINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 134 CHINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 135 INDIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 136 INDIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 INDIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 138 INDIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 139 JAPAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 140 JAPAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 JAPAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 142 JAPAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 143 SOUTH KOREA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 144 SOUTH KOREA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH KOREA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 146 SOUTH KOREA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 147 SINGAPORE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 148 SINGAPORE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 SINGAPORE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 150 SINGAPORE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 151 INDONESIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 152 INDONESIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 INDONESIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 154 INDONESIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 155 THAILAND: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 156 THAILAND: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 THAILAND: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 158 THAILAND: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 159 MALAYSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 160 MALAYSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 MALAYSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 162 MALAYSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 163 REST OF ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 166 REST OF ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 167 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 168 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 170 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 171 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 172 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 173 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 174 EUROPE: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 175 EUROPE: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 176 EUROPE: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 177 EUROPE: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 178 EUROPE: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 179 EUROPE: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 180 EUROPE: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 181 EUROPE: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 182 EUROPE: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 183 GERMANY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 184 GERMANY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 GERMANY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 186 GERMANY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 187 UK: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 188 UK: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 189 UK: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 190 UK: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 191 ITALY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 192 ITALY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 ITALY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 194 ITALY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 195 FRANCE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 196 FRANCE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 197 FRANCE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 198 FRANCE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 199 RUSSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 200 RUSSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 201 RUSSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 202 RUSSIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 203 TURKEY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 204 TURKEY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 205 TURKEY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 206 TURKEY: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 207 REST OF EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 208 REST OF EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 209 REST OF EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 210 REST OF EUROPE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 211 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 212 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 213 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 214 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 215 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 216 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 217 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 218 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 219 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 220 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 221 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 222 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 223 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 224 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 225 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 226 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 227 US: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 228 US: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 229 US: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 230 US: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 231 CANADA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 232 CANADA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 233 CANADA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 234 CANADA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 235 MEXICO: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 236 MEXICO: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 237 MEXICO: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 238 MEXICO: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 239 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 240 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 241 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 242 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 243 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 244 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 245 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 246 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 247 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 248 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 249 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 250 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 251 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 252 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 253 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 254 SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 255 BRAZIL: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 256 BRAZIL: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 257 BRAZIL: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 258 BRAZIL: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 259 ARGENTINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 260 ARGENTINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 261 ARGENTINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 262 ARGENTINA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 263 VENEZUELA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 264 VENEZUELA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 265 VENEZUELA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 266 VENEZUELA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 267 REST OF SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 268 REST OF SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 269 REST OF SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 270 REST OF SOUTH AMERICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 271 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 274 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 275 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 278 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 279 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 282 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 283 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 286 MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 287 SAUDI ARABIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 288 SAUDI ARABIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 289 SAUDI ARABIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 290 SAUDI ARABIA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 291 UAE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 292 UAE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 293 UAE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 294 UAE: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 295 IRAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 296 IRAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 297 IRAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 298 IRAN: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 299 SOUTH AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 300 SOUTH AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 301 SOUTH AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 302 SOUTH AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 303 REST OF MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 304 REST OF MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 305 REST OF MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 306 REST OF MIDDLE EAST & AFRICA: ANTI-CORROSION COATINGS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 307 OVERVIEW OF STRATEGIES ADOPTED BY KEY ANTI-CORROSION COATING PLAYERS (2018–2023)

- TABLE 308 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 309 COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 310 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 311 COMPANY FOOTPRINT

- TABLE 312 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 313 REGION FOOTPRINT OF COMPANIES

- TABLE 314 INTENSITY OF COMPETITIVE RIVALRY, 2022

- TABLE 315 ANTI-CORROSION COATINGS MARKET: PRODUCT LAUNCHES

- TABLE 316 ANTI-CORROSION COATINGS MARKET: DEALS

- TABLE 317 ANTI-CORROSION COATINGS MARKET: OTHERS

- TABLE 318 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 319 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 320 PPG INDUSTRIES, INC.: DEALS

- TABLE 321 AKZONOBEL N.V.: COMPANY OVERVIEW

- TABLE 322 AKZONOBEL N.V.: PRODUCT LAUNCHES

- TABLE 323 AKZONOBEL N.V.: DEALS

- TABLE 324 AKZONOBEL N.V.: OTHERS

- TABLE 325 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 326 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 327 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 328 JOTUN: COMPANY OVERVIEW

- TABLE 329 JOTUN: DEALS

- TABLE 330 JOTUN: OTHER DEVELOPMENTS

- TABLE 331 KANSAI PAINT CO., LTD: COMPANY OVERVIEW

- TABLE 332 KANSAI PAINT CO., LTD.: DEALS

- TABLE 333 AXALTA COATING SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 334 AXALTA COATING SYSTEMS LTD: PRODUCT LAUNCHES

- TABLE 335 AXALTA COATING SYSTEMS LTD: DEALS

- TABLE 336 BASF SE: COMPANY OVERVIEW

- TABLE 337 BASF SE: DEALS

- TABLE 338 HEMPEL A/S: PRODUCT LAUNCHES

- TABLE 339 HEMPEL A/S: DEALS

- TABLE 340 HEMPEL A/S: OTHERS

- TABLE 341 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 342 RPM INTERNATIONAL INC.: DEALS

- TABLE 343 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY OVERVIEW

- TABLE 344 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 345 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

- TABLE 346 NYCOTE LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 347 DIAMOND VOGEL: COMPANY OVERVIEW

- TABLE 348 EONCOAT, LLC: COMPANY OVERVIEW

- TABLE 349 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 350 ADVANCED NANOTECH LAB: COMPANY OVERVIEW

- TABLE 351 3M: COMPANY OVERVIEW

- TABLE 352 HEUBACH COLOR: COMPANY OVERVIEW

- TABLE 353 THE MAGNI GROUP, INC.: COMPANY OVERVIEW

- TABLE 354 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 355 SK FORMULATIONS INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 356 NOROO PAINT & COATINGS: COMPANY OVERVIEW

- TABLE 357 ANCATT INC.: COMPANY OVERVIEW

- TABLE 358 GREENKOTE PLC: COMPANY OVERVIEW

- TABLE 359 GREENKOTE PLC: PRODUCT LAUNCHES

- TABLE 360 GREENKOTE PLC: DEALS

- TABLE 361 RENNER HERRMANN SA: COMPANY OVERVIEW

- TABLE 362 SECOA METAL FINISHING: COMPANY OVERVIEW

- TABLE 363 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 364 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 365 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 366 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 367 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 368 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 369 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 370 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 371 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 372 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 373 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 374 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 375 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 376 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 377 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 378 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- FIGURE 1 ANTI-CORROSION COATINGS MARKET: RESEARCH DESIGN

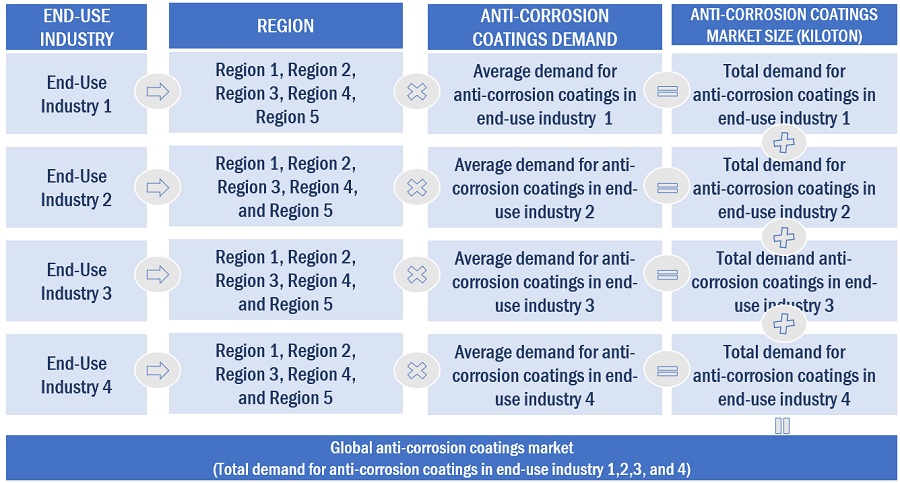

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 ANTI-CORROSION COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ANTI-CORROSION COATINGS MARKET

- FIGURE 6 ANTI-CORROSION COATINGS MARKET: DEMAND-SIDE FORECAST

- FIGURE 7 ANTI-CORROSION COATINGS MARKET: DATA TRIANGULATION

- FIGURE 8 EPOXY TYPE TO LEAD ANTI-CORROSION COATINGS MARKET

- FIGURE 9 SOLVENTBORNE TECHNOLOGY TO LEAD ANTI-CORROSION COATINGS MARKET

- FIGURE 10 MARINE TO BE LARGEST END-USE INDUSTRY OF ANTI-CORROSION COATINGS

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING ANTI-CORROSION COATINGS MARKET

- FIGURE 12 ANTI-CORROSION COATINGS MARKET TO WITNESS HIGH GROWTH IN INFRASTRUCTURE END-USE INDUSTRY

- FIGURE 13 EPOXY TO BE LARGEST TYPE SEGMENT

- FIGURE 14 WATERBORNE TO BE FASTEST-GROWING TECHNOLOGY IN ANTI-CORROSION COATINGS MARKET

- FIGURE 15 MARINE END-USE INDUSTRY TO LEAD ANTI-CORROSION COATINGS MARKET

- FIGURE 16 CHINA TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 17 INDIA TO BE FASTEST-GROWING ANTI-CORROSION COATINGS MARKET

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ANTI-CORROSION COATINGS MARKET

- FIGURE 20 ANTI-CORROSION COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 22 KEY BUYING CRITERIA FOR ANTI-CORROSION COATINGS

- FIGURE 23 INTERNATIONAL MARITIME TRADE, PERCENTAGE ANNUAL CHANGE

- FIGURE 24 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN ANTI-CORROSION COATINGS MARKET, BY REGION, 2022

- FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN ANTI-CORROSION COATINGS MARKET, BY TYPE, 2022

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN ANTI-CORROSION COATINGS MARKET, BY TECHNOLOGY, 2022

- FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN ANTI-CORROSION COATINGS MARKET, BY END-USE INDUSTRY, 2022

- FIGURE 29 PRICING ANALYSIS OF KEY PLAYERS, BY END-USE INDUSTRY, 2022

- FIGURE 30 PAINTS & COATINGS ECOSYSTEM

- FIGURE 31 TRENDS IN END-USE INDUSTRIES IMPACTING STRATEGIES OF COATING MANUFACTURERS

- FIGURE 32 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- FIGURE 33 PUBLICATION TRENDS, 2018–2023

- FIGURE 34 LEGAL STATUS OF PATENTS

- FIGURE 35 NUMBER OF PATENTS PUBLISHED, BY JURISDICTION

- FIGURE 36 PATENTS PUBLISHED BY MAJOR APPLICANTS

- FIGURE 37 ANTI-CORROSION COATING TECHNOLOGY

- FIGURE 38 EPOXY ANTI-CORROSION COATINGS TO LEAD MARKET BETWEEN 2023 AND 2028

- FIGURE 39 SOLVENTBORNE ANTI-CORROSION COATINGS TO LEAD MARKET

- FIGURE 40 MARINE END-USE INDUSTRY TO DOMINATE ANTI-CORROSION COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 41 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC: ANTI-CORROSION COATINGS MARKET SNAPSHOT

- FIGURE 43 EUROPE: ANTI-CORROSION COATINGS MARKET SNAPSHOT

- FIGURE 44 NORTH AMERICA: ANTI-CORROSION COATINGS MARKET SNAPSHOT

- FIGURE 45 BRAZIL TO BE LARGEST AND FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 46 SAUDI ARABIA TO BE LARGEST AND FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 47 COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 EMERGING COMPANIES’ MATRIX, 2022

- FIGURE 49 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 50 MARKET RANKING ANALYSIS, 2022

- FIGURE 51 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2021

- FIGURE 52 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 53 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 54 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 55 JOTUN: COMPANY SNAPSHOT

- FIGURE 56 KANSAI PAINT CO., LTD: COMPANY SNAPSHOT

- FIGURE 57 AXALTA COATING SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 58 BASF SE: COMPANY SNAPSHOT

- FIGURE 59 HEMPEL A/S: COMPANY SNAPSHOT

- FIGURE 60 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 61 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

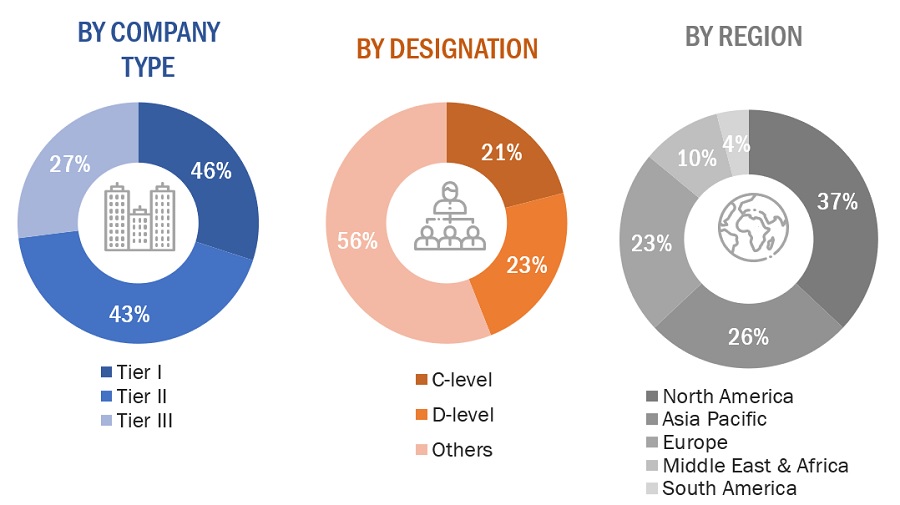

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global anti-corrosion coating market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the anti-corrosion coating market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the anti-corrosion coatings market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the anti-corrosion coating market on the basis of different end-use industries and types in each of the regions. The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that can affect the market have been accounted for in this research study, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Anti-Corrosion Coating Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Anti-Corrosion Coating Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches. Then, it has been verified through primary interviews. Hence, for every data segment, there are three sources, one from the top-down approach, second from the bottom-up approach, and third from expert interviews. Only when the values arrived at from the three points match, the data have been assumed correct.

Market Definition.

Anti-corrosion coatings are used for protecting metal, concrete, and other components from degradation caused by moisture, oxidation, and exposure to chemicals and salt water. They are specialized protective coatings used to protect the surfaces by creating a barrier between the surface and the corrosive agents. Anti-corrosion coatings are used to enhance the lifespan and quality of the structure or surface on which they are applied.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, forecast, and analyze anti-corrosion coatings market based on type, technology, and end-use industry in terms of value

- To describe and forecast the size of the market based on five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective countries in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments such as product launches, acquisitions, agreements, and partnerships in the market

Note: 1. Micromarkets are defined as the subsegments of the global anti-corrosion market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the anti-corrosion coating market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Anti-Corrosion Coating Market

Key manufacturers their products offered present in the market

Information on forecast of sales of acrylic solvent-borne anti-corrosion coatings with a focus on emerging untapped end-use opportunities in North American market.

Market trends on global anto-corrosion market

General information on Anti-corrosion Coating Market

General information on vacuum pump and measurment, thin film coating, plasma application, semiconductor, LED, OLED, TFT, Solar Cell, Optical coating

Anti-Corrosion Coating Market

General information on Anti-Corrosion Coating Market

Information on anti-corrosion coating market